Alexandria Real Estate Equities PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alexandria Real Estate Equities Bundle

Alexandria Real Estate Equities operates within a dynamic landscape shaped by evolving political regulations, economic fluctuations, and technological advancements. Understanding these external forces is crucial for strategic planning and identifying potential opportunities and threats. Our comprehensive PESTLE analysis delves into these critical factors, offering actionable insights to guide your decisions.

Gain a competitive edge by leveraging our expert-prepared PESTLE analysis for Alexandria Real Estate Equities. Discover how shifting social demographics and environmental concerns, alongside legal frameworks, are impacting the company's trajectory. Download the full version now to unlock a deeper understanding and refine your market strategy.

Political factors

Government funding for research and development, especially in the life sciences, directly influences the need for specialized lab and office spaces, a core offering for Alexandria Real Estate Equities. The U.S. President's budget proposal for Fiscal Year 2025 earmarks roughly $201.9 billion for R&D, signaling ongoing governmental commitment to scientific progress.

This substantial investment supports the expansion of biotechnology and life science firms, Alexandria's key clientele. Changes in these funding levels can affect the financial stability and growth strategies of these innovative companies, impacting demand for Alexandria's real estate portfolio.

The stability and direction of regulatory policies for the biotechnology and pharmaceutical sectors are paramount for Alexandria Real Estate Equities (ARE). Changes in FDA regulations, such as those concerning drug approval timelines or clinical trial requirements, directly impact the operational efficiency and investment attractiveness of ARE's life science tenants. For instance, a streamlined approval process can accelerate tenant growth and their need for expanded facilities.

Furthermore, shifts in National Institutes of Health (NIH) funding priorities can significantly influence the research and development activities of many biotech firms. In 2023, the NIH allocated approximately $47.5 billion to medical research, a figure that directly fuels the innovation pipeline for ARE's clients. A supportive regulatory framework, coupled with robust government funding, fosters a climate of innovation and expansion, thereby sustaining demand for ARE's specialized real estate solutions.

Conversely, increased regulatory scrutiny or unexpected cuts in federal research funding can introduce uncertainty for tenants. This uncertainty might lead to slower expansion plans or a reduced appetite for new facility leases, potentially impacting ARE's occupancy rates and rental income. The industry's reliance on both regulatory approval and public funding makes the political landscape a critical factor in ARE's strategic planning.

The United States generally offers a stable political environment, which is a key draw for life science and technology companies. Government policies in 2024 and projected into 2025 continue to emphasize innovation and economic growth, with initiatives aimed at bolstering domestic manufacturing and research and development. For instance, the CHIPS and Science Act, enacted in 2022, continues to allocate significant funding towards semiconductor research and manufacturing, indirectly benefiting the broader tech and life science ecosystem by ensuring supply chain resilience and fostering technological advancement.

Government support through tax incentives and favorable regulatory frameworks plays a crucial role in Alexandria Real Estate Equities' market. Federal and state-level programs offering R&D tax credits and grants encourage companies to invest heavily in new facilities and expansion. As of late 2024, discussions around extending or modifying these incentives are ongoing, with potential impacts on the pace of new construction and tenant demand for specialized lab and office spaces.

Shifts in political sentiment, particularly concerning international trade or specific industry regulations, can introduce uncertainty. However, the bipartisan support for the life science and technology sectors in the US, evident in continued federal funding for agencies like the National Institutes of Health (NIH) and the National Science Foundation (NSF), suggests a sustained commitment to these industries. The NIH's budget, for example, has seen consistent increases, reaching over $47 billion in fiscal year 2024, underscoring the government's dedication to scientific advancement.

Public-Private Partnerships in Innovation Clusters

Government initiatives promoting public-private partnerships (PPPs) within innovation clusters are a significant political factor. These collaborations, often involving universities, research institutions, and private companies, are designed to accelerate scientific discovery and commercialization. For Alexandria Real Estate Equities (ARE), this translates to potential increases in demand for specialized lab and office spaces within these dynamic ecosystems. For instance, in 2024, the U.S. government continued to emphasize R&D funding, with initiatives like the CHIPS and Science Act fostering such partnerships, particularly in life sciences and technology hubs where ARE has a strong presence.

ARE's Megacampus strategy is particularly well-suited to capitalize on these PPPs. By developing large, integrated campuses, ARE provides the critical infrastructure necessary for these collaborative efforts to thrive. These environments facilitate the co-location of diverse entities, fostering a synergistic effect that drives innovation. The U.S. National Science Foundation’s continued investment in research infrastructure, reaching billions annually, directly supports the growth of these cluster environments, benefiting companies like ARE that provide the physical backbone for scientific advancement.

- Government funding for R&D: In fiscal year 2024, federal agencies allocated significant budgets towards scientific research, with agencies like the NIH and NSF continuing to be major drivers of innovation.

- University-industry collaborations: Many universities are actively seeking and establishing partnerships with private companies to commercialize research, creating demand for specialized facilities.

- Tax incentives for innovation: Governments often provide tax credits and other financial incentives to companies investing in research and development, further encouraging the growth of innovation clusters.

- Policy support for cluster development: Many regions are implementing policies aimed at creating and supporting innovation districts, recognizing their economic impact and job creation potential.

Trade Policies and Global Collaboration

International trade policies and the ease of global collaboration significantly impact the life science sector's vitality. Policies fostering international research partnerships and talent mobility can boost industry dynamism. For instance, the EU's Horizon Europe program, with a budget of €95.5 billion for 2021-2027, exemplifies such collaborative efforts.

While Alexandria primarily operates domestically, its tenants are embedded in a global scientific network. Restrictive trade policies could indirectly curb their expansion and demand for specialized real estate. Geopolitical tensions, such as those impacting semiconductor supply chains in 2024, can also disrupt global pharmaceutical and biotech firm operations and investment.

- Global Research Funding: International collaboration is crucial for life science innovation, with global R&D spending in the sector projected to reach over $300 billion in 2024.

- Talent Mobility: Policies facilitating the movement of scientific talent can enhance research output, a key driver for demand in life science clusters.

- Supply Chain Resilience: Disruptions to global supply chains, exacerbated by trade disputes, can affect the operational costs and expansion plans of pharmaceutical companies.

- Trade Agreements: Favorable trade agreements can lower barriers for companies to access international markets and capital, indirectly supporting real estate needs.

Government funding for research and development remains a cornerstone of demand for Alexandria Real Estate Equities' specialized properties. The U.S. government's commitment to scientific advancement, as evidenced by the proposed $201.9 billion R&D budget for FY2025, directly fuels the growth of biotech and life science firms, ARE's primary tenants. This consistent financial backing supports innovation and expansion, translating into sustained demand for high-quality lab and office spaces.

Regulatory policies within the life sciences sector significantly shape tenant needs and operational capacity. Streamlined FDA approval processes, for example, can accelerate tenant growth, increasing their requirement for expanded facilities. Conversely, increased regulatory scrutiny or shifts in National Institutes of Health (NIH) funding priorities, which saw approximately $47.5 billion allocated in 2023, can introduce uncertainty, potentially impacting leasing decisions and ARE's occupancy rates.

The political environment's stability and pro-innovation stance are critical attractors for ARE's clientele. Initiatives like the CHIPS and Science Act continue to bolster the tech and life science ecosystem, fostering resilience and advancement. Furthermore, government support through R&D tax credits and favorable regulatory frameworks, with ongoing discussions in late 2024 regarding incentive extensions, directly encourages tenant investment in new facilities and expansion.

Public-private partnerships (PPPs) within innovation clusters, actively promoted by government initiatives in 2024, are a key driver for ARE. These collaborations, often supported by substantial federal investment in research infrastructure, create synergistic environments that necessitate specialized real estate solutions, aligning perfectly with ARE's Megacampus strategy.

What is included in the product

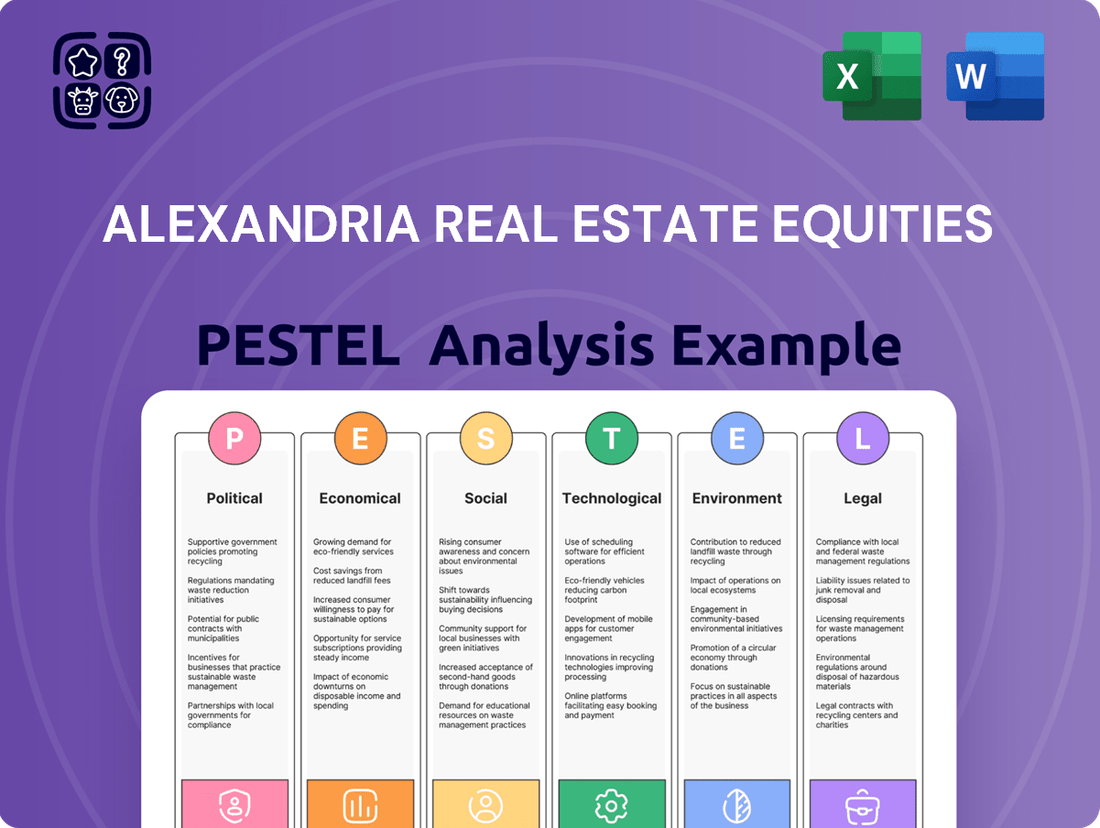

This PESTLE analysis thoroughly examines the external macro-environmental factors influencing Alexandria Real Estate Equities, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights and forward-looking perspectives to help stakeholders navigate market dynamics and inform strategic decision-making.

A PESTLE analysis for Alexandria Real Estate Equities provides a clear, summarized version of external factors, relieving the pain point of information overload for strategic decision-making.

Economic factors

The prevailing interest rate environment is a critical factor for Alexandria Real Estate Equities (ARE). As a capital-intensive Real Estate Investment Trust (REIT), ARE's profitability is closely tied to the cost of borrowing. Higher interest rates directly translate to increased capital costs, impacting both ARE's ability to finance new acquisitions and development projects, and its tenants' capacity to afford rent.

In 2024, the Federal Reserve maintained a hawkish stance, keeping benchmark interest rates elevated. This environment has likely increased ARE's borrowing costs and potentially dampened transaction volumes within the commercial real estate sector. For instance, the average interest rate on corporate bonds for REITs could have seen an uptick compared to previous years, making new debt more expensive.

Looking ahead to 2025, the market anticipates potential interest rate cuts. Such a move could significantly benefit ARE by lowering its cost of capital and making its equity more attractive to investors, potentially boosting its stock price. However, projections for the 10-year Treasury yield in 2025 suggest it will remain at elevated levels, which could still constrain substantial increases in commercial real estate valuations.

Venture capital funding remains a key indicator for demand in life science real estate, directly impacting companies like Alexandria. After a pandemic-fueled surge, VC investment has become more discerning, favoring later-stage companies. However, the sector shows resilience, with U.S. life sciences VC funding reaching $30.5 billion in 2024, a significant 16% increase from the previous year.

Early 2025 data suggests this positive trend is continuing, particularly in promising areas such as oncology and AI-powered drug discovery. This sustained investor interest, even with a more cautious approach, underpins the ongoing need for specialized lab and office spaces that Alexandria provides.

The broader economic outlook significantly impacts Alexandria's tenant base and their capacity for growth. Anticipated stronger economic expansion in 2025, alongside more favorable capital markets, is expected to boost demand for life science real estate. This positive sentiment is crucial for Alexandria's revenue streams.

A sustained U.S. economic expansion has historically supported REIT earnings, including those of Alexandria. However, current macroeconomic pressures, such as elevated interest rates, are still creating headwinds for leasing activity, potentially slowing down tenant expansion and new lease signings.

Supply and Demand Dynamics in Life Science Real Estate

The interplay of supply and demand is a crucial factor for Alexandria Real Estate Equities. The availability of specialized lab and office space, matched against the needs of life science companies, directly influences how full buildings are and how much landlords can charge in rent.

Leasing activity in the life science sector showed signs of recovery in 2024, with expectations for continued improvement through 2025. However, a persistent oversupply of space, particularly in certain markets, remains a challenge. This is partly due to a substantial amount of square footage currently under construction.

This imbalance between available space and tenant demand has contributed to increased vacancy rates and moderated rental growth across the sector. Despite this, high-quality facilities situated in prime, desirable locations continue to attract strong interest from life science firms.

- 2024 Leasing Activity: Saw an improvement compared to previous periods.

- 2025 Outlook: Expected to continue the upward trend in leasing.

- Oversupply Impact: Leading to higher vacancy rates and slower rent increases in some markets.

- Demand for Quality: Prime locations and high-quality facilities remain highly sought after.

Tenant Financial Health and Creditworthiness

The financial stability and creditworthiness of Alexandria Real Estate Equities' (ARE) tenants are paramount for ensuring steady rental income and minimizing the risk of defaults. ARE's strategic focus on high-quality tenants contributes significantly to its portfolio's resilience.

ARE's tenant base is notably strong, with a substantial 51% of its annual rental revenue originating from investment-grade and large-cap publicly traded companies. This concentration in financially robust entities provides a solid foundation for predictable cash flows.

Further underscoring this tenant strength, Alexandria reported an impressive 99% collection rate for tenant rents and receivables in the first quarter of 2025. This high collection rate reflects a tenant base that is largely capable of meeting its financial obligations, even amidst varying economic conditions.

However, it is important to acknowledge that the broader economic climate can still present challenges for certain tenants, potentially impacting their financial performance and ability to pay rent.

- Tenant Quality: 51% of annual rental revenue comes from investment-grade and large-cap public tenants.

- Collection Rate: 99% of tenant rents and receivables collected in Q1 2025.

- Revenue Stability: Strong tenant creditworthiness supports consistent rental income.

- Economic Sensitivity: Overall economic conditions can still affect some tenant's financial health.

Economic factors significantly shape Alexandria Real Estate Equities' (ARE) performance. Elevated interest rates in 2024 increased ARE's borrowing costs, impacting new projects and tenant affordability. While 2025 anticipates potential rate cuts, the 10-year Treasury yield is projected to remain high, moderating valuation growth.

Venture capital funding, a key demand driver for life science real estate, saw a robust 16% increase in 2024, reaching $30.5 billion. Early 2025 data indicates this positive trend continues, particularly in oncology and AI drug discovery, supporting demand for ARE's specialized spaces.

The broader economic outlook for 2025 suggests stronger expansion, which should boost demand for life science real estate and ARE's revenue streams. However, current macroeconomic pressures like high interest rates continue to create headwinds for leasing activity and tenant expansion.

ARE's tenant base is exceptionally strong, with 51% of rental revenue derived from investment-grade and large-cap public companies. This is further evidenced by a 99% rent collection rate in Q1 2025, highlighting tenant financial stability despite broader economic challenges.

| Economic Factor | 2024 Data/Trend | 2025 Outlook/Projection | Impact on ARE |

|---|---|---|---|

| Interest Rates | Elevated, hawkish Fed stance | Potential cuts, but elevated 10-yr Treasury yield | Increased borrowing costs, moderating valuations |

| Venture Capital Funding (Life Sciences) | $30.5 billion (16% increase from 2023) | Continued positive trend, focus on oncology/AI | Sustained demand for specialized real estate |

| Economic Expansion (U.S.) | Mixed, with some headwinds | Anticipated stronger expansion | Boosted demand, improved revenue potential |

| Tenant Financial Health | 51% of revenue from investment-grade/large-cap | Continued strength, 99% collection rate (Q1 2025) | Stable rental income, reduced default risk |

What You See Is What You Get

Alexandria Real Estate Equities PESTLE Analysis

The preview shown here is the exact Alexandria Real Estate Equities PESTLE Analysis you’ll receive after purchase—fully formatted and ready to use. This comprehensive analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Alexandria Real Estate Equities. Understand the market landscape and strategic implications with this detailed document.

Sociological factors

Life science and tech firms hinge on attracting and keeping skilled employees, directly influencing their demand for specialized real estate. Alexandria's strategy centers on creating amenity-rich, collaborative environments within innovation hubs to meet this need. For instance, in 2024, the life sciences sector continued to see intense competition for talent, with average salaries for research scientists in major biotech clusters like Boston-Cambridge reaching upwards of $120,000 annually, underscoring the importance of attractive workplaces.

Companies actively seek premium locations and high-quality facilities that foster collaboration and employee well-being, recognizing these as critical for talent acquisition. Alexandria's development of large-scale, integrated campuses, often referred to as Megacampuses, is designed precisely to offer these sought-after environments. These campuses are strategically situated in established innovation districts, enhancing their appeal to a discerning workforce.

The presence of a deep pool of highly qualified pharmaceutical professionals and access to extensive data resources are crucial for drawing significant research and development investment. In 2025, the U.S. Bureau of Labor Statistics projects continued growth in healthcare occupations, with particularly strong demand for roles in biopharmaceutical research and development, reinforcing the value of Alexandria's focus on proximity to these talent pools.

The life sciences sector's digital evolution is reshaping how companies use their real estate, directly affecting the balance between lab and office space. This trend is projected to continue, with smaller biotech firms potentially favoring higher lab-to-office ratios to manage costs in 2025, a move that could see them occupying more specialized lab facilities and less traditional office footprint.

Conversely, established pharmaceutical giants are likely to maintain a strong preference for office environments to foster crucial in-person collaboration, suggesting a more stable or even increased office component within their overall space needs. Alexandria Real Estate Equities needs to be agile, adapting its building designs and tech infrastructure to support these diverging operational demands.

Globally, populations are aging, with the UN projecting that by 2050, one in six people will be over 65. This demographic trend directly translates into increased demand for healthcare services and life sciences innovation, creating a robust, long-term tailwind for companies like Alexandria Real Estate Equities, which focuses on life science real estate. The persistent need for new treatments, with over 10,000 diseases still lacking approved therapies, underscores the sector's vital role and Alexandria's alignment with advancing human health.

Concentration in Innovation Clusters

The tendency for scientific and tech talent to congregate in innovation hubs like Greater Boston, the San Francisco Bay Area, and San Diego is a significant sociological driver that directly benefits Alexandria Real Estate Equities. These clusters are critical for fostering collaboration and the rapid exchange of knowledge, making them prime locations for life science and technology firms seeking to tap into a rich talent pool.

Alexandria leverages this phenomenon by strategically developing and operating its Megacampus ecosystems within these highly sought-after AAA locations. For instance, as of early 2024, the Greater Boston area continues to be a leading life sciences cluster, with venture capital funding in the sector remaining robust, demonstrating the sustained appeal of these concentrated innovation environments.

- Talent Concentration: Innovation hubs attract a critical mass of skilled professionals, enhancing the value proposition for companies locating there.

- Collaboration & Knowledge Spillover: Proximity fuels informal and formal interactions, accelerating discovery and development.

- Alexandria's Strategy: The company's focus on developing Megacampuses in these clusters aligns directly with the sociological demand for concentrated innovation ecosystems.

- Economic Impact: The presence of these clusters often correlates with higher regional economic output and job creation in specialized sectors.

Corporate Social Responsibility and Employee Well-being

Tenants are increasingly factoring corporate social responsibility (CSR) and employee well-being into their real estate decisions. This trend directly impacts Alexandria Real Estate Equities' ability to attract and retain premium tenants, especially those prioritizing healthy work environments. For instance, a 2024 survey indicated that 65% of employees consider a company's commitment to sustainability and employee health when choosing an employer, indirectly influencing their workspace preferences.

Alexandria's proactive approach to sustainability and operational excellence is therefore crucial. By securing certifications like LEED or WELL, Alexandria demonstrates a commitment that resonates with tenants focused on their workforce's health and productivity. This focus on creating a positive and healthy environment is a key differentiator in the competitive life science real estate market.

Alexandria's portfolio often includes amenities designed to support a greener lifestyle and employee well-being, such as fitness centers, access to public transportation, and ample green space. These features not only enhance tenant satisfaction but also contribute to higher occupancy rates and longer lease terms, as evidenced by their consistently high occupancy, often exceeding 95% in key markets through 2024.

- Tenant Demand: Growing emphasis on CSR and employee health influences leasing decisions.

- Alexandria's Strategy: Commitment to sustainability and operational excellence attracts quality tenants.

- Certification Value: Healthy building certifications (LEED, WELL) enhance marketability and tenant appeal.

- Amenity Impact: Well-being-focused amenities boost tenant satisfaction and retention.

The concentration of scientific talent in innovation hubs is a major sociological factor benefiting Alexandria Real Estate Equities. These clusters, like Boston and San Francisco, foster collaboration and knowledge sharing, which are essential for life science and tech companies. Alexandria strategically develops its Megacampuses in these prime locations to capitalize on this talent magnet effect.

Corporate social responsibility and employee well-being are increasingly influencing real estate choices for tenants. Alexandria's commitment to sustainability and healthy work environments, often demonstrated through certifications like LEED or WELL, directly appeals to companies prioritizing these aspects for their workforce. This focus enhances tenant attraction and retention, contributing to Alexandria's strong occupancy rates.

The aging global population, with the UN projecting one in six people over 65 by 2050, drives demand for healthcare and life sciences innovation. This demographic shift provides a long-term growth tailwind for Alexandria, as the need for new treatments remains high, with thousands of diseases still lacking cures.

| Sociological Factor | Impact on Alexandria RE | Supporting Data/Trends (2024-2025) |

|---|---|---|

| Talent Concentration in Innovation Hubs | Increases demand for specialized, collaborative workspaces in Alexandria's key markets. | Boston-Cambridge life sciences cluster continues robust VC funding and talent attraction in early 2024. |

| Employee Well-being & CSR Demands | Drives tenant preference for healthy, sustainable buildings, aligning with Alexandria's portfolio. | 65% of employees consider sustainability and health when choosing employers (2024 survey). Alexandria maintains >95% occupancy in key markets. |

| Aging Global Population | Creates sustained, long-term demand for life sciences innovation and related real estate. | UN projects 1 in 6 people over 65 by 2050; over 10,000 diseases still lack approved therapies. |

Technological factors

Artificial intelligence is rapidly transforming the life sciences sector, accelerating drug discovery and development. This technological advancement is also poised to address significant challenges within real estate, particularly in optimizing operations and tenant experiences.

A recent survey revealed that 85% of life science professionals believe AI can benefit their real estate strategies. However, only 51% currently have a formal AI adoption plan, highlighting a substantial opportunity for growth and the demand for AI-compatible infrastructure.

The integration of smart building technologies and the Internet of Things (IoT) is rapidly transforming the real estate landscape, with a growing emphasis on sustainability and tenant satisfaction. These advancements, from intelligent HVAC systems to occupancy sensors, are crucial for optimizing energy usage and providing valuable operational data.

For Alexandria Real Estate Equities, adopting these innovations offers a clear path to enhanced operational efficiency and a more attractive offering for tenants seeking modern, connected spaces. For instance, smart building solutions can reduce energy consumption by up to 30%, a significant factor in both cost savings and environmental responsibility.

PropTech, the integration of technology into real estate management, is fundamentally changing how properties are bought, sold, and managed. This technological wave, encompassing innovations like digital twins for virtual property representation and predictive analytics for market forecasting, promises quicker deals, greater openness, and a better experience for customers. For Alexandria Real Estate Equities (ARE), successfully adopting these digital tools is key to boosting operational efficiency, advancing sustainability goals, and ensuring tenant happiness, all vital for staying ahead in the competitive real estate market.

Advanced Laboratory Infrastructure

The life sciences sector demands cutting-edge, flexible laboratory spaces. Alexandria Real Estate Equities (ARE) distinguishes itself through its focus on developing high-performance buildings equipped with specialized ventilation, cleanrooms, and superior power and data infrastructure. This technological capability is crucial for supporting the evolving needs of research and development, especially as digital transformation reshapes laboratory operations.

ARE's strategic investments in creating integrated "Megacampus" ecosystems further underscore its technological advantage. These campuses are designed to foster collaboration and accommodate the dynamic operational requirements of tenants, from biotech startups to established pharmaceutical giants. For instance, the company's focus on adaptability allows for seamless integration of new technologies and workflows, a critical factor in the fast-paced scientific environment.

The company's commitment to technological advancement is reflected in its portfolio's ability to support critical infrastructure needs. This includes:

- Advanced HVAC and environmental controls for precise research conditions.

- High-capacity, redundant power systems to ensure uninterrupted operations.

- Robust, high-speed data connectivity to support complex computational research and data sharing.

- Specialized laboratory fit-outs, including biosafety cabinets and sterile environments.

Biotechnology and Agtech Innovation Pace

The relentless advancement in biotechnology and agtech, encompassing gene therapy, precision medicine, and sustainable farming, directly fuels the demand for Alexandria's purpose-built, specialized real estate. These breakthroughs require state-of-the-art laboratories and R&D facilities capable of supporting complex and evolving scientific endeavors. For instance, the global gene therapy market was projected to reach approximately $14.5 billion in 2024 and is expected to grow significantly in the coming years, underscoring the need for adaptable, high-tech infrastructure.

Alexandria's strategic venture capital investments, totaling hundreds of millions in recent years across early-stage life science and technology companies, are intrinsically linked to this technological acceleration. By backing innovative startups in fields like AI-driven drug discovery and advanced agricultural solutions, Alexandria not only benefits from but also actively contributes to the rapid expansion of these critical sectors. This symbiotic relationship ensures a continuous pipeline of tenants seeking cutting-edge environments to foster their growth and innovation.

- Biotech R&D Spending: Global R&D spending in the biopharmaceutical sector continues to climb, with significant portions allocated to advanced therapies and precision medicine, driving demand for specialized lab space.

- Agtech Investment Growth: Venture capital funding for agtech startups saw substantial increases in 2023 and early 2024, focusing on areas like vertical farming and sustainable inputs, requiring tailored facilities.

- Gene Therapy Market Expansion: The projected growth of the gene therapy market highlights the increasing need for specialized manufacturing and research facilities that Alexandria is positioned to provide.

- Precision Medicine Adoption: The expanding adoption of precision medicine in healthcare necessitates advanced diagnostic and research capabilities, translating into higher demand for flexible and technologically equipped lab environments.

Technological advancements are reshaping the life sciences and real estate sectors. Alexandria Real Estate Equities (ARE) is strategically positioned to capitalize on this by developing specialized, high-performance buildings crucial for cutting-edge research and development. Their focus on integrated campus ecosystems and advanced infrastructure like robust data connectivity and specialized lab fit-outs directly supports the evolving needs of biotech and agtech tenants.

The company's proactive venture capital investments in innovative startups, particularly in AI-driven drug discovery and advanced agricultural solutions, further solidify its role in fostering technological acceleration. This symbiotic relationship not only ensures a steady pipeline of tenants but also positions ARE at the forefront of emerging scientific breakthroughs.

ARE's portfolio is designed to meet the demands of rapidly growing fields such as gene therapy and precision medicine. For example, the gene therapy market was projected to reach approximately $14.5 billion in 2024, underscoring the need for the adaptable, high-tech infrastructure that Alexandria provides.

The integration of PropTech, including digital twins and predictive analytics, is enhancing operational efficiency and tenant experiences across the real estate industry. ARE's adoption of these digital tools is vital for maintaining a competitive edge and meeting tenant expectations for modern, connected, and sustainable environments.

| Technological Trend | Impact on Life Sciences Real Estate | ARE's Strategic Response |

|---|---|---|

| Artificial Intelligence (AI) | Accelerates drug discovery, optimizes building operations | Demand for AI-compatible infrastructure, tenant demand for AI-enhanced spaces |

| Internet of Things (IoT) & Smart Buildings | Enhances energy efficiency, provides operational data, improves tenant experience | Investment in smart building technologies, reduction in energy consumption (up to 30%) |

| PropTech (Digital Twins, Predictive Analytics) | Streamlines property management, improves market forecasting, enhances customer experience | Adoption of digital tools for operational efficiency and tenant satisfaction |

| Biotechnology Advancements (Gene Therapy, Precision Medicine) | Drives demand for specialized, flexible lab and R&D facilities | Development of high-performance buildings with advanced HVAC, power, and data infrastructure |

Legal factors

Alexandria Real Estate Equities' operations are heavily influenced by evolving laboratory safety protocols and compliance mandates. These regulations, overseen by agencies such as OSHA and the FDA, are paramount for safeguarding employee health and ensuring the secure management of hazardous substances. For instance, in 2024, OSHA reported over 2.8 million workplace injuries and illnesses, highlighting the critical need for rigorous safety adherence.

Strict adherence to these standards, encompassing correct personal protective equipment (PPE) usage, compliant waste disposal methods, and robust emergency response plans, is essential. Failure to comply can lead to significant legal liabilities and operational disruptions, impacting Alexandria's ability to maintain its facilities and tenant relationships.

Alexandria Real Estate Equities must meticulously adhere to a complex web of local, state, and federal building codes and zoning regulations. These rules are critical for everything from acquiring land to constructing and operating its life science and technology campuses, directly impacting project timelines and costs. For instance, in 2024, Alexandria navigated zoning approvals for significant expansion projects in key markets like Boston and San Francisco, areas with particularly stringent land-use policies.

Alexandria Real Estate Equities faces increasing regulatory pressures concerning environmental, social, and governance (ESG) factors, which directly influence real estate development and operational strategies.

The company is actively working to reduce its environmental footprint, with a stated commitment to lowering operational greenhouse gas (GHG) emissions and pursuing green building certifications such as LEED.

Alexandria's 2024 Corporate Responsibility Report showcases tangible progress, detailing an 18% reduction in operational GHG emissions intensity between 2022 and 2024, aligning with its ambitious goal of achieving a 30% reduction by 2030.

Data Privacy and Security Laws

Data privacy and security laws are becoming increasingly critical for real estate providers like Alexandria, especially as life science and technology tenants handle sensitive research data. While Alexandria doesn't directly manage this data, its infrastructure must facilitate tenant compliance with regulations like GDPR and CCPA. This means ensuring secure network capabilities and stringent physical access controls within its properties to safeguard tenant operations.

Alexandria's commitment to supporting tenant data protection is paramount. For instance, in 2024, the global data privacy software market was valued at approximately $2.5 billion and is projected to grow, highlighting the increasing importance of compliance for all businesses, including those operating within Alexandria's specialized campuses. The company must therefore continue to invest in and maintain high-security standards across its physical and digital infrastructure.

- Secure Network Infrastructure: Providing tenants with reliable and secure network access is a core requirement.

- Physical Access Controls: Implementing robust physical security measures to protect sensitive research environments.

- Compliance Support: Ensuring facilities are designed to help tenants meet evolving data protection mandates.

Intellectual Property Protection

The legal framework surrounding intellectual property (IP) protection is a cornerstone for the life science and technology companies that Alexandria Real Estate Equities (ARE) caters to. Strong IP laws are crucial as they incentivize innovation and investment in research and development, directly fueling the demand for ARE's specialized lab and office spaces. For instance, the U.S. Patent and Trademark Office (USPTO) reported a 3% increase in utility patent grants in 2023 compared to 2022, highlighting continued innovation activity among ARE's potential and existing tenants.

While Alexandria itself doesn't directly generate or own intellectual property, a robust and predictable IP environment provides an essential stable foundation for its tenants' business models. This legal certainty allows these companies to attract further investment, secure partnerships, and ultimately grow, thereby increasing their need for high-quality, flexible real estate solutions. The global IP market is substantial, with the World Intellectual Property Organization (WIPO) estimating the value of IP-intensive industries to be trillions of dollars annually, underscoring the economic importance of these legal protections for ARE's client base.

Key aspects of IP protection that directly impact ARE's tenants include patent law, copyright law, and trade secret law. These legal instruments safeguard the innovations and proprietary information that are the lifeblood of many companies within ARE's portfolio, such as those in biotechnology and software development. The strength and enforcement of these laws in ARE's key markets, like Boston and San Francisco, are critical factors in attracting and retaining leading-edge companies.

The ongoing evolution of IP law, particularly concerning digital assets and biotechnological advancements, presents both opportunities and challenges. Companies operating in these sectors rely on clear legal guidelines to protect their discoveries and creations. Alexandria's strategic positioning within innovation hubs means it benefits from and supports an ecosystem where strong IP protection is a primary driver of economic activity and real estate demand.

Alexandria Real Estate Equities (ARE) must navigate a complex legal landscape, including stringent building codes and zoning regulations critical for its campus development. In 2024, ARE focused on securing permits for expansion projects in highly regulated markets like Boston and San Francisco, demonstrating the impact of local land-use policies on project timelines and costs.

The company's commitment to ESG principles is increasingly shaped by evolving legal requirements and investor expectations. ARE reported an 18% reduction in operational GHG emissions intensity between 2022 and 2024, aligning with sustainability mandates and enhancing its appeal to environmentally conscious tenants and investors.

Data privacy and security laws, such as GDPR and CCPA, necessitate robust infrastructure to support tenant compliance. With the global data privacy software market valued at approximately $2.5 billion in 2024, ARE's investment in secure networks and physical access controls is vital for protecting sensitive tenant data.

Intellectual property (IP) law is fundamental to ARE's tenant base, with the USPTO reporting a 3% increase in utility patent grants in 2023. A stable IP environment, vital for innovation in biotech and tech sectors, underpins tenant growth and thus demand for ARE's specialized real estate.

Environmental factors

The demand for environmentally conscious buildings is on the rise in commercial real estate, with green certifications like LEED and WELL becoming increasingly important. Alexandria Real Estate Equities is actively embracing this trend.

As of December 31, 2024, a substantial 54% of Alexandria's annual rental revenue comes from properties that have either achieved or are working towards LEED certification. This focus on green building standards demonstrates a commitment to sustainability.

These certifications do more than just reduce a building's environmental impact; they also contribute to a higher market value and greater tenant satisfaction, making them a strategic advantage in the current real estate landscape.

Alexandria Real Estate Equities is actively pursuing decarbonization, setting a goal to cut its operational greenhouse gas (GHG) emissions intensity by 30% by 2030, using 2022 as its baseline year.

The company has already made significant strides, achieving an 18% reduction in emissions intensity between 2022 and 2024 by implementing energy efficiency measures, electrifying building systems, and adopting alternative energy solutions.

This proactive approach is driven by mounting regulatory demands and growing market expectations for environmentally responsible and sustainable real estate development and operations.

Alexandria Real Estate Equities is actively integrating renewable energy, recognizing its importance in sustainable development. A prime example is their large-scale solar farm in the Greater Boston region, which, as of late 2024, is projected to cover 100% of the electricity needs for their facilities there through a power purchase agreement. This initiative significantly cuts reliance on fossil fuels.

This strategic move not only lowers Alexandria's operational carbon footprint but also directly aids their tenants in achieving their own corporate sustainability targets. By providing clean energy, Alexandria enhances its value proposition for environmentally conscious businesses looking for leased space.

Climate Resilience and Risk Assessment

Alexandria Real Estate Equities, like many in the real estate sector, faces increasing scrutiny regarding climate resilience. Investors and tenants are prioritizing properties equipped to handle extreme weather, driving a need for robust risk assessment. For instance, the increasing frequency of severe weather events, such as the record-breaking hurricane season in 2024 which saw damages in the billions, underscores the financial implications of climate-related physical risks.

To mitigate these impacts, Alexandria must integrate climate modeling and scenario analysis into its property management. This involves understanding potential physical risks, like flooding or extreme heat, and transition risks associated with shifting to a low-carbon economy. By 2025, regulatory bodies are expected to mandate more stringent disclosure of climate-related financial risks, making proactive assessment crucial for Alexandria's financial health.

A key strategy for Alexandria involves weaving short-term resilience measures into its long-term decarbonization efforts. This dual approach not only addresses immediate environmental risks but also contributes to sustainability goals. For example, investing in green infrastructure that also enhances flood protection can yield both operational cost savings and reduced long-term environmental liabilities, aligning with the company's stated commitment to sustainable operations.

- Growing Demand for Climate-Resilient Properties: A 2024 survey indicated that over 60% of institutional investors consider climate risk when evaluating real estate investments.

- Financial Impact of Extreme Weather: The U.S. experienced 28 separate billion-dollar weather and climate disasters in 2023 alone, highlighting the tangible costs of climate change.

- Regulatory Landscape Evolution: Anticipated SEC climate disclosure rules by 2025 will require companies like Alexandria to report on climate-related risks and mitigation strategies.

- Integrated Resilience and Decarbonization: Implementing solutions like enhanced building insulation and on-site renewable energy can reduce carbon footprints while improving resistance to temperature fluctuations.

Waste Management and Resource Efficiency

Effective waste management and resource efficiency are paramount for specialized lab and office environments, directly impacting Alexandria Real Estate Equities' (ARE) operational footprint. This involves stringent protocols for hazardous waste disposal, a critical aspect given the nature of life science tenants, and a continuous effort to minimize contamination risks within their properties.

ARE's commitment to sustainability is woven into its operational excellence, aiming for resource-efficient buildings. This strategy not only reduces environmental impact but also aligns with tenant expectations for green facilities. For instance, in 2024, ARE reported a 15% reduction in energy consumption across its portfolio compared to a 2020 baseline, a testament to its focus on resource efficiency.

- Hazardous Waste Disposal: Implementing advanced containment and disposal methods to mitigate environmental and health risks associated with laboratory waste.

- Resource Efficiency: Prioritizing water conservation and energy-saving technologies in building design and operations. ARE aims for 20% of its portfolio to achieve LEED Gold certification by the end of 2025.

- Tenant Support: Collaborating with tenants to achieve their individual sustainability goals, including waste reduction and recycling programs.

- Circular Economy Principles: Exploring opportunities to incorporate circular economy models in construction and renovation projects, reducing landfill waste.

Alexandria Real Estate Equities (ARE) is navigating a landscape where environmental stewardship is increasingly tied to financial performance and regulatory compliance. The company's proactive stance on decarbonization, aiming for a 30% reduction in operational greenhouse gas (GHG) emissions intensity by 2030 from a 2022 baseline, is a key strategic imperative. By late 2024, ARE had already achieved an 18% reduction, demonstrating tangible progress through energy efficiency and alternative energy solutions.

The integration of renewable energy sources, such as the projected 100% electricity coverage for Greater Boston facilities via a solar power purchase agreement by late 2024, directly addresses both environmental goals and tenant needs for sustainable operations. This focus on green building certifications, with 54% of rental revenue in 2024 derived from LEED-certified or pursuing properties, underscores ARE's commitment to market-leading sustainability practices.

Climate resilience is another critical environmental factor, with increasing investor and tenant demand for properties that can withstand extreme weather events. The financial implications of climate-related physical risks are significant, as evidenced by the billions in damages from severe weather in 2024. ARE's strategy to integrate short-term resilience measures with long-term decarbonization efforts, such as investing in green infrastructure that also offers flood protection, is crucial for mitigating these risks and enhancing long-term asset value.

ARE's commitment extends to resource efficiency and waste management, particularly vital for its life science tenants. By 2025, ARE targets 20% of its portfolio to achieve LEED Gold certification, reflecting a dedication to operational excellence and minimizing environmental impact. The company's focus on hazardous waste disposal protocols and circular economy principles in renovations further solidifies its position as a responsible operator in the real estate sector.

| Environmental Metric | Target/Status | Year | Notes |

|---|---|---|---|

| GHG Emissions Intensity Reduction | 30% reduction | 2030 | Baseline: 2022 |

| Achieved GHG Emissions Reduction | 18% reduction | 2024 | Progress towards 2030 target |

| LEED Certified Revenue | 54% of annual rental revenue | 2024 | Includes properties pursuing certification |

| Renewable Energy Coverage (Boston) | 100% of electricity needs | Late 2024 | Via solar PPA |

| LEED Gold Portfolio Target | 20% of portfolio | End of 2025 | Focus on resource efficiency |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Alexandria Real Estate Equities is built on a foundation of credible data from government agencies, economic databases, and leading industry reports. We incorporate insights from regulatory updates, market research firms, and technology trend forecasts to ensure a comprehensive understanding of the macro-environment.