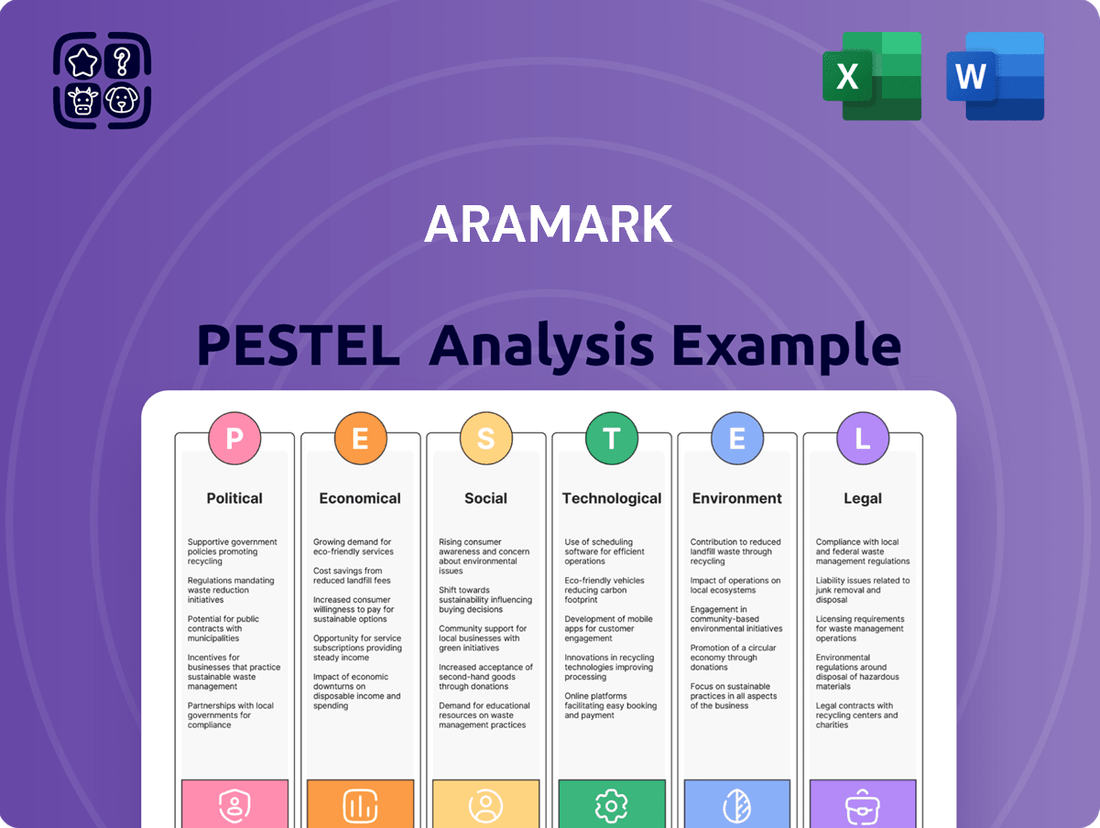

Aramark PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aramark Bundle

Uncover how political shifts, economic volatility, and evolving social trends are impacting Aramark's operational landscape. Our PESTLE analysis provides a critical look at these external forces, offering insights essential for strategic planning. Download the full version to gain a competitive edge and navigate the complexities of Aramark's market.

Political factors

Aramark navigates a landscape heavily shaped by government regulations, particularly in food safety and healthcare. For instance, in 2024, the U.S. Food and Drug Administration (FDA) continued its focus on enhancing food traceability and preventing foodborne illnesses, impacting how Aramark manages its supply chain and food handling protocols. These evolving standards necessitate ongoing investment in compliance and operational adjustments.

Changes in healthcare regulations, such as those pertaining to patient nutrition standards or healthcare facility hygiene, directly influence Aramark's healthcare division. For example, shifts in reimbursement models or new patient safety guidelines introduced in late 2024 or early 2025 could alter service requirements and cost structures for Aramark's contract food and facilities management services within hospitals and senior living communities.

A significant portion of Aramark's revenue stems from contracts with public sector clients, including educational institutions and government facilities. For instance, in fiscal year 2023, Aramark reported that its Education segment generated $4.3 billion in revenue, a substantial part of which comes from public schools and universities. Changes in public sector budget allocations, such as funding cuts or shifts in spending priorities, can directly influence the demand for Aramark's services and the profitability of its contracts.

Aramark's global operations are significantly influenced by evolving trade policies and international relations. For instance, the United States' trade deficit with China in goods, which stood at $279.4 billion in 2023 according to the U.S. Census Bureau, highlights the complex web of global trade that can affect sourcing and costs for companies like Aramark. Fluctuations in tariffs or the renegotiation of trade agreements, such as potential changes to the USMCA, could alter the cost of imported ingredients and impact profitability across different markets.

Deteriorating geopolitical stability, as seen in ongoing conflicts or trade disputes, can disrupt supply chains and increase operational risks. For example, disruptions in key agricultural regions due to political unrest could lead to ingredient shortages and price volatility, forcing Aramark to adapt its sourcing strategies. The company's ability to maintain a diversified sourcing approach, leveraging suppliers from various countries, becomes crucial in mitigating these risks and ensuring consistent service delivery to its clients worldwide.

Labor Laws and Unionization

Labor laws, including minimum wage policies, and the strength of unions in regions where Aramark operates are critical political factors. These elements directly affect the company's operational expenses and its approach to managing its workforce. For instance, a rise in minimum wage or increased union bargaining power can necessitate higher compensation and benefits, potentially squeezing profit margins.

Aramark's recent engagement with labor unions highlights the ongoing negotiation of labor terms. The company has been involved in reaching tentative agreements for new contracts, which will shape its labor costs and employee relations moving forward. These agreements are crucial for maintaining operational stability and managing human capital effectively.

The prevalence of unionization varies significantly across different geographical markets. This variability means Aramark must tailor its human resource strategies to comply with diverse labor regulations and union landscapes. For example, in 2023, the US federal minimum wage remained at $7.25 per hour, but many states and cities have enacted higher minimums, impacting Aramark's labor costs in those specific areas. Furthermore, union membership rates in the US private sector were around 6.1% in 2023, a figure that influences the intensity of labor negotiations.

- Minimum Wage Impact: Fluctuations in minimum wage laws, such as those in California which has a higher state minimum wage than the federal rate, directly influence Aramark's payroll expenses.

- Union Negotiations: Recent tentative agreements with unions indicate a dynamic labor relations environment, requiring careful management of contract terms and employee satisfaction.

- Regional Differences: Labor law enforcement and union density vary globally and domestically, necessitating adaptable HR strategies for Aramark's diverse operational footprint.

Political Stability and Geopolitical Events

Political stability is a cornerstone for Aramark's global operations, which span 16 countries. Geopolitical shifts, such as the ongoing conflicts in Eastern Europe and the Middle East, can directly impact supply chains and operational costs. For instance, disruptions in key shipping routes due to geopolitical tensions can lead to increased logistics expenses for Aramark's food and facilities services. A stable political climate fosters reliable long-term contracts and encourages the necessary investment for expansion and service improvement.

Major geopolitical events can also influence client confidence and create security concerns for Aramark's workforce and assets. In 2024, the global security landscape remains complex, with several regions experiencing heightened political instability. This necessitates robust risk management strategies to safeguard employees and ensure business continuity across all operating territories. The company's ability to navigate these political uncertainties directly affects its financial performance and market position.

- Aramark operates in 16 countries, making it susceptible to diverse political environments.

- Geopolitical events in 2024 continue to pose risks to global supply chains and operational costs.

- Political stability is crucial for securing long-term contracts and attracting investment.

Government regulations significantly shape Aramark's operations, particularly concerning food safety and labor practices. Evolving standards, such as those from the FDA in 2024 focusing on food traceability, require continuous investment in compliance. Changes in healthcare regulations also directly impact Aramark's healthcare division, potentially altering service demands and costs.

Public sector contracts represent a substantial revenue stream for Aramark, with its Education segment alone generating $4.3 billion in fiscal year 2023. Consequently, shifts in public sector budgets and spending priorities can directly affect demand for its services. Furthermore, labor laws, including minimum wage policies and union strength, critically influence operational expenses and workforce management, with regional variations necessitating adaptable HR strategies.

| Political Factor | Impact on Aramark | Supporting Data/Example |

| Food Safety Regulations | Supply chain and food handling adjustments | FDA's 2024 focus on food traceability |

| Healthcare Regulations | Service requirements and cost structures in healthcare division | Potential shifts in patient nutrition standards or hygiene guidelines |

| Public Sector Budgets | Demand for services and contract profitability | Education segment revenue of $4.3 billion in FY2023 |

| Labor Laws (Minimum Wage, Unions) | Operational expenses and workforce management | US federal minimum wage at $7.25/hour in 2023, with many states/cities higher; US private sector union membership ~6.1% in 2023 |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Aramark, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying key opportunities and threats derived from current market trends and regulatory landscapes.

A concise, actionable summary of Aramark's PESTLE factors, enabling swift identification of external opportunities and threats to inform strategic decision-making.

Economic factors

Inflation, especially for food, energy, and labor, significantly affects Aramark's cost of goods sold and operational expenses. The company's capacity to transfer these rising costs to clients via price adjustments is crucial for preserving profit margins.

Effective supply chain management and strategic sourcing are essential to lessen these inflationary impacts. For instance, in fiscal year 2024, Aramark has observed a positive trend with improving inflation rates, which aids in cost management.

Economic growth directly impacts Aramark's performance across its diverse service sectors. Stronger economies generally mean more disposable income for consumers, leading to increased spending at sports arenas, entertainment venues, and other leisure facilities where Aramark operates. This trend was reflected in Aramark's financial results, with revenue reaching $17.624 billion for the twelve months ending March 31, 2025, an increase of 4.53% compared to the previous year.

Conversely, economic slowdowns can dampen consumer enthusiasm for discretionary activities, potentially reducing client demand for Aramark's catering and facility management services. Businesses might cut back on employee dining programs or event spending during tough economic periods, directly affecting Aramark's revenue streams.

Unemployment rates directly influence Aramark's labor costs and availability. For instance, in May 2024, the U.S. unemployment rate stood at 4.0%, a slight increase from previous months, indicating a tightening labor market where attracting and retaining staff can become more challenging and potentially drive up wages. This directly impacts Aramark's operational expenses, a critical factor for a company reliant on a large service workforce.

Conversely, a higher unemployment rate, while potentially easing labor acquisition, could also signal broader economic weakness, potentially leading to reduced consumer spending and lower demand for Aramark's services across its diverse sectors like food service, facilities management, and uniforms. The ability to consistently staff operations with qualified personnel is paramount for maintaining service quality and client satisfaction.

Interest Rates and Access to Capital

Changes in interest rates directly affect Aramark's operational costs and investment capacity. For instance, if the Federal Reserve or other central banks raise benchmark rates, Aramark’s borrowing costs for new debt or refinancing existing obligations will likely increase. This is particularly relevant given Aramark's significant debt load, as higher interest expenses can eat into profitability.

Higher interest rates can also stifle growth initiatives. Projects requiring substantial capital, such as facility upgrades, technology investments, or strategic acquisitions, become more expensive to finance. This can lead companies like Aramark to delay or scale back expansion plans, impacting their long-term competitive positioning.

Access to affordable capital remains a critical factor for Aramark’s financial health and strategic flexibility. Favorable financing terms are essential for funding necessary capital expenditures and pursuing growth opportunities. For example, Aramark's November 2024 authorization of a $500 million share repurchase plan, alongside ongoing cash returns to shareholders, demonstrates a reliance on available capital for shareholder value enhancement, which is influenced by the prevailing interest rate environment.

- Interest Rate Impact: Rising interest rates increase Aramark's cost of borrowing, affecting its debt servicing obligations.

- Investment Costs: Higher rates make capital expenditures and strategic acquisitions more expensive, potentially slowing expansion.

- Financing Access: Favorable financing is crucial for Aramark's capital investments and strategic moves.

- Shareholder Returns: Aramark's $500 million share repurchase authorization in November 2024 is influenced by its ability to access capital at reasonable costs.

Client Retention and Contract Renewals

Aramark's core business model is built on securing and maintaining long-term client relationships, making client retention and contract renewals critical economic factors. Economic headwinds faced by their key client sectors, like education and healthcare, can directly impact their willingness to commit to or extend existing service agreements.

For instance, in Q2 2025, Aramark highlighted a strong client retention rate of 98%, underscoring the resilience of their contract-based revenue. However, sustained economic downturns could still pressure clients to seek renegotiations or reduce service scope, even with high retention.

- Client Retention: Aramark's success hinges on keeping existing clients satisfied and engaged.

- Economic Sensitivity: Client budget constraints, particularly in public sectors, can influence renewal decisions.

- Contract Stability: High retention rates provide predictable revenue, but economic downturns pose a risk to this stability.

- Q2 2025 Performance: A 98% client retention rate demonstrates current strength, but future economic conditions remain a key consideration.

Economic growth significantly impacts Aramark's performance, with stronger economies boosting consumer spending in leisure and hospitality sectors. For the twelve months ending March 31, 2025, Aramark reported revenue of $17.624 billion, a 4.53% increase year-over-year, reflecting this positive correlation. Conversely, economic downturns can reduce discretionary spending, potentially affecting demand for Aramark's services.

Inflation, particularly in food, energy, and labor, directly influences Aramark's operational costs. While fiscal year 2024 saw improving inflation rates which aided cost management, persistent inflation can pressure profit margins if costs cannot be fully passed on to clients. Effective supply chain management is key to mitigating these effects.

Unemployment rates affect both labor costs and service demand. A low unemployment rate, such as the U.S. rate of 4.0% in May 2024, can increase labor acquisition costs. However, broader economic weakness signaled by higher unemployment could also lead to reduced client spending, creating a dual challenge for Aramark.

Interest rates directly influence Aramark's borrowing costs and investment capacity. Higher rates make debt servicing more expensive and capital expenditures costlier, potentially impacting expansion plans. Aramark's November 2024 authorization of a $500 million share repurchase plan highlights the importance of access to capital at reasonable costs.

| Economic Factor | Impact on Aramark | Relevant Data/Trend |

|---|---|---|

| Economic Growth | Drives demand in leisure/hospitality | Revenue of $17.624 billion (12 months ending Mar 31, 2025), up 4.53% YoY |

| Inflation | Increases cost of goods and labor | Improving inflation rates in FY2024 aided cost management |

| Unemployment Rate | Affects labor costs and consumer spending | U.S. unemployment at 4.0% (May 2024) |

| Interest Rates | Impacts borrowing costs and investment | $500 million share repurchase authorized (Nov 2024) |

Preview the Actual Deliverable

Aramark PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Aramark PESTLE analysis breaks down the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. You'll gain valuable insights into market dynamics and strategic considerations.

Sociological factors

Consumers are increasingly prioritizing health, sustainability, and ethical sourcing in their food choices. This shift directly impacts Aramark's menu planning and procurement. For instance, Aramark has expanded its offerings to include over 3,000 certified Coolfood meals, reflecting a commitment to healthier, lower-carbon footprint options.

Shifts in workforce demographics, such as an aging population and increasing cultural diversity, significantly influence Aramark's approach to talent acquisition and development. For instance, the growing demand for flexible work arrangements, a key expectation for younger generations, necessitates adjustments in Aramark's recruitment and retention strategies to ensure a competitive edge in attracting top talent.

Aramark's commitment to diversity, equity, and inclusion (DEI) is vital for fostering an environment that attracts and retains a skilled and varied workforce. The company's ongoing DEI initiatives are designed to create a more inclusive workplace, which is increasingly important for employee satisfaction and overall business performance. Aramark's recognition in 2024 by Forbes as one of America's Best Employers for Diversity underscores their dedication to these principles.

There's a growing emphasis on health and wellness, with consumers actively seeking nutritious options, particularly in environments like schools and hospitals. This trend directly impacts Aramark's need to provide healthy meals and encourage better eating habits. For instance, in 2024, the global health and wellness market was valued at over $5.1 trillion, signaling a significant consumer shift.

This heightened awareness isn't limited to food; it also influences workplace well-being, making facilities management a key area for promoting employee health. Aramark's strategy to empower consumers with healthier choices aligns with this societal evolution, as evidenced by their continued investment in plant-based and allergen-friendly menu options, which saw a 15% increase in demand across their North American operations in early 2025.

Community Engagement and Corporate Social Responsibility

There's a significant and increasing demand for businesses to actively participate in corporate social responsibility (CSR) and foster meaningful connections with the communities they serve. This societal shift directly impacts how companies like Aramark operate and are perceived. Aramark's commitment to these areas is demonstrated through various programs, including employee volunteer efforts, partnerships with local agricultural producers, and financial contributions to community-based projects.

These actions are crucial for maintaining a positive social license to operate and bolstering the company's brand image. A testament to this commitment, Aramark was honored as one of the 2024 Civic 50, an initiative recognizing companies dedicated to community engagement. This recognition highlights the tangible impact of their social initiatives.

- Growing Societal Expectations: Consumers and stakeholders increasingly expect companies to go beyond profit and contribute positively to society.

- Aramark's Community Initiatives: The company actively engages through volunteer programs, support for local food systems, and community grants, reinforcing its social responsibility.

- Brand Reputation and Social License: Strong CSR and community engagement enhance Aramark's reputation and secure its acceptance within the communities it serves.

- 2024 Civic 50 Recognition: Aramark's inclusion in the 2024 Civic 50 underscores its leadership in community-minded business practices.

Lifestyle Changes and Remote Work Trends

The widespread adoption of remote and hybrid work models presents a significant challenge for Aramark, potentially dampening demand for its traditional on-site dining and facilities management services within corporate environments. For instance, a 2024 survey indicated that 60% of employees prefer hybrid work, directly impacting the volume of meals served in office cafeterias.

Aramark must proactively adapt its strategies and service portfolios to align with these evolving workplace dynamics, exploring new avenues for catering to a more distributed workforce. This could involve expanding ghost kitchen operations or developing more robust at-home meal solutions for remote employees.

Despite these shifts, Aramark anticipates a rebound in its business and industry segment as more companies encourage a return to the office. By early 2025, projections suggested a 15% increase in office occupancy rates compared to 2023, which would naturally boost demand for Aramark's core services.

- Remote/Hybrid Work Impact: Reduced on-site dining demand in corporate settings due to increased remote work.

- Adaptation Necessity: Aramark needs to evolve its offerings to suit changing workplace models.

- Business & Industry Outlook: Expected growth as companies increase office return-to-work policies.

- 2024/2025 Data: 60% of employees favoring hybrid work; projected 15% increase in office occupancy by early 2025.

Societal trends heavily influence Aramark's operations, particularly the growing consumer demand for healthier, sustainable, and ethically sourced food options. Aramark's response includes expanding plant-based and allergen-friendly menus, with a notable 15% increase in demand observed in early 2025 across North America. Furthermore, the company’s commitment to diversity, equity, and inclusion is a key factor in attracting and retaining talent, as recognized by Forbes in 2024 as one of America's Best Employers for Diversity.

| Sociological Factor | Impact on Aramark | Supporting Data/Initiatives (2024-2025) |

|---|---|---|

| Health & Wellness Consciousness | Increased demand for nutritious and specialized dietary options. | Expansion of Coolfood meals (over 3,000); 15% rise in demand for plant-based/allergen-friendly options (early 2025). |

| Workforce Demographics & Expectations | Need for flexible work arrangements and diverse talent acquisition. | Younger generations prioritize flexibility; Aramark focuses on DEI for talent retention. |

| Corporate Social Responsibility (CSR) | Expectation for community engagement and positive societal impact. | Recognized in the 2024 Civic 50 for community engagement; employee volunteer programs and local partnerships. |

| Workplace Trends (Remote/Hybrid) | Potential reduction in on-site service demand; need for adaptive strategies. | 60% of employees prefer hybrid work (2024); projected 15% increase in office occupancy by early 2025 may boost demand. |

Technological factors

The integration of automation and robotics is significantly reshaping facilities management. Autonomous cleaning robots, for instance, are proving to be a game-changer, boosting operational efficiency and cutting down on labor expenses. These advancements also contribute to a higher standard of service delivery.

Aramark is actively embracing this technological shift, having already implemented autonomous floor cleaning robots across various sectors of its operations. This strategic deployment underscores a commitment to leveraging cutting-edge technology to optimize service provision and maintain a competitive edge in the facilities management landscape.

Artificial intelligence and data analytics are transforming the food service industry, offering significant improvements in areas like food waste reduction, nutritional insights, menu development, and inventory management. These technologies enable more efficient operations and a better understanding of consumer preferences.

Aramark is actively integrating AI, notably through its Culinary Co-Pilot, to pioneer novel dining concepts and elevate the overall guest experience. This strategic adoption of AI aims to create more personalized and engaging service offerings, distinguishing Aramark in a competitive market.

The Internet of Things (IoT) is revolutionizing building management by enabling real-time identification of building and occupant needs. This is achieved through continuous monitoring of occupancy, space utilization, and equipment condition, leading to more efficient operations and better occupant experiences. For instance, smart sensors can detect when a room is unoccupied, automatically adjusting lighting and HVAC systems to save energy. This proactive approach significantly reduces waste and enhances comfort.

Aramark leverages this technology through its AIWX Connect platform, which integrates IoT data for intelligent building management. This allows for predictive maintenance, ensuring equipment is serviced before it fails, thereby minimizing downtime and repair costs. In 2024, the global smart building market, heavily reliant on IoT, was projected to reach over $100 billion, highlighting the significant investment and adoption of these technologies in facilities management.

Digital Ordering and Contactless Service

The growing preference for digital ordering, mobile payments, and contactless service across food and uniform sectors necessitates significant investment in technological infrastructure. This shift not only elevates customer convenience but also offers substantial operational efficiencies for companies like Aramark. For instance, in 2023, the global contactless payment market was valued at over $1.5 trillion, highlighting a clear consumer trend towards these methods.

Aramark has responded by integrating advanced technologies, including the launch of automated stores. These initiatives are designed to meet evolving consumer expectations for speed and ease of interaction. By embracing these digital advancements, Aramark aims to stay competitive and cater to a customer base increasingly reliant on seamless, technology-driven experiences.

Key technological factors influencing Aramark include:

- Increased consumer adoption of digital ordering platforms: Mobile food ordering saw a 15% year-over-year growth in 2023, with projections indicating continued expansion.

- Demand for contactless payment solutions: Contactless transactions accounted for over 60% of all card payments in many developed markets by late 2023.

- Investment in automated retail and service technologies: Aramark's deployment of automated stores reflects a broader industry trend towards leveraging AI and robotics for enhanced service delivery.

- Data analytics for personalized customer experiences: Utilizing data from digital interactions allows for tailored offerings, boosting customer loyalty.

Supply Chain Technology and Traceability

Technological advancements are reshaping supply chain management, with tools like blockchain and sophisticated tracking systems boosting transparency, efficiency, and ethical sourcing. For Aramark, this means better oversight and management of its extensive global operations, ensuring responsible procurement practices.

Aramark's strategic move with the launch of Avendra International underscores its commitment to strengthening its capabilities as a global procurement and supply chain services provider. This initiative aims to leverage technology for greater control and optimization across its diverse supply networks.

- Blockchain adoption in supply chains is projected to grow significantly, with estimates suggesting a market value of over $20 billion by 2027, indicating increasing demand for enhanced traceability.

- Advanced tracking systems, including IoT sensors and AI-powered analytics, are enabling real-time visibility into inventory and logistics, reducing errors and improving delivery times by up to 15%.

- Aramark's Avendra International operates as a strategic sourcing partner, managing billions in spend annually for clients in sectors like hospitality and healthcare, demonstrating the scale of its supply chain operations.

Technological advancements are fundamentally altering how Aramark operates, from enhancing service delivery through automation to personalizing customer experiences with AI. The company's proactive integration of these tools, such as autonomous cleaning robots and AI-powered culinary platforms, positions it to meet evolving market demands and operational efficiencies. This strategic embrace of technology is crucial for maintaining a competitive edge in the facilities management and food service sectors.

Legal factors

Aramark operates under a complex web of food safety regulations, including Hazard Analysis and Critical Control Points (HACCP) principles and numerous local health codes. These mandates are critical for ensuring the safety of food served in its diverse operations, from educational institutions to healthcare facilities.

Failure to comply with these stringent food safety standards can result in significant consequences. These include hefty fines, severe reputational damage that can erode customer trust, and the potential loss of lucrative contracts with clients who prioritize safety and compliance.

Aramark's dedication to robust food safety protocols is therefore not just a legal obligation but a core component of its business strategy. For instance, in 2023, the U.S. Food and Drug Administration (FDA) continued to emphasize stricter enforcement of food safety modernization acts, impacting all food service providers like Aramark.

Aramark must navigate a complex web of labor laws, from minimum wage requirements and overtime rules to stringent workplace safety standards and anti-discrimination statutes. Compliance is not merely a legal obligation but a strategic imperative; failures can lead to significant financial penalties and reputational damage. For instance, in 2024, the U.S. Department of Labor continued to emphasize enforcement of wage and hour laws, with fines for violations often running into tens of thousands of dollars per incident.

The company's operations are also heavily influenced by collective bargaining agreements, particularly in unionized sectors of its business. Recent labor negotiations, such as those impacting food service workers in various institutions, underscore the ongoing importance of managing these relationships effectively. Failure to reach favorable contract agreements can result in disruptions, impacting service delivery and profitability. The financial implications of strikes or prolonged disputes can be substantial, with lost revenue and increased operational costs.

Aramark's operations are heavily reliant on intricate, long-term contracts with diverse clients. Navigating these agreements requires meticulous attention to detail regarding terms, renewal provisions, and exit clauses, ensuring compliance and mitigating risk.

The potential for costly legal battles stemming from contract breaches or disputes poses a significant challenge. These conflicts can damage client relationships and incur substantial financial penalties, impacting Aramark's bottom line.

Aramark's reported client retention rate of approximately 95% as of fiscal year 2023 underscores its proficiency in contract management and its ability to foster enduring client partnerships.

Data Privacy and Cybersecurity Laws

Aramark's handling of extensive customer and employee data necessitates strict compliance with data privacy legislation such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA). Failure to adhere can result in significant fines; for instance, GDPR penalties can reach up to 4% of global annual turnover or €20 million, whichever is higher. The company's commitment to privacy and confidentiality is explicitly stated within its business conduct policy, underscoring the importance of safeguarding sensitive information.

In addition to privacy, robust cybersecurity measures are paramount to defend against increasingly sophisticated data breaches and cyberattacks. The global cost of cybercrime was projected to reach $10.5 trillion annually by 2025, highlighting the critical need for proactive defense strategies. Aramark's investment in cybersecurity infrastructure is therefore crucial to protect its operations and maintain customer trust.

- GDPR Fines: Up to 4% of global annual turnover or €20 million.

- CCPA Enforcement: Penalties can reach $2,500 per unintentional violation and $7,500 per intentional violation.

- Projected Cybercrime Costs: Expected to hit $10.5 trillion annually by 2025.

Environmental Regulations and Reporting

Aramark must navigate a complex web of environmental regulations concerning waste management, emissions, and resource usage, with compliance becoming increasingly critical. The company’s stated sustainability objectives and its public disclosures on environmental performance face significant legal oversight and adherence to evolving regulatory mandates.

Aramark is proactively preparing for these changes, planning to update its materiality assessment in fiscal year 2025. This refresh is specifically designed to ensure alignment with new non-financial regulatory reporting requirements, demonstrating a commitment to transparency and legal adherence.

- Waste Management: Adherence to local and international waste disposal and recycling laws is paramount for Aramark's operations.

- Emissions Control: Regulations on air and water emissions directly impact the company's operational footprint and require continuous monitoring.

- Resource Consumption: Laws governing water usage and energy efficiency necessitate strategic planning and investment in sustainable practices.

- Regulatory Reporting: The upcoming refresh of Aramark's materiality assessment in FY2025 underscores the growing importance of meeting new environmental reporting standards.

Aramark's operations are subject to a robust legal framework, encompassing food safety, labor laws, and contract compliance. Non-adherence to these regulations, such as U.S. Department of Labor wage and hour enforcement in 2024, can result in substantial financial penalties and reputational damage. The company's reported 95% client retention in FY2023 highlights its success in navigating complex contractual obligations.

| Legal Area | Key Regulations/Considerations | Potential Consequences of Non-Compliance | Relevant Data/Examples |

|---|---|---|---|

| Food Safety | HACCP, Local Health Codes | Fines, Reputational Damage, Contract Loss | FDA stricter enforcement in 2023 |

| Labor Laws | Minimum Wage, Overtime, Workplace Safety, Anti-Discrimination | Financial Penalties, Legal Battles | DOL wage/hour enforcement 2024; fines up to tens of thousands per incident |

| Contract Law | Terms, Renewals, Exit Clauses | Costly Legal Disputes, Damaged Client Relationships | 95% client retention rate (FY2023) |

| Data Privacy & Cybersecurity | GDPR, CCPA, Data Breach Protection | Significant Fines, Reputational Harm | GDPR fines up to 4% global turnover; Cybercrime costs projected $10.5T by 2025 |

| Environmental Law | Waste Management, Emissions, Resource Usage | Regulatory Scrutiny, Non-Compliance Penalties | Materiality assessment refresh planned for FY2025 |

Environmental factors

Aramark is actively addressing climate change and greenhouse gas (GHG) emissions by integrating sustainability into its operations. The company is focused on reducing its environmental footprint through various strategic initiatives.

Key strategies include expanding plant-based meal options, enhancing operational efficiency across its services, and establishing ambitious, science-based targets for emission reductions. These efforts are designed to align with global climate goals and mitigate the company's impact.

Aramark has set a specific target to reduce GHG emissions in the United States by 15% by the year 2025, using 2019 as its baseline year. This quantifiable goal demonstrates a commitment to measurable progress in environmental stewardship.

Minimizing food waste is a key environmental and operational priority for Aramark. They're implementing strategies like smarter inventory management and sourcing from responsible suppliers. Innovative technologies are also being used to better track and cut down on waste across their operations.

Aramark has set an ambitious goal to reduce food waste in the U.S. by 50% by the year 2030. This commitment reflects a growing awareness of the environmental impact of food waste and its operational cost implications.

Aramark's dedication to responsible and sustainable sourcing profoundly shapes its supply chain. By prioritizing local farms and ethical practices, the company actively reduces its environmental footprint and fosters community economic development. This approach ensures that goods and services are obtained in a manner that minimizes ecological damage and promotes inclusivity.

In 2023, Aramark reported that 85% of its U.S. food purchases were from local or regional suppliers, a testament to its commitment to supporting local economies and reducing transportation emissions. This focus on local partnerships extends to their efforts in building a traceable and sustainable supply chain, allowing for greater transparency and accountability in their operations.

Water and Energy Conservation

Aramark prioritizes the efficient use of water and energy across its facilities and operations as a core environmental commitment. This focus not only aligns with sustainability goals but also drives operational efficiencies and cost reductions. By integrating advanced technologies and practices, Aramark seeks to minimize its environmental footprint while enhancing service delivery.

The company actively invests in implementing energy-efficient equipment and water-saving fixtures throughout its diverse portfolio. These initiatives contribute to tangible environmental benefits, such as reduced greenhouse gas emissions and water consumption. For instance, in 2023, Aramark reported a 13% reduction in water usage intensity and a 10% decrease in energy usage intensity compared to their 2019 baseline, demonstrating the impact of these conservation efforts.

- Energy Efficiency: Upgrading to LED lighting and high-efficiency HVAC systems in client facilities.

- Water Conservation: Installing low-flow fixtures and implementing smart water management systems.

- Operational Improvements: Streamlining supply chains and optimizing transportation routes to reduce energy consumption.

- Waste Reduction: Focusing on reducing food waste, which indirectly conserves the water and energy used in food production.

Waste Management and Circularity

Aramark is actively working to reduce waste by shifting away from single-use plastics and increasing options for reuse, recycling, and composting throughout its diverse operations. This focus on circularity is designed to significantly cut down on landfill waste and foster a more sustainable approach to resource management.

The company has made tangible progress in this area, notably by reducing its procurement of plastic straws and stirrers. For instance, in fiscal year 2023, Aramark reported a 15% reduction in plastic straws used across its food service locations compared to the previous year, demonstrating a concrete step towards its sustainability goals.

- Reduced Single-Use Plastics: Aramark's commitment to minimizing reliance on items like plastic straws and stirrers is a key environmental strategy.

- Expanded Circular Economy Initiatives: The company is increasing opportunities for reuse, recycling, and composting to divert waste from landfills.

- Fiscal Year 2023 Progress: A 15% decrease in plastic straw usage was achieved, showcasing measurable environmental impact.

Aramark is committed to environmental stewardship, focusing on climate action and reducing its operational footprint. Key initiatives include ambitious emissions targets and minimizing food waste, demonstrating a proactive approach to sustainability.

The company is actively reducing greenhouse gas emissions, aiming for a 15% reduction in the U.S. by 2025 from a 2019 baseline. Aramark also targets a 50% reduction in food waste in the U.S. by 2030, underscoring its dedication to environmental efficiency.

Aramark prioritizes sustainable sourcing, with 85% of its U.S. food purchases in 2023 coming from local or regional suppliers. This strategy not only cuts transportation emissions but also strengthens community ties.

The company is also making strides in water and energy conservation, achieving a 13% reduction in water usage intensity and a 10% decrease in energy usage intensity in 2023 compared to 2019. Furthermore, Aramark reduced its use of plastic straws by 15% in fiscal year 2023.

| Environmental Initiative | Target/Status | Baseline Year | Reporting Year |

| GHG Emissions Reduction (U.S.) | 15% reduction | 2019 | 2025 |

| Food Waste Reduction (U.S.) | 50% reduction | N/A | 2030 |

| Local/Regional Food Sourcing (U.S.) | 85% of purchases | N/A | 2023 |

| Water Usage Intensity Reduction | 13% reduction | 2019 | 2023 |

| Energy Usage Intensity Reduction | 10% reduction | 2019 | 2023 |

| Plastic Straw Usage Reduction | 15% reduction | N/A | FY2023 |

PESTLE Analysis Data Sources

Our Aramark PESTLE Analysis is informed by a comprehensive review of public company filings, industry-specific market research reports, and reputable news sources. We also incorporate data from government agencies and economic forecasting firms to ensure a robust understanding of the external environment.