Apollo Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apollo Bundle

Apollo's competitive landscape is shaped by the intense rivalry among existing players and the significant bargaining power of its buyers. Understanding these forces is crucial for navigating the market effectively.

The full Porter's Five Forces Analysis reveals the real forces shaping Apollo’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Apollo Global Management, a significant player in alternative investments, relies on a network of specialized legal, financial advisory, and technology service providers. The highly niche nature of services required for complex alternative investments, such as specialized due diligence or bespoke financial structuring, can grant these suppliers a moderate degree of bargaining power. This is primarily due to their unique expertise and the limited availability of equally qualified alternatives in the market.

For instance, in 2024, the demand for specialized ESG (Environmental, Social, and Governance) advisory services within the private equity sector saw a notable increase, driving up fees for firms with proven track records in this area. While these specialized providers hold some leverage, Apollo's substantial scale of operations and its consistent, recurring business volume with these suppliers serves as a significant counterbalancing factor, helping to mitigate excessive supplier demands.

Apollo Global Management, like many alternative asset managers, relies on a robust pipeline of investment opportunities. Key suppliers in this context can include investment banks, specialized brokers, and even industry insiders who originate proprietary deal flow. When these sources are limited or highly sought after, their ability to command better terms or fees for bringing deals to Apollo is amplified.

The exclusivity of certain deal sourcing channels significantly bolsters supplier bargaining power. For instance, in 2024, the competitive landscape for private equity deals remained intense, with many firms vying for access to attractive, off-market transactions. A supplier with unique access to such opportunities can leverage this advantage, potentially impacting Apollo's acquisition costs and overall fund performance.

Apollo's most crucial 'supplier' is its exceptionally skilled human capital, encompassing investment professionals, strategists, and analysts. The fierce competition for top-tier talent in the alternative asset management sector directly translates into significant bargaining power for these individuals, particularly concerning compensation and retention incentives.

Data and Analytics Providers

Data and analytics providers wield significant influence in today's investment landscape. Apollo's need for precise, up-to-the-minute market intelligence and due diligence resources means these suppliers can leverage their unique offerings. For instance, specialized data sets or advanced analytical platforms, if not readily available elsewhere, can allow providers to negotiate premium pricing, impacting Apollo's operational costs.

The bargaining power of these data providers is amplified when their services are critical for competitive advantage or regulatory compliance. Consider the market for alternative data, which saw significant growth. By mid-2024, the global alternative data market was projected to reach tens of billions of dollars, indicating substantial investment and reliance on such specialized information. Providers offering proprietary algorithms or exclusive datasets that enhance Apollo's ability to identify lucrative investment opportunities or mitigate risks can therefore command higher fees.

- Criticality of Data: Apollo's investment decisions are heavily reliant on accurate market data and analytics.

- Uniqueness of Sources: Providers with exclusive or superior data sets can charge premium prices.

- Market Growth: The alternative data market's rapid expansion highlights the increasing value and demand for specialized information.

- Competitive Advantage: Providers offering tools that give Apollo a competitive edge can increase their bargaining power.

Technology and Infrastructure Vendors

Apollo relies on technology and infrastructure vendors for critical operations like portfolio management software and cybersecurity. While many tech services are becoming commoditized, specialized or deeply integrated solutions can grant these vendors significant bargaining power. For instance, a vendor providing a proprietary, highly customized portfolio management system that Apollo has heavily invested in might command higher prices or dictate terms due to the switching costs involved. In 2024, the continued demand for advanced cloud infrastructure and specialized AI-driven analytics platforms means that vendors in these niches can exert considerable influence.

The bargaining power of technology and infrastructure vendors can be assessed through several lenses:

- Vendor Concentration: A market with few dominant technology providers for essential services, like specialized risk management software, increases their leverage.

- Switching Costs: The expense and disruption associated with migrating Apollo's data and operations to a new vendor for critical systems (e.g., core banking or trading platforms) directly impacts vendor power.

- Uniqueness of Offering: Vendors providing proprietary technology or highly integrated solutions that are difficult to replicate elsewhere gain an advantage.

- Supplier's Ability to Forward Integrate: If a vendor could potentially offer a service that Apollo currently manages internally, their bargaining position strengthens.

The bargaining power of suppliers to Apollo Global Management is influenced by several factors, primarily the uniqueness of their offerings and the availability of alternatives. Specialized service providers, such as those offering niche legal expertise or bespoke financial structuring, often possess moderate bargaining power due to their limited competition.

In 2024, the demand for specialized ESG advisory services in private equity increased, allowing firms with strong ESG track records to command higher fees, illustrating supplier leverage. However, Apollo's significant scale and consistent business volume with these providers act as a counterbalance, helping to manage supplier demands.

The bargaining power of suppliers is further amplified when their services are critical for Apollo's competitive edge or regulatory compliance. For instance, providers of proprietary data or advanced analytical platforms that enhance investment identification or risk mitigation can negotiate premium pricing, impacting Apollo's operational costs.

The critical nature of data and analytics for Apollo's investment decisions means providers with exclusive or superior data sets can exert considerable influence. The global alternative data market's projected growth into tens of billions of dollars by mid-2024 underscores the increasing reliance and value placed on such specialized information.

| Supplier Type | Factors Influencing Bargaining Power | Impact on Apollo |

|---|---|---|

| Specialized Service Providers (Legal, Financial Advisory) | Niche expertise, limited alternatives, unique skill sets | Potentially higher fees for specialized services; mitigated by Apollo's scale |

| Deal Originators (Investment Banks, Brokers) | Exclusivity of deal flow, competitive sourcing landscape | Increased leverage for suppliers with access to sought-after opportunities; can affect acquisition costs |

| Data and Analytics Providers | Proprietary algorithms, exclusive datasets, critical market intelligence | Premium pricing for unique data; impacts operational costs and competitive advantage |

| Technology & Infrastructure Vendors | Proprietary systems, high switching costs, vendor concentration | Potential for higher pricing or dictated terms for integrated solutions; impacts operational efficiency |

What is included in the product

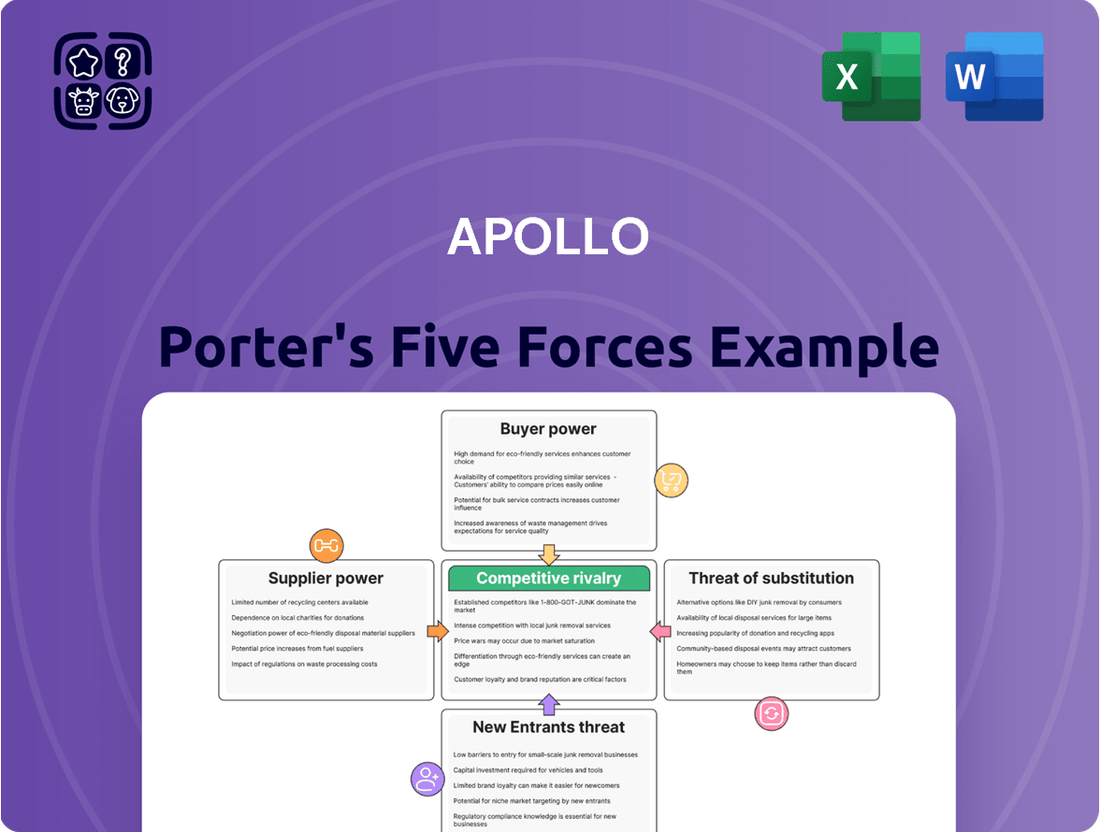

Uncovers key drivers of competition, customer influence, and market entry risks tailored to Apollo's specific industry position.

Quickly identify and address competitive threats with a visual breakdown of each Porter's Five Force, simplifying complex market dynamics.

Customers Bargaining Power

Apollo's main clients are substantial institutional investors, known as Limited Partners (LPs), which include pension funds, university endowments, and sovereign wealth funds. These LPs command significant influence due to the vast sums of capital they manage and are prepared to invest.

In the current market, where fundraising competition is intense, these large LPs can leverage their financial clout to negotiate more favorable terms. This often translates into demands for reduced management fees, performance fees, or the inclusion of co-investment rights, allowing them direct participation in specific deals.

For instance, in 2024, the alternative asset management industry saw continued fee pressure as LPs sought to optimize their investment costs. Many LPs are sophisticated in their due diligence and can easily shift capital to competing fund managers if Apollo's terms are not competitive.

Limited partners (LPs) are significantly increasing their scrutiny of fees, demanding more transparency around investment performance and the specific costs involved. This intensified focus on getting good value for their money directly bolsters their bargaining power.

Alternative asset managers are now compelled to more rigorously justify their fee structures and consistently prove strong, reliable returns to retain and attract capital. For instance, in 2024, many private equity funds faced pressure to reduce management fees or offer more performance-based fee structures as LPs became more discerning about expense ratios.

Institutional investors, a significant client base for alternative asset managers like Apollo, actively diversify their capital across numerous reputable firms. This widespread allocation significantly dilutes their reliance on any single manager, enhancing their bargaining power. For instance, in 2023, the average institutional investor allocated capital to over 20 alternative asset managers, a trend expected to continue as firms seek broader diversification strategies.

Long-Term Relationships and Re-up Decisions

Limited partners, or LPs, often extend their relationships with high-performing asset managers like Apollo. This loyalty translates into 're-up' commitments to new funds, effectively reducing their immediate bargaining power. Apollo's demonstrated success, particularly its track record in private equity, fosters this kind of enduring partnership.

For instance, in 2023, Apollo Global Management reported significant inflows into its credit and hybrid strategies, indicating strong LP confidence. While LPs can negotiate terms, the prospect of continued access to Apollo's proven investment strategies often leads to favorable renewals rather than aggressive renegotiations.

- Long-term LP relationships with successful managers like Apollo lead to 're-up' commitments for new funds.

- Apollo's consistent performance and established track record foster LP loyalty, mitigating immediate bargaining power.

- LP willingness to re-commit is directly tied to the manager's historical performance and ability to generate alpha.

- Apollo's strong fundraising in recent years, such as its $30 billion Apollo Hybrid Value Fund in 2023, underscores LP trust and commitment.

Growth of Wealth Channels and Individual Investors

Apollo's strategic push into wealth channels and its increasing appeal to individual investors are significant developments. This expansion diversifies Apollo's client base, making it less reliant on institutional capital. As of early 2024, the growth in retail participation in alternative investments, driven by platforms offering greater accessibility, demonstrates a shift in market dynamics.

While individual investors typically wield less direct bargaining power than large institutional clients, their collective influence is growing. This burgeoning demand for accessible alternative products, such as those Apollo offers, compels asset managers to adapt their product development and service terms. For instance, the increasing popularity of semi-liquid alternatives among retail investors in 2023 and early 2024 has led to product innovation and fee structure adjustments across the industry.

- Diversified Client Base: Apollo's focus on wealth channels and individual investors broadens its revenue streams and reduces dependence on large, concentrated institutional mandates.

- Collective Investor Influence: The aggregate demand from a growing number of individual investors, particularly for alternative investments, exerts pressure on product design and pricing.

- Market Responsiveness: The industry trend towards greater retail access to alternatives, evidenced by product launches and fee adjustments in 2023-2024, highlights how collective retail demand shapes offerings.

Apollo's significant client base of institutional investors, like pension funds and endowments, possesses substantial bargaining power due to the sheer volume of capital they deploy. In 2024, these Limited Partners (LPs) actively negotiated for lower management and performance fees, and sought co-investment rights, leveraging the competitive fundraising environment. Their ability to easily shift capital to other managers if terms are unfavorable further amplifies their influence.

While Apollo benefits from long-term LP relationships and strong performance, which can lead to re-commitments and mitigate immediate bargaining power, the growing retail investor segment is also a factor. The increasing accessibility of alternative investments for individuals, a trend prominent in 2023 and 2024, means that while individual investors have less direct power, their collective demand influences product development and fee structures across the industry.

| Client Type | Bargaining Power Factors | 2024/2023 Trend Impact |

|---|---|---|

| Institutional Investors (LPs) | Large capital deployment, fee sensitivity, ability to diversify managers | Increased negotiation for lower fees and co-investment rights due to competitive fundraising. |

| Retail Investors | Growing collective demand for alternatives, influence on product design | Pressure on managers to adapt product offerings and pricing due to increased accessibility. |

Same Document Delivered

Apollo Porter's Five Forces Analysis

This preview showcases the complete Apollo Porter's Five Forces Analysis, offering a detailed examination of competitive forces within an industry. The document you see here is the exact, professionally formatted analysis you will receive immediately after purchase, ensuring no surprises or placeholder content. You can confidently use this comprehensive report to understand industry attractiveness and strategic positioning.

Rivalry Among Competitors

The landscape for alternative asset managers like Apollo is intensely competitive, populated by numerous large and well-entrenched global firms. Competitors such as Blackstone, KKR, Carlyle, and Ares Management are constantly vying for investor capital and prime investment deals.

These established players, including Apollo, manage hundreds of billions of dollars in assets. For instance, as of early 2024, Blackstone reported over $1 trillion in assets under management, showcasing the sheer scale of competition for fundraising and deal sourcing.

Firms like Apollo are locked in a fierce battle to attract and secure capital for their diverse investment funds, including private equity, credit, and real assets. This intense competition for investor commitments, often referred to as dry powder, is a defining characteristic of the alternative asset management industry.

The sheer volume of undeployed capital held by private equity firms globally underscores this rivalry. As of early 2024, estimates suggest that dry powder across the private equity sector stood at over $2.5 trillion, creating a significant incentive for firms to find and execute attractive investment opportunities before their competitors.

Competition among investment firms for attractive opportunities is intense, extending beyond traditional equity stakes to encompass private credit and real asset deals. This rivalry is a significant factor in the market.

The surge in deal activity observed throughout 2024, with global M&A volume reaching hundreds of billions, underscores this fierce competition for prime investment targets. Projections for 2025 suggest this trend will continue, intensifying the battle for control stakes and specialized financing opportunities.

Performance and Track Record Differentiation

Firms in this sector largely differentiate themselves based on their historical performance and their proven ability to deliver superior risk-adjusted returns to clients. This track record is the bedrock for attracting new capital and retaining existing investor relationships.

A consistent and strong performance history is paramount. For example, in 2024, many asset managers highlighted their ability to navigate market volatility, with some actively managed funds outperforming their benchmarks. This is a key selling point.

- Performance Metrics: Firms often showcase metrics like Sharpe Ratio, Sortino Ratio, and alpha generation over multi-year periods.

- Client Retention: High client retention rates, often exceeding 90%, are a direct indicator of satisfaction with past performance.

- AUM Growth: Significant growth in Assets Under Management (AUM) is frequently tied to a compelling performance narrative.

- Awards and Recognition: Industry awards for investment performance further validate a firm's track record.

Expansion into New Asset Classes and Geographies

Competitors are actively broadening their investment horizons, venturing into areas like private credit and digital assets, while also targeting new geographical markets. This strategic expansion intensifies direct competition across a wider array of alternative investment segments.

For instance, in 2024, many asset managers reported significant inflows into private credit funds, with some estimates suggesting the market could reach $2.6 trillion by 2028, up from approximately $1.2 trillion in 2023. This growth fuels the competitive drive to capture market share.

- Increased Competition: Diversification into new asset classes and geographies means firms are no longer competing solely within their traditional domains.

- Market Share Capture: Expansion is a direct strategy to acquire a larger portion of the growing alternative investment pie.

- Geographic Reach: Firms are pushing into emerging markets and established regions alike, seeking untapped opportunities and investor bases.

The competitive rivalry among alternative asset managers like Apollo is exceptionally fierce, characterized by a crowded field of large, established global players. Firms such as Blackstone, KKR, Carlyle, and Ares Management are in constant pursuit of investor capital and lucrative investment opportunities, managing hundreds of billions of dollars. For example, as of early 2024, Blackstone's assets under management exceeded $1 trillion, highlighting the immense scale of this competition.

This intense rivalry is further amplified by the substantial amount of undeployed capital, or dry powder, available across the industry. In early 2024, estimates placed global private equity dry powder at over $2.5 trillion, creating a strong incentive for firms to execute deals before their competitors. The competition extends across various asset classes, including private equity, credit, and real assets, with firms actively seeking to secure investor commitments for their funds.

Differentiation in this market hinges on a proven track record of delivering superior risk-adjusted returns. Firms frequently highlight performance metrics like Sharpe Ratio and alpha generation over extended periods. Client retention rates, often above 90%, and consistent growth in Assets Under Management (AUM) are direct indicators of success in attracting and retaining capital. For instance, in 2024, many managers emphasized their ability to navigate market volatility and outperform benchmarks.

Moreover, competitors are strategically expanding into new asset classes, such as private credit and digital assets, and entering new geographical markets. This diversification intensifies direct competition across a broader spectrum of alternative investments. The private credit market, for example, saw significant inflows in 2024, with projections suggesting it could reach $2.6 trillion by 2028, fueling the drive for market share capture.

| Competitor | AUM (approx. early 2024) | Key Areas of Competition |

|---|---|---|

| Blackstone | >$1 Trillion | Private Equity, Real Estate, Credit, Hedge Funds |

| KKR | ~$578 Billion | Private Equity, Infrastructure, Real Estate, Credit |

| Carlyle | ~$425 Billion | Private Equity, Credit, Investment Solutions |

| Ares Management | ~$427 Billion | Credit, Private Equity, Real Estate, Infrastructure |

SSubstitutes Threaten

Publicly traded equities and fixed income represent a significant threat of substitutes for alternative investments. These traditional markets offer unparalleled liquidity, with the S&P 500, for example, trading billions of dollars daily, and government bonds providing stable, albeit lower, yields. For many investors, the ease of access and lower associated fees in public markets make them a compelling alternative to less liquid and often more complex alternative asset classes.

Large institutional investors, such as pension funds and sovereign wealth funds, are increasingly opting for direct investments or co-investments, bypassing traditional alternative asset managers like Apollo. This trend allows them to reduce management fees, which can be substantial in alternative asset classes, and exert greater control over their investment strategies and capital allocation. For instance, in 2024, many large pension plans reported allocating a growing percentage of their assets directly into private equity and infrastructure, aiming to capture more of the upside and avoid the 2% management fees and 20% performance fees common in the industry.

The rise of liquid alternatives and semi-liquid funds presents a significant threat of substitutes for traditional investment vehicles. These products, offering daily or periodic liquidity, allow investors to access alternative strategies like hedge funds or private credit without the long lock-up periods of traditional private equity. This accessibility can pull capital away from more illiquid, albeit potentially higher-returning, alternative investments.

By mid-2024, the global market for liquid alternatives was estimated to be in the trillions of dollars, with continued strong inflows driven by investor demand for diversification and liquidity. For instance, many mutual funds and ETFs now incorporate alternative strategies, making them readily available to a broader investor base and directly competing with the need for direct investment in less liquid structures.

Real Estate and Infrastructure Direct Ownership

For real asset strategies, direct ownership or co-investment in real estate or infrastructure projects presents a significant substitute. Large institutional investors, for instance, may bypass alternative asset managers to acquire and manage these assets directly, thereby controlling the entire value chain and potentially reducing management fees.

This direct approach allows for greater customization and alignment with specific investment mandates. In 2024, the trend towards greater in-house asset management among pension funds and sovereign wealth funds continued, with many seeking to build out their internal capabilities for direct real estate and infrastructure deals.

- Direct Ownership Control: Investors gain complete operational and strategic control over their real estate and infrastructure assets.

- Fee Reduction Potential: Eliminating intermediary management fees can lead to enhanced net returns.

- Asset Specialization: Direct investment allows for a deeper focus on specific asset types or geographic regions.

- Market Adaptability: Direct owners can react more swiftly to market changes and opportunities.

Hedge Funds with Different Strategies

While Apollo Global Management is known for its credit and private equity offerings, investors seeking alternative investment strategies can find substitutes in other hedge fund types. For instance, macro funds, which bet on broad economic trends, or long/short equity funds, aiming for market neutrality, can provide uncorrelated returns or specific asset class exposure that might otherwise be sought from Apollo's strategies.

The decision for an investor to choose a substitute strategy often hinges on their unique financial objectives and comfort with risk. For example, an investor prioritizing capital preservation might lean towards a low-volatility long/short fund, whereas someone seeking aggressive growth could explore a more directional macro strategy, potentially bypassing traditional Apollo products.

The hedge fund industry, as of early 2024, manages trillions of dollars in assets. This vast landscape offers a multitude of strategies beyond Apollo's core competencies.

- Macro Funds: Specialize in global economic and political events, offering broad market bets.

- Long/Short Equity Funds: Aim to profit from both rising and falling stock prices, often seeking market neutrality.

- Event-Driven Funds: Capitalize on specific corporate events like mergers, acquisitions, or bankruptcies.

- Relative Value Funds: Exploit pricing inefficiencies between related securities.

The threat of substitutes for Apollo's offerings stems from the accessibility of traditional public markets and the increasing trend of direct investment by large institutions. Public equities and fixed income, characterized by high liquidity and lower fees, often serve as a primary alternative. For instance, the S&P 500's daily trading volume frequently exceeds billions of dollars, presenting a stark contrast to the illiquidity of many alternative investments.

Institutional investors are increasingly bringing asset management in-house, particularly for real assets like real estate and infrastructure. This allows them to bypass intermediary fees and gain greater control. In 2024, many pension funds reported increasing direct allocations to these sectors, aiming to capture more upside and avoid typical management and performance fees. This shift directly competes with the need for specialized alternative asset managers.

The landscape of alternative investments itself offers substitutes. Liquid alternatives and semi-liquid funds provide access to strategies like private credit or hedge fund approaches with enhanced liquidity, directly challenging the long lock-up periods common in private equity. By mid-2024, the global liquid alternatives market was valued in the trillions, with strong inflows driven by demand for diversification and accessibility.

| Substitute Category | Key Characteristics | Investor Appeal | Example Data (2024) |

|---|---|---|---|

| Public Equities & Fixed Income | High liquidity, lower fees, broad accessibility | Capital preservation, income generation, ease of trading | S&P 500 daily trading volume: Billions USD |

| Direct Institutional Investment | Full control, potential fee reduction, customization | Enhanced net returns, strategic alignment | Increased direct allocations by pension funds to private equity/infra |

| Liquid Alternatives | Periodic liquidity, access to alternative strategies | Diversification, reduced lock-up periods | Global liquid alternatives market: Trillions USD |

Entrants Threaten

Establishing a global alternative investment management firm like Apollo requires immense capital, often in the hundreds of millions or even billions of dollars, to fund operations, seed investments, and meet regulatory capital requirements. For instance, firms managing significant assets typically need to comply with stringent capital adequacy ratios mandated by bodies like the SEC or equivalent international regulators, which can be a substantial barrier.

Navigating the intricate web of global financial regulations, including those related to investor protection, anti-money laundering (AML), and prudential supervision, demands specialized legal and compliance expertise. The sheer complexity and cost of setting up and maintaining compliance across multiple jurisdictions present a formidable challenge for potential new entrants, effectively limiting the pool of viable competitors.

New entrants struggle to establish the brand recognition and proven performance history that institutional investors demand, creating a substantial barrier. Apollo Global Management, boasting over three decades of operational history, has cultivated a robust reputation and a track record of consistent results, making it difficult for newcomers to compete for significant capital allocations.

The alternative investment sector thrives on seasoned professionals and deep, proprietary networks crucial for sourcing deals and generating value. Newcomers face a significant hurdle in attracting the industry's best talent and cultivating the extensive relationships that incumbent firms have meticulously built over years.

For instance, in 2024, the demand for specialized private equity professionals outstripped supply, with compensation packages for experienced dealmakers seeing substantial increases, making it difficult for new firms to compete for top talent.

Limited Partner (LP) Stickiness and Existing Relationships

Limited Partner (LP) stickiness, driven by deep-seated relationships with established alternative asset managers, presents a formidable barrier to new entrants. These long-standing connections often translate into significant switching costs for institutional investors, making it challenging for newcomers to displace incumbent managers.

The inherent structure of alternative investment funds, characterized by extended lock-up periods, further solidifies LP stickiness. For instance, many private equity funds have lock-up periods of 10 years or more, creating a substantial commitment that discourages LPs from easily shifting capital to new managers.

- LP Commitment Duration: Many private equity and venture capital funds impose lock-up periods of 10-12 years, creating long-term capital commitments for LPs.

- Relationship-Based Capital Allocation: A significant portion of LP capital is allocated based on trust and proven track records built over years, not just performance metrics.

- Due Diligence Costs: The extensive due diligence required for new managers can be costly and time-consuming for LPs, reinforcing their preference for existing, trusted relationships.

- Operational Inertia: The administrative and operational complexities of onboarding new fund managers can also contribute to LP inertia, favoring continuity with established players.

Increasing Competition from Traditional Asset Managers

Traditional asset managers are increasingly pushing into alternative investment spaces, a move that directly impacts Apollo. These established players are leveraging their deep existing client pools and robust distribution channels to offer a wider array of products, including private equity and credit. This expansion intensifies competition for Apollo, as these firms are not entirely new entrants to the broader asset management landscape but are now more aggressively targeting alternative asset segments.

For instance, in 2024, many large, traditional asset managers reported significant inflows into their alternative strategies. BlackRock, a giant in the traditional space, continued to grow its alternative assets under management, aiming to capture a larger share of the market. This trend signifies a heightened competitive pressure on firms like Apollo, which have historically specialized in alternatives.

- Increased competition: Traditional asset managers are actively expanding into alternative investments.

- Leveraging existing strengths: These firms utilize established client relationships and distribution networks.

- Intensified market pressure: Apollo faces greater rivalry as traditional players broaden their offerings.

- Market share impact: The move by traditional managers could dilute Apollo's market share in key alternative segments.

The threat of new entrants in the alternative investment management sector is significantly mitigated by the substantial capital requirements, regulatory hurdles, and the need for established track records and deep industry relationships. These factors create a high barrier to entry, making it exceedingly difficult for new firms to challenge established players like Apollo Global Management.

The industry's reliance on seasoned professionals and extensive networks further solidifies the position of incumbent firms. In 2024, the competition for top talent in private equity intensified, with experienced dealmakers commanding higher compensation, a challenge new entrants would find difficult to overcome.

Furthermore, the loyalty of Limited Partners (LPs) to established managers, often due to long-standing relationships and the high costs associated with switching, acts as a powerful deterrent to new competitors. The extended lock-up periods common in alternative funds, frequently 10 years or more, reinforce this LP stickiness.

The expansion of traditional asset managers into alternatives also intensifies competition, though these are not entirely new entrants but rather established players broadening their scope. In 2024, firms like BlackRock reported substantial growth in their alternative asset divisions, indicating a more crowded competitive landscape for specialized firms.

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built upon a foundation of diverse data, including company annual reports, industry-specific market research, and government economic indicators. This ensures a comprehensive understanding of competitive dynamics.