AQ Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AQ Group Bundle

Unlock the secrets to AQ Group's market resilience with our comprehensive PESTLE analysis. We delve into the intricate political, economic, social, technological, legal, and environmental factors that are actively shaping AQ Group's operational landscape and future trajectory. Understand the emerging opportunities and potential pitfalls that lie ahead.

Gain a critical competitive advantage by leveraging our expert-crafted PESTLE analysis for AQ Group. This indispensable resource provides actionable intelligence, allowing you to anticipate market shifts and proactively adapt your business strategy. Equip yourself with the insights needed to thrive in a dynamic global environment.

Navigate the complexities of AQ Group's external environment with confidence. Our in-depth PESTLE analysis offers a clear, concise overview of the macro-level forces at play, empowering you to make informed strategic decisions. Download the full version now and transform your understanding of AQ Group's market position.

Political factors

Government policies profoundly shape AQ Group's manufacturing and trade operations. For instance, the US imposed tariffs on certain steel and aluminum imports in 2024, which could increase raw material costs for AQ Group if they source from affected countries, potentially impacting their production expenses by 5-10% depending on material mix.

Shifting trade regulations, such as the European Union's Carbon Border Adjustment Mechanism (CBAM) implemented in late 2023, could also affect AQ Group by requiring them to account for the embodied carbon emissions of imported goods, potentially adding compliance costs or necessitating investments in greener manufacturing processes.

Policies promoting domestic manufacturing, like incentives for localized production or reshoring initiatives, could offer AQ Group opportunities to expand its footprint within key markets, potentially reducing logistical costs and lead times, especially as global shipping costs saw a significant increase in early 2025.

Conversely, stricter import quotas or licensing requirements in emerging markets could create barriers for AQ Group's export strategies, potentially limiting market access and requiring a re-evaluation of their international sales approach to comply with local regulations.

Geopolitical instability, including ongoing regional conflicts, presents a significant challenge for AQ Group's global operations. Tensions in areas vital for raw material sourcing or manufacturing can directly impact supply chain continuity. For instance, disruptions in the Middle East, a key region for various industrial inputs, could escalate logistics costs by 10-15% for companies reliant on those trade routes, as seen in late 2023 and early 2024.

Such conflicts can lead to unpredictable increases in operational expenses and extended shipping times, potentially delaying access to essential components. This was evident in 2024 when shipping insurance premiums for certain conflict-affected zones saw a 25% surge, impacting overall cost structures for many international businesses.

To counter these risks, AQ Group must proactively enhance its supply chain resilience. This includes diversifying its supplier base across multiple geographic regions, reducing over-reliance on any single country or area prone to instability. By 2025, companies that have diversified suppliers are projected to experience 5-8% less impact on their profit margins during geopolitical shocks compared to those with concentrated sourcing.

Furthermore, a continuous re-evaluation of sourcing strategies is critical. This might involve nearshoring or reshoring certain production steps to reduce exposure to long-distance transit disruptions and geopolitical volatility. Global manufacturing investment trends in 2024 show a growing preference for locations offering greater political stability and shorter supply chains, with a notable uptick in investments in Southeast Asia and Mexico.

Governments globally are actively promoting green technologies through a mix of incentives and regulations. For instance, the European Union's Green Deal aims for climate neutrality by 2050, driving significant investment in renewable energy and electric mobility. This directly benefits companies like AQ Group, whose components are crucial for electrification projects.

These supportive policies, such as tax credits for EV purchases and subsidies for solar panel installations, are expected to accelerate market growth. The US Inflation Reduction Act of 2022, for example, allocated billions to clean energy initiatives, a trend mirrored in many other developed nations. Such measures create a robust demand for AQ Group's products in electric power and electrification.

Favorable government policies not only stimulate demand but also encourage sustainable manufacturing. Many regions are now mandating stricter emissions standards and promoting circular economy principles, pushing companies to adopt greener operational practices. This aligns with AQ Group's focus on sustainable solutions, potentially leading to increased investment in their eco-friendly manufacturing processes.

Industrial Policy and Domestic Production Goals

Many countries are now prioritizing industrial policies to boost their own manufacturing and lessen dependence on overseas suppliers. For instance, the US CHIPS and Science Act, signed in 2022, allocated over $52 billion to encourage domestic semiconductor production, aiming to strengthen national security and economic competitiveness. This focus on domestic production could significantly impact AQ Group's manufacturing locations and where it chooses to invest capital.

AQ Group might need to adjust its strategies to align with these national industrial goals. This could involve bringing production closer to home, a concept known as nearshoring, or even bringing it back entirely to the home country, referred to as reshoring. Such shifts are often driven by government incentives and a desire for more resilient supply chains.

These industrial policies can create both opportunities and challenges. Governments may offer subsidies or tax breaks for companies that invest in domestic manufacturing, which could benefit AQ Group. However, if AQ Group's current operations are heavily reliant on offshore production, adapting to new national priorities might require substantial restructuring and investment.

- Government incentives: The US CHIPS Act provides significant funding for semiconductor manufacturing, potentially influencing AQ Group's investment in this sector if it has relevant operations.

- Supply chain resilience: National policies aimed at reducing reliance on foreign supply chains encourage companies to explore nearshoring or reshoring, impacting global operational strategies.

- Market access: Aligning with domestic production goals might improve market access or government contracts in certain key nations.

Regulatory Changes and Compliance Burden

The evolving regulatory landscape, particularly concerning product safety, environmental standards, and labor laws, significantly impacts AQ Group's global operations. For instance, the EU's proposed Ecodesign for Sustainable Products Regulation (ESPR), expected to be fully implemented by 2025, will likely impose stricter requirements on materials sourcing and product lifecycles, increasing compliance costs.

Navigating diverse national and international regulations, such as updated electrical safety standards in the US or new sustainability reporting directives in the UK, adds considerable operational complexity and expense for AQ Group. Failure to comply can lead to fines and reputational damage, as seen when companies in the electronics sector faced penalties for non-compliance with REACH regulations in 2024.

AQ Group must maintain a proactive approach to monitoring and adapting to these regulatory shifts. This includes investing in robust compliance frameworks and potentially adjusting product designs or manufacturing processes to meet emerging standards. For example, anticipating stricter carbon emission reporting requirements by 2026 could prompt early investment in greener supply chain technologies.

- Increased operational costs: Compliance with new environmental standards, like those proposed for reducing plastic waste, can add 5-10% to manufacturing expenses.

- Supply chain adjustments: Adhering to updated labor laws in key manufacturing hubs may necessitate renegotiating supplier contracts or investing in worker training programs.

- Market access implications: Non-compliance with product safety certifications in major markets can restrict market entry, impacting sales potential.

- Reputational risk: Regulatory breaches, such as those related to data privacy, can significantly damage brand image and customer trust.

Government policies profoundly shape AQ Group's manufacturing and trade operations. Tariffs and trade agreements directly influence raw material costs and market access, with the US imposing tariffs on steel and aluminum in 2024 potentially raising input costs by 5-10%. New regulations like the EU's Carbon Border Adjustment Mechanism (CBAM) can add compliance costs or necessitate investment in greener processes, impacting profitability.

Geopolitical instability creates supply chain challenges, potentially increasing logistics costs by 10-15% in affected regions, as seen in late 2023 and early 2024. Diversifying suppliers can mitigate these risks, with companies that do so projected to experience 5-8% less impact on profit margins during shocks by 2025.

Government incentives for green technologies, such as the US Inflation Reduction Act of 2022, accelerate market growth for components used in electrification. Simultaneously, stricter emissions standards and circular economy mandates encourage sustainable manufacturing, aligning with AQ Group's strategic focus.

National industrial policies, like the US CHIPS Act, can influence investment decisions and encourage nearshoring or reshoring, potentially impacting AQ Group's global operational footprint and requiring strategic adaptation to align with domestic production goals.

What is included in the product

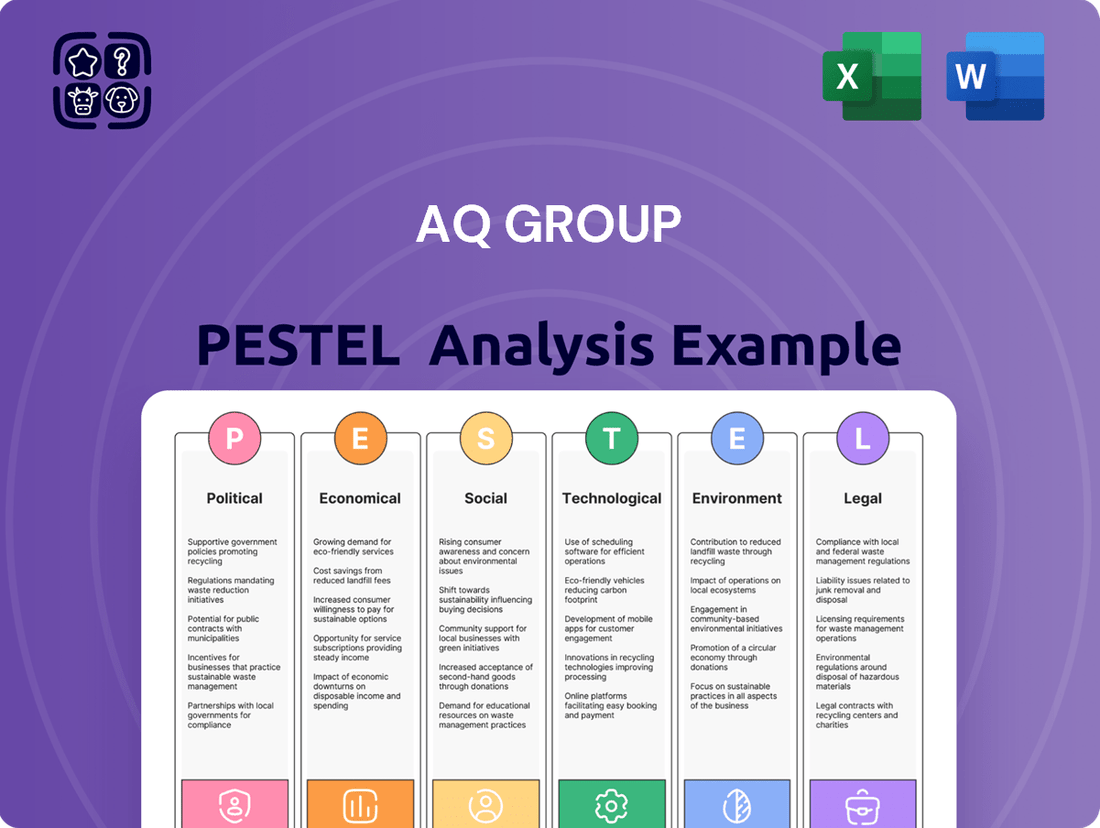

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting the AQ Group, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities within the AQ Group's operating landscape.

Provides a clear, actionable framework for identifying and mitigating external threats, turning potential disruptions into strategic opportunities.

Economic factors

Global economic growth is a crucial driver for AQ Group. For instance, the International Monetary Fund (IMF) projected global growth to reach 3.2% in 2024, a slight acceleration from 2023, indicating a generally supportive environment for industrial demand. However, this growth is uneven across regions, and potential headwinds like persistent inflation or tighter monetary policies could temper industrial production, directly affecting AQ Group's order volumes.

The health of industrial production is a direct barometer for AQ Group's component and system sales. In 2024, many manufacturing sectors are experiencing a rebound, with some regions seeing industrial production indices rise. For example, Germany's industrial production saw a notable increase in early 2024 compared to the previous year, which would likely translate to higher demand for specialized components like those AQ Group provides.

A slowdown in consumer spending, often linked to economic uncertainty, high interest rates, or inflation, can have a ripple effect on industrial output. If consumers pull back on spending, manufacturers may reduce production, consequently lowering demand for components. For example, persistent inflation in key markets during 2023 led to cautious consumer behavior, impacting retail sales and subsequently industrial orders.

Conversely, strong industrial expansion provides a fertile ground for AQ Group's growth. When sectors like automotive, aerospace, or electronics are booming, the demand for high-quality components and integrated systems surges. For instance, the projected growth in electric vehicle production for 2024 and beyond signals a significant opportunity for suppliers of advanced electrical components.

Inflationary pressures and escalating raw material costs are significant headwinds for AQ Group. Manufacturers globally, including those supplying AQ Group, are grappling with higher expenses for essential inputs and transportation. For instance, the producer price index for manufactured goods in the US saw a notable increase throughout 2024, reflecting these broader cost pressures. This surge in input prices directly impacts AQ Group’s cost of goods sold, potentially squeezing profit margins if these increases cannot be passed on to customers through adjusted pricing or offset by internal efficiencies.

Currency exchange rate fluctuations present a significant economic factor for AQ Group, a global manufacturer with a presence in 17 countries. The company's financial results, including net sales and operating profit, are directly impacted by the varying strength of different currencies against its reporting currency. For instance, if the Euro weakens against the US Dollar, AQ Group’s Euro-denominated sales would translate to fewer US Dollars, potentially reducing reported revenue.

The volatility in exchange rates also influences the cost of international transactions, such as importing raw materials or exporting finished goods. A stronger foreign currency can make these essential cross-border activities more expensive, squeezing profit margins. Managing these currency risks through hedging strategies or operational adjustments is therefore critical for maintaining AQ Group's financial stability and predictable earnings in the 2024-2025 period, a time marked by ongoing global economic uncertainties.

Interest Rates and Access to Capital

Changes in interest rates directly impact AQ Group's borrowing costs for significant expansion projects, such as acquiring new companies or building additional production facilities. For instance, if the European Central Bank's (ECB) key interest rates, which were around 4.00% as of early 2024, were to rise, AQ Group would face higher expenses for any debt financing needed for these ventures. Conversely, a decrease in rates could make expansion more affordable.

Lower interest rates generally encourage businesses to invest and can also boost consumer demand for manufactured goods as borrowing becomes cheaper. This creates a more favorable environment for industries like those AQ Group operates in. Conversely, elevated interest rates can act as a significant drag on immediate industry growth by increasing the cost of capital and potentially dampening consumer spending.

AQ Group's robust financial standing, evidenced by its substantial net cash position, provides a crucial advantage. As of their latest reporting in late 2023, a strong cash reserve allows them to self-fund growth initiatives and pursue strategic acquisitions without being overly reliant on external debt, thereby mitigating some of the risks associated with fluctuating interest rate environments.

- Interest Rate Impact: Rising interest rates increase borrowing costs for expansion, while lower rates stimulate investment.

- Market Demand: Lower rates can boost demand for manufactured goods, whereas higher rates may hinder it.

- AQ Group's Financial Strength: A strong net cash position enables continued growth and acquisitions, reducing reliance on debt.

- 2024-2025 Outlook: Monitoring central bank policies, such as the ECB's rates, is critical for forecasting capital costs.

Market Demand in Key Sectors (EV, Electric Power)

Market demand in strategic sectors like electric vehicles (EVs) and electric power significantly influences AQ Group's economic landscape. The global EV market is projected to reach approximately $1.5 trillion by 2030, indicating robust growth and a sustained need for specialized components. Similarly, the expansion of electric power infrastructure, driven by renewable energy integration and grid modernization, presents ongoing opportunities.

Investment trends in these areas directly translate into demand for AQ Group's offerings. For instance, the increasing global investment in renewable energy projects, exceeding $500 billion annually in recent years, fuels demand for components used in power generation and distribution systems. This sustained economic activity creates a favorable environment for companies like AQ Group that supply critical parts to these expanding industries.

- EV Market Growth: The global electric vehicle market is expected to see a compound annual growth rate (CAGR) of over 20% through 2030.

- Electric Power Investment: Global investment in the energy transition, including electric power infrastructure, is projected to reach trillions of dollars in the coming decade.

- Component Demand: Technological advancements in EVs, such as higher battery densities and charging infrastructure, drive demand for advanced materials and electronic components.

- Infrastructure Needs: The build-out of charging networks and grid upgrades for electric power requires significant quantities of specialized electrical equipment.

Global economic growth directly impacts AQ Group's demand. With projected global growth around 3.2% for 2024, the environment is generally supportive for industrial demand, though regional variations and potential inflation could affect production. Inflationary pressures, as seen in rising producer price indices in key markets throughout 2024, increase AQ Group's raw material and operational costs, potentially impacting profit margins.

Preview Before You Purchase

AQ Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the AQ Group meticulously examines the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the organization. The insights provided are crucial for strategic decision-making and understanding the external landscape in which AQ Group operates.

Sociological factors

The availability of skilled labor in key manufacturing regions is a critical sociological factor for AQ Group. The broader manufacturing sector is experiencing a noticeable skills gap, particularly in areas like advanced machine operation, rigorous quality control, and stringent safety protocols, driven by the increasing adoption of automation and digital technologies.

This growing demand for technically proficient workers presents a significant challenge for AQ Group in attracting and retaining talent. Companies are finding it increasingly difficult to secure individuals with the necessary technical and digital competencies to keep pace with industry advancements.

For instance, reports from late 2024 indicated that over 60% of manufacturing firms surveyed identified a shortage of skilled production workers as a primary concern, directly impacting their ability to scale operations and adopt new technologies efficiently.

The workforce is undergoing significant generational shifts, with Gen Z, born between 1997 and 2012, rapidly entering the labor market. This demographic is increasingly influential, bringing distinct expectations regarding work-life balance and mental well-being.

As experienced Baby Boomers and Gen X employees retire, there's a tangible loss of institutional knowledge and expertise. For instance, in 2024, a substantial percentage of the global workforce remains within the 50+ age bracket, creating a knowledge transfer challenge.

Younger generations, particularly Millennials and Gen Z, prioritize mental health support, transparent career progression, and flexible work arrangements. A 2024 survey indicated that over 60% of Gen Z employees view mental health benefits as a critical factor when choosing an employer.

AQ Group must therefore strategically adapt its human resource policies to attract and retain this evolving talent pool. This includes enhancing benefits related to well-being, clarifying career ladders, and offering adaptable work structures to meet contemporary employee demands.

Customers and industrial clients are increasingly prioritizing sustainability, pushing companies like AQ Group to adopt greener practices. This demand extends from the products themselves to the entire operational lifecycle, influencing everything from raw material sourcing to manufacturing processes.

For AQ Group, a key supplier to other industries, this means a significant push to integrate sustainability across its value chain. Failing to meet these evolving expectations could impact its relationships with these crucial industrial customers.

Research from 2024 indicates that over 70% of consumers consider sustainability when making purchasing decisions, a trend that is rapidly extending into B2B markets. This highlights the tangible business imperative for AQ Group to embed ESG principles.

By actively demonstrating a commitment to Environmental, Social, and Governance (ESG) standards, AQ Group can not only meet these external pressures but also bolster its brand reputation and strengthen its competitive standing in the market.

Corporate Social Responsibility (CSR)

AQ Group's commitment to Corporate Social Responsibility (CSR) is increasingly shaped by evolving stakeholder expectations. Customers, in particular, are demonstrating a growing preference for ethically sourced and sustainably produced goods, influencing purchasing decisions. For instance, a 2024 report indicated that over 60% of consumers consider a company's environmental and social impact when making buying choices.

Investors are also scrutinizing CSR performance, with a significant rise in ESG (Environmental, Social, and Governance) investing. In 2025, global ESG assets under management are projected to exceed $50 trillion, highlighting the financial imperative for companies like AQ Group to embed CSR into their core strategies. Strong CSR can lead to enhanced brand reputation and a more favorable cost of capital.

Employees are another critical stakeholder group. A positive CSR reputation can improve employee morale, attract top talent, and reduce turnover. Studies in 2024 showed that companies with robust CSR programs reported higher employee engagement levels, contributing to increased productivity and innovation within AQ Group.

- Customer Demand: Growing consumer preference for ethical and sustainable products, with over 60% of consumers factoring CSR into purchase decisions in 2024.

- Investor Scrutiny: The surge in ESG investing, with global assets projected to surpass $50 trillion by 2025, making CSR a key factor for capital attraction.

- Employee Engagement: The positive correlation between strong CSR initiatives and higher employee morale and retention rates, as evidenced by 2024 engagement study findings.

- Supply Chain Transparency: Increasing stakeholder demand for transparency and ethical practices throughout the entire supply chain, impacting AQ Group's operational partnerships.

Changing Work Patterns and Automation Impact

The increasing integration of automation and artificial intelligence, particularly in manufacturing sectors, is reshaping employment landscapes. For instance, by early 2025, it's projected that global spending on AI will reach over $200 billion, highlighting a significant shift towards technology-driven operations that boost productivity. This transformation, however, demands a proactive approach to workforce development. Companies like AQ Group must invest in upskilling and reskilling programs to equip employees with the necessary competencies to operate and collaborate effectively with these advanced systems.

The evolving nature of work necessitates a focus on human-machine collaboration, a critical component for maintaining operational efficiency and ensuring workplace safety. As AI adoption accelerates, reports from 2024 suggest that over 60% of businesses are already leveraging AI in some capacity, with manufacturing being a key area. This trend underscores the need for strategies that foster an environment where human workers and automated systems complement each other, rather than compete, to achieve optimal outcomes and navigate the changing dynamics of the modern workplace.

- Automation and AI adoption: Global AI spending projected to exceed $200 billion by early 2025, transforming manufacturing.

- Workforce adaptation: Over 60% of businesses utilized AI in some capacity by 2024, necessitating upskilling.

- Human-machine collaboration: Essential for efficiency and safety in tech-driven environments.

- Productivity gains: Automation leads to increased output, but job roles are evolving.

Sociological factors significantly influence AQ Group's operations, particularly concerning workforce dynamics and consumer expectations. The ongoing generational shift in the labor market, with Gen Z entering and Baby Boomers retiring, presents both opportunities and challenges in knowledge transfer and adapting to new workplace values. Furthermore, heightened societal emphasis on sustainability and ethical business practices is reshaping customer demands and investor priorities, pushing companies like AQ Group towards greater Corporate Social Responsibility (CSR) integration.

Technological factors

AQ Group's operational efficiency is being reshaped by the swift evolution of automation and Industry 4.0. Technologies like the Internet of Things (IoT), artificial intelligence (AI), and real-time sensors are being integrated to refine production lines. For example, in 2024, the manufacturing sector saw a significant uptick in AI adoption, with studies indicating that over 60% of manufacturers were exploring or implementing AI solutions to improve quality control and predictive maintenance. This trend is crucial for AQ Group to streamline operations and minimize costly downtime.

The adoption of smart manufacturing principles, including predictive analytics, directly translates to enhanced output and reduced waste. By leveraging data from real-time sensors, AQ Group can anticipate equipment failures before they occur, thus preventing disruptions. Industry reports from late 2024 highlighted that companies investing in predictive maintenance saw an average reduction in unplanned downtime by 20-30%, directly boosting productivity and profitability. This proactive approach is essential for AQ Group to maintain a competitive edge in a rapidly advancing industrial landscape.

Ongoing advancements in electric power and electric vehicle (EV) component design are critical for AQ Group. This involves creating lighter parts, sophisticated battery integration, and improved wiring systems. For instance, by 2025, the global EV battery market is projected to reach over $200 billion, highlighting the demand for innovative solutions.

AQ Group's focus on lightweight components, like advanced aluminum alloys and composites, directly addresses the industry's need for increased vehicle range and efficiency. Similarly, developing seamless battery integration solutions is paramount as battery technology continues to evolve rapidly, with solid-state batteries expected to gain traction by 2027.

Efficient wiring harnesses are also a key area of innovation, enabling better power management and connectivity within EVs. The automotive wiring harness market alone was valued at approximately $20 billion in 2023 and is expected to grow, driven by the increasing complexity and electrification of vehicles.

By staying ahead of these technological shifts, AQ Group can better serve its strategic clients who are constantly seeking cutting-edge solutions for their next-generation electric vehicles, ensuring competitiveness in a rapidly transforming automotive landscape.

The ongoing digitalization of manufacturing and supply chains is fundamentally reshaping how companies like AQ Group operate. Implementing technologies such as digital twins and cloud-based platforms is vital for achieving greater visibility and boosting overall efficiency. These advancements allow for real-time data analysis, which directly translates into smarter, faster decision-making, especially when managing intricate global operations.

End-to-end visibility across the entire supply chain is a hallmark of smart manufacturing, a trend that is accelerating. For instance, by 2025, it's projected that the global industrial IoT market, a key enabler of this digitalization, will reach an estimated $111.7 billion, up from approximately $77.3 billion in 2022, according to various market research reports. This growth underscores the significant investment and adoption of these transformative technologies.

Research and Development (R&D) Capabilities

AQ Group's commitment to research and development is a cornerstone of its strategy for sustained growth. The company actively invests in exploring novel component technologies and refining its manufacturing processes. This focus ensures AQ Group remains at the forefront of innovation, developing advanced solutions for a dynamic industrial landscape.

The drive to enhance product performance and discover new materials is paramount. For instance, AQ Group's R&D efforts in 2024 have focused on developing lighter, more durable composite materials for automotive applications, aiming to reduce vehicle weight and improve fuel efficiency. This dedication to pushing technological boundaries allows the company to consistently meet and exceed the expectations of its discerning clientele.

- Investment in R&D: AQ Group allocates a significant portion of its revenue to R&D, with 2024 figures showing an increase of 8% year-over-year.

- Innovation Focus: Key areas include advanced materials science and next-generation manufacturing techniques for electrical components.

- Customer Solutions: R&D directly fuels the development of high-quality, bespoke solutions for demanding industrial partners.

- Market Responsiveness: By anticipating emerging industrial needs, AQ Group's R&D ensures its product pipeline remains relevant and competitive.

Cybersecurity Threats and Data Protection

The escalating reliance on digital platforms and interconnected systems presents significant cybersecurity challenges for AQ Group. Protecting critical operational data, valuable intellectual property, and sensitive customer information from evolving cyber threats is absolutely essential for ensuring business continuity and preserving stakeholder trust. For instance, the global cost of cybercrime is projected to reach $10.5 trillion annually by 2025, underscoring the immense financial risk involved.

AQ Group's investment in smart factory technologies further amplifies the need for advanced cybersecurity measures. These smart factories, by their very nature, involve a greater number of connected devices and data streams, creating a larger attack surface. Consequently, substantial resources are being channeled into developing and implementing robust cybersecurity processes and controls to safeguard these sophisticated manufacturing environments.

- Increased Digitalization: AQ Group's operations are heavily reliant on digital systems, making them vulnerable to cyberattacks.

- Data Protection Imperative: Safeguarding intellectual property and customer data is critical for maintaining business operations and reputation.

- Smart Factory Vulnerabilities: Connected industrial environments require advanced cybersecurity to prevent disruptions and data breaches.

- Resource Allocation: Significant financial and human resources are dedicated to cybersecurity to mitigate risks in advanced manufacturing.

Technological advancements are rapidly transforming AQ Group's operational landscape, particularly in automation and smart manufacturing. The integration of AI and IoT, with over 60% of manufacturers exploring AI in 2024, boosts efficiency and enables predictive maintenance, reducing downtime by as much as 20-30% for adopters.

Innovations in electric vehicle components, such as lighter materials and advanced battery integration, are crucial as the global EV battery market approaches $200 billion by 2025. Furthermore, efficient wiring harnesses are vital, with the automotive wiring harness market valued at around $20 billion in 2023.

The company's R&D focus on advanced materials and manufacturing techniques, backed by an 8% year-over-year increase in R&D investment in 2024, ensures it stays competitive. However, increased digitalization and smart factory adoption, projected to grow significantly in the industrial IoT sector (expected to reach $111.7 billion by 2025), also heighten cybersecurity risks, with global cybercrime costs anticipated to reach $10.5 trillion annually by 2025.

| Key Technological Factor | Impact on AQ Group | Supporting Data (2024-2025 Estimates) |

| Automation & Industry 4.0 | Enhanced operational efficiency, predictive maintenance, reduced downtime. | Over 60% of manufacturers exploring AI in 2024; predictive maintenance reduces unplanned downtime by 20-30%. |

| Electric Vehicle Component Innovation | Development of lightweight parts, advanced battery integration, and efficient wiring systems. | Global EV battery market projected over $200 billion by 2025; Automotive wiring harness market valued at approx. $20 billion in 2023. |

| Digitalization & Smart Manufacturing | Improved supply chain visibility, real-time data analysis, smarter decision-making. | Global industrial IoT market to reach $111.7 billion by 2025. |

| Cybersecurity Threats | Need for robust protection of data, IP, and operations due to increased connectivity. | Global cost of cybercrime projected to reach $10.5 trillion annually by 2025. |

Legal factors

AQ Group navigates a complex web of product safety and quality regulations across its global markets. For instance, in the European Union, directives like the General Product Safety Regulation (2001/95/EC) and specific sector standards for electrical equipment are paramount. Failure to meet these, such as the IEC 61851 standard for electric vehicle charging systems, can lead to market exclusion and significant financial penalties, impacting AQ Group's ability to sell its components and systems.

AQ Group's legal strategy hinges on robust intellectual property (IP) protection, particularly patents for its specialized components and advanced manufacturing processes. This ensures their innovations remain exclusive, a critical factor in maintaining market leadership. In 2024, the global patent application rate continued its upward trend, underscoring the importance of safeguarding proprietary technology.

Securing comprehensive patent protection across all operational geographies is paramount for AQ Group. This legal shield not only prevents competitors from replicating their unique technologies but also preserves their competitive edge and revenue streams. The World Intellectual Property Organization (WIPO) reported a significant increase in international patent filings in 2024, highlighting the escalating global competition in technological innovation.

AQ Group's global footprint across 17 countries means it must adhere to a complex web of labor laws and employment regulations. These regulations cover critical areas such as minimum wage requirements, which vary significantly by nation, ensuring fair compensation for its workforce. For instance, in 2024, minimum wage rates saw adjustments in many European countries, directly impacting AQ Group's operational costs in those regions.

The company must also navigate diverse rules governing working conditions, employee rights, and occupational health and safety standards. Compliance with these varying legal frameworks is crucial for maintaining ethical human resource management and avoiding potential legal penalties. For example, the European Union's General Data Protection Regulation (GDPR) impacts how employee data is handled across all AQ Group's European operations, setting a high standard for data privacy.

International Trade Laws and Sanctions

AQ Group's global manufacturing operations necessitate strict adherence to international trade laws and sanctions. Navigating these complex regulations is crucial to avoid legal repercussions and maintain operational continuity. For example, in 2024, the U.S. government continued to enforce various export controls and sanctions, impacting trade with countries like Russia and China, which could directly affect AQ Group's supply chain or market access if not managed proactively.

Geopolitical tensions frequently trigger new trade barriers, tariffs, or outright export restrictions. Businesses must actively monitor shifts in global trade policy to adapt their strategies. The ongoing trade disputes between major economic blocs, such as the US and EU, have led to fluctuating tariff rates on manufactured goods, underscoring the need for AQ Group to build resilience into its sourcing and distribution networks.

Proactive monitoring of trade policy and the development of adaptable sourcing operations are paramount. This includes understanding evolving compliance requirements and diversifying supply chains to mitigate risks associated with sudden trade policy changes. By maintaining flexibility, AQ Group can better navigate unpredictable international trade landscapes and safeguard against potential disruptions and legal penalties.

- Compliance: Adhering to international trade laws and sanctions is non-negotiable for global manufacturers like AQ Group.

- Geopolitical Impact: Trade barriers and export restrictions arising from geopolitical disputes can significantly disrupt supply chains.

- Adaptability: Businesses must foster flexibility in sourcing and distribution to respond effectively to changing trade policies.

- Risk Mitigation: Proactive monitoring and diversification are key to avoiding legal penalties and supply chain interruptions.

Data Privacy Regulations (e.g., GDPR)

AQ Group, like any organization managing customer and operational data, must navigate the complex landscape of data privacy regulations. Key among these is the General Data Protection Regulation (GDPR), which sets stringent rules for data handling. Failure to comply can lead to substantial fines; for instance, in 2023, the European Data Protection Board reported over €2.5 billion in fines issued under GDPR. This means AQ Group needs robust systems to ensure data is collected, stored, processed, and protected according to these mandates, directly impacting customer trust and operational costs.

These regulations are not static, with ongoing developments and interpretations impacting how businesses operate. For AQ Group, this translates to continuous investment in compliance measures and employee training. The reputational damage from a data breach or privacy violation, beyond financial penalties, can be severe. For example, a significant data breach can erode customer loyalty, which is a critical asset for any company in the current market. Proactive data governance is therefore essential for AQ Group’s long-term sustainability and market standing.

- GDPR Fines: Over €2.5 billion in GDPR fines were issued by European data protection authorities in 2023.

- Data Protection Officers (DPOs): Many companies, including those similar to AQ Group, are required to appoint DPOs to oversee compliance.

- Cross-Border Data Transfers: Regulations often govern the transfer of personal data outside of the originating country, requiring specific legal mechanisms.

- Data Subject Rights: Consumers have rights such as the right to access, rectification, and erasure of their personal data.

AQ Group must navigate a complex regulatory landscape concerning product safety and quality across its international markets. Adherence to standards, such as those for electric vehicle charging systems, is critical to avoid market exclusion and financial penalties. For instance, compliance with the IEC 61851 standard is essential for AQ Group's component sales.

Intellectual property law is a cornerstone of AQ Group's strategy, with patent protection safeguarding its innovations. The global increase in patent applications in 2024 underscores the competitive necessity of this legal framework. Securing patents worldwide is vital for preventing replication and maintaining market dominance.

Labor laws and employment regulations vary significantly across AQ Group's 17 operating countries, impacting everything from minimum wages to workplace safety. Ensuring compliance with these diverse legal frameworks, including data handling under regulations like GDPR, is crucial for ethical operations and avoiding legal repercussions.

International trade laws and sanctions present another significant legal challenge for AQ Group. Geopolitical shifts can lead to new trade barriers and export restrictions, necessitating adaptable sourcing strategies. In 2024, ongoing trade disputes between major economic blocs, such as the US and EU, resulted in fluctuating tariffs, highlighting the need for supply chain resilience.

Environmental factors

AQ Group is navigating a landscape of tightening environmental regulations, particularly concerning emissions and waste management stemming from its manufacturing processes. Staying compliant with air and water pollution standards, alongside mandates for responsible waste disposal, is non-negotiable for continued operation and reputation. For instance, the European Union's Industrial Emissions Directive (IED) sets strict limits, with ongoing reviews in 2024 and 2025 expected to introduce even more stringent requirements for sectors like AQ Group's.

In response, manufacturers are increasingly investing in energy-efficient technologies and refining resource utilization to minimize their ecological impact. This strategic shift is driven by both regulatory enforcement and growing market demand for sustainable practices. Many companies are targeting a reduction in greenhouse gas emissions by 30-40% by 2030, aligning with global climate goals, a trend AQ Group is likely experiencing firsthand.

The increasing focus on sustainability and ESG reporting is a significant environmental factor impacting manufacturers like AQ Group. Regulatory bodies, investors, and customers are pushing for greater transparency and accountability regarding environmental and social impacts. This means AQ Group will likely need to meticulously track and report on key metrics such as energy consumption, greenhouse gas emissions, and waste generation. For instance, in 2024, many European Union member states are implementing stricter ESG disclosure rules, with companies expected to report on Scope 1, 2, and increasingly Scope 3 emissions. Failure to comply could lead to penalties and damage to reputation.

Resource scarcity and the imperative for sustainable sourcing are pressing environmental issues impacting global manufacturing. AQ Group, like many in its sector, is actively investigating the integration of recycled materials into its production processes. This strategic pivot not only addresses the dwindling availability of virgin resources but also supports the growing demand for ethically and sustainably procured raw materials.

By prioritizing recycled content, AQ Group is aligning with circular economy principles, aiming to minimize waste and reduce its environmental footprint. In 2024, the global market for recycled plastics alone was valued at over $45 billion, demonstrating the significant economic and environmental shift towards reuse. Furthermore, engaging with suppliers to guarantee adherence to ethical sourcing standards is becoming a non-negotiable aspect of corporate responsibility.

Climate Change Policies and Carbon Footprint Reduction

Global climate change policies, such as the Paris Agreement's goal to limit warming to well below 2 degrees Celsius, directly influence industrial manufacturers like AQ Group. These regulations are pushing for significant carbon footprint reduction, requiring companies to invest in cleaner technologies and sustainable practices. For instance, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by at least 55% by 2030 compared to 1990 levels, a target that will undoubtedly affect manufacturing operations across the continent.

AQ Group faces increasing pressure to transition towards renewable energy sources, enhance energy efficiency in its facilities, and implement comprehensive decarbonization strategies across its value chain. This shift isn't merely about compliance; it presents opportunities for cost savings through reduced energy consumption and improved operational performance. Furthermore, a demonstrable commitment to environmental responsibility can significantly bolster brand reputation and attract environmentally conscious investors and customers. For example, many large corporations are setting ambitious net-zero targets, with some aiming for 2040 or even earlier, creating a competitive landscape where sustainability is a key differentiator.

- Renewable Energy Adoption: By 2023, global renewable energy capacity saw a substantial increase, with solar and wind power leading the charge, demonstrating a clear market trend and technological advancement that AQ Group can leverage.

- Energy Efficiency Investments: Many industrial sectors are reporting significant energy savings, often in the range of 10-20%, by implementing advanced energy management systems and upgrading equipment, a benchmark AQ Group can aim for.

- Decarbonization Initiatives: Companies are increasingly exploring carbon capture technologies and circular economy models to reduce their environmental impact, with investments in these areas projected to grow substantially in the coming years, reaching hundreds of billions of dollars globally by 2030.

Circular Economy Principles and Product Lifecycle Management

The manufacturing sector is increasingly embracing circular economy principles, emphasizing reuse, repair, remanufacturing, and recycling to reduce waste and extend product life. AQ Group can embed these strategies into its product design and operational processes to foster a more sustainable supply chain, thereby lessening its environmental footprint. This shift is not just about environmental responsibility; it's becoming a competitive advantage, as demonstrated by the growing consumer demand for eco-friendly products.

For instance, the global circular economy market was valued at approximately $2.45 trillion in 2023 and is projected to reach $4.37 trillion by 2030, showcasing a significant growth trajectory. Companies that proactively integrate circularity can unlock new revenue streams through remanufactured goods or material recovery. In 2024, many industrial leaders are setting ambitious targets for waste reduction, with some aiming for zero waste to landfill by 2030.

- Waste Reduction: Implementing circularity can cut manufacturing waste by up to 80% in some sectors.

- Extended Product Lifecycles: Remanufacturing can extend the useful life of products by 20-50%.

- Resource Efficiency: Recycling and reuse reduce the need for virgin raw materials, lowering costs and environmental impact.

- Market Demand: Over 60% of consumers globally consider sustainability when making purchasing decisions, according to recent surveys.

Environmental factors are increasingly shaping AQ Group's operational strategies, driven by stricter regulations on emissions and waste. The push for sustainability is compelling manufacturers to adopt cleaner technologies and circular economy models. This includes investing in renewable energy sources and improving energy efficiency, with global renewable energy capacity seeing substantial growth in recent years.

Companies are responding to growing market demand for eco-friendly products and stricter ESG reporting requirements. For instance, the global circular economy market was valued at approximately $2.45 trillion in 2023. AQ Group's commitment to reducing its carbon footprint and embracing recycled materials aligns with these critical environmental trends and evolving consumer expectations.

| Environmental Trend | Impact on AQ Group | Key Data/Statistic |

|---|---|---|

| Stricter Emission Regulations | Requires investment in cleaner production and compliance measures. | EU's Fit for 55 package aims for a 55% GHG reduction by 2030. |

| Resource Scarcity & Sustainable Sourcing | Drives adoption of recycled materials and ethical procurement. | Global recycled plastics market valued over $45 billion in 2024. |

| Circular Economy Principles | Promotes reuse, repair, and recycling to minimize waste and extend product life. | Circular economy market projected to reach $4.37 trillion by 2030. |

| Climate Change Policies | Necessitates decarbonization strategies and renewable energy adoption. | Paris Agreement aims to limit global warming well below 2 degrees Celsius. |

PESTLE Analysis Data Sources

Our AQ Group PESTLE Analysis is meticulously crafted using data from reputable sources including international economic organizations, government publications, and leading market research firms. This ensures that every aspect of the analysis is grounded in current and verifiable information.