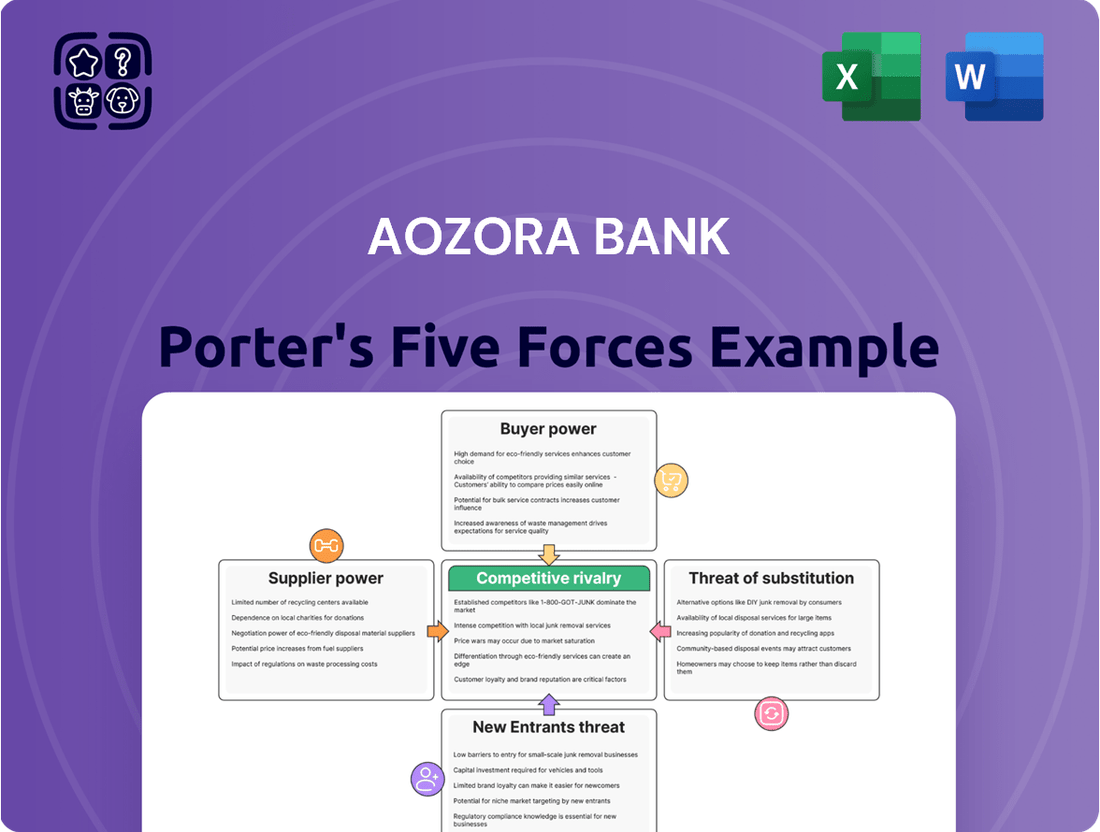

Aozora Bank Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aozora Bank Bundle

Aozora Bank navigates a competitive landscape shaped by moderate buyer power and the persistent threat of new entrants, particularly from agile fintech firms. The bank also faces substantial pressure from substitutes, such as digital payment platforms, and the influence of suppliers in the technology sector.

The complete report reveals the real forces shaping Aozora Bank’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

In the banking industry, Aozora Bank relies on suppliers for crucial services like financial technology, data analytics, and IT infrastructure. A concentrated supplier base, where a few dominant firms control these essential inputs, significantly amplifies their bargaining power.

For instance, if a limited number of fintech providers offer specialized AI-driven fraud detection systems, they can command higher prices and dictate contract terms to banks like Aozora. In 2024, the global market for financial technology solutions was valued at over $1.2 trillion, with a significant portion driven by a handful of large, established players, underscoring the potential leverage they hold over individual financial institutions.

Switching costs for technology are a significant factor for Aozora Bank, particularly concerning its core banking systems and data platforms. The expense and operational upheaval involved in migrating to new technological providers are substantial, often running into millions of dollars and requiring extensive retraining and system integration.

These high switching costs effectively increase the bargaining power of Aozora Bank's existing IT suppliers. For instance, a major core banking system upgrade could cost a financial institution tens of millions, if not hundreds of millions, of dollars, as seen in industry trends. This financial commitment makes it difficult for Aozora Bank to easily switch vendors, giving current providers leverage in contract negotiations and pricing discussions.

Suppliers providing highly specialized or proprietary financial software, crucial cybersecurity solutions, or unique data feeds essential for Aozora Bank's operations would command significant bargaining power. The absence of readily available substitutes for these critical services means Aozora Bank would have limited options, potentially driving up costs and impacting service delivery.

Regulatory Compliance and Expertise

Suppliers offering critical regulatory compliance solutions, such as Anti-Money Laundering (AML) and Counter-Financing of Terrorism (CFT) software, wield considerable bargaining power. Aozora Bank’s continued operation is directly contingent on meeting stringent Japanese financial regulations, making these specialized services indispensable.

Furthermore, vendors possessing deep expertise in navigating Japan's intricate financial regulatory landscape are in a strong position. Their specialized knowledge is not easily replicated, allowing them to command favorable terms for services essential for Aozora Bank's ongoing compliance efforts.

- Regulatory Expertise: Suppliers with proven track records in Japanese financial compliance are highly valued.

- Dependence on Compliance: Aozora Bank’s operational license relies heavily on adhering to regulations like those from the Financial Services Agency (FSA).

- Specialized Solutions: Providers of AML/CFT and data privacy platforms are crucial due to the increasing complexity and penalties associated with non-compliance.

Availability of Substitute Suppliers

The availability of substitute suppliers significantly influences a bank's bargaining power. For common operational needs like office supplies or standard IT hardware, Aozora Bank likely benefits from a broad market with many providers, diminishing the leverage of any single supplier. For instance, the global office supply market is highly competitive, with major players and numerous smaller distributors ensuring competitive pricing.

However, the landscape shifts dramatically when considering specialized financial services technology. The market for advanced trading platforms, core banking software, or sophisticated cybersecurity solutions is often concentrated, with fewer providers capable of meeting Aozora Bank's specific requirements. This scarcity of alternatives empowers these specialized technology suppliers, as switching costs can be substantial and the expertise required is not easily replicated.

In 2024, the demand for advanced FinTech solutions, particularly in areas like AI-driven analytics and blockchain integration, has intensified. This has led to increased pricing power for the limited number of firms at the forefront of these technologies. For Aozora Bank, this means that while general suppliers have little sway, providers of critical, cutting-edge financial technology can exert considerable influence.

- High competition in generic supply markets limits supplier leverage.

- Limited providers for specialized FinTech increase supplier bargaining power.

- Switching costs for advanced financial technology are a significant factor.

- 2024 trends show increased demand and pricing power for niche technology suppliers.

Suppliers of highly specialized financial technology and regulatory compliance solutions hold significant bargaining power over Aozora Bank. This leverage stems from the limited availability of substitutes for these critical services and the substantial switching costs involved in changing providers. In 2024, the global FinTech market, valued at over $1.2 trillion, saw concentrated power among key players in areas like AI and cybersecurity, directly impacting banks.

Aozora Bank's dependence on specialized software for AML/CFT and data privacy, coupled with the need for deep expertise in Japan's complex financial regulations, further amplifies supplier influence. Vendors with proven compliance track records and unique technological capabilities can command premium pricing and dictate terms, as switching such systems can cost tens to hundreds of millions of dollars.

| Supplier Type | Bargaining Power | Reason | Example | 2024 Market Context |

| General IT Hardware | Low | High competition, many providers | Standard servers, office PCs | Highly competitive global market |

| Core Banking Software | High | Few specialized providers, high switching costs | Integrated financial transaction systems | Concentrated market for advanced solutions |

| FinTech (AI/Cybersecurity) | High | Proprietary technology, critical for operations | AI-driven fraud detection, advanced cybersecurity platforms | Rapid growth with few leading firms; increased pricing power |

| Regulatory Compliance Software | High | Essential for operations, specialized knowledge required | AML/CFT, data privacy platforms | Increasingly complex regulations drive demand and supplier leverage |

What is included in the product

Tailored exclusively for Aozora Bank, this analysis dissects the intensity of rivalry, buyer and supplier power, threat of new entrants and substitutes, offering strategic insights into competitive dynamics.

Effortlessly identify and mitigate competitive threats by visualizing the impact of each Porter's Force on Aozora Bank's market position.

Gain actionable insights into customer bargaining power and the threat of substitutes, enabling proactive strategies to protect Aozora Bank's profitability.

Customers Bargaining Power

Aozora Bank caters to a diverse clientele, including corporations, financial institutions, and high-net-worth individuals. This segmentation means bargaining power isn't uniform across the board.

Larger corporate clients and other financial institutions often wield significant leverage. This is due to the substantial volume of transactions they undertake and their sophisticated understanding of financial products and pricing. For instance, in 2024, large corporate loan volumes can represent a significant portion of a bank's portfolio, giving these clients more room to negotiate terms.

Customers, particularly corporate clients and high-net-worth individuals, now possess a wealth of information about financial offerings. This enhanced transparency, fueled by digital platforms and readily available comparisons, allows them to scrutinize services from both domestic and international banks. For instance, in 2024, the proliferation of fintech comparison sites has made it easier than ever for businesses to assess loan terms and deposit rates across multiple institutions.

While complex corporate banking relationships can indeed lock customers in, many everyday banking services, like checking accounts and basic savings, have very low switching costs. This means customers can move their money to a different bank with minimal hassle or expense.

The growth of digital banking and innovative fintech companies has made it even easier for consumers to switch. For instance, in 2024, a significant portion of new account openings were initiated online, reflecting the reduced friction in changing financial institutions.

Impact of Interest Rate Environment

In a low-interest-rate environment, customers typically have less incentive to switch banks for marginally better deposit rates, which can diminish their bargaining power. This stability can benefit Aozora Bank by reducing the pressure to offer premium rates to retain deposits.

However, as the Bank of Japan navigates a gradual shift towards higher interest rates, customers, particularly those with substantial deposit balances, are likely to gain increased leverage. They may then feel empowered to negotiate for more favorable terms, such as higher interest yields or reduced fees.

For instance, with the Bank of Japan's policy rate moving from negative territory, even small increases can make deposit switching more attractive. This could translate to customers demanding better returns on their savings, directly impacting Aozora Bank's cost of funds.

- Customer Sensitivity to Rates: In periods of low rates, customer churn due to rate differentials is minimal, strengthening the bank's position.

- Deposit Growth Impact: Higher rates can encourage deposit inflows but also increase the cost of these deposits as customers seek better yields.

- Competitive Landscape: As rates rise, the competitive pressure to offer attractive deposit products intensifies, giving customers more choices and thus more power.

Customer Sophistication and Financial Needs

Customer sophistication significantly influences bargaining power. High-net-worth individuals and corporate clients often possess complex financial requirements, necessitating bespoke solutions. This complexity can translate into greater leverage when negotiating terms with banks like Aozora Bank.

Aozora Bank's strategy to counter this involves offering specialized services. By providing tailored lending, investment banking, and asset management, Aozora aims to foster deeper, more enduring client relationships. For instance, in 2024, Aozora Bank reported a notable increase in its high-net-worth client base, indicating a growing demand for such specialized services.

- Sophisticated Client Needs: High-net-worth and corporate clients demand complex financial products and personalized advice.

- Bargaining Leverage: The need for specialized solutions grants these clients increased power in negotiations with financial institutions.

- Aozora's Mitigation Strategy: Offering specialized lending, investment banking, and asset management services builds client loyalty.

- 2024 Trend: Aozora Bank observed a rise in its high-net-worth segment, highlighting the market's demand for tailored financial solutions.

Customers, especially large corporations and sophisticated individuals, possess considerable bargaining power due to the volume of business they bring and their access to information. In 2024, the ease of comparing financial products online empowers these clients to negotiate better terms, as evidenced by the significant number of new accounts opened digitally, indicating low switching costs for many services.

While Aozora Bank's specialized services for high-net-worth clients in 2024 aim to build loyalty, the general banking market sees customers easily switching for marginally better rates, especially as interest rates begin to rise. This increasing customer sensitivity to rates, coupled with the competitive landscape, amplifies their leverage.

The bargaining power of Aozora Bank's customers is influenced by factors like information access, switching costs, and client sophistication. As interest rates adjust, customers with substantial balances gain more leverage, potentially negotiating for higher yields or lower fees, a trend observable in 2024 as monetary policy shifts.

Aozora Bank's focus on specialized services for its growing high-net-worth segment in 2024 is a direct response to the increased bargaining power of sophisticated clients who demand tailored solutions and are less price-sensitive for complex needs.

| Factor | Impact on Bargaining Power | Aozora's Response/Observation (2024) |

|---|---|---|

| Information Access | Increased | Proliferation of fintech comparison sites |

| Switching Costs (Basic Services) | Low | Ease of online account opening |

| Interest Rate Sensitivity | Growing (as rates rise) | Customers seeking better yields on deposits |

| Client Sophistication | High | Demand for bespoke financial solutions |

What You See Is What You Get

Aozora Bank Porter's Five Forces Analysis

This preview displays the complete Aozora Bank Porter's Five Forces Analysis, offering a comprehensive examination of the competitive landscape. The document you see here is precisely what you will receive immediately after purchase, ensuring no surprises or placeholder content. You'll gain instant access to this professionally formatted analysis, ready for your strategic planning needs.

Rivalry Among Competitors

Aozora Bank faces significant competitive rivalry from Japan's major megabanks, including Mitsubishi UFJ Financial Group (MUFG), Sumitomo Mitsui Financial Group (SMFG), and Mizuho Financial Group. These giants command substantial market share and resources, making it challenging for smaller players like Aozora to compete effectively across all segments.

As of early 2024, these megabanks continue to dominate the Japanese financial landscape. For instance, MUFG reported total assets exceeding ¥320 trillion in fiscal year 2023, showcasing their immense scale. This sheer size allows them to offer a broader range of services, maintain extensive branch networks, and invest heavily in technology, creating a high barrier to entry and intense pressure on Aozora Bank's market position.

The banking landscape is in a fierce race for digital supremacy. Traditional institutions and nimble fintech startups are pouring billions into upgrading their services, focusing on AI and user-friendly mobile apps. This digital arms race means customers get better, faster banking, putting pressure on established players like Aozora Bank to keep pace. For instance, Aozora Bank's own GMO Aozora Net Bank initiative highlights this strategic shift towards digital innovation.

Japan's prolonged period of low interest rates has significantly squeezed banks like Aozora, forcing them to seek income beyond traditional lending. This means net interest margins, the difference between interest earned on loans and interest paid on deposits, have been under constant pressure. For instance, in the fiscal year ending March 2024, the Bank of Japan maintained its negative interest rate policy for much of the period, impacting bank profitability.

This profitability challenge fuels intense competition among Japanese banks. They are increasingly competing for fee-based income from services like wealth management, investment banking, and transaction fees. Furthermore, many are looking overseas for growth opportunities, intensifying rivalry not just domestically but on a global scale as they seek higher yields and diversified revenue streams.

Differentiated Offerings and Niche Focus

Aozora Bank's competitive rivalry is shaped by its specialized approach. By concentrating on commercial banking, financial institutions, and high-net-worth individuals, it carves out specific market segments. This focus includes lending, investment banking, and asset management services.

The bank's 'Strategic Investments Business' and venture debt offerings highlight a deliberate targeting of particular niches. While this strategy may lessen direct competition with large retail banks, it intensifies rivalry within its chosen specialized areas.

- Niche Focus: Aozora Bank targets corporations, financial institutions, and high-net-worth individuals, offering specialized lending, investment banking, and asset management.

- Strategic Investments: The bank's 'Strategic Investments Business' and venture debt services indicate a deliberate focus on specific market segments, intensifying competition within those niches.

- Reduced Broad Competition: This specialized approach generally reduces direct rivalry with banks that offer a wider range of retail banking services.

Regulatory Landscape and Market Consolidation

The regulatory environment in Japan, while generally stable, can influence competitive dynamics. Efforts to foster fintech and new entrants exist, but the entrenched nature of the Japanese banking sector, coupled with potential consolidation among regional banks, can temper competitive intensity.

For instance, the Financial Services Agency (FSA) in Japan oversees the banking sector, with regulations often emphasizing stability and consumer protection. While the FSA has been supportive of digital transformation, the capital requirements and compliance burdens can still present hurdles for smaller, newer players seeking to challenge established institutions like Aozora Bank.

Market consolidation is a recurring theme. As of early 2024, discussions around mergers and acquisitions among regional financial institutions continue, driven by factors like declining populations in certain areas and the need for greater scale. This trend could lead to fewer, larger regional banks, potentially altering the competitive landscape for national players.

- Regulatory Stability: Japan's banking regulations, overseen by the FSA, generally promote stability but can also create barriers to entry for new competitors.

- Fintech Initiatives: While the FSA encourages fintech innovation, the established infrastructure and compliance demands of the banking sector can slow the pace of disruption.

- Consolidation Potential: The ongoing trend of potential mergers among regional banks in Japan could reshape the competitive landscape, possibly leading to fewer, larger regional players.

Aozora Bank faces intense rivalry from Japan's megabanks, which possess vast resources and market dominance, as evidenced by MUFG's ¥320 trillion in assets as of fiscal year 2023. This scale allows them to invest heavily in technology and offer a wider service range, intensifying pressure on Aozora. The ongoing digital transformation across the sector, with significant investments in AI and mobile banking, further escalates competition, compelling all players, including Aozora, to innovate rapidly to retain customers.

The competitive rivalry is further shaped by Aozora's strategic focus on specific niches like commercial banking and high-net-worth individuals, rather than broad retail services. While this specialization reduces direct competition with larger, diversified banks, it heightens rivalry within its chosen specialized segments, such as venture debt and strategic investments.

A table illustrating the competitive landscape might highlight key players and their asset sizes, demonstrating the scale difference.

| Financial Institution | Total Assets (Approx. FY 2023) | Primary Focus |

|---|---|---|

| MUFG | ¥320+ trillion | Full-service banking, global operations |

| SMFG | ¥290+ trillion | Full-service banking, global operations |

| Mizuho Financial Group | ¥230+ trillion | Full-service banking, global operations |

| Aozora Bank | ¥10+ trillion | Commercial banking, financial institutions, high-net-worth individuals |

SSubstitutes Threaten

Fintech companies present a significant threat of substitutes for Aozora Bank. These innovative firms, like those offering peer-to-peer lending or digital payment solutions, directly challenge traditional banking services. For instance, the global fintech market was valued at approximately $111.7 billion in 2023 and is projected to grow substantially, indicating a strong and expanding alternative to conventional banking.

These fintech alternatives often appeal to consumers by providing enhanced convenience, reduced costs, or highly specialized financial tools. For example, digital payment platforms can offer faster and cheaper cross-border transactions compared to traditional bank wire transfers. This competitive edge means customers might opt for these fintech services, diverting business away from Aozora Bank's established product lines.

Large corporations and major financial institutions, Aozora Bank's core clientele, possess the ability to raise capital directly from the market. This can be achieved through issuing corporate bonds, selling shares on equity markets, or engaging in private placements, effectively circumventing the need for traditional bank loans. This direct access to funding significantly diminishes their dependence on banks like Aozora, presenting a potent substitute for conventional lending products.

The increasing prevalence of non-bank financial intermediaries (NBFIs) presents a significant threat of substitution for traditional banks like Aozora. Investment funds, private equity firms, and other NBFIs are becoming more involved in lending and investment, providing alternative avenues for capital that bypass conventional banking channels.

These NBFIs are not only offering direct competition in lending but also innovating financial products and services. For instance, peer-to-peer lending platforms and crowdfunding initiatives have gained considerable traction, especially among small and medium-sized enterprises seeking funding. In 2024, the global alternative lending market was projected to reach hundreds of billions of dollars, demonstrating the scale of this shift.

Internal Financing and Cash Management by Corporations

The threat of substitutes for traditional banking services, particularly for large corporations, is significant. Many well-established companies possess robust internal cash flows and advanced treasury management systems. This allows them to self-finance projects and manage liquidity without needing extensive external bank support, thereby reducing their reliance on certain banking products.

For instance, in 2024, many large corporations continued to optimize their cash management strategies. Companies with strong balance sheets, like those in the technology or energy sectors, often maintain substantial cash reserves. This internal funding capability serves as a direct substitute for services like short-term loans or working capital financing that banks typically offer.

- Internal Cash Flows: Corporations with substantial retained earnings can fund operations and investments internally, bypassing the need for external debt.

- Sophisticated Treasury Management: Advanced treasury systems enable efficient cash pooling, investment of surplus funds, and optimized working capital, reducing reliance on bank liquidity management.

- Alternative Funding Sources: Access to capital markets for issuing commercial paper or corporate bonds provides substitutes for bank credit lines.

- Fintech Solutions: Emerging financial technology platforms offer alternative payment, lending, and investment solutions that can substitute for some traditional banking functions.

Digital Currencies and Blockchain-based Solutions

The rise of digital currencies and blockchain technology presents a significant threat of substitution for traditional banking services. The potential adoption of central bank digital currencies (CBDCs) and stablecoins, alongside the growing use of blockchain for transactions, could fundamentally alter how payments, remittances, and lending operate. For instance, by mid-2024, several countries were actively exploring or piloting CBDCs, with China’s digital yuan already seeing significant transaction volumes in pilot programs, indicating a tangible shift away from traditional payment rails.

These innovations offer alternative mechanisms that could bypass established banking infrastructure, potentially reducing reliance on Aozora Bank for certain financial activities. For example, blockchain-based remittance services are already demonstrating cost and speed advantages over traditional channels. In 2023, the global remittance market saw increasing adoption of crypto-based solutions, with some platforms reporting transaction fees as low as 1% compared to the 6-7% often charged by traditional money transfer services.

- Digital Currencies as Payment Alternatives: CBDCs and stablecoins could offer faster, cheaper, and more accessible payment solutions, directly competing with banks' payment processing services.

- Blockchain for Lending and Borrowing: Decentralized finance (DeFi) platforms built on blockchain technology provide alternative avenues for lending and borrowing, potentially disintermediating traditional credit facilities.

- Reduced Need for Intermediaries: Blockchain's peer-to-peer nature can streamline transactions, reducing the need for banks as intermediaries in various financial operations.

Fintech companies and digital currencies represent significant substitutes for traditional banking services offered by Aozora Bank. These alternatives often provide greater convenience and lower costs, diverting customers from conventional channels. For instance, by mid-2024, several countries were actively piloting Central Bank Digital Currencies (CBDCs), with China's digital yuan showing substantial transaction volumes, indicating a tangible shift in payment mechanisms.

Furthermore, non-bank financial intermediaries (NBFIs) are increasingly offering lending and investment solutions that bypass traditional banking. The global alternative lending market was projected to reach hundreds of billions of dollars in 2024, highlighting the scale of these competitive forces.

Large corporations, a key demographic for Aozora Bank, can also act as substitutes by leveraging internal cash flows and accessing capital markets directly through bond issuances or equity sales, thereby reducing their reliance on bank loans.

| Substitute Category | Key Characteristics | Impact on Aozora Bank | 2024 Market Trend/Data Point |

|---|---|---|---|

| Fintech Platforms | Digital payments, P2P lending, robo-advisors | Reduced transaction fees, disintermediation of lending | Global fintech market growth projected to continue, with digital payments a major driver. |

| Digital Currencies & Blockchain | CBDCs, stablecoins, DeFi | Potential bypass of traditional payment rails, alternative credit facilities | Increased exploration and piloting of CBDCs by multiple nations in 2024. |

| Capital Markets Access | Corporate bonds, equity issuance, commercial paper | Reduced demand for bank loans and credit lines from large corporations | Strong corporate balance sheets in 2024 allowed many firms to self-finance projects. |

| Non-Bank Financial Intermediaries | Investment funds, private equity, crowdfunding | Competition in lending and investment services | Alternative lending market expansion in 2024, reaching hundreds of billions globally. |

Entrants Threaten

The Japanese banking sector presents formidable regulatory barriers that significantly deter new entrants. Obtaining the necessary licenses, meeting stringent capital adequacy ratios, and adhering to complex legal frameworks require substantial investment and expertise. For instance, as of early 2024, the Bank of Japan continues to enforce rigorous capital requirements, with major banks maintaining Common Equity Tier 1 ratios well above the Basel III minimums, illustrating the high financial threshold.

Establishing a commercial bank like Aozora Bank demands immense capital. Think about the costs for physical branches, advanced IT systems, and ensuring there's always enough cash on hand to meet customer needs. In 2024, regulatory capital requirements, such as Basel III standards, remain stringent, often necessitating billions in initial investment.

This significant financial barrier effectively discourages many aspiring new players. Without substantial backing or a proven track record of raising large sums, entering the banking sector is incredibly challenging. For instance, a new entrant would need to demonstrate robust capital adequacy ratios, a hurdle that filters out less capitalized competitors.

Established Japanese banks, including Aozora Bank, leverage deep-rooted brand loyalty and customer trust built over decades. This makes it incredibly difficult for new entrants to attract and retain customers, as they must overcome the inertia of existing relationships and the perceived security of well-known institutions.

Technological Investment and Infrastructure

New entrants into the banking sector, even with the rise of fintech, face significant hurdles in building and maintaining advanced technological infrastructure. This includes substantial investments in secure digital platforms, robust core banking systems, and sophisticated cybersecurity measures to protect customer data and maintain trust. For instance, a new digital bank might need to allocate hundreds of millions of dollars in its initial years to establish these foundational elements, a cost that can deter many potential competitors.

The technical complexity and ongoing operational costs associated with these systems present a formidable barrier. Maintaining compliance with stringent financial regulations, such as those requiring encrypted data transmission and secure transaction processing, adds another layer of expense and expertise. As of late 2024, the average cost for a mid-sized bank to upgrade its core IT infrastructure can range from $50 million to over $200 million, a clear deterrent for new players aiming to compete with established institutions like Aozora Bank.

- High Capital Outlay: Significant upfront investment is required for secure digital platforms and core banking systems.

- Cybersecurity Demands: Continuous expenditure on advanced cybersecurity is essential to protect against evolving threats.

- Regulatory Compliance: Meeting financial regulations necessitates complex and costly technological solutions.

- Technical Expertise: Access to specialized IT talent is crucial for development and ongoing maintenance.

Niche Market Opportunities and Digital-First Models

Despite significant capital and regulatory hurdles in traditional banking, the threat of new entrants persists, particularly through niche market focus and digital innovation. Companies can bypass some traditional barriers by concentrating on underserved segments or by adopting lean, digital-first strategies that minimize physical infrastructure costs.

Digital banks, such as GMO Aozora Net Bank, exemplify this disruptive potential. Partly owned by Aozora Bank, this entity has successfully attracted deposits by offering intuitive user interfaces and competitive interest rates, demonstrating how technology can lower entry barriers and appeal to a digitally native customer base.

- Niche Market Focus: New players can emerge by targeting specific customer segments, like small businesses or high-net-worth individuals, with specialized products and services.

- Digital-First Models: Online-only banks can operate with significantly lower overhead compared to traditional brick-and-mortar institutions, allowing for more aggressive pricing and product innovation.

- Example: GMO Aozora Net Bank: This digital bank, a partial affiliate of Aozora Bank, has shown success in attracting deposits through user-friendly digital platforms and competitive rates, highlighting the growing influence of digital challengers.

The threat of new entrants in Japan's banking sector, while generally low due to high capital and regulatory barriers, is evolving. Digital-first challengers, leveraging technology to reduce overhead, pose a growing concern. For instance, GMO Aozora Net Bank, a digital entity partly owned by Aozora Bank, has successfully attracted customers with its streamlined digital experience and competitive rates, demonstrating a viable alternative model.

| Factor | Impact on New Entrants | Relevance to Aozora Bank |

|---|---|---|

| Regulatory Hurdles | High; requires substantial capital and licensing. | Aozora Bank benefits from established compliance. |

| Capital Requirements | Extremely high; billions needed for operations. | Aozora Bank meets stringent capital adequacy ratios. |

| Brand Loyalty & Trust | Difficult to overcome; established banks have deep customer relationships. | Aozora Bank leverages decades of customer trust. |

| Technological Infrastructure | Costly to build and maintain secure, advanced systems. | Aozora Bank invests heavily in IT and cybersecurity. |

| Digital Challengers | Emerging threat via niche focus and lower overhead. | Aozora Bank is adapting with digital offerings like GMO Aozora Net Bank. |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Aozora Bank is built upon a foundation of comprehensive data, including the bank's official annual reports, investor relations materials, and filings with the Financial Services Agency (FSA). We also incorporate insights from reputable financial news outlets and industry-specific market research reports to capture the broader competitive landscape.