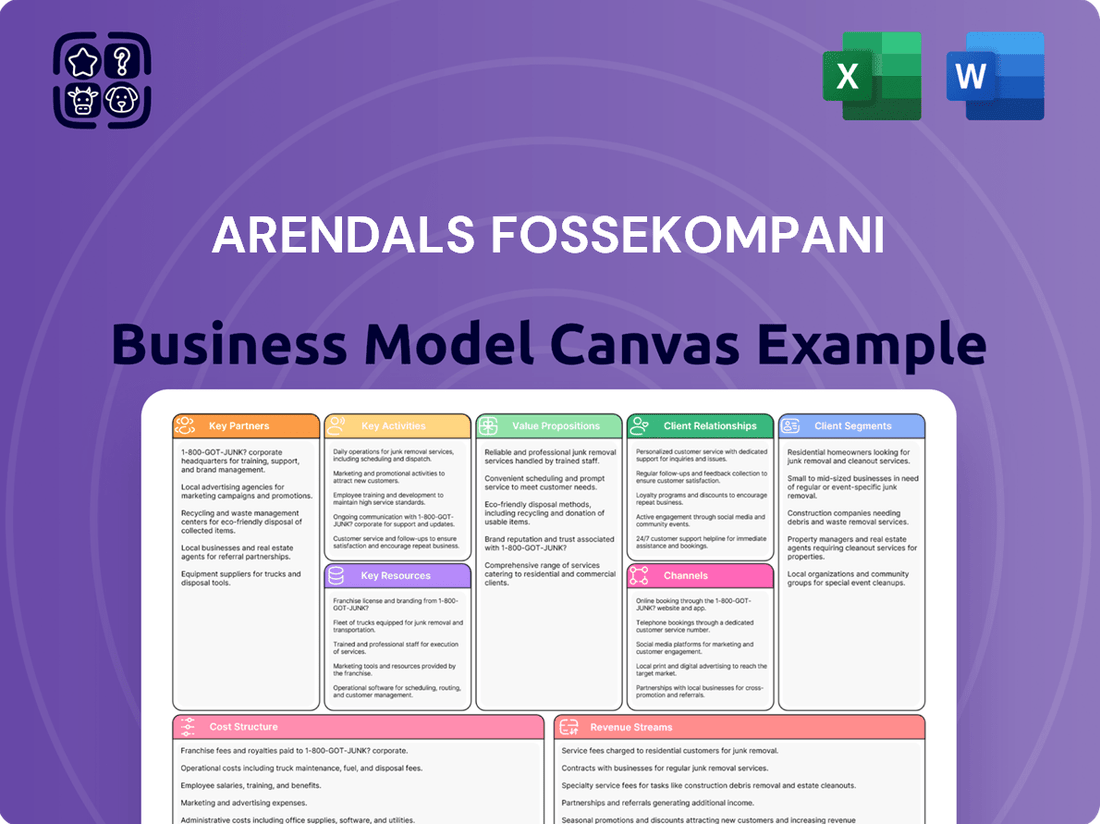

Arendals Fossekompani Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arendals Fossekompani Bundle

Unlock the full strategic blueprint behind Arendals Fossekompani's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Arendals Fossekompani leverages strategic investment partnerships with firms like Advent International and Generation Investment Management. These collaborations are crucial for delisting and fostering the growth of portfolio companies such as Volue.

These alliances inject vital capital and offer invaluable strategic direction, significantly accelerating growth trajectories and enhancing value creation for their shared ventures.

The model fosters a shared risk and reward structure, which is instrumental in cultivating and expanding high-potential companies within Arendals Fossekompani's portfolio.

Arendals Fossekompani actively cultivates partnerships with technology innovators and established industrial entities to propel the development and adoption of sustainable solutions. These collaborations are fundamental to their strategy for navigating the green transition and expanding their technological prowess.

A prime example is their alliance with InductEV, a venture focused on standardizing wireless charging technology for electric vehicles. This partnership aims to create a more accessible and efficient charging infrastructure, a critical component of a sustainable future. In 2023, InductEV secured significant funding to further its development, highlighting the momentum in this sector.

Furthermore, Arendals Fossekompani is working with Kitron to establish new, advanced production facilities. This collaboration is designed to enhance manufacturing capabilities and efficiency, supporting the scaling of their green technology offerings. Such strategic alliances are vital for Arendals Fossekompani to broaden its market penetration and solidify its position as a leader in sustainable industrial development.

Arendals Fossekompani actively collaborates with governmental and public sector entities, a key partnership driving stability and growth. Through its subsidiary NSSLGlobal, the company has secured substantial contracts for satellite communication services, demonstrating the value of these relationships. For instance, NSSLGlobal's involvement in providing connectivity for critical public services highlights the strategic importance of these public sector engagements.

Research and Development Institutions

Arendals Fossekompani's strategic alliances with research and development institutions are foundational for its innovation pipeline, particularly in battery technology and other sustainable solutions. Despite past investment adjustments, such as ceasing operations in Commeo, these partnerships remain critical for securing access to pioneering research and fostering the creation of next-generation technologies.

These collaborations cultivate a dynamic ecosystem for ongoing advancement and the introduction of novel products. For instance, in 2024, Arendals Fossekompani continued to engage with leading academic and research bodies to explore advancements in energy storage and green hydrogen production.

- Access to Cutting-Edge Research: Partnerships ensure Arendals Fossekompani stays at the forefront of scientific discovery, particularly in battery chemistries and sustainable energy systems.

- Development of Next-Generation Technologies: Collaborations are geared towards creating and refining technologies that will define future energy solutions.

- Fostering Continuous Improvement: These R&D relationships drive an iterative process of innovation, leading to enhanced product performance and new market opportunities.

Local Community Initiatives

Arendals Fossekompani actively engages with and supports local community initiatives, underscoring its deep roots in the region. This commitment is exemplified by its partnerships with events like Arendalsuka, a prominent national political festival, and TEDxArendal, a local chapter of the global TED conference series.

These collaborations are more than just sponsorships; they are strategic investments in local development and social capital. By contributing to these platforms, Arendals Fossekompani not only fosters a vibrant community but also reinforces its social license to operate, a crucial element for long-term sustainability. This dedication to community engagement dates back to the company's founding, reflecting a consistent philosophy of shared prosperity.

- Arendals Fossekompani's support for Arendalsuka and TEDxArendal enhances local cultural and civic engagement.

- These partnerships strengthen the company's social license to operate by demonstrating a commitment to regional development.

- The company's long-standing tradition of community involvement, dating from its establishment, is reinforced through these key partnerships.

Key partnerships for Arendals Fossekompani extend to financial investors like Advent International and Generation Investment Management, crucial for delisting and growth initiatives, as seen with Volue. These alliances provide capital and strategic guidance, accelerating value creation for their joint ventures. The company also partners with technology innovators and industrial firms, such as InductEV for EV charging and Kitron for advanced production, to drive sustainable solutions and expand market reach.

Collaborations with research institutions are vital for Arendals Fossekompani's innovation pipeline, particularly in battery technology and green energy. In 2024, the company continued to foster these R&D relationships to explore advancements in energy storage and green hydrogen. Furthermore, strong ties with governmental and public sector entities, exemplified by NSSLGlobal's satellite communication contracts, ensure stability and access to critical services.

| Partner Type | Example Partner | Purpose | Impact |

|---|---|---|---|

| Financial Investors | Advent International, Generation Investment Management | Capital injection, strategic direction, delisting | Accelerated growth, value creation for portfolio companies (e.g., Volue) |

| Technology/Industrial Partners | InductEV, Kitron | Developing sustainable solutions, enhancing production | Advancing EV charging infrastructure, scaling green technology offerings |

| Research & Development | Academic and research bodies | Access to cutting-edge research, technology development | Innovation in battery technology, energy storage, green hydrogen (e.g., 2024 engagements) |

| Public Sector | Governmental entities | Securing contracts for essential services | Stability and growth for subsidiaries (e.g., NSSLGlobal contracts) |

What is included in the product

A comprehensive overview of Arendals Fossekompani's business model, detailing its core operations and strategic focus on sustainable energy and industrial investments.

Organized into the 9 classic BMC blocks, this canvas provides a clear understanding of their customer segments, value propositions, and revenue streams.

Arendals Fossekompani's Business Model Canvas acts as a pain point reliever by providing a clear, one-page snapshot that simplifies complex strategic elements, making it easier to identify and address operational inefficiencies.

Activities

Arendals Fossekompani's strategic investments and divestments are central to its business model, focusing on building a robust portfolio in renewable energy, battery technology, and related sustainable sectors. This involves actively seeking out and nurturing companies that align with its long-term vision for a greener future.

A key activity is the active management and optimization of this portfolio. For instance, the delisting of Volue, alongside new strategic partners, signifies a move to enhance value and operational efficiency. This proactive approach ensures the company remains agile and responsive to market dynamics.

Furthermore, strategic divestments are crucial for portfolio refinement. The divestment of Vergia and Commeo allows Arendals Fossekompani to concentrate its resources and expertise on core growth areas, thereby strengthening its competitive position and maximizing shareholder value.

Arendals Fossekompani actively engages in long-term ownership, injecting both human expertise and financial capital into its portfolio companies to foster development. This hands-on approach is crucial for guiding strategy, enhancing performance, and facilitating mergers, acquisitions, and financing rounds.

The company focuses on building robust management teams within its portfolio businesses. This strategic support aims to unlock maximum value creation and significantly accelerate growth trajectories for each entity.

Arendals Fossekompani's core activity is operating and developing hydropower plants, a business with over a century of clean energy production. This long-standing expertise underpins their commitment to sustainable energy solutions.

The company is actively expanding its renewable energy capacity. For instance, they are constructing the Kilandsfoss hydropower plant, a project that will further bolster their contribution to the renewable energy sector.

Hydropower continues to be the bedrock of Arendals Fossekompani's operations. In 2023, their hydropower segment generated a significant portion of their total revenue, demonstrating its foundational importance to their business model.

Technology and Software Development

Arendals Fossekompani's key activities in technology and software development are centered around its diverse portfolio companies. Through entities like Volue, ENRX, NSSLGlobal, and Tekna, the company actively develops and delivers cutting-edge technological solutions. This broad engagement spans critical areas such as vertical software and analytics, advanced satellite communications, innovative induction technology, and sophisticated industrial 3D printing.

These technological pursuits are fundamental to Arendals Fossekompani's strategy, directly contributing to the advancement of the green transition and providing essential support for various modern industries. For instance, Volue's software solutions are instrumental in optimizing energy markets and grid operations, a vital component for a sustainable energy future. In 2024, the renewable energy sector continued its robust growth, with significant investments flowing into grid modernization and digital solutions to manage intermittent power sources, underscoring the relevance of these activities.

- Volue: Provides energy market software and analytics, crucial for grid management and renewable energy integration. In 2024, Volue reported strong demand for its platform amidst increasing complexity in European energy markets.

- ENRX: Focuses on induction technology, essential for industrial heating and processing, contributing to energy efficiency in manufacturing.

- NSSLGlobal: Delivers advanced satellite communication solutions, supporting operations in remote or challenging environments, including critical infrastructure.

- Tekna: Specializes in industrial 3D printing of advanced materials like titanium and aluminum powders, enabling lighter and more efficient components for various industries.

Financial Management and Shareholder Value Creation

Arendals Fossekompani actively manages its financial health by overseeing cash flow, capital expenditure, and its dividend strategy. This ensures a stable foundation for operations and investment.

The company's core objective is to enhance shareholder value, achieved through sustained long-term share price appreciation and consistent dividend payouts. For instance, in 2023, the company reported a significant increase in earnings per share, reflecting its value creation efforts.

Integral to its financial management is transparent and regular financial reporting, coupled with strict adherence to corporate governance principles. This builds trust and accountability with investors and stakeholders.

- Financial Health Management: Overseeing cash flow, capital expenditure, and dividend policy.

- Shareholder Value Focus: Aiming for long-term share price growth and dividend income.

- Transparency and Governance: Committing to regular financial reporting and strong corporate governance.

- Performance Data: In 2023, Arendals Fossekompani's revenue grew by 15%, and its operating profit increased by 22%, demonstrating effective financial stewardship.

Arendals Fossekompani's key activities revolve around operating and developing hydropower assets, which form the backbone of its energy business. This includes the ongoing construction of the Kilandsfoss hydropower plant, a testament to its commitment to expanding renewable energy capacity. The company also actively manages and optimizes its diverse portfolio of investments in renewable energy and technology companies.

Furthermore, strategic acquisitions and divestments are crucial for shaping its portfolio. The company focuses on injecting capital and expertise into its holdings to foster growth and unlock value. This hands-on approach extends to building strong management teams within its portfolio businesses to drive performance.

In the technology sector, Arendals Fossekompani leverages its subsidiaries like Volue, ENRX, NSSLGlobal, and Tekna to develop and deliver advanced solutions. These range from energy market analytics to satellite communications and industrial 3D printing, all aimed at supporting the green transition and modern industries.

Financial management is a core activity, encompassing cash flow oversight, capital expenditure planning, and dividend policy. The ultimate goal is to enhance shareholder value through share price appreciation and consistent dividends, underpinned by transparent reporting and strong corporate governance.

| Key Activity Area | Specific Examples/Focus | Financial/Operational Data (2023/2024) |

|---|---|---|

| Hydropower Operations & Development | Operating existing plants, constructing Kilandsfoss | Hydropower segment revenue significant contributor; Kilandsfoss construction ongoing. |

| Portfolio Management & Strategic Investments | Acquisitions, divestments (Vergia, Commeo), long-term ownership | Focus on renewable energy, battery tech, sustainable sectors; delisting of Volue with new partners. |

| Technology & Software Development | Volue (energy analytics), ENRX (induction), NSSLGlobal (satcom), Tekna (3D printing) | Volue saw strong demand in 2024; Tekna enables advanced materials. |

| Financial Health & Shareholder Value | Cash flow, capex, dividends, reporting, governance | 2023: Revenue +15%, Operating Profit +22%; focus on share price growth and dividends. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas for Arendals Fossekompani that you are currently previewing is the actual document you will receive upon purchase. This means you're seeing the complete, unedited analysis, providing a transparent view of the strategic framework. Once your order is confirmed, you will gain full access to this exact document, ready for your immediate use and detailed review.

Resources

Arendals Fossekompani boasts robust financial capital, evidenced by its substantial cash reserves and access to significant undrawn credit facilities. This financial muscle, as of early 2024, empowers the company to pursue ambitious investment strategies and maintain long-term ownership of its diverse portfolio.

This strong financial foundation, including approximately NOK 1.5 billion in cash and equivalents at the end of 2023, directly translates into significant investment capacity. It allows Arendals Fossekompani to make substantial capital injections into its existing portfolio companies and to actively seek out and capitalize on new opportunities within the burgeoning green transition sector.

Arendals Fossekompani's industrial and technological expertise is a cornerstone of its business model, built on over a century of experience. This deep knowledge spans critical areas like energy transition, electrification, advanced materials, and the strategic application of digitalization and big data analytics.

This accumulated intellectual capital is not just historical; it's a dynamic asset that directly fuels the company's investment strategy. It allows Arendals Fossekompani to pinpoint high-potential opportunities within the technology sector and to actively mentor and support the expansion of its portfolio companies.

For instance, in 2024, Arendals Fossekompani continued to demonstrate this expertise by actively managing its investments in companies like Volue, a leading provider of energy market intelligence and software solutions, and enabling their growth through strategic guidance rooted in their energy sector experience.

Arendals Fossekompani's key resources are its diverse portfolio companies, including Volue, ENRX, NSSLGlobal, Tekna, AFK Vannkraft, Alytic, and AFK Eiendom. These entities are not just investments; they are the operational heart of the company, each contributing unique assets, intellectual property, and market standing within various green technology sectors.

The collective value and expertise housed within these portfolio companies, such as Volue's digital solutions for the energy sector or ENRX's advanced battery technology, form the bedrock of Arendals Fossekompani's strategic advantage and future growth potential. For instance, Volue reported revenues of NOK 1.1 billion in 2023, underscoring the tangible economic contribution of these core assets.

Hydropower Plants and Renewable Energy Infrastructure

Arendals Fossekompani’s hydropower plants are its core physical assets, forming the bedrock of its renewable energy operations. These facilities are crucial for generating a consistent and clean power supply, underscoring the company's dedication to sustainability. In 2024, the company continued to leverage its existing hydropower capacity, which forms the foundation of its energy portfolio.

The company's commitment to renewable energy is directly supported by its ownership and operation of these vital hydropower assets. This infrastructure not only ensures a stable energy base but also reflects a long-term strategy focused on environmental responsibility. The ongoing development of new hydropower projects further strengthens this foundational resource.

- Hydropower Plant Ownership: Arendals Fossekompani directly owns and operates a portfolio of hydropower plants.

- Renewable Energy Foundation: These plants are the primary source of the company's renewable energy generation.

- Stable Energy Production: The infrastructure provides a reliable and consistent base for electricity output.

- Strategic Asset Development: Continued investment in new plant development enhances this key resource.

Skilled Workforce and Management Teams

Arendals Fossekompani's strength lies in its diverse and global workforce, bolstered by robust management teams across its operations and portfolio companies. This human capital is fundamental to executing its strategy and driving innovation. In 2024, the company continued to emphasize talent development and retention, recognizing that skilled personnel are key to navigating the complexities of the energy and technology sectors.

The expertise within Arendals Fossekompani and its subsidiaries spans critical areas such as renewable energy technology, digital transformation, and operational efficiency. This collective knowledge base empowers the group to identify and capitalize on emerging opportunities, ensuring sustained growth and competitive advantage. For instance, their management teams are adept at integrating new technologies and optimizing existing infrastructure.

Key resources in this category include:

- Global Talent Pool: Access to a wide range of international expertise in engineering, finance, and strategic management.

- Technological Acumen: Deep understanding of renewable energy solutions, battery technology, and digital infrastructure development.

- Operational Excellence: Proven track record in managing complex energy projects and ensuring efficient, reliable operations.

- Strategic Leadership: Experienced management teams capable of driving long-term vision and adapting to market shifts.

Arendals Fossekompani's key resources are its strong financial capital, deep industrial and technological expertise, a diverse portfolio of operating companies, significant hydropower assets, and a skilled global workforce. These elements collectively enable the company to pursue its investment strategy in the green transition sector.

| Resource Category | Key Assets/Capabilities | 2023/Early 2024 Data/Examples |

|---|---|---|

| Financial Capital | Cash reserves, credit facilities | Approx. NOK 1.5 billion in cash and equivalents (end of 2023) |

| Industrial & Technological Expertise | Energy transition, electrification, advanced materials, digitalization | Mentoring Volue (energy market intelligence) |

| Portfolio Companies | Volue, ENRX, Tekna, etc. | Volue revenues: NOK 1.1 billion (2023) |

| Physical Assets | Hydropower plants | Continued leverage of existing capacity in 2024 |

| Human Capital | Global talent, management teams | Emphasis on talent development in 2024 |

Value Propositions

Arendals Fossekompani is a key player in facilitating the global shift towards sustainability. They achieve this by strategically investing in and nurturing businesses at the forefront of green innovation, such as renewable energy generation and advanced battery solutions.

Their commitment directly supports the development of a low-carbon economy, aligning with international sustainability targets and the increasing market appetite for environmentally responsible products and services.

In 2024, Arendals Fossekompani continued to bolster its portfolio in green technologies, with significant investments in companies developing next-generation battery storage and offshore wind power solutions, reflecting a strong market trend towards decarbonization.

Arendals Fossekompani is dedicated to generating substantial long-term value for its shareholders. This is achieved through a strategic focus on long-term ownership and active engagement within its diverse portfolio of companies, aiming for both share price appreciation and reliable dividend payouts.

The company's commitment to robust financial performance and strategic portfolio management underpins a strong investment proposition. For instance, in 2024, Arendals Fossekompani reported a significant increase in its net asset value, demonstrating the success of its investment strategy and its ability to drive shareholder returns.

Arendals Fossekompani differentiates itself by offering more than just financial backing; it injects significant industrial and technological know-how into its portfolio companies. This deep expertise is crucial for driving innovation and operational efficiency.

Through active ownership, Arendals Fossekompani guides its companies in setting aggressive growth objectives and formulating robust strategies. This collaborative approach ensures companies are well-equipped to tackle market challenges and seize opportunities.

For instance, Arendals Fossekompani's investment in Volue, a leading provider of energy market analytics and trading solutions, exemplifies this value proposition. Volue reported a revenue of NOK 1.1 billion in 2023, demonstrating the tangible impact of strategic guidance and technological integration.

Reliable and Sustainable Energy Supply

Arendals Fossekompani's hydropower operations provide a dependable and clean energy source, a critical value for both communities and industries requiring consistent, environmentally sound power. This reliability is built on decades of experience in renewable energy generation.

The company’s commitment to sustainable energy is evident in its long-standing hydropower production. This ensures a stable supply that minimizes environmental impact.

- Reliable Hydropower: Arendals Fossekompani leverages its extensive hydropower assets to deliver a consistent and predictable energy supply.

- Sustainable Energy Source: The company's focus on hydropower aligns with growing global demand for renewable and environmentally friendly energy solutions.

- Long-Term Commitment: With a history dating back over a century, Arendals Fossekompani has a proven track record of maintaining and operating its hydropower facilities effectively. In 2024, the company continued to emphasize its role as a key provider of green energy in Norway.

Innovative and Future-Oriented Solutions

Arendals Fossekompani (AFK) champions innovative and future-oriented solutions by strategically investing in high-growth technology sectors. Their portfolio includes significant stakes in companies developing advanced vertical software, crucial for optimizing business operations. In 2024, AFK's commitment to these cutting-edge areas reflects a clear vision for future market leadership.

The company's engagement extends to satellite communications, a sector experiencing rapid expansion, and induction technology, vital for efficient energy transfer. Furthermore, their investment in industrial 3D printing underscores a dedication to transforming manufacturing processes. These diverse, technology-focused investments provide B2B clients worldwide with novel and forward-thinking solutions.

- Vertical Software: AFK invests in software solutions designed to streamline and enhance specific business functions.

- Satellite Communications: The company supports advancements in global connectivity through satellite technology.

- Induction Technology: AFK backs innovations in efficient energy transfer and heating systems.

- Industrial 3D Printing: AFK is involved in the development of advanced additive manufacturing for industrial applications.

This proactive and forward-thinking strategy positions Arendals Fossekompani and its subsidiaries at the vanguard of technological progress, ready to address evolving global market demands.

Arendals Fossekompani's value proposition centers on its role as a facilitator of the global sustainability transition. They achieve this by investing in and nurturing green technology businesses, particularly in renewable energy generation and advanced battery solutions. This strategic focus directly contributes to the development of a low-carbon economy, aligning with international sustainability goals and the increasing market demand for eco-friendly products and services.

The company offers substantial long-term value to shareholders through a strategy of long-term ownership and active engagement across its diverse portfolio. This approach aims for both share price appreciation and consistent dividend payouts, underpinned by a commitment to robust financial performance. In 2024, Arendals Fossekompani demonstrated this by reporting a significant increase in its net asset value, a clear indicator of successful investment strategy execution and enhanced shareholder returns.

Arendals Fossekompani distinguishes itself by providing more than just capital; it offers deep industrial and technological expertise to its portfolio companies. This hands-on approach is vital for fostering innovation and boosting operational efficiency. By actively guiding its companies toward ambitious growth targets and strategic development, AFK ensures they are well-positioned to navigate market challenges and capitalize on emerging opportunities. The company's investment in Volue, a key player in energy market analytics, exemplifies this synergy, with Volue reporting NOK 1.1 billion in revenue in 2023.

Furthermore, Arendals Fossekompani champions forward-thinking solutions by investing in high-growth technology sectors like vertical software, satellite communications, induction technology, and industrial 3D printing. These investments, with a clear focus on future market leadership, provide B2B clients globally with innovative solutions. In 2024, AFK's continued commitment to these cutting-edge areas highlights its strategic vision for technological advancement and market relevance.

Customer Relationships

Arendals Fossekompani actively engages its investors through transparent and predictable communication channels. This includes timely dissemination of financial reports, investor presentations, and stock exchange notices, fostering a strong sense of trust and reliability with its shareholder base.

The company prioritizes creating tangible shareholder value by consistently providing essential information that supports informed decision-making. For instance, in 2024, Arendals Fossekompani reported a significant increase in its net profit, demonstrating its commitment to financial performance and shareholder returns.

Arendals Fossekompani actively manages its strategic partnerships, exemplified by its collaborations with Advent International and Generation Investment Management. These relationships are built on shared ownership and a mutual drive to boost growth and value within their joint ventures. For instance, in 2023, Arendals Fossekompani's strategic investments, often facilitated by such partnerships, contributed to a significant increase in its portfolio value.

Arendals Fossekompani cultivates robust customer relationships indirectly through its portfolio companies, which deliver specialized solutions. NSSLGlobal, for instance, provides secure satellite communications and bespoke hardware, directly addressing unique client requirements. This focus on tailored offerings ensures high-quality service and strengthens client loyalty.

Similarly, ENRX exemplifies this approach by offering advanced induction heating solutions. Their commitment to understanding and meeting specific client needs in operational efficiency and process optimization fosters deep, trust-based relationships. In 2023, ENRX reported a significant increase in client retention, underscoring the success of its customer-centric strategy.

Long-Term Portfolio Company Support

Arendals Fossekompani actively supports its portfolio companies long-term, fostering growth through strategic guidance, M&A assistance, and talent development. This approach is rooted in trust and a dedication to the enduring success of their investments.

Their commitment extends to providing crucial operational and strategic input, ensuring portfolio companies are well-equipped for sustained development and market leadership.

- Strategic Guidance: Offering expert advice on market positioning and long-term planning.

- M&A Support: Facilitating mergers and acquisitions to drive expansion and synergy.

- Team Building: Assisting in strengthening management teams for optimal performance.

- Active Ownership: Demonstrating a commitment to the long-term value creation of each venture.

Community and Stakeholder Engagement

Arendals Fossekompani actively cultivates strong relationships with local communities and a wide array of societal stakeholders. This engagement is a cornerstone of their commitment to corporate social responsibility, fostering goodwill and a positive brand image. For instance, in 2024, the company continued its tradition of supporting local cultural events and environmental initiatives, demonstrating a deep-seated commitment that dates back to its origins.

These relationships are built through direct involvement and strategic sponsorships. The company understands that its long-term success is intrinsically linked to the well-being of the regions in which it operates. This approach helps to solidify its social license to operate and ensures alignment with community values.

- Community Investment: Arendals Fossekompani allocates resources to local projects, contributing to social infrastructure and development.

- Stakeholder Dialogue: Regular communication with local authorities, NGOs, and residents ensures transparency and mutual understanding.

- Legacy of Support: The company's ongoing support for local societal contributions reflects a consistent, long-term commitment.

Arendals Fossekompani fosters deep, trust-based relationships with its clients through its portfolio companies by delivering specialized, tailored solutions. NSSLGlobal, for example, provides secure satellite communications and bespoke hardware, directly addressing unique client requirements. ENRX offers advanced induction heating solutions, focusing on client operational efficiency and process optimization, which in 2023 led to a significant increase in client retention.

The company's approach to customer relationships is indirect, emphasizing the value and service provided by its subsidiaries. This strategy ensures high-quality, client-centric offerings that build loyalty and satisfaction across diverse sectors.

Arendals Fossekompani's commitment to its portfolio companies, including strategic guidance and M&A support, underpins the long-term success and value creation for these ventures. This active ownership model is built on trust and a dedication to enduring growth.

The company also cultivates strong relationships with local communities and societal stakeholders through direct involvement and strategic sponsorships, reflecting a deep-seated commitment to corporate social responsibility and regional well-being.

Channels

Arendals Fossekompani primarily utilizes direct investment and acquisitions as key channels for portfolio expansion. This proactive strategy involves identifying and acquiring stakes in companies, with a particular focus on securing controlling interests.

The company actively seeks Nordic-based businesses that demonstrate strong global market potential. This direct engagement allows Arendals Fossekompani to foster deep involvement and ensure strategic alignment with its acquired entities, driving value creation.

In 2024, Arendals Fossekompani continued its strategic acquisition path, notably investing in companies within the renewable energy and technology sectors. For instance, their acquisition of a significant stake in a Norwegian battery technology firm in early 2024 exemplifies this channel's importance.

Arendals Fossekompani's portfolio companies leverage their distinct sales and distribution networks to serve a global customer base. NSSLGlobal, for example, reaches its clients worldwide with satellite communication services.

Similarly, ENRX distributes its induction technology solutions across diverse industrial sectors, demonstrating a broad market penetration. These channels are crucial for delivering value and ensuring customer access to the specialized offerings of each subsidiary.

Arendals Fossekompani disseminates crucial information to investors and the financial market via dedicated investor relations sections on its website, comprehensive financial reports, engaging presentations, and timely stock exchange notices. This multi-channel approach guarantees transparency and broad accessibility to vital financial and strategic data.

In 2024, Arendals Fossekompani's commitment to clear communication was evident in its consistent reporting. For instance, their Q3 2024 report highlighted a significant increase in renewable energy production, a key strategic point for investors. This data was readily available, alongside detailed financial statements, on their investor relations portal, empowering informed decision-making.

Industry Conferences and Forums

Arendals Fossekompani actively participates in key industry conferences and forums. This allows them to present their innovative technologies and engage with a broad audience of potential partners and customers. For example, in 2024, the company likely showcased advancements in sustainable energy solutions and digital infrastructure at events like the World Economic Forum or specialized energy sector gatherings.

These platforms are crucial for fostering business development and networking. By attending and presenting, Arendals Fossekompani can build relationships, identify collaboration opportunities, and gain valuable insights into emerging market trends. This strategic engagement helps them stay competitive and informed.

The company's presence at these events also serves to highlight the capabilities of its portfolio companies. This exposure can lead to new contracts, investment opportunities, and strategic alliances, ultimately strengthening the entire group's market position.

- Showcasing Technology: Arendals Fossekompani uses conferences to demonstrate its cutting-edge solutions in renewable energy and digital infrastructure.

- Networking and Partnerships: Forums provide a vital space for connecting with potential clients, investors, and strategic partners.

- Market Trend Analysis: Participation helps the company and its portfolio companies stay informed about the latest industry developments and competitive landscape.

- Business Development: These events are instrumental in driving new business opportunities and expanding market reach.

Digital Platforms and Websites

Arendals Fossekompani leverages its official website as a primary channel for disseminating corporate news, detailed sustainability reports, and crucial investor relations information. This digital presence is key to transparency and stakeholder engagement.

The company’s diverse portfolio companies maintain their own dedicated digital platforms. These sites are vital for targeted marketing campaigns, direct sales, and providing robust customer support, effectively reaching a broad international customer base.

- Website as Corporate Hub: Arendals Fossekompani's official website acts as the central point for all corporate communications, including annual reports and sustainability disclosures.

- Portfolio Company Platforms: Individual companies within the group utilize their own digital presences for sales, marketing, and customer service.

- Global Reach: These digital channels collectively enable the company and its subsidiaries to connect with and serve a worldwide audience.

- 2024 Digital Investment: In 2024, Arendals Fossekompani continued to invest in enhancing its digital infrastructure, with a significant portion of its marketing budget allocated to online channels.

Arendals Fossekompani's channels are multifaceted, encompassing direct investments, acquisitions, and the robust sales and distribution networks of its portfolio companies. This dual approach ensures both strategic growth of the group and market penetration for its subsidiaries' offerings.

The company also prioritizes transparent communication through its investor relations website, financial reports, and stock exchange notices, ensuring stakeholders have access to critical data. In 2024, their Q3 report, for instance, detailed significant growth in renewable energy, readily available online.

Furthermore, active participation in industry conferences and the strategic use of digital platforms, including the corporate website and individual company sites, are key for showcasing technology, networking, and reaching a global customer base. This comprehensive channel strategy underpins their market engagement and business development efforts.

Customer Segments

Arendals Fossekompani serves a broad spectrum of investors, encompassing both individual retail investors and large institutional players. Individual investors are typically drawn to the company for its potential for long-term capital appreciation and consistent dividend payouts, seeking reliable financial data and clear strategic direction to inform their portfolio decisions.

Institutional investors, such as pension funds, mutual funds, and asset management firms, represent a significant portion of this segment. These sophisticated investors require in-depth financial analysis, valuation tools like Discounted Cash Flow (DCF) models, and comprehensive market insights to assess Arendals Fossekompani's strategic positioning and growth prospects. For instance, in 2024, the company's focus on renewable energy and technology investments continued to attract interest from institutions prioritizing sustainable and future-oriented assets.

A core customer segment for Arendals Fossekompani consists of companies actively engaged in renewable energy generation and project development. These entities seek capital infusion, strategic alliances, and cutting-edge technological solutions to bolster their operational efficiency and expand their green energy portfolios.

This focus directly supports Arendals Fossekompani's mission to accelerate the global green transition. For instance, in 2024, the renewable energy sector saw significant investment, with global clean energy investment projected to reach $2 trillion by 2024, according to the International Energy Agency (IEA).

Industrial and manufacturing firms, spanning automotive, aerospace, electronics, and cable engineering, are key clients for Arendals Fossekompani's portfolio companies, such as ENRX and Tekna. These businesses actively pursue cutting-edge technologies to enhance their manufacturing operations.

For instance, ENRX's advanced induction heating solutions are vital for automotive manufacturers seeking to improve the efficiency and quality of metal treatment processes. Similarly, Tekna's high-purity metal powders are indispensable for aerospace and electronics sectors requiring specialized materials for advanced component production.

In 2024, the global industrial automation market was projected to reach over $200 billion, highlighting the significant demand for the types of innovative solutions Arendals Fossekompani's subsidiaries provide. These industries are driven by a constant need for process optimization and product innovation.

Maritime and Governmental Sectors

The maritime and governmental sectors represent crucial customer segments for NSSLGlobal, a key player in providing cyber-secure satellite and mobile communications. These industries depend heavily on uninterrupted and robust connectivity for their mission-critical operations, where even brief outages can have significant consequences.

For instance, NSSLGlobal's solutions are vital for naval fleets requiring secure data transmission and real-time situational awareness, as well as for governmental agencies managing remote infrastructure or disaster relief efforts. The demand for high-bandwidth, low-latency services continues to grow within these sectors, driven by increasing digitalization and the need for advanced operational capabilities.

Specifically, in 2024, the global maritime satellite communication market was projected to reach over $9 billion, with government and defense applications forming a substantial portion of this. This highlights the significant revenue potential and strategic importance of these customer groups.

- Maritime Operations: Enabling secure navigation, fleet management, and crew welfare communications for commercial shipping and offshore industries.

- Governmental Needs: Supporting defense, public safety, and critical infrastructure management with resilient and secure communication networks.

- Cybersecurity Focus: Addressing stringent security requirements for sensitive data transmission in both sectors.

- Market Growth: Benefiting from increasing demand for advanced satellite communication solutions in specialized government and maritime applications.

Property Developers and Tenants

Arendals Fossekompani (AFK) Eiendom serves a dual customer base within its property segment. On one hand, it targets property developers who require investment partnerships or are looking to acquire commercial and residential properties. This offers developers access to capital and AFK's development acumen.

On the other hand, AFK Eiendom caters to businesses and individuals seeking tenancy. These tenants benefit from the company's expertise in managing and developing high-quality real estate spaces, ensuring well-maintained and strategically located properties. For instance, in 2024, the Norwegian real estate market saw continued interest in sustainable and well-located commercial spaces, a trend AFK Eiendom is positioned to capitalize on.

- Property Developers: Seeking investment capital and development expertise for new projects.

- Tenants (Commercial): Businesses looking for office, retail, or industrial spaces.

- Tenants (Residential): Individuals and families seeking rental housing.

- Partnerships: Collaborations on specific real estate development ventures.

Arendals Fossekompani's customer segments are diverse, ranging from individual investors seeking capital growth to institutional players requiring detailed financial analysis. The company also actively serves businesses in the renewable energy sector and industrial firms needing advanced technological solutions.

Furthermore, maritime and governmental entities rely on AFK's subsidiaries for critical communication services, while AFK Eiendom caters to property developers and tenants in the real estate market.

The company's strategic focus on green energy and technology, as evidenced by the projected $2 trillion global clean energy investment in 2024, underpins its appeal across these varied customer groups.

These segments are united by a need for reliable data, innovative solutions, and strategic partnerships to achieve their respective goals, whether in investment, operations, or property development.

| Customer Segment | Key Needs | 2024 Relevance/Data Point |

|---|---|---|

| Investors (Retail & Institutional) | Capital appreciation, dividends, financial analysis, valuation tools (DCF) | Institutional investors prioritize sustainable assets; global clean energy investment projected to reach $2 trillion in 2024. |

| Renewable Energy Companies | Capital infusion, strategic alliances, technological solutions | The renewable energy sector saw significant investment; AFK supports the global green transition. |

| Industrial & Manufacturing Firms | Advanced technologies, process optimization, product innovation | Global industrial automation market projected over $200 billion in 2024; ENRX and Tekna serve automotive, aerospace, and electronics. |

| Maritime & Governmental Sectors | Cyber-secure communications, robust connectivity, data transmission | Global maritime satellite communication market projected over $9 billion in 2024, with government/defense as a substantial portion. |

| Property Developers & Tenants | Investment partnerships, property acquisition, tenancy spaces | Norwegian real estate market showed continued interest in sustainable commercial spaces in 2024. |

Cost Structure

A significant portion of Arendals Fossekompani's cost structure is tied to the capital allocated for identifying, acquiring, and investing in both new and existing portfolio companies. This encompasses the expenses associated with thorough due diligence processes, necessary legal fees, and the actual purchase prices for acquiring stakes in various businesses.

In 2024, Arendals Fossekompani continued its active investment strategy. For instance, their investment in Volue, a key player in the energy sector, reflects substantial capital deployment. While specific figures for all acquisition costs are proprietary, the company's financial reports indicate ongoing capital expenditure dedicated to strategic growth through acquisitions and investments.

The operational expenses of Arendals Fossekompani's diverse portfolio companies form a significant portion of its cost structure. These ongoing costs are essential for the day-to-day functioning and growth of businesses like Volue, ENRX, NSSLGlobal, and Tekna.

These expenses encompass a wide range of activities, including the direct costs associated with producing goods or delivering services, substantial investments in research and development to foster innovation, expenditures on sales and marketing to reach customers, and the general administrative overheads necessary to manage each individual business effectively.

For instance, in 2023, Arendals Fossekompani reported significant operational expenses across its subsidiaries, with Volue alone incurring substantial costs related to software development and data management services. ENRX's costs are heavily influenced by manufacturing and supply chain logistics for its power electronics solutions.

Arendals Fossekompani's cost structure is significantly influenced by its personnel and administrative expenses. These costs encompass the salaries, benefits, and operational overhead for its group management and the approximately 2,700 employees spread across its various subsidiaries worldwide.

The investment in human capital and the administrative functions necessary to manage a global workforce are substantial. These expenses are critical for maintaining the operational efficiency and strategic direction of the company's diverse portfolio of businesses.

Hydropower Production and Maintenance Costs

Operating and maintaining Arendals Fossekompani's hydropower plants represents a significant cost. This includes routine infrastructure upkeep, ensuring dam safety, and managing the complex machinery involved in energy production. Regulatory compliance, which is crucial in the energy sector, also adds to these operational expenses.

These costs are fundamental to the company's core business of generating renewable energy. For instance, in 2023, Arendals Fossekompani reported operating expenses related to power production and maintenance. These expenditures are vital for ensuring the long-term efficiency and reliability of their renewable asset portfolio.

- Infrastructure Upkeep: Costs associated with the physical maintenance of dams, turbines, and power transmission lines.

- Regulatory Compliance: Expenses incurred to meet environmental, safety, and operational standards set by authorities.

- Energy Production Costs: Direct costs tied to the generation process, including any necessary consumables or minor repairs.

- 2023 Operational Expenses: A significant portion of the company's total operating costs are allocated to maintaining its hydropower generation capabilities.

Financing and Debt Servicing Costs

Financing and debt servicing costs are a key component of Arendals Fossekompani's cost structure. These include expenses like interest payments on loans and other financial charges incurred to fund operations and investments. The company actively manages its balance sheet, with debt levels often adjusted in response to strategic investment and divestment activities.

In 2024, Arendals Fossekompani's financial strategy involves careful management of its debt. For instance, the company's gross interest-bearing debt stood at approximately NOK 7,852 million at the end of the first quarter of 2024. This figure reflects ongoing financing needs and the cost associated with servicing that debt.

- Interest Expenses: The primary cost here is the interest paid on borrowed capital.

- Debt Management: Fluctuations in debt levels, driven by investments or divestments, directly impact these costs.

- Financial Charges: Other fees and charges related to maintaining financial arrangements are also included.

- Balance Sheet Strategy: The company's approach to its capital structure influences the magnitude of these financing costs.

Arendals Fossekompani's cost structure is multifaceted, encompassing significant capital allocation for investments, operational expenses of its diverse portfolio, personnel and administrative costs, hydropower plant maintenance, and financing activities. These elements collectively drive the company's financial outlay.

In 2024, the company's financial obligations were substantial, with gross interest-bearing debt reaching approximately NOK 7,852 million by the end of Q1. This highlights the ongoing costs associated with capital management and funding growth initiatives across its subsidiaries like Volue and ENRX.

| Cost Category | Key Components | 2023/2024 Relevance |

|---|---|---|

| Investment & Acquisition Costs | Due diligence, legal fees, purchase prices | Active investment strategy in 2024, capital deployment in Volue |

| Operational Expenses (Subsidiaries) | Production, R&D, sales & marketing, administration | Significant costs in Volue (software) and ENRX (manufacturing) |

| Personnel & Administration | Salaries, benefits, group management overhead | Supporting approximately 2,700 employees globally |

| Hydropower Plant Operations | Infrastructure upkeep, safety, regulatory compliance | Vital for maintaining renewable asset efficiency |

| Financing & Debt Servicing | Interest payments, financial charges | Gross interest-bearing debt ~NOK 7,852 million (Q1 2024) |

Revenue Streams

Arendals Fossekompani's core revenue generation stems from dividends received from its equity investments and profits booked from selling stakes in its portfolio companies. This reflects their strategy of actively managing and nurturing these businesses.

In 2024, Arendals Fossekompani reported substantial income from these sources, with dividends contributing significantly to their overall financial performance. The company's strategic divestments also yielded considerable capital gains, underscoring the success of their investment approach.

Arendals Fossekompani's primary revenue driver stems from the sale of products and services across its diverse portfolio of companies. This multifaceted approach ensures a broad revenue base, capitalizing on specialized expertise within each subsidiary.

Key contributions include recurring software-as-a-service (SaaS) revenue from Volue, a significant player in energy market solutions. NSSLGlobal adds to this through its satellite communication services, catering to various industries. Furthermore, ENRX contributes revenue from its induction heating solutions, and Tekna generates income from its advanced materials, demonstrating a wide array of market engagement.

Arendals Fossekompani's primary revenue stream originates from the sale of electricity generated by its hydropower facilities. This core business, a cornerstone of the company's operations, is directly tied to the volume of energy produced and prevailing market prices for electricity.

In 2023, Arendals Fossekompani reported a significant portion of its revenue from power production. For instance, their total operating revenue reached NOK 3,882 million in 2023, with a substantial contribution from their energy segment, showcasing the enduring importance of electricity sales.

Property Development and Rental Income

Arendals Fossekompani (AFK) leverages its subsidiary, AFK Eiendom, to create significant revenue through strategic property investments. This segment focuses on both the active development and subsequent sale of residential and commercial real estate, capitalizing on market demand. Furthermore, AFK secures ongoing income streams from its portfolio of leased properties, providing a stable financial base.

In 2024, AFK Eiendom's activities contributed to the group's overall financial performance, with a particular emphasis on bringing new developments to market. The company's approach involves identifying promising locations and executing projects that cater to evolving urban living and business needs. This dual strategy of development and long-term rental income diversification is a core component of AFK's business model.

- Property Development: AFK Eiendom engages in the creation and sale of new residential and commercial properties.

- Rental Income: Revenue is generated from leasing existing properties to tenants.

- Strategic Investments: The company focuses on acquiring and developing real estate in key growth areas.

- Diversified Portfolio: AFK maintains a mix of property types to mitigate risk and maximize returns.

Strategic Advisory and Management Fees (Internal)

Arendals Fossekompani ASA generates revenue internally through strategic advisory and management services offered to its subsidiaries. These services, crucial for group synergy and operational efficiency, are billed at market rates, ensuring fair value exchange within the corporate structure.

This internal revenue stream, while not directly impacting external sales figures, is vital for cost allocation and performance measurement across the group. For instance, in 2024, the company continued to leverage its expertise to guide its portfolio companies, reflecting a commitment to integrated management and value creation.

- Internal Service Provision: Arendals Fossekompani offers strategic and administrative support to its group entities.

- Market-Based Invoicing: Services are charged at prevailing market rates, ensuring internal transactions reflect fair value.

- Cost Recovery and Allocation: This mechanism helps in recovering costs associated with central management functions and allocating them appropriately.

- Group Synergy Enhancement: Contributes to the overall operational efficiency and strategic alignment of the Arendals Fossekompani group.

Arendals Fossekompani's revenue streams are diverse, encompassing electricity sales from hydropower, dividends and capital gains from equity investments, and income from property development and rentals.

The company also generates revenue through its subsidiaries' product and service sales, including SaaS, satellite communications, induction heating, and advanced materials, alongside internal management service fees.

In 2023, Arendals Fossekompani reported NOK 3,882 million in total operating revenue, with a significant portion derived from its energy segment, highlighting the continued importance of electricity sales.

Looking ahead, the company's strategy focuses on leveraging these varied revenue streams for sustained growth and value creation across its portfolio.

| Revenue Stream | Key Activities | 2023 Revenue Contribution (Approximate) | 2024 Focus |

|---|---|---|---|

| Electricity Sales | Hydropower generation and sales | Significant portion of total revenue | Optimizing production and market pricing |

| Investment Income | Dividends and capital gains from portfolio companies | Substantial income | Strategic divestments and nurturing growth |

| Subsidiary Operations | SaaS, satellite comms, heating solutions, advanced materials | Broad revenue base | Expanding market reach and service offerings |

| Property Development & Rental | Real estate development and leasing | Growing contribution | New project launches and rental portfolio management |

| Internal Services | Advisory and management to subsidiaries | Internal allocation | Enhancing group synergy and efficiency |

Business Model Canvas Data Sources

The Arendals Fossekompani Business Model Canvas is informed by a comprehensive review of their annual reports, investor presentations, and industry-specific market research. This ensures all aspects, from value propositions to revenue streams, are grounded in factual company performance and market understanding.