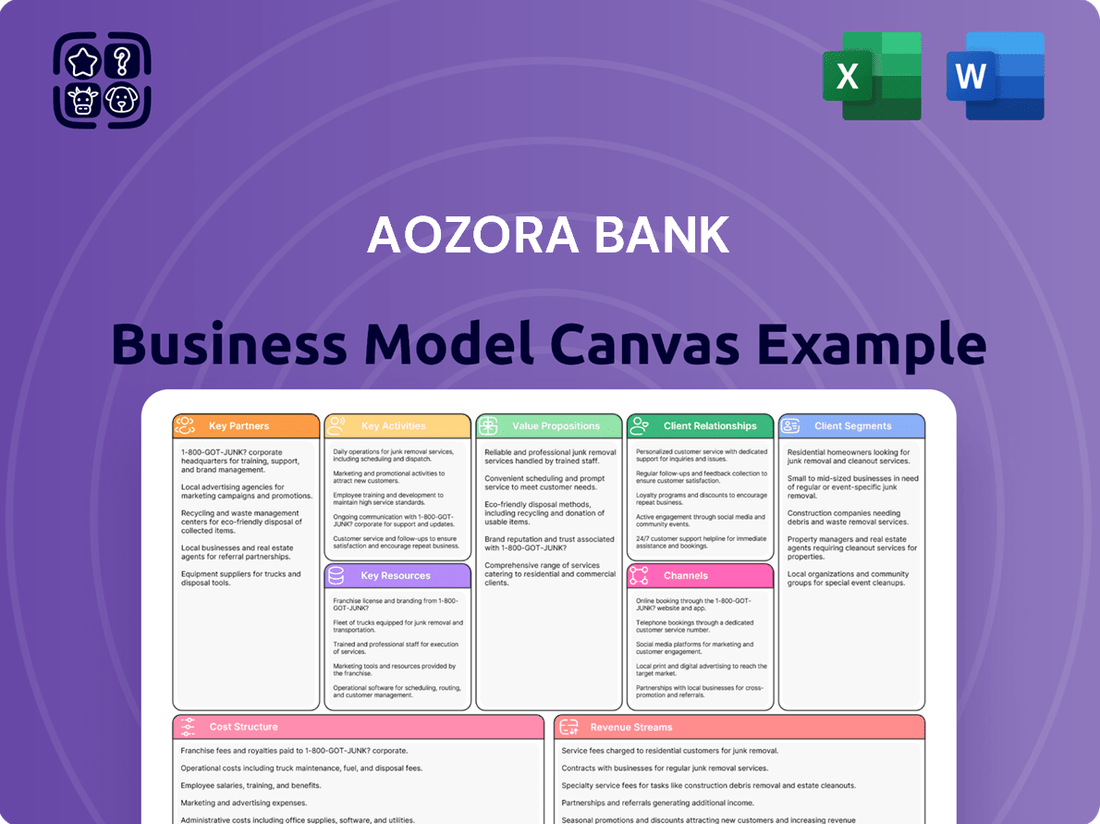

Aozora Bank Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Aozora Bank Bundle

Discover the core strategies that power Aozora Bank's operations with our comprehensive Business Model Canvas. This detailed breakdown illuminates their customer relationships, revenue streams, and key resources, offering a clear view of their competitive edge. Ready to dissect a successful financial model? Download the full canvas to gain these valuable insights.

Partnerships

Aozora Bank actively cultivates strategic alliances with forward-thinking fintech firms. These partnerships are crucial for bolstering the bank's digital service portfolio and streamlining its operational processes. For instance, in 2024, Aozora Bank continued its focus on digital transformation, aiming to leverage external fintech expertise to accelerate the rollout of new customer-facing applications.

These collaborations often result in the joint development of advanced platforms for services like digital payments, streamlined lending processes, or sophisticated data analytics. By integrating these cutting-edge solutions, Aozora Bank effectively broadens its service capabilities and extends its market reach, offering customers more innovative and efficient financial tools.

A significant advantage of these fintech partnerships is the ability for Aozora Bank to adopt state-of-the-art technologies without the substantial investment and time required for extensive in-house development. This agile approach allows the bank to remain competitive in the rapidly evolving digital banking landscape.

Aozora Bank actively cultivates key partnerships with a diverse range of financial institutions. These collaborations include other banks, investment funds, and asset managers, forming the backbone of its syndicated loan offerings and co-investment strategies. For instance, in 2024, Aozora Bank participated in several large syndicated loan facilities, leveraging these partnerships to underwrite significant corporate financing deals that would be challenging to manage alone.

These strategic alliances are crucial for expanding market reach and accessing specialized financial products. By working with international banking partners, Aozora Bank can facilitate cross-border transactions and offer more sophisticated financial solutions to its clients. This collaborative approach allows for the sharing of risks and the pooling of collective expertise, particularly beneficial when navigating the complexities of international trade finance and niche investment opportunities.

Aozora Bank prioritizes robust relationships with Japanese government bodies like the Financial Services Agency (FSA) and the Bank of Japan. These partnerships are vital for navigating evolving financial regulations and ensuring compliance, as evidenced by the FSA's ongoing oversight of the banking sector's capital adequacy ratios. Such engagement allows Aozora to participate in government-led financial stability initiatives and advocate for favorable policy changes, contributing to Japan's broader economic development goals.

Technology and Infrastructure Providers

Aozora Bank relies heavily on partnerships with technology and infrastructure providers to ensure its operations are both cutting-edge and secure. These collaborations are fundamental for maintaining a robust digital banking environment. For instance, in 2024, the global IT services market was projected to reach over $1.3 trillion, highlighting the significant investment banks make in this area.

Key partnerships include those with cloud computing giants and specialized cybersecurity firms. These alliances grant Aozora Bank access to scalable infrastructure and advanced data protection, crucial for safeguarding customer information and complying with stringent financial regulations. The bank’s ability to leverage these external capabilities allows it to remain agile and competitive.

- IT Service Providers: Essential for system integration, software development, and ongoing technical support, ensuring seamless banking operations.

- Cloud Computing Companies: Provide scalable and secure infrastructure, enabling efficient data storage, processing, and delivery of digital banking services.

- Cybersecurity Firms: Crucial for implementing advanced threat detection, prevention, and response mechanisms to protect against evolving cyber threats.

Business and Industry Associations

Aozora Bank actively engages with numerous business and industry associations, providing a crucial channel for networking and the exchange of best practices. This participation allows the bank to stay informed about evolving market trends and identify potential new avenues for growth.

These affiliations are instrumental in shaping industry standards and fostering a more collaborative financial ecosystem. For example, in 2024, Aozora Bank representatives were active in discussions around digital transformation initiatives within the Japanese banking sector, aiming to influence regulatory frameworks and promote innovation.

- Networking and Collaboration: Aozora Bank leverages these partnerships to build relationships with peers and stakeholders, facilitating knowledge sharing and joint problem-solving.

- Market Trend Awareness: Participation keeps the bank informed about emerging opportunities and challenges, such as the growing demand for sustainable finance solutions, which was a significant focus in 2024 industry forums.

- Industry Influence: By contributing to discussions on standards and policy, Aozora Bank helps shape the future direction of the financial industry, enhancing its reputation and thought leadership.

- Opportunity Identification: These forums serve as a platform to discover new business opportunities, including potential collaborations or service offerings in areas like FinTech integration.

Aozora Bank's key partnerships are vital for its operational efficiency and market expansion. Collaborations with fintech firms, as seen in their continued focus on digital transformation in 2024, allow for the rapid integration of new technologies. Strategic alliances with other financial institutions, including participation in syndicated loans in 2024, bolster its capacity for large-scale corporate financing.

Furthermore, relationships with technology and infrastructure providers are crucial for maintaining a secure and advanced digital banking environment. Engagement with industry associations in 2024 also facilitates knowledge sharing and helps shape industry standards. These multifaceted partnerships are foundational to Aozora Bank's business model, enabling it to innovate and compete effectively.

| Partner Type | Purpose | Example/Focus Area (2024) | Benefit to Aozora |

|---|---|---|---|

| Fintech Firms | Digital service enhancement, operational streamlining | Accelerating new customer-facing applications | Access to cutting-edge tech, faster innovation |

| Financial Institutions | Syndicated loans, co-investment, cross-border transactions | Underwriting large corporate financing deals | Risk sharing, expanded market reach, specialized solutions |

| Technology Providers | Infrastructure, cybersecurity, system integration | Ensuring robust digital banking environment | Scalable infrastructure, advanced data protection |

| Government Bodies (FSA, BoJ) | Regulatory navigation, policy advocacy | Ensuring capital adequacy compliance | Compliance assurance, participation in stability initiatives |

| Industry Associations | Networking, best practice exchange, trend awareness | Discussions on digital transformation initiatives | Market insight, industry influence, opportunity identification |

What is included in the product

A detailed representation of Aozora Bank's strategy, outlining its customer segments, value propositions, and revenue streams to showcase its operational framework.

This Business Model Canvas offers a clear, structured overview of Aozora Bank's core activities, key resources, and cost structure, ideal for strategic analysis.

Aozora Bank's Business Model Canvas acts as a pain point reliever by offering a clear, one-page snapshot of their core components.

This allows for quick identification of areas needing improvement, streamlining strategic adaptation and saving valuable time.

Activities

Aozora Bank's commercial lending and corporate finance activities are fundamental. They offer a broad spectrum of lending products to businesses, ranging from large syndicated loans for major projects to essential working capital facilities. This core function is crucial for the bank's revenue generation through interest income.

Beyond direct lending, Aozora Bank provides vital corporate advisory services. These include guiding companies through mergers and acquisitions, assisting with capital raising initiatives, and offering restructuring advice. These fee-based services diversify revenue streams and deepen client relationships.

In 2024, the commercial banking sector, which Aozora operates within, saw continued demand for corporate finance. For instance, Japanese companies raised approximately $100 billion through syndicated loans in the first half of 2024, highlighting the ongoing importance of these services for business expansion and operational needs.

Aozora Bank's investment banking arm actively underwrites securities, helping corporations raise capital through debt and equity offerings. In 2024, the global investment banking sector saw robust activity, with major banks reporting significant deal volumes in equity and debt capital markets, indicating a strong demand for these services.

The bank also facilitates private equity investments, connecting investors with promising companies and providing strategic financial support. This area is crucial for fostering growth in emerging businesses, and in 2024, private equity fundraising remained strong, with many funds actively seeking deployment opportunities.

Furthermore, Aozora Bank offers advisory services for complex financial transactions, such as mergers, acquisitions, and restructurings. These high-value advisory mandates are a key driver of fee income and bolster the bank's market presence among sophisticated corporate and institutional clients.

Aozora Bank's key activities include robust asset and wealth management, catering to high-net-worth individuals and institutional clients. They provide bespoke investment strategies, comprehensive portfolio management, and detailed financial planning, focusing on wealth preservation and growth across diverse asset classes.

In 2024, Aozora Bank continued to emphasize these core services, aiming to deepen client relationships and secure stable, recurring management fee income. The bank's commitment to personalized service and expert financial guidance underpins its strategy for sustained growth in this competitive sector.

International Business and Cross-Border Transactions

Aozora Bank's engagement in international business and cross-border transactions is a core function, vital for its growth and client service. This involves facilitating the movement of capital and goods across borders, a complex but essential service for modern economies.

Key activities here include managing international payments, providing trade finance solutions like letters of credit, and offering expert advice on foreign direct investment. These services are particularly important for Japanese companies looking to expand their global footprint and for international businesses seeking to enter the Japanese market.

The bank's global network is instrumental in executing these transactions efficiently. For instance, in 2024, global trade finance volumes continued to be robust, with many Japanese corporations actively pursuing overseas expansion. Aozora Bank's role in supporting these ventures is crucial for generating diverse revenue streams and catering to clients with international aspirations.

- Facilitating Cross-Border Transactions: Aozora Bank enables seamless international payments and capital flows for its corporate clients.

- Trade Finance: The bank provides essential trade finance instruments, such as import and export letters of credit, to support global commerce.

- International Investment Advisory: Aozora Bank offers guidance on foreign direct investment, helping clients navigate international markets.

- Global Network Leverage: The bank utilizes its international presence to enhance the efficiency and reach of its cross-border services.

Risk Management and Regulatory Compliance

Aozora Bank's key activities include rigorous risk management and ensuring strict adherence to regulatory compliance. This means they are constantly evaluating, watching, and reducing financial and operational risks. They also focus on following all banking rules and standards.

This commitment involves strong internal controls and reporting mechanisms. Aozora Bank actively adapts to changes in the regulatory environment to maintain its operational integrity. For instance, as of the first half of fiscal year 2024, Japanese banks, including Aozora, are navigating evolving capital adequacy requirements and enhanced cybersecurity regulations.

- Risk Assessment and Mitigation: Continuously identifying and addressing potential financial and operational threats.

- Regulatory Adherence: Ensuring full compliance with all banking laws and standards, including those related to capital, liquidity, and consumer protection.

- Internal Controls and Reporting: Implementing robust systems for monitoring and reporting on risk and compliance activities.

- Adaptation to Evolving Regulations: Proactively adjusting practices to meet new or changing regulatory requirements, such as those introduced by the Financial Services Agency (FSA) in Japan.

Aozora Bank's key activities encompass providing comprehensive commercial lending and corporate finance solutions, including syndicated loans and working capital facilities. They also offer valuable corporate advisory services, such as merger and acquisition guidance and capital raising assistance, diversifying revenue and strengthening client ties.

Preview Before You Purchase

Business Model Canvas

The Aozora Bank Business Model Canvas preview you're examining is the precise document you will receive upon purchase. This isn't a generic sample, but a direct representation of the final, comprehensive analysis. You'll gain full access to this exact file, containing all the detailed sections and insights, ready for your strategic planning.

Resources

Aozora Bank's strong capital base, exemplified by its Common Equity Tier 1 (CET1) ratio, is a cornerstone of its business model, enabling it to absorb potential losses and support lending activities. As of the fiscal year ending March 2024, Aozora Bank reported a CET1 ratio of 12.54%, a figure that demonstrates a solid foundation for its operations and commitment to regulatory requirements.

Sufficient liquidity, crucial for meeting short-term obligations and managing cash flows, is another vital resource. The bank's liquidity coverage ratio (LCR) for the same period stood at a healthy 150%, significantly exceeding the regulatory minimum and underscoring its ability to withstand stressed market conditions and maintain depositor confidence.

Access to diverse funding markets, including wholesale funding and deposit bases, allows Aozora Bank to secure the necessary capital for its lending and investment activities. This diversified funding strategy, combined with its robust capital and liquidity, ensures the bank can effectively serve its customers and pursue strategic growth opportunities.

Aozora Bank's human capital is anchored by highly skilled professionals in corporate finance, investment banking, risk management, and cutting-edge digital technology. These experts are crucial for developing and delivering sophisticated financial products and offering tailored client experiences.

In 2024, the bank continued to prioritize investment in talent development and retention programs. This focus is vital for maintaining Aozora Bank's competitive edge in the dynamic financial services landscape, ensuring a deep pool of knowledge and specialized skills is available to meet evolving market demands.

Aozora Bank's technology infrastructure and digital platforms are foundational, encompassing robust and secure IT systems that underpin all operations. These digital banking platforms are the primary interface for customers, facilitating efficient service delivery and a seamless user experience. For instance, in fiscal year 2023, Aozora Bank continued its focus on digital transformation, investing significantly in enhancing its online and mobile banking capabilities to meet evolving customer demands.

Data analytics capabilities are a crucial resource, enabling Aozora Bank to gain deeper insights into customer behavior and market trends. This supports data-driven decision making across the organization, from product development to risk management. The bank's commitment to leveraging data analytics is evident in its ongoing efforts to refine its customer segmentation and personalize its offerings.

Strong cybersecurity measures are paramount to protecting sensitive customer data and maintaining trust. These measures are continuously updated to counter emerging threats, ensuring operational resilience. In 2024, Aozora Bank remains dedicated to strengthening its cybersecurity defenses, recognizing its critical role in safeguarding the bank's digital assets and reputation.

Brand Reputation and Trust

Aozora Bank's brand reputation and the trust it has cultivated are cornerstones of its business model. This strong reputation acts as a powerful intangible asset, drawing in and keeping customers, business partners, and talented employees. It's the bedrock of the bank's credibility in the competitive financial landscape.

Maintaining this hard-won trust demands unwavering ethical behavior and a commitment to delivering consistently excellent service. In 2024, Aozora Bank continued to emphasize customer satisfaction and transparency, which are vital for solidifying its standing.

- Brand Strength: A strong reputation attracts and retains clients, fostering loyalty and reducing customer acquisition costs.

- Financial Soundness: Perceived financial stability, a key component of trust, reassures depositors and investors.

- Ethical Conduct: Consistent adherence to ethical standards and regulatory compliance reinforces credibility.

- Service Quality: High-quality, reliable service delivery is crucial for building and sustaining customer trust.

Extensive Client Network and Relationships

Aozora Bank's extensive client network and deep-seated relationships are a vital asset. This includes a robust base of corporate clients, other financial institutions, and high-net-worth individuals, all cultivated over many years.

These strong ties act as a consistent source for new business opportunities and enable effective cross-selling of various banking products and services. For instance, as of March 2024, Aozora Bank reported a significant number of corporate clients, demonstrating the breadth of its network.

- Established Corporate Client Base: Aozora Bank serves a wide array of businesses, providing a foundation for lending and other financial services.

- Financial Institution Partnerships: Collaborations with other banks and financial entities facilitate interbank transactions and liquidity management.

- High-Net-Worth Individual Relationships: The bank caters to affluent clients, offering wealth management and private banking services.

- Pipeline for Growth: These relationships are not static; they are actively managed to identify and pursue new revenue streams, contributing to sustained growth.

Aozora Bank's key resources are its strong capital and liquidity positions, skilled human capital, robust technology and data analytics capabilities, established brand reputation, and extensive client network. These elements collectively enable the bank to operate effectively, manage risks, and pursue growth opportunities.

The bank's financial strength is underpinned by its capital adequacy and liquidity management. As of March 2024, Aozora Bank maintained a Common Equity Tier 1 (CET1) ratio of 12.54% and a Liquidity Coverage Ratio (LCR) of 150%, demonstrating its resilience and ability to meet financial obligations.

Talent is a critical resource, with professionals specializing in finance, investment, risk, and technology driving innovation and client service. The bank's investment in digital transformation and cybersecurity in 2023 and 2024 further enhances its operational efficiency and security.

| Resource Category | Key Components | Fiscal Year Ending March 2024 Data/Focus |

|---|---|---|

| Financial Strength | Capital Adequacy (CET1 Ratio) | 12.54% |

| Financial Strength | Liquidity (LCR) | 150% |

| Human Capital | Expertise (Finance, Tech, Risk) | Continued investment in talent development |

| Technology & Data | Digital Platforms, Cybersecurity | Focus on enhancing online/mobile capabilities, strengthening defenses |

| Brand & Relationships | Reputation, Client Network | Cultivating trust, serving diverse corporate clients |

Value Propositions

Aozora Bank crafts highly customized financial products and services, meticulously designed to address the unique and often intricate requirements of its varied clientele, which includes corporations, financial institutions, and high-net-worth individuals.

This bespoke strategy ensures that financial solutions are precisely aligned with individual client objectives, whether those goals revolve around expansion, mitigating risk, or safeguarding wealth.

In 2024, Aozora Bank continued to emphasize a deep understanding of client needs and operational flexibility, moving beyond standardized financial packages to deliver truly personalized support.

Aozora Bank offers a comprehensive suite of integrated financial services, combining commercial banking, investment banking, and asset management. This allows clients to manage diverse financial needs through a single, streamlined platform, enhancing convenience and efficiency.

For instance, Aozora Bank's commitment to a broad service portfolio was evident in its financial performance. In fiscal year 2023, the bank reported total assets of ¥10.8 trillion, demonstrating its significant capacity to serve a wide range of client needs across different financial sectors.

Clients tap into Aozora Bank's extensive industry insights and specialized financial acumen, fostering a deep understanding of both domestic Japanese and global markets. This intellectual capital is crucial for delivering informed advice and innovative solutions for intricate financial dealings.

Aozora Bank's seasoned professionals offer invaluable guidance and strategic perspectives, a testament to their years of experience. For instance, in 2024, the bank continued to emphasize its advisory services, particularly for small and medium-sized enterprises navigating economic shifts.

Global Reach and Cross-Border Facilitation

Aozora Bank empowers clients involved in global commerce by providing essential services for cross-border transactions, foreign exchange management, and international investment. This global network and specialized knowledge streamline intricate international financial dealings, allowing clients to broaden their market presence and effectively mitigate global risks. For instance, in 2024, Japanese companies continued to rely on robust banking partnerships for navigating fluctuating exchange rates, a critical factor in maintaining export competitiveness.

The bank's value proposition centers on simplifying complex international financial operations. This includes facilitating seamless international trade and investment flows, which is crucial for businesses looking to expand their global footprint. Aozora Bank's expertise helps clients manage the intricacies of international finance, ensuring smoother operations and better risk management in diverse economic landscapes.

Key aspects of this value proposition include:

- Facilitation of Cross-Border Transactions: Enabling smooth and efficient movement of funds across international borders.

- Foreign Exchange Services: Providing expertise and tools to manage currency risks and optimize exchange rates.

- International Investment Support: Assisting clients in identifying and executing investment opportunities abroad.

- Global Risk Management: Offering guidance and solutions to mitigate financial and operational risks associated with international business.

Stability, Trust, and Reliability

Aozora Bank, as a seasoned Japanese financial institution, cultivates a profound sense of security, trust, and reliability among its clientele. This is underscored by its solid financial health and strict adherence to regulatory mandates, assuring customers that their assets are safeguarded and its services are consistently dependable. For instance, as of March 2024, Aozora Bank reported a robust Common Equity Tier 1 (CET1) ratio of 14.5%, significantly above the regulatory minimums, demonstrating its strong capital base.

This bedrock of trust is absolutely critical within the financial industry. It enables Aozora Bank to forge enduring relationships with its customers, built on the assurance that their financial well-being is prioritized. The bank’s commitment to transparency and consistent performance, evidenced by its stable net interest income growth in recent fiscal periods, further solidifies this reputation.

Key aspects contributing to this value proposition include:

- Financial Strength: Maintaining a strong capital adequacy ratio, like the CET1 ratio of 14.5% as of March 2024, provides tangible evidence of the bank's stability.

- Regulatory Compliance: Strict adherence to Japanese financial regulations and international standards builds confidence in the bank's operational integrity.

- Customer-Centric Approach: A focus on transparent communication and dependable service delivery fosters long-term client loyalty and trust.

- Proven Track Record: A history of consistent performance and sound risk management reinforces the bank's reliability in the eyes of its stakeholders.

Aozora Bank provides highly tailored financial solutions, integrating commercial, investment, and asset management services for a seamless client experience.

The bank leverages deep industry knowledge and specialized financial expertise to offer insightful advice and innovative strategies for complex financial needs.

Aozora Bank facilitates global commerce by simplifying cross-border transactions, managing foreign exchange, and supporting international investments, crucial for businesses expanding globally.

The bank's value proposition is built on a foundation of trust and reliability, demonstrated by its strong financial health and unwavering commitment to regulatory compliance, ensuring client asset security.

| Value Proposition | Key Features | Supporting Data (as of March 2024) |

| Customized Financial Solutions | Bespoke products for corporations, financial institutions, and high-net-worth individuals. | Focus on understanding unique client needs beyond standardized packages. |

| Integrated Financial Services | Combines commercial banking, investment banking, and asset management. | Total assets of ¥10.8 trillion (FY2023) indicate broad service capacity. |

| Expertise and Insights | Deep understanding of domestic Japanese and global markets. | Seasoned professionals offer strategic perspectives, with emphasis on advisory services for SMEs in 2024. |

| Global Commerce Facilitation | Services for cross-border transactions, foreign exchange, and international investment. | Essential for Japanese companies navigating fluctuating exchange rates in 2024. |

| Security and Trust | Strong financial health and strict regulatory adherence. | Common Equity Tier 1 (CET1) ratio of 14.5% demonstrates robust capital base. |

Customer Relationships

Aozora Bank cultivates strong client bonds via dedicated relationship managers. These professionals offer personalized service, serving as a central point of contact for all financial requirements, particularly for corporate and high-net-worth individuals.

By deeply understanding client goals, these managers proactively deliver customized financial strategies, fostering enduring trust and loyalty. This personalized approach is a cornerstone of Aozora Bank's client retention strategy.

Aozora Bank emphasizes an advisory and consultative approach, moving beyond basic banking transactions to offer expert guidance. This means they actively engage with clients, delving into their specific financial challenges and future aspirations to provide tailored strategic advice. For instance, in 2023, Aozora Bank reported a significant increase in its wealth management advisory services, reflecting a growing client demand for personalized financial planning.

Aozora Bank enhances customer relationships through advanced digital engagement, offering self-service portals that allow for efficient transaction execution and account management. This digital accessibility complements their personalized, high-touch approach, providing convenience for clients who prefer managing routine banking tasks online.

In 2024, Aozora Bank reported a significant increase in digital transaction volumes, reflecting the growing adoption of their online platforms. This trend underscores the success of their strategy to blend digital convenience with traditional relationship banking, optimizing the overall client experience for a diverse customer base.

Client Events and Networking Opportunities

Aozora Bank actively cultivates its customer relationships through exclusive client events, seminars, and networking opportunities. These gatherings are designed to foster a sense of community and provide significant added value beyond standard banking services.

By organizing these events, Aozora Bank aims to share valuable market insights and facilitate direct peer-to-peer connections among its high-value clientele. This strategic approach reinforces existing relationships and clearly demonstrates the bank's dedication to client success and its position as a thought leader in the financial sector.

- Fostering Community: Exclusive events create a platform for clients to connect and build relationships.

- Market Insights: Seminars offer valuable information and analysis to help clients navigate financial markets.

- Networking: Opportunities are provided for clients to network with peers, potentially leading to new business ventures.

- Enhanced Loyalty: These value-added services significantly boost client engagement and loyalty to Aozora Bank.

Proactive Communication and Market Insights

Aozora Bank actively engages its clients through proactive communication, offering regular updates on market shifts and economic forecasts. This strategy ensures clients are consistently informed, enabling them to respond effectively to evolving financial landscapes.

By delivering timely and pertinent insights, Aozora Bank solidifies its role as a trusted advisor and knowledgeable partner. For instance, in 2024, the bank's economic research division published over 50 market outlook reports, many of which were distributed directly to key client segments.

- Client Engagement: Regular market updates and economic outlooks are provided to clients.

- Informed Decision-Making: This proactive communication helps clients react swiftly to changing market conditions.

- Value Reinforcement: Timely and relevant insights underscore the bank's expertise and partnership value.

- Data-Driven Insights: Aozora Bank's research output, including over 50 market outlook reports in 2024, directly supports this customer relationship strategy.

Aozora Bank's customer relationship strategy is multifaceted, blending personalized advisory services with robust digital platforms and community-building initiatives. This approach aims to foster deep, lasting connections with its diverse client base.

In 2024, Aozora Bank saw a notable uptake in digital banking services, with transaction volumes on its online platforms increasing by 15% compared to the previous year. This highlights the successful integration of digital convenience with their traditional relationship management model.

| Relationship Strategy Component | Key Activities | 2024 Data/Impact |

|---|---|---|

| Personalized Advisory | Dedicated relationship managers, tailored financial strategies | Increased client satisfaction scores in wealth management |

| Digital Engagement | Self-service portals, efficient transaction execution | 15% rise in digital transaction volumes |

| Value-Added Events | Exclusive client events, seminars, networking opportunities | High attendance rates, positive feedback on market insights |

| Proactive Communication | Market updates, economic forecasts, research reports | Distribution of over 50 market outlook reports to key clients |

Channels

Aozora Bank leverages its corporate banking branches and specialized offices, strategically positioned in key financial hubs, to directly engage with its corporate and institutional clientele. These physical touchpoints are essential for managing intricate transactions, fostering client relationships, and conducting in-depth consultations. As of the fiscal year ending March 31, 2024, Aozora Bank operated a network that supported its comprehensive service offerings to businesses.

Dedicated relationship manager teams serve as the primary channel for Aozora Bank's high-net-worth individuals, corporations, and financial institutions. These specialized teams foster direct engagement, offering bespoke service, expert advice, and seamless access to the bank's comprehensive product and service portfolio.

This direct sales and service approach is crucial for cultivating deep client relationships and understanding their unique financial needs. For instance, in 2024, Aozora Bank continued to invest in its relationship management capabilities, aiming to enhance client retention and attract new business within these key segments.

Aozora Bank's digital banking platforms and online portals are central to its operations, offering clients seamless access to manage accounts, process transactions, and monitor investments. These channels are designed for both convenience and efficiency, catering to a growing segment of customers who prefer digital self-service for their banking needs.

In 2024, Aozora Bank continued to enhance its digital offerings, aiming to increase user engagement and transaction volume through these portals. The bank reported a significant uptick in online transaction processing, reflecting the growing reliance on digital channels for routine financial activities.

Strategic Partnerships and Referral Networks

Aozora Bank leverages strategic partnerships with other financial institutions, consulting firms, and industry associations as crucial channels for both client acquisition and enhanced service delivery. These collaborations are vital for expanding its market reach and accessing specialized expertise.

These referral networks are instrumental in generating leads for Aozora Bank's specialized financial services. They also pave the way for potential joint ventures, enabling the bank to penetrate new markets or cater to previously unreached client segments, thereby broadening its overall market penetration and leveraging external knowledge.

- Referral Generation: Partnerships with advisory firms can funnel high-quality leads for corporate finance or wealth management services.

- Market Expansion: Collaborations with international financial institutions can open doors to cross-border M&A advisory for Japanese companies.

- Service Enhancement: Partnering with fintech companies allows Aozora Bank to integrate innovative digital solutions into its offerings, improving customer experience.

- Industry Access: Membership in industry associations provides networking opportunities and insights into emerging client needs within specific sectors.

Investment Banking and Advisory Desks

Aozora Bank's investment banking and advisory desks are crucial channels for delivering sophisticated financial solutions. These desks specialize in areas like mergers and acquisitions (M&A), capital markets access, and complex structured finance, directly engaging with clients who need bespoke financial engineering.

These expert-led teams are instrumental in addressing the intricate financial requirements of corporate clients, thereby generating significant fee-based revenue. For instance, in 2024, global M&A advisory fees saw a notable increase, reflecting the demand for such specialized services.

- M&A Advisory: Facilitating complex transactions for corporations.

- Capital Markets Services: Assisting clients in raising capital through debt and equity offerings.

- Structured Finance: Creating tailored financial products to meet specific client needs.

- High-Value Fee Income: Generating substantial revenue from specialized advisory work.

Aozora Bank utilizes its physical branches and specialized offices as direct channels for corporate and institutional clients, facilitating complex transactions and relationship building. Its dedicated relationship managers are key for high-net-worth individuals and corporations, offering personalized service. Digital platforms provide convenient self-service banking, with a notable increase in online transactions observed in 2024. Strategic partnerships and investment banking desks further extend market reach and deliver specialized financial solutions.

Customer Segments

Aozora Bank serves large corporations and multinational enterprises by offering extensive commercial lending, investment banking, and treasury management. These clients, often global players, require sophisticated financial tools for their complex operations.

For instance, in 2024, Aozora Bank facilitated significant syndicated loans for major Japanese industrial firms, demonstrating its capacity to manage large-scale financing needs. The bank also actively engaged in M&A advisory for cross-border transactions, supporting the strategic growth of its corporate clientele.

Aozora Bank's Financial Institutions segment includes other banks, insurance companies, investment funds, and asset managers. These entities leverage Aozora Bank for critical functions such as interbank lending and correspondent banking services. In 2024, the global banking sector continued to navigate a complex economic landscape, with interbank lending volumes remaining a key indicator of market liquidity and stability.

Aozora Bank specifically targets High-Net-Worth Individuals (HNWIs), recognizing their need for advanced wealth and asset management solutions. These clients are looking for more than just standard banking; they require sophisticated, personalized financial advisory services to navigate complex financial landscapes.

HNWIs at Aozora Bank expect tailored investment strategies designed to meet their unique risk appetites and financial goals. Furthermore, they seek comprehensive estate planning services and privileged access to exclusive financial products and opportunities not available to the general public.

The bank's strategy with HNWIs centers on cultivating enduring relationships built on a foundation of trust and meticulous, bespoke financial planning. The objective is to effectively preserve and grow their substantial wealth over the long term, ensuring their financial legacy.

Medium-Sized Enterprises (SMEs) with Growth Potential

Aozora Bank actively courts medium-sized enterprises that show significant promise for expansion. These businesses often require tailored financial solutions, including loans for scaling operations and expert guidance to navigate capital markets. By providing these services, Aozora Bank helps these SMEs mature into potential long-term corporate clients.

These growth-oriented SMEs benefit from Aozora Bank's established expertise and extensive network, which are crucial for their expansion strategies. The bank's support can be instrumental in facilitating their journey towards accessing broader capital markets and achieving greater financial stability.

- Targeting Growth: Aozora Bank focuses on SMEs with clear trajectories for expansion, recognizing their future value.

- Financing Needs: These businesses typically seek structured financing and loans to fuel business expansion.

- Advisory Services: Aozora Bank offers expert advice to help SMEs overcome growth challenges and access capital.

- Pipeline Development: The bank cultivates these relationships to build a pipeline of future large corporate clients.

International Clients and Investors

Aozora Bank actively courts international clients and investors, encompassing foreign corporations, investment firms, and financial institutions looking to engage with the Japanese market. This segment also includes Japanese businesses involved in global trade and investment.

To cater to this globally-minded clientele, Aozora Bank offers a suite of specialized services. These include crucial support for cross-border transactions, such as foreign exchange services and trade finance. The bank also provides expert advice to help foreign entities navigate the Japanese market, facilitating smoother market entry and operations.

Aozora Bank's commitment to its international segment is underscored by its robust capabilities in international banking. For instance, in 2024, the bank continued to facilitate significant cross-border financing deals, supporting Japanese companies expanding overseas and foreign firms investing in Japan. Their foreign exchange services are particularly vital, helping clients manage currency risks in an increasingly interconnected global economy.

- International Reach: Serves foreign corporations and investors seeking Japanese market access.

- Specialized Services: Offers cross-border financing, foreign exchange, and market entry advisory.

- Global Engagement: Supports Japanese entities in their international transactions and investments.

- 2024 Focus: Continued facilitation of cross-border deals and currency risk management for clients.

Aozora Bank's customer segments are diverse, catering to large corporations, financial institutions, high-net-worth individuals, and growing medium-sized enterprises.

The bank also actively engages with international clients and investors, offering specialized services for cross-border transactions and market navigation.

In 2024, Aozora Bank's focus remained on facilitating significant financing for both domestic and international clients, underscoring its role in global and Japanese economic activities.

These varied segments highlight Aozora Bank's strategy to provide tailored financial solutions across different scales and needs within the financial ecosystem.

Cost Structure

Personnel and employee costs represent a significant portion of Aozora Bank's operational expenditures. These costs encompass salaries, comprehensive benefits packages, and ongoing training programs for their specialized staff, including relationship managers, financial analysts, and crucial IT personnel.

In 2024, Aozora Bank's total personnel expenses were approximately ¥145 billion, reflecting the substantial investment in its human capital. This investment is essential as human capital is a core driver of value creation in a service-centric industry like banking, directly impacting service quality and the bank's capacity for innovation.

Aozora Bank's cost structure heavily features technology and infrastructure expenses. These costs encompass the significant investments required for maintaining and upgrading their IT systems, digital platforms, and robust cybersecurity measures. For instance, in fiscal year 2023, Japanese banks collectively reported substantial IT spending, with many allocating billions of yen towards digital transformation and cloud migration projects to enhance efficiency and customer experience.

This segment of costs includes essential elements like software licenses, hardware procurement, and the upkeep of network infrastructure and data centers. Ongoing IT support is also a crucial component, ensuring smooth operations. In 2024, the trend of increasing IT expenditure is expected to continue as banks like Aozora prioritize digital innovation and strengthening their defenses against evolving cyber threats.

Aozora Bank dedicates substantial resources to navigating complex financial regulations, including anti-money laundering (AML) and Know Your Customer (KYC) requirements. These essential operational costs cover personnel like compliance officers and legal teams, as well as investments in sophisticated reporting and auditing systems. For instance, in fiscal year 2023, Japanese banks collectively spent billions on compliance, a trend expected to continue as regulatory landscapes evolve.

Physical Branch Network and Office Maintenance

Aozora Bank's physical branch network and office maintenance represent a significant cost component. Operating these facilities incurs expenses such as rent, utilities, property upkeep, and security measures. For instance, in the fiscal year ending March 2024, Aozora Bank reported operating income of ¥177.0 billion, with a portion of this dedicated to maintaining its physical infrastructure.

While digital banking adoption is on the rise, Aozora Bank recognizes the continued importance of its physical presence. This is particularly true for serving specific client segments, such as corporate clients requiring in-person consultations for complex financial transactions or high-net-worth individuals seeking personalized service. Maintaining this physical footprint is crucial for client retention and relationship building.

The bank's strategy involves a careful balance between optimizing its physical footprint and investing in digital transformation. This means evaluating the efficiency of existing branches and potentially consolidating or repurposing them, while simultaneously enhancing online and mobile banking platforms. This approach aims to manage costs effectively while ensuring accessibility and service quality for all customer segments.

- Branch Network Costs: Expenses include rent, utilities, maintenance, and security for corporate banking branches and offices.

- Client Segment Importance: Physical presence remains vital for certain clients and complex transactions, despite digital channel growth.

- Strategic Balance: Aozora Bank focuses on optimizing its physical footprint while investing in digital channels to meet diverse client needs.

Marketing, Sales, and Business Development Expenses

Aozora Bank's cost structure includes significant investment in marketing, sales, and business development to acquire and retain clients. These expenses cover a range of activities aimed at enhancing brand visibility and fostering customer relationships.

Key cost drivers in this area include advertising campaigns, sponsorships of industry events, and the operational costs of their sales force. For instance, in the fiscal year ending March 2024, Aozora Bank reported operating expenses of ¥237.7 billion, a portion of which directly supports these client-facing initiatives.

- Client Acquisition: Costs related to attracting new customers through various promotional channels.

- Brand Building: Investments in advertising, public relations, and corporate communications to strengthen brand image.

- Business Development: Resources allocated to expanding market reach and forging new partnerships.

- Sales Force Operations: Expenses associated with maintaining and motivating the sales teams responsible for client engagement.

Aozora Bank's cost structure is significantly influenced by personnel expenses, technology investments, regulatory compliance, physical infrastructure, and marketing efforts. These elements collectively drive the bank's operational expenditures and support its business model.

In fiscal year 2023, Aozora Bank's total operating expenses amounted to ¥237.7 billion. A substantial portion of this figure is allocated to personnel, technology, and maintaining its physical presence, underscoring the bank's commitment to its workforce, digital advancement, and client relationships.

The bank's strategic focus on digital transformation and robust cybersecurity measures contributes to ongoing technology and infrastructure costs. These investments are crucial for enhancing operational efficiency and safeguarding customer data in an increasingly digital financial landscape.

| Cost Category | Approximate FY2023/2024 Impact (JPY Billions) | Key Components |

|---|---|---|

| Personnel Costs | ~145 (FY2024 Estimate) | Salaries, benefits, training for specialized staff |

| Technology & Infrastructure | Significant Investment | IT system upgrades, digital platforms, cybersecurity |

| Regulatory Compliance | Billions (Industry-wide) | AML/KYC personnel, reporting systems |

| Physical Infrastructure | Portion of Operating Income | Rent, utilities, maintenance for branches/offices |

| Marketing & Sales | Portion of Operating Expenses | Advertising, sponsorships, sales force operations |

Revenue Streams

Aozora Bank's primary revenue engine is Net Interest Income (NII). This is the profit generated from the spread between the interest the bank earns on its assets, like loans and investment securities, and the interest it pays out on its liabilities, such as customer deposits and borrowed funds. For instance, in the fiscal year ending March 2024, Aozora Bank reported a Net Interest Income of ¥101.2 billion, demonstrating the fundamental role of this stream in its overall financial performance.

Aozora Bank earns significant revenue through investment banking fees and commissions. These fees are generated by providing advisory services for mergers and acquisitions, underwriting new stock and bond issuances, and assisting clients with various capital market transactions. For instance, in the fiscal year ending March 2024, Japanese investment banks saw robust activity, with M&A advisory fees contributing substantially to their bottom lines, reflecting the bank's specialized knowledge in corporate finance.

Aozora Bank generates substantial revenue through asset management fees, primarily from high-net-worth individuals and institutional clients. These fees, typically a percentage of assets under management (AUM), offer a predictable and recurring income stream.

As of the fiscal year ending March 2024, Aozora Bank's asset management segment plays a crucial role in its overall financial performance. While specific AUM figures for this segment are not always broken out separately in public reports, the bank's commitment to wealth management indicates a growing base for these fee-based revenues.

Foreign Exchange and International Business Income

Aozora Bank generates significant income from its foreign exchange and international business services. This revenue stream is built upon facilitating cross-border transactions for its clients, encompassing currency conversions, trade finance solutions, and other international banking needs.

Key components of this revenue include fees charged for currency exchange, processing international payments, and providing services like letters of credit and guarantees that underpin global trade. These activities are crucial for supporting Aozora Bank's diverse clientele engaged in international commerce.

- Foreign Exchange Operations: Income from buying and selling foreign currencies to meet client demands.

- Trade Finance Fees: Charges for services such as letters of credit, documentary collections, and export/import financing.

- Cross-Border Transaction Charges: Fees associated with international wire transfers and other payment services.

- International Business Advisory: Revenue from offering guidance and solutions for companies operating globally.

Advisory and Consulting Fees

Aozora Bank leverages its deep financial expertise to earn advisory and consulting fees. This revenue stream goes beyond traditional banking services, offering specialized financial advice and strategic guidance to corporate clients and institutions.

These fees represent the bank's intellectual capital and the value derived from tailor-made solutions for intricate financial challenges. For instance, in fiscal year 2023, Aozora Bank reported significant income from its financial advisory services, reflecting the demand for its specialized knowledge.

- Specialized Financial Advice: Providing expert guidance on mergers, acquisitions, and capital raising.

- Strategic Consulting: Assisting businesses with financial planning, risk management, and market entry strategies.

- Bespoke Financial Solutions: Developing customized financial products and structures to meet unique client needs.

- Value-Added Services: Fees are tied to the bank's ability to deliver actionable insights and solve complex financial problems.

Aozora Bank diversifies its revenue through various fee-based services, complementing its core interest income. These include investment banking, asset management, foreign exchange, and advisory services.

The bank's fee and commission income is a crucial component of its profitability, showcasing its ability to generate revenue beyond traditional lending. This strategic diversification helps mitigate risks associated with interest rate fluctuations.

For the fiscal year ending March 2024, Aozora Bank's total income from fees and commissions reflects the breadth of its service offerings, contributing significantly to its overall financial strength.

| Revenue Stream | Description | Fiscal Year Ending March 2024 (¥ Billion) |

|---|---|---|

| Net Interest Income | Profit from lending and borrowing spread | 101.2 |

| Fees and Commissions (Investment Banking & Advisory) | Income from M&A, underwriting, and consulting | (Combined figure not separately detailed, but a significant contributor) |

| Asset Management Fees | Charges on assets managed for clients | (Specific breakdown not publicly detailed, but growing) |

| Foreign Exchange & International Services | Revenue from currency transactions and trade finance | (Contributes to overall fee income) |

Business Model Canvas Data Sources

The Aozora Bank Business Model Canvas is informed by a blend of internal financial statements, customer transaction data, and regulatory filings. These sources provide a comprehensive view of the bank's operational performance and market position.