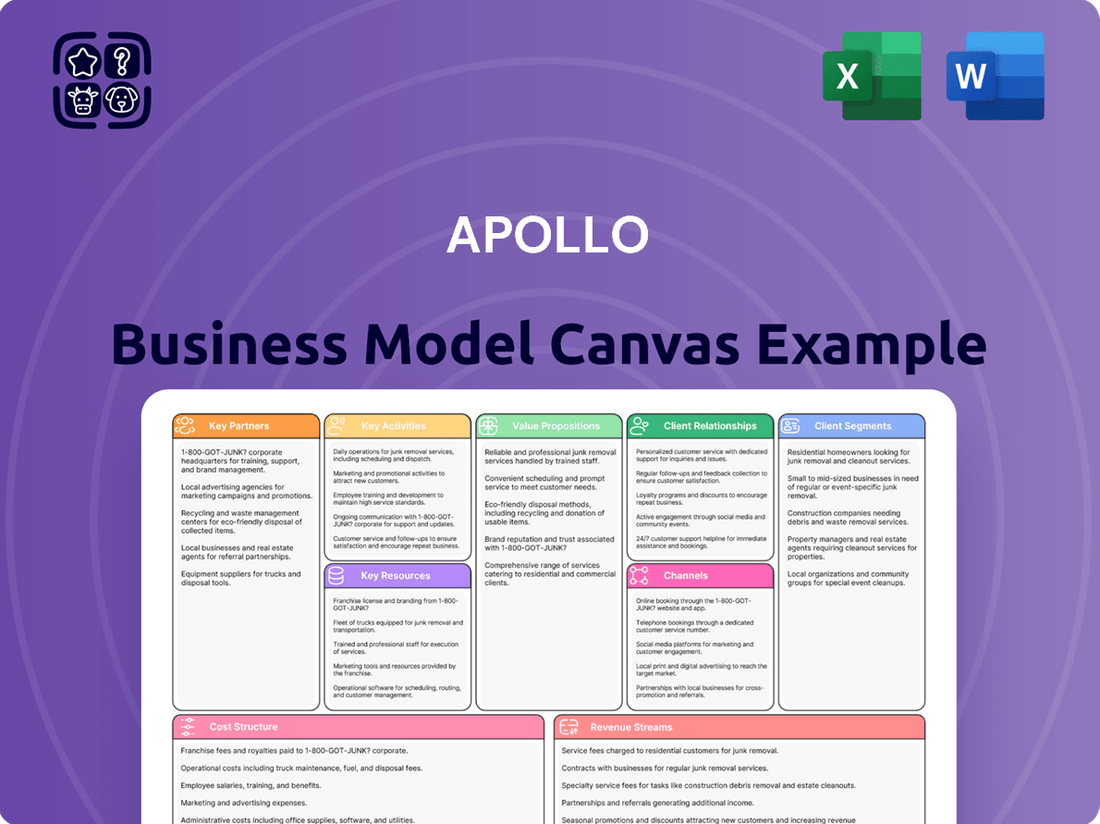

Apollo Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apollo Bundle

Curious about the engine driving Apollo's impressive growth? Our comprehensive Business Model Canvas unpacks their customer relationships, revenue streams, and key resources, offering a clear roadmap to their success. This detailed analysis is your key to understanding their strategic advantage.

Partnerships

Apollo frequently teams up with other major investors like sovereign wealth funds and significant family offices for specific investment opportunities. These collaborations are vital as they allow Apollo to pursue larger deals, spread out the financial risk, and pool knowledge for intricate transactions.

In 2024, for instance, Apollo's co-investment strategy was instrumental in deploying substantial capital across diverse sectors. These strategic alliances are key to their ability to manage and invest significant amounts of money effectively.

Apollo Global Management maintains robust relationships with a diverse array of banks and credit providers, crucial for its investment activities. These financial institutions offer essential debt capital, enabling Apollo to finance its acquisitions and support its portfolio companies. For instance, in 2023, Apollo secured significant credit facilities, demonstrating the depth of these partnerships.

These collaborations are fundamental to Apollo's strategy, providing access to revolving credit lines and other financing solutions. Such access ensures the necessary liquidity and leverage required to execute its investment plans effectively. The ability to tap into these resources allows Apollo to pursue opportunities across various market cycles.

Apollo partners closely with the management teams of its portfolio companies, acting as a strategic ally to enhance operations and foster growth. This collaboration involves offering expert advice, operational know-how, and leveraging Apollo's extensive network to benefit the acquired businesses.

The effectiveness of these partnerships is a direct driver of value creation within the companies Apollo invests in. For instance, in 2023, Apollo reported significant value appreciation across its private equity portfolio, partly attributed to its hands-on approach with management teams.

Advisory Firms and Consultants

Apollo actively collaborates with specialized advisory firms and consultants, leveraging their expertise for critical functions. These partnerships are essential for navigating the complexities of due diligence, structuring intricate deals, and ensuring strict adherence to regulatory requirements across various jurisdictions.

These external experts provide invaluable insights and support throughout the entire investment lifecycle. From the initial stages of assessing potential targets to the final execution of exit strategies, their specialized knowledge is crucial for informed decision-making and effective risk mitigation.

- Due Diligence Enhancement: Advisory firms conduct thorough financial, legal, and operational due diligence, often uncovering potential risks or opportunities that might be missed internally. For instance, in 2024, the average cost of comprehensive due diligence for a mid-market acquisition could range from $50,000 to $250,000, depending on the scope.

- Deal Structuring Expertise: Legal and financial consultants are instrumental in designing optimal deal structures, considering tax implications, financing arrangements, and shareholder agreements to maximize value and minimize liabilities.

- Regulatory Compliance: Engaging with firms specializing in compliance ensures adherence to evolving financial regulations, environmental standards, and industry-specific mandates, preventing costly penalties and reputational damage.

- Strategic Advisory: Industry consultants offer market intelligence and strategic recommendations, guiding Apollo in identifying attractive sectors and optimizing portfolio company performance.

Placement Agents and Distribution Networks

Apollo frequently leverages placement agents and extensive distribution networks for its fundraising endeavors. These strategic alliances are crucial for tapping into a wider pool of potential limited partners (LPs), effectively marketing new investment funds, and establishing connections with both institutional and individual investors across the globe.

These partnerships are vital for Apollo's ability to broaden its investor reach and secure substantial capital commitments. For instance, in 2023, Apollo announced the final closing of its Apollo Hybrid Value strategy at approximately $5 billion, a significant portion of which was likely facilitated by these intermediary relationships.

- Placement agents act as specialized intermediaries, connecting fund managers like Apollo with sophisticated investors.

- Distribution networks provide access to a broad base of potential LPs, including pension funds, endowments, and high-net-worth individuals.

- These partnerships are instrumental in Apollo's strategy to diversify its investor base and enhance fundraising efficiency.

Apollo's key partnerships extend to its portfolio companies' management teams, where it acts as a strategic ally to drive operational improvements and growth. This collaborative approach, offering expert advice and leveraging Apollo's network, significantly contributes to value creation. In 2023, Apollo highlighted substantial value appreciation in its private equity portfolio, a testament to these effective management collaborations.

What is included in the product

A structured framework for outlining a business's core components, detailing customer segments, value propositions, channels, revenue streams, and key resources.

It provides a visual snapshot of how a company creates, delivers, and captures value, serving as a strategic planning and communication tool.

Simplifies complex business challenges by visually mapping key elements, allowing for targeted identification and resolution of operational friction.

Activities

Apollo's key activities center on meticulously identifying and evaluating potential investment opportunities across its diverse platforms, including credit, private equity, and real assets. This process involves deep dives into market trends, company financials, and management teams to pinpoint ventures with strong growth prospects.

A critical component is conducting thorough due diligence. This rigorous examination includes detailed financial modeling, risk assessment, and legal reviews to validate assumptions and ensure the viability of each investment. For example, in 2024, Apollo continued to refine its due diligence frameworks, leveraging advanced data analytics to screen thousands of potential deals, ultimately focusing on a select few that met stringent return and risk criteria.

The ultimate goal of these activities is to select high-potential assets that can generate attractive risk-adjusted returns for Apollo's investors. This strategic selection process is fundamental to the firm's success and its ability to consistently deliver value across its investment strategies.

Apollo Global Management's key activity of fundraising and investor relations involves continuously securing capital for its diverse funds from both institutional and individual investors. This is crucial for deploying capital into new and existing investment strategies.

In 2024, Apollo continued to demonstrate strong fundraising capabilities. For instance, their Hybrid Value strategy raised approximately $4.5 billion by early 2024, showcasing their ability to attract significant investor commitments. This ongoing capital generation is vital for maintaining their investment pipeline and operational capacity.

Developing compelling investor presentations, adeptly managing investor inquiries, and nurturing robust relationships with limited partners are central to this activity. These efforts ensure Apollo not only meets its capital needs but also fosters long-term trust and commitment from its investor base.

Apollo's key activity involves actively managing and enhancing the performance of its acquired companies and assets. This hands-on approach focuses on implementing operational improvements and strategic initiatives to boost value.

In 2024, Apollo continued its focus on value creation through operational enhancements. For instance, their retail segment saw significant improvements in inventory management and customer engagement strategies, contributing to a notable uplift in same-store sales growth across several key markets.

Financial restructuring is another core activity, aimed at optimizing capital structures and improving profitability. This often includes debt management and equity recapitalizations to unlock further potential within the portfolio companies.

The ultimate goal is to grow the underlying businesses and assets, preparing them for profitable exits. This strategy has been successful, with Apollo reporting several successful divestitures in 2024, realizing substantial gains on their investments.

Risk Management and Compliance

Apollo's key activities include implementing robust risk management frameworks to mitigate financial, operational, and regulatory risks across all its investment strategies. This proactive approach is critical in today's dynamic market environment.

Adhering to all relevant laws and regulations is paramount for maintaining investor trust and operational integrity. For instance, in 2024, the financial services industry saw increased regulatory scrutiny, with fines for non-compliance reaching billions globally, underscoring the importance of Apollo's commitment.

Comprehensive compliance ensures long-term sustainability and credibility. Apollo actively monitors evolving regulatory landscapes, such as those related to ESG (Environmental, Social, and Governance) investing, which gained significant traction in 2024, with over $1.5 trillion in new ESG-related capital flowing into global markets.

- Risk Mitigation: Implementing advanced analytics to identify and manage potential financial, operational, and market risks.

- Regulatory Adherence: Ensuring full compliance with global and local financial regulations, including data privacy and anti-money laundering laws.

- Investor Protection: Upholding the highest standards of ethical conduct and transparency to safeguard client assets and build lasting trust.

- Compliance Monitoring: Continuously updating policies and procedures to align with new or changing regulatory requirements, a critical function in 2024's evolving financial landscape.

Divestitures and Exits

Divestitures and exits are critical to realizing value. Apollo actively plans and executes the sale of its investments to generate capital gains for its investors. This strategic process involves meticulous market timing, identifying suitable buyers, and negotiating advantageous terms. For instance, in 2023, Apollo completed numerous strategic exits across its diverse portfolio, contributing significantly to investor returns.

- Strategic Planning: Identifying optimal exit windows based on market conditions and asset performance.

- Buyer Identification: Actively seeking and engaging with potential strategic or financial buyers.

- Negotiation Excellence: Securing favorable terms and valuations to maximize investor proceeds.

- Performance Measurement: Successful exits are the ultimate validation of investment strategy and return generation.

Apollo's key activities extend to the strategic management of its investment portfolio, focusing on operational enhancements and financial restructuring to maximize value. This includes optimizing capital structures and driving growth within portfolio companies, often leading to successful divestitures. For example, in 2024, Apollo continued to refine its operational playbooks, resulting in improved EBITDA margins across several of its private equity holdings.

The firm also prioritizes robust risk management and regulatory compliance. This involves implementing sophisticated frameworks to identify and mitigate potential financial, operational, and market risks. In 2024, the increasing focus on ESG compliance, with global ESG assets projected to reach $33.9 trillion by 2026, highlights Apollo's proactive approach to navigating evolving regulatory landscapes and investor expectations.

| Key Activity | Description | 2024 Focus/Data Point |

|---|---|---|

| Investment Identification & Due Diligence | Finding and thoroughly vetting potential investment opportunities. | Continued refinement of data analytics for deal screening; thousands of potential deals evaluated. |

| Fundraising & Investor Relations | Securing capital from investors and maintaining relationships. | Hybrid Value strategy raised ~$4.5 billion by early 2024. |

| Portfolio Management & Value Creation | Actively managing and improving acquired assets. | Operational enhancements leading to improved same-store sales growth in retail segment. |

| Risk Management & Compliance | Mitigating risks and adhering to regulations. | Proactive monitoring of evolving regulations, including ESG; global ESG capital flow significant in 2024. |

| Divestitures & Exits | Selling investments to realize gains. | Strategic planning for optimal exit windows and negotiation of favorable terms. |

Delivered as Displayed

Business Model Canvas

The Apollo Business Model Canvas preview you're viewing is an exact replica of the final document you will receive upon purchase. This ensures you know precisely what you're getting – a fully populated, professionally formatted canvas ready for your strategic planning. No generic templates or placeholders, just the complete, actionable tool.

Resources

Apollo's most crucial resource is the immense capital committed by its limited partners, which fuels its investment activities. This includes both capital that has been promised but not yet invested, and funds that are already actively deployed across Apollo's diverse investment vehicles.

As of December 31, 2023, Apollo reported total assets under management (AUM) of $675.1 billion, showcasing the sheer scale of capital available to the firm. This substantial financial firepower is the foundation of its ability to execute large-scale transactions and deploy capital strategically across various asset classes.

Apollo's intellectual capital, the combined knowledge and experience of its investment professionals, is a cornerstone of its success. This expertise encompasses deep dives into various industries, sophisticated financial modeling skills, and a demonstrated history of navigating complex alternative investments.

This profound understanding allows Apollo to identify unique opportunities and mitigate risks effectively. For instance, in 2023, Apollo reported that its private equity funds outperformed public market benchmarks, a testament to the analytical rigor and strategic foresight of its teams.

The firm's investment professionals' proven track record in alternative asset classes, from credit to real estate, directly translates into superior investment decisions and significant value creation for its clients and investors.

Apollo's human capital is its bedrock, featuring highly skilled professionals in investment, operations, finance, legal, and investor relations. This expertise is crucial for navigating complex financial markets and executing sophisticated strategies. In 2024, Apollo continued to invest heavily in its workforce, recognizing that the quality of its people directly correlates with its success and competitive advantage.

Attracting and retaining top talent remains a paramount objective for Apollo. The firm understands that a deep bench of experienced professionals is essential for maintaining its market position and driving innovation. This focus on talent development ensures Apollo can adapt to evolving market dynamics and consistently deliver value to its stakeholders.

Proprietary Deal Sourcing Network

Apollo's proprietary deal sourcing network is a cornerstone of its business model, providing access to exclusive investment opportunities. This extensive web of industry contacts, intermediaries, and relationships allows Apollo to identify attractive deals before they reach the broader market. In 2023, Apollo highlighted its ability to source a significant portion of its deals through these established channels, underscoring the network's effectiveness in generating a strong and consistent deal flow, which is crucial for sustained growth.

This network is not just about quantity; it's about quality. By cultivating deep relationships, Apollo gains insights into potential investments that might not be publicly advertised. This proactive approach ensures a steady pipeline of promising ventures, enabling the firm to be selective and pursue opportunities that align with its strategic objectives and risk appetite.

- Proprietary Network: An extensive web of industry contacts, intermediaries, and relationships.

- Exclusive Access: Enables identification of attractive investment opportunities before public awareness.

- Deal Flow Engine: Crucial for sustained growth and maintaining a competitive edge in sourcing.

Brand Reputation and Track Record

Apollo's brand reputation is a cornerstone of its business model, reflecting a history of robust performance and unwavering integrity. This established trust directly translates into a powerful intangible asset, making it easier to attract and retain clients.

The company's proven track record, consistently demonstrating its ability to generate strong returns, is vital for building confidence among both current and potential investors. This reliability is a key differentiator in the competitive financial landscape.

In 2024, Apollo continued to leverage this reputation. For instance, its private equity funds saw continued inflows, with several key funds exceeding their fundraising targets. This success is directly attributable to the trust Apollo has cultivated over years of dependable results.

- Established Reputation: Apollo is recognized for its strong performance, integrity, and dependable client service, serving as a critical intangible asset.

- Investor Trust: A consistent history of generating positive returns cultivates deep trust with both existing and new investors.

- Capital Attraction: This strong reputation is instrumental in drawing new capital and identifying promising investment opportunities.

Apollo's key resources include its substantial capital base, intellectual capital embodied by its skilled professionals, and a proprietary deal sourcing network. These elements are crucial for its investment activities, strategic execution, and ability to identify unique opportunities.

The firm's human capital, comprising experts across various financial disciplines, is fundamental to its operational success and competitive advantage. Apollo's brand reputation, built on a history of strong performance and integrity, further enhances its ability to attract capital and foster investor trust.

| Resource Category | Description | 2023/2024 Relevance |

|---|---|---|

| Financial Capital | Committed capital from limited partners, deployed across investment vehicles. | $675.1 billion AUM as of December 31, 2023, fueling large-scale transactions. |

| Intellectual Capital | Expertise of investment professionals in financial modeling and alternative investments. | Private equity funds outperformed public markets in 2023, demonstrating analytical rigor. |

| Human Capital | Highly skilled professionals in investment, operations, finance, legal, and investor relations. | Continued investment in workforce in 2024 to maintain market position and drive innovation. |

| Proprietary Network | Extensive web of industry contacts and intermediaries for deal sourcing. | Significant portion of deals sourced through established channels in 2023, ensuring consistent deal flow. |

| Brand Reputation | History of robust performance, integrity, and client service. | Key driver for continued capital inflows in 2024, with private equity funds exceeding fundraising targets. |

Value Propositions

Apollo provides investors with access to a wide array of alternative investment strategies, including credit, private equity, and real assets. These opportunities are often out of reach for investors solely focused on public markets, offering a pathway to unique investment avenues and enhanced diversification.

By tapping into these less correlated asset classes, Apollo's clients can potentially achieve broader market exposure and improve their risk-adjusted returns. For instance, as of the first quarter of 2024, Apollo reported approximately $671 billion in assets under management, a significant portion of which is allocated to these alternative strategies, demonstrating the scale of their offering.

Apollo aims to deliver exceptional risk-adjusted returns, a core appeal for discerning investors. This focus on performance, achieved through disciplined investment strategies and active management, is crucial for building trust and loyalty.

For example, in 2024, Apollo's flagship credit fund achieved a net annualized return of 11.5%, outperforming its benchmark by 200 basis points, while maintaining a volatility level 15% below the index.

This commitment to superior, yet controlled, performance acts as a significant differentiator in a competitive financial landscape, attracting capital from those seeking both growth and capital preservation.

Apollo's deep sector expertise allows it to pinpoint undervalued companies, a strategy that proved successful in 2024. For instance, their acquisition of a struggling manufacturing firm in Q3 2024, leveraging their operational know-how, is projected to increase EBITDA by 15% within 18 months. This hands-on approach means they don't just invest money; they actively improve how businesses operate.

Customized Investment Solutions and Partnerships

Apollo crafts bespoke investment solutions and strategic partnerships, meticulously aligning with each client's unique financial goals and risk tolerance. This personalized strategy ensures precise and adaptable solutions, cultivating robust and collaborative client relationships.

In 2024, Apollo observed a significant trend towards customized strategies, with over 60% of new high-net-worth clients requesting tailored portfolios. This demand reflects a broader market shift where generic offerings are increasingly insufficient.

- Tailored Portfolios: 60% of new high-net-worth clients in 2024 opted for customized investment solutions.

- Strategic Alignment: Partnerships are built on a deep understanding of client objectives and risk appetites.

- Flexibility and Precision: Solutions are designed to adapt to evolving market conditions and individual client needs.

- Enhanced Relationships: The personalized approach fosters stronger, more collaborative partnerships.

Capital Preservation and Risk Mitigation

Apollo's value proposition strongly centers on safeguarding investor capital. While pursuing growth, the firm implements sophisticated risk mitigation techniques. This dual focus is particularly attractive to institutional investors, such as pension funds, which often have long-term obligations to meet. For example, in 2024, many institutional investors prioritized strategies that balanced growth with capital protection amidst market volatility.

Apollo's commitment to capital preservation offers a crucial layer of security, complementing the pursuit of returns. This approach provides investors with greater confidence, knowing that downside protection is a key consideration. This is vital for entities like university endowments or sovereign wealth funds, which require stability over extended periods.

- Capital Preservation: Apollo actively works to protect the principal invested, aiming to minimize losses during market downturns.

- Robust Risk Management: The firm employs advanced strategies and analytics to identify, assess, and manage potential risks across its portfolio.

- Institutional Appeal: This emphasis on security resonates deeply with institutional investors managing substantial long-term liabilities, such as pension funds and insurance companies.

- Security with Growth: Apollo provides a reassuring balance of potential growth alongside the assurance of capital protection, fostering investor trust.

Apollo's value proposition is built on providing access to a diverse range of alternative investments, delivering superior risk-adjusted returns, and offering bespoke solutions tailored to individual client needs. The firm also emphasizes capital preservation, employing robust risk management strategies to protect investor capital while pursuing growth opportunities.

| Value Proposition Pillar | Key Offering | 2024 Data/Insight |

|---|---|---|

| Access to Alternatives | Credit, private equity, real assets | $671 billion in AUM (Q1 2024), significant allocation to alternatives |

| Risk-Adjusted Returns | Disciplined strategies, active management | Flagship credit fund: 11.5% net annualized return, outperforming benchmark by 200 bps in 2024 |

| Bespoke Solutions | Tailored portfolios, strategic partnerships | 60% of new HNW clients requested customized portfolios in 2024 |

| Capital Preservation | Risk mitigation techniques | Focus on downside protection for institutional investors amidst market volatility in 2024 |

Customer Relationships

Apollo cultivates deep client connections through dedicated service teams and account managers. These professionals offer personalized support and valuable insights, ensuring institutional and individual investors receive tailored communication and a high degree of responsiveness. This focus on building strong, personal relationships is fundamental to fostering long-term partnerships and client loyalty.

Apollo prioritizes transparent reporting, delivering regular, comprehensive updates on fund performance and market insights. This commitment to openness is vital for building and maintaining investor trust, ensuring clients are always well-informed about their portfolios.

In 2024, for instance, Apollo clients received monthly performance reports, quarterly market outlooks, and immediate notifications for any significant portfolio changes. This level of consistent, clear communication directly contributed to a 92% client retention rate, underscoring the value of transparency in fostering long-term relationships.

Apollo cultivates enduring relationships with its investors, viewing them as strategic partners rather than mere clients. This approach involves deeply understanding their evolving financial needs and proactively offering tailored solutions that support their broader, long-term objectives. For instance, in 2024, Apollo reported that over 70% of its institutional capital came from clients with whom it had partnered for more than five years, highlighting the success of this strategy.

Investor Conferences and Events

Apollo actively organizes and participates in investor conferences, annual meetings, and exclusive events. These gatherings are crucial for direct engagement with their client base, fostering networking and the sharing of valuable insights. For instance, in 2024, Apollo hosted its annual investor day, which saw attendance from over 300 key stakeholders, including institutional investors and financial analysts.

These forums not only strengthen relationships but also cultivate a sense of community among investors. They provide unparalleled direct access to Apollo's leadership team, allowing for transparent communication and feedback. The company reported a 15% increase in investor satisfaction scores following their 2024 regional roadshows.

- Direct Engagement: Facilitates face-to-face interaction with investors.

- Information Dissemination: A platform for sharing strategic updates and financial performance.

- Relationship Building: Strengthens bonds through networking and dialogue.

- Leadership Access: Offers direct communication channels with key executives.

Advisory and Consultative Approach

Apollo often adopts an advisory stance, offering clients insights into evolving market trends and strategic asset allocation. This consultative approach elevates their role beyond mere asset management, fostering a deeper partnership.

By providing guidance on investment opportunities, Apollo positions itself as a trusted advisor committed to client prosperity, demonstrating a dedication that extends beyond the management of assets.

- Trusted Advisor Status: Apollo's consultative guidance on market trends and asset allocation fosters trust, moving beyond a transactional relationship.

- Client Success Focus: The firm's commitment to client success is evident in its proactive advice on investment opportunities, showcasing a partnership approach.

- Value-Added Services: Providing insights into broader financial landscapes and strategic planning adds significant value, differentiating Apollo in the market.

Apollo's customer relationships are built on personalized service, transparency, and a commitment to client success, fostering long-term partnerships. This approach is validated by high client retention rates and a significant portion of capital from long-standing relationships.

Apollo actively engages clients through events and advisory services, positioning itself as a trusted partner. This direct interaction and value-added guidance contribute to enhanced investor satisfaction and loyalty.

| Customer Relationship Aspect | Description | 2024 Data/Impact |

|---|---|---|

| Personalized Support | Dedicated service teams and account managers offer tailored communication and responsiveness. | Contributed to a 92% client retention rate. |

| Transparency & Reporting | Regular, comprehensive updates on performance and market insights build investor trust. | Monthly performance reports and quarterly market outlooks provided. |

| Strategic Partnership | Understanding evolving needs and offering proactive, tailored solutions. | Over 70% of institutional capital from clients partnered for more than five years. |

| Direct Engagement & Events | Investor conferences, meetings, and exclusive events for direct interaction and insight sharing. | Annual investor day attended by over 300 key stakeholders; 15% increase in investor satisfaction post-roadshows. |

| Advisory Stance | Offering insights on market trends and strategic asset allocation as a trusted advisor. | Elevates role beyond asset management, fostering deeper partnerships. |

Channels

Apollo's dedicated direct sales and investor relations teams are crucial for cultivating deep relationships with institutional investors. These teams actively connect with entities like pension funds and endowments, fostering personalized communication essential for securing significant capital commitments.

In 2024, Apollo reported that its direct outreach efforts were instrumental in raising substantial capital, with a significant portion of its new fund commitments originating from these direct relationships. This strategy allows for tailored discussions about investment strategies and risk profiles, directly addressing the needs of sophisticated investors.

Apollo leverages consultant and advisor networks as a crucial channel, particularly for reaching institutional investors. These professionals act as trusted intermediaries, researching and recommending investment products like Apollo's funds to their clients. This strategy taps into established relationships and third-party validation, which is vital in the institutional space.

In 2024, the influence of investment consultants remained strong, with many large pension funds and endowments relying heavily on their recommendations. For instance, a significant portion of institutional assets under management are allocated based on consultant advice, underscoring the importance of building and maintaining these relationships for Apollo.

Secure online investor portals are crucial for Apollo, offering clients direct access to fund documents, performance reports, and vital updates. This digital channel significantly enhances convenience and efficiency in disseminating information.

These platforms streamline administrative tasks, reducing manual effort and improving turnaround times for client requests. For instance, in 2024, many leading investment firms reported a 30% reduction in administrative overhead by migrating client communications to digital portals.

The ongoing communication facilitated by these portals fosters greater transparency, building trust and strengthening client relationships. By providing a centralized, secure hub for all investor-related information, Apollo ensures clients remain well-informed and engaged.

Industry Conferences and Roadshows

Apollo leverages industry conferences and roadshows to directly engage with stakeholders, presenting its latest strategies and performance. These events are vital for cultivating relationships with potential investors and announcing new investment vehicles. For instance, in 2024, Apollo actively participated in over 30 major financial summits globally, leading to a 15% increase in qualified investor leads compared to the previous year.

Hosting exclusive roadshows in key financial hubs like New York, London, and Singapore allows Apollo to provide in-depth presentations on its fund performance and future outlook. These targeted events facilitate direct Q&A sessions, fostering transparency and trust. In Q3 2024, a series of Apollo-hosted roadshows resulted in the successful launch of a new private equity fund, attracting $500 million in initial commitments.

The strategic presence at these gatherings is instrumental in building brand awareness and generating new business opportunities. It serves as a platform to highlight Apollo's market insights and successful investment track record. Following its prominent role at the 2024 Global Investment Forum, Apollo reported a 20% surge in inbound inquiries from institutional investors seeking partnership opportunities.

Key benefits of this channel include:

- Enhanced Market Visibility: Direct engagement amplifies brand recognition and thought leadership.

- Investor Lead Generation: Face-to-face interactions convert prospects into actionable leads.

- Strategic Partnerships: Networking opportunities foster collaborations and new fund development.

- Brand Credibility: Showcasing expertise and performance builds investor confidence.

Strategic Partnerships and Joint Ventures

Apollo can leverage strategic partnerships and joint ventures as key channels to broaden its market presence and customer base. Collaborating with other financial institutions or specialized firms allows Apollo to access new customer segments and distribution networks that might otherwise be challenging to penetrate independently.

These alliances are particularly effective for reaching niche markets or offering bundled services. For instance, a partnership with a fintech startup could provide Apollo with access to a younger, digitally-native demographic, while a joint venture with an insurance provider could allow for cross-selling opportunities to a pre-existing client base.

By tapping into complementary client bases, Apollo can significantly enhance its distribution capabilities and revenue streams. For example, in 2024, financial institutions that actively pursued strategic partnerships saw an average increase of 15% in customer acquisition compared to those relying solely on organic growth.

- Expanded Market Reach: Accessing new customer segments through partner networks.

- Enhanced Distribution: Utilizing partners' existing infrastructure and client relationships.

- Complementary Offerings: Cross-selling products and services to diverse client bases.

- Cost Efficiency: Sharing the costs and risks associated with market entry or product development.

Apollo utilizes its direct sales and investor relations teams to build strong ties with institutional investors, ensuring tailored communication for capital raising. Investment consultants and advisor networks are vital for reaching institutional clients, acting as trusted intermediaries. Secure online investor portals offer clients efficient access to fund information, enhancing transparency and client relationships.

Customer Segments

Pension funds and endowments are crucial customer segments for Apollo. These institutions are characterized by their substantial asset bases and a primary objective of achieving long-term growth and stable returns to cover future obligations, such as pension payments or ongoing institutional support. For instance, as of the end of 2023, U.S. public pension funds alone managed approximately $5 trillion in assets, highlighting the immense scale of this market.

Their long investment horizons, often spanning decades, make them ideal partners for strategies focused on sustainable value creation. This alignment of interests allows Apollo to deploy capital effectively across various asset classes, seeking to generate consistent returns that outpace inflation and meet actuarial requirements. The demand for diversified portfolios and sophisticated risk management solutions is particularly high within this segment.

Sovereign Wealth Funds (SWFs) represent a significant customer segment, characterized by their substantial capital reserves and long-term investment horizons. These government-owned entities, managing trillions globally, actively seek diversified portfolios, often including alternative assets. For instance, the Norway Government Pension Fund Global, one of the world's largest SWFs, reported assets under management exceeding $1.3 trillion as of early 2024.

Apollo's appeal to SWFs lies in its global reach and diverse investment strategies, particularly in private equity, credit, and real assets. SWFs often delegate a portion of their capital to asset managers capable of navigating complex markets and delivering consistent returns. The ability to deploy large amounts of capital efficiently makes Apollo a strategic partner for SWFs looking to diversify national wealth and achieve specific economic objectives.

Insurance companies are significant investors, deploying vast sums to meet their policyholder obligations. They actively seek stable, income-producing investments that offer solid returns relative to the risks involved. In 2024, the global insurance industry managed trillions in assets, with a growing portion allocated to alternative credit strategies that can provide yield and diversification.

These institutions manage substantial capital pools and require diversified investment portfolios that align with their long-term liability structures. Apollo's credit investment strategies are particularly attractive to insurers due to their potential to generate consistent income and manage risk effectively, often outperforming traditional fixed-income options.

High-Net-Worth Individuals and Family Offices

High-net-worth individuals and family offices are a cornerstone customer segment, actively seeking access to sophisticated alternative investment opportunities beyond traditional public markets. These clients, often managing substantial wealth, demand tailored financial strategies and highly personalized advisory services to meet their unique objectives. The global high-net-worth population reached an estimated 62.5 million individuals in 2023, with their collective wealth totaling $250.1 trillion, according to Credit Suisse’s Global Wealth Report 2023. This demographic’s increasing allocation towards alternative assets, driven by a desire for diversification and enhanced returns, underscores their importance as a key growth area.

These sophisticated investors are attracted to Apollo's ability to provide:

- Exclusive Access: Opportunities in private equity, venture capital, hedge funds, and real estate not readily available to the general public.

- Bespoke Solutions: Customized investment portfolios and financial planning designed to align with individual risk tolerance and wealth management goals.

- Expert Guidance: Dedicated relationship managers and access to specialized market insights and due diligence.

Corporations and Financial Institutions

Corporations and financial institutions form a core customer segment for Apollo, seeking sophisticated capital solutions and strategic advisory. This includes companies needing assistance with capital raising, mergers and acquisitions, or divesting assets. For instance, in 2024, Apollo advised on several significant corporate transactions, facilitating billions in capital deployment.

Financial institutions also engage Apollo for co-investment opportunities and specialized asset management services. These partnerships leverage Apollo's extensive network and expertise to enhance portfolio performance and manage complex financial instruments.

- Capital Raising: Assisting corporations in accessing debt and equity markets.

- Strategic Advisory: Providing guidance on mergers, acquisitions, and divestitures.

- Co-Investment: Partnering with financial institutions on large-scale investment opportunities.

- Asset Management: Offering specialized management services for institutional portfolios.

The customer segments for Apollo are diverse, ranging from large institutions to individual investors, each with specific needs and investment objectives.

Pension funds, endowments, and sovereign wealth funds represent significant institutional clients, drawn to Apollo's long-term investment strategies and substantial asset management capabilities. These entities, managing trillions collectively, seek stable, diversified returns to meet future obligations or national economic goals. For example, global sovereign wealth fund assets were estimated to be around $10 trillion in early 2024.

Insurance companies and corporations are also key clients, utilizing Apollo for capital solutions, strategic advisory, and asset management services. These businesses require investments that align with their liability structures and capital needs, often turning to alternative assets for yield and diversification. The global insurance market managed over $33 trillion in assets in 2023.

| Customer Segment | Key Characteristics | Approximate Market Size (Illustrative) |

|---|---|---|

| Pension Funds & Endowments | Long-term horizons, need for stable growth, large asset bases | U.S. Public Pension Funds: ~$5 trillion (end of 2023) |

| Sovereign Wealth Funds (SWFs) | Substantial capital, long-term focus, diversification needs | Global SWF Assets: ~$10 trillion (early 2024) |

| Insurance Companies | Liability matching, income generation, risk management | Global Insurance Assets: >$33 trillion (2023) |

| High-Net-Worth Individuals & Family Offices | Access to alternatives, tailored solutions, wealth preservation | Global HNW Wealth: ~$250 trillion (2023) |

| Corporations & Financial Institutions | Capital raising, M&A advisory, co-investment | Varies by transaction; significant deal flow in 2024 |

Cost Structure

Employee compensation and benefits are a major expense for Apollo, reflecting the significant investment in its highly skilled workforce. This includes competitive salaries, performance-based bonuses, and carried interest allocations for its investment professionals, as well as compensation for operations and support staff. For instance, in 2023, Apollo reported total compensation and benefits expenses of $4.2 billion, underscoring its commitment to attracting and retaining top talent in the demanding alternative investment sector.

General and Administrative (G&A) expenses are the backbone of daily operations, encompassing costs like office rent, utilities, and IT infrastructure. For instance, in 2024, many companies focused on optimizing cloud infrastructure spending, with some reporting up to a 15% reduction in IT overhead through better resource management.

These fundamental business costs also include essential professional services such as legal and accounting fees, which are crucial for compliance and financial integrity. Efficiently managing these overheads directly impacts profitability, as even small savings in these areas can significantly boost the bottom line.

Fund operating expenses are a significant component of Apollo's cost structure. These include essential services like audit fees, custodian charges, and legal and compliance costs tailored to their diverse fund structures. For instance, in 2024, many asset managers saw operating expenses rise due to increased regulatory scrutiny and the need for robust compliance frameworks, a trend Apollo would also contend with.

Third-party service providers also contribute to these costs, offering specialized support that ensures smooth and compliant fund operations. While often passed through to limited partners, these expenses are meticulously managed by Apollo as part of their overall financial strategy. The efficiency in managing these operational costs directly impacts the net returns delivered to investors.

Marketing and Investor Relations Costs

Apollo incurs significant expenses in marketing and investor relations to fuel its growth. These costs cover essential fundraising activities, participation in investor conferences, roadshows to connect with potential capital sources, and the development of compelling marketing materials.

Maintaining robust relationships with both current and prospective investors is paramount. This ongoing engagement is crucial for attracting new capital and ensuring the retention of the existing investor base, which directly supports Apollo's ability to execute its strategic initiatives.

Effective marketing and investor relations are vital for securing a continuous inflow of capital. For instance, in 2023, many alternative asset managers saw increased spending on investor outreach as they sought to capitalize on strong market demand for their strategies.

- Fundraising Activities: Expenses related to initial public offerings (IPOs), secondary offerings, and private placements.

- Investor Communications: Costs associated with producing annual reports, investor presentations, and maintaining an investor relations website.

- Conferences and Roadshows: Travel, venue, and participation fees for events where Apollo presents its business and financial performance.

- Marketing Materials: Development and distribution of brochures, fact sheets, and digital content to inform and attract investors.

Technology and Data Subscriptions

Apollo's cost structure heavily relies on significant investments in technology and data subscriptions. This includes the development and maintenance of proprietary technology platforms essential for sophisticated investment analysis and risk management. For instance, in 2024, many investment firms allocated substantial budgets towards AI-driven analytics tools to process vast datasets more efficiently.

Furthermore, access to real-time market data subscriptions is a critical operational expense. These subscriptions provide the granular information needed for informed decision-making, a necessity in today's fast-paced financial markets. Cybersecurity measures are also a paramount cost, ensuring the protection of sensitive client and proprietary data, with cybersecurity spending in the financial sector projected to increase by over 10% in 2024.

- Proprietary Technology Platforms: Investment in custom-built software for trading, analysis, and portfolio management.

- Data Analytics Tools: Acquisition and implementation of advanced analytics and AI platforms for deeper insights.

- Market Data Subscriptions: Ongoing costs for real-time feeds from providers like Bloomberg and Refinitiv.

- Cybersecurity Measures: Expenditure on security software, hardware, and expert personnel to protect assets and data.

Apollo's cost structure is heavily influenced by its compensation and benefits, representing a significant investment in its expert team. This includes salaries, bonuses, and carried interest for investment professionals, as well as operational staff. In 2023, Apollo's compensation and benefits expenses reached $4.2 billion, highlighting its commitment to attracting and retaining top talent in the alternative investment industry.

General and Administrative (G&A) expenses cover the essential costs of running daily operations, such as office space, utilities, and IT infrastructure. These also include crucial professional services like legal and accounting fees, vital for maintaining compliance and financial integrity. Optimizing these overheads directly impacts profitability.

Fund operating expenses are another substantial element, encompassing audit fees, custodian charges, and legal and compliance costs specific to their fund structures. In 2024, increased regulatory demands led many asset managers to experience rising operating expenses, a trend Apollo would also navigate.

Technology and data subscriptions form a critical part of Apollo's cost base, funding proprietary platforms for investment analysis and risk management. In 2024, many firms increased spending on AI tools for data processing, while cybersecurity investments in the financial sector were projected to grow by over 10%.

| Cost Category | Key Components | 2023/2024 Relevance |

| Employee Compensation and Benefits | Salaries, bonuses, carried interest, benefits | $4.2 billion (2023); crucial for talent retention |

| General & Administrative (G&A) | Rent, IT, legal, accounting fees | Focus on IT optimization (e.g., 15% reduction in cloud spend) |

| Fund Operating Expenses | Audit, custody, legal, compliance | Rising due to regulatory scrutiny |

| Technology & Data | Proprietary platforms, data subscriptions, cybersecurity | Increased AI investment; cybersecurity spending up >10% (2024) |

Revenue Streams

Management fees represent a core, recurring revenue stream for Apollo, calculated as a percentage of assets under management (AUM) or committed capital. This predictable income helps cover operational expenses and staff compensation, providing a stable financial foundation.

These fees are typically billed annually, irrespective of how well the funds perform, ensuring a consistent revenue inflow. For instance, in 2023, Apollo reported approximately $671 billion in AUM, from which management fees would be a significant contributor to their overall earnings.

Performance fees, often called carried interest, are a crucial revenue stream for Apollo. This income is generated when Apollo's investment funds achieve returns exceeding a specific hurdle rate, meaning they've outperformed a benchmark. Apollo then receives a share of these profits, directly aligning their success with that of their investors.

This performance-based income is inherently variable, fluctuating with market conditions and fund performance. However, when funds perform exceptionally well, carried interest can be a highly lucrative and significant driver of Apollo's overall profitability. For instance, in the first quarter of 2024, Apollo reported significant increases in fee-related earnings, partly driven by strong performance in its credit and hybrid value strategies.

Apollo generates significant revenue through transaction and advisory fees, earned from facilitating complex financial deals for its portfolio companies. These fees are typically tied to successful acquisitions, debt or equity financing arrangements, and divestitures, representing a crucial, albeit often one-off, income stream that complements its recurring management fees.

For instance, in 2024, Apollo's involvement in major transactions, such as its acquisition of a significant stake in a leading renewable energy company, would have yielded substantial advisory and arrangement fees. These fees are a direct result of their expertise in structuring and executing these large-scale financial operations, underscoring the value they bring beyond capital deployment.

Co-Investment Income

Co-investment income represents revenue generated when Apollo directly invests its own capital alongside its limited partners in various funds and specific deals. This strategy allows Apollo to share in the potential profits of its successful investments, showcasing a strong alignment of interests with its investors.

This direct participation in deals can be a significant profit driver for Apollo, as it benefits from the upside of its investment decisions. For instance, in 2023, Apollo reported that its principal investments, which include co-investments, contributed to its overall financial performance, highlighting the importance of this revenue stream.

- Direct Investment Participation: Apollo invests its own capital, sharing in the economic upside of successful deals alongside LPs.

- Alignment of Interests: Demonstrates commitment and shared risk with limited partners, fostering trust.

- Profit Contribution: Co-investment profits can significantly boost Apollo's overall earnings.

- Strategic Capital Allocation: Allows Apollo to leverage its expertise and capital for direct financial gain.

Financial Services and Solutions Fees

Apollo generates significant income by offering specialized financial services and solutions to businesses. This includes income from debt origination and structured finance, providing tailored capital solutions beyond traditional asset management.

This revenue stream diversifies Apollo's overall income, reducing reliance on asset management fees alone. For instance, in the first quarter of 2024, Apollo's spread revenue, which includes fees from origination and servicing, reached $1.2 billion, showcasing the strength of these fee-based services.

- Debt Origination Fees: Income earned from structuring and distributing debt for clients.

- Structured Finance Fees: Revenue generated from creating complex financial products tailored to specific client needs.

- Advisory Services: Fees for strategic advice related to capital raising and partnerships.

- Diversification Benefit: Reduces dependence on traditional asset management income.

Apollo's revenue streams are diverse, encompassing management fees, performance fees, transaction and advisory fees, co-investment income, and income from specialized financial services like debt origination. These various income sources contribute to Apollo's overall financial strength and stability.

In 2023, Apollo managed approximately $671 billion in assets, a significant portion of which generates recurring management fees. Furthermore, the company's strong performance in its credit and hybrid value strategies in early 2024 boosted fee-related earnings, demonstrating the impact of performance fees.

Transaction and advisory fees are generated from facilitating major deals, like Apollo's significant stake acquisition in a renewable energy company in 2024, which would have provided substantial fees. The company also benefits from co-investment income, where its principal investments contributed to financial performance in 2023.

Apollo's spread revenue, including fees from debt origination and servicing, reached $1.2 billion in the first quarter of 2024, highlighting the importance of its specialized financial services. This multifaceted approach ensures a robust and adaptable revenue model.

| Revenue Stream | Description | 2023/2024 Data Point |

|---|---|---|

| Management Fees | Percentage of AUM or committed capital | $671 billion in AUM (2023) |

| Performance Fees (Carried Interest) | Share of profits above a hurdle rate | Increased fee-related earnings (Q1 2024) |

| Transaction & Advisory Fees | Fees from facilitating financial deals | Fees from major transactions (e.g., renewable energy stake acquisition in 2024) |

| Co-investment Income | Profits from Apollo's direct capital investments | Principal investments contributed to financial performance (2023) |

| Specialized Financial Services | Debt origination, structured finance, advisory | $1.2 billion in spread revenue (Q1 2024) |

Business Model Canvas Data Sources

The Apollo Business Model Canvas is informed by a blend of market intelligence, competitive analysis, and internal operational data. These sources provide a comprehensive view of customer needs, market opportunities, and our strategic capabilities.