ArcelorMittal Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

ArcelorMittal Bundle

ArcelorMittal operates in a highly competitive steel industry, where intense rivalry among existing players significantly impacts profitability. Understanding the bargaining power of both suppliers and buyers is crucial for ArcelorMittal's strategic planning.

The threat of new entrants and the availability of substitute products also pose considerable challenges, shaping the industry's landscape. Ready to move beyond the basics? Get a full strategic breakdown of ArcelorMittal’s market position, competitive intensity, and external threats—all in one powerful analysis.

Suppliers Bargaining Power

ArcelorMittal's reliance on concentrated sources for critical raw materials like iron ore and coking coal significantly amplifies supplier bargaining power. The global market for these inputs is dominated by a handful of major mining corporations, granting them considerable leverage over pricing and supply volumes. For instance, in 2024, the top five iron ore producing companies accounted for over 70% of global output, creating a situation where ArcelorMittal has fewer viable options for securing its vast material needs.

Energy, including electricity and natural gas, along with logistics like shipping and rail, are significant expenses for steelmakers. In 2024, global energy prices saw considerable volatility, impacting ArcelorMittal's operational costs. For instance, the cost of electricity, a primary input for electric arc furnaces, can fluctuate significantly based on regional supply and demand dynamics.

Disruptions in transportation networks, whether due to geopolitical events or infrastructure issues, directly affect the cost and availability of raw materials and finished goods. In 2023, shipping costs experienced a notable increase, impacting ArcelorMittal's landed costs for imported materials. This reliance on stable and affordable energy and transportation services grants these suppliers considerable bargaining power.

Suppliers of highly specialized machinery and advanced steelmaking technology, such as those providing advanced rolling mills or sophisticated process control systems, wield significant bargaining power over ArcelorMittal. The proprietary nature and high cost of these assets, often requiring substantial upfront investment and specialized integration, restrict ArcelorMittal's ability to easily switch suppliers without incurring considerable costs and operational disruptions.

Labor Unions and Skilled Workforce

The bargaining power of suppliers, particularly concerning labor, is a significant factor for ArcelorMittal. The availability of a skilled workforce and the influence of labor unions in key operating regions directly impact production costs and operational flexibility.

Strong labor unions can negotiate for higher wages, improved benefits, and better working conditions, which can lead to increased labor expenses for ArcelorMittal. For instance, in 2023, ArcelorMittal's total employee costs amounted to approximately $11.1 billion USD, reflecting the significant impact of labor on its financial performance. The specialized nature of steel production often means that a shortage of highly skilled labor can further empower workers, giving them greater leverage in negotiations.

- Skilled Labor Dependency: Steel manufacturing requires specialized skills, making a readily available pool of qualified workers crucial for efficient operations.

- Union Influence: In many of ArcelorMittal's operating regions, powerful labor unions are established, capable of influencing wage rates and employment terms.

- Cost Implications: Union-negotiated wage increases and benefits directly contribute to ArcelorMittal's operating expenses, potentially impacting profitability.

- Operational Flexibility: Union agreements can sometimes limit management's flexibility in areas such as staffing levels, work assignments, and production scheduling.

Environmental Compliance and Regulatory Services

Suppliers of environmental compliance technologies, waste management services, and regulatory consulting firms are gaining leverage as environmental regulations tighten worldwide. ArcelorMittal's focus on sustainable steel production means substantial investments in these sectors, highlighting the critical need for dependable and efficient suppliers. Failure to comply can result in hefty fines, amplifying the significance of these specialized services.

The increasing stringency of environmental laws, for instance, the European Union's ambitious Green Deal aiming for climate neutrality by 2050, directly impacts heavy industries like steel. This creates a stronger bargaining position for suppliers who can offer innovative solutions for emissions reduction, water treatment, and hazardous waste disposal. Companies like ArcelorMittal must secure these services to avoid substantial penalties and maintain operational continuity.

- Increased Demand for Green Technologies: As global emissions targets become more aggressive, demand for advanced pollution control equipment and carbon capture technologies rises, empowering suppliers in this niche.

- Regulatory Complexity: Navigating a complex web of international and local environmental regulations requires specialized expertise, giving regulatory consulting firms greater influence.

- Cost of Non-Compliance: The financial repercussions of environmental breaches, including fines and reputational damage, compel companies like ArcelorMittal to prioritize compliance, thereby strengthening supplier bargaining power.

- Supplier Consolidation: In some specialized environmental service sectors, a limited number of providers can lead to market consolidation, further enhancing supplier negotiation strength.

ArcelorMittal faces significant supplier bargaining power due to its reliance on a concentrated number of providers for essential raw materials like iron ore and coking coal. The dominance of a few major mining companies globally, such as BHP and Rio Tinto, grants them considerable leverage over pricing and supply, as evidenced by their substantial share of global output in 2024. This situation limits ArcelorMittal's options and strengthens the suppliers' position in negotiations.

What is included in the product

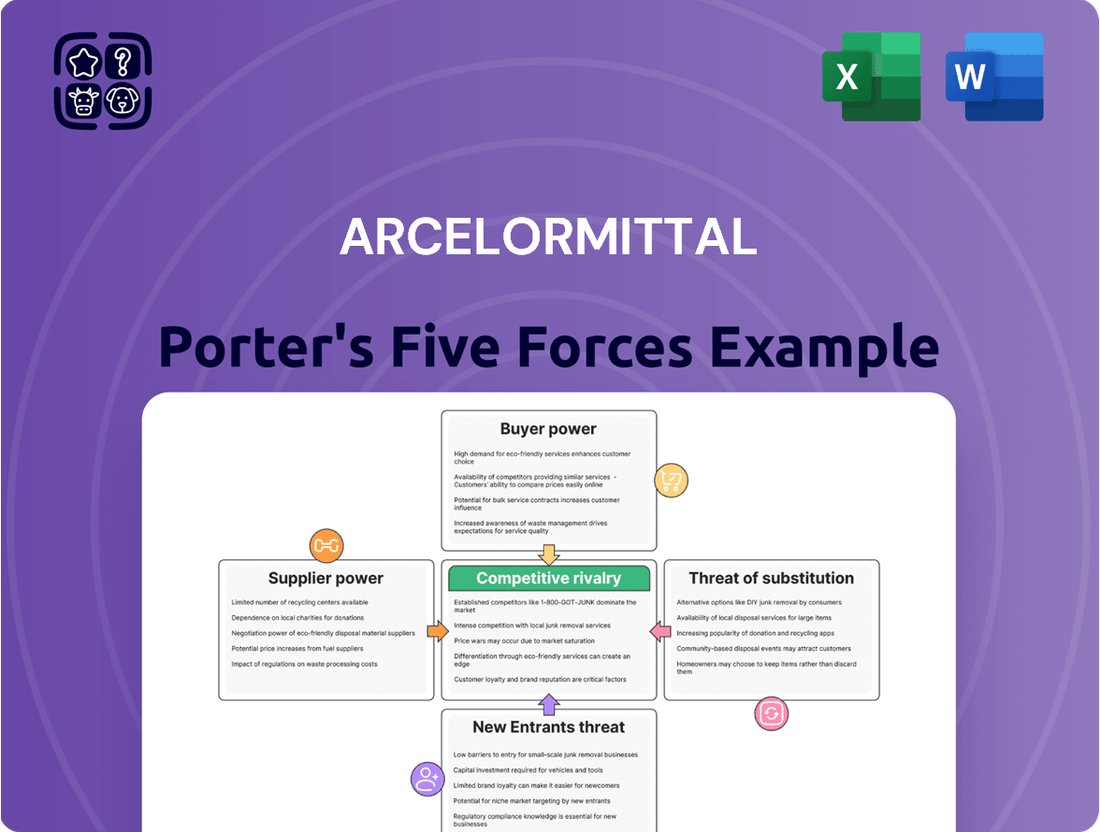

This analysis delves into the competitive forces impacting ArcelorMittal, examining the bargaining power of buyers and suppliers, the threat of new entrants and substitutes, and the intensity of rivalry within the global steel industry.

Instantly visualize the competitive landscape of the steel industry, pinpointing key threats and opportunities for ArcelorMittal.

Customers Bargaining Power

ArcelorMittal's major customers, especially in the automotive and construction industries, frequently procure steel in massive quantities. These substantial orders grant these buyers considerable influence in negotiating pricing, delivery schedules, and product details. Their capacity to redirect significant business to rival steel producers can put downward pressure on ArcelorMittal's profitability.

When ArcelorMittal's steel products are largely standardized, like many basic steel grades, customers have a greater ability to negotiate. This is because it's easier for them to switch to a competitor if pricing isn't favorable, as the product itself is largely interchangeable. This price sensitivity is a key factor in their bargaining power.

In 2023, the global steel market saw significant price fluctuations, with benchmark prices for hot-rolled coil in the US hovering around $750-$850 per ton for much of the year. This indicates that while there are market dynamics, the underlying commodity nature of many steel products allows buyers to exert pressure on pricing when supply is ample or demand softens.

The automotive sector, a significant consumer of steel, is characterized by a highly concentrated customer base. Major global automakers, such as Toyota, Volkswagen, and General Motors, represent a substantial portion of demand. In 2024, these companies' purchasing power allows them to negotiate aggressively on price and demand highly specific product configurations, directly impacting ArcelorMittal's profitability.

Backward Integration Potential

Some major steel consumers, particularly those with substantial volume requirements, could theoretically possess the financial muscle and operational expertise to explore backward integration. This means they might consider producing their own steel, thereby reducing their reliance on suppliers like ArcelorMittal.

While the immense capital investment and technical know-how required make this a rare occurrence in practice, the mere possibility of such a move significantly bolsters customer bargaining power. It compels ArcelorMittal to maintain a competitive edge in both pricing and service delivery to retain these key accounts.

- Potential for Backward Integration: Large customers might have the financial capacity to produce steel in-house.

- Threat, Not Always Reality: The high capital cost of steel production often limits actual backward integration.

- Impact on ArcelorMittal: This threat pressures ArcelorMittal to offer competitive pricing and superior customer service.

Global Supply Chain Diversification

Customers, particularly large multinational corporations, are actively diversifying their steel procurement across various global regions. This strategic move aims to mitigate supply chain disruptions and secure more competitive pricing. For instance, in 2024, major automotive manufacturers increased their sourcing from emerging markets, seeking cost advantages and alternative supply routes.

This global diversification significantly bolsters the bargaining power of these customers. By having access to a wider array of steel producers, they reduce their dependence on any single supplier, including major players like ArcelorMittal. This increased leverage allows them to negotiate more favorable terms, such as lower prices and extended payment periods.

- Increased Sourcing Options: In 2024, the global steel market saw a notable increase in the number of active suppliers, particularly from Asia and Eastern Europe, offering customers more choices.

- Price Sensitivity: Customers are increasingly sensitive to price fluctuations, using competitive quotes from multiple suppliers to drive down costs.

- Risk Mitigation: Diversification is a key strategy to avoid single-point-of-failure risks in supply chains, a concern heightened by geopolitical events in recent years.

- Negotiating Leverage: The ability to switch suppliers easily gives customers considerable power to demand better contract conditions.

The bargaining power of ArcelorMittal's customers remains a significant force, particularly for large-volume buyers in industries like automotive and construction. These customers leverage their substantial order sizes to negotiate favorable pricing and delivery terms, with the ability to shift business to competitors exerting downward pressure on ArcelorMittal's margins. The commoditized nature of many steel products further empowers buyers, as switching suppliers becomes relatively easy when prices are not competitive.

In 2024, major automotive manufacturers, a key customer segment, continued to wield considerable influence. Their concentrated purchasing power allows them to demand highly specific product configurations and aggressive pricing. For example, the global automotive industry's demand for advanced high-strength steels (AHSS) necessitates close collaboration and price negotiation, directly impacting ArcelorMittal's sales strategies.

The trend of customers diversifying their steel procurement across global regions in 2024 also amplified their bargaining power. By sourcing from a wider array of suppliers, including those in emerging markets, these buyers reduce their reliance on any single producer, thereby gaining greater leverage to secure better contract conditions and mitigate supply chain risks.

| Customer Segment | Key Negotiating Factors | Impact on ArcelorMittal |

|---|---|---|

| Automotive Manufacturers | Volume, Product Specifications, Price | Pressure on pricing, need for product innovation |

| Construction Companies | Large Order Volumes, Delivery Timelines | Negotiating power on bulk purchases, potential for price concessions |

| Distributors/Service Centers | Price, Inventory Management, Lead Times | Competition on pricing, importance of efficient logistics |

Full Version Awaits

ArcelorMittal Porter's Five Forces Analysis

This preview showcases the complete ArcelorMittal Porter's Five Forces Analysis, detailing the competitive landscape and strategic positioning of the global steel giant. You are viewing the exact, professionally formatted document you will receive instantly upon purchase, providing a comprehensive understanding of industry rivalry, buyer and supplier power, and the threat of substitutes and new entrants. This is your ready-to-use analysis, offering actionable insights without any placeholders or hidden content.

Rivalry Among Competitors

The global steel industry is grappling with substantial overcapacity, a situation particularly pronounced with producers in Asia. This persistent imbalance between supply and demand fuels fierce price competition, directly impacting ArcelorMittal's ability to implement price increases.

In 2023, global steel production reached an estimated 1.89 billion metric tons, according to the World Steel Association. A significant portion of this output originates from regions with considerable production capacity exceeding domestic demand, leading to a surplus in the international market.

This oversupply environment forces steelmakers, including ArcelorMittal, into aggressive pricing strategies to secure sales and maintain market share. The pressure to utilize existing capacity often outweighs the desire for higher profit margins per unit, intensifying rivalry.

ArcelorMittal navigates a highly competitive market, facing pressure from global integrated steelmakers like Nippon Steel and Baowu Steel, as well as significant regional players such as POSCO and Thyssenkrupp. These larger competitors often benefit from economies of scale and established supply chains, directly challenging ArcelorMittal's market position across various product lines.

In addition to these giants, ArcelorMittal also contends with a multitude of smaller, more specialized mills. These niche producers can be agile, focusing on specific high-value steel products or serving particular geographic markets, thereby carving out distinct competitive advantages and fragmenting market share. For instance, in 2024, the global steel market saw continued price volatility, with regional disparities in demand and production costs further intensifying competition.

The steel industry, including major players like ArcelorMittal, is inherently capital-intensive. This means significant upfront investment is required for plants, machinery, and technology, resulting in substantial fixed costs. For instance, building a new integrated steel mill can cost billions of dollars. These high fixed costs create a powerful incentive for companies to maintain high production levels, even when demand falters, to spread these costs over a larger output and avoid losses.

This pressure to operate at capacity intensifies competition. Companies are less likely to cut production significantly during economic downturns, leading to a persistent supply that can depress prices. Furthermore, the steel sector faces high exit barriers. Steel plants are specialized assets, making them difficult and costly to repurpose or sell. This immobility means that even companies struggling financially often remain in the market, contributing to ongoing oversupply and fierce rivalry among established players.

Product Differentiation Challenges

ArcelorMittal faces significant hurdles in differentiating its product offerings, particularly within the realm of standard steel grades. While the company invests in developing advanced steel types, competitors frequently manage to replicate these innovations or introduce comparable products. This dynamic often forces ArcelorMittal into price-sensitive competition, eroding potential margins.

The challenge is amplified because the ability to stand out through specialized alloys or superior customer service, while crucial, is not easily sustained across the broad spectrum of their product portfolio. For instance, in 2023, the global steel industry saw intense price pressures, with benchmark hot-rolled coil prices in many regions fluctuating significantly, underscoring the difficulty of maintaining premium pricing based on differentiation alone.

- Limited Differentiation in Standard Steel: Competitors can often replicate ArcelorMittal's innovations in basic steel products, leading to intense price competition.

- Replication of Innovations: The ease with which competitors can match advanced steel grades limits ArcelorMittal's ability to command premium prices based solely on product features.

- Importance of Niche Markets: Success in differentiation hinges on specialized alloys and exceptional customer service, areas that are challenging to scale universally and maintain a competitive edge.

Geopolitical and Trade Policy Impacts

ArcelorMittal's competitive rivalry is significantly shaped by geopolitical shifts and trade policies. Tariffs, quotas, and anti-dumping duties directly impact steel prices and market access, creating an uneven competitive landscape. For instance, in 2024, the European Union continued to maintain its steel import safeguard measures, which cap duty-free imports from various countries, influencing ArcelorMittal's pricing strategies and market share within the bloc.

These trade interventions can lead to retaliatory measures from affected nations, further intensifying competition. ArcelorMittal, operating across numerous countries, is particularly vulnerable to these policy shifts. For example, trade disputes between major economies in 2024 could reroute global steel flows, potentially creating oversupply in certain regions and pressuring ArcelorMittal's profitability in those markets.

- Global Trade Policy Volatility: Geopolitical tensions and evolving trade agreements in 2024 directly affect steel import/export dynamics.

- Tariff and Quota Impact: Trade barriers implemented by countries like the United States and the European Union in 2024 altered cost structures and market access for ArcelorMittal.

- Retaliatory Actions: Trade disputes can trigger counter-tariffs, leading to price volatility and reduced demand for ArcelorMittal's products in affected regions.

- Market Distortion: Policy-driven price distortions create an uneven playing field, impacting ArcelorMittal's ability to compete on cost and quality alone.

ArcelorMittal faces intense rivalry due to global steel overcapacity, particularly from Asian producers, which suppresses prices. The industry's capital-intensive nature and high exit barriers compel companies to maintain high production, exacerbating competitive pressures. Limited product differentiation for standard steel grades forces many players, including ArcelorMittal, into price-driven competition, especially as innovations are often quickly replicated by rivals.

| Key Competitor | 2023 Revenue (USD Billions, Approx.) | Key Markets | 2024 Outlook Considerations |

| Nippon Steel | $45.0 | Asia, North America, Europe | Capacity utilization, technological advancements |

| Baowu Steel | $110.0 | Asia (dominant), global exports | Government support, scale efficiencies |

| POSCO | $28.0 | Asia, North America | Specialty steel development, sustainability initiatives |

| Thyssenkrupp | $35.0 | Europe, North America | Decarbonization efforts, restructuring impact |

SSubstitutes Threaten

Aluminum presents a potent threat, particularly in automotive manufacturing where its lightweight properties enhance fuel efficiency and extend the range of electric vehicles. For instance, in 2024, the automotive sector continued its push for lighter materials, with aluminum body components becoming increasingly common in new models aiming for improved performance metrics.

In the packaging arena, aluminum cans directly challenge steel counterparts. As sustainability and weight reduction remain paramount for brands, the continued preference for aluminum could chip away at steel's established market share in beverage and food containers throughout 2024 and beyond.

Advanced plastics and composite materials are increasingly posing a threat to traditional steel usage. In construction, for instance, these materials offer benefits like lighter weight and superior corrosion resistance, making them attractive alternatives in certain applications. By 2024, the global composites market was valued at over $100 billion, indicating significant adoption.

While composites may not directly replace steel in all structural roles, their growing sophistication and cost-competitiveness, especially in consumer goods and non-load-bearing construction elements, chip away at steel's market share. The design flexibility of these advanced materials further enhances their appeal.

Wood and engineered timber products present a notable threat of substitution for steel in certain construction sectors, especially residential and light commercial building. For instance, the global engineered wood market was valued at approximately USD 15.7 billion in 2023 and is projected to grow, indicating a rising preference for these materials.

The increasing focus on sustainability and the use of renewable resources in construction further bolsters the appeal of timber. This trend can potentially siphon demand away from steel in applications where wood can effectively replace steel framing and structural elements, impacting ArcelorMittal's market share in these segments.

Concrete and Masonry in Infrastructure

For substantial infrastructure projects, including bridges, dams, and specific building designs, concrete and masonry continue to present themselves as practical alternatives to steel. These materials, while frequently employed together, are seeing advancements that could potentially lessen the need for steel in certain structural roles.

Innovations in concrete, such as the development of high-strength or self-healing varieties, are particularly noteworthy. For instance, the global market for advanced concrete, including self-healing concrete, was projected to reach billions of dollars by 2024, indicating significant investment and adoption in construction sectors. This technological progress might allow concrete to replace steel in some load-bearing applications, thereby increasing the threat of substitution for steel in infrastructure.

- Advancements in Concrete Technology: High-strength and self-healing concrete offer enhanced durability and reduced maintenance, potentially substituting steel in certain structural components.

- Infrastructure Project Suitability: Concrete and masonry are established alternatives for large-scale projects like bridges and dams, where their material properties are well-suited.

- Market Trends: The growing market for advanced concrete materials suggests increasing competition for traditional steel applications in infrastructure by 2024.

Emerging Materials and Technologies

The threat of substitutes is amplified by ongoing advancements in materials science. Emerging materials like advanced ceramics and graphene composites, while not yet mainstream, pose a long-term risk. These innovations could eventually offer performance or cost benefits that displace steel in certain applications.

For instance, the global advanced ceramics market was valued at approximately USD 45.6 billion in 2023 and is projected to grow significantly. This growth indicates increasing adoption of materials that could compete with steel in sectors like automotive and aerospace, particularly where lightweighting and high-temperature resistance are paramount. ArcelorMittal needs to actively track these developments.

- Emerging Materials: Advanced ceramics, graphene composites, and bio-based materials are developing rapidly.

- Potential Displacement: These new materials may offer superior performance or cost advantages over steel in specific uses.

- Market Growth: The advanced ceramics market alone was valued around USD 45.6 billion in 2023, showing increasing viability of alternatives.

- Strategic Imperative: ArcelorMittal must continuously monitor and adapt to these material science innovations to mitigate future threats.

The threat of substitutes for steel is multifaceted, impacting ArcelorMittal across various sectors. Lightweight metals like aluminum are gaining traction in automotive for fuel efficiency, with aluminum body components becoming more prevalent in 2024 models. In packaging, aluminum cans continue to challenge steel's dominance, driven by sustainability and weight concerns.

Advanced plastics and composites offer superior corrosion resistance and lighter weight, making them attractive alternatives in construction, with the global composites market exceeding $100 billion in 2024. Engineered timber is also a growing substitute in residential construction, valued at approximately USD 15.7 billion in 2023, appealing to the demand for renewable resources.

Concrete and masonry remain viable substitutes for steel in large infrastructure projects, with innovations in high-strength and self-healing concrete, a market projected to reach billions by 2024, potentially reducing steel's role in load-bearing applications. Emerging materials like advanced ceramics, valued at USD 45.6 billion in 2023, and graphene composites pose long-term risks due to their potential performance and cost advantages.

| Substitute Material | Key Applications | Market Data Point (Approximate) | Impact on Steel |

|---|---|---|---|

| Aluminum | Automotive (body panels), Packaging (cans) | Increasing prevalence in 2024 automotive models | Reduces demand in lightweighting applications |

| Advanced Plastics & Composites | Construction (non-load-bearing), Consumer Goods | Global composites market > $100 billion (2024) | Corrosion resistance and lightweight benefits displace steel |

| Engineered Timber | Residential & Light Commercial Construction | Global engineered wood market ~ USD 15.7 billion (2023) | Sustainability focus shifts demand from steel framing |

| Advanced Concrete | Infrastructure (bridges, dams) | Market projected to reach billions by 2024 | Potential replacement in load-bearing roles |

| Advanced Ceramics | Automotive, Aerospace | Global advanced ceramics market ~ USD 45.6 billion (2023) | Long-term threat due to performance advantages |

Entrants Threaten

The threat of new entrants in the steel industry, particularly for integrated producers like ArcelorMittal, is significantly dampened by high capital intensity. Establishing a modern, integrated steelmaking facility demands an astronomical upfront investment, often running into billions of dollars. For instance, constructing a new greenfield integrated steel plant can easily cost upwards of $10 billion, requiring extensive infrastructure for raw material handling, blast furnaces, basic oxygen furnaces, continuous casting, and rolling mills.

This prohibitive cost acts as a formidable barrier to entry. Potential competitors must possess access to vast financial resources and a robust business case to even consider such an undertaking. In 2024, the global steel industry continues to see consolidation, with smaller players struggling to compete, further emphasizing the capital requirements needed to achieve economies of scale and technological parity.

ArcelorMittal, as a global leader, leverages substantial economies of scale in its operations. This means they can produce and distribute steel at a much lower cost per unit than a smaller, new competitor could hope to achieve. For instance, in 2023, ArcelorMittal's crude steel production volume was approximately 70.2 million metric tons, a scale that allows for significant purchasing power and optimized logistics.

New entrants face a formidable barrier due to the immense capital required to match these cost efficiencies. Without achieving ArcelorMittal's production volumes, new companies would operate at a significant cost disadvantage, making it incredibly challenging to compete on price in the global steel market.

The steel industry faces substantial regulatory burdens, particularly concerning environmental compliance. New entrants must invest heavily in advanced pollution control technologies and navigate complex permitting processes, which can be both time-consuming and expensive. For instance, in 2024, the European Union continued to strengthen its Emissions Trading System (ETS), impacting carbon-intensive industries like steel production and requiring significant upfront capital for compliance.

Access to Raw Materials and Distribution Channels

Securing consistent and affordable access to key raw materials like iron ore and coking coal presents a significant hurdle for new entrants. Established players, including ArcelorMittal, often leverage long-term supply agreements or own captive mines, providing a cost advantage and supply chain stability. For instance, in 2024, ArcelorMittal's integrated mining operations significantly contributed to its cost competitiveness.

Furthermore, developing robust and efficient distribution networks to serve a global customer base is a substantial undertaking. Building the infrastructure and relationships necessary to deliver finished steel products reliably and cost-effectively requires considerable investment and time. Newcomers would find it difficult to replicate the extensive logistical capabilities that incumbents have cultivated over years.

- Raw Material Sourcing: New entrants face challenges in securing long-term, cost-effective contracts for iron ore and coking coal, unlike established firms with captive mines.

- Distribution Network: Building a global, efficient distribution system for steel products requires immense capital and time, a barrier for newcomers.

- Incumbent Advantages: Existing players like ArcelorMittal benefit from established supply chains and logistical expertise, making it hard for new entrants to compete on these fronts.

Brand Loyalty and Established Relationships

While steel might seem like a basic commodity, ArcelorMittal benefits from strong brand loyalty and deep-rooted customer relationships. These connections, built over years of reliable supply and consistent product quality, particularly for specialized steel products, create a significant barrier for newcomers. New entrants face the considerable challenge of not only matching product offerings but also earning the trust and loyalty that ArcelorMittal already commands, a process that can take years and substantial investment.

These established relationships are critical. For instance, in the automotive sector, a key consumer of steel, manufacturers often have long-term contracts and intricate supply chain integrations with their preferred suppliers. ArcelorMittal's ability to consistently deliver specific grades of steel that meet stringent automotive standards, coupled with its established logistical network, makes it difficult for a new entrant to displace them. This loyalty translates into a reduced threat from new entrants, as they must offer a compelling value proposition that goes beyond just price to break into these established markets.

- Brand Loyalty: Customers often stick with ArcelorMittal due to a history of reliable performance and specialized product offerings.

- Established Relationships: Long-standing partnerships with key industries like automotive and construction create significant switching costs for buyers.

- Supply Chain Reliability: ArcelorMittal's robust supply chain infrastructure is a key differentiator that new entrants struggle to replicate quickly.

- Perceived Product Quality: For specialized steel grades, the perceived quality and consistency offered by ArcelorMittal foster customer loyalty.

The threat of new entrants in the integrated steel sector, impacting ArcelorMittal, is generally low due to immense capital requirements, estimated at over $10 billion for a new greenfield plant. Furthermore, stringent environmental regulations, like the EU's Emissions Trading System in 2024, necessitate significant upfront investment in pollution control. Established players also benefit from economies of scale, with ArcelorMittal producing around 70.2 million metric tons in 2023, creating a substantial cost advantage for newcomers.

Securing raw materials and building efficient distribution networks are further barriers. ArcelorMittal's captive mines and established logistics provide a competitive edge that new entrants would struggle to replicate. Customer loyalty, particularly in sectors like automotive, built on years of reliable supply and specialized product quality, also deters new competition.

| Barrier | Description | Impact on New Entrants |

|---|---|---|

| Capital Intensity | Building a new integrated steel plant costs over $10 billion. | Prohibitive cost, requires vast financial resources. |

| Economies of Scale | ArcelorMittal's 2023 production: ~70.2 million metric tons. | New entrants face higher per-unit costs. |

| Regulatory Compliance | Stricter environmental rules (e.g., EU ETS in 2024). | Requires significant investment in pollution control. |

| Raw Material Access | Established players have captive mines/long-term contracts. | New entrants face higher input costs and supply uncertainty. |

| Distribution Networks | Global logistics infrastructure is extensive and costly to build. | New entrants lack efficient delivery capabilities. |

| Customer Loyalty/Relationships | Long-standing partnerships, especially in automotive. | Difficult for new players to gain market share. |

Porter's Five Forces Analysis Data Sources

Our ArcelorMittal Porter's Five Forces analysis is built upon a foundation of robust data, including ArcelorMittal's annual reports, investor presentations, and public filings. We supplement this with industry-specific market research reports and data from leading financial information providers to capture the competitive landscape.