Alexandria Real Estate Equities Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alexandria Real Estate Equities Bundle

Alexandria Real Estate Equities operates in a dynamic sector where the threat of new entrants is moderate, and the bargaining power of buyers, particularly large life science companies, can be significant. Understanding these forces is crucial for strategic planning.

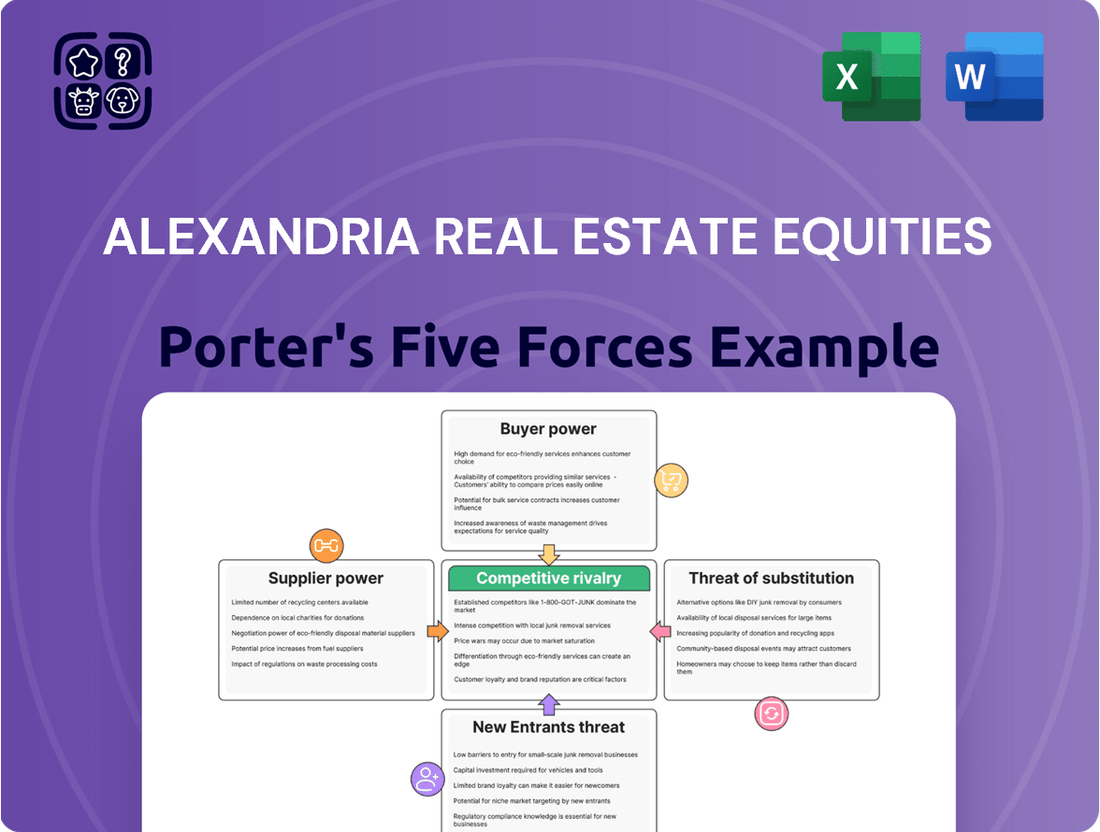

The full Porter's Five Forces Analysis reveals the strength and intensity of each market force affecting Alexandria Real Estate Equities, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

The uniqueness of inputs for Alexandria Real Estate Equities (ARE) generally leans towards moderate. While standard construction materials are readily available, the specialized nature of life science and technology lab fit-outs can involve proprietary technologies or highly specific design requirements. This can limit the pool of qualified suppliers for certain advanced systems or custom installations, thereby increasing supplier leverage.

Alexandria Real Estate Equities (ARE) likely faces moderate switching costs when changing suppliers for its properties. These costs could include the time and resources needed to re-negotiate contracts, re-familiarize new vendors with specific building systems, or potentially re-certify materials if specialized components are involved. For instance, if ARE uses a specific type of HVAC system or a particular construction material that requires specialized installation and maintenance, switching suppliers could necessitate retraining staff or investing in new tools for the new vendor.

The level of switching costs is directly tied to the complexity and customization of ARE's real estate portfolio. While standard maintenance services might have low switching costs, specialized services like advanced security system installation or unique façade maintenance could involve higher costs to transition. For example, a supplier for a cutting-edge laboratory facility might have proprietary software or unique training protocols, making a switch more disruptive and expensive than changing a general cleaning service provider.

Alexandria Real Estate Equities (ARE) faces moderate supplier power, particularly in specialized construction and development services. The market for highly specific life science and technology real estate construction involves a limited number of experienced contractors capable of meeting ARE's stringent requirements, potentially allowing these suppliers to command higher prices or more favorable terms.

In 2024, the demand for specialized lab and office space remained robust, intensifying competition for skilled construction labor and materials. While ARE benefits from long-term relationships with key developers, the concentration of expertise in certain geographic regions and niche construction areas means that the bargaining power of these suppliers is not negligible.

Threat of Forward Integration by Suppliers

Suppliers to Alexandria Real Estate Equities (ARE), such as construction firms or specialized service providers, possess a limited threat of forward integration. This is primarily because the core of ARE's business involves acquiring, developing, and managing large-scale, specialized real estate assets, a capital-intensive and complex undertaking. Suppliers typically lack the extensive capital, market knowledge, and established tenant relationships necessary to effectively compete in this arena.

For instance, a construction company might build properties, but transitioning to the role of a REIT like ARE requires navigating intricate financing, leasing, property management, and investor relations. While a supplier could theoretically develop a single property, replicating ARE's portfolio and operational scale is a significant barrier. This inherent difficulty in replicating ARE's business model curbs the suppliers' bargaining power stemming from a forward integration threat.

- Limited Supplier Capacity for Forward Integration: The high capital requirements and specialized knowledge needed to operate as a Real Estate Investment Trust (REIT) significantly hinder suppliers from effectively integrating forward into Alexandria Real Estate Equities' core business.

- Barriers to Entry for Suppliers: Developing and leasing specialized properties on a scale comparable to ARE requires substantial capital, market expertise, and established tenant networks, all of which are typically beyond the capabilities of ARE's suppliers.

- Focus of Suppliers: ARE's suppliers, such as construction or maintenance firms, generally focus on their core competencies rather than undertaking the complex and capital-intensive operations of real estate development and management.

Importance of Inputs to Alexandria's Business

The inputs provided by suppliers are crucial for Alexandria Real Estate Equities (ARE) to maintain the high quality and specialized nature of its life science and technology properties. For instance, specialized construction materials and advanced building systems are essential for creating the sophisticated laboratory and research spaces that ARE's tenants require. If these specific inputs are scarce or have limited alternatives, the suppliers offering them gain significant leverage.

ARE's reliance on specialized contractors and material providers for its unique properties significantly impacts the bargaining power of these suppliers. For example, the development of cutting-edge life science facilities often necessitates bespoke HVAC systems and specialized containment solutions. The limited number of qualified providers for such niche requirements can give these suppliers considerable pricing power.

- Criticality of Inputs: ARE's core operations depend on specialized construction, advanced HVAC, and tailored technological infrastructure for its life science and tech-focused properties.

- Lack of Substitutes: For highly specialized features like advanced laboratory ventilation or specific research-grade materials, viable substitutes are often scarce, increasing supplier leverage.

- Supplier Power: When inputs are essential and lack readily available alternatives, suppliers can command higher prices and more favorable terms, impacting ARE's development costs and profitability.

Alexandria Real Estate Equities (ARE) faces moderate supplier power, particularly for specialized construction and development services. The market for highly specific life science and technology real estate construction involves a limited number of experienced contractors capable of meeting ARE's stringent requirements, potentially allowing these suppliers to command higher prices or more favorable terms. In 2024, the demand for specialized lab and office space remained robust, intensifying competition for skilled construction labor and materials, which further bolstered supplier leverage in certain segments.

| Supplier Characteristic | Impact on ARE | 2024 Context |

|---|---|---|

| Uniqueness of Inputs | Moderate; specialized lab fit-outs require specific technologies. | Continued demand for advanced facilities amplified need for specialized suppliers. |

| Switching Costs | Moderate; re-negotiation, re-familiarization, and potential re-certification. | Higher for complex systems, lower for standard maintenance. |

| Forward Integration Threat | Limited; suppliers lack capital and expertise for REIT operations. | High barriers to entry for suppliers attempting to replicate ARE's scale. |

What is included in the product

This analysis tailors Porter's Five Forces to Alexandria Real Estate Equities, dissecting competitive intensity, buyer and supplier power, and barriers to entry within the life science real estate sector.

Alexandria Real Estate Equities' Porter's Five Forces analysis provides a clear, actionable framework to identify and mitigate competitive threats, offering a strategic advantage in a dynamic real estate market.

Customers Bargaining Power

Alexandria Real Estate Equities' (ARE) customer concentration is a key factor in their bargaining power. The company's reliance on a few large tenants, particularly in the life science and technology sectors, can give these firms significant leverage during lease negotiations. For instance, if a handful of major life science companies occupy a substantial percentage of ARE's rentable square footage, their ability to demand favorable lease terms increases.

Customer switching costs for Alexandria Real Estate Equities (ARE) tenants are a significant factor. The expense and disruption involved in relocating specialized lab or office spaces, including the cost of decommissioning existing facilities and setting up new ones, can be substantial. For instance, a tenant with highly customized lab equipment and infrastructure might face millions in relocation expenses, making them hesitant to switch providers.

Furthermore, the complexity of moving sensitive research equipment, ensuring continuity of operations, and potentially retraining staff for a new environment significantly increases switching costs. ARE's focus on life science properties means many tenants have unique, built-in infrastructure, such as specialized ventilation, power, and plumbing, which are difficult and costly to replicate elsewhere. This inherent complexity directly limits the bargaining power of these customers.

Alexandria Real Estate Equities (ARE) faces significant customer bargaining power when tenants can easily find alternative specialized laboratory or office spaces. The availability of comparable properties, particularly within ARE's key life science clusters, directly impacts tenant retention and pricing flexibility. For instance, in 2024, ARE's occupancy rate hovered around 95%, indicating strong demand, but the presence of other developers offering similar high-quality, purpose-built facilities in markets like Boston/Cambridge or San Francisco means tenants have options if ARE's terms become unfavorable.

Customer Price Sensitivity

Alexandria Real Estate Equities' (ARE) tenants, primarily in the life sciences and technology sectors, exhibit varying degrees of price sensitivity. For many, particularly early-stage biotech firms, lease rates represent a significant portion of their burn rate, making them highly sensitive to increases. Established, well-funded companies may be less sensitive, prioritizing location and specialized facilities over minor cost fluctuations.

The criticality of ARE's real estate to their tenants' operations is a key factor. For research-intensive organizations, the availability of specialized lab space, critical infrastructure, and proximity to talent pools can outweigh pure cost considerations. However, as of early 2024, the broader economic climate and funding environment for some life science startups have increased the focus on operational efficiency, potentially heightening price sensitivity across the board.

- High Sensitivity: Early-stage life science companies with limited funding rounds are highly sensitive to lease rate increases, as rent is a major operational expense.

- Moderate Sensitivity: Larger, publicly traded life science or tech companies may be less sensitive to incremental rent hikes but are still mindful of overall occupancy costs impacting profitability.

- Low Sensitivity: Tenants in highly specialized, mission-critical facilities developed by ARE, where switching costs are exceptionally high, may exhibit lower price sensitivity.

Threat of Backward Integration by Customers

Large, sophisticated tenants within Alexandria Real Estate Equities' portfolio, particularly those in the life sciences and technology sectors, possess the capability to develop or acquire their own specialized laboratory and office spaces. This potential for backward integration directly enhances their bargaining power during lease negotiations, as they can credibly threaten to self-develop if lease terms are unfavorable.

For instance, a major biopharmaceutical company might consider building its own research campus if lease renewals with Alexandria become excessively expensive or restrictive. This is a significant consideration for Alexandria, as retaining anchor tenants is crucial for occupancy and rental income stability.

- Tenant Self-Development Risk: The possibility of key tenants constructing their own facilities reduces their reliance on external providers like Alexandria.

- Negotiating Leverage: This threat allows tenants to push for more favorable lease terms, including rent concessions and build-out allowances.

- Impact on Alexandria: Alexandria must balance competitive pricing with the need to maintain profitability, especially when facing the prospect of losing high-value tenants to in-house development.

The bargaining power of Alexandria Real Estate Equities' (ARE) customers is moderately high due to the specialized nature of their facilities and the significant switching costs involved. While ARE's occupancy rates remained strong at approximately 95% in 2024, indicating tenant stickiness, the availability of comparable, high-quality life science spaces in key markets provides tenants with alternative options. This balance means tenants can exert some leverage, particularly if they represent a substantial portion of ARE's rental income.

| Factor | Impact on ARE Customer Bargaining Power | 2024 Data/Observation |

| Customer Concentration | High concentration of large tenants increases individual tenant leverage. | While specific tenant concentration figures are not publicly detailed for 2024, ARE's business model relies on securing anchor tenants in its specialized clusters. |

| Switching Costs | High due to specialized infrastructure and relocation expenses. | Relocation of advanced lab equipment and infrastructure can cost millions, creating significant barriers for tenants to move. |

| Availability of Alternatives | Moderate; depends on market supply of similar specialized spaces. | ARE's 95% occupancy in 2024 suggests demand outstrips supply in many of its key markets, but other developers offer competitive, albeit often less specialized, alternatives. |

| Price Sensitivity | Varies; higher for early-stage companies, lower for established ones. | Early-stage biotech firms are more sensitive to rent as a percentage of their burn rate. Established companies prioritize location and facility quality. |

| Tenant Self-Development Potential | Threatens ARE by allowing tenants to build their own facilities. | Large, well-capitalized biopharmaceutical companies have the capacity to consider self-development if lease terms become unfavorable. |

Full Version Awaits

Alexandria Real Estate Equities Porter's Five Forces Analysis

This preview showcases the comprehensive Porter's Five Forces analysis for Alexandria Real Estate Equities, detailing the competitive landscape and strategic positioning within the life science real estate sector. The document you see here is the exact, fully formatted report you'll receive immediately after purchase, offering actionable insights into industry dynamics. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file, enabling immediate strategic planning.

Rivalry Among Competitors

Alexandria Real Estate Equities (ARE) faces significant competitive rivalry from other specialized real estate investment trusts (REITs) focused on life science and technology hubs, such as BioMed Realty Trust and Kilroy Realty. Additionally, private developers and large institutional investors, including pension funds and private equity firms, are increasingly active in this lucrative sector, further diversifying the competitive landscape.

The life science, technology, and agtech real estate market, Alexandria Real Estate Equities' core focus, is experiencing robust growth. This expansion, however, can intensify competition as numerous players vie for prime locations and tenants. For instance, in 2024, many of these specialized submarkets continued to see strong demand, driving up rental rates and occupancy, but also attracting new development and investment.

Alexandria Real Estate Equities, like others in the life science and technology real estate sector, faces significant exit barriers. The substantial capital invested in specialized properties, often requiring custom build-outs for tenants, makes divestment difficult and costly. These illiquid assets are not easily sold, especially in downturns, trapping capital.

Long-term leases, a common feature in this industry, further cement companies in the market. For instance, a typical lease might run for 10-15 years, meaning a property owner is committed to that asset and tenant for an extended period. This commitment can intensify competition as firms are less able to quickly reallocate resources away from underperforming markets or assets.

Product and Service Differentiation

Alexandria Real Estate Equities (ARE) differentiates itself through highly specialized life science campuses, offering integrated infrastructure and amenities crucial for research and development. This specialization, including state-of-the-art laboratories and advanced building systems, significantly reduces direct price competition by catering to unique tenant needs that general office spaces cannot meet.

ARE's venture capital arm, Alexandria Venture Investments, further distinguishes the company by providing capital and strategic support to early-stage life science companies. This dual offering of real estate and investment capital creates a sticky ecosystem, enhancing tenant loyalty and reducing the likelihood of tenants seeking alternative, less integrated solutions.

- Specialized Space: ARE's focus on life science clusters provides tailored laboratory and office environments, a significant differentiator from generic commercial real estate.

- Integrated Ecosystem: The combination of real estate, infrastructure, and venture capital services creates a unique value proposition for tenants, fostering strong relationships.

- Reduced Price Sensitivity: High differentiation in specialized services and infrastructure makes tenants less sensitive to minor price fluctuations, as the value of ARE's offerings is paramount.

Fixed Costs and Capacity

Alexandria Real Estate Equities (ARE) operates in a sector where fixed costs, particularly for developing and maintaining specialized life science and technology campuses, are substantial. These costs include land acquisition, construction, and ongoing property management, creating a high barrier to entry and a significant commitment for existing players.

The capacity utilization within this niche real estate market is a critical factor influencing pricing power. When occupancy rates are high, landlords like ARE can command premium rents. However, periods of excess capacity or slower leasing can intensify competition, as companies may be incentivized to offer concessions or lower rental rates to attract and retain tenants, thereby filling vacant spaces.

For instance, the life science real estate market, while robust, can experience fluctuations in demand. ARE's strategy often involves long-term leases and developing state-of-the-art facilities that command higher rents, mitigating some of the pressure from fixed costs and capacity utilization. However, the inherent capital intensity of this business means that maintaining high occupancy is paramount to achieving favorable returns on investment.

- High Fixed Costs: The specialized nature of life science and technology real estate necessitates significant upfront investment in land, construction, and specialized infrastructure, contributing to a high proportion of fixed costs for companies like Alexandria Real Estate Equities.

- Capacity Utilization Impact: When vacancy rates rise, the pressure to fill space can lead to competitive pricing strategies, as companies aim to cover their substantial fixed costs and avoid prolonged periods of underutilization.

- Leasing Strategies: Alexandria Real Estate Equities often mitigates these pressures through long-term leases and the development of premium, highly sought-after facilities, which support higher occupancy and rental rates, thereby managing the impact of fixed costs and capacity.

The competitive rivalry within Alexandria Real Estate Equities' (ARE) niche sector is substantial, driven by both specialized REITs and large institutional investors. While ARE's unique value proposition, including integrated campuses and venture capital, mitigates direct price competition, the sector's growth attracts significant capital. In 2024, the demand for life science and technology hubs remained strong, leading to increased development and investment, which naturally heightens competition for prime locations and tenants.

| Competitor Type | Key Players | Competitive Action |

|---|---|---|

| Specialized REITs | BioMed Realty Trust, Kilroy Realty | Developing similar specialized campuses, competing for anchor tenants. |

| Institutional Investors | Pension Funds, Private Equity Firms | Acquiring existing assets, developing new properties, offering competitive lease terms. |

| Private Developers | Various | Targeting high-growth submarkets, potentially undercutting on price for less specialized spaces. |

SSubstitutes Threaten

Life science, technology, and agtech companies might explore remote work models, reducing their reliance on physical office and lab spaces. For instance, the widespread adoption of hybrid work in 2024, with many tech companies maintaining flexible arrangements, demonstrates a shift away from traditional office needs. This trend can diminish demand for specialized real estate solutions.

The threat of substitutes for Alexandria Real Estate Equities (ARE) is moderate. While there aren't direct, perfect substitutes for specialized life science and technology campuses, alternative real estate solutions can emerge. For instance, companies might consider repurposing existing office spaces or developing custom facilities on their own land, though these often involve higher upfront costs and longer development timelines compared to leasing from ARE. In 2024, the demand for flexible and modern lab and office spaces remained strong, with ARE reporting high occupancy rates, indicating that the cost and functional equivalence of substitutes were not yet compelling enough to significantly erode ARE's market position.

For Alexandria Real Estate Equities (ARE), the threat of substitutes is generally low for its core tenant base, which primarily consists of life sciences and technology companies. These tenants often require highly specialized facilities, including wet labs, clean rooms, and advanced infrastructure, which are not easily replicated by generic office spaces or alternative real estate solutions. The capital expenditure required to outfit such specialized spaces is substantial, creating a significant barrier for tenants considering a move to a less suitable, albeit cheaper, alternative. For instance, establishing a compliant life sciences lab can cost upwards of $500 to $1,000 per square foot in build-out expenses, making a simple relocation to a standard office building impractical and prohibitively expensive.

Propensity of Buyers to Substitute

Life science, technology, and agtech companies consider substitutes for physical office and lab space. This willingness is influenced by industry trends and the perceived benefits of virtual versus physical infrastructure. For instance, the rise of remote work and advanced collaboration tools can reduce the immediate need for extensive physical footprints.

The perceived benefits of physical vs. virtual infrastructure play a crucial role. While virtual collaboration is efficient, specialized lab equipment and the need for hands-on research in life sciences often necessitate physical presence. However, advancements in simulation and remote monitoring technologies are starting to offer alternatives, potentially lowering the demand for traditional lab space.

Alexandria Real Estate Equities (ARE) faces a moderate threat from substitutes. While companies in its target sectors value specialized facilities, the increasing adoption of hybrid work models and advancements in virtual R&D capabilities present potential alternatives to traditional, dedicated physical spaces. For example, a 2024 survey indicated that over 60% of tech companies are maintaining hybrid work policies, impacting their real estate needs.

- Hybrid work models are becoming standard, potentially reducing demand for large, centralized physical spaces.

- Advancements in virtual collaboration and R&D tools offer alternatives to traditional lab and office environments.

- The specialized nature of life science research still creates a strong need for physical infrastructure, mitigating some substitution risk.

- Companies weigh the costs and benefits of physical space against the efficiency and accessibility of virtual solutions.

Technological Advancements Enabling Substitutes

Emerging technologies present a significant threat of substitutes for Alexandria Real Estate Equities (ARE) by potentially reducing the demand for traditional physical lab and office spaces. For instance, advanced simulation software and AI-driven research platforms can allow companies to conduct complex experiments and analyses remotely, lessening the need for extensive on-site laboratory facilities. This trend was already gaining momentum pre-2024, with many companies exploring hybrid work models, which were further accelerated by global events.

Decentralized R&D networks and virtual collaboration tools also contribute to this threat. Companies can leverage global talent pools and share resources virtually, diminishing the necessity for centralized, physical hubs. This shift could impact ARE's rental income from specialized life science and tech tenants who might opt for more flexible, distributed real estate solutions. For example, as of late 2023 and into 2024, the demand for large, contiguous lab spaces in prime urban markets, while still strong, is being balanced by companies seeking smaller, more adaptable footprints or even fully remote R&D operations.

The increasing sophistication and accessibility of these technological substitutes mean that the cost and inconvenience of traditional real estate may become less appealing. Companies are evaluating the total cost of ownership, including rent, utilities, and operational overhead, against the productivity and collaboration gains offered by virtual and distributed models. This could lead to a recalibration of space requirements, potentially impacting occupancy rates and rental growth for ARE if they cannot adapt their offerings.

- Technological advancements like AI and simulation software can reduce the need for physical lab space.

- Virtual collaboration tools enable decentralized R&D, impacting demand for centralized office environments.

- Companies are increasingly scrutinizing the total cost of real estate versus the benefits of remote or hybrid work models.

The threat of substitutes for Alexandria Real Estate Equities (ARE) is moderate, primarily due to evolving work models and technological advancements. While ARE's tenants require specialized facilities, the rise of hybrid work and virtual R&D capabilities presents potential alternatives. For instance, over 60% of tech companies maintained hybrid policies in 2024, influencing their real estate needs.

Advanced simulation software and AI platforms allow for remote experimentation, potentially lessening the demand for extensive on-site labs. This trend, accelerated by global events, means companies may opt for more flexible, distributed real estate solutions rather than large, centralized campuses. The cost-benefit analysis of physical space versus virtual efficiency is a key driver.

| Factor | Impact on ARE | Mitigating Factors for ARE |

| Hybrid Work Models | Moderate threat; reduces demand for large, centralized physical spaces. | ARE's focus on amenity-rich, collaborative environments can still attract tenants. |

| Virtual R&D and Simulation | Moderate threat; enables remote experimentation, lessening need for physical labs. | Life science tenants still require specialized physical infrastructure for certain research. |

| Cost of Specialized Build-Out | Lowers threat; high capital expenditure for life science labs creates a barrier to switching. | Tenants face significant costs to outfit alternative, less suitable spaces. |

Entrants Threaten

Entering the life sciences real estate sector, particularly at the scale Alexandria Real Estate Equities operates, demands immense capital. Acquiring prime land in innovation hubs, constructing highly specialized laboratory and office spaces, and building a diversified portfolio requires billions of dollars. For instance, major development projects in biotech clusters can easily run into hundreds of millions, if not billions, of dollars, creating a significant hurdle for newcomers.

Alexandria Real Estate Equities, Inc. (ARE) benefits significantly from its substantial scale and deep experience in developing and managing life science and technology campuses. This allows ARE to achieve considerable economies of scale in areas like property acquisition, construction, and tenant services, which new entrants would find difficult to replicate. For instance, in 2023, ARE's total assets stood at approximately $31.7 billion, underscoring its significant market presence and operational capacity.

New competitors would face a steep climb to match ARE's established network of relationships with leading research institutions and innovative companies, as well as its proven track record in delivering highly specialized facilities. The company's long-standing expertise in navigating complex zoning, permitting, and construction processes for life science properties provides a crucial competitive advantage that shields it from immediate, large-scale threats from new market entrants.

New players face significant hurdles in securing prime real estate within established life science and technology hubs, areas where Alexandria Real Estate Equities has a strong foothold. For instance, acquiring a desirable location in Boston's Kendall Square, a premier innovation cluster, involves intense competition and substantial capital outlays, making it difficult for newcomers to gain traction.

Proprietary Technology and Expertise

Alexandria Real Estate Equities (ARE) benefits from significant proprietary technology and deep expertise in developing and managing life science and technology campuses. This includes specialized building systems, advanced data infrastructure, and a nuanced understanding of tenant needs within these highly regulated and rapidly evolving sectors. For instance, ARE's focus on creating highly collaborative and adaptable environments, often incorporating specialized lab infrastructure, represents a significant barrier to entry for newcomers who lack this specialized knowledge and proven track record.

The company's intellectual capital, cultivated over decades, is a crucial deterrent. This expertise extends to navigating complex zoning regulations, securing permits for specialized facilities, and understanding the intricate operational requirements of research and development tenants. In 2023, ARE reported a strong occupancy rate of 94.4% across its portfolio, underscoring the demand for its specialized properties and the difficulty new entrants would face in attracting similar high-quality tenants without comparable expertise.

- Specialized Development Expertise: ARE possesses unique capabilities in designing and constructing state-of-the-art life science facilities, including advanced HVAC, biosafety containment, and specialized laboratory fit-outs, which are costly and time-consuming for new entrants to replicate.

- Deep Industry Knowledge: The company's understanding of tenant needs within the life science and technology sectors, from early-stage biotech startups to established pharmaceutical giants, allows for the creation of tailored environments that attract and retain key players.

- Operational Know-How: ARE's experience in managing complex, multi-tenant campuses with specialized infrastructure provides an operational advantage that new competitors would struggle to match, ensuring seamless operations for its tenants.

Government Policy and Regulation

Government policy and regulation significantly influence the threat of new entrants in the real estate sector, particularly for specialized markets like laboratory facilities. Strict zoning laws, stringent building codes, and comprehensive environmental regulations can erect substantial barriers. For instance, the lengthy and complex permitting processes for developing advanced laboratory spaces can deter new players. In 2023, the average time to obtain building permits in major metropolitan areas often exceeded several months, adding considerable cost and uncertainty for new developers.

Specific permitting requirements for specialized laboratory facilities, such as those needing advanced ventilation or containment systems, further elevate these barriers. These often involve multiple agency approvals and adherence to precise technical standards. For example, the U.S. Environmental Protection Agency (EPA) mandates strict compliance for facilities handling hazardous materials, a common requirement in biotech and pharmaceutical labs, which can be costly and time-consuming for newcomers to navigate.

- Zoning Laws: Restrictive zoning can limit the types of properties that can be developed or redeveloped for laboratory use, particularly in established urban areas.

- Building Codes: Specialized requirements for lab spaces, such as HVAC systems, safety features, and power redundancy, increase construction costs and complexity for new entrants.

- Environmental Regulations: Compliance with regulations concerning waste disposal, emissions, and water usage adds layers of complexity and potential liability for new laboratory developments.

- Permitting Processes: Lengthy and intricate permitting procedures for specialized facilities can delay market entry and increase upfront capital requirements.

The threat of new entrants for Alexandria Real Estate Equities (ARE) is significantly mitigated by the immense capital required to enter the life sciences real estate market. Developing specialized facilities in prime innovation hubs, like Boston's Kendall Square, can cost hundreds of millions, if not billions, of dollars, creating a substantial barrier. For instance, major development projects in biotech clusters often demand such vast investment, making it exceedingly difficult for new players to compete with ARE's established scale and financial capacity.

ARE's deep industry knowledge and specialized development expertise further deter new entrants. The company's decades of experience in creating advanced laboratory spaces, understanding tenant needs, and navigating complex regulatory environments are difficult to replicate. In 2023, ARE maintained a high occupancy rate of 94.4%, demonstrating the demand for its specialized properties and the challenge new competitors face in attracting similar quality tenants without comparable expertise.

| Barrier Type | Description | Impact on New Entrants | ARE's Advantage |

|---|---|---|---|

| Capital Requirements | High cost for land acquisition and specialized construction in innovation hubs. | Significant hurdle due to immense upfront investment needed. | Established financial strength and access to capital markets. |

| Specialized Expertise | Developing and managing advanced lab facilities with specific infrastructure. | Difficult to replicate ARE's technical and operational know-how. | Decades of experience and proprietary knowledge in life science real estate. |

| Industry Relationships | Established networks with research institutions and biotech companies. | Challenging to build trust and secure high-quality tenants without a proven track record. | Long-standing partnerships and a reputation for reliability. |

| Regulatory Navigation | Complex zoning, permitting, and building codes for specialized facilities. | Time-consuming and costly for new entrants to understand and comply. | Proven ability to manage intricate approval processes efficiently. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Alexandria Real Estate Equities is built upon a foundation of comprehensive data, including the company's SEC filings, investor presentations, and annual reports. We supplement this with industry-specific market research from reputable firms and analysis of publicly available competitor data to provide a robust competitive landscape.