Aramark Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aramark Bundle

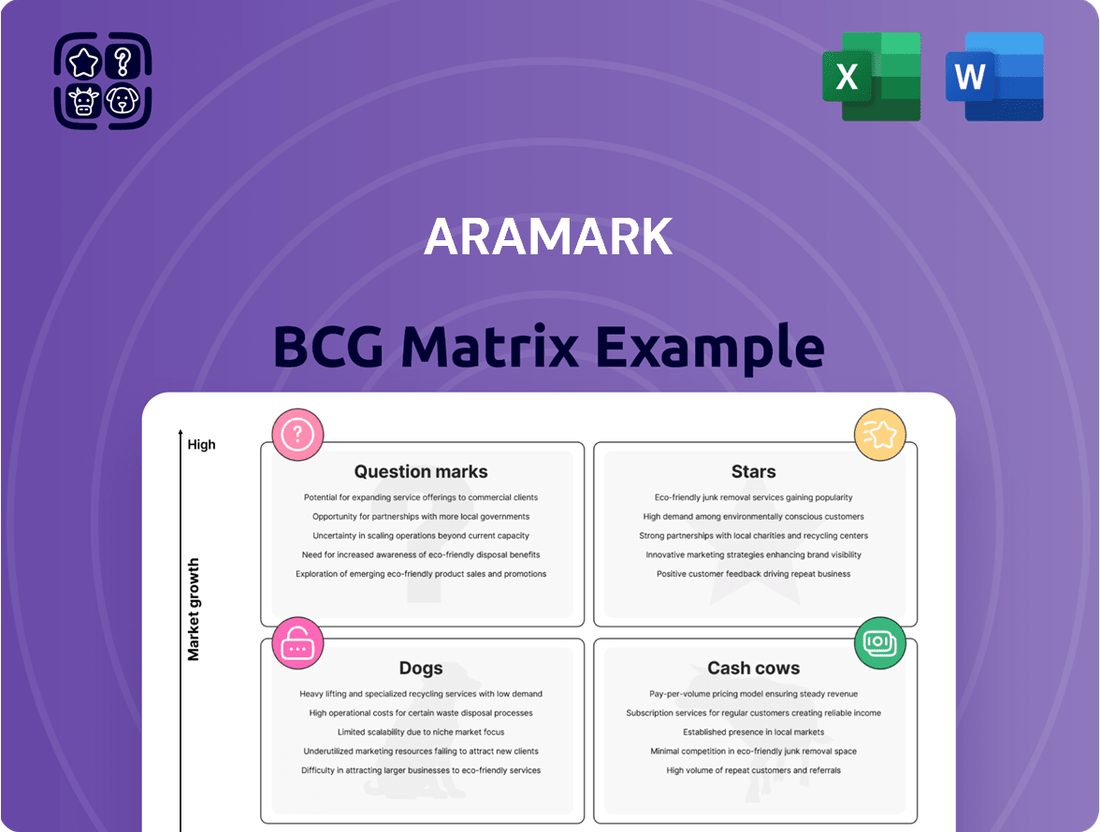

Curious about Aramark's strategic positioning? Our BCG Matrix preview offers a glimpse into their product portfolio, categorizing them as Stars, Cash Cows, Dogs, or Question Marks. Understand the foundational insights into their market share and growth potential. Purchase the full BCG Matrix for a comprehensive breakdown and actionable strategies to optimize Aramark's business performance.

Stars

Aramark's Food and Support Services (FSS) segments, encompassing both U.S. and international operations, have shown impressive organic revenue growth and strong profitability throughout fiscal 2024. This positive trend is anticipated to continue its upward trajectory into fiscal 2025, indicating a healthy and expanding business.

The driving forces behind this robust performance are multifaceted, including strong underlying volume in their core business, smart pricing adjustments, and significant success in securing new contracts. These factors collectively contribute to Aramark's expanding market share and revenue generation.

A key indicator of Aramark's success is its ability to win new business, with over $1.4 billion in annualized gross new business secured in fiscal 2024 alone. This substantial figure underscores their competitive advantage and strong position in growing markets.

Collegiate hospitality represents a significant growth avenue for Aramark, with projections pointing towards a robust recovery and acceleration of business throughout fiscal 2025. This segment is poised to benefit from renewed campus activity and evolving student needs.

Recent successes, including securing a new contract with Loyola Marymount University, underscore Aramark's expanding footprint and competitive strength within the collegiate sector. These wins are indicative of a healthy sales pipeline and successful market penetration strategies.

The expansion in collegiate hospitality is fueled by shifting student dining preferences towards more diverse and healthier options, alongside a persistent demand for integrated campus services. This dynamic environment creates opportunities for Aramark to innovate and deepen its client relationships.

Aramark's Sports & Entertainment division is a star performer, fueled by the enthusiastic return of fans and strategic new partnerships. The company's recent agreement to be the food and beverage provider for Nebraska Athletics Venues, announced in February 2025, highlights its success in landing significant contracts within this booming sector. This segment capitalizes on the demand for memorable fan experiences at large-scale events, securing a substantial market share in the expanding leisure industry.

Healthcare Food Services

Aramark is a significant player in the U.S. healthcare food services market, holding the third-largest share. This sector is experiencing robust growth, fueled by a greater emphasis on patient-centric care and the crucial role of nutrition in patient recovery.

The demand for specialized dietary services and efficient food management in hospitals and healthcare facilities is on the rise. This presents a compelling opportunity for established providers like Aramark.

- Market Position: Aramark ranks as the third-largest provider in the U.S. healthcare food services market.

- Market Growth Drivers: Increasing demand for patient-centered care and improved nutrition for patient recovery are key growth factors.

- Aramark's Strength: The company's established infrastructure and commitment to high-quality food services position it as a leader in this vital segment.

International Market Growth

Aramark's international Food and Support Services (FSS) segment is a significant growth engine, demonstrating robust organic expansion. Key markets like Chile, Germany, and Canada have been particularly strong contributors to this growth. The company's ongoing efforts to broaden its global presence and secure new contracts abroad highlight substantial growth potential across various international landscapes. This strategic emphasis on international development firmly places these operations as Stars within Aramark's business portfolio.

- Chile: Aramark's operations in Chile have shown impressive organic growth, driven by strong demand in the mining and healthcare sectors.

- Germany: The German market represents a significant opportunity, with Aramark expanding its services in the business dining and facilities management sectors.

- Canada: Canada continues to be a vital market, with Aramark securing new large-scale contracts, particularly in the remote services and healthcare segments.

Aramark's international Food and Support Services (FSS) operations, particularly in Chile, Germany, and Canada, are exhibiting strong organic growth and are considered Stars. These segments are benefiting from expanding service offerings and successful new contract acquisitions in key sectors like mining, healthcare, and business dining.

The company's U.S. Sports & Entertainment division is also a Star, driven by the return of fans and strategic partnerships, evidenced by the February 2025 agreement with Nebraska Athletics Venues. This segment capitalizes on robust demand for event experiences.

Aramark's U.S. healthcare food services, where it holds the third-largest market share, are also performing strongly. Growth is fueled by increased focus on patient-centric care and the critical role of nutrition in recovery, presenting significant opportunities for the company.

| Business Segment | Growth Trajectory | Key Drivers | Fiscal 2024/2025 Outlook |

|---|---|---|---|

| International FSS | Star | Organic expansion, new contracts in mining (Chile), business dining (Germany), remote services (Canada) | Continued robust growth |

| U.S. Sports & Entertainment | Star | Fan engagement, new partnerships (e.g., Nebraska Athletics), demand for event experiences | Strong performance driven by event resurgence |

| U.S. Healthcare Food Services | Star | Patient-centric care, nutrition's role in recovery, market share growth | Benefiting from increased healthcare spending and service demand |

What is included in the product

This overview details Aramark's portfolio across the BCG Matrix, identifying growth opportunities and areas for strategic resource allocation.

A clear BCG matrix visualizes Aramark's portfolio, simplifying complex strategic decisions and alleviating the pain of resource allocation guesswork.

Cash Cows

Aramark's established food service contracts, particularly in education and business, are prime examples of Cash Cows. These long-standing agreements provide a consistent and substantial cash flow, requiring minimal additional investment for their upkeep.

The company's impressive client retention rate, which surpassed 95% for its core foodservice operations in fiscal 2024, underscores the stability and reliability of these revenue streams. This high retention signifies strong customer loyalty and predictable income, characteristic of a Cash Cow.

Aramark's large-scale facilities management, covering cleaning, operations, and maintenance for its established institutional clients, represents a mature and stable segment. This business is a classic cash cow, generating consistent revenue streams due to the essential nature of these services for large organizations. For instance, in fiscal year 2023, Aramark reported that its Facilities & Services segment, which includes these offerings, saw significant growth, demonstrating the ongoing demand and profitability of these core operations.

Aramark's procurement and supply chain operations are a significant driver of its success, supporting a vast network of food and facilities services. These mature functions generate substantial cost savings and efficiencies by leveraging the company's scale and strong supplier relationships. This optimized purchasing power directly contributes to Aramark's profit margins, providing a consistent, low-cost advantage.

Correctional Services Food Management

Aramark's Correctional Services Food Management segment functions as a robust Cash Cow within its portfolio. This division consistently generates significant revenue due to the inelastic demand for its services in correctional facilities, a market characterized by long-term, stable contracts. The operational efficiency and established infrastructure contribute to its reliable profitability.

The correctional services sector, a key area for Aramark, demonstrates the characteristics of a Cash Cow. While the growth rate in this segment might be moderate, its substantial market share and consistent demand ensure a steady stream of income. For instance, in fiscal year 2023, Aramark reported overall revenue growth driven by its diversified service offerings, with institutional sectors like corrections providing a foundational income base.

- Stable Revenue Generation: Correctional facilities require continuous food and operational services, creating predictable revenue streams for Aramark.

- Established Market Position: Aramark holds a significant share in this sector, benefiting from economies of scale and long-standing client relationships.

- Operational Efficiency: Mature operational models and supply chains in this segment contribute to consistent profit margins.

- Low Investment Needs: As a mature business, this segment typically requires less capital investment for growth compared to newer ventures.

Vending and Micro-Market Operations

Aramark's vending and micro-market operations, bolstered by strategic 2024 acquisitions such as Tomdra and SunDun, represent a significant cash cow. These established services generate a predictable and stable revenue stream, benefiting from a wide-ranging client base. The convenience and self-service nature of these offerings in diverse business and institutional environments ensure consistent cash flow, even as the market continues to adapt.

The company's commitment to these operations, evident in its recent acquisitions, highlights their role as a dependable income source. For instance, the integration of acquired businesses is expected to enhance Aramark's market share in the convenience food sector, contributing to its overall financial stability.

- Stable Revenue Base: Acquisitions in 2024, like Tomdra and SunDun, strengthen the existing vending and micro-market segment.

- Consistent Cash Flow: Broad client adoption in business and institutional settings ensures reliable income.

- Market Evolution: Despite market changes, the fundamental demand for convenient, self-serve food options remains robust.

- Strategic Importance: These operations serve as a foundational element for consistent financial performance.

Aramark's established food service contracts, particularly in education and business, are prime examples of Cash Cows. These long-standing agreements provide a consistent and substantial cash flow, requiring minimal additional investment for their upkeep, with client retention rates exceeding 95% in fiscal 2024 for core foodservice operations.

The company's large-scale facilities management, a mature segment, generates consistent revenue due to the essential nature of these services for large organizations, as evidenced by the segment's growth in fiscal year 2023.

Aramark's vending and micro-market operations, strengthened by 2024 acquisitions like Tomdra and SunDun, represent a significant cash cow, ensuring predictable revenue streams from a broad client base.

| Business Segment | BCG Matrix Category | Key Characteristics | Supporting Data (Fiscal 2024 unless noted) |

| Education & Business Foodservice Contracts | Cash Cow | Stable, predictable revenue, high client retention | Client retention > 95% |

| Facilities Management (Institutional) | Cash Cow | Mature, essential services, consistent income | Segment growth reported in FY2023 |

| Vending & Micro-Markets | Cash Cow | Predictable cash flow, broad client adoption, strategic acquisitions | Acquisitions of Tomdra and SunDun in 2024 |

Full Transparency, Always

Aramark BCG Matrix

The Aramark BCG Matrix you are previewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive analysis, designed for strategic decision-making, contains no watermarks or demo content, offering you a ready-to-use tool for evaluating Aramark's business units.

Dogs

Aramark's strategic decision in fiscal 2024 to exit lower-margin facilities accounts within its FSS United States operations aligns with a classic BCG Matrix divestment strategy for 'Dogs'. These divested accounts likely generated minimal profit and offered little prospect for future growth, making them inefficient users of company resources.

By shedding these underperforming segments, Aramark frees up capital and management attention to focus on higher-potential business areas, a crucial step for optimizing overall portfolio performance. This move is particularly relevant as Aramark navigates a competitive landscape where operational efficiency and strategic resource allocation are paramount for sustained profitability.

Underperforming legacy contracts represent Aramark's potential 'Dogs' in the BCG matrix. These are contracts that have become unprofitable due to shifts in market conditions, rising operational expenses, or declining client interest.

While Aramark does not publicly detail specific contracts, these would likely exhibit low market share in their particular service areas and possess limited future growth potential. For instance, if a contract for a specific type of food service in a declining industry segment is no longer cost-effective, it fits this profile.

Managing these contracts requires careful consideration, potentially involving renegotiation, cost reduction efforts, or even divestiture to free up resources for more promising ventures. For example, a legacy catering contract for an industry that has significantly downsized its workforce might fall into this category.

Non-strategic niche services within Aramark's portfolio represent offerings that haven't captured substantial market share or shown promising growth. These are often experimental ventures that didn't evolve into profitable segments, draining resources without significant revenue contribution.

For instance, a hypothetical niche catering service that Aramark might have tested in a limited geographic area could be categorized here if it failed to attract a broad customer base. Such services, if they haven't demonstrated a clear path to scalability or profitability, are typically candidates for divestment or discontinuation to reallocate capital to more promising areas.

In 2024, companies like Aramark are increasingly scrutinizing their service portfolios for efficiency. Services that consume disproportionate management attention or operational costs relative to their revenue generation are flagged. A study by McKinsey in early 2024 indicated that companies focusing on core competencies and divesting non-core, low-growth units often see improved profitability and shareholder returns.

Geographic Regions with Poor Performance

Geographic regions with poor performance for Aramark, fitting the 'Dogs' category in a BCG Matrix analysis, would represent areas where the company holds a low market share and faces a stagnant or declining market. These could be specific international markets where penetration has been challenging or domestic regions experiencing significant economic headwinds. For instance, while Aramark has a strong presence in North America, certain emerging markets might present difficulties in gaining traction due to established local players or regulatory hurdles.

In 2024, companies like Aramark often review their global footprint to identify underperforming segments. While specific regional data for Aramark's 'Dog' segments isn't publicly detailed in a way that directly maps to BCG classifications, general industry trends suggest that regions with lower disposable income or unstable political environments can pose significant challenges. For example, a hypothetical scenario could see Aramark struggling in a particular South American country where economic volatility impacts client spending on food and facilities services.

- Low Market Share: Difficulty in capturing significant customer bases in these identified regions.

- Limited Growth Potential: The overall market in these areas may not be expanding, or Aramark's ability to tap into that growth is severely hampered.

- Operational Inefficiencies: Challenges in logistics, supply chain management, or labor costs specific to these geographies could be contributing factors.

- Intense Local Competition: Established local service providers with deep market understanding and lower cost structures can make it hard for Aramark to compete effectively.

Outdated Service Models

Outdated service models are a significant concern for Aramark. If the company continues to offer services that don't align with today's client expectations for efficiency, technology integration, or environmental responsibility, these offerings could become problematic. For instance, if Aramark's food service contracts still rely on manual ordering systems or lack robust digital engagement platforms, they might struggle to retain clients who demand more modern solutions. This misalignment can lead to a shrinking market share and hinder overall growth potential.

Consider the potential impact on Aramark's financial performance. Services that fail to adapt to evolving industry trends, such as a lack of investment in sustainable sourcing or energy-efficient operations within their facilities management segment, could become cash traps. These underperforming units might require continuous investment to remain competitive, draining resources that could otherwise be allocated to more promising areas of the business. In 2023, the broader contract food services market saw increased demand for personalized digital ordering and healthier, sustainably sourced options, highlighting the need for continuous adaptation.

- Service Model Mismatch: Services failing to meet modern demands for efficiency, technology, and sustainability.

- Declining Market Share: Outdated models can lead to client attrition and reduced competitive positioning.

- Cash Trap Potential: Underperforming, unadapted services can drain financial resources without generating adequate returns.

- Industry Trend Neglect: Failure to incorporate advancements like digital engagement and sustainable practices poses a risk.

Aramark's strategic divestment of low-margin facilities accounts in fiscal 2024 exemplifies a 'Dog' strategy from the BCG Matrix. These divested segments likely had minimal profitability and limited growth prospects, acting as drains on resources. By shedding these underperforming areas, Aramark can reallocate capital and management focus to more promising business ventures, a critical move for optimizing its overall portfolio in a competitive market.

Question Marks

Aramark is making substantial investments in advanced facilities technology, including digital twinning, predictive analytics, and IoT sensors. These technologies are poised for high growth, offering significant potential for operational efficiency and cost savings within facilities management.

While the market for these cutting-edge solutions is expanding rapidly, Aramark's current market share in this specific segment is likely still in its nascent stages. Developing leadership and increasing adoption in this dynamic field requires considerable ongoing investment.

Aramark is strategically investing in new plant-based and sustainable food concepts, recognizing the significant growth potential in this sector. This includes introducing novel plant-forward options within their Sports + Entertainment venues and expanding their portfolio of certified Coolfood meals, aligning with consumer preferences for healthier and environmentally conscious dining choices. The company's commitment reflects a broader industry shift, with the plant-based food market projected to reach $162 billion by 2030, according to Bloomberg Intelligence.

Aramark's recent strategic acquisitions, like Entier in February 2025 and Heathland Hospitality Group in October 2024, highlight a push into emerging niches within contract catering and client-focused dining. These moves are designed to capture growth in expanding, albeit potentially fragmented, markets, aiming to solidify Aramark's presence and market share in these specialized areas.

First-Time Outsourcing Opportunities

Aramark is identifying significant opportunities in the first-time outsourcing market, where companies are increasingly looking to delegate services they previously managed in-house. This trend suggests a robust growth area for Aramark as it can leverage its expertise to capture new clients. For example, in 2024, the market for business process outsourcing (BPO) alone was projected to reach over $300 billion globally, highlighting the scale of this shift.

However, winning these first-time outsourcing contracts demands considerable upfront investment. Aramark must allocate resources to developing compelling proposals, educating potential clients on the benefits of outsourcing, and tailoring solutions to unique needs. This investment phase can be capital-intensive before a strong market position is solidified.

- High Growth Potential: First-time outsourcing represents a substantial new business pipeline for Aramark as more organizations embrace external service providers.

- Significant Initial Investment: Securing these deals requires upfront capital for proposals, client education, and customized solution development.

- Market Penetration Strategy: Aramark's success hinges on effectively demonstrating value and building trust with clients new to outsourcing.

- Industry Trends: The broader outsourcing market, valued in the hundreds of billions, underscores the significant demand for these services.

Expansion into Untapped International Segments

Expansion into untapped international segments for Aramark would position these ventures as potential Stars or Question Marks within the BCG Matrix, depending on their growth potential and current market share. These new markets require significant investment in brand building and operational adaptation. For example, entering a new African nation with limited existing food service infrastructure would necessitate substantial upfront capital for everything from supply chains to local hiring and training.

These initiatives demand considerable capital for market entry, infrastructure development, and localized service adaptation to achieve significant growth and market leadership. For instance, establishing a presence in a developing Asian market might involve building new catering facilities or acquiring smaller local players. Aramark's 2024 strategy could involve pilot programs in select regions to test market receptiveness and refine their service models before a larger rollout.

Key considerations for these ventures include:

- Market Research: Thorough analysis of consumer preferences, competitive landscape, and regulatory environments in target geographies.

- Capital Allocation: Significant investment required for market entry, potentially in the hundreds of millions for large-scale operations.

- Operational Adaptation: Tailoring service offerings, supply chains, and workforce management to local customs and conditions.

- Brand Building: Developing brand awareness and trust in markets where Aramark may be relatively unknown.

Aramark's ventures into new international markets represent classic Question Marks. These initiatives possess high growth potential due to unmet demand but currently hold a low market share. Significant investment is required to build brand recognition and adapt operations to local conditions, mirroring the substantial capital needed for market entry in developing economies.

These emerging segments, such as first-time outsourcing clients and new plant-based food concepts, are characterized by substantial upfront investment needs. While they offer promising growth trajectories, Aramark must allocate considerable resources to secure market penetration and establish a competitive foothold.

The company's strategic acquisitions in 2024 and 2025, targeting niche catering markets, further illustrate this Question Mark positioning. These moves aim to capture growth in expanding sectors, but success hinges on effectively integrating these new entities and scaling their operations, which inherently demands significant capital outlay.

Aramark's investment in advanced facilities technology, including digital twinning and IoT sensors, also falls into the Question Mark category. The market for these solutions is growing rapidly, but Aramark's current share is nascent, requiring sustained investment to achieve leadership and widespread adoption.

BCG Matrix Data Sources

Our Aramark BCG Matrix leverages a comprehensive blend of internal financial reports, customer satisfaction surveys, and competitive market analysis to provide a clear strategic view.