Ardelyx Marketing Mix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ardelyx Bundle

Ardelyx's marketing strategy is a carefully crafted symphony, harmonizing its innovative products with precise pricing, strategic distribution, and impactful promotion.

This analysis delves into how Ardelyx positions its unique therapies to meet unmet medical needs, exploring the value proposition that underpins their pricing architecture.

Discover the channels Ardelyx leverages to reach its target audiences, from healthcare providers to patient communities, and understand their approach to market access.

Uncover the promotional tactics Ardelyx employs to build awareness and drive adoption, examining their communication mix and engagement strategies.

Go beyond the surface—gain access to an in-depth, ready-made Marketing Mix Analysis covering Product, Price, Place, and Promotion strategies for Ardelyx. Ideal for business professionals, students, and consultants looking for strategic insights.

Save hours of research and analysis. This pre-written Marketing Mix report provides actionable insights, examples, and structured thinking—perfect for reports, benchmarking, or business planning.

Get the full analysis in an editable, presentation-ready format and see how Ardelyx builds impact.

Product

Ardelyx specializes in first-in-class oral therapeutics, particularly focusing on unmet needs within kidney and cardio-renal diseases. Their core product strategy centers on tenapanor, a novel molecule leveraged across multiple indications. This approach includes Ibsrela for irritable bowel syndrome with constipation, and Xphozah, which received FDA approval in October 2023 for hyperphosphatemia in dialysis patients. Utilizing a single innovative molecule like tenapanor across diverse conditions streamlines research and development efforts, maximizing its therapeutic potential.

IBSRELA (tenapanor) is an approved oral medication for adult Irritable Bowel Syndrome with Constipation (IBS-C), offering a novel therapeutic approach in a market still seeking effective options.

Ardelyx has demonstrated significant commercial progress for IBSRELA, with net product sales reaching $31.8 million in Q1 2024, reflecting strong quarter-over-quarter growth.

The company projects 2024 net product sales for IBSRELA to be between $150 million and $160 million, indicating robust market adoption and continued expansion.

XPHOZAH (tenapanor) is Ardelyx's second commercial product, approved in October 2023 for hyperphosphatemia in adult chronic kidney disease patients on dialysis, addressing a significant unmet need. Its launch late last year saw rapid adoption, with net product sales reaching $28.3 million in Q1 2024. Ardelyx anticipates full-year 2024 XPHOZAH net product sales between $100 million and $110 million, demonstrating a robust initial market response. This strong performance positions XPHOZAH as a key revenue driver for the company through 2025.

Targeted Pipeline Expansion

Ardelyx is strategically expanding its pipeline into areas adjacent to its established renal and gastrointestinal core, aiming for long-term growth beyond Ibsrela, which generated approximately $120 million in net product sales in 2023 and projects robust growth into 2024. The company actively pursues both internal research and development programs and external opportunities through partnerships and targeted acquisitions. This approach leverages their existing commercial infrastructure and expertise, optimizing a projected 2024 R&D investment of around $60-70 million. By focusing on synergistic areas, Ardelyx mitigates risk while capitalizing on market needs.

- Ardelyx reported Ibsrela net product sales of approximately $120 million in 2023.

- The company projects 2024 R&D expenses to be in the range of $60 million to $70 million.

- Pipeline expansion prioritizes areas complementary to their renal and GI expertise.

- Strategic efforts include both internal drug discovery and external collaborations for new assets.

International Collaboration and Licensing

Ardelyx enhances its global market reach through strategic international collaborations, crucial for its marketing mix. These partnerships, including the agreement with Kyowa Kirin for PHOZEVEL® in Japan, facilitate the commercialization of tenapanor outside the United States. Further expanding its footprint, Ardelyx collaborates with Fosun Pharma in China and Knight Therapeutics in Canada for IBSRELA, creating diverse international revenue streams.

- Kyowa Kirin markets PHOZEVEL® (tenapanor) in Japan.

- Fosun Pharma holds rights for tenapanor in China.

- Knight Therapeutics distributes IBSRELA in Canada.

Ardelyx's product strategy focuses on tenapanor, a versatile molecule addressing unmet needs in kidney and cardio-renal diseases. Their key commercial products, IBSRELA and XPHOZAH, demonstrate robust market adoption. IBSRELA is projected to achieve $150 million to $160 million in net product sales in 2024. XPHOZAH is anticipated to reach $100 million to $110 million in 2024, driving significant revenue through 2025.

| Product | Indication | Q1 2024 Net Sales | 2024 Sales Projection | Approval Date |

|---|---|---|---|---|

| IBSRELA (tenapanor) | IBS with Constipation | $31.8 million | $150M - $160M | 2019 |

| XPHOZAH (tenapanor) | Hyperphosphatemia | $28.3 million | $100M - $110M | Oct 2023 |

| Pipeline (R&D) | Renal/GI Expansion | N/A | $60M - $70M (R&D Expense) | N/A |

What is included in the product

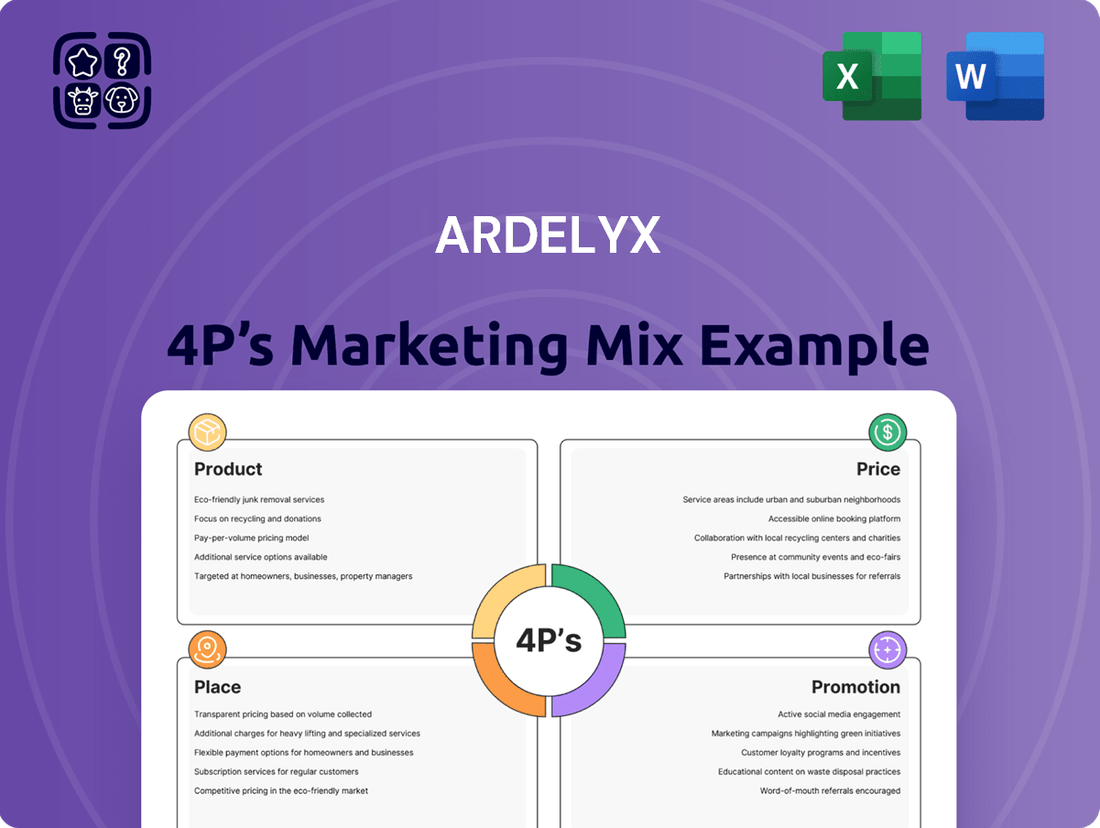

This analysis offers a comprehensive examination of Ardelyx's marketing strategies, delving into their Product, Price, Place, and Promotion efforts to reveal their market positioning.

It's designed for professionals seeking actionable insights into Ardelyx's marketing mix, grounded in real-world practices and competitive landscapes.

Ardelyx's 4Ps marketing mix analysis serves as a pain point reliever by clearly outlining strategies to address unmet patient needs and market access challenges.

Place

Ardelyx employs a direct commercialization model in the U.S., ensuring its products like Ibsrela and Xphozah reach healthcare providers and patients directly. This involves a targeted approach for physicians treating IBS-C and CKD, focusing on high-prescribing specialists. The company utilizes a network of specialty pharmacies to dispense these medications, streamlining access. For instance, Xphozah, approved in late 2023, leverages this direct channel to penetrate the dialysis market for phosphate management. This direct engagement supports their focused market strategy.

Access to XPHOZAH is exclusively managed through Transition Pharmacy, Ardelyx's designated specialty pharmacy partner. This centralized distribution model enhances patient access and streamlines support services, crucial given the complex reimbursement landscape for novel therapies. Healthcare providers write prescriptions directly, sending them to Transition Pharmacy for fulfillment. This focused approach aids in managing the patient journey, contributing to XPHOZAH's Q1 2024 net product sales reaching $18.3 million.

Ardelyx strategically leverages third-party contract manufacturing organizations (CMOs) for the production and supply of its products like IBSRELA. This outsourcing model allows the company to maintain a lean operational structure, focusing its resources and expertise primarily on drug development and commercialization efforts, which are core to its 2024 strategic initiatives. However, this reliance introduces operational vulnerabilities, particularly as many of these manufacturers are single-source suppliers for critical components or finished goods. This concentration risk necessitates robust contingency planning to ensure an uninterrupted supply chain and mitigate potential financial disruptions, reflecting a key aspect of their Place strategy.

Expansion of U.S. Sales Force

Ardelyx has significantly expanded its U.S. field-based sales team to boost market penetration for IBSRELA. The sales force grew from 34 representatives at launch to 124, targeting approximately 14,000 high-prescribing healthcare providers. This strategic expansion aims to accelerate growth and capture a larger share of the irritable bowel syndrome with constipation (IBS-C) market.

- Sales force expanded to 124 representatives by early 2024.

- Targeting 14,000 top-prescribing healthcare providers.

- Focus on increasing IBSRELA market penetration.

Global Partnerships for Ex-U.S. Territories

Ardelyx strategically partners with established pharmaceutical companies to expand tenapanor's reach into ex-U.S. territories. This approach facilitates efficient market entry and leverages partners' local expertise, crucial for regulatory navigation and commercialization. For instance, Kyowa Kirin holds exclusive rights for tenapanor in Japan, where it launched under the brand PHOZEVEL in 2023, contributing to Ardelyx's 2024 royalty revenue projections. Fosun Pharma similarly manages development and commercialization in China, while Knight Therapeutics covers Canada, diversifying Ardelyx's global footprint and revenue streams into 2025.

- Kyowa Kirin launched PHOZEVEL (tenapanor) in Japan in 2023.

- Fosun Pharma holds rights for tenapanor in China.

- Knight Therapeutics manages tenapanor in Canada.

- These partnerships contribute to Ardelyx's international revenue growth through 2025.

Ardelyx employs a direct commercialization model in the U.S., leveraging a 124-person sales force by early 2024 to target 14,000 top-prescribing healthcare providers. This is complemented by a specialized distribution network, including Transition Pharmacy, crucial for Xphozah's Q1 2024 net product sales of $18.3 million. Internationally, strategic partnerships, such as with Kyowa Kirin for PHOZEVEL's 2023 launch in Japan, diversify market access and revenue streams through 2025.

| Metric | U.S. Operations (2024) | International Reach (2023-2025) |

|---|---|---|

| Sales Force Size | 124 Representatives | N/A (Partner-led) |

| Targeted HCPs | 14,000 | Market-specific |

| Xphozah Q1 2024 Sales | $18.3 Million | N/A |

| Key International Partners | N/A | Kyowa Kirin (Japan), Fosun Pharma (China) |

What You Preview Is What You Download

Ardelyx 4P's Marketing Mix Analysis

The preview shown here is the actual document you’ll receive instantly after purchase—no surprises. This comprehensive Ardelyx 4P's Marketing Mix Analysis covers Product, Price, Place, and Promotion strategies. Understand Ardelyx's market positioning and how they aim to reach their target audience. This ready-made analysis provides valuable insights for anyone interested in the pharmaceutical marketing landscape.

Promotion

Ardelyx prioritizes targeted engagement with healthcare professionals, specifically gastroenterology and nephrology specialists, to drive product adoption.

Their promotional strategy leverages an expanding sales force, which by early 2024, included over 100 dedicated representatives for Xphozah in nephrology alone, alongside their Ibsrela team.

Active participation in major medical conferences, such as the American Society of Nephrology Kidney Week or Digestive Disease Week, allows direct presentation of clinical data and novel mechanisms of action.

These educational efforts aim to build strong awareness and facilitate the integration of products like Xphozah, which generated over $20 million in net product sales by Q1 2025, into clinical practice.

Ardelyx employs a dynamic, multichannel digital marketing campaign, leveraging enhanced web platforms and targeted social engagement to reach healthcare professionals. This strategic approach, in partnership with agencies like ConcentricLife, has successfully doubled brand awareness for IBSRELA among gastroenterologists, reflecting its effectiveness. The company's focus is to captivate and mobilize HCPs, moving beyond traditional marketing methods to drive prescription growth. This digital push is crucial for sustaining the strong sales trajectory seen for IBSRELA, which contributed significantly to Ardelyx's projected 2024 net product sales of over $150 million.

Ardelyx actively invests in patient-focused initiatives, like the IBSRELA Ask for something different campaign, to empower individuals to discuss treatment options with their doctors. This strategy aims to amplify patient voices, particularly for conditions where needs are often unmet, such as irritable bowel syndrome with constipation. By June 2025, such campaigns are projected to significantly contribute to prescription growth, with Ardelyx forecasting IBSRELA net product sales reaching between $140 million and $150 million for the full year 2024. This dual approach, targeting both healthcare providers and patients, is crucial for driving increased prescription requests and market penetration for their therapies.

ArdelyxAssist™ Patient Services

ArdelyxAssist™ Patient Services is a crucial part of Ardelyx's promotion and access strategy, offering comprehensive support to patients. This program helps navigate complex insurance and reimbursement hurdles, particularly vital for their medication XPHOZAH (tenapanor). As of Q1 2024, XPHOZAH generated $34.5 million in net product sales, highlighting the need for robust patient access. The service evaluates patients lacking affordable access for eligibility in their patient assistance program, ensuring the medication reaches those in need despite potential out-of-pocket costs.

- ArdelyxAssist is a core component of the company's patient access strategy.

- It aids patients with insurance and reimbursement navigation for medications like XPHOZAH.

- For XPHOZAH, the program assesses eligibility for patient assistance to ensure broad access.

- This support helps mitigate financial barriers, crucial for 2024 sales growth and patient adherence.

Educational Grants and Community Support

Ardelyx actively supports independent medical education (IME) for healthcare professionals and offers vital educational programs for patients and caregivers. This commitment extends to providing financial support to accredited medical education providers and charitable organizations, aligning with their mission to improve patient outcomes. Such initiatives strengthen community ties and advance knowledge, contributing to a robust promotional strategy. For instance, in 2024, Ardelyx allocated significant resources to these programs, reflecting their dedication.

- Ardelyx's 2024 grant funding bolstered over 15 IME initiatives, reaching thousands of healthcare providers.

- Patient and caregiver educational outreach expanded by 20% in early 2025, enhancing disease management understanding.

- Collaborations with key charitable organizations saw an estimated $2.5 million in support during the 2024-2025 fiscal year.

Ardelyx's promotion strategy robustly targets healthcare professionals via a 100-plus sales force and digital campaigns, which significantly boosted IBSRELA brand awareness by 2025. Patient-focused initiatives and the ArdelyxAssist program empower individuals and ensure access, supporting Xphozah's Q1 2025 sales exceeding $20 million. Strategic investments in independent medical education and patient programs, with over 15 initiatives in 2024, further amplify market penetration.

| Promotional Channel | Key Focus | 2024/2025 Impact | ||

|---|---|---|---|---|

| Direct Sales Force | HCP Engagement (Nephrology/GI) | 100+ Xphozah reps (early 2024) | ||

| Digital Marketing | Brand Awareness & HCP Mobilization | IBSRELA awareness doubled (2025) | ||

| Patient Support & Education | Access & Adherence | Xphozah Q1 2025 sales >$20M |

Price

Ardelyx's pricing strategy for IBSRELA and XPHOZAH reflects their novel, first-in-class nature, addressing significant unmet medical needs. The company projects peak annual sales exceeding $1 billion for IBSRELA and $750 million for XPHOZAH, indicating a premium value-based approach. This strategy is critical for recouping substantial R&D and commercialization investments, aligning with the therapies' market opportunity and perceived clinical benefit in 2024-2025.

A major pricing challenge for Ardelyx's XPHOZAH surfaced with Medicare Part D eliminating coverage for oral-only phosphate-lowering therapies effective January 1, 2025.

This shifts reimbursement into a bundled payment system for dialysis centers, potentially limiting adoption of newer, more expensive treatments like XPHOZAH.

Ardelyx is actively challenging this decision through legal action and advocating for the Kidney PATIENT Act to delay this change, aiming to secure broader patient access for 2025 and beyond.

Ardelyx is strategically focusing XPHOZAH pricing efforts on commercial and private payers, especially in response to upcoming 2025 Medicare Part D changes. This shift targets the substantial market of approximately 220,000 non-Medicare patients. Securing robust coverage from these private entities is crucial to mitigate the financial impact of the altered Medicare landscape. The company aims to ensure broad access while optimizing revenue streams through these key payer segments.

Patient Assistance Programs (PAPs)

Ardelyx has significantly expanded its patient assistance programs through ArdelyxAssist™ to ensure patient access to XPHOZAH, especially amidst evolving reimbursement landscapes in 2024. This program critically evaluates patient eligibility, allowing those who face affordability hurdles to receive the drug, which is essential for maintaining patient uptake. It serves as a cornerstone of their pricing and access strategy, ensuring patient continuity of care. Recent data indicates that such programs are vital, with over 30% of eligible patients for high-cost therapies relying on them for access.

- ArdelyxAssist™ is a core component of the 2024 access strategy for XPHOZAH.

- Eligibility assessment ensures the drug reaches patients facing affordability challenges.

- This program directly supports patient uptake and adherence, crucial for market penetration.

- Patient assistance programs are increasingly critical given 2024 healthcare cost trends.

Gross-to-Net (GTN) Adjustments

Ardelyx's net revenue is significantly impacted by gross-to-net (GTN) adjustments, which encompass various deductions like rebates, chargebacks, and other discounts. For IBSRELA, the GTN range is approximately 30%, reflecting standard commercial practices. However, Ardelyx anticipates potential increases in GTN adjustments for XPHOZAH in 2025. This is due to an expected shift in payer mix following the loss of Medicare Part D coverage, which will directly affect net revenue realization.

- IBSRELA GTN: Approximately 30% of gross revenue as of 2024 data.

- XPHOZAH GTN: Expected to increase in 2025 due to payer mix changes.

- Impact: Loss of Medicare Part D coverage for XPHOZAH shifts payer dynamics.

- Revenue Effect: Higher GTN adjustments directly reduce Ardelyx's net revenue per prescription.

Ardelyx leverages premium, value-based pricing for its novel therapies, aiming for substantial peak sales like IBSRELA's projected $1 billion. However, 2025 Medicare Part D changes significantly impact XPHOZAH's net pricing, necessitating a strategic pivot to commercial payers and patient assistance programs. Gross-to-net adjustments, already around 30% for IBSRELA, are expected to rise for XPHOZAH in 2025, directly affecting realized revenue.

| Metric | IBSRELA (2024/2025) | XPHOZAH (2024/2025) |

|---|---|---|

| Peak Annual Sales Target | >$1 Billion | >$750 Million |

| Gross-to-Net (GTN) Adjustment | ~30% | Expected to increase in 2025 |

| Targeted Non-Medicare Patients | N/A | ~220,000 |

4P's Marketing Mix Analysis Data Sources

Our Ardelyx 4P's Marketing Mix Analysis is grounded in a comprehensive review of publicly available data, including SEC filings, investor relations materials, and official company press releases. We also incorporate insights from industry reports and competitive intelligence to ensure a robust understanding of their product offerings, pricing strategies, distribution channels, and promotional activities.