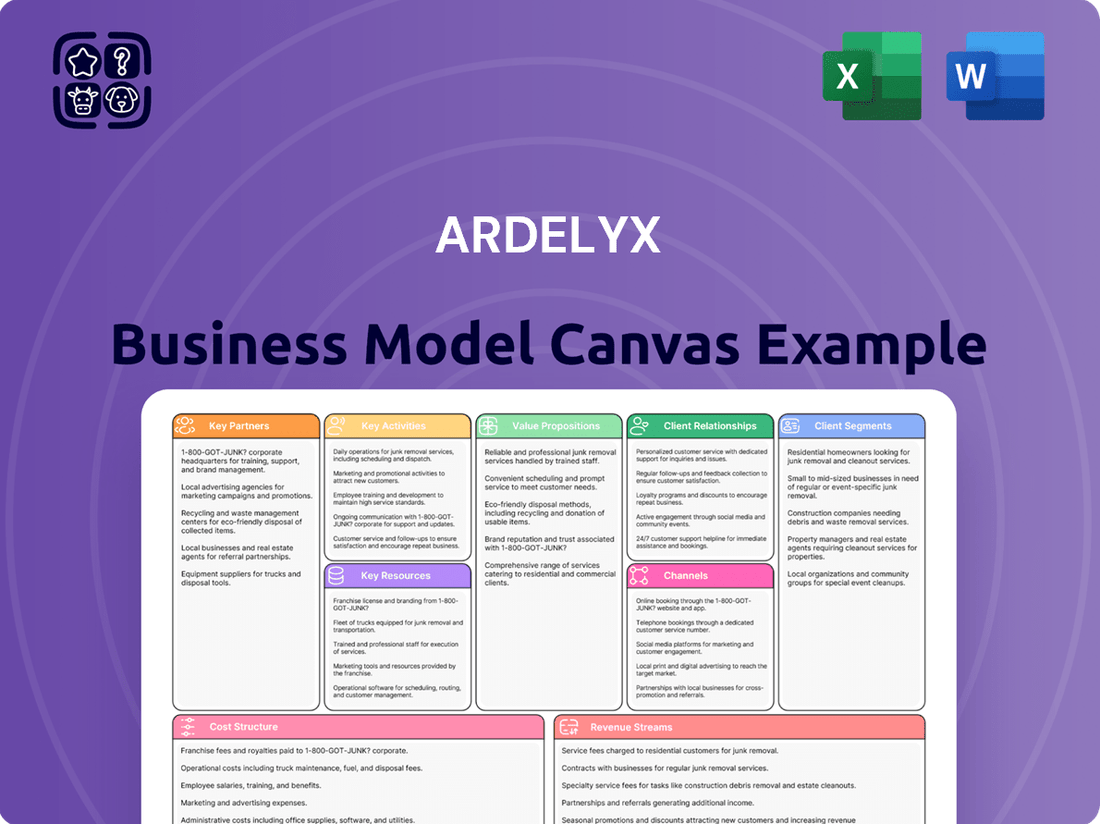

Ardelyx Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ardelyx Bundle

Unlock the full strategic blueprint behind Ardelyx's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape.

Discover Ardelyx's key customer segments, from patients with specific kidney diseases to healthcare providers. Understand their unique needs and how Ardelyx tailors its value propositions to meet them.

Explore Ardelyx's crucial partnerships, including research institutions and pharmaceutical distributors, that enable its innovative drug development and market access strategies.

Delve into Ardelyx's revenue streams, primarily driven by product sales and licensing agreements, and how they sustain its growth in the biopharmaceutical sector.

Analyze Ardelyx's cost structure, encompassing R&D expenses, manufacturing, and marketing, to understand the financial backbone of its operations.

This comprehensive canvas offers actionable insights for entrepreneurs, consultants, and investors seeking to learn from Ardelyx's proven industry strategies and accelerate their own business thinking.

Download the full Business Model Canvas to gain a complete, editable, and professionally written snapshot of Ardelyx's success, ready for deep analysis or quick adaptation.

Partnerships

Ardelyx strategically partners with established pharmaceutical companies to commercialize its products outside the United States. These agreements, like with Kyowa Kirin for tenapanor in Japan and Knight Therapeutics in Canada, leverage the partners local sales infrastructure and expertise. This approach generates royalty and milestone revenue for Ardelyx, contributing to its financial performance in 2024 without incurring the substantial costs of building an independent international presence. Such alliances ensure broader market access and maximize product reach globally.

Ardelyx, as a biopharmaceutical company, totally depends on Contract Manufacturing Organizations (CMOs) for producing tenapanor’s active pharmaceutical ingredient and finished drug product, including IBSRELA. These external partnerships are essential for a reliable and scalable supply chain, especially given IBSRELA's significant net product sales of $89.5 million in 2023, projected to increase in 2024. Effectively managing these relationships ensures the company meets growing market demand for its key commercial product and supports ongoing clinical trials. This reliance on CMOs is a core aspect of Ardelyx's operational strategy, allowing focus on development and commercialization.

Ardelyx primarily partners with Contract Research Organizations (CROs) to manage significant components of its clinical development, including trials for approved therapies like Xphozah. These CROs provide the crucial infrastructure, specialized personnel, and expertise required to conduct complex studies across numerous sites globally. This strategic outsourcing, a common practice in the biopharma sector, allows Ardelyx to maintain a lean internal structure while efficiently advancing its pipeline. The global CRO market, valued at approximately $60 billion in 2023, underscores the reliance on these external partners for regulatory adherence and data integrity. This model enables Ardelyx to focus on core research and commercialization efforts.

Regulatory Authorities

Ardelyx maintains a crucial, non-contractual relationship with regulatory bodies like the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA). This necessitates ongoing communication, extensive data submission, and careful negotiation to secure and sustain drug approvals. A prime example of this vital interaction is the successful regulatory journey of XPHOZAH (tenapanor), which received FDA approval in October 2023 for hyperphosphatemia in adult patients with chronic kidney disease on dialysis. The company’s continued engagement in 2024 ensures compliance and potential market expansion.

- FDA approval for XPHOZAH occurred in October 2023, demonstrating the critical outcome of this regulatory engagement.

- Ardelyx reported net product sales of XPHOZAH reaching $19.9 million in Q1 2024, reflecting successful market entry post-approval.

- Ongoing dialogue with the EMA continues to be essential for potential European market access for hyperphosphatemia indications.

Patient Advocacy Groups & Key Opinion Leaders (KOLs)

Ardelyx cultivates essential alliances with patient advocacy groups, such as the National Kidney Foundation, to elevate disease awareness and offer robust support to patient communities. They also forge strong relationships with Key Opinion Leaders in gastroenterology and nephrology. These medical experts provide invaluable insights, often participating in clinical trials for therapies like Ibsrela, which generated $100.8 million in net product sales in 2023, demonstrating its market acceptance. Their contributions are crucial in establishing the clinical value of Ardelyx’s therapies within the broader medical community.

- Ardelyx collaborates with groups like the National Kidney Foundation, which reaches millions annually, enhancing disease education.

- Key Opinion Leaders in gastroenterology and nephrology provide critical clinical validation for Ardelyx’s treatments.

- Their insights directly inform clinical trial designs, expediting the development of novel therapies.

- These partnerships strengthen market penetration and physician adoption for products like Xphozah, approved in 2023.

Ardelyx relies on diverse partnerships to drive its business model, including commercialization agreements with firms like Kyowa Kirin, generating revenue and expanding global reach. Crucial alliances with Contract Manufacturing Organizations ensure a scalable supply chain for products like IBSRELA, which saw $100.8 million in net product sales in 2023. The company also leverages Contract Research Organizations for efficient clinical development, enabling a lean structure while advancing its pipeline. Engagement with regulatory bodies like the FDA, instrumental in XPHOZAH's October 2023 approval, and collaborations with Key Opinion Leaders, are vital for market access and medical validation.

| Partnership Type | Primary Purpose | 2024 Relevance/Data |

|---|---|---|

| Commercialization Partners | International Market Access | Leverage existing infrastructure for global sales. |

| CMOs | Supply Chain & Manufacturing | Ensuring supply for projected IBSRELA sales increase. |

| CROs | Clinical Development | Advancing pipeline with lean internal structure. |

| Regulatory Bodies | Drug Approval & Compliance | Ongoing compliance post-XPHOZAH approval (Q1 2024 sales: $19.9M). |

What is included in the product

Ardelyx's business model focuses on developing and commercializing innovative therapies for kidney and cardiorenal diseases, targeting patients and healthcare providers through strategic partnerships and a specialized sales force.

Ardelyx's Business Model Canvas acts as a pain point reliever by clearly outlining its strategy for bringing novel therapies to patients, simplifying complex drug development and commercialization for stakeholders.

Activities

Ardelyx’s core activity in Research & Development centers on the scientific discovery and clinical advancement of novel, first-in-class medicines. This encompasses the entire spectrum, from initial discovery-stage science to executing rigorous late-stage Phase 3 clinical trials for their pipeline candidates. A key focus for 2024 includes expanding the therapeutic applications of tenapanor, their lead product, and actively progressing new assets within the crucial cardio-renal disease space. For the first quarter of 2024, Ardelyx reported research and development expenses of $12.3 million, demonstrating continued investment in their innovative pipeline.

Navigating the complex regulatory landscape is critical for Ardelyx, dedicating significant resources to preparing and filing new drug applications with the FDA and global authorities.

This involves meticulous data compilation and strategic planning, as evidenced by the October 2023 FDA approval of XPHOZAH tenapanor for CKD patients on dialysis.

Ongoing communication with regulators is essential to secure and maintain product approvals, ensuring market access for therapies like IBSRELA.

Commercial activities are paramount for Ardelyx, especially with IBSRELA's established presence and XPHOZAH's launch in November 2023. The company is actively building and training a specialized sales force to promote these key products to healthcare professionals. Extensive marketing campaigns are developed to drive adoption, aiming to maximize their commercial potential. Ardelyx reported IBSRELA net product sales of $23.1 million and XPHOZAH sales of $4.1 million for Q1 2024, highlighting the focus on market penetration and access.

Supply Chain and Manufacturing Management

Ardelyx actively manages its network of contract manufacturing organizations to ensure a consistent, high-quality supply of its flagship product, Ibsrela. This vital activity involves precise demand forecasting and diligent oversight of production schedules, ensuring all manufacturing processes adhere strictly to Good Manufacturing Practices. A robust supply chain is critical for supporting increasing commercial sales, which saw Ibsrela net product sales reach $50.3 million in the first quarter of 2024, and for ongoing clinical trials. Consistent supply chain execution directly impacts market availability and patient access.

- Ibsrela net product sales reached $50.3 million in Q1 2024, emphasizing supply chain importance.

- Manufacturing processes must strictly comply with Good Manufacturing Practices.

- Demand forecasting is essential for managing product inventory and avoiding shortages.

- The supply chain supports both commercial distribution and clinical trial material needs.

Medical Affairs and Education

Ardelyx prioritizes extensive medical affairs to inform the healthcare community about the science behind its therapies. This includes publishing clinical data, such as the 2024 peer-reviewed journal articles on Ibsrela, and presenting findings at major medical conferences. Their Medical Science Liaisons (MSLs) work to build scientific credibility and ensure appropriate use of treatments like Xphozah, which generated net product sales of $23.0 million in Q1 2024.

- Ardelyx's Xphozah gained FDA approval in October 2023 for chronic kidney disease patients on dialysis.

- Ibsrela (tenapanor) continues to be a key focus for irritable bowel syndrome with constipation (IBS-C).

- The company reported a 2024 commercial launch for Xphozah with significant physician engagement.

- Medical education efforts are critical for driving adoption and understanding of their novel mechanisms of action.

Ardelyx focuses on Research & Development, with Q1 2024 R&D expenses at $12.3 million, to advance novel medicines and expand existing therapies. Critical regulatory activities ensure product approvals, like XPHOZAH in October 2023. Commercialization efforts drive sales, with IBSRELA achieving $23.1 million and XPHOZAH $4.1 million in Q1 2024 net product sales. Additionally, robust supply chain management supports consistent product availability, and medical affairs inform the healthcare community.

| Activity Area | Key Focus | Q1 2024 Data |

|---|---|---|

| Research & Development | Pipeline advancement, Tenapanor expansion | $12.3 million R&D expenses |

| Commercialization | Product launch, Market penetration | IBSRELA sales: $23.1 million |

| Commercialization | Product launch, Market penetration | XPHOZAH sales: $4.1 million |

What You See Is What You Get

Business Model Canvas

This preview showcases the actual Ardelyx Business Model Canvas, offering a genuine glimpse into the comprehensive analysis you will receive. The document you are currently viewing is not a mockup or sample; it is an exact representation of the final deliverable. Upon purchase, you will gain full access to this complete Business Model Canvas, preserving its structure, content, and intended format without alteration.

Resources

Ardelyx's Intellectual Property (IP) portfolio, especially for tenapanor (Ibsrela/Xphozah), is its most critical asset, providing robust market exclusivity. This extensive patent protection prevents generic competition, forming the bedrock of the company's valuation. For instance, tenapanor's patents extend into the 2030s, safeguarding its revenue streams. Proactively defending and expanding this portfolio against potential infringements is a continuous strategic priority for Ardelyx.

Official marketing approvals from the FDA, such as for IBSRELA and XPHOZAH, are critical intangible assets for Ardelyx. The FDA approval of XPHOZAH in October 2023 for controlling serum phosphorus in adult dialysis patients significantly expanded Ardelyx's commercial reach into 2024. These approvals validate a drug's safety and efficacy, unlocking substantial commercial potential and creating a significant barrier to entry for competitors. Such regulatory milestones underpin the company's market position, driving projected revenue growth for both products in the coming fiscal periods.

Ardelyx's specialized human capital is crucial, featuring experienced scientists and clinical development experts focused on nephrology and cardio-renal diseases. Their deep knowledge in drug development is essential for advancing the pipeline, contributing to the $22.6 million in R&D expenses reported in Q1 2024. The regulatory affairs professionals ensure compliance, vital for product approvals like Ibsrela. Additionally, the commercial team’s expertise in launching specialty drugs is key, driving Ibsrela's net product sales to $30.0 million in Q1 2024. This collective talent forms a core resource for the company's strategic growth.

Financial Capital

Access to robust financial capital is paramount for Ardelyx as a development and commercial-stage biopharma entity. This critical resource encompasses cash on hand from product sales, funds secured through equity or debt financing, and payments from strategic collaboration partners. For instance, Ardelyx reported cash, cash equivalents, and marketable securities of approximately $208.5 million as of March 31, 2024. This capital directly fuels all key operations, from ongoing research and development initiatives to expanding the commercial sales force for products like IBSRELA, which generated $25.2 million in net product sales in Q1 2024.

- Cash on hand: Approximately $208.5 million as of Q1 2024.

- Product sales: IBSRELA net product sales reached $25.2 million in Q1 2024.

- Equity/Debt financing: Supports operational expenses and growth initiatives.

- Collaboration payments: Provides non-dilutive funding for development.

Established Commercial Infrastructure

Ardelyx possesses a robust commercial infrastructure, including dedicated sales forces, marketing teams, and market access specialists. This framework, initially built for products like IBSRELA and XPHOZAH, efficiently targets key physician audiences such as gastroenterologists and nephrologists. This established network represents a tangible, valuable asset, poised to support the successful commercialization of future pipeline assets. For instance, XPHOZAH's net product sales reached $21.5 million in Q1 2024, demonstrating the infrastructure's effectiveness.

- Ardelyx's commercial team targets over 10,000 nephrologists and gastroenterologists.

- IBSRELA generated $29.9 million in net product sales during Q1 2024.

- The established infrastructure supports market access for new indications and drugs.

- This resource minimizes the need for building new commercial teams for future launches.

Ardelyx relies on its robust intellectual property, especially patents for tenapanor extending into the 2030s, alongside critical FDA marketing approvals for IBSRELA and XPHOZAH. Specialized human capital, including experts driving $22.6 million in Q1 2024 R&D, is vital. Financial capital, with approximately $208.5 million cash as of Q1 2024, fuels operations, complemented by a strong commercial infrastructure driving XPHOZAH sales to $21.5 million in Q1 2024.

| Resource | Key Metric | Q1 2024 Data |

|---|---|---|

| IP | Tenapanor Patent Expiry | 2030s |

| Financial Capital | Cash & Equivalents | $208.5M |

| Human Capital | R&D Expenses | $22.6M |

| Commercial Infra. | XPHOZAH Net Sales | $21.5M |

Value Propositions

Ardelyx offers therapies with a first-in-class mechanism of action, exemplified by tenapanor, an NHE3 inhibitor. This novel approach provides a distinct treatment pathway for conditions such as hyperphosphatemia and irritable bowel syndrome with constipation (IBS-C). For instance, tenapanor (Ibsrela/Xphozah) generated approximately $120 million in net product sales in 2023, showcasing its market impact. This innovation provides a valuable alternative for patients who have not adequately responded to or cannot tolerate existing treatments, addressing a significant unmet medical need in 2024.

Ardelyx addresses critical unmet medical needs, focusing on the cardio-renal space where treatment options are often limited. XPHOZAH (tenapanor) is specifically developed for hyperphosphatemia in chronic kidney disease patients on dialysis, a serious condition impacting over 550,000 individuals in the U.S. as of 2024. This condition often presents challenges with adherence and efficacy with existing therapies. By offering a novel mechanism, XPHOZAH fills a crucial therapeutic gap, providing significant value to patients and the healthcare system.

Ardelyx’s Tenapanor provides targeted, gut-restricted therapy, ensuring minimal systemic absorption. This localized action in the gastrointestinal tract is a crucial value proposition, enhancing safety and tolerability for patients. As of early 2024, this profile differentiates products like Ibsrela and Xphozah, appealing to physicians seeking fewer systemic side effects. This approach helps reduce the burden of adverse events for patients with conditions like IBS-C and hyperphosphatemia.

Improving Patient Quality of Life and Outcomes

Ardelyx primarily focuses on enhancing patient health and daily life. For individuals suffering from IBS-C, IBSRELA aims to significantly reduce symptoms like abdominal pain and constipation, thereby improving daily function. In 2024, IBSRELA is projected to continue its strong commercial performance, contributing to better patient well-being.

For chronic kidney disease patients, controlling elevated serum phosphorus with XPHOZAH is vital. This control helps lower the risk of severe cardiovascular events and improves long-term outcomes. XPHOZAH's 2024 market presence underscores its critical role in managing this condition for improved patient quality of life.

- IBSRELA targets IBS-C symptom reduction, improving patient daily function.

- XPHOZAH controls serum phosphorus in CKD, reducing cardiovascular event risk.

- Both therapies aim to enhance patient quality of life and long-term outcomes.

- Ardelyx projects continued strong performance for both products in 2024.

Providing a Phosphate Absorption Inhibitor, Not a Binder

Ardelyx offers a distinct value proposition with XPHOZAH (tenapanor) for hyperphosphatemia, diverging from traditional phosphate binders. This medication acts as a phosphate absorption inhibitor, targeting the primary pathway in the gastrointestinal tract. This novel mechanism can help more patients reach their target serum phosphate levels, potentially reducing the pill burden often associated with current treatments. For nephrologists, this represents a significant advancement in managing hyperphosphatemia, providing an alternative to the 2024 standard of care that relies heavily on phosphate binders.

- XPHOZAH received FDA approval in October 2023 for hyperphosphatemia in adult CKD patients on dialysis.

- It offers a novel non-binder mechanism, inhibiting intestinal phosphate absorption.

- The approach aims to improve phosphate control and reduce daily pill count for patients.

- As of Q1 2024, Ardelyx reported strong initial uptake of XPHOZAH.

Ardelyx delivers first-in-class therapies like tenapanor, addressing unmet needs in cardio-renal and GI health. Their gut-restricted approach enhances safety and tolerability, improving patient quality of life. XPHOZAH offers a novel non-binder mechanism for hyperphosphatemia, reducing pill burden and improving outcomes. The company projects continued strong product performance in 2024.

| Product | 2023 Net Sales | 2024 Outlook |

|---|---|---|

| IBSRELA/XPHOZAH | $120M | Growth Expected |

| XPHOZAH (Q1 2024) | $14.5M | Strong Uptake |

| Target Disease | Hyperphosphatemia | IBS-C |

Customer Relationships

Ardelyx builds direct relationships with prescribing physicians through its dedicated sales representatives, crucial for educating specialists. These teams are highly trained in the clinical data and value proposition of IBSRELA, which saw Q1 2024 net product sales of $35.0 million, and XPHOZAH. This personal, high-touch engagement is vital for driving adoption and fostering trust. Their focus ensures healthcare providers understand the benefits for patients. This strategy supports market penetration and sustained growth.

Ardelyx strategically deploys Medical Science Liaisons (MSLs) to foster direct, peer-to-peer scientific dialogue with Key Opinion Leaders and healthcare professionals. These MSLs are crucial for disseminating deep clinical data, especially concerning products like Ibsrela (tenapanor), which saw net product sales reach $118.5 million in 2023. They adeptly answer complex scientific inquiries and gather vital insights from the medical community, informing future research and development. This dedicated engagement builds strong scientific credibility and cultivates enduring relationships with influential physicians, directly supporting market adoption and educational efforts for their innovative therapies.

Ardelyx builds strong patient relationships through comprehensive support programs like ArdelyxAssist, which is crucial for their commercial strategy in 2024. These services help patients and healthcare providers navigate complex insurance coverage, understand benefits, and access potential financial assistance for medications like IBSRELA. This dedicated support significantly improves patient access and adherence to treatment, fostering loyalty and trust within the patient community. For example, Ardelyx continues to invest in these programs to ensure patients can readily access their treatments, aligning with their focus on maximizing IBSRELA's market penetration, which generated $140.5 million in net product sales in 2023 and is projected to grow further in 2024.

Medical Education and Congress Engagement

Ardelyx cultivates strong relationships within the broader medical community by actively presenting clinical data at major medical conferences, such as Kidney Week 2024, and by sponsoring critical educational events. This approach underscores their commitment to advancing scientific understanding in therapeutic areas like hyperphosphatemia, particularly with their drug, Xphozah. It facilitates essential dialogue and relationship-building with a diverse range of healthcare professionals, including nephrologists and dietitians, crucial for patient care and adoption.

- Ardelyx participated in numerous medical congresses in 2024, including key nephrology events.

- Educational initiatives highlight Xphozah's role in chronic kidney disease management.

- Company outreach targets kidney care professionals, fostering direct engagement.

- Commitment to scientific exchange supports informed clinical decision-making.

Digital Portals and Resources for HCPs

Ardelyx maintains a robust digital relationship with healthcare professionals (HCPs) through dedicated online portals, offering essential resources. These platforms ensure HCPs can easily access prescribing information for products like IBSRELA, clinical trial data, and educational materials. This digital infrastructure, crucial for a biotech company, complements the efforts of their in-person sales and medical teams, streamlining information dissemination and support.

- Ardelyx's 2024 strategic focus includes enhancing digital engagement tools for HCPs.

- These portals facilitate efficient access to key drug data, supporting informed prescribing decisions.

- Digital platforms reduce the time required for HCPs to obtain product information, improving efficiency.

- The digital approach supports a broad reach to HCPs beyond direct sales force capacity.

Ardelyx cultivates diverse relationships with healthcare professionals via direct sales, Medical Science Liaisons, and digital platforms, supporting products like IBSRELA which saw $35.0 million in Q1 2024 net sales. They also build strong patient loyalty through programs like ArdelyxAssist, crucial for 2024 commercial strategy. Engaging the broader medical community through events like Kidney Week 2024 further strengthens their market position for therapies like XPHOZAH. This multi-channel approach ensures comprehensive engagement and sustained product adoption.

| Relationship Type | Primary Method | 2024 Data/Focus |

|---|---|---|

| Healthcare Professionals | Direct Sales & MSLs | IBSRELA Q1 2024 Net Sales: $35.0M |

| Patients | ArdelyxAssist Programs | Continued investment for access & adherence |

| Medical Community | Conferences & Digital Portals | Kidney Week 2024 participation & enhanced digital tools |

Channels

Ardelyx primarily uses its dedicated direct-to-physician sales force as a key channel for promoting its products. These specialized representatives directly engage gastroenterologists, focusing on IBSRELA, and nephrologists, promoting XPHOZAH. This direct channel fosters targeted messaging and strong relationship building with key prescribers. In 2024, Ardelyx continues to expand its sales team, particularly for XPHOZAH following its November 2023 FDA approval, aiming to reach a broader base of healthcare providers. This direct engagement is critical for driving prescription growth and market penetration.

Ardelyx relies on a robust network of specialty pharmacies and pharmaceutical wholesalers to distribute its products, including Ibsrela (tenapanor) which saw net product sales of $30.8 million in Q1 2024. These crucial partners are responsible for efficiently handling prescriptions and managing product inventory to ensure patients receive their necessary medication. This channel is fundamental for the physical delivery of Ardelyx’s therapies, connecting the company's innovations with patients across the United States. Effective management of this distribution network is key to maximizing patient access and commercial reach.

Publishing clinical trial results in respected, peer-reviewed medical journals is crucial for Ardelyx to establish clinical credibility. This channel disseminates evidence of a product's safety and efficacy, like Tenapanor for hyperphosphatemia, to the global medical community. Such publications are foundational for informing clinical practice guidelines, significantly influencing physician adoption. For instance, in 2024, the medical community continues to rely heavily on these publications for updated treatment protocols and drug evaluations.

National and International Medical Conferences

Ardelyx leverages major medical congresses like ASN Kidney Week and Digestive Disease Week as a crucial channel for engaging with physicians and presenting new data. These events facilitate broad dissemination of information through oral presentations, poster sessions, and exhibition booths. In 2024, such conferences continue to be vital for reaching influential leaders in nephrology and gastroenterology, directly impacting clinical practice and market adoption.

- Ardelyx presented at ASN Kidney Week 2023, showcasing new data on Ibsrela.

- These conferences attract thousands of specialists, with ASN Kidney Week 2023 having over 12,000 attendees.

- Exhibition booths allow direct interaction and education for healthcare providers.

- Oral and poster presentations enhance scientific credibility and product awareness.

Payer and Health Plan Networks

Ardelyx utilizes a dedicated market access team to engage with key payers, including major insurance companies and pharmacy benefit managers (PBMs). This engagement is crucial for securing favorable formulary placement for their therapeutics, such as Ibsrela (tenapanor). As of 2024, successful negotiations directly impact patient access, with PBMs influencing over 75% of prescription drug claims, making favorable formulary inclusion essential for market penetration and affordability.

- Payer engagement ensures broad patient access to Ardelyx products.

- Formulary placement directly impacts drug affordability for patients.

- PBM negotiations are a critical revenue driver in the pharmaceutical industry.

- Market access teams navigate complex benefit designs and coverage policies.

Ardelyx primarily utilizes a direct-to-physician sales force, expanding in 2024 for XPHOZAH, and a network of specialty pharmacies for product distribution, with Ibsrela seeing $30.8 million in Q1 2024 net sales. Clinical evidence is disseminated through medical journal publications and presentations at major congresses like ASN Kidney Week 2023, attracting over 12,000 attendees. A dedicated market access team engages payers to secure formulary placement, crucial as PBMs influence over 75% of 2024 prescription claims, ensuring broad patient access.

| Channel | Primary Function | 2024 Impact/Data |

|---|---|---|

| Direct Sales Force | Physician Engagement | Expansion for XPHOZAH |

| Specialty Pharmacies | Product Distribution | Ibsrela Q1 2024 Net Sales: $30.8M |

| Medical Congresses | Data Dissemination | ASN Kidney Week 2023: >12,000 attendees |

| Market Access Team | Payer Engagement | PBMs influence >75% of 2024 Rx claims |

Customer Segments

Specialist physicians, particularly gastroenterologists, represent the core customer segment for Ardelyx's IBSRELA. These specialists are crucial as they diagnose and manage patients suffering from irritable bowel syndrome with constipation (IBS-C), a condition impacting millions globally. Ardelyx’s commercial strategy is highly focused on these practitioners, recognizing their pivotal role in prescribing. In 2024, Ardelyx reported strong prescription growth, with IBSRELA net product sales reaching $44.1 million in Q1, underscoring the success of their targeted engagement with this physician group.

Nephrologists are the primary customer segment for Ardelyx's XPHOZAH, as they manage patients with chronic kidney disease (CKD) on dialysis. These specialists are responsible for treating complications like hyperphosphatemia, a common issue among dialysis patients. This segment encompasses both independent nephrology practices and physicians affiliated with major dialysis centers, such as the over 3,000 Fresenius Medical Care clinics in the US as of 2024. Their expertise in renal care makes them central to prescribing phosphate management therapies.

Large Dialysis Organizations (LDOs) and clinics represent a crucial customer segment for XPHOZAH, as these entities manage a significant portion of patients with chronic kidney disease on dialysis. In the United States, LDOs like DaVita and Fresenius Kidney Care serve over 80% of dialysis patients, collectively managing hundreds of thousands of individuals. Securing formulary adoption and clinical protocol integration within these large organizations is paramount, directly influencing prescribing decisions for patient populations. This strategic engagement is vital for Ardelyx to achieve substantial market penetration and broad patient access for XPHOZAH in 2024 and beyond.

Patients with Chronic Conditions

Ardelyx's core customer segments are patients grappling with chronic conditions, specifically those who are the end-users of their specialized therapies. This includes individuals suffering from Irritable Bowel Syndrome with Constipation (IBS-C) who have not found adequate relief from existing treatments, representing a significant unmet need within the estimated 10-15% of the global population affected by IBS. Additionally, a crucial segment comprises Chronic Kidney Disease (CKD) patients on dialysis who struggle to control their serum phosphorus levels, a condition affecting a large portion of the over 500,000 Americans currently undergoing dialysis in 2024.

While these patients are not the direct purchasers, their specific medical needs and the clinical outcomes achieved with Ardelyx's products, like Ibsrela for IBS-C and Xphozah for hyperphosphatemia, fundamentally define the market opportunity and strategic focus for the company. Meeting their needs is paramount, driving product development and commercialization efforts.

- IBS-C patients: Approximately 11 million adults in the US are estimated to have IBS-C, with a subset unresponsive to current therapies.

- CKD patients on dialysis: Over 550,000 Americans are on dialysis, with a high prevalence of uncontrolled hyperphosphatemia.

- Ardelyx's Q1 2024 net product sales for IBS-C (Ibsrela) were approximately $25.5 million, reflecting ongoing patient adoption.

- The prevalence of uncontrolled phosphorus in dialysis patients highlights a substantial market for new treatment options like Xphozah.

Public and Private Payers

Public and private payers are a crucial customer segment for Ardelyx, encompassing major entities like insurance companies, pharmacy benefit managers (PBMs), Medicare, and Medicaid. Their coverage and reimbursement decisions are paramount, directly dictating patient access to Ardelyx's innovative medicines, such as Ibsrela. Gaining favorable formulary status, especially with large payers covering a significant portion of the US population, is a primary goal to ensure broad market availability. For instance, Medicare Part D plans cover millions of beneficiaries, making their formulary decisions in 2024 vital for patient reach.

- PBMs manage drug benefits for over 270 million Americans, influencing Ardelyx's market access.

- Medicare Part D enrollment is projected to exceed 52 million beneficiaries in 2024, a key reimbursement channel.

- Medicaid covers roughly 85 million low-income individuals, representing another critical payer segment for drug access.

- Favorable formulary placement can significantly impact Ardelyx's sales volume, as seen with Ibsrela's market penetration.

Ardelyx primarily targets specialist physicians, including gastroenterologists for IBSRELA and nephrologists for XPHOZAH, who are crucial prescribers. Large Dialysis Organizations and various public and private payers, such as PBMs and Medicare, are essential for market access and reimbursement decisions. Ultimately, the company’s focus is on patients with IBS-C and CKD on dialysis, addressing their unmet medical needs with specialized therapies.

| Customer Segment | Key Role | 2024 Data Point |

|---|---|---|

| Specialist Physicians | Prescribers | IBSRELA Q1 2024 net sales: $44.1M |

| Large Dialysis Orgs. | Patient Management | Serve over 80% of US dialysis patients |

| Patients (IBS-C/CKD) | End-Users | Over 500,000 Americans on dialysis |

| Public/Private Payers | Reimbursement | PBMs manage benefits for over 270M Americans |

Cost Structure

Ardelyx's most significant cost component is its investment in Research & Development. This includes substantial expenses for conducting late-stage clinical trials, like those for their pipeline candidates. Personnel costs for the dedicated R&D team are also a major factor, alongside preclinical research efforts aimed at pipeline expansion. For Q1 2024, Ardelyx reported R&D expenses of $22.7 million, reflecting these value-driving yet substantial investments.

Selling, General & Administrative (SG&A) expenses represent a significant cost for Ardelyx, primarily driven by their commercialization efforts. These costs encompass the salaries and operational overhead for the sales force promoting IBSRELA and XPHOZAH, alongside marketing and promotional activities aimed at increasing product adoption. Corporate overhead, including administrative and research support functions, also contributes to this category. For the first quarter of 2024, Ardelyx reported SG&A expenses of $33.5 million, reflecting ongoing investment in market expansion. These essential expenditures are crucial for driving revenue growth and ensuring broader market penetration for their key products.

As Ardelyx's product sales, particularly for IBSRELA, increase, the Cost of Goods Sold becomes a more significant expense. This primarily consists of payments to third-party contract manufacturers responsible for producing the drug, ensuring a consistent supply. Additionally, COGS includes any royalties owed to partners based on product sales, directly reflecting the revenue generated. This cost is highly variable, fluctuating in direct proportion to the volume of products sold, such as the reported $5.4 million in cost of sales for IBSRELA in Q1 2024 against $36.7 million in net product sales.

Regulatory and Compliance Costs

Ardelyx faces substantial regulatory and compliance costs, essential for operating within the biopharmaceutical industry. These expenses include significant fees paid to regulatory bodies like the FDA for drug approvals and ongoing surveillance. For instance, in 2024, the FDA user fees for a new drug application can exceed $3.8 million, reflecting a core part of these costs. Additional outlays cover preparing and filing extensive submissions, alongside continuous post-market surveillance and reporting requirements for approved products like IBSRELA.

- FDA user fees for new drug applications can exceed $3.8 million in 2024.

- Costs include preparing and filing extensive regulatory submissions.

- Expenses cover ongoing post-market surveillance and reporting for products like IBSRELA.

Intellectual Property Legal Costs

Intellectual property legal costs represent a strategic investment for Ardelyx, encompassing significant expenses for globally filing, maintaining, and defending its patent portfolio. Protecting innovations like XPHOZAH (tenapanor) is fundamental to securing Ardelyx's market position and future revenue streams. These costs are vital for long-term viability, particularly as the biotechnology sector navigates complex intellectual property landscapes. For instance, pharmaceutical companies often allocate substantial budgets to IP; global patent litigation costs can range from hundreds of thousands to millions of dollars per case in 2024.

- Global patenting efforts are crucial for market exclusivity.

- Legal defense of key drug assets secures future profitability.

- Annual patent maintenance fees are recurring strategic costs.

- Investment in IP directly correlates with long-term competitive advantage.

Ardelyx's cost structure is heavily driven by Research & Development, totaling $22.7 million in Q1 2024, alongside significant Selling, General & Administrative expenses of $33.5 million for commercialization. Cost of Goods Sold, $5.4 million for IBSRELA in Q1 2024, scales with product sales. Substantial regulatory and intellectual property legal costs, like 2024 FDA NDA fees exceeding $3.8 million, are also critical for market access and protecting innovations.

| Cost Category | Q1 2024 Expense (Millions) | 2024 Relevant Data |

|---|---|---|

| Research & Development | $22.7 | Late-stage clinical trials |

| Selling, General & Administrative | $33.5 | Commercialization efforts for IBSRELA, XPHOZAH |

| Cost of Goods Sold (IBSRELA) | $5.4 | Tied to $36.7M Q1 2024 net product sales |

| Regulatory & Compliance | N/A | FDA NDA fees >$3.8 million in 2024 |

| Intellectual Property Legal | N/A | Global patent litigation millions per case in 2024 |

Revenue Streams

Ardelyx's primary revenue stream is the net product revenue generated from sales of IBSRELA in the United States.

This revenue, derived from prescriptions for patients with IBS-C, forms the current foundation of the company's income.

Growth in this stream is driven by increased physician adoption and prescription volume, with net product sales for IBSRELA reaching $36.7 million in Q1 2024.

Ardelyx anticipates full-year 2024 net product sales of IBSRELA to be between $150 million and $160 million.

Future net product sales of XPHOZAH, specifically for hyperphosphatemia in chronic kidney disease patients on dialysis, are anticipated to become Ardelyx's primary revenue driver. This represents the company's most significant near-term growth opportunity, with analysts projecting 2024 sales ramping up following its U.S. launch. The success of this stream hinges on strong adoption within the nephrology community, leveraging XPHOZAH's novel mechanism of action. Market forecasts for 2024 indicate a crucial period for establishing its market share and driving substantial financial returns for Ardelyx.

Ardelyx secures valuable revenue through its ex-U.S. partnerships for tenapanor, notably with Kyowa Kirin in Japan. This stream includes vital non-dilutive funding from upfront payments, alongside development and commercial milestone payments. For instance, in the first quarter of 2024, Ardelyx recognized $1.5 million in collaboration revenue. Additionally, the company earns royalties on net sales from its international partners, expanding its financial reach globally.

Royalty Revenue

Royalty revenue represents a crucial high-margin component of Ardelyx’s collaboration income, stemming from successful partner commercialization of tenapanor in their respective territories. As partners like CSL Vifor advance sales of tenapanor (branded as Kyprolis in some regions), Ardelyx receives a percentage of net sales. This mechanism establishes a recurring revenue stream that directly scales with the global market penetration and success of the product. For instance, in 2024, such royalties contribute to the overall financial strength, complementing US Ibsrela sales.

- Ardelyx's total revenue for Q1 2024 was $31.8 million, including product and collaboration revenue.

- Royalty payments are linked to partners' net sales of tenapanor outside the US.

- This stream contributes to the company's projected 2024 total revenue of $130 million to $140 million.

- The high-margin nature enhances overall profitability as global market adoption increases.

Potential Revenue from Pipeline Products

A significant long-term revenue stream for Ardelyx is anticipated from the successful development and commercialization of new pipeline products. While speculative, each new product brought to market would establish an entirely new source of product sales revenue. This strategy is crucial for sustaining the company's long-term growth and diversifying its income beyond current commercial offerings. The company's focus on kidney and cardiorenal diseases suggests future innovations will likely target these areas.

- Ardelyx's pipeline includes candidates beyond their commercialized IBSRELA and XPHOZAH, targeting further expansion.

- Successful progression of these assets through clinical trials could significantly boost future product revenue.

- New product approvals would broaden Ardelyx's market reach and patient base.

- This represents a critical component of Ardelyx's long-term financial strategy for sustainable growth.

Ardelyx primarily generates revenue from IBSRELA product sales, which reached $36.7 million in Q1 2024, with 2024 full-year guidance of $150-$160 million.

XPHOZAH sales, launching in 2024, are anticipated to become the leading revenue driver, significantly boosting product income.

Collaboration revenue from ex-U.S. partnerships, including royalties on tenapanor net sales and milestone payments, contributed $1.5 million in Q1 2024.

Future pipeline product commercialization offers long-term growth potential and diversification beyond current offerings.

| Revenue Stream | Q1 2024 ($M) | FY 2024 Est. ($M) |

|---|---|---|

| IBSRELA Product Sales | 36.7 | 150-160 |

| Collaboration Revenue | 1.5 | N/A |

| Total Revenue | 31.8 | 130-140 |

Business Model Canvas Data Sources

The Ardelyx Business Model Canvas is built upon a foundation of rigorous market research, including patient data and physician feedback, alongside detailed financial disclosures and strategic analyses of the biopharmaceutical landscape. These sources ensure each canvas block is filled with accurate, up-to-date information to reflect our operational realities and strategic objectives.