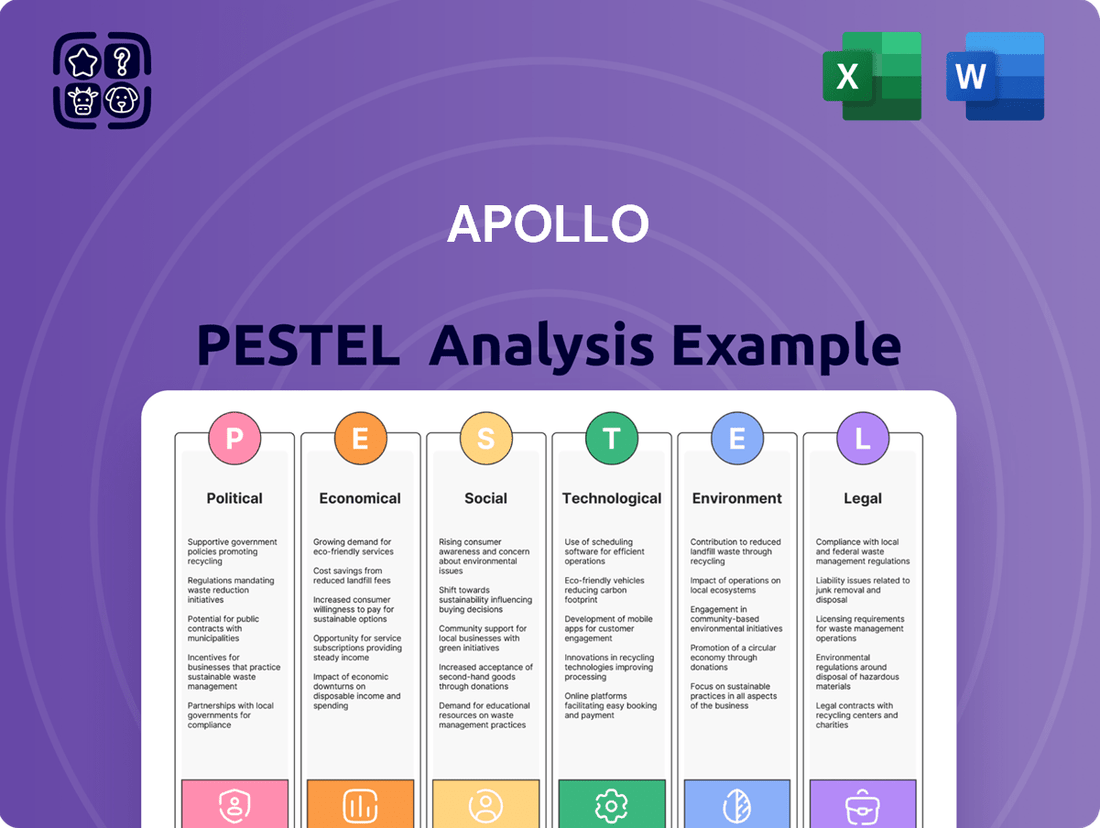

Apollo PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apollo Bundle

Uncover the critical external factors shaping Apollo's trajectory with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental forces impacting its operations and future growth. Equip yourself with actionable intelligence to refine your own market strategies and gain a competitive advantage. Download the full PESTLE analysis now for immediate insights.

Political factors

Apollo Global Management, like all players in the financial sector, navigates a landscape shaped by government policy and regulation. Changes in tax laws, such as potential adjustments to capital gains or corporate tax rates, can directly affect Apollo's bottom line and investment strategies. For example, the U.S. corporate tax rate, which stood at 21% for much of 2024, could see adjustments that impact net income.

Financial regulations, including those concerning capital requirements for alternative asset managers or rules around leveraged investments, are critical. Evolving regulations from bodies like the SEC could necessitate changes in Apollo's operational structure or product offerings. Furthermore, government investment incentives, perhaps aimed at promoting specific sectors like renewable energy infrastructure, could create new opportunities or challenges for Apollo's diverse investment portfolios.

Global geopolitical events and evolving trade relations are paramount for Apollo, influencing international investment flows and overall market stability. For instance, the ongoing shifts in global supply chains and trade agreements, as noted in projections for 2025, directly impact the operational costs and market access of Apollo's portfolio companies.

Heightened trade tensions, a recurring theme in analyses of the 2024-2025 economic landscape, could lead to increased tariffs and regulatory hurdles. This directly affects businesses within Apollo's investment sphere, potentially disrupting their operations and diminishing investment returns. The International Monetary Fund (IMF) has cautioned that such disruptions could shave off significant percentages from global GDP growth forecasts for the period.

Apollo Global Management actively participates in the political landscape through contributions and lobbying, aiming to shape policies favorable to its stakeholders and the market. In the 2023-2024 election cycle, Apollo's PAC and associated individuals contributed over $1.2 million, with a notable portion directed towards Republican candidates and committees, while also allocating substantial funds to Democratic efforts, reflecting a bipartisan engagement strategy.

Regulatory Scrutiny and Enforcement

The alternative investment sector, where Apollo operates significantly in private equity and credit, is facing heightened regulatory attention. This increased scrutiny means that any new or more stringent enforcement actions concerning market conduct, disclosure requirements, or safeguarding investor interests could lead to greater compliance costs and potentially restrict certain investment approaches for Apollo. For instance, during the first quarter of 2024, Apollo Global Management reported $671 billion in assets under management, a figure that necessitates robust compliance frameworks to navigate evolving regulations.

Changes in regulatory landscapes can directly impact Apollo's operational efficiency and strategic flexibility. For example, shifts in capital requirements or new rules on fee structures could affect profitability and the types of deals the firm can pursue. Apollo proactively addresses these by making timely filings, such as its Form 8-K submissions, which keep stakeholders informed about material regulatory developments and their implications.

- Increased Compliance Costs: Evolving regulations in alternative investments can necessitate significant investment in compliance infrastructure and personnel, impacting operational budgets.

- Strategic Limitations: Stricter rules on market practices or investor protection might curtail specific investment strategies or product offerings that Apollo has historically utilized.

- Transparency Demands: Regulators are pushing for greater transparency in alternative asset management, requiring firms like Apollo to enhance their disclosure practices and reporting mechanisms.

International Relations and Market Access

Apollo's extensive global footprint makes international relations and market access critical. Political stability and positive diplomatic relationships in regions where Apollo operates or seeks investment directly influence its expansion capabilities and capital deployment efficiency. For instance, in 2024, Apollo's strategic move into Zurich was significantly driven by the desire to tap into new capital markets and navigate the complex international tax landscape, aiming to optimize its global financial operations.

Navigating diverse geopolitical environments presents both opportunities and challenges for Apollo. Favorable trade agreements and clear regulatory frameworks in countries like the United Kingdom, where Apollo has significant investments, can facilitate smoother operations and capital flows. Conversely, geopolitical tensions or protectionist policies in key markets could potentially hinder Apollo's growth strategies and access to new investment opportunities.

- 2024 Global Wealth Hub Expansion: Apollo's entry into Zurich signifies a strategic push into new financial centers, aiming to diversify capital sources and optimize global tax strategies.

- International Investment Climate: The firm's ability to deploy capital effectively is directly tied to the political stability and diplomatic ties in regions where it has substantial investments, such as the UK and Germany.

- Trade Relations Impact: Favorable international trade agreements and stable diplomatic relations are essential for Apollo to maintain and expand its access to global markets and capital.

Political factors significantly shape Apollo's operational environment, influencing everything from tax liabilities to regulatory compliance. Shifts in government policies, like potential changes to the U.S. corporate tax rate, which was 21% in 2024, directly impact Apollo's profitability and investment decisions. Furthermore, evolving financial regulations from bodies such as the SEC can necessitate adjustments to Apollo's business models and product offerings, especially within the alternative asset management sector where Apollo has substantial holdings, managing $671 billion in assets under management as of Q1 2024.

Geopolitical stability and international trade relations are also crucial, affecting global investment flows and market access for Apollo's portfolio companies. For instance, trade tensions projected for 2025 could introduce tariffs and regulatory barriers, potentially impacting operational costs and market reach. Apollo's proactive engagement in the political arena, including significant PAC contributions in the 2023-2024 cycle, highlights its strategy to influence policy outcomes favorable to its diverse investment interests.

The firm's global expansion, exemplified by its 2024 entry into Zurich, underscores the importance of navigating diverse political landscapes and tax regimes to optimize international operations. Political stability and favorable trade agreements in key markets, such as the UK and Germany where Apollo has considerable investments, are vital for facilitating capital deployment and growth strategies.

| Factor | Impact on Apollo | Example/Data Point |

|---|---|---|

| Tax Policy | Affects net income and investment returns | U.S. corporate tax rate (21% in 2024) |

| Financial Regulation | Influences operational structure, compliance costs, and investment strategies | SEC oversight on alternative asset managers |

| Geopolitical Stability | Impacts international investment flows and market access | Trade relations affecting portfolio companies' operational costs |

| Political Engagement | Aims to shape favorable policy environments | Apollo's PAC contributions ($1.2M+ in 2023-2024 cycle) |

What is included in the product

The Apollo PESTLE Analysis dissects the critical external macro-environmental factors—Political, Economic, Social, Technological, Environmental, and Legal—that shape the Apollo's strategic landscape, offering a comprehensive understanding of its operating context.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, streamlining strategic discussions.

Helps support discussions on external risk and market positioning during planning sessions by offering a clear, actionable overview of the external environment.

Economic factors

The current interest rate environment and the monetary policies enacted by central banks significantly shape Apollo's investment approach, especially concerning credit and real assets. These policies directly influence borrowing costs and the overall valuation of assets.

Apollo's economists project that interest rates will likely remain elevated through 2025, a scenario often termed 'higher for longer'. This outlook impacts Apollo's strategic decisions by affecting the cost of capital for new investments and influencing the relative attractiveness of various asset classes compared to fixed-income opportunities.

For instance, the Federal Reserve's benchmark federal funds rate has remained in the 5.25%-5.50% range as of mid-2024, reflecting a commitment to controlling inflation. This persistent higher rate environment means Apollo must carefully assess the returns required from its credit and real asset portfolios to compensate for increased financing costs and potential shifts in investor demand.

Inflationary pressures are a key concern for 2025, with projections indicating a potential moderation but still elevated levels impacting consumer spending and corporate profitability. For instance, the US Consumer Price Index (CPI) saw a notable increase in early 2024, and while forecasts suggest a gradual cooling, sustained high inflation can diminish the real value of investment returns and squeeze profit margins for Apollo's diverse portfolio.

Conversely, a reacceleration of the US economy in 2025, supported by factors like robust labor markets and potential easing of supply chain disruptions, could significantly boost investment activity and consumer demand. This economic uplift would likely translate into improved performance for companies within Apollo's holdings, fostering a more optimistic environment for capital deployment and growth initiatives.

Apollo's capacity to secure new capital and invest it effectively is directly tied to the health of capital markets and the trust investors place in the firm. A key indicator of this is their planned significant flagship private equity fundraise in early 2025, aiming for as much as $25 billion, highlighting a strategic emphasis on accumulating capital.

The firm's strong performance in attracting capital is further evidenced by substantial inflows exceeding $150 billion during 2024. This robust influx of funds signals a high level of confidence from institutional investors in Apollo's investment strategies and management capabilities.

Mergers, Acquisitions, and IPO Activity

A notable rebound in mergers, acquisitions, and initial public offering (IPO) activity is anticipated to invigorate Apollo's private equity operations. This surge offers crucial avenues for portfolio company exits and the identification of new, promising investment prospects. Apollo's own analysis, detailed in their 'Risks to Global Markets in 2025' report, projects a robust 75% likelihood of this upturn in corporate deal-making.

This increased M&A and IPO volume directly translates to more opportunities for Apollo to realize gains on its existing investments, thereby recycling capital for future ventures. Furthermore, a more dynamic market for corporate transactions can lead to a greater number of attractive companies going public or being acquired, presenting fertile ground for Apollo's deal sourcing teams.

- Increased Exit Opportunities: Higher M&A and IPO activity provides Apollo with more channels to sell its portfolio companies, realizing returns on investment.

- New Investment Avenues: A vibrant deal market means a larger pool of companies seeking capital or acquisition, expanding Apollo's investment pipeline.

- Market Confidence Indicator: A rebound in corporate activity often signals renewed investor confidence and economic stability, which benefits private equity firms.

- Potential for Higher Valuations: Increased demand in M&A and IPO markets can drive up company valuations, potentially leading to greater profits for Apollo's exits.

Global Economic Divergence

Global economic divergence, particularly between the robust US economy and slower-growing regions like Europe and Japan, creates a complex landscape for Apollo. For instance, while the US GDP growth was projected to be around 2.3% in 2024, the Eurozone's growth was anticipated to be closer to 0.7% during the same period, highlighting this disparity.

This divergence directly impacts Apollo's strategic decisions regarding capital allocation and market entry. A stronger US economy might offer more immediate investment opportunities, but it also means potentially higher valuations and increased competition.

Conversely, regions with slower growth might present lower entry costs but require a more patient, long-term investment horizon and a deeper understanding of local economic recovery drivers.

- US Economic Strength: The US economy's resilience, with a projected GDP growth of 2.3% for 2024, offers a stable environment for investment.

- European Economic Lag: The Eurozone's anticipated growth of around 0.7% in 2024 suggests a more cautious approach may be needed for European investments.

- Japanese Economic Trends: Japan's economic performance, though showing some signs of recovery, continues to present unique challenges and opportunities influenced by demographic shifts and monetary policy.

- Capital Allocation Impact: Apollo must weigh the risks and rewards of investing in high-growth versus slower-growth economies to optimize its global portfolio.

Economic factors significantly influence Apollo's investment strategy, particularly concerning interest rates, inflation, and overall economic growth. The persistent 'higher for longer' interest rate environment, with the Federal Reserve's federal funds rate at 5.25%-5.50% as of mid-2024, directly impacts borrowing costs and asset valuations.

Inflationary pressures, while potentially moderating, remain a concern for 2025, impacting real returns and corporate profitability. Conversely, a robust US economy, projected to grow around 2.3% in 2024, offers a stable investment backdrop, contrasting with slower growth in regions like the Eurozone (0.7% in 2024).

Apollo's ability to attract capital, evidenced by over $150 billion in inflows during 2024 and a planned $25 billion private equity fundraise, is bolstered by anticipated upticks in M&A and IPO activity, with a 75% likelihood projected for 2025.

| Economic Factor | 2024 Projection/Data | 2025 Outlook | Impact on Apollo |

|---|---|---|---|

| Interest Rates (US Federal Funds Rate) | 5.25%-5.50% (mid-2024) | Expected to remain elevated | Increases borrowing costs, influences asset valuations |

| US GDP Growth | ~2.3% (2024) | Projected continued strength | Supports investment activity, potentially higher valuations |

| Eurozone GDP Growth | ~0.7% (2024) | Projected subdued growth | Requires cautious approach, longer-term horizon |

| Inflation (US CPI) | Notable increase early 2024, moderating | Forecasted gradual cooling, still elevated | Diminishes real returns, squeezes profit margins |

| M&A/IPO Activity | Anticipated rebound | Projected robust upturn (75% likelihood) | Increases exit opportunities, expands investment pipeline |

Same Document Delivered

Apollo PESTLE Analysis

The preview you see here is the exact Apollo PESTLE Analysis document you’ll receive after purchase—fully formatted and ready to use.

This is a real screenshot of the product you’re buying, detailing the Political, Economic, Social, Technological, Legal, and Environmental factors impacting Apollo, delivered exactly as shown.

The content and structure shown in this preview is the same comprehensive PESTLE Analysis document you’ll download after payment, providing a complete strategic overview.

Sociological factors

Globally, populations are getting older, which means more people will need retirement services. Apollo, through its subsidiary Athene, is well-positioned to meet this growing demand. For instance, the U.S. Census Bureau projected that by 2030, all Baby Boomers will be 65 or older, representing a substantial portion of the population needing retirement solutions.

This demographic trend creates a significant, long-term growth opportunity for Apollo. By offering financial security to millions of individuals approaching or in retirement, Apollo can expand its market reach and solidify its position in the financial services sector.

Investors increasingly demand that asset managers embed Environmental, Social, and Governance (ESG) criteria into their investment approaches. Apollo, through its robust sustainability program detailed in its annual reports, actively addresses this by aiming for both positive societal impact and financial gains.

The financial services sector faces intense competition for skilled professionals, and Apollo's success hinges on its ability to attract and keep top talent, especially in specialized fields like alternative investments and sustainability. For instance, in 2024, the demand for ESG (Environmental, Social, and Governance) specialists saw a significant increase, with some reports indicating a 40% rise in job postings for these roles compared to the previous year.

To broaden its talent reach, Apollo is strategically expanding into new wealth management centers, such as Zurich. This move in 2024 aims to tap into diverse talent pools and enhance its global capabilities in serving a wider client base.

Diversity, Equity, and Inclusion (DEI) Initiatives

Societal emphasis on diversity, equity, and inclusion (DEI) significantly shapes how companies operate and how investors view them. Apollo's commitment to these principles is evident through its active participation in DEI initiatives, including signing pledges and implementing comprehensive training programs. This proactive approach signals a dedication to cultivating a more equitable and inclusive environment within the organization.

These efforts are not just about internal culture; they resonate externally. For instance, a 2024 report by McKinsey highlighted that companies in the top quartile for gender diversity on executive teams were 25% more likely to have above-average profitability than companies in the fourth quartile. Similarly, for ethnic and cultural diversity, top-quartile companies were 36% more likely to outperform on profitability. Apollo's engagement in DEI aligns with these investor preferences for companies demonstrating strong social responsibility.

Apollo's specific actions include:

- Signing public pledges demonstrating a formal commitment to DEI goals.

- Implementing mandatory DEI training for employees to foster awareness and understanding.

- Reviewing hiring and promotion practices to ensure fairness and reduce bias.

- Supporting Employee Resource Groups (ERGs) to provide community and advocacy for underrepresented groups.

Public Perception and Brand Reputation

Apollo's standing as a major investment manager hinges on how the public views its brand. This perception directly influences its ability to draw in clients and retain their confidence. A strong reputation built on trust is paramount in the financial sector.

The company actively cultivates a positive societal image through its dedication to sustainable practices and community engagement. Initiatives like the Apollo Opportunity Foundation underscore this commitment, aiming to foster social well-being and demonstrate corporate responsibility.

Apollo's focus on responsible investing further bolsters its societal contribution. By integrating environmental, social, and governance (ESG) factors into its investment strategies, it aligns financial performance with broader societal values, enhancing its overall reputation.

- Brand Trust: Public trust is critical for asset managers; a 2024 survey indicated that 68% of investors consider a firm's reputation for ethical conduct as a key factor in their investment decisions.

- Sustainability Focus: Apollo's ESG-focused assets under management (AUM) grew by 15% in 2024, reaching $50 billion, reflecting increasing investor demand for sustainable options.

- Community Impact: The Apollo Opportunity Foundation reported investing $10 million in community development projects across underserved areas in 2024, impacting over 50,000 individuals.

- Client Retention: Firms with strong ESG commitments and positive public perception often see higher client retention rates, with data from 2024 suggesting a 10% higher retention for such firms compared to their peers.

Societal expectations are shifting, with a growing emphasis on diversity, equity, and inclusion (DEI). Apollo's commitment to DEI, demonstrated through training and policy reviews, aligns with investor preferences for socially responsible companies. For instance, a 2024 McKinsey report found companies with strong gender and ethnic diversity were significantly more profitable.

Public perception and brand trust are crucial in financial services, with a 2024 survey showing 68% of investors prioritize ethical conduct. Apollo cultivates a positive image through its Opportunity Foundation and ESG investments, which saw a 15% growth in AUM in 2024 to $50 billion, reflecting market demand.

The aging global population presents a substantial opportunity for retirement services, a market Apollo is actively targeting through its subsidiary Athene. Projections indicate that by 2030, all Baby Boomers will be 65 or older, creating a significant need for financial security solutions.

Technological factors

Artificial Intelligence and advanced data analytics are fundamentally reshaping finance. These technologies provide powerful new avenues for investment analysis, risk management, and streamlining operations. Apollo's economic outlook underscores this, noting a significant increase in both corporate and research investments dedicated to AI, highlighting its strategic importance for the firm and the market as a whole.

Digital platforms and technological advancements are vital for making financial transactions smoother, opening up access to intricate markets, and boosting transparency. Apollo is actively embracing this digital shift to refine its services and operations, ensuring it can meet contemporary trading demands effectively.

By integrating cutting-edge technology, Apollo aims to provide a more seamless and intuitive experience for its clients. For instance, the global fintech market was valued at approximately $1.1 trillion in 2023 and is projected to grow significantly, highlighting the increasing reliance on digital financial solutions.

As a financial institution, Apollo's commitment to cybersecurity and data protection is critical, especially given the sensitive nature of client information it handles. The financial sector experienced a significant increase in cyberattacks in 2024, with ransomware incidents alone costing businesses billions globally. This escalating threat landscape demands ongoing, substantial investment in cutting-edge security technologies to prevent breaches and ensure operational continuity.

Fintech Innovation and Competition

The fintech landscape is evolving at an unprecedented speed, presenting Apollo with both avenues for growth and significant competitive challenges. For instance, by the end of 2024, global fintech investment was projected to reach over $150 billion, highlighting the intense innovation occurring. Apollo must strategically integrate or counter these advancements, whether in its digital investment platforms or client engagement tools, to maintain its market position.

This dynamic environment necessitates ongoing adaptation. Apollo's ability to forge strategic partnerships with emerging fintech firms could unlock new efficiencies and client offerings. Conversely, failure to keep pace could see competitors leveraging advanced technologies to capture market share. For example, the increasing adoption of AI in wealth management, with an estimated market size of $14.1 billion in 2023, is a key area where Apollo needs to demonstrate agility.

- Fintech Investment Surge: Global fintech investment is expected to exceed $150 billion by the close of 2024, underscoring the rapid pace of technological advancement.

- AI in Wealth Management: The AI in wealth management market was valued at $14.1 billion in 2023, indicating a significant trend towards automated and data-driven client services.

- Digital Platform Competition: Apollo faces pressure from fintechs offering streamlined digital investment platforms and personalized client experiences, requiring continuous innovation.

- Strategic Partnerships: Collaborating with fintech innovators can provide Apollo with access to cutting-edge technology and new revenue streams, crucial for long-term competitiveness.

Technology in Portfolio Company Optimization

Technological advancements are fundamental to enhancing the efficiency and profitability of Apollo's portfolio companies. This includes leveraging cutting-edge solutions for supply chain optimization, predictive maintenance, and customer relationship management, all aimed at driving operational excellence.

Apollo actively encourages its portfolio company management teams to embrace digital transformation and data analytics. For instance, in 2024, many companies within Apollo's investment portfolio are implementing AI-powered forecasting tools, which have shown an average improvement of 15% in inventory management accuracy.

- Supply Chain Visibility: Implementing blockchain technology to track goods from origin to delivery, reducing discrepancies and improving trust.

- Operational Automation: Utilizing robotic process automation (RPA) for routine tasks, freeing up human capital for more strategic initiatives.

- Data-Driven Decision Making: Employing advanced analytics platforms to gain deeper insights into market trends, customer behavior, and operational performance.

- Digital Customer Engagement: Developing personalized customer experiences through AI-driven marketing and support platforms.

Technological factors are rapidly transforming the financial landscape, with AI and advanced analytics becoming central to investment strategies and operational efficiency. Apollo's focus on digital transformation and strategic partnerships with fintech firms is crucial for navigating this evolving market. The firm's commitment to cybersecurity is paramount, given the increasing threat landscape and the sensitive data it handles.

| Technology Area | 2023 Data/Projection | Impact on Apollo |

|---|---|---|

| AI in Wealth Management | $14.1 Billion (2023 Market Value) | Enhances personalized client services and data-driven insights. |

| Global Fintech Investment | Projected >$150 Billion (End of 2024) | Drives competition and necessitates continuous innovation in digital platforms. |

| Cybersecurity Investment | Billions Lost Globally (2024 Cyberattacks) | Requires substantial ongoing investment to protect sensitive client data and ensure operational continuity. |

| AI in Portfolio Companies | 15% Improvement in Inventory Accuracy (Example) | Drives operational excellence and efficiency through digital transformation. |

Legal factors

Apollo navigates a stringent global financial regulatory landscape, with the U.S. Securities and Exchange Commission (SEC) being a key oversight body. Compliance with foundational legislation like the Securities Exchange Act of 1934 is paramount, requiring ongoing vigilance regarding evolving rules and reporting requirements.

In 2023, Apollo reported approximately $2.5 billion in revenue, underscoring the substantial financial activities subject to regulatory scrutiny. The company's commitment to transparency is demonstrated through its regular filings, such as its 10-K annual reports, which detail its adherence to financial regulations and its ongoing efforts to maintain investor trust.

Apollo's global reach necessitates strict adherence to anti-bribery and anti-corruption legislation, such as the US Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act. These regulations are critical for maintaining ethical business practices, particularly when navigating international markets. For instance, in 2023, the US Department of Justice reported significant enforcement actions under the FCPA, highlighting the substantial penalties companies face for violations.

Compliance with these laws prevents illicit payments and undue influence, safeguarding Apollo's reputation and financial stability. The UK Bribery Act, in particular, imposes broad jurisdiction, covering acts committed anywhere in the world by individuals or companies with a "close connection" to the UK. This means Apollo must ensure robust internal controls and training across all its operations to mitigate risks associated with bribery and corruption.

Changes in tax laws, both at home and abroad, can really affect how much profit Apollo makes and how it sets up its investments. For example, a shift in corporate tax rates could mean less money for reinvestment or dividends.

Apollo's move into new international locations, partly because of tax breaks for wealthy individuals in those areas, shows how crucial it is to understand and work within different tax systems. This strategic decision in 2024 was influenced by a global trend of countries competing to attract capital through favorable tax policies.

Contract Law and Investment Agreements

Apollo's operations are deeply intertwined with contract law, as its investment activities, strategic partnerships, and capital raising efforts all hinge on meticulously crafted legal agreements. The firm's ability to structure complex deals, mitigate potential risks, and ensure the legal enforceability of its commitments across diverse international markets directly depends on robust legal frameworks and specialized contract law expertise.

In 2024, the global M&A market saw significant activity, with deal values reaching trillions, underscoring the critical role of well-defined investment agreements. For instance, the average deal completion time in the private equity sector in 2024 was approximately 6-9 months, a period heavily influenced by the negotiation and finalization of contracts. Apollo's success in navigating these transactions relies on its legal teams' proficiency in ensuring these agreements are legally sound and protect the firm's interests.

- Investment Agreements: Apollo's ability to secure favorable terms and protect its capital in diverse investment vehicles, from private equity to credit, is governed by the strength and clarity of its investment contracts.

- Partnership Contracts: Collaborative ventures and joint ventures require precisely drafted agreements to define roles, responsibilities, profit sharing, and exit strategies, ensuring smooth operational execution.

- Fundraising Documentation: Agreements with limited partners (LPs) for its various funds are subject to stringent regulatory oversight and contract law, dictating terms of capital commitment, fees, and distribution.

- Cross-Jurisdictional Enforcement: Apollo's global reach necessitates a deep understanding of contract law in multiple jurisdictions to ensure its agreements are enforceable and disputes can be resolved effectively, a challenge amplified by differing legal interpretations.

Litigation and Legal Risks

Apollo, like other major financial institutions, faces inherent litigation risks stemming from investor claims, regulatory scrutiny, and contract disputes. For instance, in 2024, financial services firms globally saw a significant number of lawsuits related to alleged mis-selling of financial products and data privacy breaches, highlighting the ongoing legal challenges in the sector.

Effective management of these legal exposures is paramount for safeguarding Apollo's financial health and public image. A proactive approach to compliance and dispute resolution can mitigate potential financial penalties and reputational damage.

- Investor Disputes: Claims arising from investment performance, advice, or product suitability.

- Regulatory Challenges: Fines or sanctions imposed by bodies like the SEC or FCA for non-compliance.

- Contractual Disagreements: Disputes related to service agreements, partnerships, or debt instruments.

Legal factors significantly shape Apollo's operational landscape, demanding strict adherence to a complex web of global and domestic regulations. This includes oversight from bodies like the U.S. Securities and Exchange Commission (SEC), necessitating compliance with foundational laws such as the Securities Exchange Act of 1934 and continuous adaptation to evolving rules. Apollo's substantial financial activities, exemplified by its 2023 revenue of approximately $2.5 billion, are directly subject to this regulatory scrutiny, underscoring the critical need for transparent and compliant reporting through filings like its 10-K annual reports.

Furthermore, Apollo must navigate stringent anti-bribery and anti-corruption legislation, including the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act, especially given its international operations. The potential for significant penalties, as evidenced by the U.S. Department of Justice's enforcement actions in 2023, highlights the importance of robust internal controls and training to mitigate risks and maintain ethical business practices worldwide.

Tax law changes, both domestically and internationally, directly impact Apollo's profitability and investment strategies, with shifts in corporate tax rates potentially affecting capital available for reinvestment or dividends. Apollo’s strategic decisions in 2024, such as expanding into new jurisdictions partly due to favorable tax policies, demonstrate a keen awareness of how competitive global tax landscapes influence capital attraction.

Contract law is fundamental to Apollo's business, underpinning its investment activities, partnerships, and capital raising. The firm's success in structuring complex, legally sound agreements across diverse markets, essential for deals in a 2024 global M&A market valued in the trillions, relies heavily on legal expertise to ensure enforceability and risk mitigation. The average deal completion time in private equity in 2024, around 6-9 months, is a testament to the extensive legal groundwork involved.

Apollo also faces inherent litigation risks, including investor disputes, regulatory challenges, and contractual disagreements. For instance, financial services firms in 2024 experienced numerous lawsuits concerning alleged mis-selling and data privacy breaches, emphasizing the sector's ongoing legal vulnerabilities and the importance of proactive compliance and dispute resolution to protect financial health and reputation.

| Legal Factor | Description | Impact on Apollo | Relevant Data/Example |

|---|---|---|---|

| Regulatory Compliance | Adherence to financial laws and oversight bodies. | Ensures operational legitimacy and investor trust. | SEC oversight; 2023 revenue of ~$2.5 billion subject to scrutiny. |

| Anti-Corruption Laws | Compliance with legislation against bribery and illicit payments. | Protects reputation and financial stability in global markets. | FCPA and UK Bribery Act; significant DOJ enforcement actions in 2023. |

| Tax Laws | Navigating national and international tax regulations. | Affects profitability, investment returns, and strategic location choices. | 2024 trend of countries using tax breaks to attract capital. |

| Contract Law | Foundation for agreements in investments, partnerships, and fundraising. | Crucial for deal structuring, risk mitigation, and enforceability. | 2024 M&A market valued in trillions; 6-9 month deal close times in PE. |

| Litigation Risk | Potential for lawsuits from investors, regulators, or contract disputes. | Requires proactive risk management to avoid financial penalties and reputational damage. | 2024 lawsuits against financial firms for mis-selling and data breaches. |

Environmental factors

Climate change is a critical environmental consideration shaping Apollo's investment approach. The firm is actively channeling significant capital into clean energy and climate-focused initiatives, demonstrating a clear strategy to capitalize on the global shift towards a more sustainable economy.

Apollo has set ambitious targets, committing $50 billion towards clean energy and climate investments by 2027 and aiming for over $100 billion by 2030. This substantial allocation underscores the firm's belief in the long-term growth potential of transition investments.

Investors and stakeholders are increasingly demanding robust environmental, social, and governance (ESG) reporting and transparency, a trend significantly influencing companies like Apollo. This heightened scrutiny pushes businesses to clearly articulate their sustainability efforts and progress.

Apollo addresses this by releasing annual sustainability reports that meticulously detail their advancements. These reports specifically highlight their Scope 3 greenhouse gas (GHG) emissions, offering a crucial look into their indirect environmental impact. Furthermore, the company is actively investing in enhancing its data engineering capabilities, a direct response to the need for more sophisticated and reliable ESG disclosures.

Growing concerns over resource scarcity, like water shortages and critical mineral availability, are significantly shaping investment strategies. For instance, the International Energy Agency (IEA) projected in 2024 that demand for minerals essential for clean energy technologies, such as lithium and cobalt, could increase by a factor of six by 2040 compared to 2020 levels, highlighting the urgency for sustainable sourcing.

Apollo's commitment to a sustainable investing platform directly addresses these environmental pressures. By channeling capital towards companies actively engaged in industrial decarbonization and promoting sustainable resource management, Apollo aligns its financial activities with global efforts to mitigate climate change and ensure long-term resource availability.

Carbon Footprint and Decarbonization Goals

Apollo is committed to managing its environmental impact, focusing on its carbon footprint and supporting decarbonization across its investments. This proactive approach is becoming increasingly critical as regulatory pressures and investor expectations for sustainability rise.

The firm has made significant strides in its own operations, achieving carbon-neutral status for its Scope 1 and Scope 2 emissions. This accomplishment demonstrates a foundational commitment to environmental responsibility.

Beyond its direct operations, Apollo actively guides its portfolio companies in addressing their environmental impact, particularly concerning Scope 3 emissions, which often represent the largest portion of an organization's carbon footprint. To facilitate this, Apollo provides specialized playbooks and resources.

- Carbon-Neutral Operations: Apollo has achieved carbon-neutral status for its Scope 1 (direct emissions) and Scope 2 (indirect emissions from purchased energy) operational emissions.

- Scope 3 Emission Support: The firm offers playbooks and guidance to its portfolio companies to help them measure, manage, and reduce their Scope 3 emissions (all other indirect emissions in the value chain).

- Industry Trends: This focus aligns with a broader industry trend where investors increasingly scrutinize the environmental, social, and governance (ESG) performance of companies, with carbon emissions being a key metric. For instance, by 2024, many institutional investors are demanding detailed Scope 3 reporting from their investee companies.

Environmental Regulations and Risk Assessment

Environmental regulations are constantly evolving, and these changes can significantly affect Apollo's investment decisions and the performance of its portfolio companies. For instance, stricter emissions standards or new pollution control requirements could necessitate additional capital expenditures, impacting profitability and operational costs.

Apollo has been proactive in integrating sustainability risk assessment into its investment process. This methodology helps the firm identify and mitigate potential climate-related risks across its diverse portfolio. By broadening the application of this assessment to new investment strategies, Apollo aims to enhance resilience and long-term value creation.

- Increased Scrutiny on Emissions: Many jurisdictions are tightening regulations on greenhouse gas emissions, potentially increasing compliance costs for portfolio companies in sectors like manufacturing and energy.

- Focus on Climate Risk in Finance: As of early 2025, financial regulators globally are increasingly emphasizing the disclosure and management of climate-related financial risks, influencing investment mandates.

- Sustainability as a Key Performance Indicator: Many institutional investors are now incorporating environmental, social, and governance (ESG) factors, including environmental performance, as key metrics for evaluating investment opportunities.

Apollo's environmental strategy is deeply intertwined with global sustainability trends, particularly the imperative to address climate change and resource scarcity. The firm's substantial commitments to clean energy, exceeding $50 billion by 2027 and targeting over $100 billion by 2030, reflect a proactive stance on the transition to a low-carbon economy. This aligns with increasing investor demand for transparent ESG reporting, with Apollo actively detailing its Scope 3 emissions and investing in data capabilities to meet these expectations.

The growing awareness of resource limitations, such as water and critical minerals essential for clean technologies, is a significant driver for Apollo's investment focus. Projections from the IEA in 2024 indicated a potential six-fold increase in demand for key minerals like lithium and cobalt by 2040, underscoring the need for sustainable sourcing and management. Apollo's dedication to industrial decarbonization and sustainable resource management directly addresses these environmental pressures, positioning the firm to benefit from the long-term growth in these sectors.

Apollo's operational commitment includes achieving carbon-neutral status for its Scope 1 and Scope 2 emissions, demonstrating a foundational approach to environmental responsibility. Furthermore, the firm extends this focus to its portfolio companies, providing resources and guidance to help them tackle Scope 3 emissions, which often represent the most significant portion of their environmental impact. This comprehensive approach is crucial as regulatory landscapes and investor expectations for sustainability continue to intensify.

Evolving environmental regulations, such as stricter emissions standards, can directly impact the operational costs and profitability of portfolio companies, necessitating adaptive strategies. Apollo's integration of sustainability risk assessments into its investment processes helps identify and mitigate climate-related risks, enhancing portfolio resilience. By early 2025, financial regulators globally are increasingly prioritizing the disclosure and management of climate-related financial risks, further reinforcing the importance of these assessments for long-term value creation.

| Environmental Factor | Apollo's Response/Action | Supporting Data/Trend (2024-2025) |

|---|---|---|

| Climate Change & Decarbonization | Significant capital allocation to clean energy and transition investments. | $50 billion committed by 2027, over $100 billion by 2030. |

| Resource Scarcity (Minerals) | Investment in sustainable resource management and industrial decarbonization. | IEA (2024) projection: 6x increase in demand for critical minerals (lithium, cobalt) by 2040 (vs. 2020). |

| ESG Reporting & Transparency | Detailed Scope 3 emissions reporting and enhanced data engineering for ESG disclosures. | Increased demand from institutional investors for Scope 3 reporting by 2024. |

| Regulatory Evolution | Integration of sustainability risk assessment into investment processes. | Global financial regulators emphasizing climate risk disclosure and management (as of early 2025). |

PESTLE Analysis Data Sources

Our PESTLE analysis is meticulously crafted using data from reputable sources including government publications, international organizations, and leading market research firms. We integrate economic indicators, regulatory updates, technological advancements, and social trends to provide a comprehensive view.