APi Group Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

APi Group Bundle

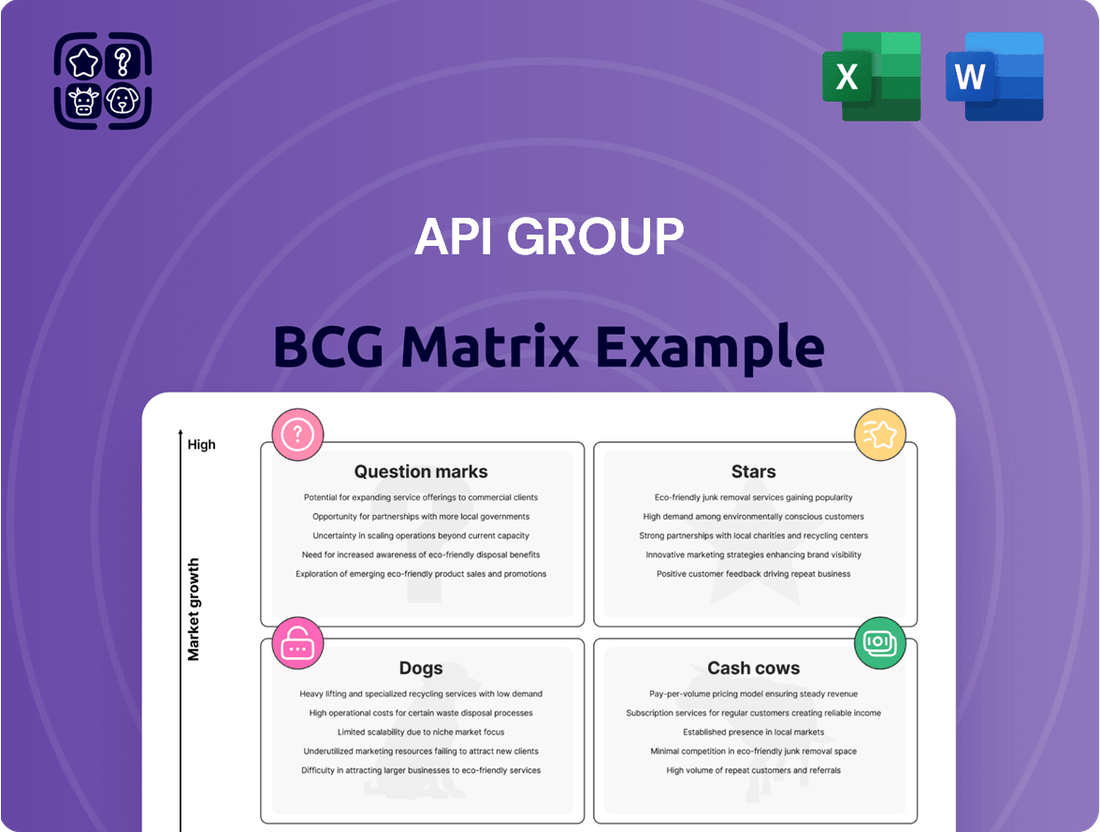

Uncover the strategic positioning of APi Group's product portfolio with our insightful BCG Matrix preview. See where your investments are yielding the most and which areas require attention. Purchase the full BCG Matrix for a comprehensive analysis, including detailed quadrant placements and actionable strategies to optimize your business growth.

Stars

APi Group's Fire Protection services are firmly positioned as a Star in the BCG Matrix. This is due to the robust expansion of the global fire protection system market, which is anticipated to hit $87.69 billion by 2025, growing at a compound annual growth rate of 7.9% from 2024, and is projected to reach $125.35 billion by 2029.

As a leading provider of fire and life safety services, APi Group capitalizes on the increasing development of urban infrastructure and the enforcement of stricter safety regulations worldwide. These factors create a favorable environment for continued growth and market share expansion in this sector.

The Security Solutions market is a true powerhouse, projected to surge from $408.43 billion in 2024 to an impressive $443.12 billion in 2025. This robust growth, with an estimated compound annual growth rate of 11.8%, is expected to propel the market to a staggering $692.05 billion by 2029.

APi Group shines in this landscape as a global leader in security services. Its strong competitive standing within this rapidly expanding market firmly places its Security Solutions segment in the Star category of the BCG Matrix. This means APi Group is well-positioned to capitalize on significant future opportunities.

APi Group is heavily investing in its recurring inspection, service, and monitoring business, with a target of 60% of its revenue coming from these areas by 2025. This strategic push is designed to create a predictable and growing income stream.

This segment is classified as a Star within the BCG matrix due to its high growth potential and strong market position. The demand for these services is consistently high, often driven by regulatory requirements, ensuring a stable revenue base for APi Group.

In 2024, APi Group's Safety Services segment, which encompasses these recurring operations, demonstrated robust performance. For instance, their fiscal year 2023 results showed significant contributions from these service-based revenues, setting a strong foundation for continued growth towards their 2025 goals.

Integrated Occupancy Systems

APi Group's integrated occupancy systems, encompassing fire protection, HVAC, and entry solutions, are positioned as a Star in the BCG matrix. This offering directly addresses the increasing demand for holistic safety and operational efficiency across commercial, educational, and healthcare environments. By bundling these critical systems, APi is well-placed to capitalize on the expanding market for comprehensive safety solutions.

The company's strategy focuses on providing a unified platform that enhances building management and occupant well-being. This integrated approach not only streamlines operations for clients but also allows APi to secure a more significant market share within the growing safety services sector.

- Market Growth: The global building automation systems market, which includes HVAC and safety components, was projected to reach over $120 billion by 2024, indicating a strong growth trajectory for integrated solutions.

- Bundled Services Advantage: APi's ability to offer combined fire protection, HVAC, and entry systems provides a competitive edge, simplifying procurement and maintenance for clients.

- Sectoral Demand: Increased regulatory focus on safety and energy efficiency in commercial, education, and healthcare sectors fuels the demand for such integrated systems.

Strategic Acquisitions in Safety Markets

APi Group's strategic acquisitions in safety markets position them strongly within the BCG matrix. Year-to-date in 2025, APi Group has completed seven acquisitions, demonstrating a clear commitment to growth. A notable example is the November 2024 acquisition of Endeavor Fire Protection, which significantly enhances their Safety Services segment.

These strategic moves are designed to consolidate and expand APi Group's market share in high-growth safety and life safety sectors. The company is actively investing in these newly acquired businesses, aiming to nurture them into future stars.

- Acquisitions Completed Year-to-Date (2025): 7

- Key Acquisition (November 2024): Endeavor Fire Protection

- Strategic Focus: Expansion of Safety Services segment

- Market Positioning: Bolstering market share in high-growth safety markets

APi Group's focus on recurring inspection, service, and monitoring is a clear Star in the BCG matrix. This segment is projected to contribute 60% of APi's revenue by 2025, highlighting its high growth and strong market position. The consistent demand, often driven by regulations, ensures a stable revenue stream.

The company's Security Solutions segment is also a Star, capitalizing on the security market's rapid expansion. This market is expected to grow from $408.43 billion in 2024 to $692.05 billion by 2029, with an 11.8% CAGR.

APi's Fire Protection services are another Star, benefiting from the global fire protection system market's growth, anticipated to reach $125.35 billion by 2029.

The integrated occupancy systems, combining fire protection, HVAC, and entry solutions, are also Stars. This segment leverages the over $120 billion global building automation systems market in 2024.

| Segment | BCG Category | Key Growth Drivers | Market Size (2024/2025) | Projected Market Size (2029) |

|---|---|---|---|---|

| Fire Protection | Star | Urban infrastructure development, stricter safety regulations | $87.69 billion (2025) | $125.35 billion |

| Security Solutions | Star | Rapid technological advancements, increasing security threats | $408.43 billion (2024) | $692.05 billion |

| Recurring Services (Inspection, Service, Monitoring) | Star | Regulatory compliance, demand for predictable revenue streams | Target 60% of revenue by 2025 | N/A (Internal Target) |

| Integrated Occupancy Systems | Star | Demand for holistic safety and operational efficiency | Over $120 billion (Building Automation Systems, 2024) | N/A (Integrated Offering) |

What is included in the product

Strategic evaluation of APi Group's portfolio, categorizing units as Stars, Cash Cows, Question Marks, or Dogs.

The APi Group BCG Matrix offers a clear, visual overview of your business portfolio, easing the pain of strategic uncertainty.

Cash Cows

Established Fire Protection Maintenance and Servicing represents a significant cash cow for APi Group. These statutorily mandated services, encompassing inspections, repairs, and ongoing maintenance contracts, form a bedrock of the company's revenue. The essential nature of these offerings ensures a high renewal rate, minimizing the need for extensive promotional spending.

This segment operates within a mature and stable market, consistently generating strong and predictable cash flow for APi Group. In 2023, APi Group's overall revenue reached $6.4 billion, with their Fire Protection segment playing a crucial role in this performance. The recurring nature of these services provides a reliable income stream, allowing APi Group to reinvest in other growth areas.

APi Group's mature security and life safety solutions, built on long-standing customer relationships and established infrastructure, are dependable cash generators. These offerings often hold significant market share in mature segments, meaning they don't need substantial new investment to keep their profit margins healthy and their cash flow consistent. For instance, in 2024, APi Group reported that its Services segment, which heavily features these mature offerings, continued to deliver robust performance, contributing significantly to the company's overall earnings stability.

Within APi Group's Specialty Services, long-standing infrastructure maintenance contracts for underground utilities are key. These represent a high market share in a stable, essential service sector, allowing APi to generate consistent, passive income. This predictable revenue acts as a financial bedrock, funding growth in other business areas.

Elevator and Escalator Services

APi Group's elevator and escalator services function as a classic Cash Cow within the BCG matrix. These offerings, encompassing maintenance, testing, and modernization, are characterized by their recurring and essential nature, meaning customers rely on them consistently, regardless of economic fluctuations.

The market for these services is mature, indicating steady but not explosive growth. However, the absolute necessity for safety, reliability, and regulatory compliance ensures a robust and predictable revenue stream. APi Group leverages its established market presence to capitalize on this consistent demand.

For instance, in 2024, the global elevator and escalator market was valued at approximately $110 billion, with maintenance and repair services forming a significant portion of this. APi Group's focus on these non-discretionary services allows for strong cash generation to fund other business initiatives.

- Recurring Revenue: Maintenance contracts provide predictable income.

- Mature Market: Stable demand driven by necessity and safety regulations.

- Strong Market Presence: APi Group benefits from established relationships and brand recognition.

- Cash Generation: High profitability funds growth in other BCG categories.

24/7 Monitoring Services

APi Group's 24/7 monitoring services within its fire protection and security segments represent a classic Cash Cow in the BCG matrix. This offering generates a highly stable, recurring revenue stream, a hallmark of mature, essential services where APi Group holds a significant market share.

The strength of these services lies in their ability to leverage existing infrastructure and established customer relationships. This synergy minimizes the need for substantial additional investment, ensuring consistent cash flow generation. For instance, in 2024, APi Group reported that its recurring revenue streams, largely driven by such services, provided a predictable financial foundation.

- Stable Revenue: The continuous demand for fire and security monitoring creates a reliable income source.

- Low Investment: Existing infrastructure and customer bases reduce the capital required for growth.

- High Market Share: APi Group's strong position in this mature market solidifies its Cash Cow status.

- Predictable Cash Flow: These services are key contributors to APi Group's consistent financial performance.

APi Group's established fire protection maintenance and servicing operations are prime examples of Cash Cows. These services are essential, legally mandated, and benefit from high customer retention, ensuring a steady, predictable revenue stream. The mature market for these offerings means they require minimal new investment to maintain their profitability, allowing APi Group to generate substantial cash flow.

In 2023, APi Group reported a total revenue of $6.4 billion, with its Services segment, which includes these mature offerings, demonstrating robust performance. This stability is crucial, as these Cash Cow businesses provide the financial resources to invest in and support other areas of APi Group's portfolio.

| Business Segment | BCG Category | Key Characteristics | 2023 Revenue Contribution (Illustrative) |

| Fire Protection Maintenance & Servicing | Cash Cow | Recurring revenue, high retention, mature market, low investment needs | Significant portion of Services segment revenue |

| Security & Life Safety Solutions | Cash Cow | Established infrastructure, strong market share, predictable cash flow | Contributes to overall earnings stability |

| Elevator & Escalator Services | Cash Cow | Essential services, consistent demand, mature market | Drives predictable revenue streams |

Preview = Final Product

APi Group BCG Matrix

The APi Group BCG Matrix preview you are viewing is the identical, fully completed document you will receive immediately after purchase. This means you're getting a professionally formatted and analysis-ready strategic tool without any watermarks or demo content, ensuring immediate usability for your business planning.

Dogs

APi Group has strategically divested certain business units, a common move for companies looking to streamline operations and focus on core strengths. These divestitures often target underperforming segments or those that no longer fit the company's long-term vision. For example, in 2023, APi Group completed the sale of its Safety Services segment, which had been identified as a non-core asset.

Units divested by APi Group typically fall into the "Dogs" category of the BCG Matrix. This means they likely operated in slow-growing markets and held a small market share. The rationale behind divesting these businesses is to release capital and management attention that can be reinvested into more promising growth areas, thereby improving overall company performance and resource allocation.

Certain legacy industrial services within APi Group's Specialty Services segment are showing signs of struggle. In 2024, these areas saw a reported revenue decrease of 13.5%, with an organic decline of 9.6%.

If these segments maintain a low market share and operate within stagnant or contracting sub-markets, they would be classified as Dogs in the BCG Matrix. This means they are likely consuming valuable resources without generating substantial returns for the company.

Certain project-based revenues within APi Group's Specialty Services segment saw a downturn in 2024. This was largely attributed to customer-related delays and issues with obtaining necessary permits, impacting the timely completion of projects. For instance, some specialty construction projects experienced delays of up to 15% in their original timelines due to these external factors.

If these project delays become a recurring issue and result in a low market share within specific sub-segments, these services could be categorized as 'Dogs' in the BCG Matrix. This classification suggests they consume significant resources and management attention without generating substantial returns, potentially hindering overall company growth.

Segments with High Fixed Costs and Low Utilization

Segments within APi Group's Specialty Services division that exhibit high fixed costs coupled with low asset utilization, perhaps due to a downturn in construction or manufacturing sectors, would likely fall into the Dog quadrant of the BCG Matrix. These operations would be cash traps, consuming resources without generating significant returns.

For instance, if a specialized fabrication unit within APi Group has substantial overheads, such as expensive machinery and skilled labor, but is only operating at 40% capacity because of fewer large-scale projects, it would represent a Dog. This low utilization means the fixed costs are spread over fewer revenue-generating activities, making profitability a challenge.

- High Fixed Costs: These could include depreciation on specialized equipment, facility leases, and base salaries for essential personnel, even during periods of low activity.

- Low Utilization: This occurs when demand for the segment's services or products is insufficient to keep its assets and workforce operating at optimal levels.

- Cash Flow Drain: Such segments often require ongoing investment for maintenance and upkeep but fail to generate enough cash to cover these costs, let alone contribute to overall profitability.

- Potential for Divestment: Companies often consider divesting or restructuring Dog segments to reallocate capital to more promising areas of the business.

Services in Fragmented, Price-Sensitive Markets

APi Group's presence in fragmented service markets, characterized by fierce competition and limited pricing flexibility, means that any offerings with a small market share in these segments are likely to be considered Dogs. These particular services often struggle with thin profit margins and face significant hurdles in achieving substantial growth or establishing a dominant market position. Consequently, they represent potential candidates for strategic reduction or outright divestiture.

For instance, in the highly fragmented HVAC maintenance sector, where hundreds of local providers compete, APi Group might have a small regional presence. If this segment, for example, represented only 1% of APi Group's total revenue in 2024 and showed a growth rate of less than 2%, it would likely be classified as a Dog. Such a scenario would prompt a review of resource allocation, potentially leading to a decision to exit or consolidate these low-performing service lines to focus on more promising areas of the business.

- Low Market Share: In fragmented service markets, a small share of a large number of competitors means limited influence.

- Price Sensitivity: Intense competition often forces providers to compete on price, squeezing profit margins.

- Limited Growth Potential: Without a strong competitive advantage, these services may struggle to expand their customer base or revenue.

- Strategic Review: Companies often consider divesting or minimizing Dog assets to reallocate capital to Stars or Question Marks.

Dogs within APi Group's portfolio represent business units operating in slow-growth markets with low market share. These segments, like certain legacy industrial services within Specialty Services that saw a 13.5% revenue decrease in 2024, often consume resources without generating substantial returns. APi Group has actively divested such units, exemplified by the 2023 sale of its Safety Services segment, to reallocate capital to more promising growth areas and improve overall financial performance.

These "Dogs" are characterized by high fixed costs and low asset utilization, such as a specialized fabrication unit operating at 40% capacity in 2024. Such segments are cash traps, requiring ongoing maintenance but failing to generate sufficient cash flow, making them prime candidates for divestment or restructuring. This strategic pruning allows APi Group to focus resources on higher-potential segments.

In fragmented markets, like HVAC maintenance where APi Group might hold a mere 1% market share in 2024 with less than 2% growth, these offerings are also classified as Dogs. The intense competition limits pricing power and growth potential, prompting a strategic review to potentially exit or consolidate these underperforming lines.

| Segment Example | BCG Category | 2024 Performance Indicators | Rationale for Classification |

|---|---|---|---|

| Legacy Industrial Services (Specialty Services) | Dog | -13.5% Revenue Decrease, -9.6% Organic Decline | Low market share in slow-growing sub-markets, consuming resources without significant returns. |

| Specialized Fabrication Unit | Dog | 40% Asset Utilization, High Fixed Costs | Low utilization due to reduced project demand, leading to cash drain and profitability challenges. |

| Fragmented HVAC Maintenance (Regional Presence) | Dog | 1% Total Revenue Contribution, <2% Growth | Small market share in a highly competitive and price-sensitive market with limited growth potential. |

Question Marks

APi Group's recent acquisitions, like Endeavor Fire Protection in November 2024 and Elevated Facility Services in April 2024, represent significant additions to its portfolio. These businesses are positioned in expanding sectors, such as the vital fire protection industry, which saw global market growth projected to reach over $250 billion by 2025.

These newly acquired entities likely fall into the question mark category of the BCG matrix. While operating in high-growth markets, their current market share within APi Group's broader structure is still nascent. Significant investment will be crucial for their successful integration and to foster scalability, aiming to transform them into future stars.

APi Group's strategic realignment of its HVAC business from Safety Services to Specialty Services, effective January 2025, signals a significant shift. This move suggests APi may be viewing its HVAC operations as a Question Mark within its portfolio, indicating a sector with high growth potential that requires substantial investment to capture market share.

The company likely aims to leverage this new positioning to aggressively expand its presence in the Specialty Services market. While HVAC services historically resided in Safety Services, the reclassification points to a deliberate strategy to foster growth and innovation within a different operational framework, potentially unlocking new opportunities and synergies.

This repositioning as a Question Mark implies APi Group sees a path to significant future success for its HVAC segment, despite the inherent uncertainties and capital requirements associated with developing new markets or strengthening existing ones. For instance, the North American HVAC market alone was valued at approximately $130 billion in 2024 and is projected to grow, presenting a fertile ground for APi's renewed focus.

APi Group is actively integrating advanced technologies like AI and IoT, boasting 50 million connected devices. This strong foundation sets the stage for future growth, but the full monetization and widespread application of these technologies within their service offerings are still developing.

While these high-growth areas hold significant potential, they currently represent a relatively low market share for APi Group. Substantial investment in research, development, and market adoption will be crucial to transform these nascent technologies into future Stars within the BCG matrix.

Expansion into New Geographic Markets

Expanding into new geographic markets, particularly in high-growth regions like Asia-Pacific, where APi Group currently holds a low market share, would position these ventures as Stars within the BCG Matrix. This strategic move requires substantial investment to establish a foothold and capture market share in these developing territories.

The global fire protection market, for instance, is projected to reach approximately $130 billion by 2028, with Asia-Pacific expected to be a significant driver of this growth. APi Group's efforts in these nascent markets would necessitate considerable capital outlay for building brand awareness, establishing distribution networks, and potentially acquiring local players to accelerate penetration.

- Market Potential: Asia-Pacific fire protection market expected to grow at a CAGR of over 7% through 2028.

- Investment Needs: Significant capital required for market entry, brand building, and operational setup.

- Strategic Objective: To capture a substantial share in these high-growth, currently low-penetration markets.

- BCG Classification: These expansion initiatives would be classified as Stars, demanding ongoing investment for sustained growth.

Niche Specialty Fabrication Services

Niche specialty fabrication services within APi Group's Specialty Services segment could represent question marks on the BCG Matrix. These are areas with potential growth in emerging industrial sectors, but where APi's current market penetration is limited.

For example, advanced composite fabrication for aerospace or specialized medical device manufacturing might fall into this category. While these sectors are expanding, APi's existing footprint might be small, requiring strategic investment to capture market share.

- Potential for High Growth: Niche fabrication services often cater to rapidly evolving industries like renewable energy components or advanced electronics, which are projected for significant expansion.

- Low Current Market Share: APi's involvement in these specific areas might be nascent, meaning they haven't yet established a dominant position.

- Strategic Investment Required: To move these services from question marks to stars, APi would need to allocate resources for R&D, capacity expansion, and targeted marketing.

- Risk of Divestment: If the investment doesn't yield substantial market share gains, these niche services could be considered for divestment to focus on more profitable ventures.

Question Marks in APi Group's portfolio represent ventures in high-growth markets where the company currently holds a low market share. These areas, such as newly acquired businesses or emerging specialty services, demand significant investment to build market presence and achieve scalability. The strategic goal is to nurture these Question Marks into Stars, transforming potential into dominant market positions.

The HVAC business reclassification and expansion into new geographic markets exemplify APi's approach to Question Marks. These initiatives, while requiring substantial capital outlay, are targeted at capitalizing on robust market growth, such as the projected expansion of the North American HVAC sector, valued at approximately $130 billion in 2024.

APi's investment in advanced technologies like AI and IoT, with 50 million connected devices, also fits the Question Mark profile. The potential for these technologies is immense, but their full monetization and market penetration are still developing, requiring continued investment to solidify their position.

Niche specialty fabrication services, particularly in rapidly expanding sectors, also fall into the Question Mark category. These areas offer high growth potential but necessitate strategic resource allocation for R&D and capacity expansion to move from low market share to a more dominant position.

| Business Area | Market Growth Potential | Current Market Share | Investment Requirement | BCG Classification |

|---|---|---|---|---|

| Acquired Fire Protection Businesses | High (Global market > $250B by 2025) | Low | High | Question Mark |

| HVAC Services (Specialty Services) | High (NA Market ~$130B in 2024) | Low to Moderate | High | Question Mark |

| Advanced Technologies (AI/IoT) | High | Low | High | Question Mark |

| Niche Specialty Fabrication | High (Emerging Industrial Sectors) | Low | High | Question Mark |

BCG Matrix Data Sources

Our API Group BCG Matrix is built using a blend of internal API usage data, market adoption rates, and competitive landscape analysis, ensuring a comprehensive view of each API's strategic position.