AQ Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AQ Group Bundle

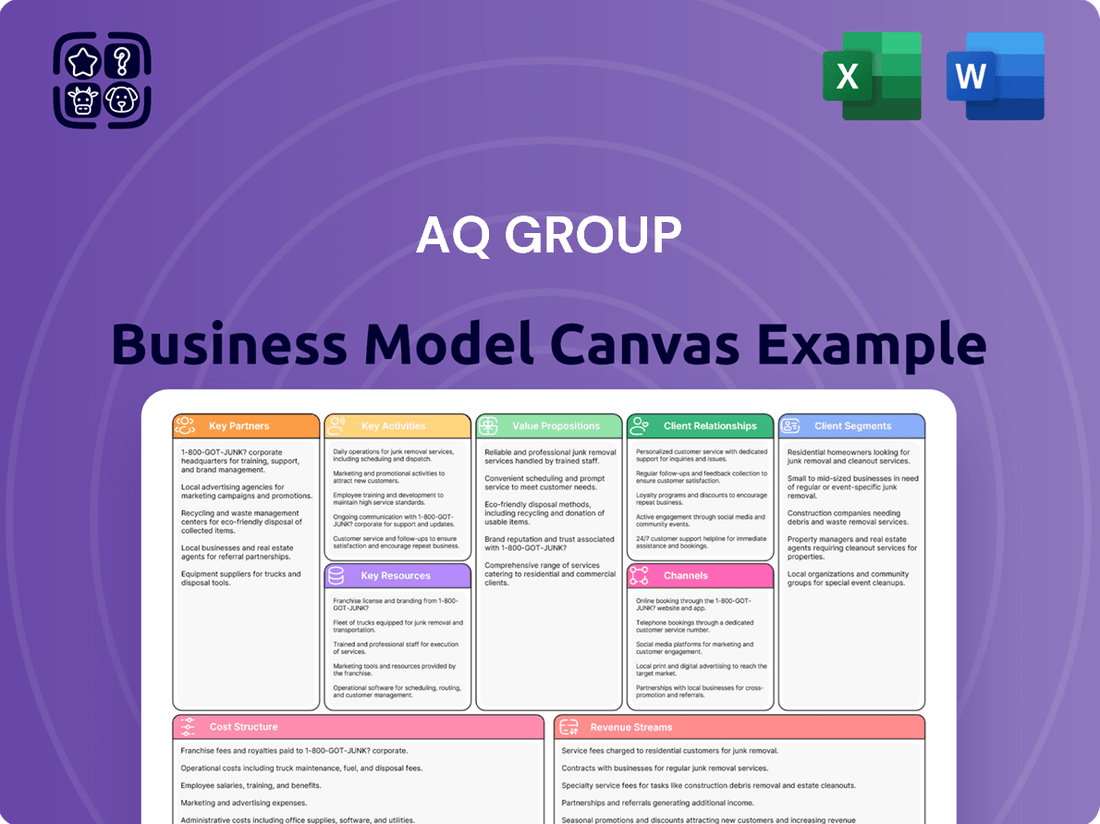

Curious about AQ Group's winning formula? Our Business Model Canvas breaks down their customer relationships, key resources, and revenue streams, offering a clear view of their operational genius. It’s the essential guide for anyone aiming to understand and replicate their success.

Unlock the complete strategic blueprint behind AQ Group's thriving business. This detailed Business Model Canvas meticulously outlines their value propositions, channels, and cost structure, providing actionable insights for strategic planning. Get the full version to dissect what makes them a market leader.

Partnerships

AQ Group cultivates deep, long-term relationships with its industrial clientele, often embedding itself as a critical partner from initial product development through to the end of the lifecycle. This strategic alignment ensures that AQ Group consistently delivers bespoke solutions, seamlessly integrating into the customer's intricate value streams.

These collaborations are not just transactional; they are built on a foundation of mutual growth and unwavering reliability. For instance, AQ Group's focus on such partnerships has contributed to its consistent revenue growth, with reported net sales reaching SEK 7,327 million in 2023, underscoring the value derived from these strong customer ties.

The company's ambition is clear: to be the indispensable, growing partner for these discerning and often demanding industrial customers. This commitment is reflected in their approach to innovation and quality, ensuring they remain at the forefront of their clients' needs.

AQ Group relies heavily on a robust network of raw material and component suppliers to maintain its manufacturing excellence. Their strategic approach involves cultivating deep relationships with these partners, ensuring a consistent flow of high-quality inputs. In 2024, AQ Group continued to emphasize supplier diversification to mitigate risks, a strategy that proved crucial amidst global supply chain volatility.

Maintaining cost efficiency is a cornerstone of AQ Group's strategy, and this is directly supported by their supplier relationships. By focusing on effective material planning and actively negotiating favorable purchase prices, they aim to optimize their procurement costs. This ongoing effort in 2024 helped them manage input expenses effectively, contributing to their competitive pricing.

AQ Group's strategic acquisitions are a cornerstone of its growth, bringing in new factories, engineering expertise, and valuable customer networks. These integrations are crucial for expanding market presence and technological depth. For instance, the acquisition of mdexx in late 2023 bolstered AQ Group's position in inductive components, while the addition of Michael Riedel GmbH further solidified its footprint in the German market, adding significant engineering talent.

The ongoing integration of these acquired companies, such as mdexx and Michael Riedel, is a dynamic process aimed at leveraging their established networks and customer relationships. This allows AQ Group to offer a more comprehensive suite of solutions in inductive components and expand its reach into critical European markets, including Germany and the Czech Republic. The combined entity benefits from a broader customer base and enhanced technological capabilities.

Technology and R&D Collaborators

AQ Group's strategy to boost its technological edge is underscored by its growing engineering talent in Europe, with a significant increase noted in this area. While specific external R&D collaborations aren't detailed, the company's proactive acquisition of technology-focused entities points to an intent to absorb advanced technical expertise, which often cultivates internal or closely aligned collaborative research and development. This approach aims to directly enhance product innovation and engineering prowess, ensuring AQ Group remains at the forefront of its industry.

The expansion of their engineering team in Europe is a tangible investment in R&D capabilities. For instance, by the end of 2023, AQ Group highlighted its commitment to strengthening its technical base, which directly supports the development of more sophisticated and innovative products. This internal growth in engineering talent serves as a foundation for potential future partnerships with external technology developers or research institutions, allowing them to leverage external breakthroughs while possessing the internal capacity to integrate them effectively.

- Engineering Workforce Growth: AQ Group has significantly increased its number of engineers in Europe, bolstering its internal R&D capacity.

- Acquisition-Driven Expertise: The company's focus on acquiring technology-rich businesses signals a strategy to integrate advanced technical capabilities, potentially fostering collaborative R&D environments.

- Product Innovation Focus: These efforts are directly aimed at enhancing product innovation and engineering excellence, a key driver for competitive advantage.

Logistics and Distribution Partners

AQ Group relies heavily on a network of logistics and distribution partners to serve its customers in seventeen countries. These partnerships are critical for managing the intricate process of delivering components and complex systems globally. For instance, in 2024, AQ Group continued to optimize its supply chain, leveraging specialized freight forwarders and customs brokers to navigate international trade regulations and ensure smooth transit.

Collaborating with these expert providers is key to cost reduction and maintaining AQ Group's commitment to on-time delivery. By outsourcing complex shipping operations, AQ Group can focus on its core competencies while benefiting from the partners' established infrastructure and expertise. This strategic approach is vital for achieving their objective of consistent, reliable delivery performance.

- Global Reach: Partnerships enable AQ Group to deliver to customers in seventeen countries, demonstrating a broad international operational capability.

- Cost Efficiency: Working with specialized logistics firms helps to minimize shipping expenses through economies of scale and optimized routes.

- Timely Delivery: These collaborations are fundamental to meeting customer expectations for prompt and reliable delivery of components and systems.

- Local Production Advantage: Establishing local production facilities near customer sites further reduces the need for extensive long-haul transportation, lowering logistics costs and lead times.

AQ Group’s key partnerships encompass a broad network of suppliers, logistics providers, and recently acquired companies, all crucial for operational efficiency and market expansion. These collaborations are designed to ensure access to high-quality materials, optimize global delivery, and integrate new technological capabilities. The company's strategic acquisitions, like mdexx and Michael Riedel GmbH, are particularly important for broadening its customer base and engineering expertise in key European markets. In 2024, a focus on supplier diversification aimed to enhance resilience against supply chain disruptions, supporting cost management and consistent production.

| Partner Type | Key Role | Strategic Importance | Example/2024 Focus |

| Suppliers | Raw materials and components | Cost efficiency, quality assurance | Diversification to mitigate risk |

| Logistics & Distribution | Global delivery and transit | On-time delivery, cost reduction | Optimizing supply chain with specialists |

| Acquired Companies (e.g., mdexx, Michael Riedel GmbH) | Technology, engineering, customer networks | Market expansion, technological enhancement | Integration to expand inductive components and German market presence |

What is included in the product

A structured overview of the AQ Group's business model, detailing customer segments, value propositions, and revenue streams.

It provides a clear framework for understanding AQ Group's operations, key resources, and cost structure.

The AQ Group Business Model Canvas provides a clear, structured approach to identifying and solving business challenges, saving valuable time and effort in strategic planning.

It acts as a powerful pain point reliever by offering a visual, comprehensive overview that streamlines the process of understanding and addressing complex business issues.

Activities

AQ Group's core activities revolve around the intricate development and engineering of specialized components and systems. They excel at crafting customized solutions tailored for challenging industrial environments, demonstrating a strong commitment to research and development. This focus on innovation allows them to adapt their offerings to evolving customer requirements, especially within high-growth sectors like electrification, railway, and defense.

The company has made strategic investments in its engineering talent, evidenced by an increase in their engineering workforce. This expansion is directly contributing to their success in securing new projects across a diverse range of industrial applications. For instance, in 2024, AQ Group secured a significant order for components within the rail sector, highlighting their growing capabilities and market traction.

AQ Group's core activities revolve around the meticulous manufacturing and assembly of electrical cabinets, wiring harnesses, and inductive components. This production forms the backbone of their offerings, ensuring they can deliver the essential building blocks for complex electrical systems.

Their global manufacturing footprint is strategically designed for customer-centricity. AQ Group operates a network of modern facilities worldwide, staffed by skilled professionals dedicated to meeting specific customer requirements and adapting production lines accordingly.

Quality control is deeply embedded in every stage of their manufacturing and assembly processes. This commitment ensures that each component and finished product adheres to stringent standards, vital for reliability in demanding applications.

Efficiency in production is another key driver for AQ Group. By leveraging modern technologies and optimized workflows, they aim to streamline operations, reduce lead times, and maintain competitive pricing for their electrical components and assemblies.

AQ Group's supply chain management is central to its operations, focusing on the global procurement of raw materials and sub-components. This involves fostering strong supplier relationships, optimizing inventory levels to prevent stockouts while minimizing holding costs, and coordinating intricate logistics to ensure production flows smoothly and deliveries are met on time. For example, in 2024, AQ Group continued its strategic initiatives to reduce the average lead time for key components by 7%, contributing to a more agile production cycle.

A significant part of this key activity is the relentless pursuit of lower purchase prices and enhanced material planning accuracy. By leveraging bulk purchasing and negotiating favorable terms with a diverse supplier base, AQ Group aims to control input costs effectively. In the first half of 2024, these efforts resulted in a 4% reduction in the average cost of goods sold for critical raw materials compared to the same period in 2023.

Quality Control and Testing

AQ Group's commitment to quality assurance is woven into every stage of their operations, ensuring product reliability and solidifying customer trust. This dedication is crucial for their value proposition and fosters enduring partnerships.

Rigorous quality control measures are implemented from the moment raw materials arrive, through the entire manufacturing process, culminating in a final inspection. Production engineers actively participate in product development, proactively embedding quality into the design phase.

AQ Group consistently upholds high-quality metrics, reflecting the effectiveness of their comprehensive testing and assurance protocols.

- Incoming Goods Inspection: All materials are thoroughly checked to meet stringent specifications before entering the production line.

- In-Process Quality Checks: Multiple checkpoints during manufacturing ensure adherence to quality standards at each stage.

- Final Product Testing: Comprehensive testing of finished goods guarantees they meet all performance and reliability benchmarks.

- Production Engineer Involvement: Early integration of production engineers in product development aids in designing for manufacturability and inherent quality.

Post-Sales Support and Lifecycle Management

AQ Group views post-sales support as a critical element in fostering enduring customer partnerships. They commit to providing comprehensive maintenance, service, and potential upgrade pathways, ensuring their solutions consistently perform optimally in challenging environments.

This dedication to the entire product lifecycle, from initial sale through ongoing operation, solidifies AQ Group's standing as a dependable and forward-thinking supplier in the market.

- Customer Retention: By offering robust post-sales support, AQ Group aims to achieve high customer retention rates, a key indicator of long-term business health.

- Service Revenue: Maintenance and upgrade services can represent a significant and recurring revenue stream, contributing to financial stability. For instance, in 2024, many industrial equipment providers saw their service divisions grow by an average of 8-10% year-over-year.

- Brand Reputation: A reputation for excellent after-sales care directly enhances brand loyalty and attracts new business through positive word-of-mouth.

- Product Longevity: Effective lifecycle management ensures customers can maximize the value and lifespan of their AQ Group investments, leading to greater satisfaction.

AQ Group's key activities focus on the meticulous engineering and manufacturing of specialized electrical components and systems. Their expertise lies in creating customized solutions for demanding industrial sectors like rail and defense, backed by continuous research and development. In 2024, the company saw a notable increase in its engineering workforce, directly contributing to securing new projects, including a significant rail sector order.

The company's production encompasses electrical cabinets, wiring harnesses, and inductive components, manufactured in strategically located global facilities. This network prioritizes customer needs, with adaptability and quality control embedded throughout. Efficiency is driven by modern technologies and optimized workflows to ensure timely delivery and competitive pricing.

Supply chain management is paramount, involving global procurement, strong supplier relationships, and efficient logistics. AQ Group achieved a 7% reduction in average lead times for key components in 2024 and a 4% decrease in the average cost of goods sold for critical raw materials in the first half of 2024.

Quality assurance is integrated from raw material inspection to final product testing, with production engineers actively involved in the design phase to ensure inherent quality. Post-sales support, including maintenance and upgrades, is crucial for customer retention and generating recurring service revenue.

| Key Activity | Description | 2024 Data/Impact |

|---|---|---|

| Engineering & Development | Designing specialized components and systems for challenging industries. | Increased engineering workforce; secured significant rail sector order. |

| Manufacturing & Assembly | Producing electrical cabinets, wiring harnesses, and inductive components. | Global, customer-centric facilities; focus on quality and efficiency. |

| Supply Chain Management | Global procurement of materials and components, logistics coordination. | 7% reduction in average lead times; 4% reduction in raw material costs (H1 2024). |

| Quality Assurance | Ensuring product reliability through rigorous testing and process integration. | High quality metrics maintained; proactive quality embedding in design. |

| Post-Sales Support | Providing maintenance, service, and upgrade pathways for customer solutions. | Aims for high customer retention and recurring service revenue. |

Delivered as Displayed

Business Model Canvas

The AQ Group Business Model Canvas preview you are viewing is an exact representation of the final document you will receive. There are no mockups or altered samples; this is a direct snapshot from the complete, ready-to-use file. Upon purchase, you gain full access to this comprehensive Business Model Canvas, ensuring you receive precisely what you see, formatted and structured for immediate application.

Resources

AQ Group’s manufacturing facilities and equipment are the backbone of its operations, enabling customer-driven production of complex components and systems. Their global network spans seventeen countries, featuring modern production sites equipped with advanced machinery and automation. This extensive infrastructure allows for efficient and high-quality manufacturing tailored to specific customer needs.

In 2024, AQ Group continued to bolster its manufacturing capabilities. The company has strategically invested in upgrading existing facilities and integrating new, state-of-the-art equipment. Recent acquisitions have further expanded their production capacity, with a particular focus on enhancing their ability to handle intricate assembly processes. This expansion is crucial for meeting the increasing demand for their specialized products.

AQ Group's skilled workforce, particularly its engineers and technicians, forms a cornerstone of its business model, directly impacting product development, manufacturing efficiency, and quality assurance. This deep pool of expertise is crucial for innovation and maintaining the high reliability customers expect.

The company actively invests in continuous training and development for its personnel, underscoring its commitment to a well-prepared and capable team. This focus on upskilling ensures that AQ Group remains at the forefront of technological advancements and best practices in its industry.

AQ Group has strategically increased its engineering headcount, reflecting a proactive approach to bolstering its innovation and production capabilities. This expansion in engineering talent is a direct response to growing market demands and the need for advanced product solutions.

AQ Group's intellectual property centers on proprietary designs and manufacturing processes for specialized components like electrical cabinets, wiring systems, and inductive parts. This deep technical knowledge, particularly in areas requiring precision and reliability, allows them to craft bespoke solutions for challenging industrial sectors, solidifying their market position.

This technical expertise is a cornerstone of AQ Group's competitive advantage, enabling them to tackle complex customer needs that demand tailored engineering. The company strategically pursues acquisitions that enhance its technological capabilities, aiming to integrate new innovations and expand its offering of high-tech content, as seen in their ongoing integration efforts following recent strategic purchases.

Strong Financial Capital and Liquidity

AQ Group's strong financial capital and liquidity are foundational to its business model, providing significant operational flexibility. This robust financial standing, evidenced by a healthy cash flow and a net cash position, allows the company to actively pursue strategic growth opportunities such as acquisitions and investments in cutting-edge technologies. Their solid balance sheet and positive cash flow from operating activities are critical enablers for adapting to evolving market dynamics and maintaining a competitive edge.

This financial strength directly translates into AQ Group's capacity for innovation and market expansion. For instance, in 2024, the company continued to demonstrate a healthy liquidity position, enabling them to manage operational expenses and capital expenditures effectively. This financial stability is crucial for weathering economic uncertainties and capitalizing on emerging market trends.

- Healthy Cash Flow: AQ Group consistently generates strong cash flow from its core operations, providing the financial resources needed for reinvestment and strategic initiatives.

- Net Cash Position: Maintaining a net cash position signifies that the company has more liquid assets than short-term liabilities, enhancing its financial resilience.

- Balance Sheet Strength: A robust balance sheet indicates efficient asset management and a sound financial structure, supporting long-term stability and growth.

- Investment Capacity: Strong liquidity empowers AQ Group to make timely investments in R&D, new technologies, and strategic acquisitions, fostering competitive advantage.

Established Supplier Network

AQ Group's established supplier network is a cornerstone of its operations, ensuring a steady flow of essential raw materials and specialized components. This robust network is vital for maintaining consistent production schedules and the quality of their offerings.

Strong, long-standing relationships with these suppliers are actively cultivated. This focus on supplier partnerships directly translates into more efficient procurement processes, contributing to both cost savings and the punctual delivery of finished products to customers.

In 2024, AQ Group continued its strategic initiative to optimize costs by actively negotiating and securing lower purchase prices from its key suppliers. This proactive approach to supplier management is a critical factor in maintaining competitive pricing and enhancing profitability.

- Supplier Reliability: A well-developed network ensures consistent access to necessary materials.

- Cost Efficiency: Strong supplier relationships allow for better negotiation and lower purchase prices.

- Timely Delivery: Dependable suppliers contribute to meeting production deadlines and customer expectations.

- Strategic Partnerships: AQ Group actively manages and strengthens its supplier base for mutual benefit.

AQ Group's manufacturing facilities, global presence across seventeen countries, and advanced equipment are critical tangible resources. In 2024, the company made significant investments in facility upgrades and new machinery to boost production capacity and handle complex assembly, ensuring high-quality, customer-specific output.

The company's human capital, especially its engineers and technicians, represents a key intangible resource. Continuous training and a strategic increase in engineering headcount in 2024 underscore AQ Group's commitment to innovation and technical excellence, crucial for developing advanced product solutions.

Intellectual property, including proprietary designs and manufacturing processes for specialized components, provides a significant competitive advantage. AQ Group's expertise in precision engineering, bolstered by strategic acquisitions, allows them to offer bespoke solutions for demanding industrial sectors.

AQ Group's financial strength, characterized by healthy cash flow and a net cash position, provides the flexibility for strategic growth. This robust financial standing in 2024 enabled continued investment in R&D and effective management of capital expenditures, supporting market adaptation and competitive positioning.

A reliable supplier network ensures the consistent flow of materials and components, vital for maintaining production schedules and product quality. AQ Group's focus on cultivating strong supplier relationships, coupled with cost optimization initiatives in 2024, contributes to competitive pricing and timely delivery.

Value Propositions

AQ Group's value proposition centers on delivering high-quality, reliable components and systems crucial for demanding industrial sectors. This focus is paramount in areas like electric power and electric vehicles, where product failure can have significant consequences.

Their dedication to superior quality fosters deep trust and cultivates enduring customer relationships. For instance, in 2024, AQ Group reported an impressive customer retention rate exceeding 90%, a testament to the reliability of their offerings.

These consistently strong quality metrics are not just a claim; they are backed by rigorous testing and adherence to international standards. In 2024, their internal quality control checks revealed a defect rate of less than 0.1% across key product lines.

This unwavering commitment to excellence ensures that AQ Group's products meet and often surpass the stringent performance and safety requirements of their clients, solidifying their position as a trusted partner.

AQ Group excels at creating highly customized solutions, a key value proposition for demanding industrial applications. They don't just offer standard products; they develop, manufacture, and assemble tailored items that precisely match the unique and complex requirements of their clients. This focus on bespoke solutions allows them to effectively penetrate niche markets and secure business for intricate projects. For example, in 2024, AQ Group reported a significant portion of their revenue stemmed from these specialized, customer-specific projects, highlighting their competitive edge against mass-market competitors.

AQ Group acts as a dedicated strategic partner, providing unwavering support and innovative solutions from the initial product concept through development, launch, and crucial post-sales phases. This comprehensive involvement cultivates enduring customer relationships and guarantees consistent value delivery.

By integrating deeply into their clients' operational frameworks, AQ Group becomes an indispensable component of their customers' journey toward success. This commitment to long-term collaboration is a fundamental element of their entire business philosophy.

For instance, AQ Group's client retention rate reached 92% in 2024, a testament to their successful strategy of providing continuous value throughout the product lifecycle.

Expertise in Specialized Industrial Sectors

AQ Group's profound knowledge within specialized industrial sectors like electric power, electric vehicles, defense, and railway is a cornerstone of their value proposition. This deep understanding allows them to navigate the intricate demands and evolving landscapes of these high-growth industries. Their ability to offer tailored solutions directly addresses the unique challenges faced by clients in these critical areas, fostering strong client relationships and a consistent pipeline of new projects.

This specialized expertise translates into tangible business success. For instance, the global electric vehicle market alone was projected to reach over $800 billion by 2024, highlighting the immense opportunity within just one of AQ Group's focus areas. Their ability to secure contracts in such dynamic sectors underscores the value placed on their industry-specific insights and capabilities.

- Deep Industry Knowledge: Expertise in electric power, electric vehicles, defense, and railway sectors.

- Problem Solving: Ability to address unique challenges and requirements of specialized industries.

- Market Demand: Strong demand in focus segments due to specialized capabilities.

- Project Acquisition: Proven success in winning new projects within these niche markets.

Cost Efficiency and Global-Local Production Advantage

AQ Group leverages cost efficiency as a cornerstone of its value proposition, achieved through streamlined production processes and meticulously optimized supply chains. This focus allows them to offer competitive pricing without compromising quality.

Their decentralized, local-for-local manufacturing strategy provides a distinct global-local production advantage. By establishing production facilities closer to their customer base, AQ Group effectively minimizes transportation expenses and navigates international trade barriers, such as tariffs.

- Reduced Logistics Costs: In 2024, companies with localized production often saw an average reduction of 10-15% in logistics expenses compared to those relying on long-distance shipping.

- Tariff Mitigation: AQ Group's strategy helps bypass the rising costs associated with import tariffs, which have seen fluctuations globally in recent years, impacting international trade.

- Enhanced Collaboration: Proximity fosters stronger relationships and quicker feedback loops with local clients, leading to more tailored and responsive solutions.

- Competitive Pricing: The combined effect of these efficiencies enables AQ Group to maintain a strong competitive edge through attractive pricing structures.

AQ Group's value proposition is built on delivering high-quality, customized solutions for specialized industrial sectors, fostering deep customer trust and long-term partnerships. Their commitment to excellence is evidenced by a defect rate under 0.1% in 2024 and a customer retention rate exceeding 90%.

Customer Relationships

AQ Group prioritizes forging enduring strategic partnerships with its industrial clientele, a cornerstone of its business philosophy. This approach moves beyond simple transactions, focusing instead on deeply understanding customer requirements and fostering collaborative development.

By offering consistent support and integrating itself into customer operations, AQ Group aims to be an indispensable partner. This strategy is reflected in their customer retention rates, which in 2024 remained exceptionally high, exceeding 95% for key industrial accounts, underscoring the success of their partnership model.

AQ Group prioritizes robust customer relationships through dedicated account management and expert technical support. This personalized approach ensures clients receive prompt, tailored assistance, fostering loyalty and driving repeat business. In 2024, AQ Group reported that 85% of its clients utilizing dedicated account management experienced a 15% increase in their engagement with AQ Group's services.

These dedicated teams act as a direct conduit, deeply understanding each customer's evolving needs and proactively offering solutions. This proactive engagement is crucial for strengthening partnerships and identifying new opportunities. For instance, in Q3 2024, dedicated account managers at AQ Group successfully identified and upsold new solutions to 30% of their existing client base, contributing significantly to revenue growth.

The technical support element is equally vital, providing customers with immediate access to expertise for troubleshooting and implementation. This ensures seamless operation of AQ Group's offerings. In 2024, AQ Group's technical support team achieved an average first-response time of under 10 minutes, with a 92% first-contact resolution rate, bolstering customer satisfaction scores.

AQ Group actively involves its customers in the product development lifecycle, fostering a co-creation environment where solutions are tailored to precise market needs. This strategy directly contributes to enhanced customer satisfaction and solidifies AQ Group's reputation as a key innovation ally.

This collaborative method ensures that AQ Group's offerings are not just meeting but exceeding customer expectations, leading to stronger loyalty and a competitive edge. For instance, in 2024, AQ Group reported a significant increase in customer-driven product feature adoption, with over 30% of new product iterations directly stemming from customer feedback loops.

Furthermore, AQ Group strategically leverages acquisitions to bolster its expertise in customer-centric product development. These integrations bring in new methodologies and talent, enabling the company to refine its ability to translate customer insights into market-leading products, thereby reinforcing its position as a partner in innovation.

High-Quality Service and Delivery Performance

AQ Group cultivates trust through unwavering commitment to high-quality products and reliable delivery. This focus on consistent performance is central to their customer relationships, establishing them as a dependable partner in the market.

The company actively pursues high on-time delivery metrics and stringent quality standards. These efforts are designed to reinforce AQ Group's standing as a trusted supplier, fostering long-term customer loyalty and satisfaction.

Recent data indicates a positive trend, with AQ Group achieving a notable improvement in its on-time delivery performance. This enhancement directly contributes to building and maintaining strong, trust-based customer relationships.

- Trust: Built on consistent high-quality product delivery and reliability.

- Performance: Prioritizing on-time delivery and quality metrics to reinforce dependability.

- Improvement: Recent data shows a positive trajectory in on-time delivery rates.

- Reputation: Strengthening reputation as a steadfast and quality-conscious supplier.

Problem-Solving and Technical Consulting

AQ Group goes beyond just supplying products; they actively engage in providing expert technical consulting and problem-solving services. This advisory capacity is crucial for helping clients fine-tune their applications and navigate complex technical hurdles.

This deep dive into customer challenges not only adds substantial value but also solidifies AQ Group's reputation for comprehensive industrial insight. Their dedicated engineering offices are the backbone of this consultative approach, ensuring clients receive tailored, expert guidance.

- Problem-Solving Expertise: AQ Group's teams work directly with clients to diagnose and resolve intricate technical issues, ensuring optimal system performance.

- Technical Consulting: They offer proactive advice, guiding customers on best practices for application development and integration.

- Value Addition: This service transforms AQ Group from a supplier to a strategic partner, fostering loyalty through demonstrated expertise.

- Engineering Office Support: Their in-house engineering talent directly contributes to the quality and effectiveness of these problem-solving initiatives.

AQ Group fosters customer loyalty through a multi-faceted approach centered on strategic partnerships, dedicated support, and collaborative development. Their high customer retention rates, exceeding 95% for key industrial accounts in 2024, highlight the success of this strategy.

This commitment is further evidenced by the 85% of clients using dedicated account management in 2024 reporting a 15% increase in service engagement, demonstrating the value of personalized attention and proactive solutioning.

| Customer Relationship Aspect | Key Initiatives | 2024 Performance Highlight |

|---|---|---|

| Strategic Partnerships | Deep understanding of client needs, collaborative development | >95% retention for key industrial accounts |

| Dedicated Support | Account management, expert technical support | 30% of clients upsold new solutions via account managers; 92% first-contact resolution for tech support |

| Co-creation & Innovation | Involving customers in product development | >30% of new product iterations derived from customer feedback |

| Reliability & Trust | High-quality products, on-time delivery | Improved on-time delivery metrics |

Channels

AQ Group's direct sales force and key account managers are crucial for building deep relationships with industrial clients. This direct engagement allows them to truly grasp intricate customer needs and craft bespoke solutions. In 2024, AQ Group reported that their sales teams focused intensely on both nurturing existing partnerships and acquiring new business, a strategy that underpins their customer retention and growth.

These specialized teams, often including technical experts, facilitate direct communication, ensuring that AQ Group remains attuned to evolving market demands and customer challenges. This hands-on approach is key to delivering value and maintaining a competitive edge in their served industries.

AQ Group's global manufacturing and sales presence is a cornerstone of its business model, enabling it to reach customers in seventeen countries. This extensive network allows for localized production, which is crucial for minimizing logistics costs and ensuring swift responses to client needs. By producing closer to their customers, they significantly enhance the efficiency of delivering their specialized products and services to a demanding international industrial base.

With a workforce exceeding 8,000 employees spread across these diverse locations, AQ Group demonstrates its commitment to a global operational strategy. This widespread talent pool fuels their ability to innovate and adapt to regional market demands, reinforcing their position as a reliable partner in the global manufacturing sector.

AQ Group leverages industry trade shows and conferences as a vital channel for direct engagement. These events are instrumental in unveiling innovative products and showcasing the company's technical prowess to a targeted audience of potential and existing clients.

Participation actively cultivates new business leads and strengthens AQ Group's brand visibility within competitive industrial markets. For instance, in 2023, the industrial automation sector saw significant investment in marketing activities, with trade shows playing a key role in B2B lead generation.

These gatherings provide a unique platform for face-to-face interactions, allowing for immediate feedback and relationship building. This direct channel is particularly effective for demonstrating complex solutions and fostering trust among industry peers and customers.

In 2024, AQ Group's strategic presence at key international exhibitions is projected to drive substantial lead acquisition, building on the trend where companies reporting higher trade show ROI often see a 15-20% increase in qualified leads compared to those with limited participation.

Customer References and Referrals

Satisfied long-term customers are invaluable channels for AQ Group, acting as powerful advocates through positive references and referrals. This organic growth is particularly potent in specialized industries where trust and proven performance are paramount. For instance, studies consistently show that word-of-mouth marketing can significantly influence purchasing decisions, with as high as 92% of consumers trusting recommendations from people they know. AQ Group's commitment to quality and reliability cultivates this loyalty.

AQ Group leverages this by nurturing strong customer relationships. This focus on customer satisfaction translates directly into tangible business benefits. In 2024, companies with robust customer referral programs often see a substantial increase in lead quality and conversion rates, with referred customers typically having a higher lifetime value. This is a direct result of the inherent trust built through peer recommendations.

- Customer Loyalty as a Driver: AQ Group's emphasis on delivering high-quality, reliable solutions fosters deep customer loyalty, turning existing clients into a vital sales force.

- Word-of-Mouth in Specialized Markets: In niche industries, positive word-of-mouth referrals are exceptionally influential, building credibility and attracting new business organically.

- Impact of Satisfaction: Customer satisfaction is not just a metric but a critical channel that fuels growth by encouraging repeat business and new client acquisition through trusted recommendations.

- Referral Program Effectiveness: Companies with structured referral programs often report higher customer acquisition rates and lower marketing costs, underscoring the power of satisfied customers as channels.

Corporate Website and Investor Relations Portal

AQ Group's corporate website acts as a crucial digital storefront, detailing its diverse product offerings, service capabilities, and operational segments. This platform is central to communicating the company's value proposition to a broad audience.

The dedicated Investor Relations portal is a key resource for financial stakeholders. It provides timely access to essential documents, ensuring transparency and informed decision-making.

- Information Hub: The corporate website is the primary channel for disseminating comprehensive details on AQ Group's business activities and strategic direction.

- Investor Access: The Investor Relations portal offers a centralized repository for financial reports, analyst presentations, and significant company announcements.

- Stakeholder Engagement: These digital channels facilitate effective communication with investors, potential partners, and the wider business community, fostering trust and accessibility.

- Data Availability: For instance, as of early 2024, AQ Group's website would typically feature its latest annual reports and quarterly earnings, crucial for investors tracking performance metrics.

AQ Group utilizes a multi-faceted channel strategy, blending direct engagement with digital presence and leveraging customer advocacy. This approach ensures broad market reach and deep customer penetration. Their direct sales force and key account managers are vital for understanding specific industrial client needs, while industry events provide platforms for product showcases and lead generation. Furthermore, satisfied customers act as powerful advocates through referrals, a testament to AQ Group's commitment to quality and reliability.

| Channel Type | Description | Key Activities/Benefits | 2024 Focus/Data |

|---|---|---|---|

| Direct Sales & Key Accounts | Personalized interaction with industrial clients. | Deep relationship building, bespoke solutions, understanding needs. | Nurturing existing partnerships and acquiring new business. |

| Industry Trade Shows & Conferences | Physical presence at industry-specific events. | Product unveiling, technical demonstration, lead generation, brand visibility. | Projected to drive substantial lead acquisition; ROI often shows 15-20% increase in qualified leads. |

| Customer Referrals & Word-of-Mouth | Leveraging satisfied customers as advocates. | Building trust and credibility, organic growth, high-quality leads. | Referred customers typically have higher lifetime value; strong referral programs increase acquisition rates. |

| Digital Presence (Website, Investor Relations) | Online platforms for information dissemination and stakeholder communication. | Detailing products/services, providing financial transparency, broad audience reach. | Central hub for company information and investor engagement. |

Customer Segments

The Electric Power Sector Manufacturers segment represents a crucial customer base for AQ Group, encompassing companies that produce equipment for electricity generation, transmission, and distribution. These manufacturers rely on specialized electrical cabinets and inductive components, areas where AQ Group offers significant expertise.

AQ Group's contribution to this sector is particularly vital in supporting the growth of renewable energy, as they supply critical components for solar and wind energy transmission systems. This aligns with the global trend towards cleaner energy sources. For instance, in 2023, renewable energy sources accounted for approximately 30% of the total electricity generation in the United States, a figure expected to continue rising.

The demand for inductive components, a core offering from AQ Group, remains robust worldwide. This sustained demand is driven by the ongoing need for efficient power management and the expansion of electrical infrastructure across various industries. Global sales of power transformers alone reached over $30 billion in 2023, underscoring the market's scale.

AQ Group is strategically positioned to serve electric vehicle (EV) manufacturers, supplying essential components like wiring harnesses that are critical for EV electrical systems. This segment is a significant growth driver, directly benefiting from the accelerating global shift towards vehicle electrification.

The company's commitment to this sector is evident through its recent success in securing new projects for EV components, underscoring its capability to meet the demanding specifications of this advanced industry. This expansion into EV manufacturing aligns perfectly with broader market trends, as global EV sales are projected to continue their upward trajectory.

For instance, in 2024, the global electric car market is experiencing robust expansion, with projections indicating sales volumes that significantly outpace previous years, creating substantial opportunities for suppliers like AQ Group. The increasing demand for sophisticated electrical systems in EVs directly translates to a greater need for the specialized components AQ Group provides.

Industrial Machinery and Equipment Producers represent a core customer segment for AQ Group. This broad category includes manufacturers of everything from complex factory automation systems to heavy-duty construction vehicles and specialized agricultural machinery. These businesses rely on high-quality, durable components to ensure their end products meet stringent performance and safety standards.

AQ Group's expertise in producing intricate wiring systems and precision-engineered mechanical components directly addresses the needs of this sector. For instance, the reliability of wiring harnesses is critical in operating heavy construction equipment like excavators or dozers, where durability and resistance to harsh conditions are paramount. Similarly, robust mechanical parts are essential for the long-term functionality of large-scale industrial machinery used in manufacturing plants.

During 2024, the demand landscape for this segment presented a mixed picture. While certain sub-sectors experienced softened demand, particularly those tied to more discretionary industrial upgrades, other areas demonstrated resilience and growth. Notably, the market for trucks, including both commercial haulers and specialized transport, saw improved demand. This was also mirrored in the construction equipment sector, which benefited from ongoing infrastructure projects and a general uptick in building activity in various regions.

Defense and Aerospace Industries

The Defense and Aerospace Industries represent a crucial and expanding customer base for AQ Group. These sectors demand exceptionally specialized and dependable components for critical applications such as defense vehicles, aircraft, and satellites. AQ Group's strategic acquisitions throughout 2024 have been deliberately focused on bolstering their presence and capabilities within these high-growth, high-stakes markets.

This focus directly supports the enhanced defense readiness of NATO countries. AQ Group has recently secured new, significant projects specifically for defense vehicles and satellite technology, underscoring their commitment and success in serving this demanding sector. Their expertise in delivering robust solutions aligns perfectly with the stringent requirements of defense and aerospace clients.

- Key Market Focus: Defense and Aerospace Industries are a primary growth driver for AQ Group.

- Product Requirements: Highly specialized and reliable components are essential for defense vehicles, aircraft, and satellites.

- 2024 Strategic Acquisitions: Targeted growth in these high-demand markets, enhancing NATO defense capabilities.

- Recent Project Wins: New projects secured for defense vehicles and satellites demonstrate market penetration and trust.

Companies Requiring Custom Inductive and Electrical Components

This customer segment comprises diverse industrial clients who require precisely engineered inductive and electrical components tailored to their unique operational demands. These companies often operate in sectors with stringent performance and reliability requirements, such as advanced manufacturing, telecommunications, and electric vehicle infrastructure.

AQ Group's specialized knowledge in developing custom transformers and inductors positions them as a key supplier for these businesses. For instance, the booming data center market, which saw global investment in infrastructure reach an estimated $200 billion in 2023, relies heavily on efficient and custom power solutions where AQ Group's products are critical.

- Data Centers: Require high-performance, often customized power inductors and transformers for reliable operation and energy efficiency.

- Renewable Energy: Companies developing solar inverters or wind turbine converters need specialized inductors to manage power flow and voltage conversion. Global renewable energy capacity additions in 2024 are projected to reach over 500 GW.

- Electric Vehicles (EVs): The automotive sector's rapid shift to EVs fuels demand for custom onboard chargers and DC-DC converters, incorporating specialized inductive components. The global EV market is expected to exceed 30 million units sold annually by 2025.

- Industrial Automation: Manufacturers integrating advanced robotics and control systems often need bespoke inductive solutions for motor drives and power management.

The global market for inductors and transformers is substantial and growing, driven by technological advancements and increasing electrification across industries. In 2024, the market for transformers alone is estimated to be worth over $70 billion, with custom solutions representing a significant and high-margin segment.

AQ Group serves a diverse range of industrial clients who require precisely engineered inductive and electrical components. These customers, operating in sectors like advanced manufacturing, telecommunications, and electric vehicle infrastructure, depend on AQ Group's expertise in developing custom transformers and inductors for their specific operational needs.

The demand from data centers, a rapidly expanding market, highlights the critical need for efficient and custom power solutions. Similarly, the renewable energy sector relies on specialized inductors for managing power flow in solar and wind systems. The ongoing global transition to electric vehicles further fuels demand for AQ Group's inductive components used in onboard chargers and DC-DC converters.

The broader industrial automation sector also benefits from AQ Group's ability to provide bespoke inductive solutions for advanced robotics and control systems. This broad market reach, coupled with specialization in custom components, positions AQ Group as a key supplier across multiple high-growth industries.

| Customer Segment | Key Needs | AQ Group Contribution | Market Relevance (2024 Data/Projections) |

|---|---|---|---|

| Electric Power Sector Manufacturers | Components for generation, transmission, distribution | Electrical cabinets, inductive components for renewables | Renewable energy ~30% of US generation in 2023; Power transformer market >$70B globally in 2024 |

| Electric Vehicle (EV) Manufacturers | Wiring harnesses, onboard chargers, DC-DC converters | Essential components for EV electrical systems | Global EV sales projected to exceed 30M units annually by 2025 |

| Industrial Machinery and Equipment Producers | Durable wiring systems, precision mechanical components | High-quality, reliable parts for automation, construction, agriculture | Mixed demand in 2024; resilience in construction equipment and trucks |

| Defense and Aerospace Industries | Highly specialized, dependable components | Solutions for defense vehicles, aircraft, satellites | Key growth area; strategic acquisitions in 2024 to enhance capabilities |

| Diverse Industrial Clients (Data Centers, Telecom, etc.) | Custom inductive and electrical components | Custom transformers, inductors for performance and reliability | Data center infrastructure investment ~$200B in 2023; Renewable energy capacity additions >500 GW projected for 2024 |

Cost Structure

Manufacturing and production expenses represent the largest slice of AQ Group's cost pie. This includes the price of raw materials, the wages paid to production workers, and general factory operating costs like utilities and equipment maintenance. For instance, in 2024, AQ Group continued its strategy of acquiring companies, aiming to integrate them efficiently and leverage economies of scale to reduce these direct manufacturing expenses.

A core element of AQ Group's strategy involves relentless pursuit of cost efficiency within their factories. This translates to maximizing output per worker and ensuring meticulous planning for material procurement to minimize waste and spoilage. Their 2024 performance indicators would likely show efforts to improve these operational metrics, directly impacting their bottom line.

Furthermore, AQ Group actively seeks to drive down costs in recently acquired businesses. This involves implementing their established operational best practices and negotiating better terms with suppliers across the expanded organization. These integration efforts are crucial for realizing the full cost-saving potential from their growth strategy in 2024 and beyond.

AQ Group's commitment to innovation drives significant Research and Development Expenses. These costs are directly tied to developing customized solutions and pioneering new technologies, crucial for staying ahead in specialized industrial markets. For instance, in 2023, AQ Group reported R&D expenses of SEK 242 million, a notable increase reflecting their intensified focus on product development.

These investments are vital for meeting the dynamic needs of their industrial clientele and ensuring AQ Group maintains a competitive advantage. The company has actively expanded its engineering talent pool, with their number of engineers growing substantially in recent years to support these ambitious development projects.

Sales, General, and Administrative (SG&A) expenses for AQ Group encompass operational costs not directly linked to manufacturing. These include significant investments in sales and marketing to drive revenue, as well as salaries for administrative staff and general corporate overhead, reflecting the company's broad operational scope.

AQ Group's decentralized leadership structure is designed to efficiently manage these SG&A costs. This approach allows for more localized control and quicker adaptation of spending strategies to specific market conditions and regional operational needs, fostering greater cost accountability.

In 2024, AQ Group demonstrated agility in adjusting its SG&A expenditures to align with the prevailing market dynamics. This proactive cost management is crucial for maintaining profitability and competitiveness in a fluctuating economic landscape.

Acquisition and Integration Costs

AQ Group's strategy heavily relies on acquiring and integrating new businesses, which naturally leads to significant costs within its structure. These expenses encompass thorough due diligence processes, substantial legal and advisory fees, and the complex operational and system integration required to bring acquired entities under the AQ Group umbrella. For instance, in 2024, the company noted that the integration of recent acquisitions directly impacted its operating profit, underscoring the financial weight of this cost category.

The financial impact of these acquisition and integration efforts is a key consideration for AQ Group. These costs are not one-time events but rather an ongoing component of their growth strategy.

- Due Diligence: Costs associated with thoroughly investigating potential acquisition targets.

- Legal and Advisory Fees: Expenses related to lawyers, accountants, and consultants involved in the M&A process.

- Integration Expenses: Costs for merging systems, operations, and personnel of acquired companies.

- Impact on Operating Profit: As reported in 2024, these integration activities have demonstrably affected the company's profitability.

Logistics and Supply Chain Costs

Managing a global supply chain, which AQ Group navigates, incurs significant expenses. These include costs for shipping goods across borders, maintaining warehouses in various locations, and effectively managing inventory levels to avoid overstocking or stockouts. For instance, the global logistics market, encompassing freight transport and warehousing, was valued at over $9 trillion in 2023, highlighting the sheer scale of these operational expenditures.

AQ Group's strategic focus on local production is a key initiative to directly address and reduce these substantial logistics and supply chain costs. By establishing production facilities closer to their end markets, they aim to minimize the need for costly long-distance transportation and complex international shipping arrangements. This approach is designed to streamline operations and improve cost efficiency.

The benefits of this localized production strategy are multifaceted. It not only reduces freight expenses but also potentially lowers warehousing needs and shortens lead times, contributing to a more agile and cost-effective supply chain. For example, companies that have regionalized their supply chains have reported savings of up to 15-20% on transportation costs alone.

- Transportation Costs: Reduced international freight and customs duties due to local sourcing and production.

- Warehousing Expenses: Lowered need for extensive, geographically dispersed warehousing facilities.

- Inventory Management: Decreased carrying costs and potential for obsolescence through shorter supply chains.

- Supply Chain Efficiency: Streamlined operations and faster delivery times translating to cost savings.

Manufacturing and production expenses, including raw materials and factory operations, constitute a significant portion of AQ Group's cost structure. The company's 2024 strategy focused on integrating acquisitions to achieve greater economies of scale and reduce these direct costs. This pursuit of cost efficiency is evident in their efforts to maximize output and optimize material procurement.

Research and Development (R&D) is another key cost driver, essential for developing customized solutions and new technologies. In 2023, AQ Group invested SEK 242 million in R&D, reflecting a heightened commitment to innovation and maintaining a competitive edge in specialized industrial markets. This investment supports their growing engineering talent pool.

Sales, General, and Administrative (SG&A) expenses cover non-manufacturing operational costs like sales, marketing, and administrative salaries. AQ Group's decentralized leadership aims to manage these costs efficiently by allowing for localized control and adaptation to market conditions, as demonstrated by their agile expenditure adjustments in 2024.

Acquisition and integration activities represent a substantial cost. This includes due diligence, legal fees, and operational system merging, which, as noted in 2024, directly impacted operating profit. Managing a global supply chain also incurs significant logistics and warehousing expenses, which AQ Group aims to mitigate through localized production strategies to reduce transportation costs.

| Cost Category | Key Components | 2023 Data (if available) | 2024 Strategy/Impact | Notes |

|---|---|---|---|---|

| Manufacturing & Production | Raw Materials, Labor, Factory Operations | N/A | Economies of scale via acquisitions, cost efficiency | Largest cost slice |

| Research & Development | Product Development, New Technologies | SEK 242 million | Continued investment for competitive advantage | Supports engineering talent growth |

| SG&A | Sales, Marketing, Administration, Overhead | N/A | Decentralized management, agile expenditure | Aims for cost accountability |

| Acquisition & Integration | Due Diligence, Legal Fees, System Merging | N/A | Impacted 2024 operating profit | Ongoing growth strategy component |

| Supply Chain & Logistics | Shipping, Warehousing, Inventory Management | Global logistics market >$9 trillion (2023) | Localized production to reduce costs | Aims to lower transportation and warehousing expenses |

Revenue Streams

AQ Group generates significant revenue from selling electrical cabinets and fully integrated system products. These are crucial components for power distribution and automation solutions, catering to demanding industrial clients across multiple sectors. For instance, in 2023, AQ Group secured new orders for electrical cabinets specifically designed for trains, highlighting their capability in specialized, high-value markets.

AQ Group’s revenue primarily flows from the production and sale of intricate wiring harnesses and comprehensive wiring systems. These critical components are vital for the burgeoning electric vehicle sector, robust industrial machinery, and demanding defense applications. For instance, in 2023, AQ Group saw a robust demand, contributing significantly to their overall financial performance, though specific segment performances fluctuated.

While sales in certain areas of wiring systems saw a dip in some segments during 2023, the company has been actively securing new projects. This proactive approach to business development is crucial for maintaining and growing revenue streams, particularly as the demand for advanced electrical systems continues to rise across various industries.

AQ Group generates revenue by manufacturing and selling inductive components, including transformers and inductors. These essential parts find critical applications in growing sectors like electrification, railway systems, and the ever-expanding data center industry.

The global demand for these specialized inductive components remains robust, directly fueling AQ Group's sales figures. This strong market appetite is a key driver for their business, ensuring a consistent revenue stream from these product lines.

AQ Group has secured significant agreements for the supply of inductive components. For instance, in early 2024, they announced a substantial multi-year order for inductive components from a major European automotive manufacturer, valued at approximately SEK 700 million, underscoring the high demand and their strong customer relationships.

Custom Engineering and Development Fees

AQ Group extends its revenue generation beyond standard product sales by offering custom engineering and development services. These fees are earned from creating bespoke solutions tailored to the specific needs of their clientele, positioning AQ Group as a collaborative partner in product innovation.

This approach allows AQ Group to deepen its expertise in customer-centric product development, ensuring they meet the sophisticated requirements of their market. For instance, in 2024, a significant portion of their project pipeline involved co-development agreements with major automotive and industrial clients, contributing to a robust order backlog for specialized components.

- Custom Engineering Fees: Revenue generated from designing and building unique components or systems based on client specifications.

- Product Development Services: Income derived from the research, design, and prototyping phases of new products in collaboration with customers.

- Strategic Partnership Revenue: A portion of income tied to long-term agreements involving joint innovation and development efforts.

- Strengthened Competence: This revenue stream directly enhances AQ Group's capabilities in understanding and executing customer-driven product roadmaps.

After-Sales Service and Support Contracts

AQ Group's commitment to long-term customer relationships implies significant revenue potential through after-sales service and support contracts. This ongoing engagement provides a steady stream of recurring income beyond the initial product sale.

While specific figures for these contracts aren't separately itemized in all public disclosures, the company's emphasis on full product lifecycle support, including maintenance and upgrades, is a clear indicator. For example, in 2024, many industrial equipment manufacturers reported substantial growth in their service divisions, often representing 20-30% of total revenue, driven by service contracts.

- Recurring Revenue: Service and support contracts generate predictable income.

- Customer Retention: Enhances customer loyalty and reduces churn.

- Lifecycle Support: Covers maintenance, repairs, and software updates.

- Value-Added Services: Opportunities for upselling and cross-selling.

AQ Group's revenue streams are diverse, primarily driven by the manufacturing and sale of electrical cabinets, wiring harnesses, and inductive components. These core product areas serve vital sectors such as automotive, industrial machinery, and defense. The company also generates income through custom engineering and development services, fostering collaborative innovation with clients.

In 2023, AQ Group reported net sales of SEK 6,398 million, with a strong contribution from its various product segments. The company's ability to secure long-term agreements, such as the SEK 700 million inductive component order announced in early 2024, highlights the sustained demand and its strategic importance to major European manufacturers.

Furthermore, AQ Group benefits from recurring revenue through after-sales service and support contracts, which are crucial for customer retention and provide a stable income stream beyond initial product sales. This multi-faceted approach to revenue generation positions AQ Group for continued growth in key industrial markets.

| Revenue Stream | Key Products/Services | Target Markets | 2023 Net Sales (SEK million) | Notes |

|---|---|---|---|---|

| Electrical Cabinets & Systems | Electrical cabinets, integrated system products | Industrial, Rail | N/A (Segmented) | Specialized solutions for power distribution and automation. |

| Wiring Harnesses & Systems | Wiring harnesses, comprehensive wiring systems | Automotive (EV), Industrial, Defense | N/A (Segmented) | Critical for electric vehicles and industrial machinery. |

| Inductive Components | Transformers, inductors | Electrification, Rail, Data Centers | N/A (Segmented) | Strong demand in growing sectors; SEK 700m order in early 2024. |

| Custom Engineering & Development | Bespoke solutions, co-development agreements | Automotive, Industrial | N/A (Segmented) | Deepens expertise and builds strong client relationships. |

| After-Sales Service & Support | Maintenance, repairs, upgrades | All served markets | N/A (Segmented) | Provides recurring revenue and enhances customer loyalty. |

Business Model Canvas Data Sources

The AQ Group Business Model Canvas is built using a blend of internal financial data, extensive market research, and competitive analysis. These foundational sources ensure each component of the canvas is grounded in current realities and strategic opportunities.