Aozora Bank Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aozora Bank Bundle

Curious about Aozora Bank's strategic positioning? Our BCG Matrix analysis offers a glimpse into whether their offerings are Stars, Cash Cows, Dogs, or Question Marks. Uncover the full picture and gain actionable insights by purchasing the complete report.

This preview is just the beginning. Get the full BCG Matrix report to uncover detailed quadrant placements, data-backed recommendations, and a roadmap to smart investment and product decisions for Aozora Bank.

The complete BCG Matrix reveals exactly how Aozora Bank is positioned in a fast-evolving market. With quadrant-by-quadrant insights and strategic takeaways, this report is your shortcut to competitive clarity.

Stars

Aozora Bank is actively growing its Strategic Investments Business, which includes activities like LBO financing, structured equity investments, and venture debt. This segment is crucial for supporting clients through different phases of their business journey, from early-stage development to recovery, and is identified as a primary engine for the bank's future expansion, particularly within the Japanese market.

The bank's strategic roadmap, outlined in its Mid-term Plan 'Aozora 2027', underscores a commitment to sustained investment in this business area. This focus is designed to drive sustainable growth and improve overall corporate value.

Aozora Bank is aggressively pursuing digital transformation (DX) initiatives. This includes significant upgrades to its mobile banking platform and the introduction of AI-powered chatbots to improve customer interaction. The bank is also exploring blockchain technology, aiming to streamline operations and reduce costs.

A key objective of these DX efforts is to elevate the customer experience and boost operational efficiency. By the close of fiscal year 2024, Aozora Bank aims to have half of all its transactions conducted digitally. This push towards online transactions underscores their commitment to modernizing financial services.

GMO Aozora Net Bank (GANB) has transformed into a profitable entity and a substantial contributor to Aozora Bank's overall earnings. This digital bank's focus on providing highly convenient services, particularly for small and medium-sized enterprises (SMEs) and startups, has fueled its rapid expansion. By the end of fiscal year 2023, GANB reported a net profit of ¥5.6 billion, a significant increase from the previous year, underscoring its growing importance.

GANB's success is a pivotal element of Aozora Bank's strategic pivot, as emphasized in the 'Aozora 2027' Mid-term Plan. The bank has seen impressive growth in online account openings, reaching over 1.2 million by March 2024. Furthermore, its robust development of banking APIs is fostering innovation and expanding its service ecosystem, positioning it as a key player in the digital banking landscape.

Sustainable Finance

Aozora Bank is making significant strides in sustainable finance, offering a range of products like green loans, social loans, sustainability-linked loans, and Positive Impact Finance. This commitment is backed by a concrete goal: to achieve 1 trillion yen in sustainable financing by fiscal year 2027. The bank is particularly focused on channeling these funds into renewable energy projects and green building initiatives, demonstrating a clear strategy for environmental impact.

The expansion of Aozora Bank's sustainable finance portfolio is driven by new agreements and frameworks, ensuring alignment with international ESG (Environmental, Social, and Governance) principles. This proactive approach positions the bank as a key player in fostering a more sustainable economic future.

- Sustainable Financing Target: 1 trillion yen by FY2027.

- Key Focus Areas: Renewable energy projects and green building finance.

- Product Offerings: Green loans, social loans, sustainability-linked loans, Positive Impact Finance.

- Strategic Alignment: Adherence to global ESG principles through new agreements and frameworks.

Collaboration with Daiwa Securities Group

Aozora Bank's strategic capital and business alliance with Daiwa Securities Group is demonstrating robust progress, with expectations of significant synergy realization. This partnership is particularly focused on enhancing corporate finance services and expanding asset management capabilities.

The collaboration is designed to harness Daiwa Securities' extensive client network and Aozora Bank's specialized skills in structured finance and startup investments. This synergy is poised to bolster their collective market competitiveness and unlock new avenues for business growth.

- Synergy Focus: Corporate finance and asset management are key areas targeted for synergy maximization.

- Leveraging Strengths: Daiwa's client base and Aozora's structured finance/startup investment expertise are being combined.

- Objective: To enhance overall competitiveness and broaden business opportunities for both entities.

- Progress Indicator: The alliance is described as progressing favorably, suggesting positive momentum in integration and joint initiatives.

Stars represent business units with high market share in high-growth markets. For Aozora Bank, its Strategic Investments Business, particularly its venture debt and structured equity investments, can be viewed as a potential Star. This segment is identified as a primary engine for future expansion, especially within the dynamic Japanese market, indicating high growth potential.

The bank's aggressive digital transformation initiatives, especially through GMO Aozora Net Bank (GANB), also position it strongly. GANB's profitability and rapid expansion, fueled by serving SMEs and startups, demonstrate its success in a growing digital financial services sector. By March 2024, GANB's online account openings surpassed 1.2 million, reflecting strong market penetration in a high-growth area.

Aozora Bank's commitment to sustainable finance, aiming for 1 trillion yen by FY2027, targets areas like renewable energy, which are experiencing significant growth. This strategic focus on ESG-aligned financing, coupled with new agreements and frameworks, places it in a high-growth, high-potential market segment.

What is included in the product

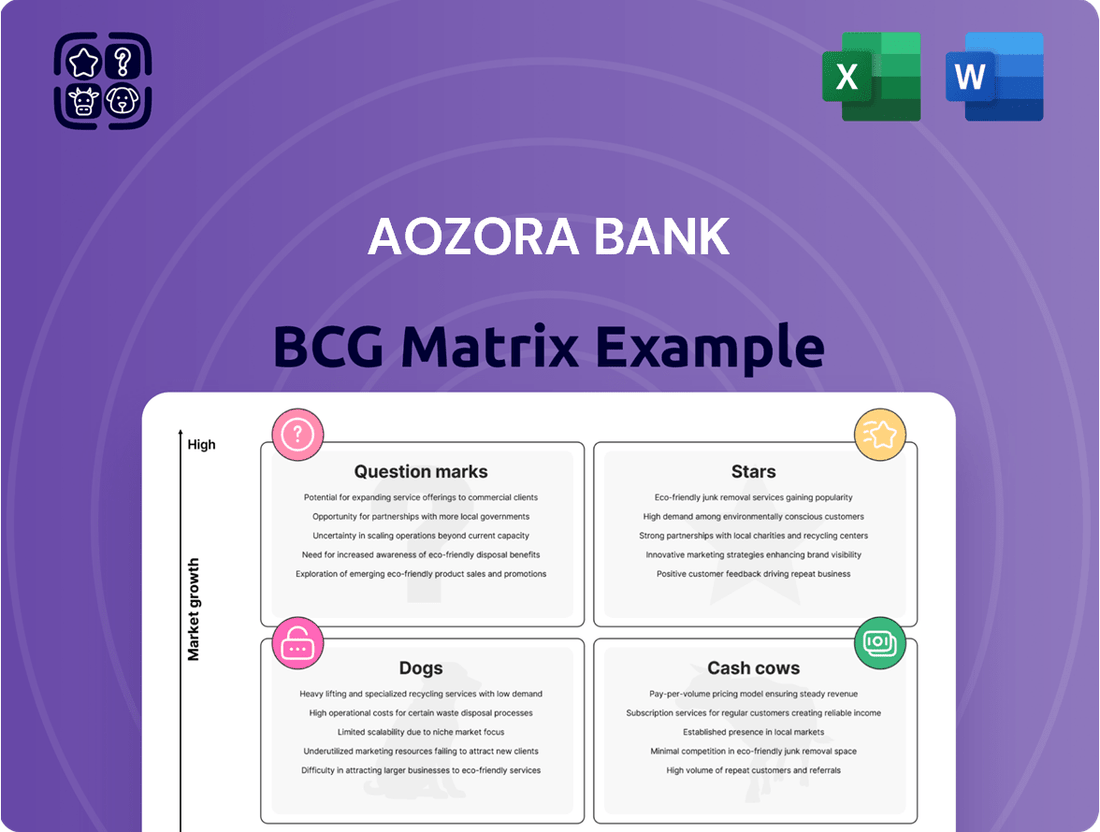

The Aozora Bank BCG Matrix provides a strategic overview of its business units, categorizing them as Stars, Cash Cows, Question Marks, and Dogs to guide investment decisions.

Aozora Bank's BCG Matrix offers a clear, one-page overview, simplifying complex business unit analysis for strategic decision-making.

Cash Cows

Aozora Bank's corporate lending services are a robust cash cow, representing a substantial 65% of its total sales in fiscal year 2024. This strong performance is driven by consistent demand for loans across a diverse range of industries, directly contributing to a significant uptick in net interest income.

The bank's core corporate lending business generates a stable and considerable cash flow, underscoring its position as a reliable revenue generator. This segment's dominance highlights Aozora Bank's established strength in serving the business sector.

Securities investment played a crucial role in Aozora Bank's financial performance for FY2024, acting as a substantial revenue generator alongside its corporate lending activities. The bank's strategic approach to managing its investment portfolio, which included actively addressing unrealized losses, was instrumental in ensuring a consistent flow of income.

Aozora Bank's established retail banking services, focusing on traditional offerings like deposits and loans, act as significant cash cows. These mature services benefit from a wide, loyal customer base and a strong, established market share, ensuring a steady stream of revenue despite the bank's investments in newer digital ventures.

In fiscal year 2023, Aozora Bank reported total deposits of approximately ¥7.2 trillion, underscoring the substantial scale and stability of its traditional retail banking operations. This consistent inflow of funds from a broad customer base fuels the bank's ability to invest in growth areas.

Real Estate Finance Group (Domestic)

Aozora Bank's Real Estate Finance Group (Domestic) functions as a cash cow within its portfolio. This division leverages a substantial history in Japanese real estate, focusing on non-recourse loans and equity investments. The mature nature of this market, characterized by consistent demand, allows the group to generate predictable and substantial cash flows, underpinned by its specialized knowledge.

The group’s established presence in domestic real estate finance is a key strength. In 2024, the Japanese real estate market continued to show resilience, with Tokyo’s prime office rents remaining stable. Aozora's deep understanding of these dynamics allows for optimized risk management and consistent profitability.

- Stable Revenue Streams: The group benefits from recurring income through interest payments on its loan portfolio and rental income from equity investments.

- Mature Market Expertise: Decades of experience in the Japanese real estate sector enable efficient deal sourcing and asset management.

- Significant Cash Generation: The division consistently contributes strong, reliable cash flow to the bank, supporting other business areas.

- Low Growth, High Share: While the domestic real estate market is mature and unlikely to experience rapid expansion, Aozora's established position gives it a high market share, making it a reliable cash generator.

Fee Income from LBO Financing

Aozora Bank's fee income from leveraged buyout (LBO) financing has seen a notable uptick. This growth is largely attributed to increased merger and acquisition (M&A) activity, spurred by ongoing corporate governance reforms in Japan.

The bank has successfully carved out a significant niche in the M&A landscape, leveraging its expertise in LBO financing and other structured finance solutions. This strategic focus allows Aozora Bank to command high profit margins within this specialized segment of the financial market.

- Increased M&A Activity: Driven by corporate governance reforms, M&A transactions requiring LBO financing have expanded.

- High Profitability: LBO financing and structured finance operations yield substantial profit margins for Aozora Bank.

- Market Position: Aozora Bank is recognized as a key facilitator in the M&A market through its LBO financing capabilities.

Aozora Bank's corporate lending, retail banking, securities investments, and real estate finance all function as significant cash cows. These segments benefit from stable demand, established market positions, and consistent revenue generation. For instance, corporate lending represented 65% of total sales in FY2024, and total deposits reached ¥7.2 trillion in FY2023, highlighting their robust nature.

| Business Segment | Role in BCG Matrix | Key Financial Indicators (FY2024 unless noted) | Notes |

|---|---|---|---|

| Corporate Lending | Cash Cow | 65% of total sales; significant net interest income | Stable demand across diverse industries |

| Retail Banking | Cash Cow | ¥7.2 trillion in total deposits (FY2023) | Wide, loyal customer base; strong market share |

| Securities Investment | Cash Cow | Substantial revenue generator; consistent income flow | Strategic portfolio management |

| Real Estate Finance (Domestic) | Cash Cow | Predictable and substantial cash flows | Leverages deep Japanese real estate market expertise |

| Leveraged Buyout (LBO) Financing | Potential Cash Cow/Star | Notable uptick in fee income; high profit margins | Driven by increased M&A activity and corporate governance reforms |

Delivered as Shown

Aozora Bank BCG Matrix

The Aozora Bank BCG Matrix preview you are currently viewing is the exact, fully formatted document you will receive immediately after purchase. This comprehensive report is designed to offer clear strategic insights into Aozora Bank's business units, presented without any watermarks or demo content. You can be confident that the analysis and presentation style will be precisely as displayed, ready for immediate use in your strategic planning or client presentations.

Dogs

Aozora Bank's Overseas Office Loans in the U.S. represent a classic 'dog' in the BCG matrix. The bank experienced substantial losses, with its ordinary income falling by 83% to ¥10.2 billion in FY2023, largely due to provisions for bad loans related to U.S. commercial real estate, especially office properties. This segment clearly demonstrates low market share and low growth potential, acting as a significant drain on resources.

The bank has been actively working to reduce its exposure to these troubled U.S. office loan segments. In FY2023, Aozora Bank wrote off approximately ¥54.7 billion in loans, with a significant portion attributed to its U.S. commercial real estate portfolio. This strategic divestment aims to mitigate further financial damage and reallocate capital to more promising areas.

Aozora Bank's traditional international business, characterized by general overseas lending in less differentiated markets, could be classified as a 'dog' in the BCG matrix. This is especially true if these operations haven't secured substantial market share or experienced robust growth. For instance, while specific 2024 figures for Aozora's general overseas lending are not publicly detailed, the broader trend in Japanese banking has seen a cautious approach to expanding in highly competitive international segments without a clear competitive advantage.

Aozora Bank is actively working to reposition its balance sheet by addressing non-core, legacy assets. This includes managing foreign currency securities portfolios that have experienced unrealized losses. These assets, though being managed to achieve zero net risk, are a result of past investments that haven't yielded optimal returns, necessitating considerable effort to mitigate their adverse effects.

Outdated or Underutilized Branch Network

Traditional physical branch networks, if not strategically adapted, can become underperforming assets in the banking sector. For Aozora Bank, this might manifest as a 'dog' if its extensive physical footprint isn't effectively leveraged alongside its digital offerings. As of late 2024, the banking industry continues to see a significant shift towards digital channels, with customer interactions increasingly occurring online or via mobile apps. This trend puts pressure on the return on investment for physical branches that are underutilized or not integrated into a broader omni-channel strategy.

Aozora Bank's stated commitment to digital transformation, highlighted by its BANK™ app, indicates a strategic pivot. This focus suggests a potential de-emphasis on traditional branch reliance, positioning older, less digitized physical networks as potential 'dogs' within its portfolio. While specific data on Aozora's branch utilization versus digital engagement isn't publicly detailed in a way that directly maps to a BCG matrix, the broader industry trend is clear: banks are re-evaluating their physical presence to align with evolving customer behavior.

- Digital Adoption Growth: In 2023, Japanese banks reported a continued rise in digital transaction volumes, with mobile banking usage seeing double-digit percentage increases year-over-year.

- Branch Network Re-evaluation: Many financial institutions globally, including those in Japan, have been consolidating or repurposing branches, recognizing that a large, traditional network can be a drag on profitability if not optimized for the digital age.

- Customer Preference Shift: Surveys from 2024 indicate that a majority of retail banking customers prefer digital self-service for routine transactions, reserving branch visits for more complex needs or advisory services.

Highly Competitive, Low-Margin Retail Investment Products

Highly Competitive, Low-Margin Retail Investment Products, often found in the question mark quadrant of the BCG matrix, represent a challenge for Aozora Bank. These products, like basic savings accounts or simple mutual funds, face intense competition from numerous financial institutions, leading to slim profit margins. For instance, in 2024, the average expense ratio for actively managed equity funds in Japan remained around 1.0%, a figure that can significantly eat into returns for both the investor and the bank, especially with low asset under management.

Aozora Bank's strategy to address these products involves enhancing their features and actively seeking customer feedback. This approach aims to differentiate these offerings and potentially increase their market share. By improving product appeal, the bank hopes to move these investments from a low-growth, low-market share position to one with higher potential. For example, a focus on digital integration and personalized advice for these products could be a key differentiator.

- Low Profitability: Intense competition in retail investment products often drives down profit margins for financial institutions like Aozora Bank.

- Market Share Struggles: Standardized offerings may find it difficult to capture significant market share against more specialized or attractively priced alternatives.

- Strategic Enhancement: Aozora Bank is working on improving these products through feature upgrades and customer-centric initiatives.

- Customer Feedback Focus: Initiatives to gather and act on customer feedback are crucial for refining and repositioning these less competitive investment options.

Aozora Bank's U.S. overseas office loans are a prime example of a 'dog' in the BCG matrix, characterized by low market share and minimal growth potential. The bank incurred significant losses, with ordinary income dropping 83% to ¥10.2 billion in FY2023 due to provisions for bad loans in U.S. commercial real estate, particularly office properties. This segment represents a considerable drain on the bank's resources.

To address this, Aozora Bank has actively reduced its exposure to these troubled U.S. office loan segments. In FY2023, the bank wrote off approximately ¥54.7 billion in loans, with a substantial portion linked to its U.S. commercial real estate portfolio. This strategic divestment is designed to curb further financial damage and reallocate capital to more promising ventures.

The bank's traditional international business, encompassing general overseas lending in less differentiated markets, can also be viewed as a 'dog'. If these operations have not achieved significant market share or robust growth, they fall into this category. While specific 2024 figures for Aozora's general overseas lending are not publicly detailed, Japanese banks have generally adopted a cautious stance in highly competitive international markets without a clear competitive edge.

Aozora Bank is actively working to reposition its balance sheet by managing non-core, legacy assets, including foreign currency securities portfolios that have experienced unrealized losses. Although these assets are being managed to achieve zero net risk, they stem from past investments that did not yield optimal returns, requiring considerable effort to mitigate their negative impact.

Question Marks

Aozora Bank is strategically boosting its fintech investments, targeting 50% of all transactions to be digital by the close of fiscal year 2024. This aggressive push into new digital banking capabilities signifies a commitment to innovation and customer convenience.

These developing digital offerings represent high-growth potential but are still in the process of capturing significant market share. The bank's substantial investment in these areas is crucial for scaling operations and ensuring broad customer adoption.

Aozora Bank is making a significant move into the burgeoning venture debt market in Japan, launching what is recognized as the nation's inaugural venture debt fund. This strategic initiative underscores the bank's commitment to fostering startup growth through a blend of equity investments and specialized debt financing, aiming to capture a substantial share of this high-potential sector.

While venture debt represents a rapidly expanding market, Aozora Bank's presence in this relatively new domain is still in its early stages. To elevate its market share from a nascent position to a dominant 'star' category within the BCG framework, the bank will need to channel considerable investment and implement robust strategic cultivation efforts.

Aozora Bank's historical international expansion, though encountering some headwinds like U.S. office loan challenges, presents a clear opportunity for strategic re-engagement in emerging overseas markets. Focusing on regions like Asia, where market share is currently low but growth potential is high, could be a significant driver for future revenue.

For instance, by mid-2024, many Asian economies were showing robust GDP growth projections, with countries like Vietnam and Indonesia demonstrating particular strength. Aozora Bank could leverage its financial expertise to tap into these expanding economies, potentially through targeted lending or strategic alliances with local financial institutions to navigate regulatory landscapes and build market presence.

Specialized ESG Framework Loans to New Customer Segments

Aozora Bank is actively expanding its Aozora Positive Impact Finance and ESG Framework Loans to a broader range of corporate customers and industries. This strategic move aims to tap into the growing demand for sustainable financial products.

While the overall sustainable finance market is expanding, Aozora Bank's specific market share in these specialized ESG-linked lending products, particularly with newly acquired client segments, is still in its nascent stages. This necessitates ongoing investment in product development and targeted marketing efforts to gain traction.

The bank's commitment is reflected in its efforts to integrate ESG principles across its lending portfolio, recognizing the long-term value creation potential for both the bank and its clients. As of early 2024, Aozora Bank reported a notable increase in its ESG-focused loan origination, though specific figures for the newly targeted segments are still being compiled.

- Expanding ESG Reach: Aozora Bank's Aozora Positive Impact Finance and ESG Framework Loans are now accessible to a wider array of corporate clients and sectors.

- Market Development: The bank's market share in specialized ESG-linked lending, especially with new customer groups, is still growing and requires continued strategic focus.

- Investment Focus: Continued investment in promoting and refining these ESG products is crucial for Aozora Bank to solidify its position in this evolving market.

Advanced Services for Regional Financial Institutions (RFIs)

Aozora Bank is actively expanding its reach by offering specialized, advanced services to regional financial institutions (RFIs). This strategic move capitalizes on Aozora's established network and expertise, aiming to support RFIs navigating evolving market demands and technological shifts. For instance, in 2024, Aozora Bank announced a partnership with several regional banks to implement new digital banking platforms, a move expected to enhance customer experience and operational efficiency for these institutions.

The potential for growth in this segment is substantial, as many RFIs are seeking to upgrade their offerings and adopt innovative solutions to remain competitive. These RFIs often face challenges related to scale, technology investment, and regulatory compliance, making them receptive to external support. Aozora's advanced services could include areas like cybersecurity enhancements, data analytics for risk management, and digital transformation consulting.

However, achieving significant market penetration and ensuring broad adoption of these advanced services among a diverse range of RFIs presents a notable challenge. Success will hinge on Aozora's ability to tailor its offerings to the specific needs of different regional institutions and demonstrate clear value propositions. For example, while some RFIs might prioritize cost-effective cloud solutions, others may seek sophisticated AI-driven fraud detection systems, requiring a flexible service delivery model.

- Focus on tailored solutions: Aozora needs to develop service packages that address the unique pain points of various RFIs, from community banks to larger regional players.

- Demonstrate ROI: Clear case studies and data showcasing the tangible benefits of Aozora's advanced services, such as reduced operational costs or increased customer engagement, will be crucial for adoption.

- Strategic partnerships: Collaborating with technology providers and fintech companies can help Aozora offer a more comprehensive suite of advanced solutions.

- Scalability and support: Ensuring that the advanced services can be scaled efficiently and that robust support is provided to RFIs throughout the implementation process is key to long-term success.

These are the bank's new ventures, characterized by high growth potential but currently holding a small market share. Aozora Bank's investment in these areas is substantial, aiming to build market presence and capture future growth. These initiatives, while promising, require significant nurturing and strategic development to transition into market leaders.

BCG Matrix Data Sources

Our Aozora Bank BCG Matrix leverages comprehensive data from financial reports, market share analyses, and industry growth forecasts. This ensures a robust and accurate representation of each business unit's strategic position.