Ardelyx Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Ardelyx Bundle

Ardelyx operates within a pharmaceutical landscape characterized by intense competition and significant regulatory hurdles. The threat of new entrants is moderate, as high R&D costs and patent protection create barriers, yet innovative startups can disrupt the market.

Buyer power, particularly from large insurance companies and healthcare systems, exerts considerable pressure on Ardelyx's pricing strategies and market access. The threat of substitutes, though less direct in specialized biopharmaceuticals, is always present as alternative treatment pathways emerge.

Supplier power is generally low for most raw materials but can be high for specialized components or contract manufacturing services crucial for Ardelyx's drug production.

Existing competitive rivalry is fierce, with established players and emerging biotechs vying for market share and physician adoption of their therapies.

The complete report reveals the real forces shaping Ardelyx’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Ardelyx, like many biopharmaceutical companies, faces significant supplier bargaining power due to the specialized nature of its inputs. The industry relies heavily on a limited number of contract manufacturing organizations (CMOs) for critical raw materials and drug production. As of 2024, Ardelyx completely depends on third-party CMOs for manufacturing its commercial supply of Ibsrela and for its clinical trial materials. This concentrated supplier base allows these specialized entities to exert considerable influence over pricing, delivery terms, and quality control, directly impacting Ardelyx's operational costs and supply chain stability.

Transitioning to new suppliers in the biopharmaceutical sector, as Ardelyx would experience, is a costly and time-consuming process. It involves significant expenses for re-validation and quality assessments to comply with stringent regulatory standards like current Good Manufacturing Practices (cGMPs). For instance, re-validating a critical component supplier can take 12-24 months and incur costs upwards of $500,000 for analytical testing and documentation in 2024. These high switching costs effectively lock companies like Ardelyx into their existing supplier relationships, thereby strengthening the bargaining power of those suppliers.

Suppliers in the biopharmaceutical sector often hold patents on critical manufacturing processes or specialized technologies, limiting Ardelyx's alternative options. This intellectual property protection significantly boosts the supplier's bargaining power, as seen with complex drug substance manufacturing. Ardelyx's commercialization efforts, particularly for products like Xphozah, are highly dependent on these unique suppliers. Any disruption or increased costs from a key supplier, such as those providing active pharmaceutical ingredients (APIs), could materially impact Ardelyx's financial performance in 2024 and beyond. This reliance underscores a significant vulnerability within their supply chain.

Potential for Price Increases

Given the specialized nature of raw materials and services, suppliers hold significant power to increase prices, directly impacting Ardelyx's profitability. Between 2021 and 2023, biopharma companies experienced price hikes of up to 15% for essential raw materials, a trend continuing into 2024 with ongoing supply chain pressures. Ardelyx's reliance on third parties for manufacturing makes it particularly susceptible to these fluctuations, potentially raising production costs for drugs like Xphozah.

- Specialized inputs give suppliers leverage over pricing.

- Biopharma raw material costs rose up to 15% from 2021-2023, impacting 2024 budgets.

- Ardelyx's outsourced manufacturing amplifies vulnerability to supplier price adjustments.

- Increased supplier costs can directly erode Ardelyx's profit margins.

Forward Integration by Suppliers

Some suppliers in the biopharmaceutical sector engage in forward integration, controlling the distribution and sale of their products, which presents a notable dynamic for companies like Ardelyx. While not universally dominant, this strategy is moderately prevalent, particularly among larger contract manufacturing organizations (CMOs) or specialized raw material providers. This control grants integrated suppliers significant leverage, influencing pricing and supply terms, a critical factor given Ardelyx's focus on research and development and strategic partnerships rather than in-house manufacturing capabilities. As of 2024, the global biopharmaceutical CMO market size continues to expand, reflecting the reliance on external partners.

- Integrated suppliers can dictate terms due to their expanded control over the supply chain.

- Ardelyx's reliance on external manufacturing makes supplier forward integration a relevant risk.

- The global biopharmaceutical CMO market was valued at over $100 billion in 2024, indicating significant external reliance.

- This structure gives certain suppliers heightened bargaining power over drug developers.

Ardelyx experiences significant supplier bargaining power due to its heavy reliance on a limited number of specialized CMOs for drug manufacturing, including Ibsrela and Xphozah. High switching costs, estimated at over $500,000 for re-validation in 2024, lock Ardelyx into existing relationships. Suppliers holding intellectual property on critical processes further amplify their leverage over pricing and supply terms. This vulnerability is underscored by biopharma raw material cost hikes, up to 15% between 2021-2023, impacting 2024 budgets.

| Factor | Impact on Ardelyx | 2024 Data/Context |

|---|---|---|

| Supplier Concentration | Limited CMO options for Ibsrela/Xphozah production. | Ardelyx fully depends on third-party CMOs. |

| Switching Costs | High expenses for re-validation and compliance. | Re-validation costs exceed $500,000; takes 12-24 months. |

| Input Specialization | Reliance on patented processes or unique raw materials. | Biopharma raw material costs rose up to 15% (2021-2023). |

What is included in the product

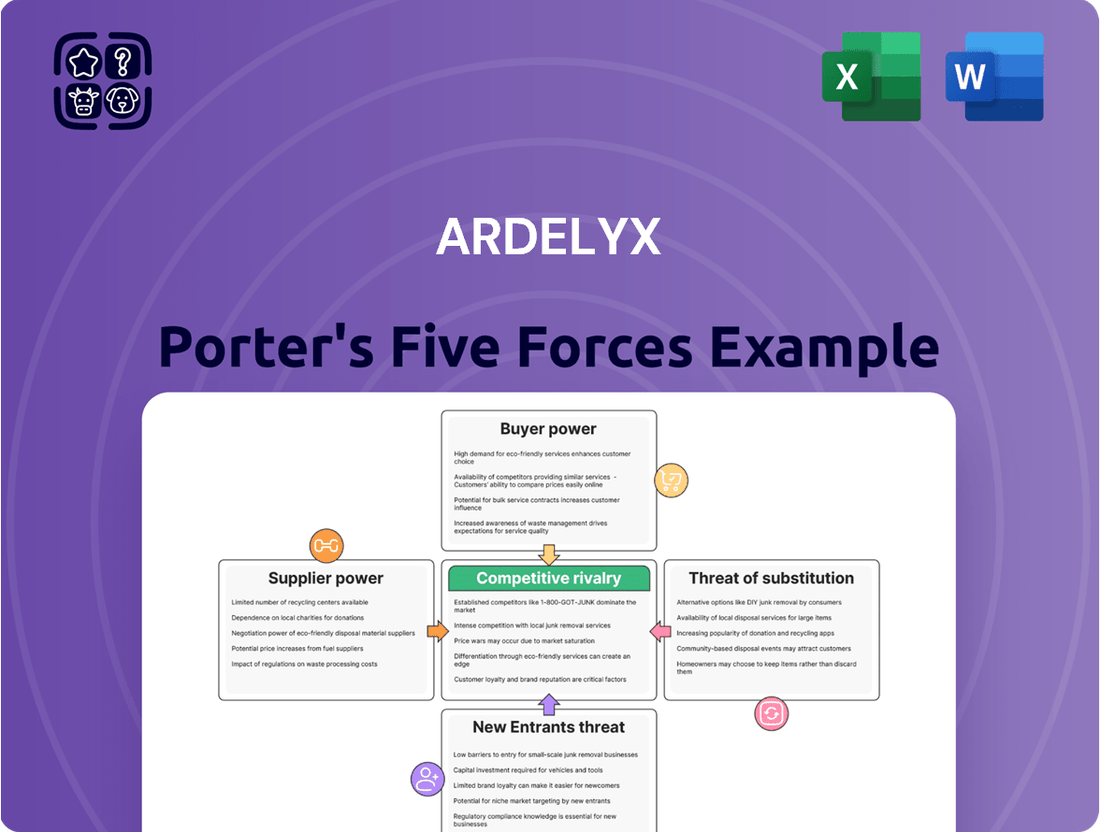

This Porter's Five Forces analysis for Ardelyx dissects the competitive intensity within the biopharmaceutical industry, focusing on the company's specific therapeutic areas.

Streamline Ardelyx's competitive landscape analysis to pinpoint and address key market pressures impacting their pain point relievers.

Customers Bargaining Power

The primary customers for pharmaceutical companies like Ardelyx are large, concentrated entities such as governments, major hospital systems, pharmacy benefit managers (PBMs), and extensive insurance networks. These powerful buyers, including distributors who then supply pharmacies and patients for Ardelyx, exert significant bargaining power. For instance, large PBMs like CVS Caremark, Express Scripts, and OptumRx, which cover over 270 million Americans, can demand substantial price concessions and rebates. This concentration of purchasing power allows them to influence drug pricing and formulary placement, directly impacting Ardelyx's revenue potential in 2024.

Customers, particularly large payors like Medicare, demonstrate significant price sensitivity, which strengthens their bargaining power over pharmaceutical companies such as Ardelyx. The intense national debate surrounding prescription drug costs, influenced by policies like the Inflation Reduction Act, directly impacts Ardelyx's potential pricing strategies. A crucial development is the discontinuation of Medicare Part D coverage for oral-only therapies like Ardelyx's XPHOZAH, effective January 1, 2025. This change, impacting 2024 planning and beyond, could negatively affect Ardelyx's revenue streams for its key products.

While individual patients often have limited information regarding complex biopharmaceuticals, major institutional buyers, such as large hospital systems and pharmacy benefit managers, possess extensive market data. Successful marketing campaigns are crucial for Ardelyx to enhance brand awareness among both healthcare professionals and patients. For instance, Ardelyx's focused marketing efforts for IBSRELA significantly boosted brand awareness among gastroenterologists, doubling it by 2024. This increased awareness can somewhat mitigate the information advantage of sophisticated buyers by driving demand from the prescriber and patient side.

Low to Moderate Switching Costs for Buyers

For Ardelyx, buyers may face low to moderate costs when switching between treatments for certain conditions, which can increase their power. However, in therapeutic areas with established and effective drugs like chronic kidney disease, patient loyalty can be high, making it challenging for new products to gain traction. Ardelyx’s primary product, IBSRELA (tenapanor), addresses an unmet need for irritable bowel syndrome with constipation (IBS-C) in adults, which helps foster patient and physician loyalty due to its novel mechanism of action. This differentiation can mitigate the impact of low switching costs by creating a strong preference.

- IBSRELA generated $22.7 million in net product sales for Ardelyx in Q1 2024, demonstrating growing market acceptance.

- Despite potential alternatives, patient adherence to effective therapies for chronic conditions can be high, limiting switching.

- Ardelyx’s pipeline candidates for hyperkalemia also target areas with significant unmet needs, potentially reducing buyer power.

- The unique mechanism of action for Ardelyx's drugs aims to build strong patient and physician relationships, enhancing retention.

Product Differentiation

Ardelyx’s development of patented drugs with unique medical advantages, such as IBSRELA (tenapanor), significantly reduces the bargaining power of customers. By focusing on innovative, first-in-class medicines that address significant unmet medical needs, Ardelyx creates products without direct substitutes. This differentiation strategy is crucial for the company to compete effectively in 2024, especially against larger pharmaceutical players. This approach ensures that customers have fewer alternatives, thus limiting their leverage.

- IBSRELA generated $116.7 million in net product sales in 2023, demonstrating its market acceptance and differentiation.

- The drug's unique mechanism of action for irritable bowel syndrome with constipation (IBS-C) provides a distinct offering.

- Ardelyx's pipeline continues to emphasize novel compounds to maintain this competitive edge.

- Such product distinction minimizes price sensitivity among patients and healthcare providers.

Customers, largely concentrated entities like PBMs, possess significant bargaining power over Ardelyx due to their purchasing volume and price sensitivity, notably impacting 2024 strategies with Medicare Part D changes for oral therapies effective January 2025. Despite this, Ardelyx's patented, first-in-class drugs like IBSRELA, which generated $22.7 million in Q1 2024 net product sales, reduce customer leverage. These unique offerings address unmet needs, fostering loyalty and limiting direct substitutes.

| Customer Segment | Bargaining Power Factor | 2024 Impact |

|---|---|---|

| PBMs/Insurers | Concentrated Purchasing | High; demand rebates, formulary influence |

| Government (Medicare) | Price Sensitivity/Regulation | High; Part D changes for oral therapies (Jan 2025) |

| Patients/Physicians | Product Differentiation | Lower; IBSRELA's Q1 2024 sales ($22.7M) show loyalty |

Full Version Awaits

Ardelyx Porter's Five Forces Analysis

This preview showcases the comprehensive Ardelyx Porter's Five Forces Analysis, detailing the competitive landscape for the company. You're looking at the actual document; once you complete your purchase, you’ll get instant access to this exact file. The analysis delves into the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within Ardelyx's industry. This professionally written analysis is fully formatted and ready to use, providing actionable insights into Ardelyx's strategic positioning.

Rivalry Among Competitors

The market for treatments addressing irritable bowel syndrome with constipation (IBS-C) and hyperphosphatemia is highly competitive, featuring several well-established pharmaceutical companies. Key players in the IBS-C treatment landscape for 2024 include Ironwood Pharmaceuticals with Linzess, and AbbVie, which acquired Allergan's IBS portfolio. Takeda also maintains a strong presence in this therapeutic area. For hyperphosphatemia, major competitors like Sanofi, Amgen, and Pfizer offer various phosphate binders, creating significant market rivalry for Ardelyx. This competitive intensity means companies must continually innovate and differentiate their offerings to capture market share.

Aggressive marketing and brand recognition are crucial in pharmaceuticals. Ardelyx has significantly boosted IBSRELA awareness through multichannel campaigns, driving a notable increase in new prescriptions. For instance, IBSRELA's net product sales reached $56.8 million in Q1 2024, up from $20.4 million in Q1 2023, showcasing effective market penetration. This rapid growth highlights the intense competitive struggle for healthcare professional and patient attention in the irritable bowel syndrome with constipation (IBS-C) market.

Price competition significantly shapes Ardelyx's market position, driven by the availability of generic drugs and strong payor pressure to control healthcare costs. The global generic drugs market is projected to continue its substantial growth, estimated to reach over $500 billion by 2024, intensifying price-based rivalry. Ardelyx's XPHOZAH, approved in 2023, faces direct competition from established phosphate binders like Renvela, Auryxia, and Velphoro, which have longer market histories and potentially entrenched pricing strategies. This environment necessitates Ardelyx to carefully navigate its pricing to gain market share while demonstrating XPHOZAH's unique value proposition.

Innovation and Product Differentiation

Competitive rivalry in the pharmaceutical sector often hinges on innovation and product differentiation. Companies like Ardelyx must develop novel medicines offering significant advantages over existing treatments. Ardelyx’s strategy centers on creating first-in-class therapies, such as Xphozah for hyperphosphatemia, which addresses unmet patient needs with a unique mechanism of action. The success of this innovative approach is crucial for Ardelyx to compete against larger, more established pharmaceutical companies. Xphozah’s Q1 2024 net product sales of $30.8 million highlight its initial market impact.

- Ardelyx focuses on first-in-class medicines like Xphozah (tenapanor).

- Xphozah targets hyperphosphatemia in dialysis, a market with existing treatments.

- Q1 2024 Xphozah net product sales reached $30.8 million, indicating early market adoption.

- Innovation is key to gaining market share against larger industry players.

Global Market Presence of Competitors

Many of Ardelyx's competitors are large multinational pharmaceutical corporations that boast significant global presence and extensive resources. These firms, like AstraZeneca or Amgen, command substantial market share, often exceeding billions in annual revenue, as seen in their 2024 financial projections. Ardelyx is strategically expanding its global footprint to compete, notably through key partnerships. Its agreement with Kyowa Kirin covers tenapanor commercialization in Japan, while Fosun Pharma handles China. This global expansion is crucial for Ardelyx to challenge established market leaders.

- Major competitors hold vast global market shares, backed by substantial financial reserves.

- Ardelyx's 2024 strategic focus includes leveraging international partnerships to expand tenapanor's reach.

- Collaborations with Kyowa Kirin in Japan and Fosun Pharma in China are pivotal for global market entry.

Competitive rivalry for Ardelyx is intense, driven by established players like Ironwood and AbbVie in IBS-C, and Sanofi and Amgen in hyperphosphatemia. Ardelyx leverages innovation with Xphozah, which generated $30.8 million in Q1 2024 net sales, to differentiate against larger competitors. Strategic global partnerships are also crucial for market penetration.

| Product | Q1 2024 Sales | Q1 2023 Sales |

|---|---|---|

| IBSRELA | $56.8M | $20.4M |

| XPHOZAH | $30.8M | N/A |

| Total Net Product Sales | $87.6M | $20.4M |

SSubstitutes Threaten

The availability of alternative treatments presents a high threat of substitution for Ardelyx. For patients managing hyperphosphatemia, XPHOZAH faces competition from established phosphate binders such as Renagel, Fosrenol, Velphoro, and Auryxia, which collectively hold significant market presence. In the Irritable Bowel Syndrome with Constipation (IBS-C) market, IBSRELA competes directly with widely prescribed options like Linzess and Amitiza. Linzess, for instance, reported global net sales of $1.2 billion in 2023, underscoring the strong presence of these alternatives in 2024.

The expiration of patents for established drugs significantly increases the threat of substitution by introducing lower-priced generic versions. While Ardelyx's key product, tenapanor, benefits from patent protection extending until the mid-2030s, the broader market for hyperphosphatemia treatments, for example, includes various generic alternatives for competing drugs. This availability, even if not directly competitive with tenapanor's unique mechanism, creates an overarching pricing pressure on all branded pharmaceutical products. This dynamic means that even with patent protection, the general market trend toward affordability from generics influences pricing strategies across the industry in 2024.

Patients experiencing IBS-C symptoms frequently consider over-the-counter laxatives and herbal remedies as direct substitutes for prescription medications like those offered by Ardelyx. This preference for non-prescription options is driving growth in the alternative therapies market. For instance, the global digestive health supplements market, which includes many herbal remedies, was valued at approximately $58 billion in 2024. Ardelyx must effectively demonstrate the superior efficacy and safety profile of their prescribed treatments to counteract this competitive pressure.

Dietary and Lifestyle Interventions

Dietary modifications and lifestyle changes pose a threat as substitutes for Ardelyx's pharmaceutical treatments for kidney disease and gastrointestinal disorders. For chronic kidney disease, for instance, a low-phosphate diet can help manage hyperphosphatemia, a condition Ardelyx's tenapanor addresses. Similarly, for irritable bowel syndrome with constipation (IBS-C), a condition also targeted by tenapanor, lifestyle adjustments like increased fiber intake or specific dietary patterns are often recommended. These non-pharmacological approaches, while not always fully effective, can reduce the perceived need for prescription medications, impacting patient and physician choices in 2024.

- Dietary phosphorus restriction remains a primary recommendation for managing hyperphosphatemia in CKD patients.

- Low-FODMAP diets are frequently advised for IBS patients, potentially reducing symptoms without medication.

- Patient adherence to lifestyle changes can directly influence the demand for drug therapies.

- Healthcare systems increasingly emphasize non-pharmacological interventions due to cost-effectiveness and patient preference.

Emerging Therapies and Technologies

The biopharmaceutical industry is continuously innovating, presenting a significant threat of substitution through novel therapeutic approaches. Emerging fields like gene therapies, biosimilars, and personalized medicine are rapidly developing, potentially offering future alternatives to Ardelyx's current product portfolio. For instance, the global biosimilars market is projected to exceed $40 billion in 2024, showcasing the increasing availability of alternative treatments. This innovation pipeline suggests a dynamic competitive landscape where new solutions could displace existing therapies.

- Global gene therapy market projected to continue rapid growth through 2024.

- Biosimilars market expected to reach over $40 billion in 2024, increasing competition.

- Personalized medicine advancements offer targeted, potentially superior, future treatments.

- New oral small molecule inhibitors are also in development for Ardelyx's target indications.

Ardelyx faces a high threat from substitutes, including established branded medications like Linzess, which generated $1.2 billion in global net sales in 2023 for IBS-C, and numerous generic alternatives for hyperphosphatemia. Non-pharmacological options, such as dietary changes and the global digestive health supplements market valued at $58 billion in 2024, also present strong alternatives. Furthermore, the rapid growth of biosimilars, projected to exceed $40 billion in 2024, and other novel therapies represent a significant long-term substitution risk.

| Substitute Type | Examples | 2024 Impact |

|---|---|---|

| Established Pharmaceuticals | Linzess, Renagel, Generic Phosphate Binders | Linzess: $1.2B global sales (2023) |

| Non-Prescription/Lifestyle | OTC Laxatives, Low-FODMAP Diet | Digestive Health Supplements: ~$58B (2024) |

| Emerging Therapies | Biosimilars, Gene Therapies | Biosimilars market: >$40B (2024) |

Entrants Threaten

The biopharmaceutical sector, where Ardelyx operates, presents a significant barrier to new entrants due to incredibly high research and development costs. Bringing a single new drug to market can easily exceed $2.5 billion, a figure encompassing years of pre-clinical and clinical trials through regulatory approval. Ardelyx's business model relies heavily on this sustained, multi-year R&D investment for pipeline expansion. This substantial capital requirement, projected to continue rising in 2024, effectively deters most potential new competitors from entering the specialized market.

The pharmaceutical industry's stringent regulatory landscape significantly deters new entrants. Developing new drugs demands extensive clinical trials, often spanning years and costing hundreds of millions of dollars, before seeking approval from bodies like the FDA. This complex and lengthy regulatory pathway acts as a formidable barrier, requiring substantial capital and expertise. Ardelyx itself navigated such hurdles, notably receiving a Complete Response Letter from the FDA for tenapanor in 2020 before its eventual approval for Xphozah in 2023.

Ardelyx, like other established pharmaceutical companies, protects its innovations with a robust portfolio of patents. Its key drug, tenapanor, benefits from multiple patents, with some intellectual property protections extending well into the 2030s. This strong patent landscape makes it very difficult for new pharmaceutical entrants to launch competing products. Any attempt by new players to enter the market would face significant legal hurdles and the risk of patent infringement, creating a formidable barrier to entry.

Economies of Scale and Distribution Channels

Large, established pharmaceutical companies benefit significantly from economies of scale in manufacturing, producing treatments like those for chronic kidney disease in high volumes. New entrants face substantial barriers, finding it difficult to match the production efficiency and extensive market access of these incumbents, who often leverage long-standing relationships with healthcare providers and payers. Ardelyx, however, has proactively built its own dedicated distribution channels and strategic partnerships to commercialize its products, such as XPHOZAH, approved in 2023 for elevated serum phosphate in adult CKD patients on dialysis. This strategic move helps mitigate the distribution advantage held by larger competitors, allowing Ardelyx to directly reach its target market.

- Established pharmaceutical firms leverage vast manufacturing scale.

- New entrants struggle to match incumbent production efficiency.

- Accessing established distribution networks is a significant barrier.

- Ardelyx has developed its own channels for products like XPHOZAH, launched in 2024.

Brand Loyalty and Physician Relationships

In the pharmaceutical sector, established brand loyalty and strong physician relationships pose a significant barrier to new entrants. When drugs demonstrate a proven track record of efficacy and safety, patient and physician trust solidifies, making it challenging for new competitors to gain market share. Building this recognition requires substantial marketing investment and time, often years, to overcome existing preferences. Ardelyx is actively working to cultivate these relationships through targeted marketing and educational campaigns, enhancing the barrier for potential competitors.

- Ardelyx reported net product sales of Ibsrela at $39.5 million in Q1 2024, demonstrating growing market penetration.

- The company's investment in commercial infrastructure aims to deepen physician engagement and patient awareness.

- Physician prescribing habits are often resistant to change without compelling new data or significant clinical advantages.

- Building trust in the pharmaceutical market can take 5-7 years for new brands to achieve significant adoption.

Switching costs pose a notable barrier to new entrants in the biopharmaceutical market. For patients managing chronic conditions, like those treated by Ardelyx's XPHOZAH, launched in 2024, the established efficacy and familiarity with current medications make transitions difficult. Physicians also face high switching costs due to ingrained prescribing habits and the time investment required to adopt and trust new, unproven therapies. This inherent inertia protects incumbent market share, making it challenging for new players to displace existing treatments.

| Factor | Impact on New Entrants | Ardelyx Context (2024) |

|---|---|---|

| Patient Inertia | High due to established trust and treatment regimens. | XPHOZAH's growing adoption post-2024 launch reinforces patient comfort. |

| Physician Habits | Resistant to change, requiring significant clinical advantage. | Ardelyx's ongoing engagement builds physician confidence in its portfolio. |

| Regulatory Burden | Costly and time-consuming to introduce new drugs. | Ardelyx successfully navigated FDA for XPHOZAH approval in 2023. |

Porter's Five Forces Analysis Data Sources

Our Ardelyx Porter's Five Forces analysis is built upon a foundation of robust data, including Ardelyx's SEC filings, investor presentations, and industry-specific market research reports. We also leverage information from pharmaceutical trade publications and competitor financial disclosures to provide a comprehensive view of the competitive landscape.