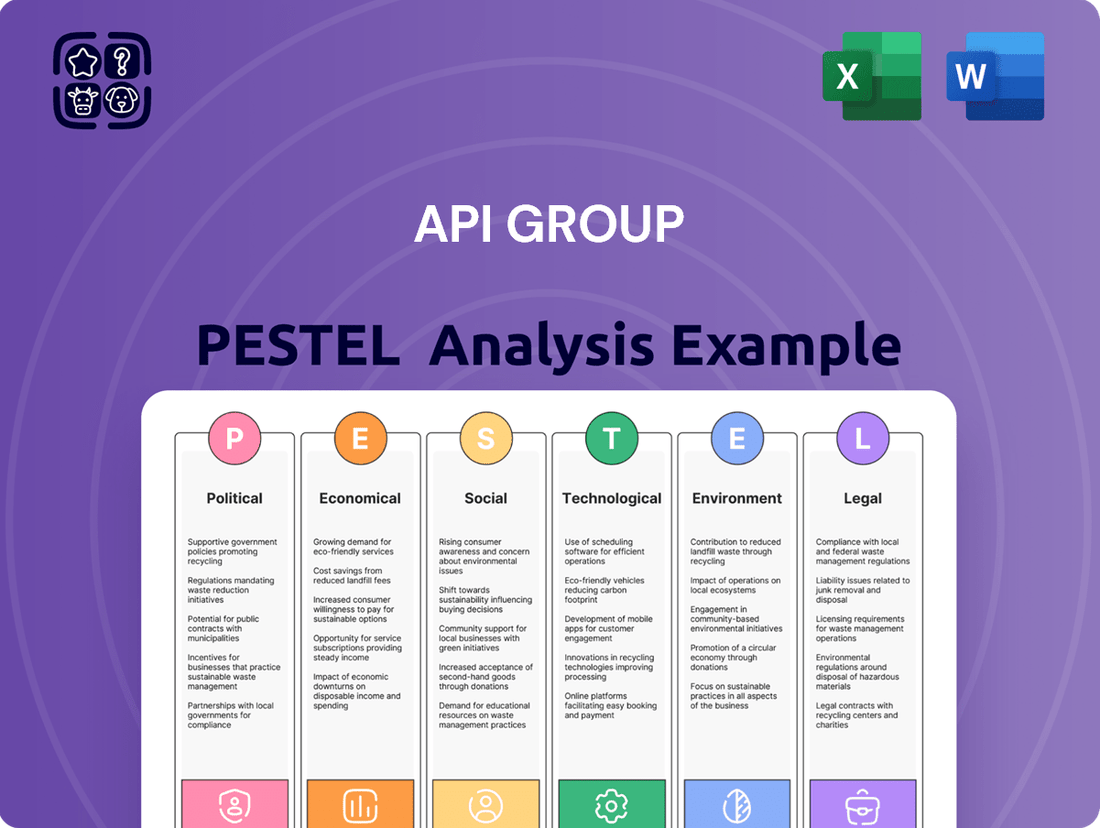

APi Group PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

APi Group Bundle

Unlock the critical external factors shaping APi Group's trajectory with our comprehensive PESTLE analysis. Understand how political stability, economic fluctuations, technological advancements, environmental regulations, and social shifts are influencing their operations and market position. Equip yourself with actionable intelligence to navigate these forces effectively. Purchase the full PESTLE analysis now for a strategic advantage.

Political factors

Government spending on infrastructure is a key driver for APi Group's Specialty Services. For instance, the United States' Infrastructure Investment and Jobs Act, enacted in 2021, allocated over $1.2 trillion, with a significant portion dedicated to roads, bridges, and public transit. This surge in public works projects directly translates to increased demand for APi Group's fabrication and industrial services.

Fluctuations in government infrastructure budgets, often influenced by political cycles and economic stimulus measures, can create volatility in demand. For example, a slowdown in federal infrastructure spending could impact project pipelines for APi Group's clients. Conversely, policy shifts prioritizing infrastructure modernization, such as investments in smart grids or renewable energy transmission, create new avenues for growth.

The regulatory landscape for safety services in North America and Europe significantly shapes APi Group's Safety Services segment. Stringent enforcement of fire protection, security, and life safety regulations directly impacts demand for their compliant solutions.

Evolving building codes and fire safety standards, often driven by political priorities and public safety concerns, require continuous adaptation from APi Group. For instance, the adoption of stricter fire sprinkler requirements in new commercial constructions across many US states in 2024-2025 creates a direct market opportunity for their fire protection systems.

Political stability is crucial for the consistent application of these safety mandates. Unforeseen political shifts or changes in government priorities could lead to fluctuations in regulatory enforcement, affecting project timelines and investment in safety infrastructure.

APi Group's reliance on international sourcing for specialized components means that trade policies and tariffs are critical. For instance, changes in tariffs between the US and China, or within the European Union, could directly affect the cost of goods and the efficiency of their supply chain operations in 2024 and 2025.

Shifting global trade relations, such as potential renegotiations of existing trade agreements or the imposition of new tariffs, could increase APi Group's operational expenses. This necessitates continuous monitoring of geopolitical developments to mitigate risks related to supply chain disruptions and material cost fluctuations.

Political Stability in Operating Regions

APi Group's operations in North America and Europe are significantly influenced by the political stability of these regions. For instance, the United States, a key market, has maintained a relatively stable political landscape, though election cycles can introduce a degree of policy uncertainty. In 2024, the upcoming US presidential election will be closely watched for its potential impact on regulatory environments and infrastructure spending, areas directly relevant to APi Group's services.

Geopolitical tensions, such as ongoing conflicts or trade disputes, can create ripple effects, impacting supply chains and client confidence. While Europe has generally seen stable governance in its major economies, localized political shifts or regional instability can still pose challenges. For example, the ongoing economic recovery and political focus on energy security in the EU, as of mid-2024, create both opportunities and potential headwinds for businesses operating within the bloc.

- North American Stability: The US and Canada offer generally stable political environments, crucial for APi Group's extensive operations and project pipelines.

- European Considerations: While major European economies are stable, localized political events or shifts in EU policy can influence business conditions.

- Impact of Uncertainty: Geopolitical tensions and significant governmental changes can disrupt service delivery and affect client investment decisions.

- Predictable Environment: A stable political climate is essential for APi Group to plan long-term investments and maintain consistent service delivery.

Government Incentives for Green Building and Safety

Government policies and incentives promoting sustainable construction practices, energy efficiency, and enhanced safety standards are a significant driver for APi Group's business. For instance, the Inflation Reduction Act of 2022 in the United States offers substantial tax credits for energy-efficient building upgrades, directly benefiting projects that APi Group's services support. This legislation is expected to accelerate investments in green building technologies and retrofits.

These incentives, including tax credits, grants, and mandates for green building certifications like LEED or BREEAM, encourage clients to invest in solutions that APi Group provides. For example, the increasing adoption of stringent building codes, such as those emphasizing fire safety and resilience, creates a greater need for specialized services and products offered by APi Group. This aligns with broader environmental and social goals, making APi Group's offerings more attractive.

- Increased Demand: Government support for green building and safety standards directly boosts demand for APi Group's specialized services and products.

- Investment Acceleration: Tax credits and grants incentivize clients to undertake projects involving energy efficiency and advanced safety systems.

- Regulatory Alignment: APi Group's solutions are well-positioned to meet evolving regulatory requirements and sustainability mandates.

Government spending on infrastructure, particularly in North America and Europe, directly fuels demand for APi Group's specialty services. The Infrastructure Investment and Jobs Act in the US, with over $1.2 trillion allocated, is a prime example of how public works projects increase the need for fabrication and industrial services. Political cycles and economic stimulus measures can influence these budgets, creating both opportunities and potential volatility for APi Group's project pipelines.

Evolving safety regulations and building codes, often driven by political priorities, are critical for APi Group's Safety Services segment. Stricter fire protection and life safety mandates, such as enhanced sprinkler requirements in new commercial constructions across US states in 2024-2025, create direct market opportunities for their compliant solutions. Political stability ensures consistent regulatory enforcement, vital for APi Group's long-term planning and investment in safety infrastructure.

Trade policies and geopolitical stability significantly impact APi Group's international sourcing and supply chain efficiency. Changes in tariffs, such as those between the US and China or within the EU, can affect material costs and operational expenses throughout 2024 and 2025. Monitoring geopolitical developments is essential to mitigate risks associated with supply chain disruptions and fluctuating material costs.

| Factor | Impact on APi Group | 2024-2025 Data/Trend |

|---|---|---|

| Infrastructure Spending | Increased demand for fabrication and industrial services. | US Infrastructure Investment and Jobs Act ($1.2T+ allocation) driving projects. |

| Safety Regulations | Demand for compliant safety solutions. | Stricter fire sprinkler requirements in US commercial construction (2024-2025). |

| Trade Policies & Geopolitics | Supply chain costs and efficiency. | Tariff fluctuations and trade agreement renegotiations impacting material costs. |

| Political Stability | Predictability of regulatory enforcement and investment. | Stable environments in US/Canada, with election cycles introducing policy uncertainty (e.g., US Presidential Election 2024). |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing APi Group, covering political, economic, social, technological, environmental, and legal dimensions.

It offers actionable insights for strategic decision-making by identifying potential threats and opportunities derived from current market trends and regulatory landscapes.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, transforming complex PESTLE insights into actionable talking points for API Group's strategic discussions.

Economic factors

The overall health of the economy, especially in North America and Europe, significantly impacts APi Group's business. Strong economic growth usually translates to more construction projects, both commercial and industrial, which directly benefits APi Group's Safety and Specialty Services. For instance, in 2024, North American construction spending was projected to reach approximately $2.0 trillion, indicating robust demand.

Conversely, economic slowdowns can curb new construction and maintenance budgets, leading to reduced demand for APi Group's offerings. A key indicator to watch is the GDP growth rate in these regions; for example, the US GDP grew at an annualized rate of 1.3% in the first quarter of 2024, a slowdown from previous periods, which could temper construction activity.

Fluctuations in interest rates directly impact APi Group's cost of capital and the investment decisions of its customers. For instance, the Federal Reserve's benchmark rate, which influences broader lending costs, saw increases throughout 2022 and 2023, reaching a target range of 5.25%-5.50% by July 2023. This environment makes borrowing more expensive for APi Group for acquisitions and expansions.

Higher borrowing costs can also translate to decreased demand for APi Group's services. When interest rates rise, potential clients, particularly those undertaking large infrastructure or industrial projects, may postpone or scale back their capital expenditures due to increased financing expenses. This could lead to a slowdown in project pipelines, affecting APi Group's revenue streams.

For APi Group, the cost of financing its operations and strategic growth initiatives, including mergers and acquisitions, is significantly tied to prevailing interest rates. For example, if APi Group were to issue new debt in a higher interest rate environment, its interest expense would rise, directly impacting its net income and potentially limiting its capacity for future investments or share buybacks.

Inflation is a significant headwind for APi Group, directly impacting the cost of essential inputs like labor, raw materials, and specialized equipment. For instance, the Producer Price Index for construction materials saw a notable increase in late 2023 and early 2024, putting pressure on APi Group's project budgets.

If APi Group cannot fully pass these escalating input costs onto its clients through pricing adjustments, its profit margins are likely to shrink. This dynamic necessitates a keen focus on operational efficiency and strategic procurement to mitigate the impact of rising expenses.

Consequently, closely tracking inflation indicators and developing robust cost management strategies are paramount for APi Group to safeguard its financial health and maintain competitive pricing in the market.

Currency Exchange Rate Volatility

Currency exchange rate volatility presents a significant consideration for APi Group, given its substantial operations in both North America, primarily using the US Dollar (USD), and Europe, where the Euro (EUR) is prevalent. Fluctuations between these currencies directly impact the reported value of earnings generated abroad. For instance, a strengthening USD relative to the EUR can diminish the reported USD value of APi Group's European profits.

Managing this foreign exchange risk is crucial for maintaining financial stability and predictable earnings. APi Group's financial reporting, particularly in its 2024 and projected 2025 results, will reflect the impact of these currency movements. As of late 2024, the EUR/USD exchange rate has seen notable shifts, with the dollar experiencing periods of strength, which would translate to lower reported earnings from European segments if not adequately hedged.

- Impact on Revenue: A stronger USD can reduce the reported USD value of sales made in EUR. For example, if APi Group generated €1 billion in Europe and the average EUR/USD rate was 1.10, that would translate to $1.1 billion. If the rate weakened to 1.05, the same €1 billion would only report as $1.05 billion, a $50 million reduction.

- Profitability Concerns: Beyond revenue, the cost of goods sold and operating expenses incurred in EUR also translate back to USD. A stronger dollar can make these costs appear lower in USD terms, but the net effect on profitability depends on the balance of revenues and expenses in each currency.

- Hedging Strategies: APi Group likely employs hedging strategies, such as forward contracts or options, to mitigate the impact of adverse currency movements. The effectiveness of these strategies in 2024 and 2025 will be a key factor in managing financial performance.

- Geographic Revenue Mix: The proportion of APi Group's total revenue derived from Europe versus North America will determine the overall sensitivity to EUR/USD exchange rate changes. A higher percentage of European revenue means greater exposure to currency volatility.

Customer Spending and Investment Cycles

APi Group's performance is intrinsically linked to the spending patterns and investment cycles of its broad customer base, spanning critical sectors like manufacturing, healthcare, and commercial real estate. These industries exhibit unique investment rhythms that directly impact the demand for APi's essential fire protection, security, and industrial services.

For instance, the manufacturing sector's capital expenditure cycles, often influenced by global supply chain dynamics and technological adoption, can lead to fluctuations in demand for industrial safety equipment and services. Similarly, healthcare infrastructure spending, a consistent driver, saw significant investment in 2024 as facilities upgraded to meet evolving patient care standards and technological integration, benefiting APi's specialized offerings.

The commercial real estate market's investment cycles, influenced by interest rates and occupancy rates, also play a crucial role. A strong commercial real estate outlook, with increased new construction and renovation projects, typically translates to higher demand for building systems and safety installations. In 2024, while interest rate hikes presented some headwinds, robust demand in certain segments like logistics and data centers continued to support construction activity, indirectly bolstering APi's market.

- Manufacturing Investment: Global manufacturing PMI figures in late 2024 and early 2025 are expected to show moderate growth, indicating continued, albeit cautious, capital expenditure on new equipment and facility upgrades.

- Healthcare Spending: Healthcare construction spending in the US was projected to grow by approximately 4-5% in 2024, reflecting ongoing investments in hospital expansions and modernization.

- Commercial Real Estate Trends: Despite higher borrowing costs, the US commercial real estate market saw continued activity in sectors like industrial and multifamily housing through 2024, driving demand for integrated safety and security solutions.

- Industrial Services Demand: Demand for industrial maintenance and upgrade services often correlates with asset age and utilization rates, with a growing emphasis on efficiency and compliance in 2024-2025.

Economic growth directly fuels APi Group's revenue through increased construction and maintenance spending, particularly in North America and Europe. However, economic slowdowns and rising interest rates, such as the Federal Reserve's 5.25%-5.50% target range, increase borrowing costs and can dampen customer investment in projects. Inflation also poses a challenge by raising input costs for labor and materials, potentially squeezing profit margins if not passed on to clients.

| Economic Factor | 2024/2025 Data Point | Impact on APi Group |

|---|---|---|

| North American Construction Spending (Projected) | ~$2.0 trillion (2024) | Drives demand for APi's services. |

| US GDP Growth Rate | 1.3% annualized (Q1 2024) | Slowdown may temper construction activity. |

| Federal Reserve Interest Rate Target | 5.25%-5.50% (as of July 2023) | Increases APi's cost of capital and customer financing costs. |

| Inflation (Construction Materials PPI) | Notable increase late 2023/early 2024 | Pressures APi's project budgets and profit margins. |

| EUR/USD Exchange Rate | Periods of USD strength (late 2024) | Reduces reported USD value of European earnings. |

What You See Is What You Get

APi Group PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive PESTLE analysis of the API Group covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company's operations and strategy. It provides a detailed overview of the external forces shaping the API Group's business landscape.

Sociological factors

Societies today are increasingly prioritizing safety and security across all environments, from workplaces to public venues. This heightened awareness directly fuels demand for companies like APi Group, which specialize in essential safety services.

For instance, the global fire protection systems market was valued at approximately $60 billion in 2023 and is projected to reach over $90 billion by 2028, indicating a strong and growing need for APi Group's core offerings. This trend is amplified by regulatory bodies and public discourse that emphasize proactive risk mitigation.

Businesses and institutions are responding by investing more in sophisticated fire suppression, alarm systems, and comprehensive life safety solutions. This sustained focus on enhancing occupant well-being and asset protection creates a robust and expanding market for APi Group's specialized expertise and services.

North America and Europe are experiencing significant demographic shifts, with population growth and increasing urbanization driving demand for construction and infrastructure. For instance, by 2050, the UN projects that 68% of the world's population will live in urban areas, a substantial increase from today. This trend directly translates to a greater need for new buildings, roads, and utilities, areas where APi Group's specialized services are crucial.

The expansion of urban centers, often referred to as urban sprawl, creates a continuous need for new construction projects. This includes everything from residential complexes to commercial spaces and essential public facilities. APi Group's expertise in fire protection and life safety solutions is therefore highly relevant as these urban areas grow and develop.

Furthermore, the aging infrastructure in many developed nations presents ongoing opportunities for APi Group. As existing buildings and infrastructure systems reach the end of their lifespan, they require substantial maintenance, upgrades, and replacements. This creates a steady demand for the specialized services APi Group provides in retrofitting and modernizing these critical assets.

Societal expectations for worker safety are intensifying, pushing industries to adopt higher occupational health standards. This trend directly benefits APi Group, as demand grows for their specialized services in creating and maintaining secure industrial settings, especially as workplace accident prevention becomes a paramount concern.

In 2024, the U.S. Bureau of Labor Statistics reported a total of 2.8 million nonfatal workplace injuries and illnesses. This figure underscores the ongoing need for robust safety solutions, a core offering of APi Group.

Labor availability and the persistent skill gap present a significant challenge for many sectors, including those APi Group serves. This dynamic can impact project timelines and the cost of specialized labor, influencing service delivery and potentially increasing the value of APi Group's integrated solutions that address these shortages.

Sustainability and ESG Consciousness

Growing societal concern for environmental, social, and governance (ESG) factors is significantly influencing client decisions and investment strategies. For instance, a 2024 survey indicated that 65% of investors consider ESG performance when making investment choices. This trend directly impacts companies like APi Group, as customers increasingly seek partners demonstrating robust ESG commitments, including sustainable practices in construction and operations.

APi Group's capacity to deliver environmentally friendly solutions and operate with a strong sense of corporate responsibility directly addresses this evolving societal expectation. The company's focus on safety, community engagement, and responsible resource management positions it favorably. For example, in 2023, APi Group reported a 15% reduction in its carbon intensity compared to 2022, showcasing tangible progress in its sustainability efforts.

- Client Preference: A significant majority of clients now prioritize suppliers with verifiable ESG credentials.

- Investment Flows: ESG-focused funds saw substantial inflows in 2024, reaching over $2 trillion globally.

- Operational Alignment: APi Group's commitment to sustainable building materials and energy-efficient operations resonates with market demands.

- Reputational Advantage: Strong ESG performance enhances brand image and attracts top talent, crucial for long-term success.

Public Health and Emergency Preparedness

Societal responses to public health crises and natural disasters, like the ongoing focus on pandemic preparedness and climate change resilience, highlight the critical need for robust emergency systems. This increased awareness directly benefits APi Group by potentially driving demand for their life safety solutions, emergency response technologies, and infrastructure hardening services. For instance, the global market for emergency management is projected to reach $216.7 billion by 2028, indicating a significant growth trajectory fueled by these societal concerns.

Collective societal learning from events such as the COVID-19 pandemic or major weather events often translates into increased investment in protective measures and resilient infrastructure. This translates to a greater emphasis on building codes, public safety investments, and the adoption of advanced fire detection and suppression systems, all areas where APi Group holds strong market positions.

- Increased Demand: Societal emphasis on safety following crises boosts demand for APi Group's life safety and emergency response products.

- Infrastructure Investment: Events like the 2023 US wildfire season, which caused billions in damages, spur investment in resilient infrastructure and protective systems.

- Regulatory Tailwinds: Public health and disaster preparedness initiatives often lead to stricter regulations, benefiting companies offering compliant solutions.

- Market Growth: The global fire protection systems market was valued at $77.9 billion in 2023 and is expected to grow, reflecting this societal focus.

Societal focus on health and well-being continues to rise, driving demand for secure and healthy environments. This trend benefits APi Group as clients increasingly invest in life safety and health-focused building solutions.

The global market for healthy buildings was projected to reach $125 billion by 2025, indicating a strong consumer and corporate push for safer, more sustainable spaces. APi Group's services in fire protection and environmental systems align directly with these evolving societal priorities.

Furthermore, changing attitudes towards work-life balance and remote work influence commercial real estate needs, potentially increasing demand for upgraded safety and comfort features in office spaces and mixed-use developments.

Societal expectations for corporate responsibility and ethical business practices are paramount. APi Group's commitment to safety, community, and sustainable operations directly addresses these concerns, enhancing its brand reputation and client appeal.

| Sociological Factor | Description | Impact on APi Group | Relevant Data (2024/2025) |

| Safety & Security Focus | Heightened societal emphasis on personal and environmental safety. | Increased demand for APi Group's life safety and protection services. | Global fire protection market projected to exceed $90 billion by 2028. |

| Demographic Shifts | Urbanization and population growth in developed regions. | Drives demand for new construction and infrastructure upgrades, where APi Group's services are essential. | UN projects 68% global urban population by 2050. |

| Worker Safety Standards | Growing expectations for occupational health and accident prevention. | Boosts demand for APi Group's industrial safety and secure environment solutions. | US nonfatal workplace injuries reported at 2.8 million in 2024. |

| ESG Consciousness | Increased investor and consumer consideration of environmental, social, and governance factors. | Favors APi Group's sustainable practices and responsible operations. | 65% of investors consider ESG performance in 2024 investment decisions. |

Technological factors

Technological advancements are continuously reshaping the fire protection and security landscape, directly benefiting APi Group's Safety Services division. Innovations like IoT-enabled sensors for early fire detection and AI-powered surveillance systems are becoming standard, allowing APi to offer more sophisticated and integrated solutions. These technologies not only improve system responsiveness but also provide clients with enhanced data analytics for better risk management, a key differentiator in the market.

The integration of these cutting-edge technologies, such as smart building management systems that link fire suppression and security, directly boosts APi Group's competitive advantage. For instance, the global market for smart fire and smoke detectors was projected to reach approximately $2.5 billion in 2024, with significant growth expected in the coming years. By adopting and expertly deploying these solutions, APi Group can deliver more efficient, reliable, and comprehensive safety services, meeting the evolving demands of its clientele.

APi Group is experiencing a significant shift in service delivery due to digital transformation. The adoption of digital tools for project management, remote monitoring, and data analytics is reshaping operations across all its segments. For instance, in 2024, the construction industry saw a notable increase in the use of digital project management software, with reports indicating over 70% of firms utilizing cloud-based platforms for collaboration and tracking.

Technologies like Building Information Modeling (BIM) and digital twins are becoming increasingly vital. These tools enhance operational efficiency by providing detailed 3D models and real-time data, leading to cost reductions through optimized resource allocation and fewer errors. APi Group's segments, such as those in fire protection and specialty contracting, can leverage BIM for improved project execution and digital twins for proactive asset management, ultimately boosting client satisfaction.

The increasing adoption of automation and robotics within industrial services presents a significant opportunity for APi Group's Specialty Services segment. Technologies like robotic welding and automated inspection are becoming more prevalent, promising enhanced safety and efficiency.

For instance, the global industrial robotics market was valued at approximately $50 billion in 2023 and is projected to grow substantially by 2030, indicating a strong trend towards automation. APi Group should actively assess how to integrate these advancements, such as drone-based surveys for inspections, into their existing service portfolio to maintain a competitive edge.

Emerging Materials and Construction Techniques

Innovations in construction materials and techniques significantly impact APi Group's service offerings. For instance, the increasing adoption of advanced composites and smart materials in building projects can alter the requirements for installation and maintenance, potentially creating new service opportunities. The global construction materials market was valued at approximately $1.1 trillion in 2023 and is projected to grow, indicating a dynamic environment for APi Group to navigate.

Emerging construction techniques like modular and prefabricated building methods, along with advancements in 3D printing for construction, are reshaping project delivery timelines and on-site labor needs. APi Group's ability to adapt its installation, maintenance, and fabrication processes to these evolving methods is crucial for maintaining its competitive edge. The modular construction market alone is expected to reach over $200 billion by 2027, highlighting a substantial shift in construction practices.

Staying ahead of these technological advancements allows APi Group to proactively adjust its operational strategies and service portfolio. This adaptability ensures they can effectively integrate new materials and construction approaches into their business model, thereby remaining a relevant and valuable partner in the construction industry.

- Advanced Composites: Lighter, stronger, and more durable than traditional materials, potentially reducing installation complexity and lifecycle maintenance costs.

- Smart Materials: Materials with built-in sensors or responsive capabilities that could require specialized integration and maintenance services.

- Modular Construction: Pre-fabrication of building components off-site, leading to faster on-site assembly and potentially different labor and logistical demands for APi Group.

- 3D Printing in Construction: Enabling rapid creation of complex structures, which may necessitate new approaches to integrating building systems and services.

Data Analytics and Predictive Maintenance

APi Group's adoption of data analytics and machine learning is pivotal for enhancing its service offerings. By analyzing operational data, the company can predict equipment failures before they occur, enabling proactive maintenance. This shift from reactive to proactive service significantly reduces client downtime and boosts the efficiency of APi Group's field service teams.

The implementation of these technologies allows APi Group to develop more sophisticated service contracts. For instance, predictive maintenance can be bundled into service agreements, offering clients greater reliability and cost predictability. This data-driven approach not only improves customer satisfaction but also creates new revenue streams through value-added services.

APi Group's field operations stand to gain considerably from these advancements. Optimized scheduling and resource allocation, driven by predictive analytics, can lead to substantial cost savings. Furthermore, real-time data insights empower technicians to address issues more effectively, improving first-time fix rates and overall operational performance.

- Predictive Maintenance Savings: Studies suggest that predictive maintenance can reduce maintenance costs by 10-40% and prevent up to 75% of equipment failures.

- Service Contract Enhancements: APi Group can leverage data to offer tiered service contracts based on predictive insights, potentially increasing service revenue by 5-15%.

- Operational Efficiency Gains: Improved scheduling and reduced travel time for field technicians, facilitated by data analytics, could boost overall field service efficiency by 10-20% in the coming years.

Technological advancements are crucial for APi Group's competitive edge, particularly in fire protection and security. Innovations like IoT sensors and AI surveillance are enhancing APi's ability to offer integrated, sophisticated solutions. The global smart fire and smoke detector market was projected around $2.5 billion in 2024, underscoring the demand for these advanced technologies.

Digital transformation is reshaping APi's service delivery, with tools like BIM and digital twins improving project efficiency and asset management. The construction industry's embrace of cloud-based project management software, used by over 70% of firms in 2024, highlights this trend. These digital tools reduce errors and optimize resource allocation, directly benefiting APi's operations.

Automation and robotics are creating new opportunities, especially for APi's Specialty Services segment. The industrial robotics market, valued at approximately $50 billion in 2023, is set for substantial growth. Integrating technologies like drone inspections can significantly enhance APi's service offerings and maintain its market leadership.

APi Group's adoption of data analytics and machine learning is key to its service evolution. Predictive maintenance, which can reduce maintenance costs by 10-40%, allows for proactive client support. This data-driven approach not only boosts customer satisfaction but also opens new revenue streams through enhanced service contracts.

Legal factors

APi Group's Safety Services segment must strictly adhere to evolving building codes, fire safety standards, and life safety regulations. These legally mandated requirements, which differ across North America and Europe, govern everything from design to installation and ongoing maintenance.

Failure to comply with these regulations can lead to substantial penalties, damage to APi Group's reputation, and significant legal liabilities. For instance, in 2023, the construction industry faced increased scrutiny following several high-profile incidents, prompting regulatory bodies to review and potentially tighten existing safety standards, impacting project timelines and costs.

Environmental regulations significantly shape APi Group's operational landscape, particularly within its industrial and fabrication services. Laws governing waste disposal, emissions control, hazardous material handling, and energy efficiency directly influence project execution and cost structures. For instance, stringent waste management protocols can increase operational expenses, while mandates for energy-efficient processes might necessitate capital investment in new technologies.

Compliance with key environmental legislation, such as the Clean Air Act and Clean Water Act in the United States, and various European environmental directives, is paramount. Failure to adhere to these regulations can result in substantial fines and reputational damage, impacting APi Group's ability to secure contracts and maintain its social license to operate. In 2024, the global focus on sustainability continues to intensify, with increasing scrutiny on industrial emissions and resource management.

APi Group, operating globally, navigates a complex web of labor laws. In the US, the Fair Labor Standards Act (FLSA) dictates minimum wage and overtime, which APi Group must adhere to across its diverse operations. For instance, as of January 1, 2025, many states will see updated minimum wage rates, requiring constant HR vigilance.

Compliance with varying health and safety regulations, such as OSHA standards in the United States and similar directives in Europe, is paramount. APi Group's commitment to workplace safety directly impacts its operational efficiency and legal standing, with workplace injuries costing the US economy billions annually.

The right to unionize and collective bargaining significantly influences employment relations. APi Group's approach to labor relations, whether unionized or non-unionized, must align with national labor relations acts, such as the National Labor Relations Act (NLRA) in the US, ensuring fair practices and mitigating potential disputes.

Contract Law and Business Agreements

APi Group's operations are fundamentally built on a robust framework of contracts. These agreements govern relationships with clients, ensuring clear deliverables and payment terms, and with suppliers, securing necessary materials and services. For instance, in 2024, APi Group reported significant revenue streams derived from long-term service agreements and project-specific contracts across its various segments, highlighting the critical nature of these legal instruments.

Compliance with contract law is paramount for mitigating commercial risks. This includes meticulous attention to terms of service, which define the scope of work and customer expectations, as well as liability clauses that allocate responsibility in case of unforeseen issues. Dispute resolution mechanisms embedded within these contracts are also vital for efficiently addressing any disagreements and protecting APi Group's financial and reputational interests.

The company's ability to effectively draft, negotiate, and manage these contracts directly impacts its profitability and operational stability. In 2024, APi Group continued to invest in legal and contractual expertise to ensure all agreements are legally sound and strategically advantageous. This focus is crucial for navigating the complexities of the construction and industrial services sectors, where contract disputes can lead to significant financial and operational disruptions.

- Contractual Reliance: APi Group's business model is heavily dependent on contracts with clients, suppliers, and subcontractors for revenue generation and operational execution.

- Risk Management: Understanding and adhering to contract law, including liability and dispute resolution clauses, is essential for managing commercial risks and safeguarding the company's interests.

- Legal Expertise: The company's success is partly attributed to its investment in legal professionals skilled in drafting and negotiating agreements to protect its position.

Data Privacy and Cybersecurity Regulations

APi Group must navigate a complex web of data privacy and cybersecurity regulations. In 2024, the global regulatory landscape continued to evolve, with increased scrutiny on how companies handle personal data. For instance, the enforcement of GDPR in Europe and the growing number of comprehensive state-level privacy laws in North America, like California's CCPA/CPRA, necessitate stringent compliance measures.

Failure to adhere to these laws can result in significant financial penalties and reputational damage. Cybersecurity incidents are not just technical issues; they are legal liabilities. APi Group's commitment to protecting sensitive client and operational data is therefore paramount to maintaining legal standing and trust.

- GDPR Fines: Non-compliance can lead to fines of up to 4% of annual global turnover or €20 million, whichever is higher.

- North American Privacy Laws: As of late 2024, over a dozen US states have enacted comprehensive data privacy legislation, creating a patchwork of compliance requirements.

- Cybersecurity Breaches: The average cost of a data breach globally reached $4.45 million in 2024, underscoring the financial impact of inadequate security.

APi Group's operations are intrinsically linked to intellectual property laws, particularly concerning its proprietary technologies and service methodologies. Protecting patents, trademarks, and copyrights is crucial for maintaining competitive advantage and preventing unauthorized use of its innovations.

In 2024, the company continued to invest in securing and defending its intellectual property portfolio. This includes vigilance against infringement, which can lead to costly litigation and loss of market share. For instance, the rise of AI-driven design tools in the construction sector necessitates clear IP protection strategies to safeguard unique engineering solutions.

The legal framework surrounding mergers and acquisitions is also a significant factor for APi Group. Compliance with antitrust laws and regulatory approvals is vital for successful integration of acquired businesses, ensuring fair competition and preventing monopolistic practices.

Environmental factors

Climate change is increasingly leading to more frequent and severe weather events. This trend directly impacts infrastructure and building safety, which in turn boosts the demand for APi Group's expertise in both repair and making structures more resilient. For instance, in 2024, the global cost of natural disasters reached hundreds of billions of dollars, highlighting the growing need for robust safety and preparedness solutions.

As a result, clients are actively seeking enhanced fire protection, storm hardening, and emergency response systems. This creates significant growth opportunities for APi Group's specialized safety and specialty services, as they can offer solutions to mitigate these climate-related risks.

The increasing global focus on sustainability and energy efficiency is significantly shaping client demand in construction and industrial sectors. APi Group is well-positioned to capitalize on this shift by providing solutions that help clients reduce their environmental impact, such as advanced energy-efficient fire suppression systems. This trend directly supports corporate Environmental, Social, and Governance (ESG) objectives, a growing priority for many businesses.

APi Group faces potential impacts from the scarcity or rising costs of key raw materials essential for its products, such as metals and specialized chemicals. Environmental regulations and global supply chain vulnerabilities, highlighted by events in 2023 and early 2024, can directly affect profitability by increasing input expenses.

To mitigate these risks, APi Group's focus on responsible sourcing and the exploration of alternative, more sustainable materials is crucial. For instance, the growing demand for recycled metals in construction, a key sector for APi, presents both challenges in consistent supply and opportunities for cost-effective, environmentally friendly sourcing.

Waste Management and Pollution Control

Environmental regulations are a major consideration for APi Group, especially concerning their industrial and fabrication activities. These rules cover everything from how waste is handled to how pollution is managed. For instance, in 2024, the U.S. Environmental Protection Agency (EPA) continued to emphasize stricter enforcement of air and water quality standards, impacting industrial processes nationwide.

APi Group must meticulously follow regulations for construction waste, industrial wastewater, and air emissions. Failing to do so can lead to significant fines and damage their public image. For example, non-compliance with the Clean Water Act can result in penalties reaching tens of thousands of dollars per day per violation. By 2025, it's anticipated that reporting requirements for hazardous waste will also become more stringent.

Investing in greener technologies and sustainable practices can set APi Group apart from competitors. This proactive approach not only ensures compliance but also can lead to operational efficiencies and cost savings. Companies demonstrating strong environmental stewardship, such as those investing in advanced emission control systems, often find it easier to secure contracts with environmentally conscious clients.

- Stricter EPA Enforcement: Expect continued and potentially increased scrutiny on industrial emissions and waste disposal throughout 2024-2025.

- Financial Penalties: Non-compliance with environmental laws can lead to substantial fines, impacting profitability. For instance, violations of the Clean Air Act can incur civil penalties of up to $48,434 per day per violation as of 2024.

- Reputational Risk: Environmental incidents can severely damage APi Group's brand and client trust.

- Opportunity in Sustainability: Investments in eco-friendly processes, like advanced wastewater treatment or waste reduction programs, can offer a competitive advantage.

Carbon Footprint and Emissions Reduction

APi Group faces increasing pressure from regulators, investors, and clients to actively reduce its carbon footprint and greenhouse gas emissions. This environmental scrutiny directly influences operational strategies and the development of its product and service offerings.

The company can gain a significant competitive edge by developing and promoting solutions that assist clients in meeting their emissions reduction goals. Examples include optimizing building energy consumption and enhancing the efficiency of industrial processes, aligning APi Group with broader global environmental objectives.

- Regulatory Compliance: APi Group must adhere to evolving environmental regulations, such as those related to Scope 1, 2, and 3 emissions, which are becoming more stringent globally.

- Investor Demand: A growing number of investors, particularly those focused on ESG (Environmental, Social, and Governance) criteria, are scrutinizing companies for their emissions data and reduction strategies. For instance, in 2024, many large institutional investors are increasing their allocation to companies with demonstrable sustainability commitments.

- Client Expectations: Many of APi Group's clients, especially in sectors like construction and manufacturing, are setting their own ambitious sustainability targets, requiring their supply chain partners to demonstrate similar commitments.

- Market Opportunity: The demand for energy-efficient building technologies and industrial process optimization solutions is projected to grow significantly. For example, the global green building market was valued at over $1 trillion in 2023 and is expected to continue its upward trajectory through 2025 and beyond, presenting a substantial opportunity for APi Group's relevant services.

APi Group's operations are increasingly influenced by environmental concerns, particularly climate change and the drive for sustainability. More frequent extreme weather events, with global disaster costs in the hundreds of billions in 2024, create demand for APi's resilience and repair services. Simultaneously, clients are prioritizing energy efficiency and reduced environmental impact, aligning with APi's offerings in areas like advanced fire suppression systems.

The company must navigate stricter environmental regulations, with agencies like the EPA continuing robust enforcement in 2024, imposing significant penalties for non-compliance. This necessitates careful management of waste, emissions, and pollution, with potential fines for violations of acts like the Clean Water Act. Furthermore, pressure from investors and clients to reduce carbon footprints is growing, with a substantial market opportunity in green building technologies, a sector valued over $1 trillion in 2023.

| Environmental Factor | Impact on APi Group | Data/Trend (2024-2025) |

|---|---|---|

| Climate Change & Extreme Weather | Increased demand for resilience and repair services | Global natural disaster costs in hundreds of billions (2024) |

| Sustainability & Energy Efficiency | Opportunity for eco-friendly solutions, ESG alignment | Green building market > $1 trillion (2023), growing through 2025 |

| Environmental Regulations & Enforcement | Compliance costs, risk of fines, reputational damage | Stricter EPA enforcement; Clean Air Act penalties up to $48,434/day/violation (2024) |

| Carbon Footprint Reduction Pressure | Need for emissions reduction strategies, investor/client demand | Growing investor allocation to sustainable companies (2024) |

PESTLE Analysis Data Sources

Our API Group PESTLE Analysis is meticulously constructed using data from reputable sources, including government regulatory bodies, international economic organizations, and leading technology research firms. This ensures that our insights into political, economic, social, technological, legal, and environmental factors are both comprehensive and current.