Alexandria Real Estate Equities Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Alexandria Real Estate Equities Bundle

Alexandria Real Estate Equities (ARE) operates within a dynamic real estate sector, and understanding its position through the BCG Matrix is crucial for investors. This framework helps categorize ARE's diverse portfolio of life science and technology campuses. Are its properties Stars, Cash Cows, Dogs, or Question Marks in today's market?

Gain a comprehensive understanding of Alexandria Real Estate Equities' strategic positioning by purchasing the full BCG Matrix. This detailed report offers quadrant-by-quadrant insights and actionable recommendations to guide your investment decisions in the life science real estate market.

Stars

Alexandria Real Estate Equities excels in developing and managing life science Megacampus ecosystems in prime innovation hubs like Boston, San Francisco, and San Diego.

These specialized campuses offer critical lab and office space, crucial for R&D, and are considered Stars within the BCG Matrix due to the robust, sustained demand in the life sciences sector.

In 2024, Alexandria's portfolio continued to benefit from this trend, with high occupancy rates reflecting the sector's resilience and growth, underscoring the strategic value of these clustered innovation environments.

Alexandria Venture Investments, the company's strategic venture capital arm, actively invests in promising disruptive life science companies. This platform offers valuable insights into emerging industry trends and cultivates crucial relationships with entrepreneurs and academic institutions, thereby strengthening Alexandria's tenant ecosystem.

In 2024, Alexandria Venture made substantial investments totaling approximately $2.7 billion across a range of funding rounds. This significant capital deployment underscores the high-growth potential of this sector and Alexandria's strategy to secure future market leadership through early-stage investments in innovative ventures.

Alexandria's long-term leases with high-quality tenants are a significant strength, akin to a Star in the BCG matrix. A substantial 53% of its annual rental revenue is derived from investment-grade or large-cap public companies. This includes prominent names such as Eli Lilly, Moderna, and Bristol-Myers Squibb, underscoring the caliber of its tenant base.

The company secures its revenue through leases with extended terms, boasting a weighted-average remaining lease term of 7.6 years. Furthermore, these leases typically incorporate contractual annual rent escalations of approximately 3%. This structure generates consistent and predictable cash flow, reinforcing the stability of these tenant relationships in a market experiencing escalating demand for specialized life science facilities.

Development and Redevelopment Pipeline

Alexandria Real Estate Equities (ARE) maintains a robust development and redevelopment pipeline, focusing on Class A/A+ properties. This strategic approach fuels future growth by creating high-demand assets.

Projects completed and placed into service in the first quarter of 2025 achieved full occupancy, demonstrating strong market absorption and contributing positively to annual net operating income (NOI). This leasing success underscores the demand for ARE's premium properties.

ARE anticipates significant NOI growth stemming from its development pipeline through 2027. This outlook highlights the company's commitment to investing in assets that are positioned to become future cash cows, capitalizing on sustained demand in key life science and technology hubs.

- Pipeline Focus: Primarily Class A/A+ properties in high-demand life science and technology clusters.

- Q1 2025 Leasing: Projects placed in service during Q1 2025 reported 100% leased status.

- NOI Growth Projection: Expects substantial additional NOI from the pipeline through 2027.

- Strategic Positioning: Investments are geared towards assets likely to become future cash cows.

Strong Tenant Retention and Leasing Activity

Alexandria Real Estate Equities (ARE) showcases impressive tenant loyalty, with a substantial 84% of its leasing activity over the past year coming from its existing tenants. This high retention rate strongly suggests that current occupants are very satisfied with ARE's specialized life science properties and services, creating a stable and predictable revenue stream. It reflects a sticky customer base in a dynamic and expanding market.

The company's recent leasing successes further underscore this strength. A notable example is the significant 466,598 rentable square feet (RSF) lease secured with a major multinational pharmaceutical company in the second quarter of 2025. This deal highlights the robust demand for ARE's high-quality, strategically located facilities tailored to the needs of the life science industry.

- Tenant Retention Rate: 84% of leasing activity in the last twelve months originated from existing tenants.

- Customer Stickiness: High retention indicates strong tenant satisfaction and a resilient customer base.

- Recent Major Lease: A 466,598 RSF lease with a multinational pharmaceutical tenant was signed in Q2 2025.

- Market Demand: This activity demonstrates continued strong demand for ARE's specialized properties.

Alexandria Real Estate Equities' (ARE) specialized life science campuses are prime examples of Stars in the BCG Matrix. These properties benefit from high demand and growth in the life sciences sector, as evidenced by strong occupancy rates in 2024. The company's venture capital arm, Alexandria Venture Investments, further solidifies this Star status by investing in disruptive life science companies, with approximately $2.7 billion deployed in 2024, ensuring ARE remains at the forefront of innovation.

| Metric | Value (2024/Early 2025) | Significance |

|---|---|---|

| Portfolio Occupancy | High, reflecting sustained demand | Indicates strong market position and revenue stability |

| Alexandria Venture Investments Deployment | ~$2.7 billion | Highlights commitment to high-growth life science ventures |

| Tenant Retention | 84% of leasing activity from existing tenants | Demonstrates strong tenant satisfaction and predictable revenue |

| Major Lease Secured (Q2 2025) | 466,598 RSF | Confirms ongoing demand for premium life science facilities |

What is included in the product

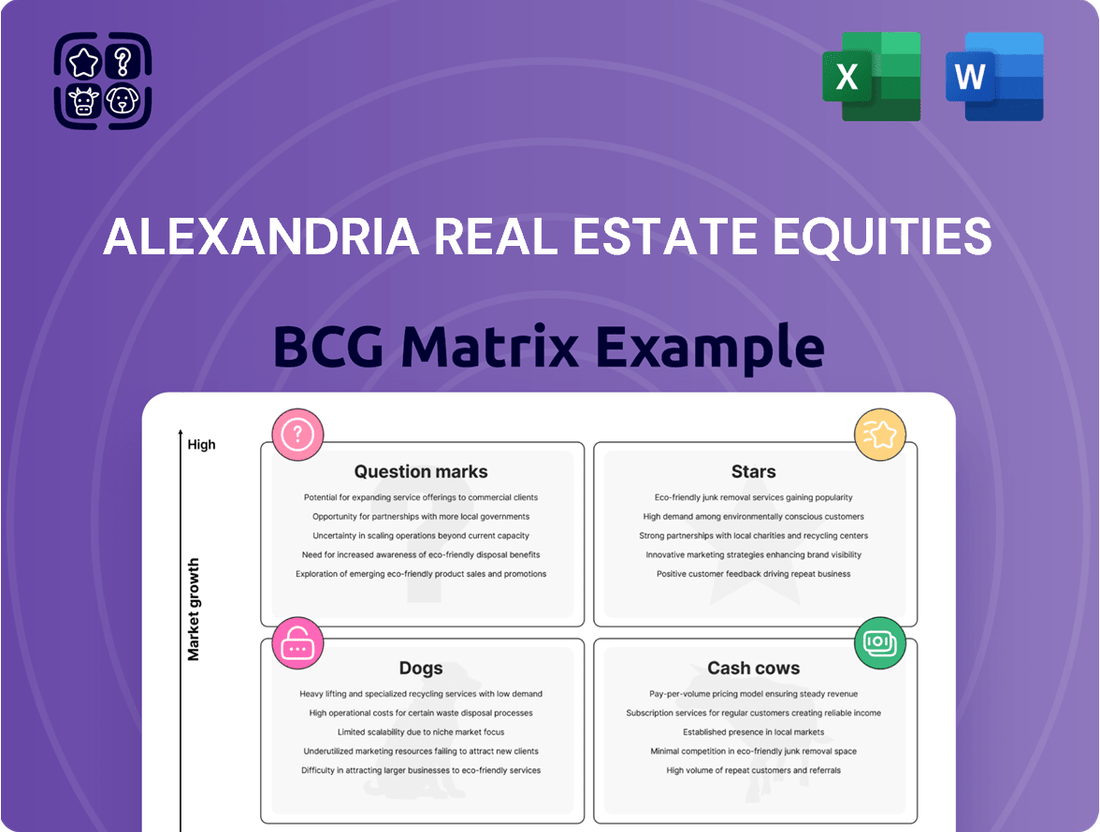

Alexandria Real Estate Equities BCG Matrix: Strategic insights for optimizing its real estate portfolio.

A clear BCG Matrix visualizes Alexandria Real Estate Equities' portfolio, relieving the pain of strategic uncertainty.

Cash Cows

Alexandria's established operating properties in prime life science hubs like Greater Boston, San Francisco Bay Area, and San Diego are true cash cows. These mature assets consistently deliver strong rental income, forming the backbone of the company's revenue. As of early 2024, these clusters maintained high occupancy, reflecting their enduring demand.

These properties, particularly those within the Megacampus platform, are characterized by their stable performance and robust cash flow generation. Their significant contribution to Alexandria's annual rental revenue solidifies their position as established operating properties in core clusters, fitting the description of cash cows within the BCG matrix.

Alexandria Real Estate Equities' Megacampus properties are the company's undisputed cash cows. This platform is the backbone of their revenue, generating a substantial 75% of their annual rental income.

These prime assets boast an impressive 91% occupancy rate, significantly outperforming the average in their key coastal markets. This high occupancy, combined with the unique, specialized nature of the facilities, translates into a predictable and robust cash flow stream.

As mature, market-leading assets, these Megacampus properties require minimal marketing or promotional investment. They consistently deliver reliable returns, underscoring their status as a stable and highly profitable segment of Alexandria's portfolio.

Alexandria Real Estate Equities demonstrates its Cash Cow status through consistent dividend payouts. For the second quarter of 2025, the company declared a quarterly cash dividend of $1.32 per common share, marking a 3.5% increase year-over-year.

This reliable distribution to shareholders, currently yielding an attractive 7.3%, is underpinned by robust net cash flows from its operating activities. The capacity to generate substantial cash and return it to investors without compromising its core business operations is a defining characteristic of a Cash Cow.

Robust Tenant Collections

Alexandria Real Estate Equities (ARE) demonstrates exceptional tenant rent collections, a clear indicator of its Cash Cow status. For the second quarter of 2025, the company reported an outstanding collection rate of 99.9%.

This near-perfect collection rate highlights the robust financial health of ARE's tenant base and the dependable nature of its rental revenue. Such consistent and high collection levels are characteristic of a Cash Cow, signifying a stable and predictable stream of cash flow with negligible exposure to default risk.

- Consistent High Collections: ARE's ability to collect nearly all rent payments, exemplified by the 99.9% rate in Q2 2025, provides a reliable income foundation.

- Tenant Stability: The near-perfect collection rate suggests a high-quality tenant roster, likely comprising stable, creditworthy organizations.

- Predictable Cash Flow: This strong collection performance translates directly into predictable and consistent cash inflows, a key trait of a Cash Cow.

- Low Bad Debt Risk: The minimal uncollected rent minimizes the risk of bad debt, further solidifying the stability of ARE's earnings.

Strategic Asset Dispositions for Capital Recycling

Alexandria Real Estate Equities strategically uses its Cash Cows by selling off mature or less critical properties. This capital recycling allows them to reinvest in promising development and redevelopment projects.

In 2024, Alexandria achieved significant success with this approach, bringing in $1.4 billion from asset sales. This demonstrates a strong ability to harvest value from existing holdings.

- Capital Recycling: Alexandria's strategy of selling non-core assets and land is a prime example of leveraging Cash Cow resources.

- 2024 Performance: The company generated $1.4 billion from dispositions in 2024, highlighting effective value harvesting.

- 2025 Target: A target of $1.95 billion for dispositions in 2025 indicates continued commitment to this capital recycling strategy.

- Funding Growth: These dispositions directly fund Alexandria's development and redevelopment pipeline, fueling future growth opportunities.

Alexandria Real Estate Equities' Megacampus properties are its undisputed cash cows, generating a substantial 75% of its annual rental income. These prime assets boast an impressive 91% occupancy rate, significantly outperforming market averages and translating into predictable, robust cash flow.

As mature, market-leading assets, they require minimal investment, consistently delivering reliable returns. This stability is further evidenced by a near-perfect 99.9% tenant rent collection rate in Q2 2025, underscoring the dependable nature of their rental revenue.

The company strategically recycles capital from these mature holdings, evidenced by $1.4 billion in asset sales in 2024, to fuel its development pipeline.

| Metric | Value (Q2 2025) | Significance |

|---|---|---|

| Rental Income Contribution | 75% of Annual Rental Income | Core revenue driver |

| Occupancy Rate | 91% | Outperforms market averages |

| Tenant Rent Collection | 99.9% | Indicates tenant stability and predictable cash flow |

| Asset Dispositions (2024) | $1.4 Billion | Capital recycling for growth |

Delivered as Shown

Alexandria Real Estate Equities BCG Matrix

The preview you see is the complete and final Alexandria Real Estate Equities BCG Matrix report, identical to what you will receive immediately after purchase. This comprehensive analysis, meticulously crafted, will be delivered to you without any watermarks or demo content, ensuring you have a professional and ready-to-use strategic tool. You can confidently download this document knowing it's the exact, fully formatted BCG Matrix report designed for insightful business planning and decision-making.

Dogs

Alexandria Real Estate Equities (ARE) may identify certain operating properties as potential 'Dogs' in its BCG Matrix, particularly those outside its core Megacampus strategy. These assets are showing signs of weakness, such as declining occupancy rates.

As of June 30, 2025, North American occupancy for ARE was 90.8%. This represents a notable decrease from 94.6% recorded a year earlier, indicating a broader trend of softening demand or increased competition in some of its markets.

Properties burdened by significant temporary vacancies or situated in submarkets with an oversupply of lab space, leading to subdued demand, fit the 'Dog' profile. These assets tie up valuable capital but are not generating the desired returns, suggesting a need for strategic review.

Older, less amenitized properties within Alexandria Real Estate Equities' portfolio, while not explicitly labeled as such, could be considered the 'Dogs' in a BCG-like analysis. These assets might not align with the current tenant demand for cutting-edge, highly amenitized Class A life science spaces.

The market clearly favors premium, well-equipped facilities, indicating that properties lagging in amenities could face slower leasing velocity and potentially become capital drains. For instance, in 2024, the demand for flexible lab space with advanced features like specialized ventilation and high-speed connectivity remained exceptionally strong, pushing rental rates for top-tier properties higher.

If Alexandria has properties that don't meet these evolving standards, they might experience lower occupancy rates or require significant capital investment to remain competitive. This strategic challenge necessitates careful evaluation for potential repositioning, sale, or redevelopment to avoid becoming a drag on overall portfolio performance.

Alexandria Real Estate Equities is actively working to divest its underperforming non-core assets, a strategy aligned with its BCG Matrix approach to portfolio optimization. This includes selling undeveloped land parcels and properties that are not yet stabilized or generating optimal returns.

These assets are identified as having limited growth potential or a small market footprint within Alexandria's broader portfolio. The capital generated from these dispositions is earmarked for reinvestment into higher-growth, more strategic opportunities that better align with the company's long-term vision.

The company anticipates these sales will occur at a weighted average capitalization rate between 7.5% and 8.5%. This range signals that these assets are not meeting expected performance benchmarks, making them prime candidates for divestiture to improve overall portfolio efficiency and returns.

Properties in Markets with Oversupply

Some established life science hubs are currently facing an oversupply of lab and R&D space. This situation has driven the national lab availability rate to a significant 30%, largely due to a surge in new construction and increased subleasing activity.

Properties situated in these particular submarkets, where the supply of space is outpacing demand, present a unique challenge. Rental rates in these areas may be softer, impacting a company's ability to maintain market share and profitability.

- High Availability: National lab availability rate reached 30% in early 2024.

- Oversupply Factors: Driven by new construction and increased subleasing.

- Market Impact: Potential for lower rental rates and challenges in maintaining market share.

- Strategic Consideration: Properties in these submarkets may represent a "Dog" in the BCG Matrix due to slower growth and lower market share potential.

Projects with Significant Impairment Charges

Alexandria Real Estate Equities faced significant challenges with projects carrying substantial impairment charges. In the second quarter of 2025, the company reported real estate impairment charges totaling $129.6 million. This substantial figure directly contributed to a net loss for the period.

These impairment charges signal a decline in the value of specific real estate assets. It suggests that these particular properties are not performing as expected or have dim future prospects. Such assets can become cash traps, draining resources without generating adequate returns.

- Asset Underperformance: The $129.6 million in Q2 2025 impairment charges indicates that certain real estate holdings are significantly underperforming.

- Negative Future Prospects: These charges suggest that the future revenue-generating potential of these assets is now viewed as considerably lower.

- Cash Trap Identification: Properties with large impairment charges often represent cash traps, requiring ongoing investment without a clear path to profitability.

- Strategic Divestment Consideration: For strategic portfolio management, these underperforming assets may warrant divestment to reallocate capital to more promising ventures.

Properties within Alexandria Real Estate Equities' portfolio that exhibit low occupancy, are situated in submarkets with oversupply, or lack modern amenities can be categorized as 'Dogs' in a BCG Matrix framework. These assets often require significant capital investment without yielding commensurate returns, necessitating strategic reassessment for potential repositioning or divestment. By June 30, 2025, ARE's North American occupancy dipped to 90.8%, a decline from 94.6% the previous year, highlighting potential weaknesses in certain segments.

| Asset Characteristic | BCG Matrix Classification | Potential Strategic Action |

|---|---|---|

| Low occupancy, declining demand | Dog | Divestment or repositioning |

| Oversupplied submarkets, soft rental rates | Dog | Evaluate for sale or redevelopment |

| Outdated amenities, lagging tenant demand | Dog | Capital infusion for upgrades or sale |

Question Marks

Alexandria Venture Investments targets early-stage life science firms, particularly those with groundbreaking technologies. These ventures, often in Seed or Series A funding, are characterized by immense growth potential but also substantial risk and prolonged capital needs before generating revenue. For example, in 2024, venture capital funding for biotech startups saw significant activity, with many early-stage companies securing substantial rounds to fuel research and development, underscoring the high-stakes nature of these investments.

Alexandria Real Estate Equities is actively pursuing new development projects in emerging submarkets, such as those in Colorado and Texas. These ventures represent a strategic push into areas with high growth potential, aiming to capture future market share.

These emerging market projects, while promising, are classified as question marks. They demand substantial capital investment to establish a foothold and achieve profitability, with their ultimate market success still uncertain.

For instance, Alexandria's Austin, Texas portfolio, which includes significant new development, is a prime example of this strategy. As of early 2024, the company reported substantial ongoing development activity in these burgeoning markets, underscoring their commitment to future expansion.

Alexandria Real Estate Equities' investment in AI-powered drug discovery infrastructure positions them in a rapidly expanding segment of the life sciences market. The demand for specialized lab spaces catering to these advanced technologies is on the rise, reflecting the significant capital flowing into AI-driven R&D. For instance, venture capital funding for AI in drug discovery reached an estimated $10.5 billion globally in 2023, showcasing the sector's momentum.

While this represents a high-growth opportunity, the long-term market penetration and specific infrastructure needs for AI-focused drug discovery are still crystallizing. Alexandria's strategic approach involves careful observation and measured investment in these evolving spaces. The company's focus on providing flexible, state-of-the-art facilities allows them to adapt as the precise requirements of AI drug discovery companies become clearer.

Properties with Future Lease-Up Potential

Alexandria Real Estate Equities possesses 669,000 square feet of space currently leased but not yet delivered. This future lease-up potential is crucial for bolstering occupancy rates, with a projected positive impact expected in early 2026. These properties are in a transitional phase, not yet generating full revenue.

These assets, while secured by leases, are not yet contributing their full revenue potential. They represent opportunities to stabilize and reach operational capacity, ultimately transitioning into Stars or Cash Cows within the portfolio.

- Future Revenue Generation: The 669,000 sq ft of leased but undelivered space offers a clear path to increased rental income.

- Occupancy Enhancement: This space is poised to significantly boost occupancy figures, particularly anticipated in early 2026.

- Portfolio Maturation: These properties require time to stabilize and achieve full operational capacity, a key step in their lifecycle.

- Potential for Growth: Successful lease-up and stabilization will likely see these assets mature into high-performing Stars or Cash Cows.

Strategic Redevelopment Projects with Evaluated Alternatives

Alexandria Real Estate Equities (ARE) is actively reassessing its 2027 redevelopment projects, seeking more cost-effective investment avenues amidst a challenging high-interest-rate environment. This strategic pivot reflects a cautious approach to capital deployment, prioritizing projects with clearer paths to profitability and market differentiation.

These projects are currently categorized as question marks within ARE's portfolio, meaning their future trajectory and financial viability are under close scrutiny. The company is weighing the potential for these redevelopments to capture market share and deliver robust returns against the prevailing economic headwinds.

- Project Re-evaluation: ARE is exploring lower-cost alternatives for several 2027 redevelopment initiatives.

- Market Conditions: The high cost of capital is a primary driver for this strategic reassessment.

- Future Uncertainty: The success of these projects hinges on ongoing evaluation and evolving market dynamics.

- Decision Criteria: Continued investment will be contingent on demonstrated potential for market share growth and strong financial returns.

Alexandria Real Estate Equities' new development projects in emerging markets like Colorado and Texas are classified as question marks. These ventures require significant capital to establish a presence and achieve profitability, with their ultimate market success still uncertain. For example, ARE's substantial ongoing development activity in Austin, Texas, as of early 2024, highlights this strategic push into high-growth, but unproven, areas.

Similarly, ARE's investment in AI-powered drug discovery infrastructure represents a question mark. While the sector shows strong growth, with global venture capital funding for AI in drug discovery reaching an estimated $10.5 billion in 2023, the long-term market needs and specific infrastructure requirements are still evolving. ARE's approach involves careful observation and measured investment in these developing spaces.

ARE's 2027 redevelopment projects are also considered question marks due to the challenging high-interest-rate environment. The company is reassessing these projects, seeking more cost-effective investment avenues and prioritizing those with clearer paths to profitability and market differentiation. Continued investment will depend on demonstrated potential for market share growth and strong financial returns.

| ARE Portfolio Segment | BCG Category | Key Characteristics | Capital Needs | Market Uncertainty |

|---|---|---|---|---|

| Emerging Market Developments (e.g., Austin, TX) | Question Mark | High growth potential, new submarkets | Substantial | High |

| AI Drug Discovery Infrastructure | Question Mark | Rapidly expanding sector, evolving needs | Significant | Moderate to High |

| 2027 Redevelopment Projects | Question Mark | Re-evaluation due to economic headwinds | Variable (seeking cost-effectiveness) | High |

BCG Matrix Data Sources

Our BCG Matrix is built on verified market intelligence, combining financial data from SEC filings, industry research from leading real estate analytics firms, and expert commentary from sector specialists to ensure reliable insights.