ArcelorMittal PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ArcelorMittal Bundle

Navigate the complex global landscape impacting ArcelorMittal with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and technological advancements are reshaping the steel industry. Gain a strategic advantage by uncovering the social, environmental, and legal forces at play. Download the full analysis now to arm yourself with actionable intelligence and secure your competitive edge.

Political factors

Trade policies, particularly tariffs, present a significant hurdle for ArcelorMittal. The US Section 232 tariffs are projected to negatively impact the company's core profit by $150 million in 2025, a revision upwards from previous estimates.

These protectionist measures have dampened economic activity and fostered a cautious stance among customers across the US, Canada, and Mexico. This 'wait-and-see' attitude directly affects demand and investment decisions in these key markets.

In response, ArcelorMittal is strategically bolstering its manufacturing footprint within the United States. Simultaneously, the company is actively pursuing cost-sharing arrangements with its clientele to offset the financial burden imposed by tariffs and to safeguard its market share.

ArcelorMittal's ambitious green steel initiatives in Europe face headwinds due to an unsupportive policy and market landscape. The company has postponed crucial investment decisions on major decarbonization projects, even after securing significant subsidies. This delay stems from concerns over the slow development of green hydrogen's viability and perceived shortcomings in carbon border adjustment mechanisms (CBAM).

The company's investment strategy hinges on policy certainty, particularly regarding the upcoming review of CBAM and existing steel safeguards. Without a clearer and more favorable regulatory framework, ArcelorMittal's ability to commit to large-scale, capital-intensive decarbonization efforts remains uncertain, impacting the pace of its transition to greener steel production.

Ongoing geopolitical tensions, such as those in Eastern Europe and the Middle East, continue to pose significant risks to ArcelorMittal's global supply chains and market access. These disruptions can lead to unpredictable shifts in demand and pricing, impacting regional shipment volumes and overall financial performance. For instance, the company noted mixed segment performance in Q1 2025, partly attributable to these volatile regional dynamics.

ArcelorMittal's strategic focus on operational discipline and maintaining robust liquidity positions is crucial for weathering these geopolitical storms. By prioritizing efficient production and strong cash reserves, the company aims to mitigate the financial impact of regional instability and ensure continued operational resilience throughout 2024 and into 2025.

Regulatory Stability in Operating Countries

ArcelorMittal's extensive global footprint, spanning operations in approximately 60 countries as of early 2024, makes it inherently susceptible to the varying degrees of regulatory stability and the robustness of legal frameworks in each jurisdiction. Predictable and consistent regulations, particularly concerning environmental compliance and international trade policies, are vital for the company's ability to undertake long-term capital investments and ensure efficient operations.

The company's continuous engagement with diverse regulatory environments necessitates ongoing adaptation to maintain its license to operate and foster sustainable business practices. For instance, evolving carbon pricing mechanisms or stricter emissions standards in key markets like the European Union, where ArcelorMittal has significant operations, directly impact operational costs and strategic investment decisions. In 2023, the company reported significant investments in decarbonization initiatives, underscoring the direct link between regulatory pressures and capital allocation.

- Global Reach: ArcelorMittal operates in 60 countries, exposing it to a wide array of regulatory systems.

- Environmental Regulations: Stricter environmental standards, particularly regarding emissions, are a key factor influencing operational costs and investment.

- Trade Policies: Fluctuations in tariffs and trade agreements between nations can significantly affect ArcelorMittal's supply chains and market access.

- Legal Frameworks: The stability and predictability of legal systems are crucial for contract enforcement and long-term business planning.

Influence of Carbon Border Adjustment Mechanisms (CBAM)

The European Union's Carbon Border Adjustment Mechanism (CBAM), which began its transitional phase in October 2023, significantly impacts ArcelorMittal's European operations. Its effectiveness in leveling the playing field against imports from countries with less stringent carbon pricing is a key concern for the company's competitiveness in the European market. ArcelorMittal, a major steel producer, faces challenges if CBAM implementation proves weak or if trade protection measures are inadequate, potentially leading to an uneven competitive landscape.

ArcelorMittal is actively lobbying for policy adjustments to ensure fair competition as it invests heavily in decarbonization. One such proposed intervention is a cap on flat product imports, aiming to prevent market distortion. For instance, in 2023, the EU imported approximately 37 million tonnes of steel products, highlighting the scale of potential competition that needs careful management under CBAM.

- CBAM's transitional phase commenced in October 2023, impacting steel imports into the EU.

- ArcelorMittal seeks policy interventions, such as import caps, to counter uneven competition due to varying environmental regulations globally.

- The company views robust CBAM implementation as crucial for its European market competitiveness amidst its green transition investments.

Political factors significantly shape ArcelorMittal's operational landscape, with trade policies like US Section 232 tariffs projected to reduce core profit by $150 million in 2025. Protectionist measures have led to customer caution in North America, prompting ArcelorMittal to increase its US manufacturing footprint and explore cost-sharing with clients.

The company's green steel initiatives in Europe are hampered by an unfavorable policy environment, leading to postponed decarbonization investments due to concerns over green hydrogen viability and CBAM's effectiveness. Policy certainty, particularly regarding CBAM and steel safeguards, is critical for ArcelorMittal's capital-intensive transition to greener production.

Geopolitical tensions in Eastern Europe and the Middle East create supply chain risks and market access challenges, impacting demand and pricing. ArcelorMittal's focus on operational discipline and liquidity is a strategy to navigate these volatile regional dynamics and ensure resilience.

ArcelorMittal's extensive global operations in 60 countries expose it to diverse regulatory environments. Stable legal frameworks and consistent regulations, especially for environmental compliance and trade, are vital for long-term investments and efficient operations. Evolving carbon pricing and emissions standards, like those in the EU, directly influence operational costs and strategic capital allocation, as evidenced by significant 2023 decarbonization investments.

| Factor | Impact on ArcelorMittal | Data Point/Year |

|---|---|---|

| US Section 232 Tariffs | Projected $150 million negative impact on core profit | 2025 |

| Green Steel Investment Delays (Europe) | Postponement of decarbonization projects | Post-subsidy, due to policy/market concerns |

| Geopolitical Tensions | Supply chain risks, market access challenges, demand/pricing shifts | Ongoing, noted in Q1 2025 segment performance |

| Global Operations Exposure | Susceptibility to varying regulatory stability and legal frameworks | Operates in ~60 countries (early 2024) |

What is included in the product

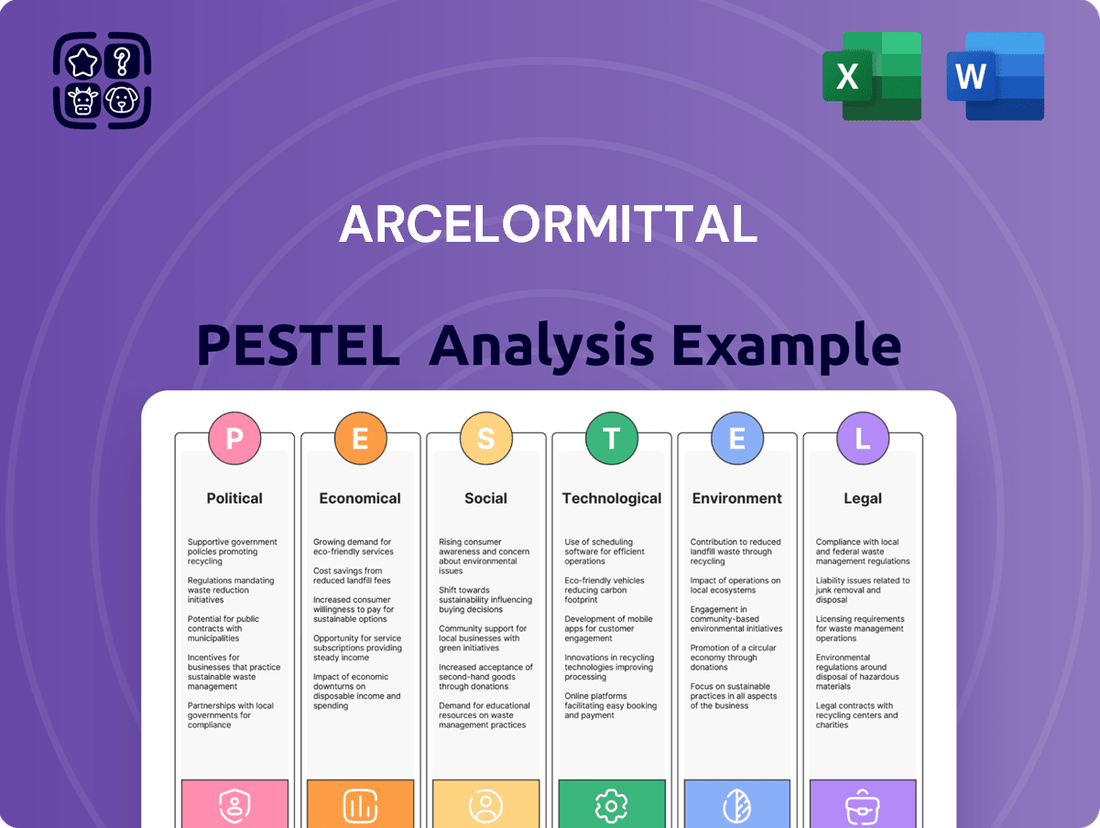

This PESTLE analysis examines the political, economic, social, technological, environmental, and legal forces impacting ArcelorMittal's global operations and strategic decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, offering a clear overview of ArcelorMittal's external environment to streamline strategic discussions and decision-making.

Helps support discussions on external risk and market positioning during planning sessions by presenting a structured PESTLE analysis, enabling a more informed and proactive approach to navigating challenges and opportunities.

Economic factors

ArcelorMittal has adjusted its 2025 global steel demand forecast outside China to a more modest 1.5%-2.5% growth, a reduction from earlier expectations. This recalibration reflects a cooling of demand, particularly in the United States, where persistent tariff impacts and customer hesitancy to build inventory have dampened consumption.

While the European market shows some resilience, the broader global picture indicates subdued demand conditions. The cautious sentiment among customers, especially in the US, is a significant factor limiting restocking activities and, consequently, overall steel consumption growth.

The fluctuating costs of essential inputs like iron ore and coking coal directly affect ArcelorMittal's manufacturing expenses. In 2025, these input costs saw an 18% jump compared to the previous year.

Disruptions to global shipping, exemplified by the Red Sea incidents, caused raw material transport expenses to climb by 45% in 2024, significantly inflating operational overheads.

Furthermore, the growing consolidation within the iron ore mining sector weakens ArcelorMittal's bargaining power when securing these vital resources.

High energy prices, especially in Europe, are a major hurdle for ArcelorMittal's decarbonization plans and increase its operational expenses. For example, in early 2024, European natural gas prices remained significantly higher than in other regions, impacting the cost-competitiveness of steel production.

The slow development of green hydrogen as a practical fuel and the current unsuitability of natural gas-based direct reduced iron (DRI) production in Europe as a transitional step highlight the need for supportive government policies. These policies are crucial to help offset the elevated energy and operating costs that are currently hindering progress.

Consequently, these economic pressures have resulted in postponed investments in green steel projects in several European locations, demonstrating the direct impact of energy costs on strategic capital allocation and the pace of environmental initiatives.

Interest Rates and Industry Demand

Interest rate shifts significantly impact demand in ArcelorMittal's core markets like automotive and construction. Lower borrowing costs generally stimulate investment and consumer spending, boosting demand for steel. Conversely, rising rates can dampen these sectors, leading to reduced steel consumption.

While European steel demand showed resilience in parts of 2024, supported by a generally lower interest rate environment compared to some other major economies, overall economic activity in certain regions remained constrained. This mixed demand picture presents a challenge for steel producers.

ArcelorMittal has navigated these macroeconomic conditions effectively, showcasing financial strength. For instance, the company reported a strong liquidity position and continued to advance strategic projects throughout 2024, demonstrating its ability to manage through economic volatility.

- Interest Rate Impact: Higher interest rates in 2024-2025 are expected to slow construction and automotive sectors, key steel consumers.

- European Demand: Europe experienced relatively stable steel demand in 2024, aided by supportive interest rate policies.

- ArcelorMittal's Resilience: The company maintained robust liquidity and executed strategic initiatives despite macroeconomic headwinds in 2024.

Foreign Exchange Fluctuations and Profitability

Foreign exchange fluctuations are a significant factor for ArcelorMittal, impacting its profitability. For instance, in the first quarter of 2025, the company reported positive net income, a notable turnaround from the prior quarter, largely driven by foreign exchange gains stemming from the US dollar's depreciation against many global currencies. This highlights how currency movements can directly influence financial performance, especially for a company with extensive international operations.

ArcelorMittal's global presence means it's exposed to a variety of market dynamics and regional economic shifts. These currency movements can therefore have a substantial effect on its reported sales and operating income across different geographies.

- Q1 2025 Net Income Boost: ArcelorMittal's Q1 2025 results showed a positive net income, partly attributed to foreign exchange gains.

- US Dollar Depreciation Impact: The weakening of the US dollar against other currencies in early 2025 was a key driver of these gains.

- Global Operational Exposure: The company's worldwide operations mean currency volatility can significantly influence its financial reporting.

- Regional Sales and Income Variability: Fluctuations in exchange rates directly affect how sales and operating income translate from various regional markets.

Economic factors present a mixed outlook for ArcelorMittal. While global steel demand outside China saw a revised forecast of 1.5%-2.5% growth for 2025, indicating a slowdown, particularly in the US due to tariffs and inventory caution, European demand showed some resilience in 2024. However, input costs, including iron ore and coking coal, surged by 18% in 2025, and shipping disruptions in 2024 inflated raw material transport expenses by 45%. High European energy prices also continue to impact operational costs and delay green steel projects.

Interest rate shifts are critical, with higher rates in 2024-2025 expected to curb demand in construction and automotive sectors. Despite these headwinds, ArcelorMittal maintained strong liquidity and advanced strategic projects in 2024. Foreign exchange fluctuations also play a significant role; the depreciation of the US dollar in early 2025 contributed to positive net income in Q1 2025, underscoring the impact of currency movements on global operations.

| Economic Factor | 2024/2025 Impact | ArcelorMittal's Situation |

|---|---|---|

| Global Steel Demand (ex-China) | Revised forecast: 1.5%-2.5% growth (slowdown) | US demand dampened by tariffs and inventory caution. |

| Input Costs (Iron Ore/Coking Coal) | 18% jump in 2025 | Increases manufacturing expenses. |

| Shipping Costs | 45% climb in 2024 (Red Sea incidents) | Inflated raw material transport expenses. |

| Energy Prices (Europe) | Significantly higher than other regions (early 2024) | Hinders decarbonization, increases operational costs. |

| Interest Rates | Higher rates expected (2024-2025) | Likely to slow construction and automotive demand. |

| Foreign Exchange (US Dollar) | Depreciation in early 2025 | Contributed to positive net income via gains in Q1 2025. |

Full Version Awaits

ArcelorMittal PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive ArcelorMittal PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the global steel and mining giant. Gain actionable insights into market dynamics, regulatory landscapes, and future trends shaping ArcelorMittal's operations and strategic decisions.

Sociological factors

ArcelorMittal is deeply invested in enhancing workplace safety and health, a critical sociological factor influencing its operations. Following a comprehensive dss+ safety audit in 2024, the company committed to implementing over 1,200 recommendations. This extensive effort is designed to foster a unified safety culture across its global sites, with a particular emphasis on managing occupational risks and elevating contractor safety protocols.

The tangible results of these initiatives are already evident. In the first quarter of 2024, ArcelorMittal reported a significant reduction in its Lost-Time Injury Frequency (LTIF) rate, which fell to 0.61x. This downward trend signifies substantial progress in creating a safer working environment for all employees and contractors.

ArcelorMittal places significant emphasis on community engagement to maintain its social license to operate, recognizing that strong local relationships are vital for sustained operations. The company actively works to build trust and foster positive interactions in the regions where it has a presence.

The 2024 Sustainability Report details ArcelorMittal's commitment to strengthening community ties and upholding its human rights policy. This includes initiatives aimed at ensuring local populations benefit from the company's activities and that their rights are respected throughout the value chain.

Achieving and maintaining ResponsibleSteel™ certification, which incorporates stringent social and governance criteria, further demonstrates ArcelorMittal's dedication to responsible community relations. This certification requires adherence to principles that promote fair labor practices, stakeholder engagement, and respect for human rights, reinforcing the company's commitment to social responsibility.

ArcelorMittal prioritizes attracting and keeping a skilled workforce, viewing talent optimization as crucial for performance. This involves cultivating a strong safety culture and upholding employee rights through updated grievance mechanisms, aiming to create a more appealing and secure workplace.

In 2023, ArcelorMittal reported a strong focus on its people, with initiatives aimed at enhancing employee well-being and development. The company's ongoing investment in health and safety systems, a cornerstone of its talent strategy, directly impacts its ability to retain experienced personnel in a competitive global labor market.

Human Rights Policies and Due Diligence

ArcelorMittal's commitment to human rights is a significant sociological factor, demonstrated by its proactive development of a Human Rights Due Diligence guide and an updated Whistleblowing and Grievance Procedure in 2024. These measures aim to foster greater transparency and accountability in addressing employee rights and stakeholder concerns throughout its global operations.

These initiatives are designed to create robust mechanisms for identifying, preventing, and mitigating potential human rights risks. By aligning with ResponsibleSteel™ principles, ArcelorMittal signals its dedication to ethical conduct and sustainable business practices.

- Human Rights Due Diligence Guide: Launched in 2024 to systematically assess and address human rights impacts.

- Updated Whistleblowing and Grievance Procedure: Enhanced in 2024 to provide clearer channels for reporting and resolving concerns.

- ResponsibleSteel™ Alignment: Demonstrates commitment to industry-leading ethical and social standards.

- Stakeholder Engagement: Focuses on building trust and ensuring the well-being of communities where it operates.

Consumer and Investor Pressure for Sustainable Products

Consumers and investors are increasingly demanding sustainable products, pushing companies like ArcelorMittal to prioritize decarbonization and low-carbon steel production. This trend is a significant sociological factor influencing ArcelorMittal's strategic direction.

While the market for premium-priced green steel is still developing, ArcelorMittal is actively expanding its XCarb® product line. This initiative directly addresses the growing demand for environmentally responsible steel options.

The company is also seeing increased sales of recycled and renewably produced low-carbon emissions steel, indicating a tangible shift in consumer and investor preferences. For instance, in 2023, ArcelorMittal's XCarb® offerings contributed to a reduction of 1.1 million tonnes of CO2e.

- Growing Consumer Demand: Societal expectations are shifting towards environmentally conscious purchasing.

- Investor Scrutiny: Investors are increasingly incorporating ESG (Environmental, Social, and Governance) factors into their decision-making, favoring companies with strong sustainability credentials.

- ArcelorMittal's Response: Expansion of the XCarb® portfolio and increased sales of low-carbon steel products.

- Market Penetration: While customer willingness to pay a premium for green steel is still evolving, the volume of these products is growing.

Societal expectations are increasingly driving demand for sustainable and ethically produced goods, influencing ArcelorMittal's strategic focus on decarbonization and low-carbon steel. This shift is evident in the growing sales of its XCarb® products, which contributed to a 1.1 million tonne CO2e reduction in 2023, reflecting a tangible market preference for environmentally responsible options.

ArcelorMittal's commitment to its workforce is paramount, with a strong emphasis on safety and talent retention. The company's safety initiatives, including over 1,200 recommendations from a 2024 audit, have led to a reduced Lost-Time Injury Frequency rate of 0.61x in Q1 2024.

Furthermore, ArcelorMittal actively engages with communities to maintain its social license to operate, reinforcing its human rights policy and fostering positive local relationships. This dedication is underscored by its adherence to ResponsibleSteel™ principles, which mandate fair labor practices and stakeholder engagement.

The company's proactive development of a Human Rights Due Diligence guide and an updated Whistleblowing and Grievance Procedure in 2024 demonstrates a commitment to transparency and accountability in addressing employee and stakeholder concerns across its global operations.

Technological factors

ArcelorMittal is actively pursuing decarbonization through significant investments in technologies like Direct Reduced Iron-Electric Arc Furnace (DRI-EAF) and Carbon Capture, Utilization, and Storage (CCUS). The company has committed $1 billion to these initiatives since 2018, aiming for net-zero emissions by 2050. This includes developing 'hydrogen ready' DRI-EAF facilities to replace traditional blast furnaces.

Electric Arc Furnaces (EAFs) now represent 25% of ArcelorMittal's global steel output, a notable increase from 19% in 2018, highlighting a strategic shift towards lower-emission production methods.

ArcelorMittal is significantly enhancing its operations through digitalization and artificial intelligence. The company's AI-driven 'Approach to Investment Assessment' received an award in 2025, showcasing its commitment to data-led innovation. This advanced system utilizes AI and machine learning to model capital investment scenarios, predict product demand, streamline operations, and reduce decision-making risks.

Further demonstrating the impact of AI, ArcelorMittal's SteelChain supply chain tool has achieved a notable 12% reduction in inventory costs. These technological advancements are crucial for optimizing efficiency and improving financial performance in a competitive global market.

ArcelorMittal is heavily invested in R&D to pioneer advanced steel products. Their focus is on creating sustainable, high-value materials that cater to evolving industry needs.

A prime example is their Multi Part Integration® (MPI) technology for the automotive sector, designed to decrease steel consumption and vehicle weight, contributing to fuel efficiency. In 2024, the automotive industry's demand for lighter, stronger materials continues to drive innovation in steel production.

Furthermore, ArcelorMittal is expanding its electrical steel output, crucial for the efficiency of traction motors in electric vehicles and other energy-intensive applications. The global electric vehicle market is projected to reach over $1.5 trillion by 2030, highlighting the growing importance of these specialized steel products.

The company is also developing critical solutions for the burgeoning hydrogen economy, such as Hymatch®, a specialized steel designed for the safe transportation of hydrogen, a key element in the global transition to cleaner energy sources.

Innovation in Mining Processes

Technological advancements are significantly reshaping ArcelorMittal's mining operations. The company's research and development is focused on innovating mining practices to minimize waste and enhance worker safety.

A key area of exploration involves producing hydrogen from blast-furnace waste gases. This is being pursued through electricity-free electrolysis, with a pilot project underway in Brazil. This initiative underscores ArcelorMittal's dedication to fostering more circular and sustainable mining approaches.

- Hydrogen Production: Pilot project in Brazil using electricity-free electrolysis to convert blast-furnace waste gases into hydrogen.

- Waste Reduction: R&D efforts aimed at developing new mining techniques that generate less waste.

- Safety Enhancements: Technological innovations designed to improve safety protocols and conditions in mining environments.

- Circular Economy: Focus on integrating waste streams into productive processes, such as hydrogen generation.

Circular Economy Technologies for By-products

ArcelorMittal is actively developing technologies to foster a circular economy, focusing on processing by-products like dust, sludges, scale, and slags in cost-effective and environmentally sound ways. This approach not only reduces waste but also unlocks potential value from materials previously considered discardable. The company's commitment to resource efficiency is evident in its 2024 efforts to characterize by-products from new steel production routes under various operational scenarios, aiming to predict their quality and volume. This proactive stance is crucial for optimizing resource utilization and minimizing environmental impact.

These technological advancements are key to ArcelorMittal's sustainability strategy, enabling the transformation of waste streams into valuable inputs.

- By-product Processing: Development of eco-friendly technologies for dust, sludges, scale, and slags.

- Resource Efficiency: Characterization of new steel route by-products in 2024 to forecast quality and quantity.

- Circular Economy Focus: Transforming waste into valuable resources, reducing landfill dependency.

- Cost-Effectiveness: Aiming for economically viable solutions in by-product management.

ArcelorMittal's technological strategy centers on decarbonization and operational efficiency. Investments in DRI-EAF and CCUS technologies, totaling $1 billion since 2018, underscore a commitment to net-zero emissions by 2050, with EAFs now accounting for 25% of global steel output. Digitalization and AI are enhancing operations, evidenced by an award-winning AI system for investment assessment in 2025 and a 12% reduction in inventory costs via the SteelChain tool.

Innovation in advanced steel products, like MPI technology for lighter automotive components, addresses market demands for fuel efficiency. The company is also expanding electrical steel production for electric vehicles, a market projected to exceed $1.5 trillion by 2030, and developing specialized steels like Hymatch® for hydrogen transport.

Technological advancements are also transforming mining, with a pilot project in Brazil using electricity-free electrolysis to produce hydrogen from blast-furnace waste gases, promoting circular economy principles. ArcelorMittal is also developing cost-effective, environmentally sound methods for processing by-products like dust and slags, with 2024 efforts focused on characterizing new steel route by-products.

| Technology Area | Key Initiative/Metric | Impact/Target | Year/Status |

| Decarbonization | DRI-EAF and CCUS Investment | Aiming for net-zero emissions by 2050 | $1 billion invested since 2018 |

| Production Methods | Electric Arc Furnace (EAF) Output | 25% of global steel output | Increased from 19% in 2018 |

| Digitalization & AI | AI Investment Assessment System | Improved decision-making, risk reduction | Awarded in 2025 |

| Supply Chain | SteelChain Tool | 12% reduction in inventory costs | Implemented |

| Advanced Materials | Multi Part Integration® (MPI) | Reduced steel consumption and vehicle weight | Automotive sector focus |

| Emerging Markets | Electrical Steel for EVs | Catering to growing EV market | Market projected >$1.5 trillion by 2030 |

| Hydrogen Economy | Hymatch® Steel | Safe hydrogen transportation | Development stage |

| Mining Innovation | Hydrogen from Waste Gases | Pilot project in Brazil | Electricity-free electrolysis |

| Circular Economy | By-product Processing | Waste reduction and value creation | 2024 focus on by-product characterization |

Legal factors

ArcelorMittal navigates a complex web of global environmental regulations and emissions standards, directly shaping its operational methods and strategic investment choices. These rules necessitate significant adjustments in production, pushing for cleaner technologies and processes.

The company's commitment to decarbonization is evident in its ambitious target of reducing absolute emissions by nearly 50% compared to 2018 levels. This proactive approach aims not only for compliance but also to surpass current environmental benchmarks.

Despite these efforts, the absence of a clearly defined and supportive policy framework in Europe for green steel initiatives has created considerable delays in crucial investment decisions, impacting the pace of transition.

ArcelorMittal's operations are heavily influenced by trade defense measures, such as import tariffs and anti-dumping laws, designed to shield domestic steel sectors. The US Section 232 tariffs, for instance, have demonstrably raised operational expenses and disrupted North American supply-demand dynamics. For example, in 2023, steel import volumes into the US saw fluctuations influenced by these tariffs, impacting ArcelorMittal's regional sales strategies.

The company actively champions more robust trade protection in Europe to combat the influx of imports, largely attributed to global overcapacity, especially from China. This advocacy aims to foster a more equitable competitive landscape. In 2024, the European Union continued to review and implement safeguard measures on steel imports, with ArcelorMittal a vocal proponent of their extension and strengthening to address market distortions.

ArcelorMittal, as a dominant global player, faces intense scrutiny under competition law and antitrust regulations in all its operating regions. Navigating these complex rules is paramount for its acquisitions, market strategies, and day-to-day operations to uphold fair competition and avoid significant penalties.

The proposed acquisition of a stake in U.S. Steel by Nippon Steel, which ArcelorMittal had previously expressed interest in, highlights the critical role of antitrust reviews. Regulators worldwide, including those in the United States, are closely examining such large-scale consolidation to prevent monopolistic practices.

Labor Laws and Industrial Relations

ArcelorMittal navigates a complex web of labor laws and industrial relations across its global operations, impacting everything from hiring practices to collective bargaining. The company's commitment to fair employment is underscored by its Human Rights Policy and Employee Relations Policy, which guide its approach to worker well-being and engagement.

These policies emphasize strong grievance mechanisms and a paramount focus on workplace safety, directly influencing labor practices and employee health. For instance, in 2023, ArcelorMittal reported a Total Recordable Injury Frequency Rate (TRIFR) of 0.64, reflecting its ongoing efforts in safety management, which is a critical component of industrial relations.

- Global Compliance: Adherence to varying national labor laws in over 60 countries, including those in the EU, North America, and emerging markets.

- Employee Relations Framework: Implementation of formal policies addressing human rights, grievance procedures, and employee well-being.

- Safety as a Priority: Demonstrated commitment to reducing workplace incidents, with a TRIFR of 0.64 in 2023, impacting labor conditions and productivity.

- Collective Bargaining: Engagement with trade unions and works councils in various jurisdictions to manage industrial relations.

Compliance with International Sanctions and Human Rights Laws

ArcelorMittal places a strong emphasis on maintaining the highest standards of integrity, which includes rigorous adherence to economic sanctions and international human rights laws. The company has established internal protocols, such as its Economic Sanctions Procedure and Human Rights Policy, to ensure these commitments are met. Failure to comply with these regulations can result in substantial financial penalties and significant damage to the company's reputation.

For instance, in 2023, global regulatory fines for sanctions violations reached billions of dollars, underscoring the severe financial risks associated with non-compliance. ArcelorMittal’s proactive approach aims to mitigate these risks, recognizing the interconnectedness of legal compliance, ethical operations, and long-term business sustainability.

- Economic Sanctions Procedure: Outlines ArcelorMittal's framework for identifying and complying with global economic sanctions.

- Human Rights Policy: Details the company's commitment to respecting human rights across its operations and supply chains.

- Reputational Risk: Non-compliance can lead to negative publicity and loss of stakeholder trust.

- Financial Penalties: Significant fines can be imposed by regulatory bodies for violations.

ArcelorMittal operates under stringent global trade regulations, including tariffs and anti-dumping measures, which directly influence its market access and pricing strategies. The company actively advocates for protective trade policies in key markets like Europe to counter overcapacity, particularly from China. For instance, the European Union's continued review of steel import safeguard measures in 2024, supported by ArcelorMittal, aims to level the playing field.

Antitrust and competition laws are critical legal factors, requiring ArcelorMittal to navigate complex regulatory scrutiny for its mergers, acquisitions, and market practices. The proposed acquisition of U.S. Steel by Nippon Steel, a deal ArcelorMittal had previously considered, underscores the intense antitrust review process globally, highlighting the need to prevent monopolistic behavior.

Labor laws and industrial relations significantly shape ArcelorMittal's operational framework across its diverse global footprint. The company's commitment to employee well-being is reflected in its Human Rights Policy and a focus on workplace safety, evidenced by a Total Recordable Injury Frequency Rate (TRIFR) of 0.64 in 2023.

Compliance with economic sanctions and international human rights laws is paramount, with robust internal procedures in place. Non-compliance carries substantial financial penalties and reputational damage, as global regulatory fines for sanctions violations in 2023 reached billions of dollars.

Environmental factors

ArcelorMittal has made significant strides in reducing its environmental impact, achieving a nearly 50% reduction in absolute CO2 emissions from its 2018 operating perimeter by 2024. This accomplishment was supported by a substantial $1 billion investment in decarbonization projects. The company's carbon intensity has also improved, now averaging 1.75 tonnes of CO2 per tonne of crude steel, which positions it favorably against the global average.

Looking ahead, ArcelorMittal remains committed to achieving net-zero emissions by 2050. However, meeting its 2030 targets is presenting increasing challenges, largely influenced by evolving policy landscapes and market dynamics, particularly within Europe. These external factors require careful navigation to ensure continued progress towards sustainability goals.

ArcelorMittal is actively pursuing resource efficiency, aiming to boost its use of scrap steel in production. The electric arc furnace (EAF) route, a key component of this strategy, accounted for approximately 25% of global steel production in 2024. This focus on scrap utilization not only conserves virgin resources but also reduces the carbon footprint associated with steelmaking.

The company is also investing in innovative technologies to process its by-products more sustainably and cost-effectively. This includes exploring new methods for repurposing waste streams, turning them into valuable materials rather than landfilling them, aligning with broader circular economy principles.

ArcelorMittal is committed to enhancing its environmental stewardship through robust waste management and the innovative utilization of by-products. The company invests in technologies designed to transform industrial waste streams, such as dust, sludges, scale, and slags, into valuable secondary raw materials, thereby reducing landfill dependency and promoting a circular economy.

In 2023, ArcelorMittal reported a significant focus on by-product valorization, with initiatives aimed at increasing the reuse of materials like slag in construction and other industries. Their ongoing research into advanced gas cleaning technologies targets the reduction of harmful emissions, specifically Nitrogen Oxides (NOx) and Sulphur Oxides (SOx), which are critical for improving air quality around their production facilities and meeting stringent environmental regulations.

Water Management and Biodiversity Protection

ArcelorMittal recognizes water management and biodiversity protection as crucial sustainability issues. Their commitment is evident through initiatives like the ResponsibleSteel™ certification, which 42 of their sites had attained by 2024. This certification specifically includes environmental principles related to biodiversity, underscoring the company's dedication to minimizing its ecological footprint.

The company is actively working to deepen its understanding and improve its management of biodiversity across its operations. This includes assessing impacts and implementing measures to protect and enhance local ecosystems. ArcelorMittal's approach aims to ensure that its industrial activities are conducted with a mindful consideration for the natural environment.

- ResponsibleSteel™ Certification: 42 ArcelorMittal sites held this certification by 2024, incorporating biodiversity principles.

- Materiality: Water management and biodiversity protection are identified as significant sustainability topics for the company.

- Enhanced Efforts: ArcelorMittal is increasing its focus on understanding and managing biodiversity impacts at its locations.

Climate Change Impacts on Operations

ArcelorMittal recognizes that climate change presents significant operational risks, particularly through extreme weather events such as floods and severe storms. These events can disrupt supply chains, damage infrastructure, and impact production capacity. For instance, in 2023, several of its European facilities experienced minor disruptions due to localized flooding, leading to temporary production slowdowns.

The company is actively investing in sustainable product development and process research to enhance its resilience against these climate-related impacts. This includes exploring new materials and engineering solutions to better withstand extreme weather conditions. ArcelorMittal's commitment to decarbonization, with a target to reduce its carbon emissions intensity by 25% by 2030 compared to 2018 levels, is intrinsically linked to building long-term operational resilience against the broader, systemic effects of climate change and the increasing stringency of environmental regulations globally.

- Operational Risks: Acknowledged vulnerability to floods and storms impacting infrastructure and production.

- Resilience Initiatives: Investment in sustainable product development and process research for adaptation.

- Decarbonization Strategy: Aims to mitigate broader climate change effects and regulatory evolution, targeting a 25% reduction in carbon emissions intensity by 2030 (vs. 2018).

ArcelorMittal's environmental efforts are substantial, with a nearly 50% reduction in absolute CO2 emissions achieved by 2024 compared to 2018, supported by a $1 billion decarbonization investment. The company's carbon intensity stands at 1.75 tonnes of CO2 per tonne of crude steel, outperforming the global average. By 2024, 42 sites had attained ResponsibleSteel™ certification, integrating biodiversity principles, and water management and biodiversity protection are key sustainability focus areas, with increased efforts to understand and manage biodiversity impacts.

The company is actively enhancing resource efficiency by increasing scrap steel utilization, a strategy supported by the growing adoption of Electric Arc Furnaces (EAFs), which accounted for about 25% of global steel production in 2024. ArcelorMittal is also investing in technologies to sustainably process by-products like slag, turning waste into valuable secondary raw materials for industries such as construction.

Climate change poses operational risks, with extreme weather events like floods and storms impacting infrastructure and production, as seen with minor disruptions in European facilities in 2023 due to localized flooding. To counter this, ArcelorMittal is investing in sustainable product development and process research, aiming for a 25% reduction in carbon emissions intensity by 2030 (versus 2018) to bolster resilience against climate effects and evolving environmental regulations.

| Environmental Factor | 2024 Data/Status | 2030 Target | Key Initiatives |

| CO2 Emissions Reduction | Nearly 50% absolute reduction (vs. 2018) | 25% intensity reduction (vs. 2018) | Decarbonization projects ($1bn investment), EAF adoption |

| Carbon Intensity | 1.75 tonnes CO2/tonne crude steel | N/A | Process optimization, scrap utilization |

| Resource Efficiency | Increased scrap steel use | N/A | By-product valorization (e.g., slag in construction) |

| Biodiversity & Water Management | 42 sites ResponsibleSteel™ certified | N/A | Assessing impacts, protecting local ecosystems |

| Climate Change Resilience | Minor disruptions from 2023 flooding | N/A | Sustainable product development, process research |

PESTLE Analysis Data Sources

Our ArcelorMittal PESTLE analysis is built on a comprehensive blend of official government publications, international financial institution reports, and leading industry research firms. We meticulously gather data on political stability, economic indicators, environmental regulations, technological advancements, and social trends to provide a robust overview.