Arendals Fossekompani Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Arendals Fossekompani Bundle

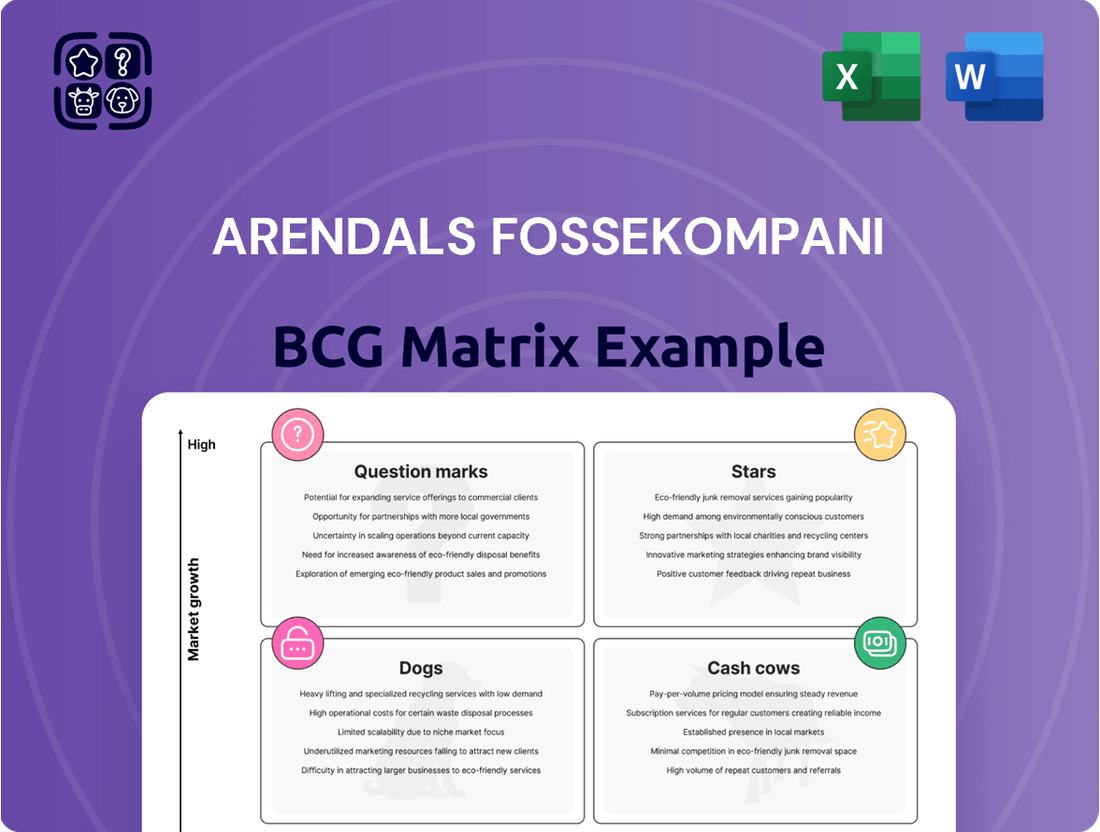

Curious about Arendals Fossekompani's market standing? Our BCG Matrix preview highlights key product categories, but to truly unlock strategic growth, you need the full picture. Understand which of their ventures are Stars, Cash Cows, Dogs, or Question Marks and gain actionable insights.

Don't miss out on the detailed analysis that powers informed decisions. Purchase the complete Arendals Fossekompani BCG Matrix to receive a comprehensive breakdown, including data-driven recommendations and a clear roadmap for optimizing their portfolio and future investments.

Stars

Volue stands out as a star performer within Arendals Fossekompani's portfolio, driven by robust growth in the burgeoning energy software market. Its Software as a Service (SaaS) revenue experienced an impressive 42% year-on-year surge in the first quarter of 2025, underscoring its strong market position and the increasing demand for its solutions.

The company's strategic focus on investing in its SaaS platform and expanding into new geographical territories, particularly capitalizing on the global green transition, is yielding significant results. Volue achieved 13% year-on-year revenue growth and notable margin expansion, solidifying its leadership in the energy software sector.

To further accelerate its growth trajectory and unlock greater value, Volue was delisted from the stock exchange in 2024. This move, supported by new partners Advent International and Generation Investment Management, aims to provide the company with the flexibility and resources needed to pursue ambitious expansion plans and innovation in the rapidly evolving energy technology landscape.

AFK Vannkraft, Arendals Fossekompani's hydropower segment, is a bedrock of stability. In 2023, this segment achieved an operating profit of NOK 666 million, showcasing its consistent performance. The mature nature of the hydropower market ensures a reliable cash flow, even with occasional power price volatility.

This stability is further reinforced by ongoing strategic investments. The development of Kilandsfoss, projected to add 38 GWh of annual production, highlights AFK Vannkraft's dedication to maintaining and growing its dependable asset base. This commitment ensures continued strong revenue streams for the company.

NSSLGlobal, a key player in secure satellite communications, achieved record-high results in 2024, underscoring its robust market standing. The company maintained a solid operating margin, a testament to its efficient operations and strong demand for its specialized services.

Significant new contract wins, particularly within the government and maritime sectors, highlight NSSLGlobal's continued relevance and ability to secure critical business. These agreements reflect the growing need for secure, reliable connectivity in demanding environments.

While a transition in the airtime revenue model is expected to influence margins, NSSLGlobal's substantial contract pipeline, including a notable win with a major European government agency valued at over €50 million, demonstrates its enduring market share and growth potential.

Alytic

Alytic, a key player in Arendals Fossekompani's portfolio, is demonstrating robust expansion. Its Annual Recurring Revenue (ARR) across its companies hit NOK 61 million, marking a significant 40% surge from the previous year's first quarter. This upward trajectory highlights Alytic's increasing market relevance.

The strength of Alytic is underscored by the performance of its individual portfolio companies. Kontali, Veyt, Factlines, and Utel all experienced substantial year-on-year ARR growth, collectively contributing to Alytic's overall success. This widespread growth across its subsidiaries indicates a healthy and expanding business model.

Given the accelerating digitalization trend, Alytic's consistent performance positions it as a potentially major asset for Arendals Fossekompani. The company's ability to drive adoption of its data analytics and software solutions suggests a promising future, capable of significantly boosting the parent company's market standing.

- Alytic's ARR reached NOK 61 million, a 40% increase year-on-year.

- All four portfolio companies (Kontali, Veyt, Factlines, Utel) showed strong ARR growth.

- This growth reflects Alytic's potential in the digitalizing market.

- Alytic is poised to become a significant contributor to Arendals Fossekompani's portfolio.

Tekna's Materials Business

Tekna's Materials business is a significant contributor to Arendals Fossekompani's portfolio, showcasing robust growth and market potential. In the first quarter of 2025, this segment achieved a 7% increase in revenue compared to the same period in the previous year. This expansion is further underscored by a substantial 73% rise in total order intake, signaling strong market demand.

The surge in orders is directly linked to the increasing popularity of Tekna's advanced materials, available in both small and large particle sizes. These materials are particularly sought after for emerging applications such as 3D printing, a sector experiencing rapid advancement and adoption. Tekna's success here highlights its strategic positioning in a high-growth market.

Key performance indicators for Tekna's Materials business in Q1 2025 include:

- 7% year-on-year revenue growth.

- 73% increase in total order intake compared to Q1 2024.

- Strong demand for both small and large particle-sized materials.

- Significant traction in the high-growth 3D printing market.

Volue, Arendals Fossekompani's energy software arm, is a clear star in the BCG matrix. Its Software as a Service (SaaS) revenue saw a remarkable 42% year-on-year increase in Q1 2025, demonstrating strong market demand. The company's strategic investments in its platform and global expansion, especially within the green transition, have led to 13% revenue growth and improved margins.

The delisting of Volue in 2024, supported by new partners Advent International and Generation Investment Management, signals a strategic move to foster further growth and innovation in the rapidly evolving energy technology sector. This focus on expansion and technological advancement solidifies Volue's position as a high-growth, high-market-share asset for Arendals Fossekompani.

| Segment | BCG Category | Key Performance Indicator (Q1 2025 unless stated) | Notes |

| Volue | Star | 42% YoY SaaS Revenue Growth | Delisted in 2024 to enable accelerated growth. |

| Alytic | Star | 40% YoY ARR Growth (NOK 61 million) | Strong performance across all subsidiaries. |

| Tekna Materials | Star | 7% YoY Revenue Growth, 73% Order Intake Increase | Benefiting from demand in 3D printing. |

| NSSLGlobal | Cash Cow | Record-high results in 2024, solid operating margin | Secured over €50 million contract with a European government agency. |

| AFK Vannkraft | Cash Cow | NOK 666 million operating profit (2023) | Stable cash flow from hydropower operations. |

What is included in the product

Arendals Fossekompani's BCG Matrix offers tailored analysis for its product portfolio, highlighting which units to invest in, hold, or divest.

A clear BCG Matrix visualizes Arendals Fossekompani's portfolio, relieving the pain of strategic uncertainty.

This optimized BCG Matrix provides a quick, actionable overview for decisive leadership.

Cash Cows

AFK Vannkraft, Arendals Fossekompani's hydropower division, is a quintessential cash cow. It consistently delivers robust revenue and operating profit within the mature and stable hydropower market. For instance, in 2023, the company reported that its hydropower segment contributed significantly to its overall financial performance, with a steady operational output from its existing facilities.

Despite potential fluctuations in electricity prices, the inherent stability of hydropower infrastructure and its long-term operational profile guarantee a predictable and reliable cash flow. This segment is the bedrock of AFK's financial stability, providing the essential capital needed for other ventures.

The company's ongoing commitment to its two operational hydropower plants, alongside strategic investments such as the Kilandsfoss project, reinforces AFK Vannkraft's role as a dependable income generator. This stable income stream is crucial for funding the company's growth and development initiatives.

NSSLGlobal, a key player within Arendals Fossekompani's portfolio, demonstrated exceptional performance in 2024, achieving record-high results and maintaining a robust operating margin. This strong financial standing solidifies its position as a cash cow.

The company commands a significant market share by offering secure satellite and mobile communication solutions across corporate, government, and maritime industries. This established presence provides a stable foundation for its revenue streams.

Despite potential evolutions in revenue models, NSSLGlobal's loyal customer base and the predictable nature of its recurring service contracts ensure consistent cash flow generation. The mature market position also means that promotional investments remain relatively low, further contributing to its cash-generating efficiency.

AFK Eiendom, as part of Arendals Fossekompani's portfolio, functions as a Cash Cow. These property investments are characterized by their stability in a mature market, consistently generating rental income and offering potential for long-term capital appreciation.

This predictable cash flow requires minimal ongoing investment compared to more volatile growth sectors. For instance, Arendals Fossekompani's involvement in constructing new facilities, such as the one for Kitron Arendal, highlights a strategic approach to asset enhancement, ensuring sustained and stable returns from its property division.

Established Software Solutions within Volue

Within Volue, certain established software solutions, especially those with significant Annual Recurring Revenue (ARR) and Software-as-a-Service (SaaS) models, function as cash cows. These mature offerings in the energy and power grid sectors generate consistent and predictable income, bolstered by high profit margins stemming from their recurring revenue and widespread market acceptance.

Volue's strategic emphasis on enhancing margins across its portfolio indicates a deliberate effort to maximize cash generation from these dependable, established software products. This focus ensures these mature solutions continue to be significant contributors to the company's overall financial strength.

- High ARR and SaaS: Mature software solutions with substantial Annual Recurring Revenue (ARR) and Software-as-a-Service (SaaS) delivery models are core cash cows.

- Stable Revenue Streams: These established products in the energy and power grid sectors provide predictable and reliable income.

- Profit Margin Optimization: Volue's strategy aims to expand margins on these offerings, maximizing cash flow.

ENRX's Core Industrial Heating Business

ENRX's core industrial heating business, a key component of Arendals Fossekompani's portfolio, has demonstrated remarkable resilience. Despite facing market headwinds in 2024, this segment achieved record-high annual revenue and operating profit. This performance underscores its position as a stable cash generator.

Serving mature industrial markets, ENRX's industrial heating division likely holds a substantial market share. Its established customer base and proven product offerings contribute to its strong cash flow generation capabilities, a hallmark of a cash cow.

While current market conditions pose challenges, the inherent strength of ENRX's core business is undeniable. The company's focus on enhancing operational capabilities further positions this segment to capitalize on market stabilization and continue its role as a significant cash contributor.

- 2024 Record Revenue: ENRX's industrial heating segment posted record annual revenue in 2024, exceeding previous benchmarks.

- Strong Operating Profit: The business also achieved its highest-ever operating profit in the same year, highlighting its efficiency.

- Mature Market Dominance: This segment benefits from a strong market share in established industrial sectors.

- Cash Flow Generation: Its loyal customer base and reliable products ensure consistent and significant cash flow.

AFK Vannkraft, Arendals Fossekompani's hydropower operations, continues to be a strong cash cow, generating consistent revenue from its mature and stable assets. In 2023, this segment was a significant contributor to the company's financial performance, with predictable operational output from its existing hydropower facilities. The long-term nature of hydropower infrastructure ensures a reliable cash flow, supporting other business ventures.

NSSLGlobal, a key player in satellite and mobile communications, solidified its cash cow status in 2024 with record-high results and a robust operating margin. Its significant market share in secure communication solutions across various industries, coupled with a loyal customer base and recurring service contracts, guarantees consistent cash flow generation. Low promotional investments further enhance its efficiency.

AFK Eiendom, the property investment arm, functions as a cash cow through stable rental income and potential long-term capital appreciation in a mature market. The minimal ongoing investment required for these assets, contrasted with more volatile sectors, ensures sustained and stable returns, as demonstrated by strategic asset enhancements like the Kitron Arendal facility.

Within Volue, established software solutions with substantial Annual Recurring Revenue (ARR) and Software-as-a-Service (SaaS) models are core cash cows. These mature offerings in the energy sector provide predictable income and high profit margins, with Volue actively working to optimize margins on these dependable products.

ENRX's industrial heating business achieved record annual revenue and operating profit in 2024, underscoring its resilience and cash-generating capabilities. Serving mature industrial markets with a strong market share and loyal customer base, this segment is a stable contributor, with ongoing efforts to enhance operational capabilities further solidifying its role.

| Segment | BCG Category | Key Financial Indicator (2023/2024) | Market Position | Cash Flow Contribution |

| AFK Vannkraft | Cash Cow | Significant revenue and operating profit contribution (2023) | Mature, stable hydropower market | Predictable and reliable |

| NSSLGlobal | Cash Cow | Record-high results, robust operating margin (2024) | Significant market share in secure communications | Consistent, driven by recurring revenue |

| AFK Eiendom | Cash Cow | Stable rental income, potential capital appreciation | Mature property market | Sustained and stable |

| Volue (SaaS/ARR) | Cash Cow | High profit margins on established software | Mature energy and power grid sectors | Consistent and predictable |

| ENRX (Industrial Heating) | Cash Cow | Record annual revenue and operating profit (2024) | Established industrial markets, strong share | Significant and stable |

What You’re Viewing Is Included

Arendals Fossekompani BCG Matrix

The Arendals Fossekompani BCG Matrix preview you are viewing is the identical, fully formatted document you will receive immediately after purchase. This means no watermarks, no demo content, and no alterations—just a complete, analysis-ready strategic tool ready for your immediate use.

Rest assured, the BCG Matrix report you see here is the exact file that will be delivered to you upon completing your purchase. It has been meticulously crafted to provide clear, actionable insights into Arendals Fossekompani's business units, ensuring you receive a polished and professional strategic document.

What you are previewing is the definitive Arendals Fossekompani BCG Matrix report, which you will download in its entirety after your purchase. This ensures you gain instant access to a professionally designed and thoroughly analyzed document, perfect for strategic decision-making.

Dogs

Arendals Fossekompani's divestment from Commeo in 2024 highlights the challenges faced by European battery manufacturing. The company cited rising production costs and extended sales timelines as key factors in its decision to cease investment. This move effectively reclassifies Commeo as a 'Dog' within the BCG matrix, reflecting its position in a slow-growth market with a minimal market share, where further capital infusion was deemed unlikely to yield positive returns.

Tekna's Systems business is showing signs of being a 'Dog' in the BCG Matrix. In the first quarter of 2025, operating revenue saw a dip because of reduced activity. This segment is facing challenges with sales and order intake, a stark contrast to the Materials business's growth.

The weak performance resulted in an adjusted EBITDA loss for the Systems segment in Q1 2025. This situation, characterized by low sales and order intake, points towards a market that is either not growing much or is actually shrinking. Furthermore, a low market share in such an environment solidifies its potential 'Dog' status.

Given these indicators, Tekna's Systems business likely requires serious strategic consideration. Options might include divesting the segment or undertaking a substantial restructuring to improve its market position and profitability. The financial performance in early 2025 clearly signals a need for decisive action.

Within Arendals Fossekompani's (AFK) property division, certain legacy assets might be categorized as Dogs. These are properties that, despite the overall portfolio's strength, demand substantial capital for upkeep or modernization without yielding proportionate income or growth. For instance, an older office building in a declining industrial area, facing high vacancy rates and minimal rental growth, would fit this description.

These underperforming assets can create a drag on AFK's financial performance. Consider a hypothetical scenario where a specific retail property, acquired years ago, now suffers from low foot traffic due to changing consumer habits and competition from online retailers. If its rental income barely covers operating costs and it shows no signs of appreciation, it represents a classic Dog.

Such assets tie up valuable capital that could be reinvested in more promising ventures. For AFK, identifying and potentially divesting these properties is crucial for optimizing its portfolio. For example, if a portfolio review in late 2024 revealed a specific industrial warehouse with a vacancy rate of 40% and requiring a $2 million upgrade for minimal potential return, it would likely be classified as a Dog.

Investments with Prolonged Sales Delays or Market Uncertainty

Investments with prolonged sales delays or market uncertainty within Arendals Fossekompani's portfolio, particularly those experiencing shifts in their competitive landscape without clear profitability, could be classified as Dogs. These ventures might consume capital without generating adequate market share or revenue.

Arendals Fossekompani has acknowledged that political turmoil and unstable tariff schemes can impact certain companies within its portfolio, increasing the risk of some investments becoming Dogs. For instance, the company's exposure to projects in regions with volatile regulatory environments could lead to such classifications.

- Revenue Stagnation: Investments that show little to no revenue growth over multiple reporting periods.

- High Cash Burn Rate: Ventures requiring significant ongoing investment without commensurate returns.

- Declining Market Share: A situation where the investment's position in its market is consistently weakening.

- Uncertain Regulatory Environment: Projects heavily reliant on stable political and tariff frameworks that are currently unstable.

Divested or Restructured Entities with Limited Future Potential

Divested or restructured entities with limited future potential, often termed 'Dogs' in the BCG matrix, represent business units or subsidiaries that Arendals Fossekompani has strategically exited or significantly altered. These moves are typically driven by underperformance in terms of growth and profitability, signaling a shift away from segments deemed less viable for future investment.

A prime example is the divestiture of Vergia, a renewable energy development company. While specific financial figures for Vergia at the time of its sale are not publicly detailed as a standalone 'Dog' within the BCG framework, the strategic decision to sell indicates that its growth trajectory or profitability did not align with Arendals Fossekompani's evolving objectives. This action reflects a proactive management approach to optimize the company's portfolio by shedding assets with limited long-term prospects.

- Divestiture Rationale: Exits are driven by a lack of sustained growth and profitability, freeing up capital for more promising ventures.

- Vergia Example: The sale of Vergia, a renewable development company, highlights a strategic exit from a segment not meeting future expectations.

- Portfolio Optimization: These actions are crucial for Arendals Fossekompani's strategy to focus on core, high-potential business areas.

- Past Performance Indicator: While no longer active, the history of these divested entities serves as a case study for identifying 'Dog' characteristics.

Arendals Fossekompani's strategic decisions in 2024 and early 2025 have led to the classification of several ventures as 'Dogs' within the BCG matrix. These are typically assets or business units characterized by low market share and operating in slow-growth or declining industries, where further investment is unlikely to yield significant returns.

The divestment from Commeo in 2024, citing rising costs and slow sales, exemplifies this. Similarly, Tekna's Systems business, showing declining revenue and an adjusted EBITDA loss in Q1 2025 due to weak sales and order intake, is exhibiting strong 'Dog' characteristics. These situations highlight the company's proactive approach to portfolio management by identifying and addressing underperforming segments.

Legacy properties within AFK's property division, such as an older office building with high vacancy or a retail property with low foot traffic and minimal rental growth, also fit the 'Dog' profile. These assets tie up capital and require careful consideration for divestment or restructuring to optimize overall financial performance.

The sale of Vergia, a renewable energy development company, further illustrates AFK's strategy of divesting from ventures that do not meet growth or profitability expectations, thereby optimizing its portfolio for higher-potential areas.

Question Marks

Even though Arendals Fossekompani has stopped investing in Commeo, their commitment to the green transition means they might look into new battery technology ventures or advanced energy storage. These would likely target fast-growing markets but, as new players, would start with a small market share and need substantial funding to grow.

These potential ventures would fit into the question mark category of the BCG matrix. They represent high-growth potential, but their current low market share means they are uncertain stars. Success hinges on rapid market adoption and gaining significant market share quickly. For context, the global battery energy storage market was valued at approximately $120 billion in 2023 and is projected to reach over $400 billion by 2030, indicating the immense growth potential in this sector.

Arendals Fossekompani's strategic focus on early-stage digitalization and big data analytics places it squarely in the 'question mark' quadrant of the BCG matrix. These investments, often found within its Alytic portfolio or through new ventures, are characterized by high growth potential but also significant upfront investment and uncertain market outcomes.

Companies in this phase, such as nascent AI startups or emerging data platform developers, typically require substantial capital for research, development, and initial market entry. For instance, the global big data analytics market was projected to reach over $100 billion by 2027, indicating a strong growth trajectory that Arendals Fossekompani aims to capitalize on.

Arendals Fossekompani's commitment to sustainable technologies and the green transition extends to actively seeking out emerging green energy technologies. This means looking beyond their established hydropower and battery investments into newer, less mature areas of renewable energy.

These emerging technologies could represent niche segments within solar, wind, or entirely novel renewable energy concepts. While these markets may be experiencing rapid growth, Arendals Fossekompani's current market share in them is likely minimal, positioning them as potential 'question marks' in a BCG-style analysis.

Investing in these nascent green energy sectors typically demands significant capital outlay for research, development, and achieving market penetration. This high investment requirement, coupled with the inherent uncertainty of new technologies, translates to a high-risk, high-reward profile, characteristic of question mark assets.

New Geographic Market Expansions for Existing Portfolio Companies

When Arendals Fossekompani's portfolio companies, like Volue or NSSLGlobal, venture into new geographic territories where their current market presence is minimal, these expansions are categorized as Stars within the BCG framework.

Although their offerings might be well-established in other regions, these new market entries necessitate substantial investment in marketing and sales to build market share in what could be a rapidly expanding regional market.

For instance, Volue's expansion into the German energy market in 2023, following its earlier successes in the Nordics, represents a strategic move into a territory with significant growth potential but requiring concentrated effort to establish its presence.

- New Geographic Market Expansion: Companies entering markets with low current presence but high growth potential are classified as Stars.

- Strategic Investment: Significant marketing and sales investment is crucial for capturing market share in these new territories.

- Example - Volue: Volue's 2023 entry into the German energy market exemplifies this strategy, targeting a high-growth region.

- Market Potential: These expansions aim to leverage established product maturity in new, potentially lucrative, regional markets.

Early-Stage Electrification and Advanced Materials Applications

Arendals Fossekompani's focus on electrification and advanced materials suggests a strategic interest in early-stage applications. These areas represent potential '?' stars in a BCG matrix, characterized by high market growth but currently low market share for the company. For instance, the burgeoning market for advanced battery materials, crucial for the electric vehicle sector, could be an example. Global battery material demand is projected to grow significantly, with the lithium-ion battery market alone expected to reach over $100 billion by 2025, presenting a rapidly developing but competitive landscape.

Within this context, Arendals Fossekompani might explore niche applications of advanced materials in specialized industrial processes, such as high-performance composites for aerospace or novel catalysts for green hydrogen production. These segments often exhibit strong growth potential driven by technological advancements and sustainability initiatives. For example, the global advanced composites market was valued at approximately $17.7 billion in 2023 and is anticipated to expand further, offering opportunities for companies with innovative material solutions.

- Emerging Battery Technologies: Investing in research and development for next-generation battery chemistries beyond current lithium-ion, targeting higher energy density and faster charging capabilities.

- Sustainable Materials for Electronics: Exploring the use of biodegradable or recycled advanced materials in consumer electronics, tapping into growing consumer demand for eco-friendly products.

- Specialized Industrial Electrification: Developing advanced materials for high-temperature or high-pressure electrical components used in sectors like renewable energy infrastructure or advanced manufacturing.

- Green Hydrogen Production Materials: Focusing on novel materials for electrolyzers and fuel cells that improve efficiency and reduce the cost of green hydrogen production.

Arendals Fossekompani's exploration into new green energy technologies, such as novel solar cell designs or advanced geothermal systems, positions them within the question mark quadrant of the BCG matrix. These ventures often represent high-growth market potential but start with minimal market share and require significant capital for research and development.

These emerging technologies, while promising, carry inherent risks due to their unproven market acceptance and technological uncertainties. For example, the global market for advanced solar technologies was projected to grow at a compound annual growth rate of over 15% in the coming years, highlighting the attractive growth but also the competitive and evolving nature of this space.

The company's strategic investments in early-stage digital solutions and data analytics, particularly within its Alytic portfolio, also fall into the question mark category. These are high-potential, high-investment areas where market dominance is not yet established, demanding substantial funding for innovation and market penetration.

These digital ventures aim to capitalize on rapidly expanding markets, such as the global AI market, which was estimated to reach hundreds of billions of dollars by 2024, but their current market share is typically small, reflecting their status as question marks requiring focused development to become future stars.

| BCG Category | Arendals Fossekompani Example | Market Characteristic | Strategic Implication | 2024 Data Point/Projection |

|---|---|---|---|---|

| Question Marks | Emerging Green Energy Tech (e.g., novel solar, advanced geothermal) | High Market Growth, Low Market Share | Requires significant investment for R&D and market penetration; high risk, high reward potential. | Global advanced solar market projected to grow over 15% CAGR. |

| Question Marks | Early-Stage Digital Solutions (e.g., AI, data analytics) | High Market Growth, Low Market Share | Needs substantial capital for innovation and market entry; potential to become future Stars. | Global AI market expected to reach hundreds of billions in 2024. |

BCG Matrix Data Sources

Our Arendals Fossekompani BCG Matrix is built on comprehensive data, integrating financial reports, market analysis, and industry growth projections.