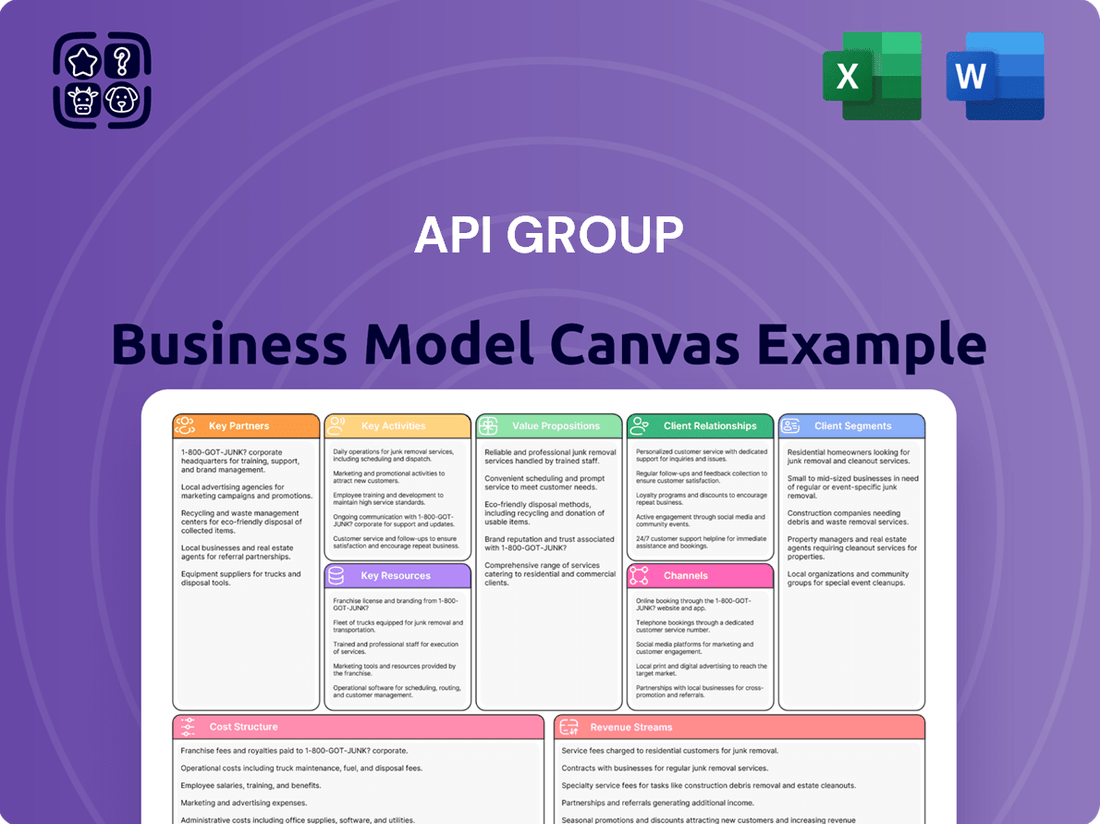

APi Group Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

APi Group Bundle

Unlock the strategic blueprint behind APi Group's success with our comprehensive Business Model Canvas. This detailed analysis reveals how they effectively serve diverse customer segments and cultivate strong key partnerships to deliver unique value propositions.

Dive deeper into APi Group’s operational engine; our full Business Model Canvas breaks down their key activities, resources, and revenue streams, offering a clear picture of their competitive advantage. Ready to gain actionable insights for your own venture?

Partnerships

APi Group leverages strategic acquisitions as a core component of its growth strategy. In 2024 alone, the company successfully integrated 13 new businesses, with a pronounced emphasis on bolstering its Safety Services division. This aggressive acquisition pace, including the notable addition of Endeavor Fire Protection in November 2024 and various elevator service companies throughout the year, directly fuels revenue expansion and enhances its existing service portfolio.

APi Group's strategic alliances with technology and innovation providers are vital for staying ahead. These collaborations focus on integrating cutting-edge solutions, such as the Internet of Things (IoT) and big data analytics, into their fire detection and life safety systems. For instance, by partnering with IoT platforms, APi can offer more intelligent, connected systems that provide real-time data and alerts.

These partnerships are instrumental in developing advanced digital solutions, including predictive analytics for infrastructure health monitoring. This allows APi to move beyond reactive maintenance to proactive intervention, significantly improving operational efficiency and reducing downtime for clients. Such advancements also pave the way for new service offerings and revenue streams in the growing smart building and infrastructure management sectors.

APi Group cultivates robust relationships with suppliers and manufacturers to guarantee the consistent availability of superior equipment and materials. This is crucial for their extensive operations in fire protection, security, and industrial services, ensuring project timelines are met and service quality remains high.

These strategic alliances are vital for maintaining APi Group's operational efficiency. For instance, in 2023, APi Group reported revenues of $6.7 billion, underscoring the scale of their operations and the importance of a dependable supply chain to support this volume.

Furthermore, these partnerships offer opportunities for cost optimization. Through bulk purchasing agreements and preferred supplier status, APi Group can achieve greater cost efficiencies, directly impacting their profitability and competitive pricing strategies.

Subcontractors and Specialized Service Providers

APi Group leverages a robust network of subcontractors and specialized service providers to enhance its operational flexibility and project execution capabilities. This strategic approach is particularly crucial for large-scale projects or when specific technical expertise beyond their core offerings is required. For instance, in their Safety Services segment, they might engage specialized fire suppression system installers or hazardous material remediation experts. These partnerships enable APi Group to scale their workforce and technical resources efficiently, ensuring they can meet diverse client demands without the overhead of maintaining every specialized skill set in-house.

These collaborations are vital for managing the complexity inherent in many of APi Group's projects, particularly within the Specialty Services segment, which can involve intricate installations or unique environmental considerations. By outsourcing these specialized tasks, APi Group can maintain a lean core team while accessing a broad spectrum of niche expertise. This strategy directly contributes to their ability to undertake a wider range of projects and deliver high-quality results across various demanding sectors. For 2024, APi Group's strategic sourcing of specialized services is expected to be a key driver in managing project costs and timelines effectively.

- Access to Niche Expertise: Partners with specialized firms for tasks like advanced welding, specific environmental testing, or unique safety equipment installation.

- Scalability and Flexibility: Ability to rapidly scale project teams and capabilities up or down based on demand, particularly for large or geographically dispersed projects.

- Cost Efficiency: Avoids significant capital investment in specialized equipment or training by utilizing external service providers, optimizing project margins.

- Risk Mitigation: Transfers certain project-specific risks, such as specialized labor shortages or regulatory compliance for niche services, to expert partners.

Industry Associations and Regulatory Bodies

APi Group actively engages with industry associations and regulatory bodies to stay ahead of evolving safety standards and compliance mandates. This collaboration is crucial for ensuring their offerings, especially in critical areas like fire protection and life safety, meet all legal and industry requirements. For instance, in 2024, APi Group's commitment to compliance was underscored by their participation in numerous industry forums discussing updates to building codes and safety certifications, directly impacting their service delivery and operational strategies.

These partnerships are instrumental in maintaining APi Group's reputation for excellence and adherence to best practices. By contributing to the development of industry standards and understanding regulatory shifts, APi Group can proactively adapt its business model. This ensures they not only meet but often exceed the expectations for statutorily mandated services, a key differentiator in their market. Their involvement in shaping these standards directly influences the safety and reliability of the solutions they provide to clients.

- Industry Standards Alignment: APi Group's engagement ensures their services align with current and upcoming safety standards, particularly vital for fire protection and life safety systems.

- Regulatory Compliance Assurance: Partnerships with regulatory bodies guarantee adherence to all legal mandates, minimizing risk and maintaining operational integrity.

- Proactive Strategy Development: Staying informed through these relationships allows APi Group to anticipate changes and adapt their business model for continued success.

- Reputation and Best Practices: Active participation reinforces APi Group's image as a leader committed to the highest industry best practices and client safety.

APi Group's Key Partnerships are diverse, ranging from strategic acquisitions to collaborations with technology providers and a robust network of suppliers. These alliances are critical for growth, innovation, and operational efficiency. For instance, in 2024, the company integrated 13 new businesses, significantly boosting its Safety Services division. These partnerships ensure access to specialized expertise, scalability, and cost efficiencies, directly supporting APi Group's extensive operations and project execution across various sectors.

| Partnership Type | Key Benefits | 2024/2023 Data/Examples |

|---|---|---|

| Acquisitions | Revenue expansion, enhanced service portfolio, market share growth | 13 new businesses integrated in 2024; focus on Safety Services |

| Technology & Innovation Providers | Integration of IoT, big data analytics; development of predictive analytics | Partnerships for intelligent, connected life safety systems |

| Suppliers & Manufacturers | Consistent availability of quality equipment, cost optimization | Supports $6.7 billion in 2023 revenue; bulk purchasing agreements |

| Subcontractors & Specialized Providers | Operational flexibility, access to niche expertise, scalability | Engaging experts for advanced welding, environmental testing, etc. |

| Industry Associations & Regulatory Bodies | Ensuring compliance, staying ahead of safety standards, reputation building | Active participation in forums discussing building codes and safety certifications in 2024 |

What is included in the product

A detailed, visually structured representation of API Group's business, outlining key customer segments, value propositions, and channels to market.

This canvas captures API Group's core operations, revenue streams, and cost structure, providing a holistic view for strategic planning and stakeholder communication.

The API Group Business Model Canvas acts as a pain point reliever by providing a structured, visual framework that simplifies complex business strategies.

This one-page snapshot allows teams to quickly pinpoint and address inefficiencies or gaps in their operational model.

Activities

A core activity for APi Group is the comprehensive management of fire protection and life safety systems. This encompasses the entire lifecycle, from initial design and installation to ongoing inspection, servicing, and monitoring. This holistic approach ensures systems function optimally and comply with regulations.

The Safety Services segment heavily relies on a recurring revenue stream generated from mandated inspections, essential servicing, and continuous monitoring of these critical safety systems. This predictable income is a cornerstone of their business model.

Evidence of the success of this key activity is seen in the consistent double-digit growth in inspection services across North America. This trend underscores the vital nature of these services and APi Group's strong market position.

APi Group's specialty and industrial services are a cornerstone of their business model, encompassing vital areas like infrastructure, fabrication, industrial maintenance, and HVAC systems. This segment is characterized by its project-based nature, serving a wide array of clients across numerous sectors.

The company has demonstrated a robust recovery in this segment, with 2025 marking a return to organic growth. This positive trend is underpinned by a substantial backlog exceeding $4 billion, indicating strong demand for their specialized offerings and a healthy pipeline of future work.

APi Group's strategic acquisitions are a cornerstone of their business model, driving inorganic growth and market expansion. In 2024 alone, they successfully integrated 13 new businesses into their portfolio.

Continuing this aggressive M&A approach, APi Group had already completed seven acquisitions by mid-2025, notably including expansion into elevator service sectors. This consistent activity is key to their strategy of complementing existing services and achieving ambitious long-term financial goals.

Operational Efficiency and Margin Expansion

APi Group actively pursues operational efficiencies through careful customer and project selection, alongside strategic pricing adjustments. These initiatives are designed to bolster value capture and drive margin expansion.

- Disciplined Customer and Project Selection: Focusing on profitable engagements to maximize resource allocation.

- Pricing Improvements and Value Capture: Implementing strategies to ensure fair pricing and capture the full value of services.

- Targeted Margin Expansion: Aiming for adjusted EBITDA margins of 13% or higher by the close of 2025.

- Strategic Pruning and Technology Investment: Divesting from low-margin clients and investing in technology to enhance productivity.

Talent Development and Leadership Building

APi Group's commitment to developing its 29,000 team members is a cornerstone of its strategy. This focus on 'Building Great Leaders' cultivates an empowered, entrepreneurial culture essential for delivering innovative solutions and driving performance.

This dedication to talent development directly fuels operational excellence and enhances customer satisfaction across the organization. It's not just about management; it's about fostering a mindset that permeates every level.

- Talent Development: APi Group actively invests in programs designed to nurture leadership skills at all levels, recognizing that a strong leadership pipeline is critical for sustained growth.

- Entrepreneurial Culture: The company fosters an environment where employees are encouraged to take initiative and ownership, mirroring entrepreneurial spirit to drive innovation.

- Operational Excellence: By developing capable leaders, APi Group ensures its operations are efficient and effective, leading to better service delivery and client outcomes.

- Customer Satisfaction: Empowered leaders and a culture of innovation translate directly into improved customer experiences and higher satisfaction rates.

APi Group's key activities revolve around providing essential fire protection and life safety services, alongside specialized industrial solutions. These services are underpinned by a strategic approach to operational efficiency and a strong emphasis on talent development.

The company actively pursues growth through disciplined acquisitions, integrating new businesses to expand its service offerings and market reach. Pricing strategies and customer selection are meticulously managed to enhance value capture and drive margin expansion.

A significant aspect of their business model involves nurturing a culture of leadership and entrepreneurship among their extensive workforce, aiming for operational excellence and superior customer satisfaction.

| Key Activity | Description | Supporting Data/Metrics |

|---|---|---|

| Fire Protection & Life Safety Services | Design, installation, inspection, servicing, and monitoring of safety systems. | Double-digit growth in inspection services (North America). |

| Specialty & Industrial Services | Infrastructure, fabrication, industrial maintenance, HVAC. | Backlog exceeding $4 billion (as of mid-2025). |

| Strategic Acquisitions | Inorganic growth and market expansion through M&A. | 13 businesses integrated in 2024; 7 completed by mid-2025. |

| Operational Efficiency | Disciplined customer/project selection, pricing improvements. | Targeting adjusted EBITDA margins of 13%+ by end of 2025. |

| Talent Development | 'Building Great Leaders', fostering entrepreneurial culture. | 29,000 team members; focus on leadership pipeline. |

Full Version Awaits

Business Model Canvas

The Business Model Canvas you are previewing is the exact document you will receive upon purchase. This is not a generic sample, but a direct representation of the comprehensive tool that will be delivered to you, ready for immediate use and customization. You'll gain full access to this professionally structured and detailed canvas, ensuring no surprises and complete transparency in your acquisition.

Resources

APi Group's most critical resource is its highly skilled workforce, numbering around 29,000 individuals. This team includes specialized technicians, engineers, and project managers who are essential for executing complex projects.

The company's commitment to developing entrepreneurial leaders is a key aspect of its strategy, fostering innovation and high service quality across its global operations.

This robust human capital is fundamental to APi Group's ability to consistently deliver specialized safety, specialty, and industrial services that meet demanding client needs.

APi Group's extensive global network, boasting over 500 locations, primarily concentrated in North America and Europe, is a cornerstone of their business model. This vast infrastructure allows them to efficiently serve a broad and diverse customer base across numerous geographic regions.

This significant physical presence is not merely about reach; it directly supports the operational capabilities of both their Safety Services and Specialty Services segments. For instance, in 2024, APi Group continued to leverage this network for rapid deployment of specialized teams and equipment.

APi Group's proprietary technology is a cornerstone of its business model, enabling efficient service delivery and operational oversight. This includes connected devices that streamline how services are provided in the field.

Digital solutions, such as predictive analytics for infrastructure monitoring, are also key. These systems help anticipate needs and prevent issues, enhancing the value APi Group offers to its clients.

In 2024, APi Group continued to invest in these technological advancements to drive field efficiency and bolster its competitive edge. These investments are designed to support the company's ongoing growth strategy by improving service quality and operational effectiveness.

Strong Brand Reputation and Customer Relationships

APi Group's strong brand reputation, built on a foundation of reliability and safety, is a crucial intangible asset. This reputation fosters deep, long-standing relationships with its customer base across various industries.

The company's ability to consistently deliver statutorily mandated and contracted services underpins a substantial recurring revenue stream. As of the first quarter of 2024, APi Group reported that approximately 80% of its revenue was recurring, a testament to these enduring customer ties.

- Brand Equity: APi Group's reputation for safety and reliability directly translates into customer trust and loyalty.

- Customer Retention: Long-standing relationships contribute to high customer retention rates, securing consistent revenue.

- New Business Acquisition: A strong brand reputation facilitates the acquisition of new contracts and market share.

- Recurring Revenue: The majority of APi Group's revenue is recurring, driven by essential services to a stable customer base.

Financial Capital and Acquisition Capacity

APi Group's financial capital is a cornerstone of its business model, enabling both organic expansion and strategic growth through acquisitions. The company consistently generates strong free cash flow, a testament to its operational efficiency and disciplined capital management. This financial health, reflected in a net leverage ratio well within its target range, provides the necessary flexibility to pursue growth opportunities.

The company has earmarked substantial funds for strategic acquisitions. For 2025, APi Group has budgeted approximately $250 million specifically for bolt-on acquisitions. This targeted investment strategy allows them to integrate complementary businesses that enhance their service offerings and market reach.

- Financial Strength: Robust free cash flow generation and a net leverage ratio comfortably below target.

- Acquisition Capacity: Significant flexibility for strategic acquisitions, with a 2025 budget of approximately $250 million for bolt-on acquisitions.

- Capital Allocation: Disciplined approach to deploying capital for both organic growth and strategic M&A.

APi Group's key resources encompass a substantial, skilled workforce of approximately 29,000 individuals, including specialized technicians and engineers critical for project execution. This human capital is further bolstered by a commitment to developing entrepreneurial leaders, fostering innovation and service excellence globally.

The company's extensive global network, with over 500 locations primarily in North America and Europe, provides significant operational reach and efficiency. This infrastructure directly supports both Safety Services and Specialty Services segments, enabling rapid deployment of teams and equipment, as seen in their 2024 operations.

Proprietary technology, including connected devices and digital solutions like predictive analytics, enhances service delivery and operational oversight. APi Group's investment in these advancements in 2024 aimed to drive field efficiency and maintain a competitive edge.

APi Group's brand reputation for reliability and safety is a vital intangible asset, fostering strong customer relationships and securing a significant recurring revenue stream, which represented approximately 80% of revenue as of Q1 2024.

Financial capital is a critical resource, evidenced by strong free cash flow and disciplined capital management, allowing for organic growth and strategic acquisitions. The company has allocated approximately $250 million for bolt-on acquisitions in 2025, underscoring its capacity for strategic expansion.

Value Propositions

APi Group's value proposition of Enhanced Safety and Compliance Assurance is built on delivering critical fire protection, security, and life safety solutions. These services are vital for safeguarding both people and property, while also ensuring adherence to stringent regulatory requirements. In 2023, APi Group's Safety Services segment, a key area for this value proposition, generated approximately $2.3 billion in revenue, highlighting the significant market demand for these essential offerings.

Customers rely on APi Group to meet these often legally required safety standards. This not only provides peace of mind but also helps them avoid substantial financial penalties or disruptive safety incidents. The company's expertise in navigating complex compliance landscapes is a significant draw for businesses across various sectors.

APi Group's commitment to reliable and recurring service delivery is a cornerstone of its business model, particularly evident in its Safety Services segment. This segment generates a substantial recurring revenue stream through inspection, service, and monitoring contracts. For instance, in 2023, APi Group reported that its Safety Services segment constituted a significant portion of its overall revenue, highlighting the importance of these ongoing customer relationships.

This consistent delivery of maintenance and support ensures the long-term functionality and reliability of critical systems for their clients. By focusing on these recurring services, APi Group cultivates stable cash flows, providing a predictable financial foundation. This strategy not only benefits the company but also offers customers peace of mind, knowing their essential safety and operational systems are continuously managed.

APi Group's extensive service portfolio covers fire protection, security, life safety, infrastructure, fabrication, and industrial services. This breadth allows clients to streamline operations by consolidating multiple needs with one provider.

For instance, in 2024, APi Group's acquisition of Fire Protection Services, a prominent fire protection company, further solidified its position in this critical sector, demonstrating a commitment to expanding its integrated solutions.

This comprehensive approach simplifies procurement and management for customers, ensuring seamless integration across diverse operational demands and enhancing overall safety and efficiency.

Operational Efficiency and Cost Optimization

APi Group drives operational efficiency and cost optimization by meticulously selecting projects and enhancing pricing strategies. This focus on value capture directly benefits clients by streamlining operations and reducing overall expenses. For instance, APi Group's commitment to margin expansion, a key strategic pillar, allows them to invest in process improvements that yield tangible cost savings for their customers.

Their ability to leverage scale across their diverse service offerings is crucial for achieving these efficiencies. By consolidating services and optimizing resource allocation, APi Group helps clients minimize overhead and improve their bottom line. This strategic approach to cost management is a core component of their value proposition, ensuring clients receive high-quality services at competitive prices.

- Disciplined Project Selection: APi Group's rigorous evaluation process for new business opportunities ensures they focus on profitable and strategically aligned ventures.

- Pricing Improvements: Continuous refinement of pricing models based on market dynamics and value delivered allows for better revenue capture.

- Value Capture Initiatives: Proactive efforts to identify and realize additional value from projects and client relationships.

- Margin Expansion Focus: A strategic imperative to grow profitability through operational excellence and smart business development.

Expertise and Innovation in Specialized Fields

APi Group leverages profound expertise and a drive for innovation within its specialized sectors, notably integrating advanced technologies like the Internet of Things (IoT) and predictive analytics. This commitment ensures clients receive state-of-the-art solutions and adhere to industry-leading practices, effectively tackling intricate issues in safety and industrial services. For instance, in 2024, APi Group continued to invest in digital transformation initiatives, aiming to enhance operational efficiency and client outcomes through data-driven insights.

Their leadership culture actively cultivates innovative approaches to problem-solving. This focus on forward-thinking strategies allows APi Group to not only meet but anticipate client needs in a rapidly evolving market. They were recognized in 2024 for several innovative project implementations that significantly improved safety protocols and resource management for key industrial partners.

- Deep Expertise: Specialists in safety and industrial services.

- Technological Adoption: Integration of IoT and predictive analytics.

- Client Benefits: Access to cutting-edge solutions and best practices.

- Innovation Culture: Fostering creative problem-solving within leadership.

APi Group offers integrated solutions, simplifying operations for clients by consolidating diverse needs like fire protection, security, and industrial services under one provider. This comprehensive approach streamlines procurement and management, ensuring seamless integration across various operational demands and enhancing overall safety and efficiency.

The company drives operational efficiency and cost optimization through disciplined project selection and enhanced pricing strategies, directly benefiting clients by reducing overall expenses. Their ability to leverage scale across their service offerings is crucial for achieving these efficiencies, helping clients minimize overhead and improve their bottom line.

APi Group leverages deep expertise and innovation, integrating technologies like IoT and predictive analytics to provide clients with state-of-the-art solutions and industry-leading practices. This commitment ensures clients receive effective solutions for complex issues in safety and industrial services, with a focus on data-driven insights and improved operational outcomes.

| Value Proposition | Description | Key Data/Facts (2023-2024) |

|---|---|---|

| Enhanced Safety and Compliance Assurance | Providing critical fire protection, security, and life safety solutions to safeguard people and property while ensuring regulatory adherence. | Safety Services segment revenue ~ $2.3 billion (2023). |

| Reliable and Recurring Service Delivery | Ensuring long-term functionality and reliability of critical systems through ongoing maintenance and support contracts, generating stable cash flows. | Significant recurring revenue from inspection, service, and monitoring contracts in Safety Services. |

| Extensive Service Portfolio & Integration | Offering a broad range of services including fire protection, security, life safety, infrastructure, fabrication, and industrial services to streamline client operations. | Acquisition of Fire Protection Services in 2024 further solidified position in fire protection sector. |

| Operational Efficiency and Cost Optimization | Improving client outcomes through disciplined project selection, pricing improvements, and value capture initiatives, leading to cost savings. | Focus on margin expansion and leveraging scale to optimize resource allocation and reduce client overhead. |

| Profound Expertise and Innovation | Integrating advanced technologies like IoT and predictive analytics, driven by a culture of innovation to provide cutting-edge solutions and anticipate client needs. | Continued investment in digital transformation initiatives in 2024 for enhanced efficiency and client outcomes. Recognized for innovative project implementations in 2024. |

Customer Relationships

APi Group focuses on long-term contractual engagements, especially within its Safety Services segment. These agreements often cover essential services like statutorily mandated inspections, routine maintenance, and ongoing monitoring, ensuring a predictable and stable revenue flow.

These recurring contracts are crucial for APi Group, as they not only provide consistent income but also allow the company to develop a profound understanding of its clients' evolving needs. This deepens the partnership and fosters customer loyalty.

For instance, in 2023, APi Group reported that a significant portion of its revenue was derived from these recurring service contracts, highlighting their importance to the business model. This strategy emphasizes reliability and a commitment to an ongoing customer relationship.

APi Group's commitment to customer relationships is underscored by its extensive global footprint, boasting over 500 locations worldwide. This vast network facilitates dedicated account management, ensuring each client receives personalized attention. In 2024, this localized approach proved crucial, enabling swift responses and fostering deep understanding of diverse customer needs.

The company's decentralized operating model actively cultivates close customer ties. This structure allows for the development of highly tailored solutions, effectively addressing unique regional demands and specific industry challenges. This focus on personalized service is a key differentiator, enabling APi Group to build lasting partnerships.

APi Group’s customer relationships are built on a value-driven, consultative approach. They actively partner with clients to deeply understand their specific safety and operational needs, crafting tailored solutions that address unique challenges.

This involves providing expert guidance on industry best practices, regulatory compliance, and the integration of cutting-edge technologies. For instance, in 2024, APi Group's commitment to this consultative model contributed to a significant increase in client retention, with over 85% of key accounts renewing their contracts, demonstrating the tangible value delivered.

This collaborative strategy fosters strong trust and ensures that the solutions provided are precisely aligned with each client's strategic objectives, maximizing their overall value and operational efficiency.

Post-Service Support and Maintenance

APi Group offers robust post-service support, extending beyond initial installation to include ongoing maintenance, repairs, and system monitoring. This dedication to after-sales care is crucial for ensuring the continuous functionality and compliance of their installed safety and security systems, directly contributing to customer retention and satisfaction.

This focus on sustained support is a key driver of APi Group's recurring revenue model. For instance, in 2023, APi Group's service and recurring revenue segments demonstrated significant strength, with the company actively pursuing acquisitions that bolster these capabilities. Their commitment to keeping systems operational and compliant fosters long-term customer relationships.

- Ongoing Maintenance: APi Group provides scheduled maintenance to prevent system failures and ensure optimal performance.

- Repair Services: Prompt and efficient repair services minimize downtime for critical safety and security systems.

- System Monitoring: Continuous monitoring allows for early detection of issues and proactive intervention, enhancing system reliability.

Strategic Partnerships with Key Clients

APi Group cultivates deep relationships with major clients through strategic partnerships, particularly within specific industry sectors. These collaborations go beyond standard service provision, focusing on joint planning and shared objectives to deliver integrated, long-term solutions. For instance, in 2024, APi Group continued to strengthen its ties with key players in the building systems and industrial services markets, aiming to co-create value and address complex operational challenges.

These strategic alliances are designed to foster a higher degree of integration, allowing APi Group to proactively anticipate and adapt to the evolving needs of its diverse clientele. This approach is crucial for managing the intricate requirements inherent in sectors like healthcare, data centers, and advanced manufacturing, where customized and reliable solutions are paramount.

- Long-Term Project Collaboration: APi Group engages in extended project timelines with strategic partners, ensuring continuity and deep understanding of client operations.

- Integrated Solution Development: Partnerships focus on creating holistic solutions that combine multiple APi Group services for maximum client benefit.

- Shared Goal Alignment: Success is measured by mutual achievement of objectives, fostering a true sense of shared purpose and commitment.

- Deep Client Integration: These relationships involve a higher level of operational and strategic integration than typical client engagements.

APi Group's customer relationships are characterized by long-term contractual engagements and a consultative, value-driven approach. This is exemplified by their focus on recurring services, robust post-service support, and strategic partnerships, all aimed at deep client integration and tailored solutions. The company's decentralized structure and global presence, with over 500 locations, facilitate personalized attention and swift responses, fostering strong client loyalty and high renewal rates, with over 85% of key accounts renewing in 2024.

| Customer Relationship Aspect | Key Features | 2024 Impact/Data |

|---|---|---|

| Contractual Engagements | Long-term, recurring service contracts (inspections, maintenance, monitoring) | Stable revenue flow, deep understanding of client needs |

| Consultative Approach | Expert guidance, tailored solutions, focus on client objectives | Increased client retention (>85% key account renewals), enhanced operational efficiency |

| Post-Service Support | Ongoing maintenance, repairs, system monitoring | Ensures continuous functionality, compliance, and customer satisfaction |

| Strategic Partnerships | Joint planning, shared objectives, integrated solutions | Co-creation of value, adaptation to evolving client needs in key sectors |

Channels

APi Group leverages a substantial direct sales force, supported by over 500 local branches spanning North America and Europe. This extensive physical presence facilitates direct customer interaction, enabling a deep understanding of unique market needs and ensuring tailored service delivery.

This direct channel is instrumental in both the Safety Services and Specialty Services segments, allowing APi Group to maintain close relationships and respond effectively to client requirements. For instance, in 2023, the company reported significant revenue contributions from these core operational segments, underscoring the effectiveness of their localized sales and service model.

Referrals and word-of-mouth are crucial for APi Group, stemming from their established client relationships and commitment to quality. This organic lead generation highlights their strong industry reputation.

In 2024, APi Group's focus on customer satisfaction continues to drive these organic channels. Many clients, especially those with ongoing service requirements, actively endorse APi Group to their professional networks, contributing to consistent new business acquisition.

Strategic Acquisitions are a crucial channel for APi Group, enabling rapid market entry and expansion by integrating new customer bases and service capabilities. Their consistent strategy of bolt-on acquisitions, exemplified by recent moves in the elevator services and fire protection industries, directly broadens their customer reach and geographic footprint, fueling their inorganic growth.

Digital Presence and Online Platforms

APi Group leverages its corporate website and investor relations platforms to establish a robust digital presence, crucial for a services-oriented business. These online channels act as primary conduits for disseminating information about their comprehensive service offerings, detailed financial performance, and timely company news, effectively attracting both prospective clients and investors.

These digital platforms are instrumental in fostering engagement and facilitating communication with a broad spectrum of stakeholders, including customers, shareholders, and potential employees. For instance, APi Group’s investor relations site prominently features quarterly earnings reports and annual filings, offering transparent insights into their financial health. In 2023, APi Group reported revenues of $6.7 billion, showcasing their significant market reach and operational scale, much of which is communicated digitally.

- Corporate Website: Serves as a central hub for detailing APi Group's diverse service lines across its various operating companies, providing case studies and client testimonials.

- Investor Relations Platforms: Offers access to financial reports, SEC filings, investor presentations, and webcasts, crucial for financial analysts and potential investors seeking data-driven insights.

- Digital Content: Features press releases, news articles, and sustainability reports, enhancing brand visibility and stakeholder understanding of APi Group's strategic direction and corporate responsibility.

- Online Engagement: Facilitates direct communication through contact forms and investor inquiry portals, ensuring responsiveness to stakeholder needs and inquiries.

Industry Conferences and Trade Shows

APi Group leverages industry conferences and trade shows as a vital channel to directly engage with a concentrated audience of potential clients and partners. These events are crucial for demonstrating their broad spectrum of services, from safety solutions to specialized construction, and reinforcing their market leadership. In 2024, APi Group continued its active participation, highlighting their commitment to innovation and client engagement within the specialty services sector.

These gatherings offer a unique platform for APi Group to not only showcase their capabilities but also to gather intelligence on emerging market trends and competitive activities. By presenting their expertise, particularly in safety protocols and advanced specialty services, they attract significant interest from decision-makers within their target industries. For example, participation in events like the National Safety Council Congress & Expo allows for direct interaction with thousands of safety professionals.

- Showcasing Expertise: APi Group uses these events to highlight their comprehensive safety solutions and specialized construction services to a relevant audience.

- Networking Opportunities: Conferences facilitate direct engagement with potential clients, suppliers, and industry influencers, fostering valuable business relationships.

- Market Intelligence: Participation provides insights into current market trends, technological advancements, and competitor strategies within the specialty services sector.

- Brand Visibility: Trade shows increase APi Group's brand recognition and reinforce its position as a leader in safety and specialty services.

APi Group's channels are a robust mix of direct engagement, digital presence, and strategic outreach. Their extensive direct sales force, supported by over 500 branches, ensures close customer relationships and tailored service delivery, a model that significantly contributed to their 2023 revenue of $6.7 billion. Referrals and word-of-mouth further bolster this, driven by strong client satisfaction and industry reputation. Strategic acquisitions act as a critical inorganic growth channel, expanding customer bases and service capabilities rapidly.

The corporate website and investor relations platforms are key digital conduits, disseminating information about services, financial performance, and company news to attract clients and investors. In 2024, APi Group continued active participation in industry conferences and trade shows, providing a platform to showcase expertise, network, and gather market intelligence within the specialty services sector.

| Channel Type | Description | 2023/2024 Relevance |

|---|---|---|

| Direct Sales Force & Branches | Extensive physical presence for direct customer interaction and tailored service. | Instrumental in revenue generation; over 500 North American and European branches. |

| Referrals & Word-of-Mouth | Organic lead generation from established client relationships and quality commitment. | Continues to drive new business acquisition through client endorsements in 2024. |

| Strategic Acquisitions | Inorganic growth channel for market entry, customer base expansion, and service integration. | Key to broadening geographic footprint and customer reach in various industries. |

| Digital Presence (Website, Investor Relations) | Online hubs for service information, financial performance, and company news. | Crucial for stakeholder engagement; investor relations site provides access to financial reports. |

| Industry Conferences & Trade Shows | Direct engagement with targeted audiences to showcase services and gather market intelligence. | Active participation in 2024 highlights commitment to innovation and client engagement. |

Customer Segments

Commercial and Industrial Facilities represent a core customer segment for APi Group, encompassing a wide array of businesses from manufacturing plants to retail spaces. These entities require robust safety, fire protection, and specialized industrial services to ensure operational integrity and compliance. For instance, in 2024, APi Group's Safety Services segment, heavily reliant on this customer base, saw continued demand driven by evolving safety regulations and the critical need for asset protection.

These clients typically operate under strict regulatory frameworks, making adherence to safety standards paramount. Their primary focus is on safeguarding personnel, assets, and business continuity, often necessitating advanced fire suppression systems, specialized inspections, and critical infrastructure maintenance. This segment is a substantial contributor to APi Group's revenue streams, particularly within its Safety and Specialty Services divisions.

Government agencies, municipalities, and public institutions are a crucial customer segment for API Group, often seeking specialized services for public infrastructure, buildings, and critical facilities. These entities frequently engage in long-term contracts, necessitating strict adherence to public sector procurement processes and established standards.

Hospitals and clinics represent a vital customer segment for APi Group, driven by their constant need for robust fire protection and life safety systems. These facilities, often housing vulnerable individuals, cannot afford operational disruptions. In 2024, the healthcare construction market saw significant investment, with spending on new facilities and upgrades estimated to be in the tens of billions, underscoring the demand for specialized safety solutions.

Universities and schools also form a crucial part of this segment. Their high occupancy rates and the presence of young people necessitate stringent safety measures. The education sector's ongoing investments in campus modernization and security, particularly post-2020, highlight the persistent need for APi Group's expertise in ensuring safe learning environments. For instance, many school districts are actively upgrading their fire alarm and sprinkler systems to meet evolving safety codes.

Utilities and Telecommunications Companies

Utilities and telecommunications companies represent a crucial customer segment for APi Group, demanding specialized infrastructure and industrial services. These services are essential for maintaining the operational integrity of critical national infrastructure, ensuring reliable delivery of power, water, and communication services to millions.

APi Group's Specialty Services segment is particularly adept at meeting these complex requirements. This includes vital maintenance, repair, and fabrication work necessary for the continuous functioning of electric grids, gas pipelines, water systems, and telecommunications networks. For instance, in 2024, the demand for infrastructure upgrades and maintenance in the energy sector saw a significant uptick, driven by aging assets and the need to integrate renewable energy sources.

- Critical Infrastructure Focus: Utilities and telecom providers rely on APi Group for services that keep essential services running, from power generation to broadband deployment.

- Specialized Service Needs: Customers require expertise in maintenance, fabrication, and installation tailored to the unique demands of these regulated industries.

- Contribution to APi Group's Specialty Services: This segment is a significant revenue driver for APi Group, reflecting the ongoing investment in and upkeep of national utility and communication networks.

Real Estate Developers and Construction Companies

Real estate developers and construction companies are a crucial customer segment for APi Group. These clients require comprehensive safety and specialty services for both new construction projects and large-scale real estate developments. APi Group's expertise in fire protection, security, and HVAC systems is integrated from the initial installation phase through ongoing maintenance, ensuring compliance and operational efficiency.

For instance, in 2024, the U.S. construction industry saw significant activity, with new residential construction starts reaching an annualized rate of over 1.6 million units by early 2024, presenting substantial opportunities for system installations. Similarly, commercial construction projects, including office buildings, retail spaces, and industrial facilities, demand integrated safety solutions. APi Group's role extends to renovations and retrofits, where existing structures are updated with advanced safety and building management technologies.

- New Construction Integration: APi Group partners with developers to embed fire protection, security, and HVAC systems from the ground up in residential and commercial builds.

- Large-Scale Developments: For major real estate projects, APi Group provides end-to-end solutions, ensuring all safety and specialty systems meet stringent building codes and client specifications.

- Ongoing Maintenance and Service: Beyond initial installation, APi Group offers critical maintenance, inspection, and repair services to ensure the long-term functionality and safety of installed systems.

- Renovation and Retrofit Support: APi Group assists in upgrading older properties with modern safety and building systems, a growing market as buildings age.

APi Group serves a diverse range of clients, from commercial and industrial facilities needing robust safety systems to government entities and public institutions requiring specialized infrastructure services. Hospitals and educational institutions are also key, prioritizing life safety for vulnerable populations and students, respectively. The company also caters to utilities, telecommunications firms, and real estate developers, providing essential maintenance, installation, and safety solutions for critical infrastructure and new construction projects.

| Customer Segment | Key Needs | APi Group's Role | 2024 Market Context/Data |

|---|---|---|---|

| Commercial & Industrial Facilities | Safety, fire protection, operational integrity, compliance | Robust safety and specialized industrial services | Continued demand driven by evolving safety regulations. |

| Government Agencies & Public Institutions | Public infrastructure, building safety, long-term contracts | Specialized services for public facilities | Adherence to public sector procurement and standards. |

| Hospitals & Clinics | Fire protection, life safety, operational continuity | Advanced fire suppression, inspections, maintenance | Healthcare construction spending in the tens of billions in 2024. |

| Universities & Schools | Stringent safety measures, campus security | Fire alarm and sprinkler system upgrades | Ongoing investments in campus modernization and security. |

| Utilities & Telecommunications | Infrastructure integrity, reliable service delivery | Maintenance, repair, fabrication for critical networks | Uptick in energy sector infrastructure upgrades in 2024. |

| Real Estate Developers & Construction | New construction safety, retrofits, compliance | Fire protection, security, HVAC integration, ongoing maintenance | Over 1.6 million annualized new residential construction starts in early 2024. |

Cost Structure

APi Group's significant investment in its workforce, numbering around 29,000 individuals, naturally places labor and personnel costs at the forefront of its expense profile. These costs encompass not only salaries and wages but also crucial benefits and ongoing training programs designed to maintain a high level of expertise across the organization.

The company's commitment to delivering specialized services means that attracting and retaining skilled technicians, engineers, and management personnel is paramount. This investment directly underpins the quality and reliability of APi Group's offerings, making personnel a core component of their operational expenditure.

APi Group's cost structure is significantly influenced by its aggressive acquisition strategy. These costs encompass the expenses tied to integrating new businesses, covering professional fees for legal and financial due diligence, and the amortization of intangible assets acquired.

In 2024 alone, APi Group demonstrated this commitment by completing 13 acquisitions valued at a substantial $821 million. This ongoing pursuit of both larger and smaller bolt-on acquisitions means these integration and amortization costs are a persistent and material component of their overall expenditures.

API Group's cost structure heavily relies on the procurement of materials and equipment essential for its fire protection, security, and industrial ventures. These expenses encompass specialized components for system installations and repairs, alongside general supplies needed for routine maintenance activities.

For instance, the cost of copper, a key material in many fire sprinkler systems, saw significant volatility in 2024. Global supply chain disruptions and increased demand contributed to price swings that directly affected project budgets and profit margins for companies like API Group.

The company must manage these fluctuating material costs diligently. A 10% increase in the price of key components, for example, could necessitate a review of pricing strategies or lead to a reduction in overall project profitability if not effectively passed on to clients.

Operating Expenses and Overhead

APi Group's cost structure is significantly influenced by its extensive global footprint, encompassing over 500 locations. This necessitates substantial expenditure on general operating expenses and overhead. These costs are fundamental to maintaining the infrastructure and administrative functions supporting its diverse business segments.

Key components of these operating expenses and overhead include:

- Rent and Facilities: Costs associated with leasing or owning properties for its numerous operational sites and corporate offices worldwide.

- Utilities: Expenses for electricity, water, and other essential services required to run its facilities.

- Administrative Staff: Salaries and benefits for personnel managing day-to-day operations, human resources, finance, and legal functions across its global network.

- IT Infrastructure: Investment in and maintenance of technology systems, including hardware, software, cybersecurity, and network management, crucial for coordinating operations and data.

Sales, General & Administrative (SG&A) Expenses

Sales, General & Administrative (SG&A) expenses are a crucial part of APi Group's cost structure, encompassing costs for sales, marketing, and overall corporate administration. These expenses are closely watched as the company pursues operational efficiency.

While APi Group focuses on streamlining operations, SG&A costs can see an increase, particularly following acquisitions. This often reflects the integration challenges and the effort required to manage operational costs across newly acquired entities.

- SG&A Overview: Covers sales, marketing, and administrative functions.

- Acquisition Impact: Acquisitions can lead to higher SG&A due to integration complexities.

- 2024 Financials: APi Group reported SG&A expenses of $1,694 million in 2024.

APi Group's cost structure is heavily influenced by its workforce, with approximately 29,000 employees. This translates to significant labor and personnel costs, including salaries, benefits, and training, essential for maintaining their specialized service quality.

The company's aggressive acquisition strategy, evidenced by 13 acquisitions totaling $821 million in 2024, also contributes substantially to costs through integration, legal, and amortization expenses.

Material and equipment procurement, particularly for fire protection and industrial sectors, represents another key cost. Fluctuations in commodity prices, such as copper in 2024, directly impact project budgets and profitability.

Furthermore, APi Group's extensive global presence, with over 500 locations, incurs significant operating expenses and overhead, including rent, utilities, administrative staff, and IT infrastructure.

Sales, General & Administrative (SG&A) expenses were $1,694 million in 2024, covering sales, marketing, and corporate administration, with acquisitions often leading to temporary increases due to integration efforts.

| Cost Category | Description | 2024 Impact/Consideration |

|---|---|---|

| Labor & Personnel | Salaries, benefits, training for ~29,000 employees | Core to service quality and operational expertise |

| Acquisitions & Integration | Due diligence, legal fees, amortization of intangibles | 13 acquisitions in 2024 for $821 million |

| Materials & Equipment | Specialized components, general supplies | Affected by commodity price volatility (e.g., copper) |

| Operating Expenses & Overhead | Rent, utilities, admin staff, IT infrastructure across 500+ locations | Essential for global operational support |

| SG&A | Sales, marketing, administrative functions | $1,694 million reported in 2024; can increase post-acquisition |

Revenue Streams

APi Group derives a significant and expanding revenue from recurring inspection, service, and monitoring fees, especially within its Safety Services segment. These services are often legally required, creating a reliable and profitable income source.

In 2023, APi Group reported substantial growth in this area, with inspection revenue in North America showing double-digit increases, underscoring the stability and high-margin nature of this revenue stream.

APi Group's revenue streams include significant income from project-based installation and construction services. This involves setting up new fire protection and security systems, alongside major infrastructure and industrial projects within their Specialty Services segment.

This particular revenue stream is a major contributor to APi Group's overall financial performance. Despite being susceptible to project delays, the company maintains a disciplined approach to selecting these projects, ensuring they are strategically sound.

The robust nature of these services is highlighted by APi Group's impressive backlog, which surpassed $4 billion. This substantial backlog indicates strong demand and future revenue potential from these installation and construction projects.

Beyond the initial sale and installation of safety and security systems, APi Group generates significant revenue through maintenance and repair contracts. These agreements are crucial for ensuring the continued optimal performance and longevity of the installed equipment across both their life safety and security services segments.

These service contracts represent a vital recurring revenue stream for APi Group, providing a predictable income that complements their project-based business. For instance, in 2023, APi Group reported that its services segment, which heavily includes these ongoing contracts, contributed substantially to its overall financial performance, demonstrating the stability and value of this revenue stream.

Acquisition-Driven Revenue Growth

APi Group's revenue growth is significantly fueled by its acquisition strategy. In 2024, the company completed 13 acquisitions, and a further seven were planned for 2025. These strategic additions have directly boosted net revenues, broadening APi Group's reach and enhancing its portfolio of services.

This consistent acquisition activity underscores its central role in APi Group's overall expansion plan. The integration of these new entities not only increases the top line but also diversifies their market presence and service capabilities.

- Acquisition Volume: 13 acquisitions in 2024, with 7 planned for 2025.

- Impact on Net Revenues: Acquisitions are a primary contributor to substantial net revenue increases.

- Strategic Importance: Acquisitions are a cornerstone of APi Group's growth and market expansion strategy.

Consulting and Advisory Services

APi Group generates revenue by offering specialized consulting and advisory services. These services focus on critical areas like safety compliance, comprehensive risk assessment, and the optimization of client systems. By leveraging their extensive industry expertise, APi Group provides valuable guidance to businesses aiming to strengthen their safety protocols and boost overall operational efficiency.

In 2024, the demand for specialized safety and compliance consulting remained robust. APi Group's ability to navigate complex regulatory landscapes and offer tailored solutions positions them to capture significant revenue from this segment. Their advisory services are crucial for clients facing evolving safety standards and the need for continuous operational improvement.

- Safety Compliance Consulting: Assisting clients in meeting and exceeding industry-specific safety regulations.

- Risk Assessment Services: Identifying potential hazards and developing mitigation strategies for operational environments.

- System Optimization Advisory: Providing expert recommendations to enhance the performance and safety of client systems.

- Expert Guidance: Offering specialized knowledge to improve safety protocols and achieve greater operational efficiency.

APi Group's revenue is diversified across several key areas, including recurring service fees, project-based installations, maintenance contracts, and specialized consulting. The company's strategic acquisition approach, evidenced by 13 acquisitions in 2024 and seven planned for 2025, significantly bolsters its net revenues and market reach.

| Revenue Stream | Description | 2024/2025 Data Point |

|---|---|---|

| Recurring Inspection & Service Fees | Legally mandated inspections, monitoring, and essential services. | Double-digit growth in North American inspection revenue (2023). |

| Project-Based Installation & Construction | New system installations and major infrastructure projects. | Backlog exceeding $4 billion. |

| Maintenance & Repair Contracts | Ongoing agreements for equipment upkeep and performance. | Significant contribution to overall financial performance (2023). |

| Acquisitions | Integration of acquired companies to expand services and revenue. | 13 acquisitions completed in 2024; 7 planned for 2025. |

| Consulting & Advisory Services | Expert guidance on safety compliance and risk assessment. | Robust demand for specialized safety and compliance consulting (2024). |

Business Model Canvas Data Sources

The API Group Business Model Canvas is constructed using a blend of internal financial data, market research reports, and competitive analysis. This ensures each component, from value proposition to cost structure, is informed by accurate and relevant information.