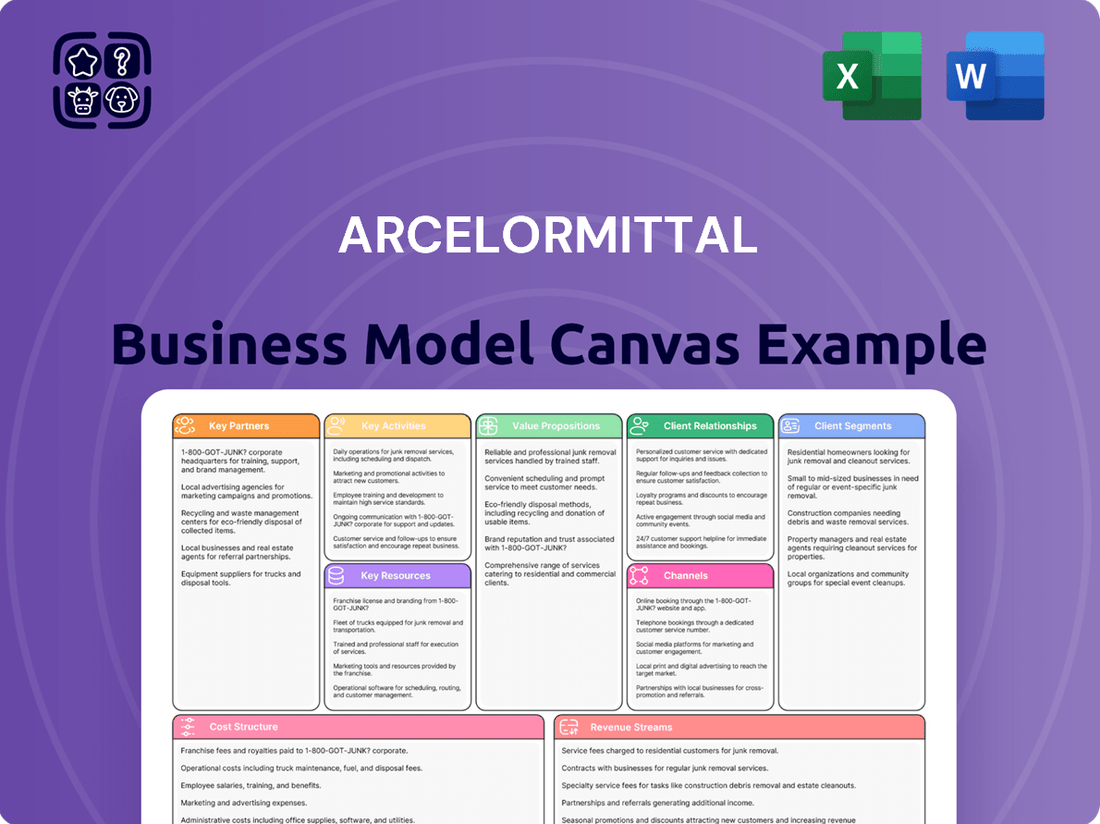

ArcelorMittal Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ArcelorMittal Bundle

Discover the intricate workings of ArcelorMittal's global steel empire with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer segments, value propositions, and revenue streams, offering a clear roadmap to their market dominance. Download the full canvas to gain actionable insights for your own strategic planning and competitive analysis.

Partnerships

ArcelorMittal actively engages in technology and research collaborations with leading universities, renowned research institutions, and innovative technology providers. These partnerships are fundamental to ArcelorMittal's strategy of advancing steelmaking processes and pioneering the development of novel materials.

These collaborations are vital for maintaining leadership in sustainable steel production and driving product innovation, particularly in high-growth sectors like e-mobility and clean energy. For instance, ArcelorMittal's commitment to decarbonization is supported by research into hydrogen-based steelmaking and carbon capture technologies, often in conjunction with academic and industrial partners.

ArcelorMittal, despite its significant mining capacity, continues to depend on external sources for a portion of its iron ore, coal, and other critical raw materials. These external suppliers are crucial for supplementing the company's internal production and ensuring a stable supply chain for its numerous steel plants worldwide. In 2023, ArcelorMittal's iron ore production reached 56.4 million tonnes, but the need for external sourcing remains to meet full operational demands.

ArcelorMittal cultivates deep ties with leading companies in the automotive, construction, and packaging industries. These collaborations often involve joint development of tailored steel solutions, ensuring ArcelorMittal's offerings align precisely with industry demands. For instance, in 2024, the automotive sector continued to drive demand for advanced high-strength steels, with ArcelorMittal actively partnering with manufacturers on lightweighting solutions.

Logistics and Distribution Partners

ArcelorMittal relies on a robust network of logistics and distribution partners to ensure its steel products reach customers efficiently across its global operations. These partnerships are crucial for managing the complexities of transporting large volumes of steel to diverse markets.

This extensive network allows ArcelorMittal to serve its customers in approximately 129 countries, demonstrating the vital role these partners play in the company's reach and market penetration. The ability to deliver reliably, even to remote locations, is a key competitive advantage facilitated by these relationships.

Key aspects of these partnerships include:

- Ocean Freight: Collaborations with major shipping lines to transport steel coils, sheets, and other products across continents, a significant portion of ArcelorMittal's global trade volume.

- Rail and Trucking: Agreements with land-based transportation providers to facilitate last-mile delivery and movement within continents, ensuring timely access to manufacturing hubs and construction sites.

- Warehousing and Storage: Partnerships with third-party logistics (3PL) providers who offer warehousing solutions, enabling ArcelorMittal to maintain inventory closer to key customer bases and manage supply chain fluctuations.

Government and Regulatory Bodies

ArcelorMittal actively partners with government and regulatory bodies globally. These collaborations are crucial for navigating complex environmental regulations, particularly those focused on decarbonization and promoting sustainable practices within the steel industry. For instance, in 2024, ArcelorMittal continued its engagement with policymakers to advocate for supportive frameworks that facilitate the transition to greener steel production.

The company's engagement aims to ensure compliance with evolving standards, such as the Low Emission Steel Standard (LESS). This partnership allows ArcelorMittal to contribute to the development of effective climate policies and to align its operations with national and international sustainability goals. In 2024, ArcelorMittal's European operations, for example, were actively involved in discussions regarding the implementation of new emissions trading schemes and carbon border adjustment mechanisms.

- Policy Advocacy: Engaging with governments to shape supportive policies for decarbonization in steel.

- Regulatory Compliance: Ensuring adherence to evolving environmental standards like the Low Emission Steel Standard (LESS).

- **Stakeholder Dialogue**: Participating in discussions on climate action and sustainable industrial development.

- **Investment Facilitation**: Seeking government support and incentives for green steel technologies and projects.

ArcelorMittal's key partnerships extend to technology and research collaborators, including universities and specialized providers, crucial for advancing steelmaking and developing new materials. These alliances are vital for ArcelorMittal's sustainability goals, particularly in areas like hydrogen-based steelmaking, with ongoing research in 2024 focusing on these innovative processes.

The company also relies on a broad network of raw material suppliers, supplementing its own production to ensure consistent operations across its global facilities. Furthermore, deep ties with automotive, construction, and packaging firms involve co-developing tailored steel solutions, such as lightweighting steels for the automotive sector, a key focus in 2024.

Logistics and distribution partners are indispensable for ArcelorMittal's global reach, enabling efficient delivery to customers in approximately 129 countries. These relationships are essential for managing the complex transportation of steel products worldwide.

ArcelorMittal also actively engages with government and regulatory bodies to navigate environmental standards and advocate for supportive policies for green steel production. This includes participation in discussions around emissions trading and carbon border adjustments, as seen in its European operations in 2024.

| Partner Type | Purpose | Example Focus Area | 2024 Relevance |

| Technology & Research Institutions | Process Innovation & Material Development | Hydrogen-based steelmaking | Advancing decarbonization technologies |

| Raw Material Suppliers | Supply Chain Stability | Iron ore, coking coal | Supplementing ArcelorMittal's 56.4 million tonnes of iron ore production (2023) |

| Industry Customers (Automotive, Construction) | Product Co-development & Market Alignment | Lightweighting steels for EVs | Meeting demand for advanced high-strength steels |

| Logistics & Distribution Providers | Global Reach & Efficient Delivery | Ocean freight, trucking, warehousing | Ensuring service to ~129 countries |

| Government & Regulatory Bodies | Policy Advocacy & Compliance | Decarbonization frameworks, LESS | Navigating evolving environmental standards |

What is included in the product

A structured overview of ArcelorMittal's operations, detailing its diverse customer base, extensive distribution networks, and its core value proposition of providing essential steel products and innovative solutions.

ArcelorMittal's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their complex operations, enabling swift identification of inefficiencies and strategic alignment across diverse business units.

Activities

ArcelorMittal's core activity is the integrated production of a vast array of steel products, encompassing everything from initial semi-finished goods to diverse flat and long steel items. This comprehensive process underpins their global manufacturing footprint.

The company operates a significant network of integrated and mini-mill steelmaking facilities, strategically located across 15 countries. This extensive infrastructure allows for a broad reach in steel production and supply.

In 2023, ArcelorMittal reported crude steel production of 74.5 million metric tons. This figure highlights the sheer scale of their manufacturing operations and their position as a major global steel producer.

ArcelorMittal's mining operations are a cornerstone of its vertically integrated model, focusing on the extraction of iron ore and metallurgical coal. These raw materials are crucial for its extensive steelmaking facilities worldwide.

In 2024, ArcelorMittal reported that its mining segment produced 46.6 million tonnes of iron ore and 4.1 million tonnes of coal. This robust production underpins the company's strategy for supply chain security and cost management.

This vertical integration provides ArcelorMittal with significant advantages, including enhanced control over the quality and availability of essential raw materials, directly contributing to cost efficiencies and operational stability in its core steel business.

ArcelorMittal's commitment to Research and Development is a cornerstone of its strategy, with significant investments directed towards creating more sustainable steel products and enhancing its environmental footprint. This focus is crucial for staying competitive and meeting evolving market demands.

The company is actively exploring and advancing decarbonization technologies, a vital area given the global push for net-zero emissions. In 2023, ArcelorMittal reported a 23% reduction in absolute Scope 1 and 2 emissions compared to 2018, demonstrating tangible progress in this critical field.

Furthermore, ArcelorMittal is investigating the application of its advanced steel solutions in burgeoning sectors like e-mobility and artificial intelligence. This forward-looking approach ensures the company remains at the forefront of innovation, offering high-quality, technologically advanced steel for future industries.

Sales and Distribution

ArcelorMittal's sales and distribution are crucial, involving the sale of a wide array of steel products to customers in numerous industries and regions worldwide. This global reach is facilitated by an extensive sales network, enabling the company to serve clients in approximately 129 countries.

The company's sales strategy is multifaceted, aiming to connect with a diverse customer base. This includes direct sales to large industrial clients, as well as utilizing distribution channels to reach smaller and more geographically dispersed customers.

In 2024, ArcelorMittal continued to focus on strengthening its customer relationships and optimizing its supply chain to ensure efficient delivery of its products. The company's ability to manage a global sales network is a key competitive advantage.

- Global Sales Network: Operations in approximately 129 countries.

- Diverse Customer Base: Serving various industries including automotive, construction, and appliances.

- Distribution Channels: Utilizing direct sales and established distribution partners.

- Market Reach: Ensuring product availability across key international markets.

Decarbonization and Sustainability Initiatives

ArcelorMittal's key activities heavily feature decarbonization and sustainability. They are investing significantly in technologies like electric arc furnaces (EAFs) to lower emissions, alongside exploring carbon capture solutions. This focus is crucial for their long-term strategy.

A core part of this is the development and promotion of low-carbon steel products, notably their XCarb® range. This demonstrates a tangible commitment to providing greener alternatives in the steel market.

- Investment in EAFs: ArcelorMittal is expanding its EAF capacity, aiming to increase the proportion of steel produced through this lower-emission route.

- Carbon Capture R&D: The company is actively researching and piloting carbon capture, utilization, and storage (CCUS) technologies to mitigate emissions from traditional processes.

- XCarb® Portfolio: ArcelorMittal is growing its XCarb® offering, which includes products with a significantly reduced carbon footprint, meeting increasing customer demand for sustainable materials.

- 2024 Targets: By 2030, ArcelorMittal aims to reduce its net carbon emissions intensity by 25% compared to 2018 levels, with ongoing progress reported throughout 2024.

ArcelorMittal's key activities revolve around the integrated production of steel, from mining raw materials like iron ore and coal to manufacturing a wide range of steel products. This vertical integration is supported by significant investments in research and development, particularly in decarbonization technologies and the creation of sustainable steel solutions. The company also manages a vast global sales and distribution network, serving customers across numerous industries and approximately 129 countries.

| Key Activity | Description | 2024 Data/Focus |

| Steel Production | Integrated steelmaking from raw materials to finished products. | Continued focus on operational efficiency and product quality across its global facilities. |

| Mining Operations | Extraction of iron ore and metallurgical coal. | In 2024, ArcelorMittal reported mining 46.6 million tonnes of iron ore and 4.1 million tonnes of coal, ensuring supply chain security. |

| Decarbonization & Sustainability | Investment in low-carbon technologies and development of sustainable steel products. | Progress towards a 2030 target of a 25% reduction in net carbon emissions intensity (vs. 2018); expansion of EAF capacity and XCarb® portfolio. |

| Sales & Distribution | Global sales of steel products to diverse industries. | Maintaining a strong presence in approximately 129 countries, strengthening customer relationships and optimizing logistics. |

Preview Before You Purchase

Business Model Canvas

The ArcelorMittal Business Model Canvas preview you are viewing is an exact representation of the final document you will receive upon purchase. This ensures you know precisely what you are getting – a comprehensive and professionally structured analysis of ArcelorMittal's business strategy. You'll gain immediate access to this complete, ready-to-use document, mirroring the exact content and layout shown here, allowing you to leverage it immediately for your strategic insights.

Resources

ArcelorMittal's global steelmaking facilities are a cornerstone of its business model, encompassing 36 integrated and mini-mill operations spread across 15 countries. This expansive network provides substantial production capacity and crucial geographic diversification, mitigating risks associated with regional economic downturns or operational disruptions. For instance, in 2023, ArcelorMittal reported crude steel production of 75.8 million tonnes, showcasing the sheer scale of its manufacturing capabilities.

ArcelorMittal's ownership and operation of captive iron ore and coal mines are fundamental to its business model, providing a secure and cost-efficient supply of critical raw materials for its extensive steelmaking operations. This vertical integration significantly enhances its self-sufficiency, insulating it from market volatility in raw material prices.

In 2023, ArcelorMittal's mining segment generated $10.7 billion in revenue, demonstrating the substantial economic contribution of these assets. The company's mining production capabilities are vast, with significant reserves that underpin its long-term operational strategy and competitive cost structure in steel production.

ArcelorMittal's strength lies in its approximately 125,416 employees as of December 31, 2024. This vast team includes highly specialized engineers, metallurgists, and researchers who are critical for the company's intricate manufacturing processes and ongoing innovation.

This human capital is the bedrock of ArcelorMittal's operational excellence and commitment to safety. Their expertise drives advancements in steel production, product development, and the implementation of cutting-edge technologies across its global facilities.

Proprietary Technology and R&D Capabilities

ArcelorMittal's commitment to innovation is evident in its substantial investments in research and development, leading to proprietary technologies crucial for advanced steelmaking and decarbonization efforts. These capabilities are a cornerstone of their competitive advantage.

The company operates major research hubs and fosters strong collaborations with academic institutions, ensuring its technical expertise remains at the forefront of the industry. This focus on R&D directly supports their ability to develop and implement cutting-edge solutions.

- Proprietary Technologies: Development of advanced steel grades and innovative production processes.

- Decarbonization Focus: Investment in technologies for reducing CO2 emissions, such as hydrogen-based steelmaking.

- R&D Investment: Significant capital allocation towards research centers and collaborative projects.

- Technical Expertise: Leveraging academic partnerships to drive innovation and maintain a technological edge.

Strong Financial Capital

ArcelorMittal's strong financial capital is a cornerstone of its business model, enabling significant investments. In 2024, the company reported impressive financial results, demonstrating its robust financial health and capacity for strategic initiatives.

- Revenue Generation: ArcelorMittal achieved revenues of $62.4 billion in 2024, highlighting its substantial market presence and sales volume.

- Profitability: The company posted an EBITDA of $7.1 billion in 2024, indicating strong operational performance and profitability.

- Investment Capacity: This financial strength allows ArcelorMittal to fund strategic growth projects, crucial decarbonization efforts, and provide returns to shareholders.

ArcelorMittal's key resources are its extensive global steelmaking facilities, which include 36 integrated and mini-mill operations across 15 countries, producing 75.8 million tonnes of crude steel in 2023. Complementing this are its captive iron ore and coal mines, securing raw material supply and contributing $10.7 billion in revenue in 2023. The company's 125,416 employees as of December 31, 2024, provide critical technical expertise, supported by significant investments in R&D for proprietary technologies and decarbonization initiatives. This operational foundation is underpinned by strong financial capital, evidenced by $62.4 billion in revenue and $7.1 billion in EBITDA in 2024.

| Resource Type | Description | Key Data/Metrics |

|---|---|---|

| Steelmaking Facilities | Global network of integrated and mini-mills | 36 facilities in 15 countries; 75.8 million tonnes crude steel production (2023) |

| Mining Assets | Captive iron ore and coal mines | $10.7 billion revenue (Mining segment, 2023) |

| Human Capital | Skilled workforce including engineers, metallurgists, researchers | 125,416 employees (as of Dec 31, 2024) |

| Intellectual Property | Proprietary technologies, R&D investments | Focus on advanced steel grades and decarbonization technologies |

| Financial Capital | Revenue, profitability, investment capacity | $62.4 billion revenue, $7.1 billion EBITDA (2024) |

Value Propositions

ArcelorMittal's value proposition centers on its extensive selection of steel products. This includes both flat products like sheets and plates, and long products such as bars, rods, and structural shapes. They also provide pipes and tubes, ensuring a comprehensive offering for various industrial needs.

This wide array of high-quality finished and semi-finished steel products allows ArcelorMittal to serve a diverse customer base across numerous sectors. For instance, in 2023, ArcelorMittal reported crude steel production of 77.4 million tonnes, demonstrating its significant manufacturing capacity to meet broad market demand.

ArcelorMittal crafts specialized steel solutions, meticulously engineered for the distinct demands of vital industries like automotive, construction, and packaging. This means developing advanced steel grades that deliver specific performance characteristics, from lightweight strength for vehicles to durable resilience for buildings.

In 2024, the automotive sector continued to be a major focus, with ArcelorMittal investing in advanced high-strength steels (AHSS) to help car manufacturers meet fuel efficiency and safety standards. For instance, their Usibor® and Ductibor® grades are crucial for vehicle crashworthiness and weight reduction, contributing to lower emissions.

The construction industry benefits from ArcelorMittal's tailored offerings, including high-performance structural steels that enable more sustainable and efficient building designs. Their commitment extends to packaging, where they provide innovative steel solutions for food and beverage containers, emphasizing recyclability and product integrity.

ArcelorMittal's commitment to sustainable and low-carbon steel is a core value proposition, encapsulated in their 'smarter steels for people and planet' mission. This translates into innovative production methods designed to significantly reduce energy consumption and carbon emissions.

The XCarb® brand is central to this, offering a range of low-carbon steel products that directly address the growing demand from customers focused on environmental, social, and governance (ESG) objectives. This strategic positioning allows ArcelorMittal to capture market share among sustainability-conscious buyers.

In 2023, ArcelorMittal announced a target to reduce its net carbon emissions intensity from steelmaking by 25% by 2030, compared to a 2018 baseline, demonstrating a concrete commitment to its low-carbon steel ambition. This aligns with their broader goal of achieving net-zero by 2050.

Global Scale and Supply Chain Reliability

ArcelorMittal's global scale is a cornerstone of its value proposition, with operations spanning 60 countries and sales reaching approximately 129 nations. This vast operational footprint directly translates into exceptional supply chain reliability for its customers.

The company's extensive network is crucial for ensuring consistent product availability and timely delivery, mitigating risks associated with localized disruptions. For instance, in 2024, ArcelorMittal's diversified production base allowed it to maintain robust supply chains even amidst regional geopolitical and economic challenges.

- Global Reach: Operations in 60 countries, sales in 129 countries.

- Supply Chain Resilience: Extensive network ensures consistent product availability.

- Reliable Delivery: Mitigates risks through diversified production and logistics.

- Market Access: Facilitates access to diverse customer bases worldwide.

Innovation and Technical Expertise

ArcelorMittal’s commitment to innovation and technical expertise is a cornerstone of its value proposition. Through consistent investment in research and development, the company consistently brings forward novel steel solutions. This focus on advancement ensures customers receive materials that push the boundaries of quality and performance.

In 2024, ArcelorMittal continued to emphasize its technical prowess. For example, the company’s advanced high-strength steels (AHSS) are critical for the automotive industry, enabling lighter and more fuel-efficient vehicles. This technical leadership translates directly into tangible benefits for their clients.

- Research & Development Investment: ArcelorMittal allocated significant resources to R&D in 2024, focusing on next-generation steel grades.

- Product Innovation: The company launched several new steel products in 2024, designed for enhanced durability and sustainability.

- Technical Support: ArcelorMittal provides extensive technical support to customers, helping them optimize the use of its advanced materials.

- Industry Standards: The company actively contributes to setting new industry standards for steel quality and performance through its technical expertise.

ArcelorMittal offers a comprehensive portfolio of steel products, from flat and long steel to pipes and tubes, catering to diverse industrial needs. This extensive product range, coupled with a commitment to high quality, ensures they meet the varied demands of their global clientele.

The company specializes in advanced steel solutions tailored for critical sectors like automotive, construction, and packaging, focusing on performance and sustainability. For example, their AHSS grades are vital for lighter, more fuel-efficient vehicles, a key trend in 2024.

ArcelorMittal's value proposition is strengthened by its focus on low-carbon steel production under the XCarb® brand, addressing increasing ESG demands. They aim to reduce net carbon emissions intensity by 25% by 2030, a significant step towards their net-zero goal.

A key differentiator is ArcelorMittal's vast global presence, operating in 60 countries and selling to 129, which ensures supply chain resilience and reliable delivery. This broad network is crucial for consistent product availability, especially in dynamic global markets observed in 2024.

Customer Relationships

ArcelorMittal cultivates robust customer connections through specialized sales and technical support teams. These experts offer tailored advice, helping clients choose and effectively use the right steel products for their unique needs. This direct interaction is key to ensuring customer satisfaction and meeting precise technical demands.

ArcelorMittal cultivates enduring relationships through long-term contracts and strategic alliances, especially with key players in the automotive and construction industries. These collaborations are founded on mutual trust, consistent dependability, and a joint dedication to superior quality and forward-thinking advancements.

In 2023, ArcelorMittal's automotive segment, a significant area for these partnerships, saw continued demand, reflecting the strength of these established ties. The company's focus on innovation, such as developing advanced high-strength steels, further solidifies these customer bonds by meeting evolving industry needs.

ArcelorMittal actively solicits customer feedback to stay ahead of changing demands and partners with clients on co-development projects for innovative steel products. This collaborative strategy ensures their solutions are market-relevant. For instance, in 2024, the company highlighted successful collaborations with automotive manufacturers on advanced high-strength steels for lighter, safer vehicles.

Sustainability Reporting and Transparency

ArcelorMittal fosters customer loyalty through its commitment to transparency in sustainability reporting. By regularly publishing detailed reports, the company showcases its environmental and social progress, building significant trust with its client base. This proactive communication underscores a dedication to operating responsibly and ethically.

Their participation in industry initiatives like ResponsibleSteel™ further solidifies this customer relationship. It highlights a shared commitment to higher standards within the steel sector. For instance, in 2023, ArcelorMittal reported a 7% reduction in its Scope 1 and 2 GHG intensity compared to 2022, a tangible metric shared with stakeholders.

- Transparency in Reporting: Annual Sustainability Reports detail environmental, social, and governance (ESG) performance.

- Industry Collaboration: Engagement with ResponsibleSteel™ demonstrates a commitment to sector-wide improvement.

- Building Trust: Open communication about performance metrics, such as GHG intensity reductions, enhances customer confidence.

- Demonstrating Responsibility: Proactive disclosure of efforts in areas like water management and community engagement reinforces ethical business practices.

Digital Platforms and E-commerce

ArcelorMittal likely utilizes digital platforms to foster customer relationships, offering interactive portals for order tracking, technical support, and access to product information. These platforms serve as crucial touchpoints for enhancing customer engagement and providing a streamlined experience.

While specific e-commerce adoption varies by product and region, ArcelorMittal's digital presence aims to improve accessibility and communication. This digital engagement is vital for managing a diverse customer base, from large industrial clients to smaller fabricators, ensuring efficient information exchange.

- Digital Engagement: ArcelorMittal's digital platforms facilitate direct customer interaction, providing self-service options and personalized support.

- Information Hubs: Online portals offer comprehensive product catalogs, technical specifications, and market insights, empowering customers with data.

- Streamlined Processes: Digital tools are employed to simplify order placement, inquiry management, and communication, improving operational efficiency.

- E-commerce Potential: For specific product segments, ArcelorMittal may leverage e-commerce functionalities to facilitate transactions and broaden market reach.

ArcelorMittal's customer relationships are built on a foundation of specialized support and collaborative innovation. Their dedicated sales and technical teams provide tailored advice, ensuring clients select and utilize steel products effectively to meet specific project requirements.

Long-term contracts and strategic partnerships, particularly within the automotive and construction sectors, underscore ArcelorMittal's commitment to reliability and quality. These deep-rooted connections are vital for sustained business growth and mutual development.

In 2023, ArcelorMittal's automotive segment, a key area for these relationships, demonstrated resilience. The company’s ongoing investment in advanced steel solutions, such as high-strength alloys, directly addresses evolving industry demands, reinforcing customer loyalty.

Proactive engagement through customer feedback loops and co-development projects ensures ArcelorMittal's offerings remain market-aligned. For example, 2024 saw continued success in joint ventures with automakers to create lighter, more fuel-efficient vehicles using advanced steels.

ArcelorMittal prioritizes transparency in its sustainability reporting, which significantly builds trust with its customer base. Publishing detailed ESG performance data, including a 7% reduction in Scope 1 and 2 GHG intensity in 2023 compared to 2022, demonstrates a commitment to responsible operations.

Participation in industry standards like ResponsibleSteel™ further solidifies these relationships by showcasing a shared dedication to ethical practices and sector-wide improvement.

| Customer Relationship Aspect | Key Initiatives/Data | Impact |

|---|---|---|

| Specialized Support | Dedicated sales & technical teams | Enhanced product selection & utilization |

| Long-Term Partnerships | Automotive & Construction sectors | Sustained demand & quality focus |

| Innovation Collaboration | Co-development of advanced steels (2024) | Meeting evolving industry needs (e.g., lighter vehicles) |

| Sustainability Transparency | 2023 GHG intensity reduction: 7% | Increased customer trust & confidence |

| Industry Standards | ResponsibleSteel™ membership | Reinforced commitment to ethical practices |

Channels

ArcelorMittal's direct sales force is a cornerstone for engaging major industrial clients, providing specialized support and customized product offerings. This approach is vital for handling intricate transactions and cultivating robust B2B partnerships.

In 2024, ArcelorMittal's direct sales network continued to be instrumental in securing significant contracts, particularly within the automotive and construction sectors. This channel allows for direct feedback loops, enabling product development to align precisely with evolving industry needs.

ArcelorMittal leverages a vast global network of distribution and service centers to ensure efficient delivery of its steel products. These strategically located facilities cater to a wide array of markets, including smaller customers who require more localized support and faster turnaround times.

In 2024, the company's commitment to this robust network was evident in its operational efficiency, facilitating timely access to ArcelorMittal’s diverse steel offerings across various industries.

ArcelorMittal actively utilizes joint ventures and strategic alliances to bolster its global footprint and market penetration. A prime example is its significant stake in AM/NS India, a venture that grants ArcelorMittal access to India's rapidly growing steel market.

These strategic partnerships offer ArcelorMittal established production capabilities and sales networks within specific geographical areas, facilitating efficient market entry and expansion. For instance, the AM/NS India joint venture has been instrumental in ArcelorMittal’s operational growth in the subcontinent.

In 2023, ArcelorMittal reported a significant increase in crude steel production, partly supported by the performance of its joint ventures. The company’s overall production for the year reached 76.3 million metric tons, with its share in joint ventures contributing substantially to this volume.

Online Presence and Corporate Website

ArcelorMittal’s corporate website is a crucial touchpoint, acting as the central repository for investor relations, detailed sustainability reports, comprehensive product information, and timely company news. This digital platform ensures all stakeholders, from individual investors to industry professionals, can easily access and digest information about ArcelorMittal's global operations, strategic initiatives, and diverse product portfolio.

In 2024, the website continues to be a vital tool for transparency and engagement. It offers interactive tools, financial performance data, and updates on ArcelorMittal's commitment to decarbonization, a key focus area. For instance, stakeholders can find detailed breakdowns of their 2023 financial results, including revenues and production volumes, directly on the site, facilitating informed decision-making.

- Investor Relations Hub: Provides access to financial reports, stock performance, and investor presentations.

- Sustainability Center: Showcases environmental, social, and governance (ESG) initiatives, including progress on decarbonization targets.

- Product Catalog: Details the wide range of steel and mining products offered by ArcelorMittal.

- News and Media: Features press releases, corporate announcements, and multimedia content.

Industry Trade Shows and Conferences

ArcelorMittal actively participates in key industry trade shows and conferences, such as the European Steel Association (EUROFER) annual meetings and the World Steel Association (worldsteel) events. These platforms are crucial for demonstrating advancements in sustainable steelmaking and digital solutions, directly engaging with a global customer base, and understanding evolving market dynamics. In 2024, for instance, ArcelorMittal highlighted its progress in decarbonization initiatives at these gatherings, reinforcing its commitment to a greener future for the industry.

These events are pivotal for ArcelorMittal’s brand visibility and strategic networking. They provide direct access to industry peers, potential partners, and key decision-makers within the steel and mining sectors. For example, at the 2024 International Mining and Metals Conference, ArcelorMittal representatives fostered discussions on supply chain resilience and technological integration, solidifying relationships and exploring new business avenues.

- Showcasing Innovation: Demonstrating new products and sustainable technologies.

- Customer Engagement: Connecting with existing and prospective clients.

- Market Intelligence: Gathering insights on industry trends and competitor activities.

- Brand Building: Enhancing ArcelorMittal's presence and reputation in the global market.

ArcelorMittal utilizes a multi-channel approach, blending direct sales with extensive distribution networks to reach its diverse customer base. Strategic joint ventures and a robust online presence further enhance market penetration and stakeholder engagement. Participation in industry events ensures brand visibility and fosters crucial relationships.

In 2024, ArcelorMittal's direct sales force continued to be a vital conduit for large industrial clients, facilitating tailored solutions and strong B2B relationships. Simultaneously, its global network of distribution centers ensured efficient product delivery, catering to a broad spectrum of customers, including those requiring localized support.

The company's strategic alliances, such as its stake in AM/NS India, proved instrumental in expanding its reach into high-growth markets. ArcelorMittal's corporate website served as a key information hub, providing stakeholders with access to financial data, sustainability reports, and product details, reinforcing transparency and accessibility.

Industry trade shows and conferences in 2024 provided ArcelorMittal with critical platforms to showcase its innovations, particularly in sustainable steelmaking, and to engage directly with customers and industry peers, thereby gathering valuable market intelligence.

Customer Segments

The automotive industry is a cornerstone customer for ArcelorMittal, demanding specialized steel products engineered for strength and reduced weight. In 2024, ArcelorMittal continued to be a key supplier, providing advanced steel solutions crucial for both traditional internal combustion engine vehicles and the rapidly growing electric vehicle (EV) market. This segment requires innovative materials that enhance fuel efficiency and safety.

The construction and infrastructure sector is a cornerstone customer segment for ArcelorMittal, requiring a diverse portfolio of steel products. This includes vital materials like rebar for reinforcing concrete, structural steel shapes for building frames, and heavy plates for bridges and industrial facilities. In 2024, global construction output is projected to see moderate growth, driven by infrastructure spending in many developed and emerging economies.

ArcelorMittal's role extends to supplying essential steel for both residential and commercial building projects, from housing developments to large-scale commercial complexes. The company's ability to provide high-quality, reliable steel products is critical for the timely and safe completion of these endeavors. For instance, the infrastructure investment plans announced by various governments in 2023 and continuing into 2024 are expected to significantly boost demand for structural steel and plates.

ArcelorMittal is a key supplier of steel to the packaging industry, providing high-quality, recyclable steel for a wide range of applications like food and beverage cans, aerosols, and general line containers. The demand for sustainable packaging solutions continues to grow, making ArcelorMittal's offerings particularly relevant. In 2024, the global metal packaging market was valued at approximately $130 billion, with steel playing a significant role in its growth.

Appliance and Engineering Industries

ArcelorMittal's steel finds significant application in the appliance and engineering sectors. Manufacturers of household appliances, from refrigerators to washing machines, rely on ArcelorMittal's flat steel products for their casings and internal components. Similarly, diverse engineered products, such as automotive parts, construction elements, and industrial machinery, utilize both flat and long steel offerings.

In 2024, the global appliance market was projected to reach over $1 trillion, with steel being a primary material. For engineered products, the demand is equally robust, driven by infrastructure development and industrial expansion worldwide. ArcelorMittal's ability to supply high-quality, specialized steel grades is crucial for these industries.

- Appliance Manufacturers: Utilize flat steel for durable and aesthetically pleasing product exteriors and interiors.

- Engineered Product Makers: Employ a range of steel products for structural integrity and performance in applications like construction and machinery.

- Market Demand: The appliance sector's growth, coupled with ongoing infrastructure projects, fuels consistent demand for steel.

- Material Needs: These customers require specific steel properties such as corrosion resistance, formability, and strength.

Energy Sector (including Renewables)

ArcelorMittal's energy sector customers are increasingly focused on the clean energy transition. The company provides essential steel for renewable energy infrastructure, including components for wind turbines and solar panel installations. This segment is crucial for ArcelorMittal's growth, as evidenced by its dedicated 'Climate Solutions' product range designed to meet the demands of this expanding market.

In 2024, the global renewable energy sector continued its robust expansion. For instance, offshore wind capacity additions were projected to reach significant new levels, requiring substantial quantities of specialized steel for foundations and turbines. Similarly, the solar energy market saw continued growth in installations, further driving demand for steel in mounting structures and other components.

- Renewable Infrastructure: Supplying high-strength steel for wind turbine towers, foundations, and solar panel mounting systems.

- Energy Projects: Providing steel for infrastructure related to energy transmission and distribution, including pipelines and support structures.

- Climate Solutions: Offering specialized steel products with lower carbon footprints, aligning with the sustainability goals of energy sector clients.

ArcelorMittal serves a diverse range of industrial clients beyond the major sectors. This includes manufacturers of agricultural machinery, where robust steel is vital for durability and performance in demanding environments. Additionally, the company supplies steel for the production of various industrial equipment and components, underpinning manufacturing processes globally.

In 2024, the agricultural machinery market continued to be a significant consumer of steel, driven by the need for efficient food production. The industrial equipment sector also saw steady demand, reflecting ongoing investments in manufacturing capacity and upgrades. For example, the global market for industrial robots, a key indicator of manufacturing investment, was projected for continued growth in 2024.

| Customer Segment | Key Products Supplied | 2024 Market Relevance |

|---|---|---|

| Industrial Equipment Manufacturers | Structural steel, plates, specialized alloys | Steady demand driven by manufacturing investment |

| Agricultural Machinery Producers | High-strength steel for frames and components | Continued demand for durable, efficient farm equipment |

| Other Industrial Applications | Various steel grades for diverse manufacturing needs | Underpins a broad spectrum of manufacturing processes |

Cost Structure

Raw material costs are a primary expense for ArcelorMittal, covering the acquisition of iron ore, coal, and scrap metal, which are fundamental to steel manufacturing. These costs are highly susceptible to global commodity price swings, directly influencing profitability.

Energy costs are a major expense for ArcelorMittal, as steel production demands significant amounts of electricity and natural gas. In 2024, the company continued to navigate volatile energy markets, which directly impacted its operational expenses and profitability.

ArcelorMittal's commitment to decarbonization also translates into substantial energy-related investments. These include upgrades to more energy-efficient technologies and the exploration of alternative energy sources, adding to the overall energy cost structure but aiming for long-term sustainability and cost reduction.

ArcelorMittal's labor costs are substantial, driven by its global workforce exceeding 125,000 employees. These costs encompass salaries, wages, comprehensive benefits packages, and ongoing training initiatives critical for maintaining a skilled workforce in the demanding steel industry.

Capital Expenditures (CAPEX)

ArcelorMittal's Capital Expenditures (CAPEX) are a significant component of its cost structure, reflecting the immense investment required to operate and grow its global steel and mining empire. These expenditures are crucial for keeping its vast network of steelmaking plants and mining sites up-to-date, efficient, and competitive. Furthermore, a substantial portion of this CAPEX is now being directed towards future-proofing the business through decarbonization initiatives and the adoption of new, cleaner technologies.

The company has outlined ambitious investment plans, projecting CAPEX to be in the range of $4.5 billion to $5.0 billion for the year 2025. This significant outlay underscores ArcelorMittal's commitment to both maintaining its existing operational capabilities and driving innovation, especially in areas critical for long-term sustainability and environmental responsibility.

- Maintenance and Modernization: Ongoing investment in existing steel plants and mining infrastructure to ensure operational efficiency and safety.

- Expansion Projects: Capital allocated for increasing production capacity or entering new geographical markets.

- Decarbonization Investments: Significant spending on technologies and processes aimed at reducing the company's carbon footprint, such as hydrogen-based steelmaking.

- Technological Upgrades: Investment in new equipment and digital solutions to enhance productivity and reduce costs.

Logistics and Distribution Costs

ArcelorMittal incurs substantial logistics and distribution costs due to its global operations. These expenses cover the movement of raw materials like iron ore and coal to its production facilities and the delivery of finished steel products to a diverse customer base worldwide. This includes significant outlays for freight, warehousing, and the intricate management of inventory across its extensive supply chain.

In 2024, ArcelorMittal's commitment to optimizing its supply chain continued. The company's vast network of mines, production sites, and distribution hubs necessitates robust logistical planning. These costs are a critical component of its overall cost structure, directly impacting profitability and competitiveness in the global steel market.

- Freight Expenses: Costs associated with shipping raw materials and finished goods via sea, rail, and road transport.

- Warehousing and Storage: Expenses related to maintaining inventory at various strategic locations to ensure timely delivery.

- Inventory Management: Costs involved in tracking, controlling, and optimizing stock levels to minimize holding costs and prevent stockouts.

- Distribution Network: Investment in and maintenance of the infrastructure required to move products efficiently to end-users.

ArcelorMittal's cost structure is heavily influenced by its significant investments in decarbonization technologies. These expenditures are crucial for meeting environmental targets and adapting to evolving industry standards. The company is channeling substantial capital into developing and implementing cleaner steelmaking processes, such as hydrogen-based production, which represent a long-term strategic investment.

Research and Development (R&D) costs are also a vital part of ArcelorMittal's operational expenses. These investments fuel innovation in steel products, manufacturing processes, and sustainability initiatives. By dedicating resources to R&D, the company aims to maintain its competitive edge and explore new market opportunities, particularly in areas like advanced materials and circular economy solutions.

| Cost Category | Description | Impact on ArcelorMittal |

|---|---|---|

| Decarbonization Investments | Spending on cleaner technologies and processes (e.g., hydrogen steelmaking) | Essential for long-term sustainability and regulatory compliance; represents significant capital outlay. |

| Research & Development (R&D) | Investment in new steel products, manufacturing processes, and sustainability solutions | Drives innovation, maintains competitiveness, and explores new market potential. |

Revenue Streams

ArcelorMittal generates significant revenue from selling flat steel products. These include items like hot-rolled, cold-rolled, and coated coils and sheets. These materials are vital components for major industries.

The automotive, appliance, and packaging sectors are key customers for ArcelorMittal's flat steel. In 2024, the global automotive industry's demand for steel, including flat products, remained robust, driven by new model launches and increased vehicle production in many regions.

ArcelorMittal generates significant income from selling long steel products. This includes essential items like rebar for concrete reinforcement, wire rod used in various manufacturing processes, and structural sections vital for building frameworks. These products are primarily purchased by the construction and infrastructure industries, making them a cornerstone of ArcelorMittal's revenue.

In 2024, the global construction market, a key driver for long steel products, showed resilience. For instance, infrastructure spending, particularly in emerging economies, continued to be robust, directly translating into demand for ArcelorMittal's offerings. The company's ability to supply these foundational materials is crucial for large-scale projects.

ArcelorMittal generates significant revenue from selling its mining products, primarily iron ore, to customers beyond its internal steelmaking needs. This diversification allows the company to capitalize on the global demand for raw materials. In 2024, ArcelorMittal reported producing 42.4 million tonnes of iron ore, a substantial portion of which was available for external sales.

Sales of Value-Added and Specialty Steels

ArcelorMittal generates revenue from selling value-added and specialty steels. This includes advanced high-strength steels crucial for the automotive sector, enabling lighter and more fuel-efficient vehicles. They also profit from electrical steels used in energy transmission and specialized grades that fetch higher prices due to their unique properties.

The company is actively working to shift its product mix towards these higher-margin offerings. This strategic focus aims to capture more value from its production capabilities and meet growing market demand for sophisticated steel solutions.

- Automotive Steels: Revenue from advanced high-strength steels (AHSS) for lighter, safer vehicles.

- Electrical Steels: Sales of specialized steels for transformers and motors, vital for energy efficiency.

- Premium Pricing: Specialty steel grades command higher prices due to unique performance characteristics.

- Strategic Focus: ArcelorMittal aims to increase the share of these higher value-added products in its overall sales.

Sales of Low-Carbon Steel (XCarb®)

Sales of ArcelorMittal's XCarb® low-carbon steel represent a significant and expanding revenue stream. This product line directly supports critical sectors like climate infrastructure and packaging, underscoring the company's commitment to sustainable business practices.

The growth in XCarb® sales reflects a strategic pivot towards environmentally conscious solutions. In 2024, ArcelorMittal achieved a notable milestone, with sales of XCarb® products reaching 0.4 million tons.

- Growing Market Demand: Driven by increasing global focus on sustainability and decarbonization efforts.

- Strategic Product Focus: XCarb® products cater to sectors requiring low-carbon materials for climate-friendly projects and packaging.

- 2024 Sales Performance: Achieved 0.4 million tons in XCarb® product sales, demonstrating market traction.

ArcelorMittal's revenue streams are diverse, encompassing both primary steel products and mining outputs. The company's core business involves the sale of flat and long steel products, which are essential materials for industries like automotive, construction, and appliances.

Beyond its steel operations, ArcelorMittal also generates substantial income from its mining segment, primarily through the sale of iron ore. This dual approach allows the company to leverage its integrated value chain and capitalize on global demand for both finished steel and raw materials.

In addition to these foundational products, ArcelorMittal is increasingly focusing on value-added and specialty steels, including low-carbon XCarb® products, to capture higher margins and meet evolving market demands for sustainable solutions.

| Revenue Stream | Key Products | Primary Industries Served | 2024 Data Point |

|---|---|---|---|

| Flat Steel Products | Hot-rolled, cold-rolled, coated coils/sheets | Automotive, Appliances, Packaging | Robust demand in automotive sector |

| Long Steel Products | Rebar, wire rod, structural sections | Construction, Infrastructure | Resilient construction market, infrastructure spending |

| Mining Products | Iron Ore | Internal steelmaking, external sales | 42.4 million tonnes of iron ore produced |

| Value-Added & Specialty Steels | AHSS, Electrical Steels, Premium Grades | Automotive, Energy, Manufacturing | Strategic focus on higher-margin offerings |

| XCarb® Low-Carbon Steel | Low-carbon steel products | Climate Infrastructure, Packaging | 0.4 million tons sold |

Business Model Canvas Data Sources

The ArcelorMittal Business Model Canvas is constructed using a blend of internal financial reporting, global market intelligence, and extensive operational data. These sources provide a comprehensive view of the company's strategic positioning and market engagement.