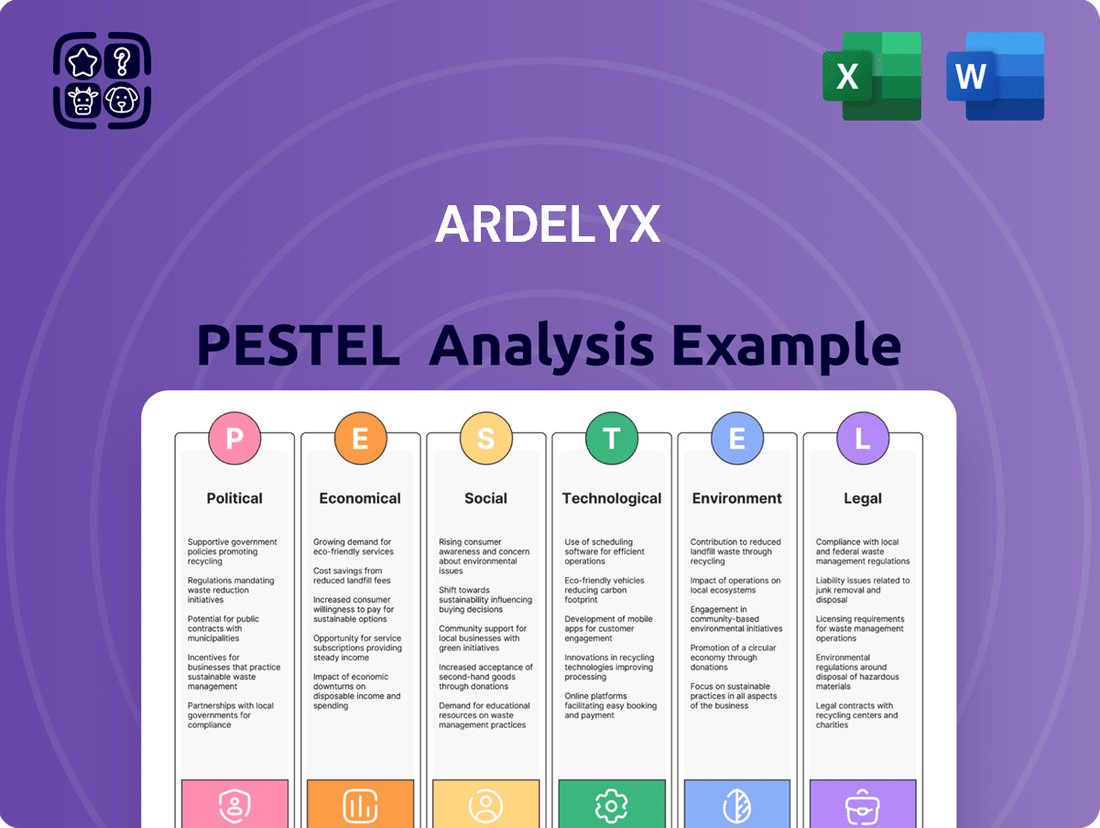

Ardelyx PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ardelyx Bundle

Ardelyx operates within a dynamic external environment, significantly influenced by political shifts in healthcare policy, economic fluctuations impacting patient access, and technological advancements in drug discovery. Understanding these forces is crucial for strategic planning.

Our expertly crafted PESTLE analysis delves deep into these factors, providing you with actionable intelligence to anticipate challenges and capitalize on opportunities within the biopharmaceutical sector.

Gain a competitive advantage by exploring the social trends affecting patient advocacy and the legal landscape governing drug approvals.

Unlock the full picture of Ardelyx's external operating environment and elevate your market strategy.

Download the complete PESTLE analysis now and make informed decisions with confidence.

Political factors

Changes in healthcare laws, especially those impacting drug pricing and reimbursement, are a crucial political factor for Ardelyx. The Inflation Reduction Act's provisions for Medicare to negotiate drug prices could significantly affect the profitability of both IBSRELA and XPHOZAH. Furthermore, XPHOZAH's classification under Medicare Part D and its potential inclusion in the End-Stage Renal Disease prospective payment system bundle in 2025 introduces considerable uncertainty for its future revenue streams. Ardelyx is actively advocating for legislative solutions, like the Kidney Patient Act, aiming to ensure favorable reimbursement conditions for its products.

The U.S. Food and Drug Administration (FDA) critically impacts Ardelyx, with ongoing success dependent on maintaining product approvals and adherence to strict regulations. Ardelyx previously faced a Complete Response Letter for XPHOZAH (tenapanor), delaying its market entry until its October 2022 approval. For 2024 and 2025, continuous compliance with FDA guidelines for drug development, manufacturing, and marketing remains a significant operational and political pressure. The current political climate can also influence FDA priorities, affecting timelines for potential new indications or future product candidates.

While Ardelyx primarily relies on private investment, government funding significantly shapes the broader pharmaceutical research landscape. Political decisions regarding budgets for institutions like the National Institutes of Health (NIH), projected at over $48 billion for fiscal year 2025, can spur innovation in areas like kidney and cardio-renal diseases relevant to Ardelyx. Although the company has not reported significant direct government grants, a political environment that encourages public-private partnerships could present future opportunities, potentially accessing the $1.5 billion allocated for NIH innovation initiatives.

'America First' Policies and Domestic Manufacturing

America First policies, emphasizing domestic pharmaceutical manufacturing, present a dual impact for Ardelyx. These initiatives could offer significant incentives for U.S.-based production, potentially benefiting Ardelyx's operational footprint and reducing reliance on foreign supply chains. However, such policies may also increase production costs domestically, impacting profitability, especially given the current inflationary pressures seen in early 2025. Furthermore, potential trade tensions could disrupt the global supply of crucial raw materials, a risk for pharmaceutical companies. The Biden administration's focus on bolstering domestic supply chains, including a 2024 executive order, highlights this ongoing shift.

- Potential 2025 federal incentives for U.S. drug manufacturing could reduce Ardelyx's reliance on international sourcing.

- Increased domestic production costs, projected to rise by 3-5% for some materials in 2024-2025, could impact Ardelyx's margins.

- Trade disputes stemming from protectionist policies might disrupt global raw material access, a concern for 2025 supply stability.

Political Action and Patient Advocacy

Ardelyx actively engages in the political process, leveraging its Political Action Committee to advocate for policies that support the biopharmaceutical industry and patient access. The company collaborates with patient advocacy groups to highlight critical unmet medical needs, pushing for legislative frameworks that ensure access to affordable treatments, particularly for conditions like chronic kidney disease. This direct political involvement is essential for shaping regulations concerning drug approvals, pricing structures, and patient access initiatives expected through 2025.

- Ardelyx's PAC contributions for 2024-2025 focus on healthcare policy advocacy.

- Partnerships with patient groups amplify calls for broader insurance coverage for new therapies.

- Anticipated legislative debates in 2025 regarding drug pricing directly impact future revenue streams.

- Advocacy efforts aim to streamline FDA approval processes for innovative treatments.

New healthcare laws, like the Inflation Reduction Act, significantly impact Ardelyx's drug pricing, especially for XPHOZAH's 2025 Medicare status. Ongoing FDA compliance and the potential for increased domestic manufacturing costs, projected to rise 3-5% for some materials by 2025, also present political pressures. Ardelyx actively lobbies and partners with patient groups to influence policy, ensuring favorable market access and reimbursement for its therapies. Government funding, such as NIH's $48 billion FY2025 budget, indirectly supports the broader research ecosystem vital for future innovation.

| Political Factor | Impact on Ardelyx | 2024/2025 Data Point |

|---|---|---|

| Drug Pricing Legislation | Revenue uncertainty for IBSRELA and XPHOZAH | XPHOZAH's 2025 Medicare Part D inclusion |

| FDA Regulatory Environment | Approval timelines and market access | Continuous compliance with FDA guidelines |

| Domestic Manufacturing Incentives | Operational costs and supply chain stability | 3-5% projected rise in some material costs by 2025 |

What is included in the product

This Ardelyx PESTLE analysis delves into the Political, Economic, Social, Technological, Environmental, and Legal forces impacting the company's operations and strategic outlook.

It provides a comprehensive assessment of external influences to inform decision-making and identify strategic advantages within its market.

Ardelyx's PESTLE analysis offers a clear, summarized version of external factors, acting as a pain point reliever by highlighting potential challenges and opportunities for strategic planning.

This analysis provides a concise version that can be dropped into PowerPoints or used in group planning sessions, easing the burden of synthesizing complex market dynamics.

Economic factors

Ardelyx's financial health directly correlates with the fluctuating investment landscape for the biotechnology sector. The willingness of venture capitalists and public market investors to fund biopharmaceutical companies impacts Ardelyx's ability to raise capital for crucial research and development. In 2024, biotech funding saw continued adjustments from peak levels, requiring companies like Ardelyx to demonstrate clear pathways to commercialization. The overall economic climate and investor sentiment towards the biotech industry can significantly affect the company's stock performance and valuation.

Ardelyx's economic performance is fundamentally tied to the commercial success of its key products, IBSRELA and XPHOZAH. The company reported strong 2023 net product sales for IBSRELA at $114.6 million, with 2024 guidance projected between $140 million and $150 million. Achieving ambitious peak sales targets, including over $1 billion for IBSRELA and $750 million for XPHOZAH, is crucial for long-term economic viability. Continued revenue growth from these assets is essential for sustaining operations and driving future investment.

Ardelyx allocates a significant budget to R&D, essential for its product pipeline, with 2023 expenditures reaching $57.1 million. Managing these substantial costs, particularly through the lengthy and uncertain drug development process, poses a key economic challenge. For Q1 2024, R&D expenses were $13.5 million. The company's capacity to efficiently manage this spending directly impacts its future profitability and long-term growth prospects through 2025.

Market Competition and Pricing Pressure

The biopharmaceutical sector remains intensely competitive, directly impacting Ardelyx as it navigates the market for products like Ibsrela. This challenging environment, coupled with increased scrutiny from managed care organizations and government payors, exerts significant pressure on drug pricing strategies. Ardelyx must meticulously balance pricing to secure market access and ensure profitability, especially as healthcare cost containment remains a top priority for payors in 2024 and 2025. Demonstrating clear value proposition is crucial for favorable formulary placement and sustained revenue growth.

- Ardelyx's Ibsrela competes with various IBS-C treatments, necessitating strategic pricing to maintain market share.

- Managed care organizations are intensifying negotiations, aiming to reduce pharmaceutical expenditures by 5-7% annually through 2025.

- Government payors, like Medicare and Medicaid, continue to implement policies to control drug costs, impacting net pricing.

- Ardelyx must highlight Ibsrela's clinical efficacy and economic value to justify its price point amidst rising payor scrutiny.

Global Economic Conditions

Ardelyx, with its international commercialization agreements for tenapanor, faces direct exposure to global economic conditions, impacting its revenue streams. Currency fluctuations, such as the volatility seen between the USD and the Japanese Yen in early 2024, directly influence reported international sales. Economic instability in key markets and diverse price control mechanisms further complicate revenue predictability.

A global economic downturn, as anticipated by some economists for late 2024 or early 2025 in certain regions, could reduce healthcare spending, potentially affecting sales of therapies like XPHOZAH.

- Currency Impact: A 5% appreciation of the USD against major trading currencies could reduce international revenue by a similar percentage.

- Market Instability: Economic contraction in a key market like Japan (forecasted Q1 2025 GDP growth around 0.5%) directly impacts partner sales.

- Price Controls: Varying drug pricing regulations across Europe can limit profit margins on international sales.

Ardelyx's economic performance is fundamentally driven by its ability to secure funding in a tightening biotech market and achieve robust sales for IBSRELA and XPHOZAH, with 2024 IBSRELA guidance at $140-$150 million. Managing substantial R&D costs, totaling $57.1 million in 2023, is critical for long-term profitability. The company faces significant pressure from managed care organizations aiming to reduce pharmaceutical expenditures by 5-7% annually through 2025, necessitating strategic pricing. Global economic conditions, including currency volatility and international price controls, further impact its revenue streams.

| Metric | 2023 Actual | 2024 Guidance |

|---|---|---|

| IBSRELA Net Sales | $114.6 Million | $140-$150 Million |

| R&D Expenses | $57.1 Million | Q1 2024: $13.5 Million |

| MCO Cost Reduction Target | N/A | 5-7% Annually (Through 2025) |

Full Version Awaits

Ardelyx PESTLE Analysis

The Ardelyx PESTLE Analysis preview you see is the exact document you’ll receive after purchase—fully formatted and ready to use.

This in-depth analysis explores the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Ardelyx's operations and strategy.

You'll gain a comprehensive understanding of the external forces shaping the biopharmaceutical landscape and Ardelyx's position within it.

Every section, from market trends to regulatory challenges, is presented as you see it here, ensuring no surprises.

Sociological factors

The increasing prevalence of chronic kidney disease (CKD) and irritable bowel syndrome with constipation (IBS-C) creates a substantial market for Ardelyx. Globally, CKD affects over 850 million people, with projections indicating continued growth into 2025 due to an aging population and rising comorbidities. Similarly, IBS-C impacts an estimated 10-15% of the global population, driven by lifestyle shifts. This expanding patient base underscores a significant unmet medical need, offering Ardelyx a robust opportunity for its targeted treatments.

Both Irritable Bowel Syndrome with Constipation (IBS-C) and Chronic Kidney Disease (CKD) severely diminish patient quality of life, leading to significant daily challenges. An estimated 11% of the global population suffers from IBS, with IBS-C being a prevalent subtype, while CKD affects over 800 million people worldwide as of 2024. There remains a substantial unmet need for innovative and highly effective therapeutic options in these conditions. Ardelyx's strategic development of first-in-class medicines like tenapanor, addressing these critical unmet needs, strongly resonates with patients seeking improved treatment outcomes and enhanced well-being.

Growing patient advocacy groups, such as the National Kidney Foundation for CKD and the International Foundation for Gastrointestinal Disorders for IBS-C, significantly influence healthcare policy and treatment access. Ardelyx actively collaborates with these organizations, understanding patient needs to advocate for broader availability of its therapies like Ibsrela and Xphozah. This increased patient awareness, amplified by advocacy efforts, drives earlier diagnoses and a rising demand for effective treatments. For instance, the global CKD market is projected to reach over $19 billion by 2025, partly fueled by such awareness and the need for better solutions.

Demographic Shifts and Health Disparities

Demographic shifts, including an aging population and persistent ethnic and socioeconomic disparities, significantly influence the prevalence and outcomes of kidney and cardio-renal diseases. For example, by 2030, over 73 million Americans will be aged 65 or older, contributing to a rise in chronic conditions. Specific populations are disproportionately affected by Chronic Kidney Disease (CKD), with Black adults being approximately three times more likely to experience kidney failure than White adults. Ardelyx addresses these sociological factors through programs like ArdelyxAssist™, aiming to ensure equitable patient access to its medications, including XPHOZAH, which received FDA approval in late 2023.

- US population aged 65+ projected to exceed 73 million by 2030.

- Black adults are 3x more likely to experience kidney failure than White adults.

- ArdelyxAssist™ supports patient access to vital treatments like XPHOZAH.

- CKD affects over 37 million US adults, with significant disparities.

Focus on Patient-Centricity in Healthcare

A significant sociological trend in healthcare is the growing emphasis on patient-centricity, where treatment and drug development prioritize individual needs and experiences. Ardelyx explicitly integrates this patient-first approach into its mission and business strategy for products like IBSRELA. This focus builds crucial trust and loyalty among patients and healthcare providers, directly impacting adoption and adherence. By 2025, patient satisfaction scores are projected to be a key performance indicator for over 70% of healthcare organizations globally, highlighting this shift.

- Patient engagement initiatives can improve medication adherence by up to 25%.

- A 2024 survey showed 85% of patients prefer providers who actively involve them in treatment decisions.

- Companies prioritizing patient experience report 1.5x higher revenue growth than competitors.

Sociological factors significantly influence Ardelyx's market, driven by the global burden of chronic kidney disease (CKD) affecting over 850 million and IBS-C impacting 10-15% of the population, both severely diminishing quality of life. An aging global demographic, with projections of over 73 million Americans aged 65+ by 2030, fuels this rise in chronic conditions, alongside persistent health disparities where Black adults are three times more likely to experience kidney failure. Growing patient advocacy and a strong shift towards patient-centric healthcare, projected to make patient satisfaction a key KPI for 70% of organizations by 2025, further shape demand and adoption for Ardelyx's therapies like XPHOZAH and IBSRELA.

| Sociological Factor | 2024/2025 Data Point | Impact on Ardelyx |

|---|---|---|

| Global CKD Prevalence | Over 850 million people | Expands target market for XPHOZAH. |

| US Population 65+ (2030) | Projected >73 million | Increases chronic disease patient pool. |

| Patient-Centricity Focus | 70% healthcare orgs use satisfaction as KPI by 2025 | Enhances adoption and adherence for patient-focused drugs. |

Technological factors

Ardelyx’s core strength lies in its ability to discover and develop innovative, first-in-class medicines, leveraging significant advancements in biotechnology to create novel therapeutic platforms. Continued investment in and adoption of new research technologies, such as AI in drug discovery, are crucial for maintaining a competitive edge and building a robust pipeline. For example, the biopharmaceutical sector is projected to see AI adoption accelerate, with global AI in drug discovery market size estimated to reach over $2.5 billion by 2025, emphasizing its growing importance for companies like Ardelyx. This technological edge supports the development of treatments like Ibsrela, strengthening market position.

The field of nephrology is experiencing significant technological advancements, including novel therapeutic targets and enhanced diagnostic tools. Ardelyx's lead compound, tenapanor, marketed as Xphozah, represents a unique mechanism as a phosphate absorption inhibitor. The market anticipates further innovations, with the global chronic kidney disease therapeutics market projected to reach over $18 billion by 2025, driven by emerging cell and gene therapies. Ardelyx must strategically monitor these developments, particularly given Xphozah's 2024 commercialization ramp-up, to ensure long-term competitive positioning and potential integration of new modalities.

Ardelyx leverages digital health and data analytics to streamline drug development, improving efficiency. This involves using advanced clinical trial management systems and data analytics platforms to optimize research and gain critical insights. The growing adoption of real-world evidence and digital tools in clinical trials, projected to reach a global market value of over $50 billion by 2025, significantly expedites product development and regulatory submissions for companies like Ardelyx.

Manufacturing Technology

The manufacturing of Ardelyx's complex biopharmaceutical products, like Ibsrela, demands highly sophisticated technology and robust processes. Ardelyx relies on third-party manufacturers, meaning the technological capabilities and compliance of these partners are crucial to maintaining product supply and quality, especially with anticipated revenue growth for Ibsrela potentially reaching $140-$150 million in 2024. Advancements in biomanufacturing technology, such as continuous processing or advanced analytics, offer opportunities for improved efficiency, lower production costs, and enhanced quality control, critical for scaling operations and market penetration.

- Ardelyx's dependence on CMOs for Ibsrela production highlights the critical need for partners with cutting-edge manufacturing technology.

- The biopharmaceutical manufacturing sector is seeing significant investment in automation and AI, projected to optimize processes by 15-20% by mid-2025.

- Ensuring compliance with evolving FDA and international Good Manufacturing Practices (GMP) requires constant technological upgrades from manufacturing partners.

Intellectual Property and Patent Protection

Protecting its technological innovations through patents is fundamental to Ardelyx's business model, particularly for its key product, tenapanor. The company's ability to secure and defend these patents ensures market exclusivity, crucial for maintaining revenue streams against potential generic competition. As of early 2025, Ardelyx continues to manage its patent portfolio diligently, critical in the biopharmaceutical sector where intellectual property often dictates commercial success. The legal and technological complexities within patent law demand constant vigilance to safeguard its competitive edge.

- Tenapanor’s patent protection extends into the 2030s, providing a significant competitive moat.

- In 2024, Ardelyx reported ongoing efforts to strengthen its global IP portfolio.

- The biopharma industry saw over $100 billion in R&D spending in 2024, emphasizing the value of patentable innovation.

- Patent litigation risks remain a key consideration for Ardelyx, impacting potential earnings.

Ardelyx leverages cutting-edge biotechnology and AI in drug discovery, with the global AI market in this sector reaching over $2.5 billion by 2025, to develop innovative treatments like tenapanor. The company also utilizes digital health tools and data analytics, a market projected to exceed $50 billion by 2025, to streamline its clinical trials. Dependence on third-party manufacturers for products like Ibsrela, with 2024 revenues potentially hitting $140-$150 million, necessitates partners with advanced biomanufacturing technology. Robust patent protection, extending into the 2030s for tenapanor, is crucial for maintaining market exclusivity.

| Technological Aspect | Key Impact | 2024/2025 Data Point |

|---|---|---|

| AI & Biotech R&D | Accelerates drug discovery | Global AI in drug discovery market >$2.5B by 2025 |

| Digital Health & Data | Optimizes clinical trials | Digital tools in clinical trials market >$50B by 2025 |

| Advanced Manufacturing | Ensures product quality & supply | Ibsrela 2024 revenue projection $140-$150M |

| Intellectual Property | Secures market exclusivity | Tenapanor patent protection into 2030s |

Legal factors

Ardelyx's commercial viability significantly relies on securing and defending its patents for key products like tenapanor, marketed as Ibsrela for IBS-C and Xphozah for hyperphosphatemia. The intricate legal framework surrounding pharmaceutical intellectual property is prone to challenges, making robust patent protection essential. Protecting tenapanor's market exclusivity through a strong patent portfolio is paramount, particularly as generic drug manufacturers actively seek opportunities, with patent expirations often leading to substantial revenue declines.

Navigating the rigorous FDA approval process represents a significant legal hurdle for biopharmaceutical companies like Ardelyx. The company experienced this directly with XPHOZAH (tenapanor), which faced an initial FDA complete response letter in 2021 before ultimately securing approval in October 2022 for adults with CKD on dialysis. Ardelyx must continuously adhere to a complex framework of laws governing clinical trials, manufacturing quality, and marketing practices to maintain XPHOZAH's market authorization and ensure compliance with 21 CFR regulations. This ongoing regulatory oversight is critical for commercial success, with XPHOZAH generating approximately $25.5 million in net product sales during Q1 2024. Strict adherence is vital for future product development and market access.

Ardelyx, like all pharmaceutical firms, must strictly comply with federal and state healthcare fraud and abuse laws, including the Anti-Kickback Statute and False Claims Act. These regulations govern their interactions with healthcare professionals, marketing strategies, and drug pricing. For instance, in 2024, enforcement actions resulted in significant penalties; a major pharmaceutical company faced over $100 million in fines for alleged kickbacks. Violations can lead to substantial legal and financial repercussions, impacting Ardelyx's operational stability and market standing.

Product Liability and Litigation

As a pharmaceutical manufacturer, Ardelyx faces significant product liability risks, particularly for its key drug Ibsrela (tenapanor), approved in 2023. Undesirable side effects or efficacy issues could lead to costly lawsuits, potentially impacting their 2024 revenue projections which include Ibsrela sales. Beyond product-specific claims, Ardelyx is also exposed to broader litigation, such as securities class actions, especially given market volatility in the biotech sector. For instance, the average cost of a securities class action settlement for biotech companies exceeded $20 million in recent years, diverting substantial management attention and financial resources from core operations.

- Ardelyx’s Ibsrela approval in 2023 increases exposure to product liability litigation.

- Potential 2024 revenue growth from Ibsrela could be offset by legal defense costs.

- Biotech companies face high average settlement costs for securities class actions, impacting financial stability.

International Laws and Regulations

Ardelyx operates globally, with commercialization agreements for Ibsrela (tenapanor) in key markets like Japan and Canada, subjecting it to diverse international laws. For instance, Japan's Pharmaceutical and Medical Devices Agency (PMDA) has distinct drug approval pathways, impacting market entry timelines. Different pricing controls, such as Canada's Patented Medicine Prices Review Board, directly influence the drug's profitability and market access. Navigating these varied regulatory frameworks, including specific marketing regulations in each territory, is critical for the company's sustained international growth and revenue generation as it seeks to expand its global footprint beyond 2024.

- Japan: PMDA approval processes and annual NHI drug price revisions.

- Canada: Health Canada regulations and Patented Medicine Prices Review Board oversight.

- Global: Compliance costs for differing marketing and promotional standards.

Ardelyx’s legal framework centers on robust patent defense for tenapanor, crucial against generic competition, and continuous adherence to FDA regulations for XPHOZAH, generating $25.5 million in Q1 2024 sales. Compliance with healthcare fraud laws, exemplified by significant 2024 industry fines, is essential for operational stability. Product liability risks for Ibsrela, approved in 2023, coupled with potential securities class actions averaging over $20 million in settlements for biotech, pose financial threats. International regulatory navigation in markets like Japan and Canada also influences profitability.

| Legal Area | Key Impact | 2024/2025 Data Point | ||

|---|---|---|---|---|

| Patent Protection | Market Exclusivity | Generic entry threats post-expiration | ||

| FDA Compliance | Product Approval & Sales | XPHOZAH Q1 2024 Sales: $25.5M | ||

| Litigation Risk | Financial Stability | Biotech average securities settlement: >$20M |

Environmental factors

The drug development and clinical trial processes at Ardelyx generate diverse waste streams, including biological and chemical materials. Ardelyx is obligated to manage this waste in strict compliance with evolving environmental regulations, such as those governing hazardous waste disposal, which saw increased enforcement in 2024. Proper disposal and efforts to boost recycling rates, aligning with broader industry goals to reduce landfill waste by 10-15% by late 2025, are integral to the company's environmental health and safety responsibilities.

Like many companies in the biopharmaceutical manufacturing sector, Ardelyx faces scrutiny over its environmental impact, particularly its carbon footprint. The company has publicly committed to investing in carbon reduction technologies, aiming to lower its overall emissions. This initiative aligns with a broader industry trend where pharmaceutical and biotech firms are increasingly prioritizing sustainability, with many targeting net-zero emissions by 2050. Ardelyx's efforts reflect a proactive stance on environmental stewardship, acknowledging growing stakeholder expectations for eco-conscious operations in 2024 and 2025.

Pharmaceutical manufacturing, vital for Ardelyx, faces stringent environmental regulations primarily from the U.S. Environmental Protection Agency (EPA). These rules, including those under the Clean Air Act and Clean Water Act, govern air emissions, water discharge, and hazardous waste disposal. Ardelyx and its third-party manufacturers must adhere to these standards to avoid significant penalties, which can exceed $60,000 per violation per day in 2024. Compliance ensures environmentally responsible operations and mitigates legal and reputational risks.

Sustainable Business Practices

The increasing investor and public focus on Environmental, Social, and Governance (ESG) factors significantly influences pharmaceutical companies like Ardelyx. Ardelyx's commitment to environmental sustainability, detailed in its latest 2024 ESG report, is becoming a crucial part of its corporate identity. Implementing sustainable practices enhances the company's reputation and appeals to a growing segment of socially responsible investors, with global sustainable investment assets projected to exceed $50 trillion by 2025.

- Ardelyx's 2024 ESG report highlights initiatives to reduce its environmental footprint.

- Sustainable practices can attract capital from ESG-focused funds, which saw inflows of over $70 billion in Q1 2024.

- Enhanced corporate reputation through sustainability can improve market valuation and stakeholder trust.

Impact of Environmental Factors on Disease

Environmental factors are increasingly linked to the burden of kidney disease, influencing public health policies and research priorities. This growing understanding of environmental determinants shapes the broader context in which Ardelyx operates. While not a direct operational factor for Ardelyx, these trends could indirectly influence future research and market needs for kidney disease treatments. For instance, increased focus on environmental links might shift funding or patient demographics in the 2024-2025 period.

- Growing recognition of environmental links to chronic kidney disease.

- Potential shifts in public health funding for preventative measures.

- Indirect influence on the long-term demand for kidney disease therapies.

Ardelyx navigates stringent environmental regulations, including 2024 EPA rules governing waste and emissions, with potential daily penalties exceeding $60,000 for non-compliance. The company actively manages its carbon footprint and waste streams, aiming for 2025 recycling improvements and aligning with industry-wide net-zero goals. This commitment, detailed in its 2024 ESG report, attracts growing sustainable investment, projected to reach over $50 trillion by 2025 globally.

| Environmental Factor | Impact on Ardelyx | 2024-2025 Data Point |

|---|---|---|

| Regulatory Compliance | Operational risk, cost of adherence | EPA penalties over $60,000/day |

| Carbon Footprint | Sustainability goals, stakeholder pressure | Industry net-zero by 2050 trend |

| ESG Investor Focus | Access to capital, reputation | Sustainable investment >$50T by 2025 |

PESTLE Analysis Data Sources

Our PESTLE Analysis for Ardelyx is meticulously crafted using data from leading healthcare industry publications, regulatory body updates (such as the FDA), economic forecasting reports, and market research firms specializing in the biopharmaceutical sector. This comprehensive approach ensures our insights are grounded in current, relevant information.