Aramark SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aramark Bundle

Aramark's diverse service offerings present significant strengths in a stable market, but also expose potential weaknesses in operational efficiency and brand perception. Understanding these internal capabilities and external threats is crucial for navigating the competitive landscape.

Want the full story behind Aramark's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Aramark's strength lies in its remarkably diversified service portfolio, touching key sectors like education, healthcare, business, and sports. This wide reach means they aren't overly dependent on just one industry, which is a big plus for keeping revenue steady, especially when one sector might be struggling. For instance, in fiscal year 2023, Aramark reported revenues of $21.5 billion, showcasing the scale and breadth of their operations across these varied markets.

Aramark's ability to keep its existing clients happy is a major plus. In the second quarter of 2025, they managed to retain over 98% of their clients, showing just how satisfied customers are and how reliable their income stream is. This high retention rate is a clear sign of their strong service delivery and customer loyalty.

Adding to this strength, Aramark has also been successful in bringing in new business. Major wins in the first quarter of 2025, including contracts with giants like Walmart and General Dynamics, underscore the company's competitive edge. These new partnerships not only boost revenue but also expand Aramark's reach and influence in key markets.

Aramark's financial performance is a significant strength, highlighted by a record $17.4 billion in revenue for fiscal 2024. This was coupled with a robust 20% surge in adjusted operating income, demonstrating strong profitability. The company anticipates this positive momentum to continue into fiscal 2025.

Looking ahead to fiscal 2025, Aramark projects impressive organic revenue growth in the range of 7.5% to 9.5%. This optimistic outlook is underpinned by strategic initiatives focused on enhancing operational efficiencies and optimizing its supply chain. Furthermore, a strengthened balance sheet, bolstered by a $500 million share repurchase program, provides a solid foundation for sustained growth and shareholder value.

Advanced Technology and Innovation Adoption

Aramark's commitment to advanced technology is a significant strength, particularly evident in its investment in AI. The Hospitality IQ platform is a prime example, integrating AI to refine guest experiences and boost operational efficiency across its diverse service sectors. This forward-thinking approach positions Aramark at the forefront of tech-driven hospitality solutions.

The company is actively deploying innovative technologies like AI-powered chatbots for customer service and exploring autonomous retail options to streamline operations. Furthermore, Aramark utilizes sophisticated supply chain analytics to optimize its resource management, ensuring greater cost-effectiveness and service quality. These technological advancements are key differentiators in the competitive landscape.

- AI Integration: Hospitality IQ platform enhances guest services and operational efficiency.

- Autonomous Solutions: Exploring autonomous retail for streamlined service delivery.

- Data Analytics: Advanced supply chain analytics improve resource management and cost control.

- Innovation Focus: Positions Aramark as a leader in technology-enabled hospitality.

Commitment to Sustainability and Responsible Practices

Aramark's robust commitment to sustainability and responsible practices is a significant strength, underscored by clearly defined environmental, social, and governance (ESG) goals. The company has set ambitious targets, including science-based greenhouse gas (GHG) reduction goals validated by the Science Based Targets initiative (SBTi). Furthermore, Aramark actively pursues initiatives aimed at reducing food waste and phasing out single-use plastics, demonstrating a tangible effort towards environmental stewardship.

This dedication extends beyond environmental concerns, encompassing responsible sourcing, diversity, equity, and inclusion (DEI), and meaningful community engagement. These efforts have not gone unnoticed, leading to multiple industry recognitions that bolster Aramark's brand reputation and appeal to increasingly conscious consumers and stakeholders. For instance, in 2023, Aramark was recognized by Forbes as one of America's Best Large Employers, highlighting its positive social impact.

- Science-Based Targets: Validated GHG reduction goals align with global climate efforts.

- Waste Reduction: Initiatives targeting food waste and single-use plastics show environmental commitment.

- Responsible Sourcing: Ethical procurement practices enhance supply chain integrity.

- DEI and Community: Strong focus on diversity, equity, inclusion, and community impact builds brand loyalty.

Aramark's diversified service portfolio across education, healthcare, and business sectors provides stability, as evidenced by its $21.5 billion revenue in fiscal year 2023. This broad reach minimizes reliance on any single industry, ensuring a more consistent revenue stream. The company's strong client retention, exceeding 98% in Q2 2025, highlights exceptional service delivery and customer satisfaction.

What is included in the product

Provides a clear SWOT framework for analyzing Aramark’s business strategy, highlighting its internal capabilities and market challenges.

Identifies key internal weaknesses and external threats, allowing Aramark to proactively address operational challenges and mitigate risks for smoother service delivery.

Weaknesses

Aramark, like many in the food and facilities services sector, often contends with thin operating margins. This means even a small increase in costs can significantly impact profitability. For instance, in fiscal year 2023, Aramark reported an adjusted operating income margin of 5.9%, a notable improvement but still indicative of the industry's inherent margin pressures.

While Aramark has been working to expand its margins, the business model itself presents challenges. Fluctuations in labor costs, food prices, and energy expenses can quickly erode profits. The company's ability to consistently grow these margins, especially in the face of economic headwinds, remains a key area to monitor.

Aramark's reliance on long-term contracts, while providing stability, also presents a weakness. The company's financial performance is heavily tied to the successful renewal of these agreements, which are not guaranteed and can be influenced by various external factors.

The company's performance is also susceptible to economic conditions. For instance, a slowdown in sectors like education or healthcare, where Aramark has a significant presence, could lead to clients reducing their spending or seeking less expensive service options, thereby pressuring contract renewals and overall revenue.

Aramark's extensive reliance on a workforce exceeding 266,000 individuals presents significant labor relations challenges. The company faces ongoing pressures from union negotiations, which can influence wage structures and operational flexibility. Furthermore, rising wage demands and potential workforce shortages in the service industry directly impact Aramark's cost base and its ability to consistently deliver high-quality services across its diverse operations.

Exposure to Food Price Volatility and Supply Chain Risks

Aramark's significant footprint in food services exposes it to the unpredictable nature of food commodity prices and potential disruptions within the global supply chain. Even with established efficiencies, sharp, unforeseen hikes in ingredient costs or logistical breakdowns pose a tangible threat to the company's earnings. For instance, in fiscal year 2023, the Consumer Price Index for food away from home saw an increase, highlighting ongoing inflationary pressures that can directly affect Aramark's cost of goods sold.

These vulnerabilities can directly impact profitability, as demonstrated by the challenges faced by many food service providers during periods of high inflation. While Aramark aims to mitigate these risks through strategic sourcing and operational adjustments, the sheer scale of its operations means that widespread supply chain issues or significant price spikes for key ingredients, such as beef or dairy, could still strain margins. The company's reliance on a complex network of suppliers globally means that geopolitical events or natural disasters can trigger unforeseen cost increases or shortages.

- Food Price Volatility: Fluctuations in commodity markets for items like meat, poultry, and produce can directly increase operating expenses.

- Supply Chain Disruptions: Events such as labor shortages, transportation issues, or geopolitical instability can impede the timely and cost-effective delivery of essential food supplies.

- Impact on Profitability: Unexpected increases in ingredient costs or the inability to secure necessary supplies can lead to reduced profit margins if these costs cannot be fully passed on to clients.

- Reliance on Global Sourcing: A significant portion of ingredients are sourced internationally, increasing exposure to currency fluctuations and international trade policy changes.

Intense Competition in a Fragmented Market

Aramark faces a crowded landscape with major global competitors such as Compass Group, Sodexo, and ISS, alongside many smaller regional providers. This intense rivalry can lead to price wars and force constant innovation in service delivery to stand out. For instance, in the competitive contract catering sector, securing large-scale contracts often involves aggressive bidding, potentially impacting profit margins.

The fragmented nature of the market means that while Aramark is a significant player, no single entity holds a dominant share across all segments. This can make market share growth a challenging endeavor, as opportunities are often spread across numerous smaller deals rather than a few massive ones. This dynamic requires a highly adaptable sales and operational strategy to effectively compete for and retain business.

Aramark's considerable workforce, exceeding 266,000 employees, presents ongoing labor relations challenges. Union negotiations can impact wage structures and operational flexibility, and rising wage demands, coupled with potential service industry labor shortages, directly affect the company's cost base and service consistency.

The company's extensive reliance on food services exposes it to volatile food commodity prices and supply chain disruptions. Unforeseen hikes in ingredient costs or logistical breakdowns, such as those seen with increased food away from home prices in fiscal year 2023, can directly impact earnings if not passed on to clients.

Intense competition from global players like Compass Group and Sodexo, as well as numerous regional providers, can lead to price wars and necessitate continuous service innovation, potentially impacting profit margins on secured contracts.

Aramark's financial performance is significantly tied to the renewal of long-term contracts, which are not guaranteed and can be influenced by economic downturns in sectors like education and healthcare, leading clients to reduce spending.

Preview Before You Purchase

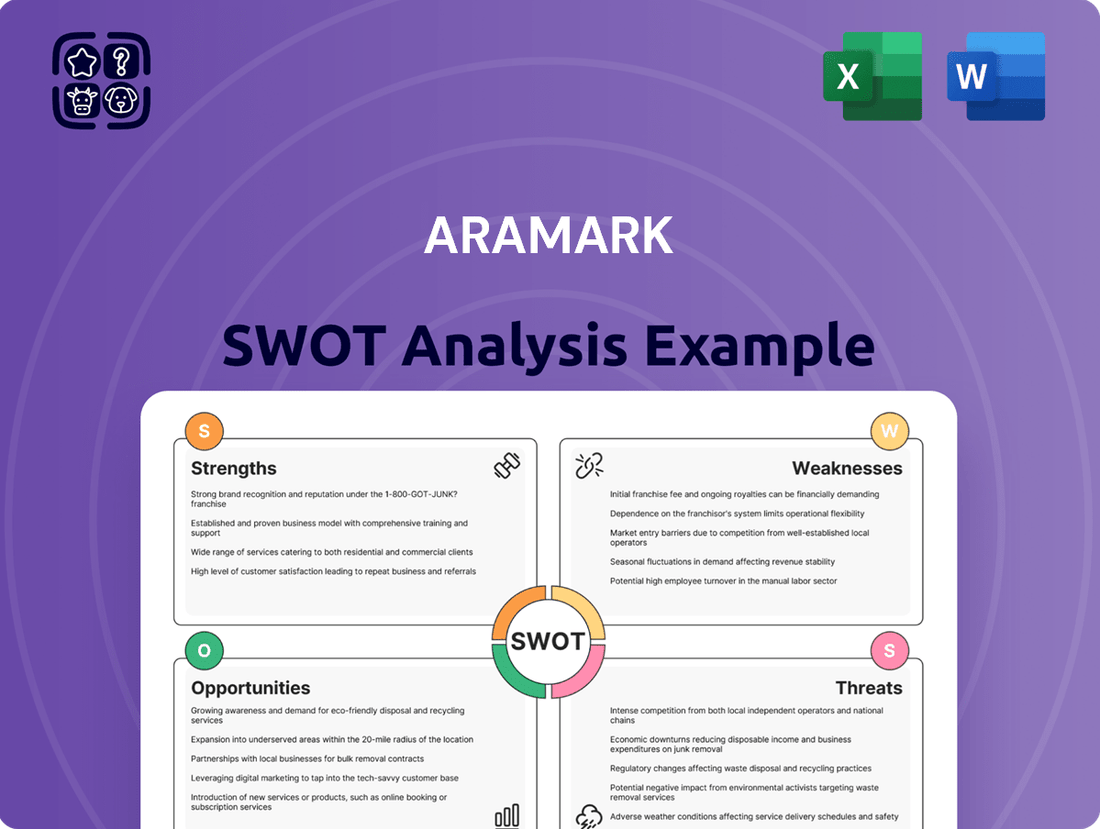

Aramark SWOT Analysis

This is the actual Aramark SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. You're getting a direct look at the comprehensive report, ready for your strategic planning needs.

Opportunities

Aramark's international segment has demonstrated robust organic growth, signaling significant opportunities for further global expansion. The company's proven operational expertise and varied service offerings position it well to explore strategic acquisitions or alliances to tap into rapidly expanding economies.

Aramark can significantly boost its operational efficiency and cut costs by investing more in advanced technologies like AI, automation, and data analytics. For instance, in 2023, companies across various sectors reported an average of 15% cost reduction through automation, a trend Aramark can capitalize on.

These technological advancements also pave the way for exciting new service offerings. Imagine personalized dining experiences tailored to individual preferences or smart facility management that proactively addresses maintenance needs, thereby increasing client satisfaction and loyalty.

The healthcare and education sectors offer Aramark significant growth avenues, driven by their inherently stable and expanding demand. For instance, the global healthcare market was valued at approximately $11.9 trillion in 2023 and is projected to reach $20.7 trillion by 2030, demonstrating robust expansion.

Aramark can capitalize on this by broadening its service footprint, especially in specialized nutritional programs tailored to patient needs and in providing comprehensive facilities management solutions that ensure safe and efficient environments within these critical institutions.

Focus on Sustainability and Health-Conscious Trends

The increasing consumer and client demand for sustainable, ethically sourced, and health-conscious food and facility solutions presents a significant opportunity for Aramark. By doubling down on Environmental, Social, and Governance (ESG) initiatives, the company can capture a larger market share and solidify its competitive standing.

Aramark can capitalize on this trend by:

- Expanding Plant-Based Offerings: A growing segment of the market actively seeks plant-based meals, aligning with health and sustainability goals.

- Implementing Robust Waste Reduction Programs: Demonstrating commitment to reducing food waste and packaging resonates with environmentally aware clients and consumers.

- Prioritizing Responsible Sourcing: Highlighting ethical sourcing practices for ingredients and materials can differentiate Aramark in a crowded marketplace.

- Promoting Health and Wellness: Developing and promoting menus and services that emphasize nutritional value and healthy choices directly addresses the health-conscious trend.

Strategic Acquisitions and Partnerships

Aramark can strategically acquire companies to broaden its service offerings, extend its global footprint, or capture greater market share in specialized sectors. For example, an acquisition could bolster its presence in the growing healthcare dining market, which saw significant investment in 2024.

Forming alliances with innovative technology firms or businesses offering complementary services presents another avenue for growth. These collaborations can introduce novel revenue streams and sharpen Aramark's competitive positioning by integrating advanced solutions, such as AI-driven operational efficiencies, which gained traction throughout 2024 and into early 2025.

- Expand Service Capabilities: Acquire specialized catering or facilities management firms to enhance existing client solutions.

- Increase Geographic Reach: Target companies with established operations in underpenetrated international markets.

- Gain Market Share: Pursue acquisitions in high-growth segments like university dining or sports and entertainment venues.

- Forge Technology Partnerships: Collaborate with tech providers to implement smart building solutions or data analytics platforms.

Aramark has a clear opportunity to expand its global reach, leveraging its operational expertise in growing economies. The company can also significantly boost efficiency and explore new service lines by investing in advanced technologies like AI and automation, mirroring the 15% cost reductions observed by other firms in 2023 due to automation. The healthcare and education sectors, projected to continue their substantial growth, offer stable demand for Aramark's services, especially in specialized nutrition and facility management.

Aramark's commitment to sustainability and health-conscious offerings presents a chance to capture a larger market share by expanding plant-based options and waste reduction programs. Strategic acquisitions or alliances with tech firms can further broaden service capabilities, geographic reach, and market share in high-growth segments, integrating solutions like AI-driven efficiencies which saw increased adoption through 2024 and early 2025.

| Opportunity Area | Key Action | Market Context/Data |

|---|---|---|

| Global Expansion | Leverage international growth, explore acquisitions in emerging markets. | International segment shows robust organic growth. |

| Technology Integration | Invest in AI, automation, data analytics for efficiency and new services. | Automation led to ~15% cost reduction in 2023 for various sectors. |

| Sector Focus | Deepen penetration in healthcare and education. | Global healthcare market valued at ~$11.9 trillion in 2023, projected to reach $20.7 trillion by 2030. |

| Sustainability & Wellness | Expand plant-based, reduce waste, prioritize ethical sourcing, promote healthy choices. | Growing consumer demand for ESG-aligned services. |

| Strategic Growth | Acquire complementary businesses or form tech partnerships. | Healthcare dining market saw significant investment in 2024. AI adoption increased through 2024-2025. |

Threats

Economic downturns, like the potential slowdowns anticipated in late 2024 and early 2025, pose a significant threat. Clients facing budget constraints may curb discretionary spending on services like premium dining or enhanced facility management, directly impacting Aramark's revenue streams. For instance, a 1% drop in consumer discretionary spending, a common reaction during recessions, could translate to millions in lost revenue for a company of Aramark's scale.

Periods of high inflation, which remained a concern through 2024, also pressure clients to seek more cost-effective solutions. This could lead to renegotiations of existing contracts, a reduction in the scope of services provided, or even outright contract losses as clients opt for cheaper alternatives. Such shifts directly affect Aramark's top-line growth and profitability, as seen in the increased client focus on cost optimization strategies throughout 2024.

The food and facilities services sector is incredibly competitive, with giants like Compass Group and Sodexo constantly vying for market share. This intense rivalry often translates into aggressive pricing tactics. For example, in 2023, the global contract catering market was valued at approximately $240 billion, and this intense competition means companies must be very strategic about their pricing to remain attractive.

This competitive landscape puts significant pressure on Aramark. They might be forced to reduce their prices or enhance the value of their services without a corresponding price increase. Such a scenario could directly impact their profit margins, making it harder to achieve their financial targets. In 2024, many companies in this sector reported tighter margins due to these pressures.

Aramark faces a significant threat from rising labor costs, exacerbated by increasing minimum wage mandates and a persistently tight labor market. For instance, in 2024, many states continued to implement phased minimum wage increases, impacting a substantial portion of Aramark's frontline workforce. This, coupled with a potential uptick in unionization efforts across the service industry, could drive up wages and benefits, directly pressuring the company's operating margins given its extensive employee base.

Supply Chain Disruptions and Inflationary Pressures

Global events, geopolitical tensions, and natural disasters are significant threats, capable of disrupting Aramark's supply chains. This can result in shortages of critical items like food and other essential supplies, directly impacting operational costs and availability. For instance, the ongoing impact of the Ukraine conflict has continued to affect global food commodity prices throughout 2024, a trend expected to persist into 2025.

Persistent inflationary pressures on food, energy, and labor present a considerable challenge for Aramark. If the company cannot effectively pass these rising costs onto its clients through existing contract terms, its profit margins could be significantly compressed. In Q1 2025, the US Bureau of Labor Statistics reported a 3.5% year-over-year increase in the Consumer Price Index for food away from home, a key input cost for Aramark.

- Supply Chain Vulnerability: Global disruptions can lead to shortages and price hikes for essential goods.

- Inflationary Impact: Rising costs for food, energy, and labor threaten to squeeze profit margins.

- Contractual Limitations: Inability to pass increased costs to clients via contract terms exacerbates margin pressure.

- Geopolitical and Environmental Risks: Ongoing global instability and climate-related events pose continuous threats to operational stability.

Reputational Risks and Food Safety Concerns

Aramark's extensive operations as a major food service provider expose it to significant reputational risks. Incidents involving food safety, such as contamination or outbreaks, can severely damage customer trust and lead to immediate contract terminations. For instance, a widely publicized foodborne illness outbreak at a client venue could result in substantial financial penalties and a long-lasting negative impact on Aramark's brand image, affecting its ability to secure new business.

Quality control failures, from poor food preparation to inconsistent service, also present a considerable threat. Negative reviews and social media complaints can quickly escalate, eroding client confidence and potentially leading to contract renegotiations or cancellations. Maintaining high standards across all service locations is crucial to mitigate these risks, as a single lapse can have widespread repercussions.

In 2024, the food service industry continues to face heightened scrutiny regarding hygiene and safety protocols. Aramark's commitment to robust food safety management systems, including advanced tracking and sanitation technologies, is paramount. The company's proactive approach to addressing these concerns, evidenced by its investments in employee training and quality assurance programs, directly combats the potential for negative publicity and its associated financial fallout.

The potential for reputational damage is amplified by the interconnectedness of its client relationships. A failure to uphold standards with one major client could create a ripple effect, impacting perceptions among other potential partners and the broader market. This underscores the critical need for consistent operational excellence and transparent communication regarding safety measures.

Aramark's reliance on a large, often lower-wage workforce makes it susceptible to rising labor costs. Increased minimum wage laws, as seen in various states throughout 2024, and a competitive labor market can drive up wages and benefits. For example, a 5% increase in average hourly wages for front-line staff could significantly impact operating expenses, especially given Aramark's substantial employee base.

Intense competition within the food and facilities services sector, with key rivals like Compass Group and Sodexo, forces Aramark into aggressive pricing strategies. This competitive pressure, evident in the global contract catering market valued at approximately $240 billion in 2023, can erode profit margins if cost increases cannot be passed on to clients. Companies in this space reported tighter margins in 2024 due to these dynamics.

Supply chain disruptions, stemming from geopolitical instability or natural disasters, pose a threat by causing shortages and price volatility for essential goods. The ongoing impact of global events on food commodity prices, which saw a 3.5% year-over-year increase in food away from home costs in Q1 2025 according to the BLS, directly affects Aramark's operational costs and service delivery.

Reputational damage from food safety incidents or quality control failures presents a critical threat. A single widely publicized foodborne illness outbreak could lead to substantial financial penalties and long-term brand damage, impacting client retention and new business acquisition. Maintaining stringent quality standards across all operations is paramount to mitigate these risks.

SWOT Analysis Data Sources

This Aramark SWOT analysis is built upon a foundation of credible data, drawing from Aramark's official financial reports, comprehensive market research, and insights from industry experts to ensure a robust and accurate strategic assessment.