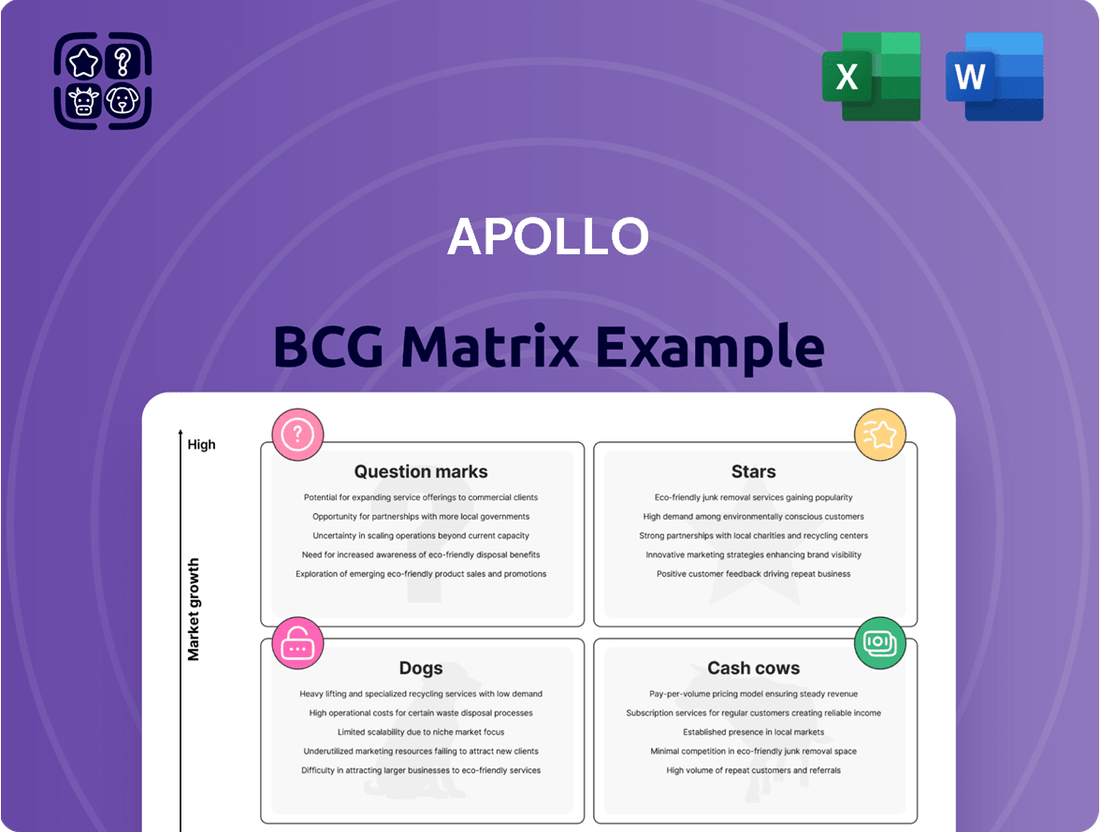

Apollo Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Apollo Bundle

The Apollo BCG Matrix categorizes products into Stars, Cash Cows, Dogs, and Question Marks, offering a powerful framework for strategic decision-making. Understand which products are driving growth and which require careful consideration. Purchase the full BCG Matrix to unlock detailed analysis, actionable insights, and a clear roadmap for optimizing your product portfolio and maximizing profitability.

Stars

Apollo's private credit origination is a powerhouse, leading in corporate lending and asset-backed finance within a booming market. Their expertise in crafting tailored financing for global companies, especially as private debt and equity demand surges, highlights this as a prime growth sector with significant market share.

Apollo's advantage is amplified by strategic partnerships with major banks, boosting liquidity and syndication capabilities in the private credit space. This collaborative approach allows them to deploy capital efficiently and meet diverse client needs. By the end of 2024, Apollo managed over $670 billion in assets under management, with private credit being a substantial and growing component of that figure.

Athene, Apollo's retirement services arm, is a powerhouse of organic growth. In 2023, the company reported significant net inflows of $40 billion, a testament to its strong market appeal. This growth is driven by increasing spread-related earnings, highlighting the profitability of its retirement savings products and institutional solutions.

Apollo is strategically targeting infrastructure, especially data centers and sustainable energy, recognizing their robust growth trajectories. This focus aligns with their ambition to deploy over $100 billion in clean energy and climate investments by 2030, signaling a significant market opportunity where they aim for a dominant position.

The immense capital needs for expanding data center capacity and related infrastructure create a fertile ground for Apollo's private credit solutions. These investments are crucial for supporting the digital economy's expansion and the global transition to cleaner energy sources.

Global Wealth Channel Expansion

Apollo is actively broadening its reach within the global wealth sector, specifically targeting individual investors interested in private market investments. This expansion is a strategic move to tap into the increasing demand for alternative assets among affluent individuals.

The company has established new offices in significant wealth management centers such as Zurich, demonstrating a commitment to being present where the affluent investors are. Furthermore, Apollo is forging partnerships with major financial institutions, including State Street Global Advisors, to enhance its distribution capabilities and offer its products to a wider audience.

This initiative is particularly focused on democratizing access to private assets, notably private investment grade credit. This segment is recognized as a high-growth area, and Apollo aims to capture a substantial portion of this expanding market by making these opportunities more accessible.

- Global Wealth Channel Expansion: Apollo is increasing its presence in key wealth hubs like Zurich to attract individual investors to private markets.

- Strategic Partnerships: Collaborations with firms such as State Street Global Advisors are crucial for expanding distribution and reaching more affluent clients.

- Focus on Private Credit: The expansion prioritizes access to private investment grade credit, a recognized high-growth area within alternative assets.

- Market Opportunity: This strategy aims to capitalize on the growing affluent investor market seeking diversification beyond traditional public markets.

Flagship Fund Launches and AUM Growth

Apollo's fundraising prowess is evident in its consistent success, with plans for its next flagship fund launch in 2025 aiming to propel Assets Under Management (AUM) towards $1.5 trillion. This strategic move underscores the firm's capacity to attract significant capital and solidify its leadership in alternative asset management.

The firm has experienced record inflows, contributing to substantial overall AUM growth. This expansion reflects a strong market share within a steadily expanding sector.

- Flagship Fund 2025 Target: Apollo aims to reach $1.5 trillion in AUM with its next flagship fund launch in 2025.

- Record Inflows: The firm has seen unprecedented capital inflows, demonstrating strong investor confidence.

- Market Position: Sustained AUM growth reinforces Apollo's leading position in the alternative asset management industry.

- Capital Deployment: This consistent capital formation is vital for fueling new investment opportunities and broadening market reach.

Stars in the Apollo BCG Matrix represent high-growth, high-market-share businesses. Apollo's infrastructure investments, particularly in data centers and sustainable energy, fit this profile due to robust demand and the firm's significant capital allocation targets. Their expansion into global wealth management also positions them to capture a growing market segment with strong potential.

Apollo's infrastructure focus is a prime example of a Star, with ambitious plans to deploy over $100 billion in clean energy and climate investments by 2030. This aligns with the high-growth nature of the sector, driven by the digital economy's needs and the energy transition. The firm's strategic targeting of this area indicates a strong market position and a clear path for continued expansion.

The firm’s private credit origination, a significant part of its business, also exhibits Star-like characteristics. With over $670 billion in AUM by the end of 2024, and private credit being a key growth driver, Apollo is well-positioned in a booming market. Their success in corporate lending and asset-backed finance, amplified by bank partnerships, showcases a high-growth, high-share segment.

| Business Segment | Growth Rate | Market Share | BCG Classification |

|---|---|---|---|

| Infrastructure (Data Centers, Sustainable Energy) | High | High | Star |

| Private Credit Origination | High | High | Star |

| Global Wealth Management Expansion | High | Growing | Potential Star |

| Athene (Retirement Services) | High (Organic Growth) | Significant | Cash Cow (with Star potential in specific products) |

What is included in the product

The Apollo BCG Matrix categorizes products by market share and growth to guide investment decisions.

Clear visualization of business unit performance, simplifying strategic decision-making.

Cash Cows

Apollo's established private equity funds are the classic cash cows. These mature vehicles have secured substantial market share, giving them a significant edge. Think of them as the reliable income generators, consistently producing strong cash flow from earlier successful investments and sales.

While these funds are in a slower growth phase, they are still delivering excellent returns. The strategy here is all about efficiency – milking these established assets for all they're worth to fund newer, more ambitious ventures within Apollo's broader portfolio.

Legacy credit portfolios, characterized by their established performance and predictable income, often function as cash cows for firms like Apollo. These portfolios, typically in mature and stable credit markets, generate consistent returns without requiring significant new capital infusions. For instance, as of late 2024, Apollo managed substantial legacy credit assets that continued to deliver reliable income, allowing for strategic capital reallocation to emerging growth areas.

Apollo's extensive real estate debt group, with a deep history of deploying significant capital into commercial real estate credit, likely manages a portfolio characterized by mature, income-producing assets. These investments, often comprising senior mortgages and mezzanine loans secured by stable properties, are designed to deliver consistent cash flows, though growth potential may be limited in a well-established market.

Athene's In-Force Annuity Business

Athene's in-force annuity business is a prime example of a Cash Cow within Apollo's broader strategic framework. This established base of annuity policies provides a consistent and predictable revenue stream, largely independent of aggressive new business acquisition efforts. The substantial pool of existing policyholders generates ongoing premiums and investment income, acting as a dependable source of capital.

This stable income generation allows Athene to operate with lower marketing and sales expenses compared to growth-oriented segments. For instance, as of the first quarter of 2024, Athene reported a significant increase in its in-force block, underscoring the sustained revenue power of these policies. This reliable cash flow is then strategically deployed to support other areas of Apollo's investment and business development initiatives, demonstrating its role as a foundational asset.

- Stable Recurring Revenue: Athene's in-force annuity policies generate consistent premiums and investment income.

- Lower Promotional Investment: The existing base requires less capital for new sales compared to growth businesses.

- Capital Generation: Provides a reliable source of funds for Apollo's wider investment strategies.

- Q1 2024 Performance: Athene's in-force block showed robust performance, highlighting its Cash Cow status.

Fee-Related Earnings from Management Fees

Apollo's management fees, particularly from its perpetual capital, form a substantial part of its fee-related earnings. These fees provide a stable and predictable revenue stream, as they are largely insulated from short-term market volatility.

This segment represents a low-growth, high-market share component within the BCG framework, contributing significantly to Apollo's overall financial resilience.

- Management Fees: Apollo generated approximately $4.7 billion in fee-related earnings in 2023, with management fees being a core driver.

- Perpetual Capital: A growing portion of these fees stems from perpetual capital vehicles, offering long-term, recurring revenue.

- Stability: These fees are largely uncorrelated with market performance, providing a consistent revenue base.

- BCG Classification: This revenue stream aligns with the characteristics of a Cash Cow – high market share in a low-growth segment.

Apollo's established private equity funds and legacy credit portfolios are prime examples of Cash Cows. These mature assets, having achieved significant market share, consistently generate strong cash flow with minimal need for new capital. Their predictable income streams are vital for funding newer, growth-oriented ventures.

Athene's in-force annuity business is another critical Cash Cow, providing stable, recurring revenue through premiums and investment income. This segment requires less promotional investment, allowing Apollo to strategically deploy these reliable funds across its broader investment landscape.

Apollo's management fees, particularly from perpetual capital, also function as Cash Cows. In 2023, Apollo generated approximately $4.7 billion in fee-related earnings, with these stable, recurring fees providing significant financial resilience, aligning perfectly with the high market share, low-growth profile of a Cash Cow.

| Asset Type | BCG Classification | Key Characteristics | 2023/2024 Data Point |

|---|---|---|---|

| Established Private Equity Funds | Cash Cow | Mature, high market share, consistent cash flow | Significant market share in mature PE segments |

| Legacy Credit Portfolios | Cash Cow | Predictable income, stable markets, low capital needs | Managed substantial legacy credit assets, delivering reliable income |

| Athene's In-force Annuity Business | Cash Cow | Stable recurring revenue, low promotional investment | Significant increase in in-force block reported Q1 2024 |

| Management Fees (Perpetual Capital) | Cash Cow | Stable, predictable revenue, insulated from volatility | Contributed to $4.7 billion in fee-related earnings (2023) |

What You’re Viewing Is Included

Apollo BCG Matrix

The Apollo BCG Matrix you're previewing is the exact, fully formatted document you'll receive upon purchase, ready for immediate strategic application. This comprehensive analysis, designed for clarity and professional use, contains no watermarks or demo content, ensuring you get a complete and actionable report. Once purchased, this same high-quality BCG Matrix will be directly accessible for your business planning needs. You can confidently use this preview as it accurately represents the final, unwatermarked file you'll download and integrate into your strategic decision-making processes.

Dogs

Underperforming legacy private equity holdings often fall into the 'dog' category of the BCG matrix. These are typically older investments in industries experiencing a downturn or those with a weak competitive position. For instance, a private equity fund holding a significant stake in a traditional brick-and-mortar retail chain that has struggled to adapt to e-commerce might find itself with such an underperforming asset.

These 'dog' assets can drain resources, requiring continued capital infusion and management oversight without yielding substantial returns. In 2024, many private equity firms are actively reviewing their portfolios for these types of holdings. Data from Preqin in early 2024 indicated that a notable percentage of older funds, particularly those raised before 2015, were still holding onto underperforming assets, impacting overall fund performance metrics.

The challenge with these legacy holdings is finding a viable exit strategy. Divesting a 'dog' might mean selling at a loss, while restructuring could involve significant operational changes and further investment, with no guarantee of success. Some firms are exploring options like secondary market sales or even winding down these specific portfolio companies if the cost of continued management outweighs any potential future gains.

Niche or outdated investment strategies, often categorized as dogs in a BCG-like framework, are those that have struggled to gain significant market share or operate within stagnant sectors. These strategies might include highly specialized funds that haven't attracted substantial assets or approaches that are no longer relevant due to technological shifts or evolving consumer preferences.

For instance, some actively managed mutual funds focused on specific, declining industries, like traditional print media or certain types of brick-and-mortar retail, could be considered dogs. In 2023, the active versus passive debate continued, with passive funds, like ETFs, attracting significantly more net inflows than actively managed funds, highlighting a trend away from many traditional, niche strategies.

Highly illiquid, non-strategic assets are the "dogs" in the Apollo BCG Matrix. These are assets that are tough to sell and don't align with Apollo's main business goals. Think of them as small, scattered investments that aren't likely to grow much or increase in value, providing very little return.

Investments Affected by Persistent Regulatory Headwinds

Investments caught in a perpetual cycle of unfavorable regulatory shifts or escalating compliance burdens can easily morph into dogs within a portfolio. These are typically found in low-growth sectors, further hampered by external pressures, leaving them with a diminished market presence and profitability.

Consider the pharmaceutical sector, where new drug approvals face increasingly stringent and lengthy regulatory processes. For instance, the average time to bring a new drug to market in the US has been steadily increasing, impacting the return on investment for many pharmaceutical companies.

- Increased Compliance Costs: Companies in highly regulated industries, such as banking and energy, often face significant expenses related to adhering to new or evolving regulations, directly impacting their bottom line.

- Stagnant Growth Due to Regulatory Barriers: Sectors with high barriers to entry, often created by complex licensing or environmental regulations, may see limited new competition and slow overall market expansion, pushing existing players towards dog status.

- Reduced Profitability: When regulatory changes necessitate costly operational adjustments or limit pricing power, the profitability of affected investments can be severely eroded, making them unattractive.

- Limited Future Potential: Investments facing persistent regulatory headwinds often have restricted avenues for future growth or innovation, as regulatory frameworks may stifle new business models or market penetration.

Small, Non-Core Businesses Acquired but Not Integrated

Small, non-core businesses acquired by Apollo that haven't been integrated well into its main operations often fall into the 'dog' category of the BCG matrix. These companies might have low market share and little growth potential, failing to meet expected synergies.

These underperforming acquisitions can become a drain on resources, essentially acting as cash traps if not managed strategically. For instance, a small tech acquisition from 2023, intended to bolster Apollo's digital capabilities, reported a mere 3% contribution to the group's overall revenue in early 2024, with integration efforts proving significantly more costly than anticipated.

- Low Market Share: These businesses typically operate in niche markets with limited competitive advantage.

- Poor Integration: Failure to align with Apollo's core platform hinders operational efficiency and synergy realization.

- Resource Drain: Continued investment without significant returns makes them a drag on overall financial performance.

- Strategic Review Needed: Such units often require divestment or a complete overhaul to avoid ongoing losses.

Dogs represent underperforming, non-strategic assets within Apollo's portfolio, characterized by low market share and limited growth prospects. These investments often require significant resources without generating substantial returns, necessitating careful strategic review for divestment or restructuring.

In 2024, Apollo, like many investment firms, actively manages its portfolio to identify and address these underperforming "dog" assets. These could be legacy private equity holdings in declining industries or smaller, non-core businesses that failed to integrate effectively, as seen with a tech acquisition in early 2024 contributing only 3% to group revenue.

The challenge lies in finding viable exit strategies for these dogs, whether through a sale at a loss or a costly restructuring. Data from Preqin in early 2024 highlighted that older funds often still held onto such underperforming assets, impacting overall fund performance.

Investments caught in unfavorable regulatory shifts or facing high compliance costs, particularly in sectors like pharmaceuticals with increasing time to market for new drugs, can also become dogs.

| Asset Type | Characteristics | 2024 Portfolio Impact | Potential Strategy |

|---|---|---|---|

| Legacy Retail Holdings | Low market share, struggling with e-commerce adaptation | Resource drain, low return on investment | Divestment, restructuring |

| Niche/Outdated Strategies | Stagnant sectors, low asset attraction | Limited growth, passive funds gaining market share | Re-evaluation, potential winding down |

| Non-Core Acquired Businesses | Poor integration, low synergy realization | Cash trap, impacting overall financial performance | Divestment, operational overhaul |

| Regulated Industry Investments | High compliance costs, stagnant growth | Reduced profitability, limited future potential | Strategic review, compliance optimization |

Question Marks

Emerging market credit strategies represent a potential BCG Matrix ‘Question Mark’ for Apollo, characterized by high growth prospects but currently low market penetration. These ventures necessitate significant capital and specialized knowledge to overcome inherent market complexities and risks. For instance, Apollo's expansion into frontier market debt, a segment with projected GDP growth rates exceeding 5% in many regions for 2024, exemplifies this.

Successfully navigating these nascent markets could see these strategies transition into ‘Stars,’ generating substantial returns for Apollo. However, failure to establish a strong presence or manage the unique risks, such as currency volatility and regulatory uncertainty prevalent in many emerging economies, could relegate them to ‘Dogs.’ The firm's strategic allocation of resources to these areas in 2024 will be a key indicator of their potential trajectory.

Early-stage sustainable investing initiatives at Apollo, while representing a high-growth sector, may currently hold a low market share. These pioneering efforts are crucial for establishing future leadership in the ESG space. For instance, as of early 2024, Apollo's commitment to sustainable finance saw significant capital allocation towards developing new platforms and technologies aimed at identifying and supporting early-stage green ventures.

These nascent ventures often require substantial upfront investment for research, development, and scaling to compete effectively. Apollo's strategy involves nurturing these early-stage opportunities, recognizing their potential to become market leaders in the rapidly expanding sustainable finance landscape. This approach is reflected in their increased venture capital funding for cleantech startups and renewable energy projects throughout 2023, aiming to build a robust pipeline for future growth.

Apollo's new technology-focused private equity ventures, while potentially high-growth, represent a strategic allocation to nascent or rapidly evolving sectors. These investments, though a smaller part of their vast portfolio, demand significant capital to foster market penetration and competitive positioning. For instance, in 2024, private equity firms globally saw a surge in technology deals, with venture capital funding in AI and cybersecurity reaching record highs, indicating Apollo's potential focus areas.

Expansion into New Geographic Regions for Asset Management

Apollo's strategic expansion into new geographic regions for asset management, such as growing its Zurich office for wealth and capital formation, positions the firm in high-growth markets. However, these regions currently represent a relatively low market share for Apollo. This necessitates significant investment in talent acquisition and cultivating robust client relationships to establish a stronger foothold.

The expansion strategy aligns with a 'Question Mark' positioning in the BCG matrix, indicating potential for high growth but also requiring substantial capital to capture market share. For instance, Apollo's commitment to building out its European presence reflects this approach.

- High-Growth Markets: Apollo is targeting regions with strong economic growth potential for its asset management services.

- Low Market Share: Despite growth potential, Apollo's current penetration in these new regions is relatively limited.

- Significant Investment Required: Building teams and client bases in these new territories demands considerable financial and operational resources.

- Strategic Importance: These expansions are crucial for diversifying Apollo's revenue streams and securing future growth opportunities.

Specialized Lending Platforms with Untapped Potential

Developing or acquiring highly specialized lending platforms, especially those focusing on niche markets or tailored financing, represents a significant question mark within the BCG matrix. These platforms hold considerable growth prospects by addressing unmet market demands, but their current limited market share necessitates substantial investment to achieve scalability.

For instance, platforms offering specialized financing for renewable energy projects or intellectual property-backed loans might fall into this category. While the global green finance market is projected to reach trillions by 2030, specific segments within it may still be nascent, requiring significant capital to build out infrastructure and client bases.

- Niche Market Focus: Platforms targeting underserved sectors like specialized equipment financing or creative industry loans.

- High Growth Potential: Driven by unique market needs and less competition from broad-based lenders.

- Investment Requirement: Significant capital needed for technology development, risk assessment expertise, and market penetration.

- Scalability Challenges: Overcoming regulatory hurdles and building brand recognition in specialized fields.

Apollo's strategic investments in emerging market credit strategies are classic 'Question Marks' on the BCG matrix. These ventures offer high growth potential, as seen in the 2024 projected GDP growth rates exceeding 5% in many frontier markets, but currently hold a low market share. Significant capital and specialized expertise are essential to navigate the inherent complexities and risks, such as currency volatility, to potentially elevate them to 'Stars'.

Apollo's early-stage sustainable investing initiatives also fit the 'Question Mark' profile. The firm is channeling substantial capital into developing new platforms and technologies for ESG, reflecting the sector's rapid expansion. For instance, venture capital funding for cleantech startups saw a notable increase in 2023, underscoring the need for significant upfront investment to scale these nascent opportunities and build future market leadership.

New technology-focused private equity ventures represent another 'Question Mark' for Apollo. While these sectors, like AI and cybersecurity, are experiencing record venture capital funding in 2024, Apollo's specific ventures in these areas may still have low market penetration. This necessitates considerable capital deployment to foster competitive positioning and market capture.

Apollo's expansion into new geographic regions for asset management, such as its growing presence in Europe, also positions it within the 'Question Mark' quadrant. These markets offer high growth potential, but Apollo's current market share is relatively limited. Substantial investment in talent and client relationship building is crucial to gain traction and secure future revenue diversification.

Specialized lending platforms, particularly those targeting niche markets like renewable energy project financing, are also considered 'Question Marks'. While the broader green finance market is projected to reach trillions by 2030, specific segments require significant capital for infrastructure development and market penetration to overcome scalability challenges and build brand recognition.

| BCG Category | Apollo Initiative | Market Growth | Market Share | Investment Need | Key Considerations |

|---|---|---|---|---|---|

| Question Mark | Emerging Market Credit Strategies | High (e.g., >5% projected GDP growth in many frontier markets for 2024) | Low | Significant Capital & Expertise | Currency volatility, regulatory uncertainty |

| Question Mark | Early-Stage Sustainable Investing | High (Rapidly expanding ESG sector) | Low | Substantial Upfront Investment | Technology development, scaling nascent ventures |

| Question Mark | New Technology Private Equity | High (e.g., Record VC funding in AI, Cybersecurity in 2024) | Low | Considerable Capital Deployment | Competitive positioning, market capture |

| Question Mark | Geographic Asset Management Expansion (e.g., Europe) | High | Limited | Talent Acquisition, Client Building | Diversification, future growth |

| Question Mark | Specialized Lending Platforms (e.g., Green Finance) | High (e.g., Trillions projected by 2030 for green finance) | Low | Significant Capital for Infrastructure | Scalability, brand recognition in niches |

BCG Matrix Data Sources

Our BCG Matrix is constructed using a blend of proprietary market research, financial performance data, and competitor analysis to provide a comprehensive view of business units.