APi Group Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

APi Group Bundle

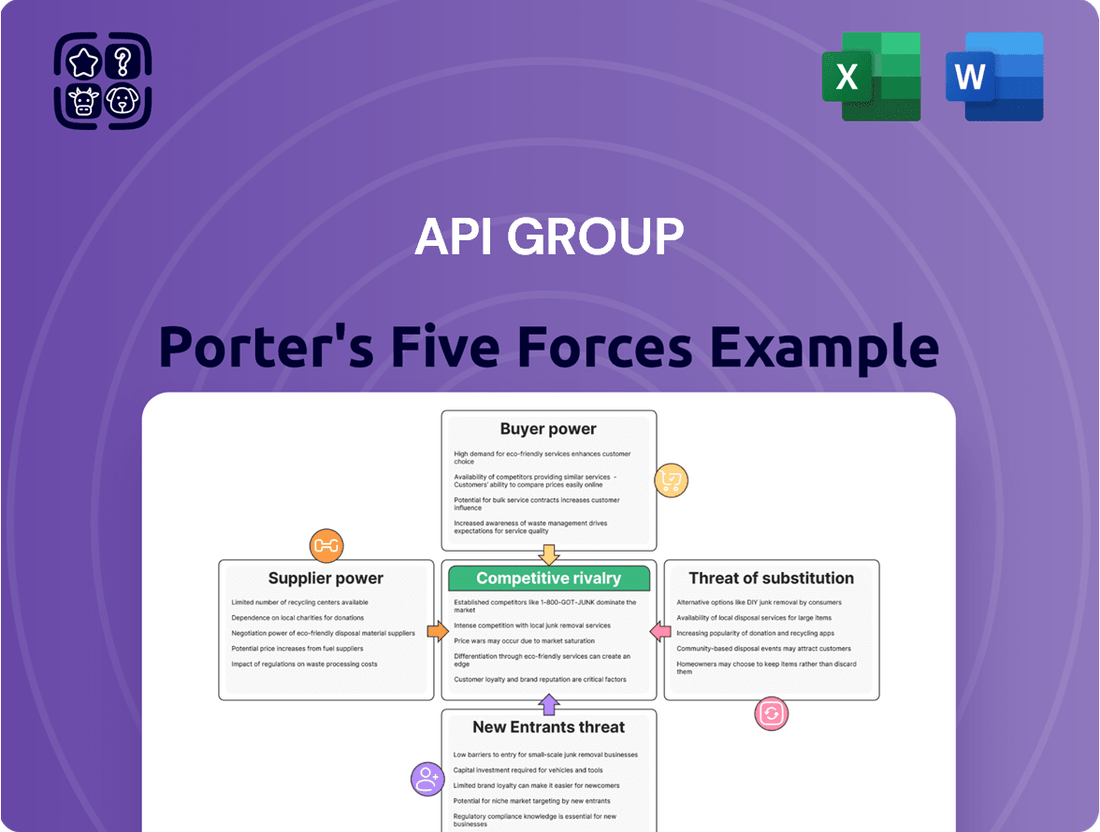

APi Group operates within a dynamic landscape shaped by intense rivalry, significant buyer power, and the constant threat of substitutes. Understanding these forces is crucial for navigating its competitive environment. The full analysis reveals the strength and intensity of each market force affecting APi Group, complete with visuals and summaries for fast, clear interpretation.

Suppliers Bargaining Power

APi Group's broad operational scope, spanning various service sectors, naturally leads to a wide array of suppliers for everything from essential components to specialized labor. This inherent diversity means APi Group isn't overly reliant on any one supplier or a small, exclusive group of them. For instance, in 2024, APi Group's procurement likely involved thousands of distinct vendors across its various business units, from HVAC services to fire protection systems.

This wide supplier base significantly dilutes the bargaining power of individual suppliers. When a company like APi Group can easily source materials or services from multiple providers, it reduces the leverage any single supplier holds. This is crucial for maintaining cost control and operational flexibility, as suppliers are less likely to dictate terms when faced with the prospect of losing APi Group's business to a competitor.

While APi Group might face moderate costs when switching suppliers for common materials and standard equipment, these are typically manageable. These costs often involve the effort of vetting new vendors and adjusting logistical arrangements, which are standard business processes.

APi Group's substantial operational scale and established procurement expertise across its many locations likely grant it significant leverage in negotiating with suppliers. This scale allows them to command better terms and potentially absorb minor switching costs more readily than smaller competitors.

Suppliers of highly specialized fire protection, security, and industrial equipment, along with advanced technologies, can wield significant bargaining power. This stems from the unique nature of their products and the specialized expertise needed to develop and maintain them. For instance, a supplier of a proprietary fire suppression system with unique chemical compounds might have considerable leverage.

APi Group's strategic approach to customer and project selection plays a crucial role in managing this supplier power. By focusing on profitable engagements and carefully vetting opportunities, APi Group can potentially reduce its reliance on any single specialized supplier or negotiate more favorable terms, thereby mitigating some of the inherent supplier leverage.

Impact of Raw Material Price Fluctuations

Suppliers of essential raw materials, particularly for APi Group's fabrication and infrastructure segments, hold significant bargaining power. This power is amplified during times of economic inflation or when supply chains face disruptions, allowing them to implement price hikes. For instance, steel prices, a key input for many construction projects, saw considerable volatility in 2024, impacting project costs across the industry.

APi Group's capacity to mitigate this supplier leverage hinges on its ability to pass these increased costs onto its diverse customer base or to capitalize on its substantial procurement volume. By leveraging economies of scale, APi Group can negotiate more favorable terms, thereby absorbing some of the impact of rising material expenses. This strategic approach is vital for maintaining profit margins in a fluctuating cost environment.

- Supplier Power: Raw material suppliers can increase prices, especially during inflationary periods or supply chain issues.

- APi Group's Response: The company's ability to pass on costs or use its scale in purchasing is key to managing this power.

- Market Context: Volatility in commodity prices, such as steel in 2024, directly influences the bargaining power of suppliers in the infrastructure sector.

Low Threat of Forward Integration by Suppliers

The threat of suppliers integrating forward into APi Group's business is minimal. APi Group's operations are highly service-intensive, encompassing installation, maintenance, and monitoring across a wide array of client locations. This complexity requires specialized infrastructure, established customer relationships, and deep regulatory knowledge, which suppliers typically do not possess.

Suppliers generally focus on providing components or materials, not the intricate, on-site service delivery that defines APi Group's value proposition. For instance, a supplier of fire suppression systems might provide the equipment, but they lack the trained technicians, logistical networks, and client-specific installation protocols that APi Group manages.

- Low Integration Risk: Suppliers typically lack the extensive service infrastructure and customer relationships necessary to replicate APi Group's core offerings.

- Service Complexity: APi Group's business model relies on specialized installation, maintenance, and monitoring, which are difficult for suppliers to duplicate.

- Regulatory Expertise: Navigating diverse regulatory environments for safety and compliance is a significant barrier for potential supplier integration.

- Focus on Core Competencies: Suppliers are generally focused on manufacturing and material provision, not on the direct provision of complex, site-specific services.

APi Group's diverse supplier base generally limits the bargaining power of individual suppliers. However, suppliers of specialized equipment, like advanced fire suppression systems, and providers of essential raw materials, such as steel, can exert significant influence, particularly during inflationary periods or supply chain disruptions. For example, steel prices experienced notable volatility in 2024, impacting project costs for APi Group's infrastructure segments.

| Supplier Type | Bargaining Power Factors | APi Group's Mitigation Strategies |

|---|---|---|

| Raw Material Suppliers (e.g., Steel) | Price volatility, supply chain disruptions, inflation | Leveraging purchasing scale, passing costs to customers |

| Specialized Equipment Suppliers (e.g., Fire Suppression) | Proprietary technology, unique expertise, high R&D costs | Strategic customer selection, negotiating favorable terms |

| General Component Suppliers | Low differentiation, high competition | Diversified sourcing, efficient vendor management |

What is included in the product

This analysis dissects the competitive forces impacting APi Group, revealing the intensity of rivalry, buyer and supplier power, threat of new entrants, and the impact of substitutes on its market position.

Effortlessly identify and quantify competitive pressures to proactively mitigate threats and capitalize on opportunities.

Customers Bargaining Power

APi Group's diverse customer base, spanning numerous industries across North America and Europe, significantly dilutes the bargaining power of any single customer. This broad market reach means no one client holds substantial sway over APi Group's pricing or terms.

The company's revenue structure further reinforces this. In 2023, for instance, no single customer represented more than 5% of APi Group's total net revenues. This low customer concentration inherently limits the leverage any individual client can exert, as their business is not critical enough to dictate terms.

For statutorily mandated services like fire protection and life safety, customers face significant switching costs. These costs stem from regulatory requirements, the deep integration of existing systems, and the long-term nature of inspection, service, and monitoring contracts. This makes it difficult and expensive for customers to change providers.

This dynamic creates a 'sticky business' model for APi Group, significantly enhancing customer retention. In fact, APi Group has reported customer retention rates exceeding 90% on its service side, a testament to the high switching costs and the value customers derive from their integrated, compliant solutions.

APi Group benefits from a recurring revenue model, primarily driven by inspection, service, and monitoring contracts. This stability inherently limits the bargaining power of customers, as many are tied into long-term agreements for essential safety and operational systems. For instance, in 2023, APi Group reported that approximately 70% of its revenue was recurring, demonstrating the significant impact of these service contracts on its customer relationships.

Price Sensitivity Varies by Service Type

Customer price sensitivity for APi Group’s services isn't uniform; it shifts based on the nature of the service. For instance, essential safety services, often mandated by regulations, typically see lower price sensitivity because reliability and compliance are non-negotiable. This contrasts with more discretionary specialty or industrial projects where customers might be more attuned to pricing variations.

APi Group actively manages this by employing disciplined customer and project selection strategies. Their focus on services where value outweighs price sensitivity, coupled with continuous pricing improvements, allows them to maintain profitability even when market conditions fluctuate. This approach ensures they are not solely competing on price for all their offerings.

- Essential Safety Services: Lower price sensitivity due to compliance and reliability needs.

- Specialty/Industrial Projects: Higher price sensitivity on discretionary elements.

- APi Group's Strategy: Disciplined selection and pricing improvements to manage profitability.

Low Threat of Backward Integration by Customers

Customers of API Group face a low threat of backward integration. Undertaking complex safety, specialty, and industrial services requires substantial capital, specialized knowledge, and regulatory compliance. For instance, establishing the necessary infrastructure for hazardous material handling or advanced industrial cleaning demands millions in investment and years of operational experience, making it economically unfeasible for most customers to replicate API Group's capabilities.

This high barrier to entry significantly curtails customers' ability to produce these services in-house. Consequently, their bargaining power is diminished as they remain reliant on specialized providers like API Group.

- High Capital Expenditure: Setting up operations for specialized industrial cleaning or safety services can cost millions, deterring customer integration.

- Specialized Expertise & Licensing: Acquiring the necessary technical skills and obtaining industry-specific licenses is a lengthy and costly process.

- Operational Infrastructure: Building the required facilities, equipment, and logistical networks is a significant undertaking.

- Reduced Customer Bargaining Power: The inability to integrate backward leaves customers dependent on API Group's specialized offerings, limiting their negotiation leverage.

APi Group's diverse customer base, with no single customer exceeding 5% of revenue in 2023, significantly limits individual customer bargaining power. The company's strong customer retention, often above 90% for services, highlights the difficulty customers face in switching due to high costs associated with regulatory compliance and integrated systems.

The recurring revenue model, making up approximately 70% of APi Group's income in 2023, further anchors customer relationships, especially for essential safety services where price sensitivity is lower. Customers are unlikely to integrate backward into APi Group's specialized services due to the immense capital, expertise, and regulatory hurdles involved.

| Factor | Impact on Customer Bargaining Power | Supporting Data/Reasoning |

|---|---|---|

| Customer Concentration | Low | No single customer > 5% of revenue (2023). |

| Switching Costs | Low for Customers | High for regulatory compliance, system integration, and long-term contracts. |

| Customer Retention | High | Service retention rates > 90%. |

| Recurring Revenue | Low for Customers | ~70% of revenue is recurring (2023), indicating long-term commitments. |

| Backward Integration Threat | Very Low | Requires substantial capital, specialized knowledge, and regulatory compliance. |

Full Version Awaits

APi Group Porter's Five Forces Analysis

This preview showcases the complete APi Group Porter's Five Forces Analysis, offering a detailed examination of competitive forces within the industry. You are viewing the exact document you will receive immediately after purchase, ensuring no discrepancies or missing sections. This professionally formatted report provides actionable insights for strategic decision-making.

Rivalry Among Competitors

APi Group operates in fragmented markets like fire protection and specialty services, but a significant consolidation trend is underway. This presents an opportunity for larger players to gain scale and efficiency.

APi Group is actively participating in this consolidation, leveraging its position as a major entity to make bolt-on acquisitions. These strategic moves aim to bolster its market share and extend its operational footprint across various geographies.

For instance, APi Group's acquisition strategy in 2024 has focused on integrating smaller, specialized companies, thereby increasing its competitive standing against a multitude of smaller rivals. This approach is typical in industries undergoing such consolidation phases.

APi Group stands out by offering a wide array of specialized safety, specialty, and industrial services, a key factor in its competitive rivalry. The company emphasizes high customer retention within its service segments, indicating a strong hold on its client base.

Their 'inspection first' approach is designed to foster enduring customer relationships, moving away from purely project-based engagements. This strategy is crucial in a market where building loyalty can mitigate intense competition.

APi Group's competitive rivalry is shaped by its robust recurring revenue streams from essential services like inspections, maintenance, and monitoring. This consistent income base provides stability and reduces reliance on one-off project wins, making the company less susceptible to intense price competition on individual contracts.

Furthermore, APi Group's accelerating backlog, which reached $2.8 billion as of Q1 2024, significantly influences rivalry. This substantial backlog indicates strong customer commitment and sustained demand for APi's offerings, allowing the company to maintain pricing power and focus on execution rather than constantly battling for new, often lower-margin, work.

Geographic and Segment Diversification

APi Group's geographic and segment diversification plays a crucial role in its competitive landscape. Operating across North America and Europe, and within distinct Safety Services and Specialty Services segments, the company effectively spreads its competitive risks.

This diversification allows APi Group to capitalize on strengths in one region or segment to counterbalance weaknesses elsewhere. For instance, the strong performance in its Safety Services division in early 2025 helped to offset some of the more challenging conditions experienced in its Specialty Services segment during the same period. This strategic approach enhances resilience against localized economic downturns or sector-specific pressures.

- Geographic Reach: Operates in North America and Europe, reducing reliance on any single market.

- Segment Strength: Diversified into Safety Services and Specialty Services, allowing for cross-segment support.

- Resilience: Robust growth in Safety Services in early 2025 demonstrated the ability to mitigate sector-specific challenges.

Focus on Margin Expansion and Value Capture

APi Group's emphasis on margin expansion, driven by careful customer and project selection, alongside pricing enhancements, points to a marketplace where profitability is paramount. This approach is crucial in a competitive arena where operational excellence and strategic pricing are key differentiators.

The company's focus on value capture, including from recent acquisitions, further highlights the intense rivalry. For instance, APi Group's 2023 revenue reached $6.7 billion, with a stated commitment to improving profitability through strategic integration and operational efficiencies.

- Disciplined Selection: APi Group aims to improve margins by being more selective about the projects and customers they engage with, prioritizing those that offer better profitability.

- Pricing Power: The company is actively working on improving its pricing strategies to better reflect the value it delivers, a necessary step in competitive markets.

- Acquisition Integration: Successfully capturing value from acquisitions, such as the recent additions to its portfolio, is vital for enhancing overall financial performance amidst competition.

- Mature Market Dynamics: The strategic focus suggests APi Group operates in a mature industry where cost management and effective value proposition are critical for sustained success and outperforming rivals.

APi Group faces intense rivalry due to its fragmented market presence, yet its strategic consolidation and focus on recurring revenue from essential services like inspections provide a competitive edge. The company's substantial backlog, reaching $2.8 billion in Q1 2024, demonstrates strong customer commitment and allows for better pricing power against numerous smaller competitors.

| Metric | Value (Q1 2024) | Significance |

|---|---|---|

| Backlog | $2.8 billion | Indicates strong demand and customer commitment, supporting pricing power. |

| 2023 Revenue | $6.7 billion | Demonstrates scale and market presence amidst competitive pressures. |

| Geographic Footprint | North America & Europe | Diversification mitigates risks and broadens competitive opportunities. |

SSubstitutes Threaten

For essential safety services, particularly those legally required such as fire protection and life safety, direct substitutes are extremely scarce. Regulations often dictate specific standards and systems, making it challenging for alternative solutions to fully supplant APi Group's offerings.

Customers might consider handling safety and specialty services internally, but the significant upfront investment in specialized equipment and training, coupled with the ongoing need for expert personnel, often makes this approach prohibitively expensive and less efficient than outsourcing. For instance, the cost of a single sophisticated fire suppression system installation can run into hundreds of thousands of dollars, a burden many businesses prefer to avoid.

Emerging technologies, such as advanced automation or digital monitoring systems, can act as indirect substitutes by offering alternative solutions to traditional safety and industrial process management. For instance, AI-powered predictive maintenance could reduce the reliance on some of the physical inspection and repair services APi Group provides.

While these technological shifts present a potential threat, APi Group's strategy often involves integrating these advancements into their existing service portfolio. This proactive adaptation means that rather than being entirely replaced, new technologies can enhance APi Group's offerings, thereby mitigating the direct impact of substitution.

Performance and Reliability as Key Differentiators

The threat of substitutes for APi Group's offerings is relatively low, primarily because performance and reliability are non-negotiable for their clients. Industries like construction, energy, and manufacturing depend heavily on safety and uninterrupted operations, making substitutes that fall short on these critical aspects highly undesirable.

For a substitute to gain traction, it would need to match or exceed APi Group's proven effectiveness, which is a significant hurdle. This is especially true considering APi Group's extensive industry certifications, deep technical expertise, and established track record with long-term customers.

For instance, in the fire protection sector, a critical area for APi Group, any substitute system must meet stringent regulatory standards and demonstrate robust performance in real-world emergencies. Failure in this domain can lead to catastrophic consequences, including loss of life and significant property damage. APi Group's 2023 revenue reached approximately $4.7 billion, reflecting the trust and reliance customers place on their established solutions.

- High Switching Costs: Customers often face substantial costs and operational disruptions when switching from established safety and operational continuity providers.

- Regulatory Compliance: Many of APi Group's services are tied to strict industry regulations, making it difficult for untested substitutes to meet compliance requirements.

- Brand Reputation and Trust: APi Group benefits from a strong reputation built over years of reliable service, a factor that new entrants struggle to replicate quickly.

- Technical Expertise: The specialized nature of APi Group's offerings requires significant technical knowledge and experience, which substitutes may lack.

Regulatory Landscape as a Barrier to Substitution

The complex and ever-changing regulatory environment in fire safety and other vital services presents a substantial hurdle for potential substitutes. Meeting stringent codes and standards demands specialized expertise and a history of successful execution, qualities typically found in established firms like APi Group.

For instance, in the United States, the National Fire Protection Association (NFPA) codes are widely adopted, requiring specific knowledge for compliance. APi Group's extensive experience in navigating these regulations, including NFPA 72 for fire alarm systems, makes it difficult for less experienced or specialized providers to offer comparable solutions.

- Regulatory Compliance: APi Group's deep understanding of evolving fire safety regulations, such as NFPA standards, acts as a significant barrier to entry for substitute providers.

- Industry Expertise: The need for specialized knowledge in areas like fire suppression systems and life safety technology favors established players with proven track records.

- High Switching Costs: For clients, the cost and complexity associated with switching to a new, unproven provider for critical safety systems can be prohibitive.

- Market Trust: APi Group's established reputation and long-standing relationships built on reliable compliance in a high-stakes industry deter the adoption of less credible alternatives.

The threat of substitutes for APi Group's services is generally low, largely due to the critical nature of safety and the high switching costs involved. Clients prioritize reliability and regulatory compliance, making it difficult for alternative solutions to gain traction without a proven track record.

While some technological advancements, like AI-driven monitoring, could offer indirect substitution, APi Group often integrates these into their offerings. This strategy allows them to maintain their competitive edge rather than being displaced.

The significant investment required for clients to bring specialized safety services in-house, coupled with the expertise needed to navigate complex regulations like NFPA standards, further solidifies APi Group's position.

APi Group's 2023 revenue of approximately $4.7 billion underscores the market's confidence in their established, compliant, and highly reliable solutions, which are difficult for substitutes to replicate.

Entrants Threaten

Entering the diversified business services market, especially in areas like fire protection and large-scale industrial services, demands substantial capital. Potential new players need to invest heavily in specialized equipment, advanced technology, and establishing a broad operational network. For instance, a fire protection service might need millions in specialized vehicles, suppression systems, and certified technicians, creating a significant hurdle.

The Safety Services segment, a key area for APi Group, faces significant barriers due to demanding regulatory requirements and the need for numerous certifications and licenses. For instance, in the United States, companies providing fire protection systems must comply with standards set by organizations like the National Fire Protection Association (NFPA) and obtain licenses from state and local authorities, a process that can take years and substantial investment.

New entrants must dedicate considerable time and financial resources to navigate this intricate compliance landscape. This includes understanding and adhering to varying state and local building codes, safety regulations, and obtaining specialized certifications for installers and technicians, effectively deterring smaller or less capitalized competitors from entering the market.

The need for specialized expertise and skilled labor presents a significant barrier to entry for new companies looking to compete with APi Group. APi Group's core services, such as the design, installation, and maintenance of complex life safety systems and specialty construction, require a deep understanding of engineering principles and hands-on technical proficiency. New entrants would face considerable hurdles in attracting and training a workforce with this level of specialized knowledge, a process that can take years and substantial investment.

Established Customer Relationships and Brand Reputation

APi Group leverages deeply entrenched customer relationships and a robust brand reputation, forged through years of reliable service. This makes it challenging for new entrants to gain immediate traction.

New competitors face significant hurdles in replicating the trust and loyalty APi Group commands, particularly in sectors demanding high reliability and ongoing service provision. For instance, in the fire protection sector, where APi Group has a strong presence, long-term contracts and safety compliance are paramount, creating substantial switching costs for customers.

The difficulty for newcomers to establish credibility and secure critical, recurring business is a significant barrier to entry.

Key factors contributing to this threat include:

- Long-standing customer loyalty: Many APi Group clients have multi-year service agreements, reducing immediate opportunities for new players.

- Brand equity and trust: APi Group's established name signifies quality and dependability, which new entrants must painstakingly build.

- Switching costs: For critical services like life safety systems, the cost and complexity of switching providers are often prohibitive.

- Reputation for consistent service: APi Group's track record of dependable delivery makes it the preferred choice, leaving little room for unproven competitors.

Economies of Scale and Acquisition Strategy

APi Group's formidable presence, built on over 500 locations, creates significant economies of scale. This extensive network allows for bulk purchasing and efficient distribution, driving down costs in a way that new, smaller competitors struggle to match. Their ongoing acquisition strategy further solidifies this advantage by integrating new capabilities and expanding market reach, making it challenging for nascent firms to enter and compete effectively on price or service scope.

The company's commitment to growth through mergers and acquisitions is evident, with a consistently robust M&A pipeline. This proactive approach to expansion means APi Group is continually enhancing its competitive positioning, absorbing potential rivals or complementary businesses, thereby raising the barrier to entry for any emerging players.

- Economies of Scale: APi Group's vast operational footprint, encompassing over 500 locations, enables substantial cost advantages through bulk procurement and optimized logistics.

- Acquisition Strategy: A continuous and active acquisition strategy allows APi Group to rapidly integrate new technologies, services, and market access, creating a formidable barrier for new entrants.

- Competitive Disadvantage for New Entrants: The scale and integrated capabilities achieved through acquisitions make it difficult for smaller, newer companies to compete on price, breadth of service, or operational efficiency.

- Robust M&A Pipeline: APi Group's ongoing focus on mergers and acquisitions indicates a sustained effort to strengthen its market position and further deter new competition.

The threat of new entrants for APi Group is generally low due to significant capital requirements for specialized equipment and advanced technology, particularly in sectors like fire protection. Regulatory hurdles, including numerous certifications and licenses in areas like safety services, further deter new players. For instance, compliance with NFPA standards in the US requires substantial investment and time.

APi Group's established customer loyalty, strong brand reputation, and high switching costs for critical services create a formidable barrier. New entrants struggle to build the necessary trust and secure recurring business in sectors demanding high reliability. The company's extensive network of over 500 locations also provides significant economies of scale, making it difficult for smaller, newer companies to compete on price or service scope.

APi Group's proactive acquisition strategy continually strengthens its market position, absorbing potential competitors and integrating new capabilities. This M&A activity, coupled with the need for specialized expertise and skilled labor, presents a substantial challenge for newcomers. The company's consistent growth through acquisitions means it is always enhancing its competitive edge, effectively raising the entry barrier.

| Factor | Impact on APi Group | Barrier Level |

|---|---|---|

| Capital Requirements | High for specialized equipment and technology | High |

| Regulatory Compliance | Extensive certifications and licenses required | High |

| Customer Loyalty & Switching Costs | Deeply entrenched relationships, high costs for critical services | High |

| Economies of Scale | Leveraged through over 500 locations and bulk purchasing | High |

| Acquisition Strategy | Continuous integration of new capabilities and market access | High |

| Specialized Expertise | Need for deep engineering and technical proficiency | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for API groups is built upon a foundation of diverse data sources. This includes publicly available financial filings from API providers, industry-specific market research reports, and analyses from reputable technology consulting firms.