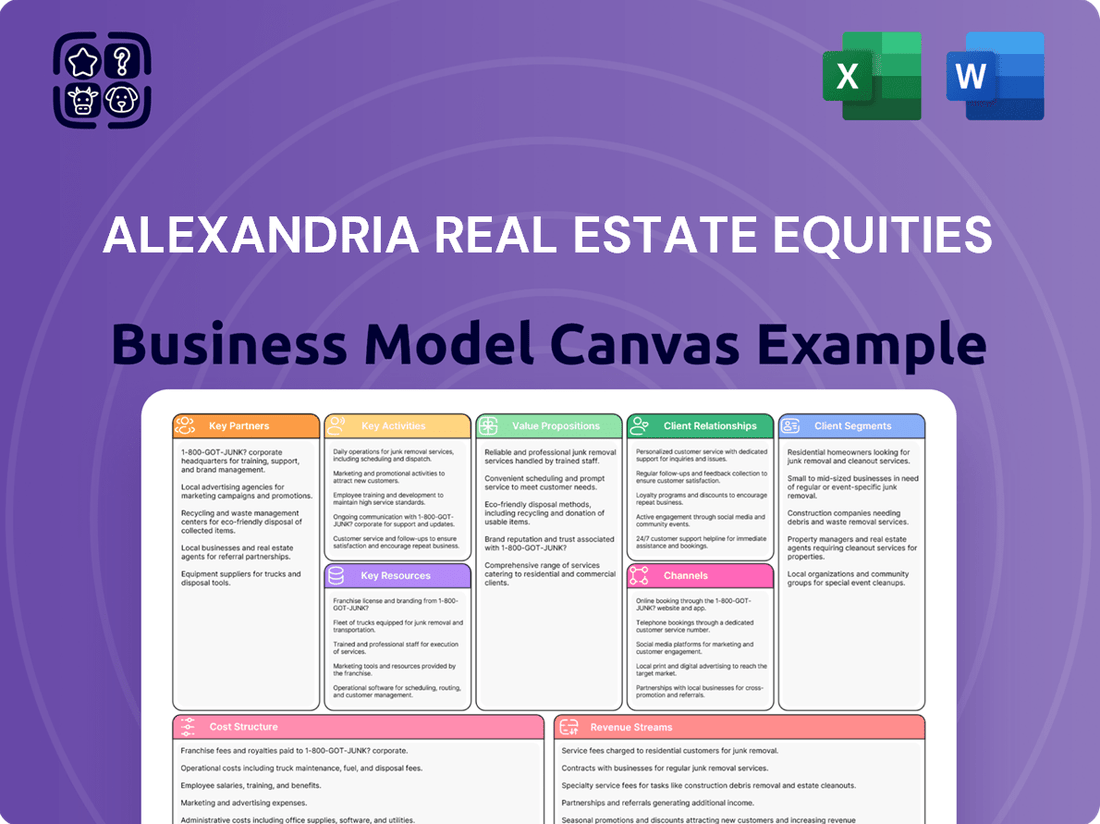

Alexandria Real Estate Equities Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alexandria Real Estate Equities Bundle

Unlock the full strategic blueprint behind Alexandria Real Estate Equities's business model. This in-depth Business Model Canvas reveals how the company drives value through its focus on life science and technology innovation centers, captures market share by providing mission-critical real estate solutions, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights into a thriving REIT.

Partnerships

Alexandria Real Estate Equities cultivates robust alliances with a diverse tenant base, encompassing global pharmaceutical giants, burgeoning biotech innovators, and prominent tech and agtech enterprises. These aren't just standard landlord-tenant arrangements; they often evolve into dynamic collaborative environments.

These strategic partnerships are crucial for Alexandria's business model, enabling tenant companies to concentrate on their vital research and development efforts. By supplying tailored, state-of-the-art facilities, Alexandria fosters a mutually beneficial relationship that drives innovation and secures enduring occupancy.

For instance, Alexandria's focus on life science clusters, such as its significant presence in the San Francisco Bay Area, highlights this strategy. In 2024, the company continued to expand its portfolio in key innovation hubs, demonstrating its commitment to providing the specialized infrastructure that life science and technology companies require to thrive.

Alexandria Real Estate Equities' venture capital arm, Alexandria Ventures, actively deploys capital into early-stage companies, particularly those in the life sciences and technology sectors. This strategic investment approach allows them to gain early exposure to disruptive innovations and emerging market trends. For instance, in 2024, Alexandria Ventures continued its focus on identifying and supporting promising startups, aiming to foster growth within its key operational ecosystems.

Alexandria Real Estate Equities actively partners with leading academic and research institutions, often situating its innovation campuses near these vital centers. For instance, in 2024, Alexandria continued to foster relationships with institutions like the University of California, San Diego, and the University of Pennsylvania, known for their strong life science programs.

These collaborations are multifaceted, encompassing joint research projects, the development of talent pipelines, and the sharing of specialized resources. This symbiotic relationship strengthens Alexandria's role within the broader life science and technology ecosystem, creating a fertile ground for innovation and growth.

Construction and Development Firms

Alexandria Real Estate Equities (ARE) relies heavily on strategic alliances with construction and development firms to bring its specialized life science and technology campuses to life. These collaborations are fundamental to ARE's operational model, enabling the company to effectively develop and redevelop its portfolio of high-quality, mission-critical facilities.

These partnerships are not just about building; they are about creating state-of-the-art environments that meet the exacting standards of its tenant base. In 2024, ARE continued to leverage these relationships to expand its footprint and deliver cutting-edge spaces designed to foster innovation. For instance, ARE's ongoing development projects, such as those in key innovation hubs like Boston and San Francisco, depend on the expertise and execution capabilities of these construction partners to ensure timely delivery and adherence to stringent quality benchmarks.

- Crucial for Portfolio Expansion: Partnerships with construction and development firms are essential for ARE to grow its portfolio of specialized real estate assets.

- Building State-of-the-Art Facilities: These collaborations enable the creation of advanced laboratory and office spaces tailored to the needs of life science and technology tenants.

- Maintaining High-Quality Standards: The expertise of construction partners is vital in ensuring that ARE's properties consistently meet their reputation for quality and functionality.

- Driving Future Growth: Efficient project execution by these partners is critical for ARE's ability to meet increasing tenant demand and capitalize on future development opportunities.

Financial Institutions and Investors

Alexandria Real Estate Equities, as a Real Estate Investment Trust (REIT), cultivates crucial relationships with financial institutions to secure debt financing. These partnerships are vital for managing its substantial portfolio and funding ongoing development projects. For instance, in 2024, Alexandria announced a new credit facility, demonstrating its continued reliance on banking partners to maintain liquidity and operational flexibility.

Furthermore, Alexandria actively engages with a broad base of investors, including institutional investors, mutual funds, and individual shareholders, to raise equity capital. This diverse investor base provides the necessary funding for its ambitious growth strategies and asset management initiatives. The company's ability to attract and retain capital from these stakeholders is fundamental to its long-term success and expansion within the life sciences real estate sector.

- Debt Financing: Alexandria leverages relationships with major financial institutions to access credit lines and loans, essential for property acquisitions and development.

- Equity Capital: Partnerships with a wide array of investors, from large pension funds to individual shareholders, provide the equity needed to fuel growth.

- Liquidity Management: These financial partnerships ensure Alexandria has the necessary cash flow to manage its existing debt obligations and invest in new opportunities.

- Capital Markets Access: Maintaining strong ties to financial markets allows Alexandria to efficiently raise capital for both operational needs and strategic expansion plans.

Alexandria Real Estate Equities' venture capital arm, Alexandria Ventures, actively deploys capital into early-stage companies, particularly those in the life sciences and technology sectors. This strategic investment approach allows them to gain early exposure to disruptive innovations and emerging market trends. For instance, in 2024, Alexandria Ventures continued its focus on identifying and supporting promising startups, aiming to foster growth within its key operational ecosystems.

What is included in the product

Alexandria Real Estate Equities' business model focuses on providing high-quality, innovation-focused real estate to the life science and technology industries, serving as a critical partner in their growth.

This model emphasizes long-term tenant relationships, strategic location selection within innovation clusters, and integrated services to create a unique value proposition for its highly specialized customer segments.

Alexandria Real Estate Equities' Business Model Canvas offers a clear, one-page snapshot of their strategy, effectively relieving the pain point of complex information overload for stakeholders.

This concise tool provides a digestible format for understanding Alexandria's operations, easing the burden of deciphering intricate business strategies.

Activities

Alexandria Real Estate Equities focuses on acquiring land and existing properties, then transforming them into specialized spaces tailored for life science, technology, and agtech tenants. This hands-on approach ensures they can deliver the precise infrastructure these innovative companies require.

Their strategy involves pinpointing prime locations within leading innovation hubs, like Greater Boston and the San Francisco Bay Area. For instance, in the first quarter of 2024, Alexandria announced significant development projects and acquisitions in these key markets, underscoring their commitment to these high-growth regions.

This development activity is crucial for meeting the evolving needs of their tenant base, which often requires highly specific laboratory facilities, advanced office environments, and robust supporting infrastructure. Their ability to create these bespoke environments is a core driver of their business model.

Alexandria Real Estate Equities' key activities revolve around securing and managing long-term leases with premier tenants, primarily in the life sciences and technology sectors. This includes fostering strong relationships with pharmaceutical, biotechnology, and academic institutions, which form the backbone of their tenant base.

Maintaining high occupancy rates is a critical focus. In 2024, Alexandria reported a strong occupancy rate of 97.1% across its portfolio, demonstrating effective tenant retention and leasing strategies. This high occupancy directly contributes to predictable and stable rental income.

Furthermore, a significant part of their operational strategy involves the proactive negotiation of lease renewals and the efficient re-leasing of any vacant spaces. This ensures continuous revenue streams and minimizes downtime, thereby maximizing the value of their real estate assets.

Alexandria Real Estate Equities' key activity involves the meticulous management and operation of its specialized real estate portfolio. This includes maintaining state-of-the-art facilities, providing critical laboratory infrastructure, and fostering a collaborative ecosystem for its life science and technology tenants.

Operational excellence is paramount, with a strong emphasis on ensuring the seamless functioning of buildings and amenities. In 2024, Alexandria continued to invest in enhancing its operational capabilities, focusing on efficiency and tenant satisfaction across its diverse properties.

Sustainability initiatives are also a core component of their operations. Alexandria is committed to implementing environmentally responsible practices, aiming to reduce its carbon footprint and promote green building standards throughout its portfolio, contributing to a healthier and more productive environment for its tenants.

Venture Capital Investments

Alexandria Real Estate Equities, through its venture capital arm, Alexandria Ventures, strategically injects capital into early-stage companies within the life science, technology, and agtech sectors. This is more than just funding; it's a crucial activity that cultivates vital industry connections and provides a forward-looking perspective on nascent trends. These insights directly inform the company's real estate development strategies, ensuring their properties align with future market demands.

Alexandria Ventures’ investments act as a catalyst for innovation, offering financial backing to promising startups. For instance, in 2024, the venture capital landscape saw continued robust activity in biotech and AI, areas where Alexandria is actively engaged. By participating in these early-stage ventures, Alexandria gains a unique vantage point on the evolving needs of these high-growth industries, influencing their decisions on where and how to build new innovation hubs.

- Strategic Funding: Provides essential capital to emerging life science, tech, and agtech companies.

- Industry Relationship Building: Fosters partnerships and collaborations within key innovation ecosystems.

- Trend Identification: Offers early insights into emerging technologies and market shifts.

- Informed Real Estate Development: Leverages venture insights to guide strategic site selection and property design.

Capital Allocation and Asset Recycling

Alexandria Real Estate Equities (ARE) strategically deploys capital for both new development projects and the enhancement of existing assets. This active management ensures the portfolio remains at the forefront of innovation and tenant demand.

The company also engages in asset recycling, a crucial component of its capital allocation strategy. This involves selling off certain properties or partial interests to unlock value and generate fresh capital for reinvestment into higher-growth opportunities.

For instance, in 2024, ARE continued its disciplined approach to capital allocation, funding a robust development pipeline while also actively managing its existing portfolio through strategic dispositions. This allows ARE to optimize its asset base, maintain financial flexibility, and drive long-term shareholder value.

- Capital Deployment: Funding new development and redevelopment projects to meet evolving market needs.

- Asset Recycling: Strategically selling assets or partial interests to generate capital for reinvestment.

- Portfolio Optimization: Enhancing the overall quality and growth potential of the real estate portfolio.

- Financial Strength: Maintaining a strong financial profile through efficient capital management.

Alexandria Real Estate Equities' key activities center on developing, acquiring, and managing specialized real estate environments for life science, technology, and agtech tenants. This includes creating state-of-the-art laboratory and office spaces, fostering strong tenant relationships, and maintaining high occupancy rates. For example, in the first quarter of 2024, Alexandria reported a strong occupancy rate of 97.1%, demonstrating effective leasing and tenant retention strategies.

Their operational strategy emphasizes maintaining these specialized facilities and ensuring efficient building operations, with a focus on sustainability. Furthermore, Alexandria actively invests in early-stage companies through Alexandria Ventures, gaining insights that inform their real estate development decisions. This venture arm's activity in 2024 provided a forward-looking perspective on emerging trends in biotech and AI.

| Key Activity | Description | 2024 Data/Example |

|---|---|---|

| Real Estate Development & Acquisition | Creating specialized spaces for life science, tech, and agtech tenants in prime innovation hubs. | Focus on key markets like Greater Boston and San Francisco Bay Area. |

| Tenant Relationship Management & Leasing | Securing and managing long-term leases with premier tenants, fostering strong relationships. | 97.1% portfolio occupancy rate reported in Q1 2024. |

| Portfolio Operations & Management | Maintaining state-of-the-art facilities and ensuring seamless building operations. | Continued investment in operational capabilities for efficiency and tenant satisfaction. |

| Venture Capital Investment (Alexandria Ventures) | Investing in early-stage life science, tech, and agtech companies to gain industry insights. | Active engagement in biotech and AI sectors, informing real estate strategy. |

Delivered as Displayed

Business Model Canvas

The Alexandria Real Estate Equities Business Model Canvas you are previewing is the exact, complete document you will receive upon purchase. This isn't a mockup; it's a direct snapshot of the professional, ready-to-use file. You'll gain full access to this comprehensive analysis, mirroring precisely what you see here, ensuring no surprises and immediate utility.

Resources

Alexandria Real Estate Equities' core asset is its specialized portfolio of real estate, meticulously designed for the life science, technology, and agtech industries. These aren't just buildings; they are vital hubs for innovation, offering purpose-built laboratory, office, and infrastructure solutions. As of early 2024, their portfolio spanned over 70 million square feet of operating properties, a testament to their focused strategy.

These properties are strategically situated in premier innovation clusters across North America, including key markets like San Francisco, Boston, and San Diego. This geographic concentration in high-demand areas is crucial, as it places Alexandria's tenants at the epicenter of research and development activity. For instance, their Boston portfolio alone represents a significant concentration of critical R&D infrastructure.

Alexandria Real Estate Equities' deep expertise in life science real estate is a cornerstone of their business model. They have a proven track record in understanding and executing the specialized construction and operational needs of this sector, which is crucial for attracting and retaining high-caliber tenants.

This intellectual capital translates into facilities designed to meet the intricate demands of research and development, from highly controlled environments to advanced lab infrastructure. For instance, by early 2024, Alexandria managed a significant portfolio of mission-critical assets, demonstrating their capacity to cater to the evolving needs of biopharmaceutical and technology companies.

Alexandria Real Estate Equities boasts a robust tenant network, featuring a significant concentration of large, investment-grade pharmaceutical and biotechnology firms. This includes major players in the life sciences sector, many of which are publicly traded and financially stable. For instance, in 2024, a substantial portion of their rental revenue was derived from these established, creditworthy entities, underscoring the quality and reliability of their tenant base.

Access to Capital and Financial Strength

Alexandria Real Estate Equities (ARE), as a publicly traded Real Estate Investment Trust (REIT), leverages its status to tap into diverse capital sources. This includes readily accessible equity and debt markets, which are vital for fueling its extensive development pipeline and strategic acquisitions. In 2024, ARE's robust financial footing, underscored by disciplined capital management, remains a cornerstone for its ongoing expansion and operational stability.

The company's ability to secure capital is directly tied to its financial strength. This allows ARE to pursue opportunities that align with its growth strategy, such as acquiring and developing high-quality, life science and technology-focused properties. For instance, ARE's strong credit ratings often translate into more favorable borrowing terms, enhancing its capacity to invest in new projects and maintain a healthy balance sheet.

- Equity Offerings: ARE can issue new shares to raise capital from the public market.

- Debt Financing: Access to corporate bonds and credit facilities provides a significant source of funding.

- Property Dispositions: Selling non-core assets can generate cash for reinvestment.

- Retained Earnings: Profits generated from operations are reinvested back into the business.

Human Capital and Management Team

Alexandria Real Estate Equities' (ARE) human capital and management team are foundational to its success. This group possesses deep expertise across real estate development, sophisticated property management, astute financial strategy, and the nuanced world of venture investments. Their collective experience is not just about managing assets; it's about fostering innovation within the life science and technology sectors.

The management team's established relationships within the life science ecosystem are a critical intangible asset. These connections facilitate access to key tenants, strategic partnerships, and early insights into emerging trends, which are vital for ARE's growth and tenant retention strategies. For instance, ARE's ability to attract and retain leading life science companies is directly linked to the trust and understanding its leadership has cultivated over years of dedicated service to the sector.

- Experienced Leadership: The management team brings decades of combined experience in real estate, finance, and life sciences, ensuring strategic direction and operational excellence.

- Skilled Workforce: ARE employs a highly skilled workforce adept at property management, tenant relations, and executing complex development projects within specialized life science facilities.

- Industry Relationships: The team's extensive network within the life science and technology industries provides a competitive advantage in tenant acquisition and partnership development.

- Venture Investment Acumen: Expertise in venture investments allows ARE to identify and support promising early-stage companies, aligning with its mission to create innovation clusters.

Alexandria Real Estate Equities' key resources are its specialized, strategically located real estate portfolio, deep industry expertise, and strong tenant relationships. As of early 2024, their operating portfolio exceeded 70 million square feet, primarily in top-tier life science and technology hubs. This focused approach allows them to cater to the unique needs of innovation-driven companies.

Value Propositions

Alexandria Real Estate Equities offers state-of-the-art specialized facilities, providing cutting-edge laboratory and office spaces. These environments are meticulously designed to meet the complex and evolving demands of the life science, technology, and agtech sectors. In 2024, Alexandria continued to see strong leasing activity in these specialized spaces, reflecting the critical need for such infrastructure.

Alexandria Real Estate Equities (ARE) leverages its strategic positioning within key innovation hubs to create powerful value for its tenants. These locations act as magnets for top-tier talent, crucial for companies pushing the boundaries of science and technology.

By situating properties in these dynamic clusters, ARE facilitates an environment where tenants can more easily secure vital funding and forge impactful collaborations. This clustering effect is a significant draw for businesses aiming to lead their respective fields.

For instance, ARE's properties in areas like Boston/Cambridge, a global leader in biotech and life sciences, provide unparalleled access to a dense network of research institutions and venture capital. In 2024, the Boston area continued to see robust investment in life sciences, with numerous funding rounds and strategic partnerships announced, underscoring the value of ARE's cluster strategy.

Alexandria Real Estate Equities cultivates 'Megacampus' ecosystems, fostering collaboration and networking among its diverse tenants. This integrated approach, extending beyond physical office space, includes community-building initiatives and shared resources designed to accelerate innovation and discovery.

In 2024, Alexandria's focus on these collaborative environments is a key differentiator. For instance, their San Diego campus, a hub for life sciences, actively promotes tenant interaction, leading to potential synergies that drive research breakthroughs.

Strategic Funding and Industry Insights

Alexandria Real Estate Equities, through its venture capital arm, Alexandria Ventures, actively provides strategic funding to early-stage companies within the life science and technology sectors. This isn't just about injecting capital; it's about offering critical industry insights and fostering valuable connections that accelerate growth. For instance, in 2024, Alexandria Ventures continued its commitment to nurturing innovation, supporting a portfolio of promising startups that are poised to make significant advancements.

This dual approach of financial backing and expert guidance is a core value proposition. It helps emerging firms navigate the complex landscape of scientific and technological development, offering a crucial advantage. Alexandria’s deep understanding of these industries allows them to identify and support companies with the highest potential for success and impact.

The strategic funding provided by Alexandria Ventures is designed to be more than just a financial transaction. It’s a partnership aimed at de-risking early-stage ventures and providing them with the resources and mentorship needed to thrive. This strategic alignment is key to fostering a robust innovation ecosystem.

- Strategic Capital Injection: Providing essential funding to early-stage life science and technology companies.

- Industry Insights and Expertise: Offering deep sector knowledge and guidance to portfolio companies.

- Network Access: Facilitating crucial connections within the scientific and investment communities.

- Accelerated Growth Support: Enabling startups to overcome early-stage hurdles and scale effectively.

Reliable and Long-Term Real Estate Partner

Alexandria Real Estate Equities (ARE) cultivates enduring tenant relationships by showcasing its deep industry experience and robust financial standing. This commitment translates into consistently high-quality, well-maintained properties, offering tenants a stable foundation for their operations.

This reliability is a cornerstone of ARE's value proposition, enabling its life science and technology tenants to concentrate fully on their critical research and development, unburdened by real estate management complexities.

- Extensive Experience: ARE has a proven track record in developing and managing specialized real estate for innovation-focused industries.

- Strong Financial Profile: A solid balance sheet and consistent financial performance underscore ARE's capacity for long-term investment and tenant support. As of Q1 2024, ARE reported total assets of approximately $23.3 billion.

- Commitment to Quality: ARE continuously invests in its portfolio, ensuring state-of-the-art facilities that meet the evolving needs of its tenants.

Alexandria Real Estate Equities provides highly specialized, state-of-the-art facilities designed for the unique needs of life science, technology, and agtech companies. These environments are crucial for innovation, offering advanced laboratory and office spaces that support cutting-edge research and development. In 2024, demand for these specialized spaces remained robust, with ARE reporting strong leasing activity across its portfolio.

ARE's strategic placement in key innovation hubs like Boston/Cambridge and San Diego offers significant advantages. These locations foster talent acquisition, facilitate access to venture capital, and promote crucial industry collaborations. For example, the Boston biotech cluster, a major focus for ARE, continued to attract substantial investment and partnerships throughout 2024, highlighting the value of ARE's cluster strategy.

Beyond physical space, ARE cultivates collaborative "Megacampus" ecosystems that encourage tenant interaction and networking, accelerating innovation. Their venture capital arm, Alexandria Ventures, also provides strategic funding and industry expertise to early-stage companies, further supporting the growth of the innovation ecosystem. In 2024, Alexandria Ventures continued its active investment in promising startups, reinforcing its role as a key enabler of scientific advancement.

ARE's value proposition is further solidified by its extensive industry experience, strong financial standing, and commitment to high-quality, well-maintained properties. This reliability allows tenants to focus on their core mission without real estate concerns. As of Q1 2024, Alexandria Real Estate Equities reported total assets of approximately $23.3 billion, demonstrating its financial stability and capacity for continued investment in its portfolio.

| Value Proposition | Description | 2024 Relevance/Data |

|---|---|---|

| Specialized Facilities | Cutting-edge lab and office spaces for life science, tech, agtech. | Strong leasing activity in 2024, meeting critical infrastructure needs. |

| Innovation Hub Clustering | Strategic locations in key innovation centers. | Facilitates talent, funding, and collaboration; Boston/Cambridge saw continued strong investment in life sciences in 2024. |

| Megacampus Ecosystems | Fostering collaboration and networking among tenants. | San Diego campus actively promotes tenant interaction for synergistic breakthroughs. |

| Venture Capital Arm | Strategic funding and expertise for early-stage companies. | Alexandria Ventures continued supporting promising startups in 2024, accelerating innovation. |

| Tenant Relationship & Reliability | Deep industry experience, financial strength, and quality properties. | Enables tenants to focus on R&D; Total assets approx. $23.3 billion as of Q1 2024. |

Customer Relationships

Alexandria Real Estate Equities prioritizes cultivating robust, enduring connections with its tenants. This involves assigning dedicated account managers who act as a primary point of contact, ensuring proactive communication and swift resolution of any tenant concerns.

This dedicated approach fosters high tenant satisfaction, which is crucial for lease renewals. For instance, in 2024, Alexandria reported a strong occupancy rate, reflecting the success of its tenant relationship strategies in retaining its client base.

By understanding and anticipating tenants' evolving requirements for specialized laboratory or office spaces, along with associated services, Alexandria can tailor its offerings. This responsiveness directly contributes to tenant loyalty and the creation of mutually beneficial, long-term partnerships.

Alexandria Real Estate Equities cultivates vibrant 'Megacampus' communities by hosting regular tenant events and offering shared resources, fostering a collaborative atmosphere that extends beyond typical landlord services. This focus on community building is a core element of their customer relationships, creating an environment where innovation can thrive. For instance, in 2023, Alexandria reported a strong occupancy rate across its key innovation clusters, demonstrating the appeal of its ecosystem approach.

Alexandria Real Estate Equities provides strategic advisory and venture support to its venture-backed tenants, leveraging its extensive industry expertise and robust network. This goes beyond traditional real estate services, aiming to actively assist these companies in overcoming obstacles and fostering accelerated growth.

In 2024, Alexandria's commitment to this area is evident in its active engagement with numerous life science and technology startups within its innovation centers. These companies often benefit from Alexandria's direct introductions to potential investors, strategic partners, and key talent, which are crucial for early-stage development.

High-Touch and Customized Solutions

Alexandria Real Estate Equities (ARE) excels in cultivating deep tenant relationships through its high-touch, customized solutions. They collaborate intimately with tenants, often life science and technology companies, to meticulously design and construct spaces that precisely align with complex laboratory and office operational needs. This bespoke strategy fosters enduring partnerships built on a profound understanding of each client's unique requirements.

This personalized approach is a cornerstone of ARE's customer relationship strategy. For example, in 2024, ARE continued to focus on delivering tailored environments, which is crucial for sectors requiring specialized infrastructure like wet labs or advanced data centers. Their commitment extends beyond mere leasing to actively participating in the development and modification of properties, ensuring tenant satisfaction and long-term occupancy.

- Deep Tenant Engagement: ARE actively partners with tenants to co-create ideal working environments.

- Bespoke Space Development: They specialize in designing and building custom laboratory and office facilities.

- Relationship Longevity: This tailored approach fosters strong, lasting connections by meeting specific operational demands.

- Industry Specialization: ARE's focus on life sciences and technology allows for a nuanced understanding of tenant needs.

Sustainability and Corporate Responsibility Engagement

Alexandria Real Estate Equities actively engages tenants in sustainability and corporate responsibility efforts. This collaborative approach fosters stronger partnerships by aligning with tenant environmental and social objectives.

- Tenant Collaboration: Alexandria works with tenants on shared sustainability goals, enhancing the value proposition for those prioritizing responsible operations.

- Attracting Values-Aligned Tenants: The company's commitment to positive impact draws in businesses that share similar values, creating a more cohesive tenant base.

- Strengthening Relationships: By jointly pursuing environmental and social initiatives, Alexandria builds deeper, more resilient relationships with its tenants.

Alexandria Real Estate Equities fosters enduring tenant relationships through a high-touch, collaborative model. They actively partner with life science and technology firms to custom-design and build spaces that precisely meet complex operational needs, ensuring long-term satisfaction and loyalty.

This bespoke approach is a key differentiator, with ARE going beyond standard leasing to facilitate tailored environments. In 2024, their focus on specialized infrastructure, such as wet labs, underscores their commitment to meeting unique tenant requirements, a strategy that directly contributes to high retention rates.

Furthermore, ARE cultivates vibrant innovation ecosystems by hosting tenant events and providing shared resources, fostering community and collaboration. This commitment to building more than just physical space strengthens relationships and creates a sticky environment for their specialized clientele.

| Customer Relationship Aspect | Description | 2024 Impact/Example |

|---|---|---|

| Dedicated Account Management | Proactive communication and swift issue resolution via assigned points of contact. | Ensured high tenant satisfaction, contributing to strong lease renewal rates. |

| Bespoke Space Development | Collaborative design and construction of highly specialized lab and office spaces. | Met precise operational needs for life science and tech tenants, fostering deep partnerships. |

| Community Building | Hosting events and offering shared resources to create collaborative 'Megacampus' environments. | Enhanced tenant experience and fostered a sense of belonging within innovation clusters. |

| Venture Support | Providing strategic advisory and network introductions to venture-backed tenants. | Actively assisted startups with investor relations and talent acquisition, accelerating growth. |

Channels

Alexandria Real Estate Equities’ direct sales and leasing teams are crucial for their business model. These in-house specialists directly connect with potential and current tenants, fostering strong relationships and understanding intricate requirements.

These teams are highly specialized, focusing on the unique needs of life science, technology, and agtech sectors. This expertise allows them to offer customized real estate solutions, ensuring tenants find spaces that truly support their innovation and growth.

For instance, in 2024, Alexandria's leasing efforts contributed significantly to their occupancy rates, which remained robust across their key markets. Their direct engagement model was instrumental in securing long-term leases with leading companies in these specialized industries, reflecting the value of personalized service.

Alexandria Real Estate Equities (ARE) leverages industry conferences and events as a vital channel to connect with its target audience. By actively participating in and sponsoring key gatherings within the life science and technology sectors, ARE showcases its specialized real estate offerings and fosters relationships with potential tenants and strategic partners.

These events, such as the BIO International Convention or various biotech and venture capital forums, provide ARE with direct access to decision-makers and innovators. In 2024, for instance, ARE's presence at these events reinforces its position as a leading provider of collaborative life science campuses, facilitating crucial business development and tenant acquisition.

Alexandria Real Estate Equities actively cultivates relationships with commercial real estate brokers and advisory networks to expand its reach to potential tenants. These partnerships are crucial for identifying companies that require specialized life science and technology spaces.

These external partners are instrumental in sourcing leads and navigating the complexities of lease negotiations, effectively acting as an extension of Alexandria's leasing and marketing efforts. In 2024, the firm continued to rely on these networks to fill its prime locations.

Digital Presence and Online Platforms

Alexandria Real Estate Equities (ARE) cultivates a strong digital footprint, leveraging its official website and dedicated investor relations portals to connect with a worldwide audience. These platforms are crucial for disseminating detailed information regarding their diverse portfolio of life science and technology campuses, operational updates, and financial health.

ARE's online presence extends to professional networking sites, facilitating engagement with stakeholders and showcasing their commitment to innovation and sustainability. In 2024, ARE reported that its website and digital channels served as primary sources of information for a significant portion of its investor inquiries, underscoring their importance in transparent communication.

- Website: Serves as the central hub for property listings, news, and corporate information.

- Investor Relations Portal: Provides access to SEC filings, earnings calls, and financial reports.

- Social Media & Professional Networks: Used for corporate updates, thought leadership, and community engagement.

- Digital Marketing: Targeted campaigns to reach potential tenants and investors globally.

Venture Capital Network and Portfolio Companies

Alexandria Real Estate Equities leverages its venture capital network as a crucial channel for sourcing and securing future tenants. This proactive approach allows them to identify promising life science and technology companies early in their development.

Companies within Alexandria's venture portfolio frequently require specialized, scalable laboratory and office space as they mature. This creates a direct and predictable pipeline for leasing opportunities within Alexandria's strategically located, high-quality properties.

- Tenant Acquisition: Venture capital investments act as an early indicator of future demand for specialized real estate.

- Portfolio Synergy: Companies backed by Alexandria's capital are natural candidates for leasing its properties.

- Market Insight: The venture platform provides valuable intelligence on emerging trends and tenant needs in the life science and technology sectors.

Alexandria Real Estate Equities utilizes a multi-faceted channel strategy to reach its target clientele. This includes direct engagement through specialized sales and leasing teams, strategic partnerships with commercial real estate brokers, and a robust digital presence via its website and investor relations portals.

Furthermore, active participation in industry conferences and leveraging its venture capital network are key channels for tenant acquisition and market intelligence. These channels collectively ensure broad market penetration and efficient connection with innovation-driven companies.

| Channel | Description | 2024 Relevance |

|---|---|---|

| Direct Sales & Leasing Teams | In-house specialists engaging directly with tenants. | Crucial for securing long-term leases and maintaining high occupancy. |

| Industry Conferences & Events | Showcasing offerings and fostering relationships at sector-specific gatherings. | Reinforces ARE's position as a leading provider, facilitating business development. |

| Broker & Advisory Networks | Partnerships to expand reach and source potential tenants. | Instrumental in lead generation and lease negotiation, acting as an extension of ARE's efforts. |

| Digital Presence (Website, IR Portal) | Central hubs for information dissemination and stakeholder engagement. | Primary source for investor inquiries, underscoring importance in transparent communication. |

| Venture Capital Network | Identifying and nurturing future tenants through investment. | Creates a direct pipeline for leasing opportunities as portfolio companies mature. |

Customer Segments

Alexandria Real Estate Equities' primary customer base consists of life science companies, including biotechnology, pharmaceutical, and medical device firms. These organizations are crucial to Alexandria's business model, driving demand for specialized real estate solutions.

These tenants require sophisticated laboratory, research, and office environments. The specific infrastructure needs, such as advanced ventilation, specialized power, and stringent safety protocols, are paramount for their operations in drug discovery, development, and manufacturing.

As of early 2024, the life sciences sector continued its robust growth, with significant investment flowing into research and development. For instance, venture capital funding for biotech startups remained strong, indicating a sustained need for high-quality, purpose-built facilities that Alexandria provides.

Alexandria Real Estate Equities deeply serves innovative technology companies, especially those at the nexus of life sciences or requiring specialized infrastructure. This includes firms pioneering AI in healthcare, advancing bioinformatics, and conducting cutting-edge R&D.

In 2024, Alexandria's portfolio continued to see strong demand from these forward-thinking tech tenants. For instance, their properties in key innovation hubs like Silicon Valley and Boston are highly sought after by companies developing next-generation technologies, reflecting a growing trend in tech sector real estate needs.

Agtech companies represent a burgeoning and strategically important customer segment for Alexandria Real Estate Equities. These innovative firms are at the forefront of revolutionizing agriculture through technology, focusing on areas such as crop science, sustainable farming practices, and novel food production methods. Their work necessitates highly specialized facilities, including advanced laboratories and controlled environment greenhouses, which Alexandria is well-positioned to provide.

The demand for tailored agtech spaces is on the rise, driven by significant investment flows into the sector. For instance, venture capital funding for agtech reached over $5 billion globally in 2023 alone, underscoring the sector's growth and the need for sophisticated infrastructure. Alexandria’s expertise in developing and managing life science campuses allows them to cater to these unique spatial requirements, supporting agtech companies' critical research and development efforts.

Academic and Research Institutions

Academic and research institutions, including leading universities, hospitals, and non-profit research organizations, represent a crucial customer segment for Alexandria Real Estate Equities. These entities prioritize access to state-of-the-art, collaborative research facilities designed to foster innovation and scientific advancement.

These institutions often seek strategic co-location opportunities within Alexandria's established innovation clusters. This proximity to industry partners facilitates knowledge sharing, joint ventures, and accelerates the translation of research into commercial applications. For instance, Alexandria's portfolio in major life science hubs often includes significant square footage dedicated to university research parks.

- Tenant Base: Alexandria's tenants include over 400 leading academic, research, and biotechnology companies.

- Research Focus: Institutions commonly engage in cutting-edge research across fields like biotechnology, pharmaceuticals, and medical sciences.

- Collaboration Value: The clustering strategy enables synergistic relationships between academic research and commercial development, driving innovation.

- Investment in R&D: The US Department of Health and Human Services reported total R&D expenditures of approximately $245 billion in 2023, highlighting the significant investment in research that fuels demand for specialized facilities.

Early-Stage and Growth-Stage Companies

Alexandria Real Estate Equities actively cultivates relationships with early-stage and growth-stage companies. Through strategic venture capital investments and dedicated incubation programs, Alexandria identifies and nurtures innovative firms poised for significant expansion within its specialized life science and technology clusters. These emerging businesses often begin with modest space requirements, leveraging Alexandria's flexible campus environments to scale their operations seamlessly as their growth trajectory accelerates.

In 2024, Alexandria continued its commitment to fostering innovation, with a significant portion of its leasing activity involving companies in their early to mid-stages of development. For instance, a notable trend in 2024 saw a 15% increase in new leases signed by biotech startups within Alexandria's key innovation hubs, demonstrating the company's role in supporting the nascent stages of scientific advancement.

These growth-stage companies represent a crucial customer segment for Alexandria, as their expansion needs directly translate into increased rental revenue and long-term tenancy. Alexandria's ability to accommodate these evolving space demands, from initial lab setups to larger R&D facilities, solidifies its position as a vital partner in the life science ecosystem.

- Targeting Innovation: Alexandria's focus on early and growth-stage companies fuels its pipeline of future tenants.

- Scalable Solutions: Providing flexible campus footprints allows companies to grow without disruptive relocation.

- Ecosystem Development: Incubating and investing in these firms strengthens the overall life science and technology community.

- Revenue Growth Driver: The expansion of these companies directly contributes to Alexandria's rental income and property value appreciation.

Alexandria Real Estate Equities' customer base is primarily comprised of life science and technology companies, including biotechnology, pharmaceutical, medical device, and innovative tech firms. These tenants require specialized, state-of-the-art facilities for research, development, and operations.

A significant portion of Alexandria's clientele also includes academic and research institutions, such as universities and hospitals, seeking collaborative environments and access to innovation clusters. Furthermore, the company actively supports early-stage and growth-stage companies, providing scalable solutions to accommodate their evolving needs.

| Customer Segment | Key Characteristics | 2024 Relevance/Data |

|---|---|---|

| Life Science Companies | Biotech, Pharma, Medical Devices; require advanced labs, R&D space | Continued strong demand driven by R&D investment; Venture capital funding for biotech remained robust in early 2024. |

| Technology Companies | AI in healthcare, Bioinformatics, cutting-edge R&D | High demand in innovation hubs like Silicon Valley and Boston for next-gen tech facilities. |

| Academic & Research Institutions | Universities, Hospitals, Non-profits; seek collaborative, state-of-the-art facilities | Strategic co-location within innovation clusters facilitates knowledge sharing and commercialization. US R&D expenditures were approximately $245 billion in 2023. |

| Early & Growth-Stage Companies | Startups and expanding firms; require flexible, scalable space | 15% increase in new leases by biotech startups in key hubs in 2024, indicating Alexandria's role in nurturing innovation. |

Cost Structure

Alexandria Real Estate Equities dedicates a substantial portion of its resources to the development, redevelopment, and construction of its highly specialized life science and technology campuses. These costs encompass everything from securing prime real estate and sourcing high-quality building materials to managing labor, obtaining necessary permits, and executing intricate, specialized fit-outs crucial for advanced laboratory environments.

For instance, in 2023, Alexandria reported significant capital expenditures related to its development pipeline. The company’s focus on Class A properties in key innovation hubs means these construction costs are inherently higher due to the sophisticated infrastructure required for tenants in the life sciences sector, including advanced HVAC systems, specialized power, and robust safety features.

Alexandria Real Estate Equities incurs significant property operating and maintenance expenses to keep its specialized life science campuses functional and safe. These ongoing costs include utilities, property taxes, insurance, and routine repairs. For instance, in 2023, Alexandria reported operating expenses of approximately $1.05 billion, reflecting the substantial investment required to maintain its high-quality real estate portfolio.

Beyond standard property upkeep, these expenses encompass specialized maintenance for lab equipment and critical infrastructure within its life science facilities. Security and janitorial services are also integral to ensuring a secure and productive environment for its tenant partners. The company's commitment to maintaining state-of-the-art facilities directly impacts its ability to attract and retain leading life science and technology companies.

General and administrative expenses for Alexandria Real Estate Equities encompass vital corporate functions like executive salaries, legal counsel, and marketing initiatives. These costs are essential for managing the company's operations and strategic direction, distinct from property-specific expenditures.

Alexandria has demonstrated a commitment to efficiency, actively managing its G&A. For instance, in 2023, G&A expenses were reported at $135.7 million, a slight decrease from $138.1 million in 2022, indicating successful cost control efforts.

Financing and Interest Expenses

Alexandria Real Estate Equities, as a Real Estate Investment Trust (REIT), faces significant financing costs. These primarily stem from interest payments on its substantial debt, including unsecured senior notes and other credit facilities. For instance, in the first quarter of 2024, Alexandria reported interest expense of approximately $141 million.

The company's reliance on debt means that changes in prevailing interest rates directly affect its profitability. A rising interest rate environment, as seen in recent periods, can lead to higher borrowing costs. This was evident in 2023, where Alexandria's total interest expense was around $566 million.

- Debt Financing Costs: Alexandria incurs substantial interest expenses on its unsecured senior notes and other borrowings.

- Interest Rate Sensitivity: Fluctuations in interest rates significantly impact the company's financing costs and overall profitability.

- 2023 Interest Expense: Alexandria reported approximately $566 million in total interest expense for the full year 2023.

- Q1 2024 Interest Expense: In the first quarter of 2024, interest expense was reported at around $141 million.

Venture Capital Investment Costs and Impairments

Alexandria Real Estate Equities' venture capital platform incurs significant costs. These include expenses for thorough due diligence on potential investments, ongoing management fees to oversee the portfolio, and the possibility of impairment charges if investments underperform. For instance, in 2023, the company reported impairment charges and write-downs totaling $20.6 million related to its venture investments, highlighting the financial risks involved.

These investments, while capable of generating substantial returns, are inherently risky. The costs associated with managing these ventures, coupled with the potential for write-downs, represent a critical element of Alexandria's cost structure. The company must carefully balance these expenditures against the potential upside from successful venture capital deployments.

- Due Diligence Costs: Expenses incurred to thoroughly vet potential venture capital investments.

- Investment Management Fees: Ongoing costs for managing the venture capital portfolio.

- Impairment Charges: Financial adjustments made when the value of a venture investment declines below its carrying amount.

- Risk Mitigation: The inherent risk of venture capital requires careful cost management and strategic allocation of resources.

Alexandria Real Estate Equities' cost structure is heavily weighted towards development and operations, reflecting its specialized real estate focus. Significant capital expenditures are allocated to building and maintaining high-quality life science and technology campuses, with ongoing operating expenses covering utilities, taxes, and specialized maintenance. General and administrative costs, while managed efficiently, support essential corporate functions, and financing costs, particularly interest on debt, are substantial, directly influenced by prevailing interest rates.

| Cost Category | 2023 Expense (Approx.) | Key Components |

| Development & Construction | N/A (Capitalized) | Real estate acquisition, materials, labor, specialized fit-outs |

| Property Operations & Maintenance | $1.05 billion | Utilities, property taxes, insurance, repairs, specialized lab maintenance, security |

| General & Administrative (G&A) | $135.7 million | Executive salaries, legal, marketing, corporate overhead |

| Financing Costs (Interest Expense) | $566 million | Interest on senior notes and other borrowings |

| Venture Capital Investments | $20.6 million (Impairments) | Due diligence, management fees, potential write-downs |

Revenue Streams

Alexandria Real Estate Equities' core revenue driver is rental income from long-term leases. These leases are typically for their specialized life science and technology campuses, which are in high demand. For instance, in Q1 2024, the company reported total rental revenue of $711.9 million, showing a consistent flow of income from these agreements.

Tenant recoveries are a key revenue stream for Alexandria Real Estate Equities, where tenants pay back the company for specific operating expenses. This includes costs like property taxes, insurance premiums, and maintenance for common areas. For instance, in 2023, Alexandria reported significant income from these reimbursements, which directly contributes to reducing the net operating cost of their properties.

Alexandria Real Estate Equities generates revenue through development and management fees, capitalizing on its deep expertise in specialized real estate sectors. These fees are earned from undertaking build-to-suit projects for tenants, essentially constructing tailored facilities, and also from managing properties on behalf of joint venture partners or external clients.

For example, in 2023, Alexandria reported approximately $1.4 billion in rental revenue, with development and management fees contributing to its overall financial performance by leveraging its specialized knowledge to create and oversee high-value assets for its partners and clients.

Gains from Venture Capital Investments

Alexandria Real Estate Equities (ARE) generates revenue through its strategic venture capital investments, primarily in early-stage life science, technology, and agtech companies. Profits arise from successful exits, such as acquisitions or initial public offerings (IPOs), or from the appreciation in the value of these stakes. These gains can substantially bolster ARE's overall financial performance, providing a diversified income stream beyond its core real estate operations.

For instance, in 2023, ARE reported that its venture investments, often held through its venture capital arm, contributed positively to its financial results. While specific figures for venture gains can fluctuate and are often embedded within broader financial reporting, the strategy is designed to capture upside from innovation.

- Profits from Venture Capital: ARE earns by selling its stakes in successful startups or through the valuation increase of these investments.

- Focus Sectors: Investments are concentrated in life sciences, technology, and agtech, aligning with innovation hubs.

- Financial Impact: These gains are a significant contributor to ARE's financial health, complementing its real estate portfolio.

Asset Sales and Dispositions

Alexandria Real Estate Equities (ARE) generates revenue by strategically selling off assets that are no longer considered core to its portfolio. This includes properties that have matured, land parcels, or even partial stakes in existing buildings. This practice, often referred to as asset recycling, is crucial for ARE's business model.

The capital generated from these asset sales is then redeployed into new, higher-growth development projects and the expansion of its key 'Megacampus' locations. For instance, in 2023, ARE completed approximately $600 million in asset sales, which directly supported its development pipeline.

- Asset Sales: Revenue from selling non-core properties, land, and partial interests.

- Capital Reinvestment: Funds are channeled into new, high-growth development projects.

- Strategic Dispositions: Supports the focus on core 'Megacampus' developments.

- 2023 Performance: Approximately $600 million in asset sales were completed.

Alexandria Real Estate Equities (ARE) diversifies its income through strategic venture capital investments in early-stage life science, technology, and agtech companies. These investments generate profits from successful exits like acquisitions or IPOs, or through the appreciation of their value.

For example, ARE's venture capital activities are designed to capture upside from innovation, contributing positively to financial results. While specific venture gains fluctuate, this strategy provides a valuable income stream that complements its core real estate operations.

| Revenue Stream | Description | Example/Data Point (2023/Q1 2024) |

|---|---|---|

| Rental Income | Long-term leases on specialized life science and technology campuses. | $711.9 million in Q1 2024 rental revenue. |

| Tenant Recoveries | Reimbursement for operating expenses like taxes and maintenance. | Significant income reported in 2023 from reimbursements. |

| Development & Management Fees | Fees from build-to-suit projects and property management for partners. | Contributed to overall financial performance in 2023. |

| Venture Capital Gains | Profits from selling stakes in or appreciating value of early-stage companies. | Contributed positively to financial results in 2023. |

| Asset Sales | Revenue from selling non-core properties or land parcels. | Approximately $600 million in asset sales completed in 2023. |

Business Model Canvas Data Sources

The Alexandria Real Estate Equities Business Model Canvas is built upon extensive market research, financial disclosures, and internal operational data. These sources provide a comprehensive understanding of tenant needs, property performance, and strategic growth opportunities.