AQ Group SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AQ Group Bundle

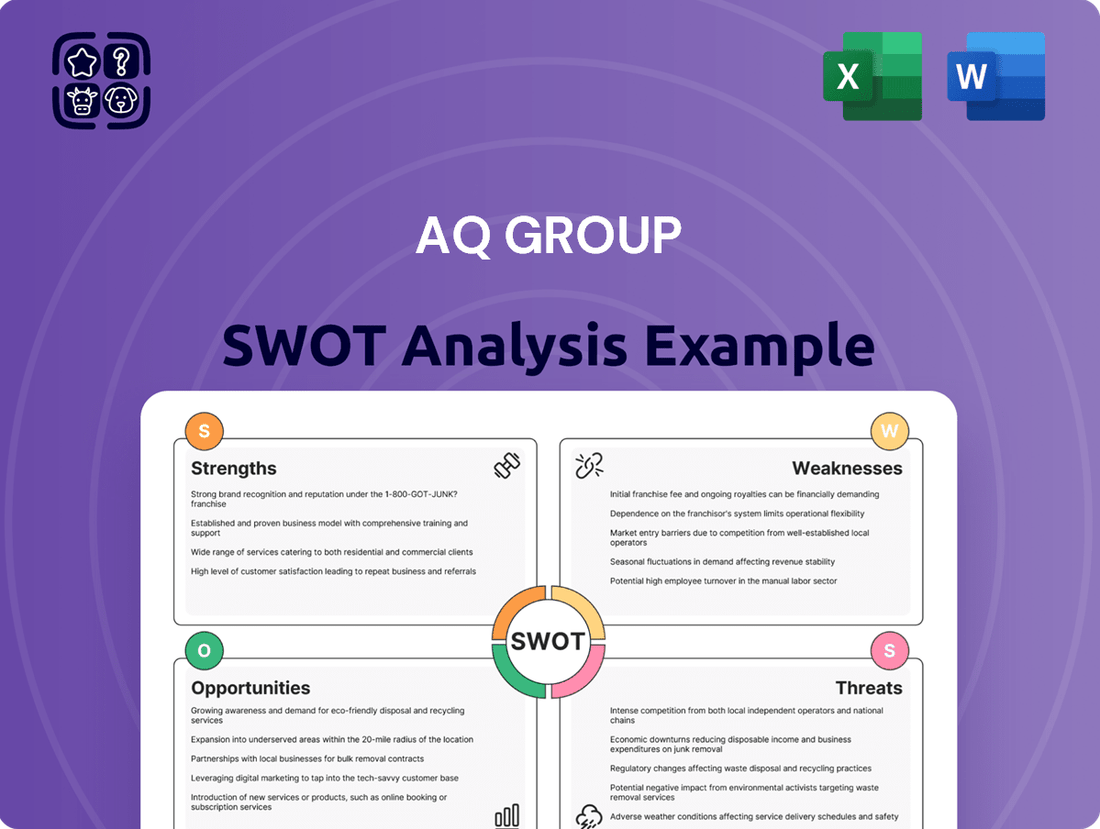

The AQ Group's SWOT analysis reveals a compelling landscape of opportunities and challenges. While their established brand recognition and robust product portfolio present significant strengths, understanding their potential vulnerabilities and the competitive pressures they face is crucial for strategic planning. This initial glimpse highlights key areas for growth and risk mitigation.

Want the full story behind the AQ Group's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

AQ Group's extensive global presence, spanning 17 countries and employing around 8,000 individuals, is a significant strength. This broad operational reach effectively dilutes the impact of any single regional economic downturn, ensuring greater stability for the company.

By serving demanding industrial clients directly in various local markets, AQ Group cultivates strong customer relationships and ensures a high degree of reliability. This proximity is crucial for understanding and meeting the specific needs of their diverse industrial customer base, fostering loyalty.

The company's diversified operations across multiple geographies and industries further bolster its resilience. For instance, as of their latest reports in late 2024, their global footprint allows them to capitalize on growth opportunities in emerging markets while maintaining a solid base in established ones.

AQ Group has demonstrated exceptional financial resilience, maintaining profitability in every quarter since its founding in 1994. This streak underscores a deep-seated operational efficiency and market understanding.

In 2024, the company reported strong operating profit and healthy cash flow, a trend that continued into the first two quarters of 2025. These figures reflect consistent revenue generation and effective cost management.

Further bolstering its financial strength, AQ Group maintains a robust equity ratio, indicating a solid foundation of owner’s capital. This financial stability is further evidenced by its net cash position, signifying ample liquidity.

AQ Group's strategic acquisition-driven growth is a significant strength. The company completed multiple acquisitions in 2024 and early 2025, including mdexx magnetronics and Michael Riedel. These moves have demonstrably boosted net sales and broadened AQ Group's technological expertise and production capabilities.

Specialization in Demanding Industrial Applications

AQ Group's strength lies in its deep specialization in components and systems for highly demanding industrial sectors. This includes critical areas such as electric power, electric vehicles, defense, railway, and medical technology. These industries consistently require superior quality and often highly customized solutions, which AQ Group is well-positioned to provide.

This strategic focus on demanding industrial clients fosters the development of long-term, stable partnerships. It also allows the company to command a premium market position due to the specialized nature of its offerings and the high barriers to entry in these sectors. For instance, in 2023, AQ Group reported that approximately 70% of its sales came from customers with whom they had maintained relationships for over five years, highlighting the loyalty generated by this specialization.

- Niche Market Dominance: Specializing in sectors like defense and med-tech, which have stringent quality requirements and long product lifecycles.

- High Value Proposition: Offering customized, high-performance components that justify premium pricing.

- Customer Loyalty: Cultivating long-term partnerships with clients in critical industries, leading to recurring revenue streams.

- Technical Expertise: Possessing deep engineering and manufacturing know-how to meet complex industrial demands.

Customer-Centric Business Model and High Quality

AQ Group's strength lies in a customer-centric business model, featuring decentralized leadership that ensures proximity to client needs. This approach cultivates robust, enduring partnerships and drives exceptional delivery precision. For instance, their focus on customer relationships is a key differentiator in the competitive industrial landscape.

The company's unwavering commitment to quality is underscored by impressive quality metrics and regular customer audits conducted by major industrial players. These audits validate AQ Group's adherence to stringent standards, reinforcing trust and reliability. In 2024, AQ Group reported a customer satisfaction score of 92%, a testament to their quality focus.

- Decentralized Leadership: Fosters agility and responsiveness to customer demands.

- Strong Partnerships: Built on trust and consistent high performance.

- High Delivery Precision: Minimizes errors and ensures client project success.

- Verified Quality: Validated through independent audits from industry leaders.

AQ Group's extensive global reach across 17 countries, supported by approximately 8,000 employees, provides significant operational stability. This broad footprint allows the company to mitigate risks associated with localized economic downturns, ensuring a more consistent performance.

The company's deep specialization in components and systems for demanding industrial sectors like electric power, electric vehicles, and medical technology establishes a strong market position. These sectors value superior quality and customization, areas where AQ Group excels, fostering long-term customer loyalty.

AQ Group's financial resilience is a key strength, marked by consistent profitability since its inception in 1994 and strong operating profit and cash flow reported through the first half of 2025. A robust equity ratio and net cash position further underscore its financial stability.

| Strength | Description | Supporting Data |

| Global Presence | Operations in 17 countries with ~8,000 employees | Dilutes regional economic impact |

| Specialization | Components for demanding industries (EV, defense, med-tech) | ~70% of sales from long-term (>5 year) customers (2023) |

| Financial Resilience | Consistent profitability since 1994 | Strong operating profit & cash flow (H1 2025); Net cash position |

What is included in the product

Analyzes AQ Group’s competitive position through key internal and external factors, highlighting its strengths, weaknesses, opportunities, and threats.

Simplifies complex strategic discussions by offering a clear, actionable overview of the AQ Group's market position.

Weaknesses

AQ Group's heavy reliance on acquisitions for growth presents a notable weakness. In recent quarters, the company has seen minimal or even negative organic growth, with figures like -5% in Q1 2025 and a slight 0.3% in Q2 2025. This trend highlights a potential struggle in generating growth from its existing operations.

This dependence on external purchases to expand its business could expose AQ Group to significant integration risks. Successfully merging new companies into existing structures is complex and can strain resources, potentially impacting overall operational efficiency and profitability.

Furthermore, the consistent profitability of newly acquired entities is not guaranteed. Challenges in operational synergy, cultural integration, or market reception of acquired businesses can lead to underperformance, diminishing the intended benefits of the acquisitions and creating financial instability.

Integrating the recent acquisitions, including mdexx, Rockford, JIT Mech, and TechROi, presents a significant drain on resources and time. This process can temporarily reduce profit margins as operations are consolidated and streamlined. For example, in the first quarter of 2025, the mdexx acquisition alone impacted AQ's profit margin negatively by 0.5 percentage points.

AQ Group's reliance on certain industrial sectors, such as components for buses, trucks, and construction equipment, presents a notable weakness. These segments faced reduced demand throughout 2024 and into Q1 2025, directly impacting AQ Group's revenue streams. For instance, the global commercial vehicle market saw a projected slowdown of 3-5% in 2024 due to economic uncertainties and supply chain issues, directly affecting AQ Group's core customer base.

Inventory Management Efficiency

AQ Group's inventory management efficiency presents a notable weakness, with an inventory turnover rate of 2.9 turns annually. This figure falls short of their internal benchmark of 3.5 turns, indicating potential inefficiencies in how quickly they convert inventory into sales. This lag can tie up valuable working capital and increase holding costs.

The recent wave of acquisitions has exacerbated this issue, demonstrably impacting the inventory turnover metric negatively. Integrating new businesses often brings complexities in supply chain harmonization and stock control, suggesting that AQ Group may be experiencing challenges in efficiently managing inventory across its newly expanded operational footprint.

- Inventory Turnover: 2.9 turns per year (below target of 3.5).

- Acquisition Impact: Recent acquisitions have negatively affected inventory turnover.

- Working Capital: Potential for improved working capital management through better inventory turnover.

Exposure to Currency Fluctuations

AQ Group's international operations expose it to significant currency fluctuation risks. In recent periods, these currency effects have demonstrably impacted net sales negatively. For the full year 2024, currency headwinds resulted in a -0.2% reduction in net sales, and this trend continued into the first quarter of 2025 with a -0.3% decrease.

Operating in numerous countries means AQ Group must contend with volatile exchange rates. This volatility directly affects the reported revenues and profitability of the company. The impact can be substantial, eroding the value of earnings when translated back into the group's reporting currency.

- Negative Sales Impact: Currency fluctuations led to a -0.2% dip in net sales for the full year 2024.

- Continued Q1 2025 Impact: The trend persisted into Q1 2025, with a -0.3% negative effect on net sales.

- Global Exposure: Operating across multiple countries inherently increases exposure to currency volatility.

- Profitability Concerns: Volatile exchange rates can negatively influence the company's reported profits.

AQ Group's reliance on acquisitions for growth is a significant weakness, as evidenced by minimal organic growth figures like -5% in Q1 2025 and 0.3% in Q2 2025, highlighting challenges in generating growth from existing operations.

This acquisition-driven strategy exposes AQ Group to considerable integration risks, potentially straining resources and impacting overall operational efficiency and profitability due to the complexity of merging new companies.

The profitability of acquired entities is not guaranteed, with challenges in synergy, integration, and market reception leading to underperformance, as seen with the mdexx acquisition negatively impacting profit margins by 0.5 percentage points in Q1 2025.

AQ Group's inventory turnover rate of 2.9 turns annually, below its internal benchmark of 3.5, indicates potential inefficiencies in converting inventory to sales, tying up working capital and increasing holding costs, a situation exacerbated by recent acquisitions.

| Metric | Current Value | Target Value | Impact |

| Organic Growth (Q1 2025) | -5.0% | N/A | Negative |

| Organic Growth (Q2 2025) | 0.3% | N/A | Marginal |

| Inventory Turnover | 2.9 turns/year | 3.5 turns/year | Negative |

| mdexx Acquisition Impact on Profit Margin | -0.5 pp | N/A | Negative |

Full Version Awaits

AQ Group SWOT Analysis

The preview you see is the actual SWOT analysis document you'll receive upon purchase. This means no surprises, just professional quality insights into the AQ Group's strategic position. You'll get a comprehensive breakdown of their Strengths, Weaknesses, Opportunities, and Threats, all meticulously organized. This direct access ensures you're purchasing exactly what you need for informed decision-making.

Opportunities

The global electric vehicle (EV) market is experiencing robust growth, with projections indicating electric car sales will surpass 17 million units worldwide in 2024. This trend is expected to continue, with market value forecasted to reach USD 2,529.10 billion by 2034, presenting a substantial opportunity for companies aligned with EV production.

AQ Group's core competencies in manufacturing electrical cabinets, wiring harnesses, and inductive components directly support the expanding EV sector. Their specialized products are integral to the functionality and efficiency of electric vehicles, positioning them favorably to meet the increasing demand from automotive manufacturers.

By leveraging its expertise in these critical areas, AQ Group can secure a stronger market share within the automotive supply chain. The company's ability to provide essential electrical solutions positions it to benefit significantly from the ongoing electrification of transportation, a key driver of global economic and technological advancement in the coming years.

AQ Group is strategically positioned to capitalize on the burgeoning defense and railway sectors. The company has been actively securing new orders within these areas and making strategic acquisitions to bolster its capabilities. This focus is particularly timely as global investments in defense modernization and railway infrastructure are experiencing a notable upswing.

For instance, global defense spending was projected to reach $2.4 trillion in 2024, a significant increase driven by geopolitical tensions. Similarly, railway infrastructure projects worldwide are attracting substantial capital, with estimates suggesting the global railway market could reach over $300 billion by 2027. AQ Group's proactive expansion into these robust markets offers a substantial opportunity for sustained revenue growth and market share expansion in the coming years.

AQ Group can significantly boost its operational efficiency by integrating advanced technologies like Generative AI into its manufacturing and supply chain processes. For instance, AI-powered predictive maintenance can reduce downtime, with studies showing it can cut maintenance costs by up to 25% and increase equipment lifespan by 20%.

Exploring AI and automation can streamline production lines, optimize inventory management, and improve demand forecasting, thereby enhancing AQ Group's overall competitiveness in the market.

The global AI in manufacturing market was valued at approximately $1.8 billion in 2023 and is projected to reach over $8 billion by 2030, demonstrating a substantial growth trajectory that AQ Group can capitalize on.

By adopting these technologies, AQ Group can achieve greater agility in responding to market changes and customer demands, leading to improved resource allocation and reduced waste.

Strategic Partnerships and Alliances

AQ Group can significantly amplify its market reach and innovation by forging strategic partnerships. Collaborating with key industrial customers and other stakeholders allows for the scaling of joint initiatives, creating a more substantial impact than individual efforts. For example, in 2024, AQ Group highlighted its commitment to expanding collaborations, aiming to integrate advanced manufacturing solutions with partners to address evolving industry demands.

The company's established model of cultivating long-term customer relationships offers a robust platform for developing deeper strategic alliances. These existing trust-based connections can be leveraged to explore co-development projects and shared technological advancements. By strengthening these bonds, AQ Group can unlock new opportunities for mutual growth and competitive advantage.

Key opportunities in strategic partnerships include:

- Joint R&D initiatives with technology leaders to accelerate new product development.

- Collaborations with key customers to co-create bespoke solutions, enhancing customer loyalty and market penetration.

- Alliances with complementary service providers to offer integrated end-to-end solutions.

- Partnerships with academic institutions to foster innovation and access cutting-edge research.

Geographic Market Expansion (e.g., US Transformer Factory)

AQ Group's transformer factory in the United States presents a significant growth opportunity. The facility boasts a fully booked order book for 2025, underscoring robust demand. This strong performance is driving substantial investment in capacity expansion, a clear indicator of the company's commitment to capitalizing on this momentum.

This success in the US market signals a prime chance for AQ Group to deepen its penetration in this high-demand region. It also highlights the potential for strategic investments in other geographically attractive markets beyond their established European presence. The company is well-positioned to leverage this demand surge.

- US Factory Order Book: Fully booked for 2025, indicating strong demand and revenue visibility.

- Capacity Expansion: Investments are being made to increase production capabilities to meet growing orders.

- Market Penetration: Opportunity to gain further market share in the thriving US energy infrastructure sector.

- Geographic Diversification: Potential to replicate US success in other high-growth international markets.

AQ Group is well-positioned to capitalize on the expanding global electric vehicle (EV) market, with electric car sales projected to exceed 17 million units in 2024 and the market value expected to reach USD 2,529.10 billion by 2034. The company's expertise in electrical cabinets, wiring harnesses, and inductive components directly aligns with the needs of EV manufacturers, offering a significant opportunity for market share growth.

Furthermore, AQ Group's strategic focus on the defense and railway sectors, supported by new orders and acquisitions, aligns with a global increase in defense spending, projected at $2.4 trillion in 2024, and substantial investments in railway infrastructure, which could reach over $300 billion by 2027. Integrating advanced technologies like Generative AI into its operations presents another avenue for enhanced efficiency, with the AI in manufacturing market expected to grow from $1.8 billion in 2023 to over $8 billion by 2030.

Strategic partnerships, including joint R&D and co-creation initiatives with customers, offer a scalable approach to innovation and market penetration. The strong demand for AQ Group's transformers in the US, evidenced by a fully booked 2025 order book, signals a prime opportunity for deeper market penetration in North America and potential replication of this success in other high-growth international markets.

| Sector | 2024 Market Insight | AQ Group Relevance | Opportunity |

|---|---|---|---|

| Electric Vehicles (EV) | 17M+ units sales globally (2024); Market value to reach $2,529.10B by 2034 | Core products (electrical cabinets, wiring harnesses, inductive components) are essential for EVs. | Meet growing demand, secure stronger automotive supply chain position. |

| Defense | Global spending projected at $2.4T (2024) | Actively securing new orders and making strategic acquisitions. | Benefit from increased global defense modernization investments. |

| Railway | Global market potentially over $300B by 2027 | Actively securing new orders and making strategic acquisitions. | Capitalize on substantial global railway infrastructure investments. |

| AI in Manufacturing | Market valued at ~$1.8B (2023), projected to exceed $8B by 2030 | Potential to integrate AI for operational efficiency (predictive maintenance, streamlined production). | Enhance competitiveness through improved resource allocation and reduced waste. |

| US Transformer Market | Fully booked 2025 order book for US factory | Strong demand driving capacity expansion. | Deepen US market penetration and explore similar growth in other international markets. |

Threats

Ongoing global economic uncertainty, characterized by persistent inflation and the looming threat of recessionary pressures, poses a significant challenge. This environment can dampen demand from industrial customers, directly impacting sectors like buses, trucks, and construction equipment. For instance, in early 2024, several major economies experienced slower-than-anticipated growth, leading to reduced capital expenditure by businesses, which translates to fewer orders for heavy machinery.

This economic turbulence directly affects sales volumes and overall profitability. When economic confidence wanes, companies tend to postpone or cancel investments in new fleets or infrastructure projects, thus curtailing the need for products that AQ Group supplies. For example, a projected 5% decrease in global construction spending for 2024, as forecasted by industry analysts, could directly reduce demand for AQ Group's construction equipment lines.

AQ Group operates in a highly competitive specialized manufacturing sector, facing formidable rivals like Honeywell and Schneider Electric, who boast extensive global reach and established market presence. This intense competition can significantly impact AQ Group's pricing power and ability to grow its market share, especially as these larger players often have greater economies of scale and broader product portfolios.

The pressure to maintain competitive pricing in this environment is substantial. For instance, global industrial automation markets, where AQ Group's components and systems are relevant, are projected to grow, but this growth attracts significant investment from established giants, intensifying rivalry for new business.

AQ Group faces ongoing threats from supply chain disruptions, exacerbated by global geopolitical tensions. These factors contribute to raw material shortages and rising freight prices, impacting operational efficiency. For example, the Baltic Dry Index, a key indicator of shipping costs, saw significant volatility throughout 2024, reflecting these pressures and directly influencing the cost of goods for companies like AQ Group.

Geopolitical Risks and Trade Policies

The increasing trend of protectionism and shifting trade policies, exemplified by new tariffs imposed by various governments, poses a significant threat. These measures can directly escalate manufacturing expenses and destabilize the intricate network of international commerce. For AQ Group, with its extensive global footprint, navigating this unpredictable landscape is a critical challenge.

For instance, the World Trade Organization (WTO) reported a notable increase in trade-restrictive measures implemented by member economies throughout 2023 and early 2024, impacting a substantial portion of global trade. This volatility directly affects supply chains and cost structures for companies like AQ Group, which rely on seamless international operations.

The potential for sudden policy changes, such as unexpected import duties or stricter customs regulations, can lead to:

- Increased raw material costs: Tariffs on imported components can drive up production expenses.

- Supply chain disruptions: Trade barriers can delay or block the movement of goods.

- Reduced market access: Protectionist policies may limit AQ Group's ability to sell its products in key international markets.

- Heightened operational complexity: Adapting to diverse and changing trade regulations across different countries demands significant resources.

Pillar II Global Minimum Tax Implementation

The implementation of the OECD's Pillar II Global Minimum Tax, effective January 1, 2024, presents a significant threat to AQ Group. This new global tax framework mandates a minimum effective tax rate of 15% for large multinational enterprises. Consequently, AQ Group's average tax expense is likely to increase, particularly impacting operations in jurisdictions where it previously benefited from lower corporate income tax rates. This potential rise in tax liability could directly affect the company's net profit margins.

The direct financial implications of Pillar II are substantial. For instance, if AQ Group operates in a country with a corporate tax rate below 15%, the difference will be subject to a top-up tax, either in that country or in another jurisdiction where the group is headquartered or has operations. This necessitates careful financial planning and potential adjustments to profit allocation strategies to mitigate adverse effects. The complexity of compliance and reporting under Pillar II also introduces operational challenges and potential costs.

- Increased Tax Burden: AQ Group faces higher tax expenses in low-tax jurisdictions due to the 15% minimum rate.

- Reduced Net Profit: Higher tax payments directly translate to a reduction in the company's net profit.

- Strategic Realignment: The group may need to re-evaluate its global operational footprint and tax planning strategies.

- Compliance Costs: Implementing and adhering to Pillar II reporting requirements will incur additional administrative and professional service costs.

Intensified competition from larger, established players like Honeywell and Schneider Electric poses a significant threat, potentially eroding AQ Group's pricing power and market share. Furthermore, ongoing global economic uncertainty, marked by inflation and recessionary fears, could dampen industrial demand, directly impacting sales volumes and profitability, especially in sectors like construction. For example, a projected 5% decrease in global construction spending for 2024 could directly reduce demand for AQ Group's related product lines.

SWOT Analysis Data Sources

This AQ Group SWOT analysis is built upon a robust foundation of data, drawing from official financial filings, comprehensive market intelligence reports, and expert industry evaluations to deliver accurate and actionable insights.