ArcelorMittal Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ArcelorMittal Bundle

ArcelorMittal's BCG Matrix offers a critical lens into its diverse product portfolio, highlighting potential growth areas and resource drains. Understand which segments are driving cash flow and which require strategic re-evaluation to optimize performance.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for ArcelorMittal.

Stars

The AM/NS India joint venture is a prime example of a Star in ArcelorMittal's portfolio. India’s steel market is experiencing robust growth, projected at 6-7% for 2025, making it the fastest-expanding major steel market globally. This dynamic environment fuels AM/NS India's significant contribution to ArcelorMittal's overall income, as evidenced by a higher income reported in Q2 2025.

Further solidifying its Star status, AM/NS India is undergoing a substantial Phase 1 expansion at Hazira, aiming for a 15 million tonne capacity by the close of 2026. The introduction of new downstream facilities in 2025, specifically targeting the high-demand automotive sector, will enhance its market share and revenue generation in this rapidly growing economy.

The Calvert EAF represents a significant strategic move for ArcelorMittal, designed to capitalize on the burgeoning demand for high-quality automotive steel. With a substantial 1.5 million tonnes annual capacity, this Electric Arc Furnace is specifically engineered for exposed automotive-grade steels, utilizing domestically sourced materials. This positions the company to gain a strong foothold in a lucrative and expanding market segment.

The commencement of its first slab pour in Q2 2025 marks a critical milestone, initiating the ramp-up phase for this advanced facility. ArcelorMittal's acquisition of full control of Calvert in June 2025 further solidifies its commitment and strategic advantage, enabling it to effectively meet regional demand for sophisticated steel solutions tailored for the automotive industry.

ArcelorMittal's XCarb Low-Carbon Steel Solutions represent a significant Star in the BCG Matrix. The global green steel market is projected to expand at an impressive compound annual growth rate of 60.4% between 2025 and 2032, driven by increasing environmental regulations and corporate sustainability goals.

XCarb products offer a compelling value proposition by reducing CO2 footprints by as much as 81%, directly addressing the growing demand for sustainable materials across various industries. This focus on decarbonization makes XCarb highly attractive to businesses actively seeking to lower their environmental impact.

The projected doubling of XCarb product sales in 2024 underscores strong market adoption and the significant growth potential of these offerings. This rapid acceptance in an environmentally conscious market solidifies XCarb's position as a high-growth, high-market-share product.

Liberia Iron Ore Expansion

The expansion of ArcelorMittal's iron ore operations in Liberia to a 20 million tonne capacity is a prime example of a Star in the BCG matrix. This significant growth initiative has already contributed to record quarterly production and shipments for the company's mining segment, demonstrating its high market share and rapid growth potential.

This strategic expansion is on schedule to reach its full 20 million tonne capacity by the close of 2025, reinforcing its position as a key growth driver. The increased output and operational diversification directly bolster ArcelorMittal's raw material self-sufficiency.

- Liberian Operations Capacity: Targeting 20 million tonnes.

- Expansion Timeline: On track for full capacity by end of 2025.

- Market Impact: Drives record production and shipments for ArcelorMittal's mining segment.

- Strategic Benefit: Enhances raw material self-sufficiency and profitability amidst growing global demand for high-quality iron ore.

Strategic Growth Projects (Overall)

ArcelorMittal's strategic growth projects are positioned as Stars in its BCG Matrix, signifying high market growth and strong competitive positions. These initiatives are designed to deliver substantial future earnings, with an anticipated incremental $2.1 billion in EBITDA. This portfolio includes key investments in decarbonization efforts and ongoing asset optimization programs, all aimed at driving long-term profitability.

The company is demonstrating a clear commitment to these high-return opportunities through significant capital allocation. For 2025 alone, ArcelorMittal expects these projects to contribute approximately $0.7 billion in EBITDA, underscoring the immediate impact and growth potential management sees in these strategic ventures.

- Strategic Growth Projects as Stars: ArcelorMittal's portfolio of strategic growth projects are classified as Stars due to their high growth potential and strong competitive standing.

- EBITDA Contribution: These projects are projected to generate an incremental $2.1 billion in EBITDA, significantly boosting future profitability.

- Key Investment Areas: Focus areas include decarbonization initiatives and asset optimization, targeting high-return opportunities.

- 2025 EBITDA Target: A notable $0.7 billion EBITDA benefit is anticipated from these projects in 2025, reflecting confidence in their near-term impact and growth trajectory.

ArcelorMittal's strategic growth projects are classified as Stars due to their high market growth and strong competitive positions, projected to generate an incremental $2.1 billion in EBITDA. These initiatives, including decarbonization efforts and asset optimization, are expected to contribute approximately $0.7 billion in EBITDA in 2025 alone, highlighting their immediate impact and significant growth potential.

| Project/Segment | BCG Category | Key Metric | 2025 Projected EBITDA (Approx.) | Strategic Significance |

|---|---|---|---|---|

| AM/NS India (Hazira Expansion) | Star | 15 MT capacity by end of 2026 | N/A (Segmental) | Capitalizes on India's high steel market growth |

| Calvert EAF (Automotive Steel) | Star | 1.5 MT annual capacity | N/A (Segmental) | Targets high-demand automotive sector with domestic materials |

| XCarb Low-Carbon Steel Solutions | Star | 60.4% CAGR (Green Steel Market 2025-2032) | N/A (Segmental) | Addresses growing demand for sustainable materials |

| Liberian Iron Ore Operations | Star | 20 MT capacity by end of 2025 | N/A (Segmental) | Drives record production and enhances raw material self-sufficiency |

| Overall Strategic Growth Projects | Star | Incremental $2.1 billion EBITDA | $0.7 billion | Drives long-term profitability through decarbonization and optimization |

What is included in the product

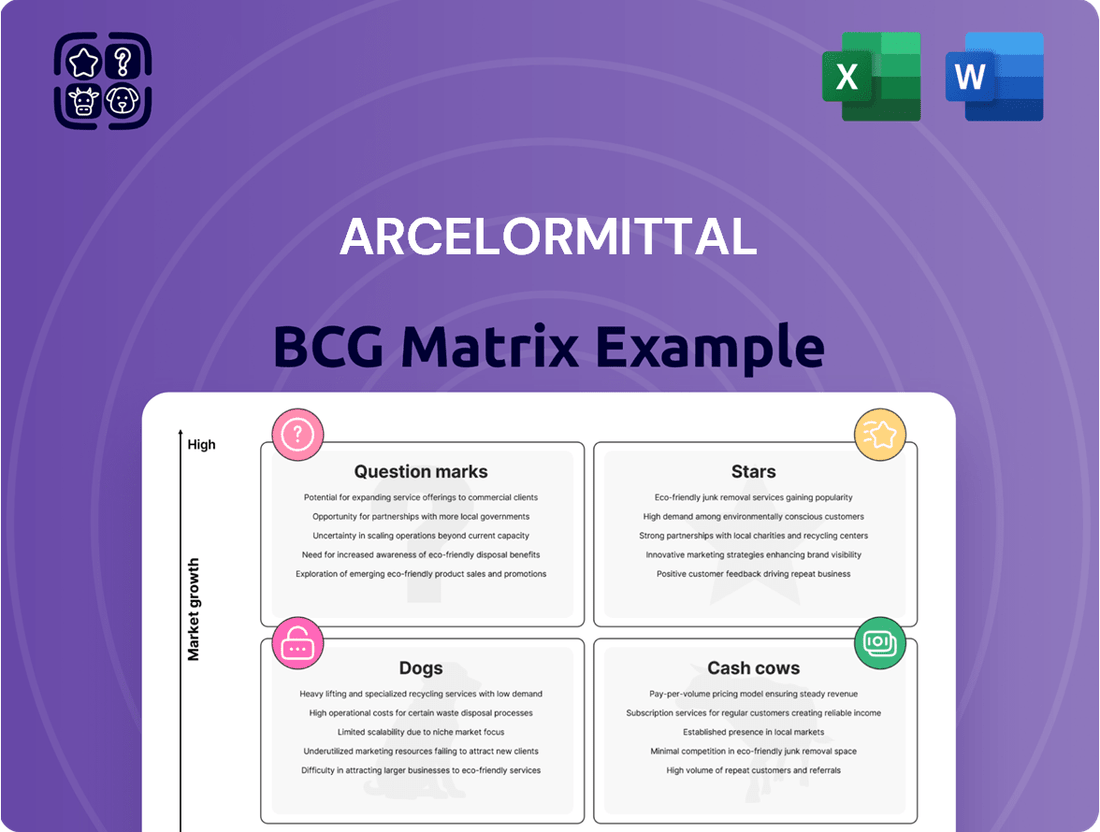

This BCG Matrix overview will detail ArcelorMittal's product portfolio, categorizing each unit as a Star, Cash Cow, Question Mark, or Dog.

A clear ArcelorMittal BCG Matrix overview, visually placing each business unit, simplifies complex portfolio analysis for strategic decision-making.

Cash Cows

ArcelorMittal's global integrated steel production stands as a prime Cash Cow. In 2024, the company solidified its position as the world's largest steel producer, churning out an impressive 57.9 million metric tonnes of crude steel. This massive output, generated from its extensive network of integrated steelmaking facilities across the globe, ensures a dominant market share in the mature steel industry.

The sheer scale and efficiency of these operations translate into a reliable and consistent stream of revenue and cash flow. This financial stability is crucial, as it underpins ArcelorMittal's ability to fund other strategic initiatives and investments within its diverse portfolio.

ArcelorMittal's extensive steel product range, serving industries like automotive, construction, and packaging, firmly positions these offerings as Cash Cows. These mature markets benefit from ArcelorMittal's significant global presence and deep customer ties, ensuring a consistent revenue stream.

The company's established product lines benefit from stable demand across these varied sectors, translating into predictable profit margins and robust cash flow generation. For instance, in 2023, ArcelorMittal reported a net income of $2.4 billion, reflecting the consistent performance of its core, mature businesses.

ArcelorMittal's mature European operations are a significant Cash Cow. Despite some pricing challenges, these established businesses provide a steady stream of income. Europe's sales remained stable at $7.2 billion in the first quarter of 2025, reflecting a mature market where ArcelorMittal maintains a strong presence.

The company's strategy in Europe centers on optimizing existing assets and diversifying within the region. This approach helps ensure consistent profit margins and robust cash flow generation from these long-standing operations.

Established Mining Operations (Non-Expansion)

ArcelorMittal's established mining operations, particularly its iron ore and coal assets, represent a significant Cash Cow. In 2024, these operations demonstrated their strength by producing 42.4 million tonnes of iron ore. This consistent output ensures a reliable and cost-efficient supply of essential raw materials for the company's extensive steel production, directly bolstering profitability.

These mature mining assets hold a substantial market share in raw material sourcing. This dominance minimizes ArcelorMittal's reliance on external suppliers, thereby reducing supply chain risks and significantly improving overall operational efficiency. The stability and predictability of these cash flows are crucial for funding other strategic initiatives within the company.

- Stable Production: 42.4 million tonnes of iron ore produced in 2024.

- Cost Efficiency: Provides a cost-effective supply of raw materials.

- Reduced Dependency: High market share in raw material sourcing.

- Profitability Driver: Contributes significantly to overall company profits.

North American Operations (Excluding New EAF)

ArcelorMittal's established North American operations, excluding the new Calvert EAF, function as a Cash Cow within the company's portfolio. These facilities benefit from a strong market presence and a mature customer base, generating consistent cash flow.

Despite some challenges from tariffs, this segment showed resilience. In the first quarter of 2025, North American sales grew by 9.6%. This growth was fueled by an increase in steel shipments, indicating a recovery from earlier supply chain issues.

The robust cash generation from these operations, while subject to market fluctuations, supports the company's overall financial stability. This segment's ability to deliver steady returns makes it a vital component of ArcelorMittal's business strategy.

- Established Market Position: ArcelorMittal's North American facilities outside the Calvert EAF hold a significant share in a mature market.

- Sales Growth: The region achieved 9.6% sales growth in Q1 2025, outperforming expectations.

- Operational Recovery: Increased steel shipments in Q1 2025 point to the resolution of supply chain disruptions.

- Cash Flow Generation: The segment provides a reliable, though variable, source of cash flow for the company.

ArcelorMittal's global integrated steel production, a cornerstone of its operations, exemplifies a Cash Cow. The company's massive output, reaching 57.9 million metric tonnes of crude steel in 2024, secures a dominant position in the mature steel market, ensuring consistent revenue and cash flow to fund other ventures.

The established product lines, serving critical sectors like automotive and construction, are also strong Cash Cows. These mature markets, supported by ArcelorMittal's extensive global reach and customer relationships, yield predictable profit margins and robust cash generation, evidenced by a net income of $2.4 billion in 2023.

ArcelorMittal's mature European operations, despite market dynamics, consistently contribute as a Cash Cow, with Q1 2025 sales holding steady at $7.2 billion. This stability is maintained through asset optimization and diversification within the region, ensuring reliable profit margins.

The company's iron ore and coal mining assets are significant Cash Cows, with 42.4 million tonnes of iron ore produced in 2024. This consistent, cost-efficient raw material supply reduces external dependency and directly boosts profitability.

Established North American operations, excluding the new Calvert EAF, act as Cash Cows, showing resilience with Q1 2025 sales up 9.6% due to increased shipments. This segment provides a stable, albeit variable, cash flow essential for the company's financial health.

| Business Segment | BCG Category | Key Metric (2024/Q1 2025) | Significance |

|---|---|---|---|

| Global Integrated Steel Production | Cash Cow | 57.9 million tonnes crude steel (2024) | Dominant market share, consistent revenue |

| Established Product Lines (Auto, Construction) | Cash Cow | $2.4 billion net income (2023) | Predictable profit margins, robust cash flow |

| European Operations | Cash Cow | $7.2 billion sales (Q1 2025) | Stable income, optimized assets |

| Mining Operations (Iron Ore, Coal) | Cash Cow | 42.4 million tonnes iron ore (2024) | Cost-efficient raw materials, reduced dependency |

| North American Operations (Excl. Calvert EAF) | Cash Cow | 9.6% sales growth (Q1 2025) | Resilient cash flow, increased shipments |

What You See Is What You Get

ArcelorMittal BCG Matrix

The ArcelorMittal BCG Matrix preview you are viewing is the complete, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, crafted by industry experts, offers a detailed breakdown of ArcelorMittal's business units, categorizing them into Stars, Cash Cows, Question Marks, and Dogs based on market share and growth rate. The report is fully editable and ready for immediate integration into your strategic planning, providing actionable insights for resource allocation and future investment decisions.

Dogs

ArcelorMittal's Zenica integrated steel plant and Prijedor iron ore mining business in Bosnia are prime examples of underperforming divested assets within its BCG matrix. These operations faced significant challenges, leading to impairments and eventual divestment decisions.

These units likely occupied a low market share within slow-growing markets, fitting the description of Dogs. Their divestment signals ArcelorMittal's strategic move to streamline its portfolio, shedding assets that were potentially cash traps and hindering overall financial efficiency.

For instance, in 2023, ArcelorMittal reported a net loss of $1.6 billion, partly influenced by the performance of such legacy assets and the challenging global steel market. The decision to divest these Bosnian operations aims to free up capital and management focus for investment in higher-growth and more profitable ventures.

Certain older or less efficient legacy steelmaking facilities within ArcelorMittal's vast portfolio, particularly those in fragmented or highly competitive low-growth markets, can be categorized as Dogs. These operations might struggle with high operating costs and low market share, making them unprofitable and candidates for restructuring or closure. For instance, ArcelorMittal has been actively managing its European footprint, with reports in early 2024 indicating a review of certain facilities facing significant cost pressures and declining demand.

ArcelorMittal's segments heavily reliant on exports to the U.S. market face significant headwinds due to U.S. tariffs. These tariffs directly impact segments shipping high-value-added materials from Canada and Mexico, leading to reduced shipments and profitability. The company has projected the financial impact from these U.S. tariffs to reach $150 million in 2025.

Products Facing Unsustainably Low Spreads

ArcelorMittal's Q1 2025 results highlighted specific steel products and regional sales experiencing unsustainably low spreads, where selling prices were barely covering production costs. This situation, particularly if associated with a low market share, strongly suggests 'Dog' characteristics within their product portfolio. These offerings are likely generating minimal profits and could be tying up valuable capital without delivering adequate returns, a common trait of underperforming assets.

The pressure on these spreads is often exacerbated in highly commoditized steel segments or in geographical markets grappling with significant overcapacity. For instance, reports from early 2025 indicated that certain flat steel products in specific European regions were trading at levels that offered very little margin, making them prime candidates for the Dog category if their market penetration remained low.

- Low Profitability: Products with selling prices barely above cost, as observed in some flat steel segments in Q1 2025, indicate minimal profit generation.

- Capital Tie-up: These low-margin products can immobilize capital that could be better invested in higher-growth or higher-margin areas of the business.

- Market Saturation: Intense competition and overcapacity in certain steel markets, particularly in commoditized areas, contribute to the downward pressure on spreads.

- Strategic Review: Products exhibiting Dog characteristics often warrant a strategic review, potentially leading to divestment, restructuring, or a focused effort to improve market position and profitability.

Outdated Production Technologies

ArcelorMittal’s continued reliance on legacy production technologies, particularly in certain older facilities, presents a significant challenge. These outdated methods often lead to higher greenhouse gas emissions and lower energy efficiency when compared to contemporary steelmaking processes. For instance, blast furnace operations, while still crucial, are inherently more carbon-intensive than electric arc furnaces (EAFs). In 2023, ArcelorMittal reported that its blast furnace operations accounted for the majority of its Scope 1 and 2 emissions, highlighting the environmental and operational cost implications of these older technologies.

The economic viability of these outdated units is increasingly questionable as global markets demand more sustainable and cost-effective steel. Facilities struggling with lower yields and higher input costs due to older machinery find it difficult to compete. ArcelorMittal’s strategic investments, such as the planned EAF in Hamburg, Germany, which aims for a 70% reduction in CO2 emissions compared to traditional methods, underscore a clear move away from these less efficient legacy processes. This strategic pivot is essential for long-term competitiveness and meeting decarbonization targets.

The implications for ArcelorMittal’s BCG Matrix positioning are clear. Production units still heavily dependent on outdated technologies would likely fall into the Dogs category. These segments are characterized by low market share in a growing sustainable steel market and low growth potential without significant capital investment for modernization.

- Higher Emissions: Legacy blast furnace operations contribute significantly to ArcelorMittal's carbon footprint.

- Lower Efficiency: Outdated technologies result in reduced energy efficiency and higher operational costs.

- Competitive Disadvantage: These units struggle to compete on cost and sustainability against modern steelmaking.

- Strategic Divestment/Modernization: ArcelorMittal's focus on EAFs signals a move away from these legacy assets.

ArcelorMittal's "Dogs" in the BCG matrix represent business units or products with low market share in slow-growing or declining markets. These are often legacy assets or less competitive product lines that consume resources without generating significant returns. The company's strategy involves managing or divesting these to focus on more promising areas.

For example, certain older, less efficient steelmaking facilities within ArcelorMittal's portfolio, particularly those in highly competitive, low-growth markets, fit the Dog profile. These units may struggle with high operating costs and low yields, making them candidates for restructuring or divestment. ArcelorMittal's Q1 2025 results showed some steel products with unsustainably low spreads, barely covering production costs, indicating Dog characteristics if their market penetration is also low.

The company's strategic moves, such as divesting underperforming integrated steel plants and iron ore mining businesses, like those in Bosnia, exemplify the management of Dog assets. These divestments free up capital and management attention for investment in higher-growth, more profitable ventures. The financial impact of U.S. tariffs on certain segments, projected at $150 million in 2025, also highlights how external factors can push even previously viable segments towards Dog status if profitability erodes significantly.

| ArcelorMittal Business Segment/Product | BCG Matrix Category (Likely) | Reasoning | Key Data/Indicators |

|---|---|---|---|

| Legacy Bosnian Steel Operations | Dog | Underperforming, divested assets facing significant challenges. | Impairments, eventual divestment decisions. |

| Certain Older European Steel Facilities | Dog | High operating costs, low market share in slow-growth markets. | Facing cost pressures and declining demand (early 2024 reports). |

| Specific Steel Products with Low Spreads (Q1 2025) | Dog | Selling prices barely cover production costs, indicating low profitability. | Low profit margins, capital tie-up, market saturation. |

| Production Units Reliant on Outdated Technologies | Dog | Low market share in sustainable steel market, low growth potential without modernization. | Higher emissions, lower energy efficiency, competitive disadvantage. |

Question Marks

ArcelorMittal's exploration into hydrogen-based green steel production, exemplified by its pilot project in Brazil to generate hydrogen from blast-furnace waste gases, positions it within the question mark category of the BCG matrix. This initiative directly supports their broader commitment to utilizing green hydrogen for direct-reduced iron (DRI) production, a key pathway for decarbonizing steelmaking.

While the potential for high growth and significant emissions reduction is undeniable, the technology remains in its nascent stages of adoption, resulting in a currently low market share for this specific production method. Substantial capital investment is crucial for scaling these green steel endeavors, with widespread integration of green hydrogen in steelmaking generally anticipated to mature beyond 2030.

ArcelorMittal's new facility in Calvert, Alabama, focused on producing non-grain-oriented electrical steel (NOES), is currently positioned as a Question Mark in its BCG Matrix. This strategic move targets the burgeoning electric vehicle (EV) market, a sector experiencing significant growth and demand for specialized materials like NOES.

The critical role of NOES in EV powertrains and other advanced electrical applications signifies a high-potential market. For instance, the global EV market is projected to reach over 30 million units in 2024, a substantial increase from previous years, directly fueling demand for components manufactured using NOES.

However, as a nascent product line for ArcelorMittal, the NOES venture begins with a low market share. The success of this Question Mark hinges on significant investment in production capacity and a smooth operational ramp-up to capture a meaningful share of this expanding market and potentially transition into a Star product.

ArcelorMittal's early-stage renewable energy ventures in India, while aligned with the company's broader sustainability goals, are positioned as Question Marks within the BCG Matrix. These are investments in a high-growth sector, crucial for supporting sustainable steel production and reducing operational carbon footprints. For instance, ArcelorMittal is actively pursuing solar and wind power projects to meet its energy needs.

While the renewable energy market in India is expanding rapidly, with the solar power capacity alone projected to reach 300 GW by 2030 according to government targets, ArcelorMittal's direct market share in energy generation is still developing. These ventures require significant ongoing investment to scale up, gain market traction, and achieve profitability, characteristic of a Question Mark's need for strategic evaluation and potential future growth.

Investments via XCarb Innovation Fund

ArcelorMittal's XCarb Innovation Fund actively pursues investments in promising decarbonization technologies. For instance, a $5 million investment was made in Utility Global, a company focused on advanced recycling and carbon capture solutions.

These strategic investments are geared towards identifying and nurturing innovative, high-potential solutions essential for the steel industry's transition to net-zero emissions. While these ventures are in their nascent stages, often involving early development or pilot programs, they represent ArcelorMittal's commitment to future-proofing its operations.

- Investment Focus: Targeting early-stage, high-growth potential technologies for steel decarbonization.

- Example: $5 million invested in Utility Global for carbon reduction technologies.

- Current Stage: Investments are typically in early development or pilot phases, indicating inherent uncertainty.

- Future Potential: Success hinges on further funding, technological advancement, and successful commercialization for integration into ArcelorMittal's core business.

Exploration of New Geographic Markets or Niches

ArcelorMittal's strategic moves into new geographic markets or specialized product areas where its presence is currently limited are best categorized as Question Marks in the BCG Matrix. These initiatives require significant capital investment for market entry, brand building, and establishing distribution networks, much like the initial stages of a Question Mark's lifecycle.

For instance, ArcelorMittal's continued investment in developing markets or focusing on high-strength steel for the automotive sector, where its market share might be nascent, exemplifies this. In 2024, the company continued its focus on expanding its presence in Africa, a region offering significant long-term growth potential for steel demand, particularly in infrastructure and construction.

- Pursuit of Emerging Opportunities: ArcelorMittal actively seeks out regions and product segments with high growth potential but low current market penetration.

- Cash Consumption for Growth: Entry into these new markets necessitates substantial investment in infrastructure, sales, and marketing, draining current cash reserves.

- Potential for Future Stars: Successful penetration and market development in these areas could transform them into high-growth, high-market-share Stars for ArcelorMittal.

- Leveraging Global Footprint: The company's extensive global operations provide the intelligence and operational capacity to identify and capitalize on these emerging market opportunities.

ArcelorMittal's investments in emerging green steel technologies, such as hydrogen-based production and renewable energy projects in India, are prime examples of Question Marks. These initiatives are in high-growth potential sectors but currently hold a low market share for ArcelorMittal, requiring substantial capital for scaling.

The company's foray into producing non-grain-oriented electrical steel (NOES) for the booming EV market also falls into this category. While the EV market is expanding rapidly, with over 30 million units projected for 2024, ArcelorMittal's NOES production is a new venture needing significant investment to capture market share.

The XCarb Innovation Fund's investments, like the $5 million in Utility Global, represent bets on early-stage decarbonization technologies. These ventures, though promising for future net-zero goals, are inherently uncertain and require further development and commercialization to become established business units.

ArcelorMittal's expansion into new geographic markets, such as Africa in 2024, also fits the Question Mark profile. These moves demand considerable investment for market entry and brand establishment, with the potential to become future Stars if successful.

| Initiative | BCG Category | Market Potential | Current Market Share | Investment Needs |

|---|---|---|---|---|

| Hydrogen-based Green Steel | Question Mark | High (Decarbonization) | Low | High (Scaling Technology) |

| Non-Grain-Oriented Electrical Steel (NOES) | Question Mark | High (EV Market Growth) | Low (New Product Line) | High (Capacity Expansion) |

| Renewable Energy Ventures (India) | Question Mark | High (Energy Transition) | Low (Developing Presence) | High (Project Development) |

| XCarb Innovation Fund Investments | Question Mark | High (Decarbonization Tech) | Low (Early Stage) | High (Seed/Growth Funding) |

| New Geographic Markets (e.g., Africa) | Question Mark | High (Infrastructure Growth) | Low (Market Entry) | High (Market Penetration) |

BCG Matrix Data Sources

Our ArcelorMittal BCG Matrix is constructed using a blend of internal financial disclosures, industry growth forecasts, and competitive market analysis to provide a comprehensive view of their business units.