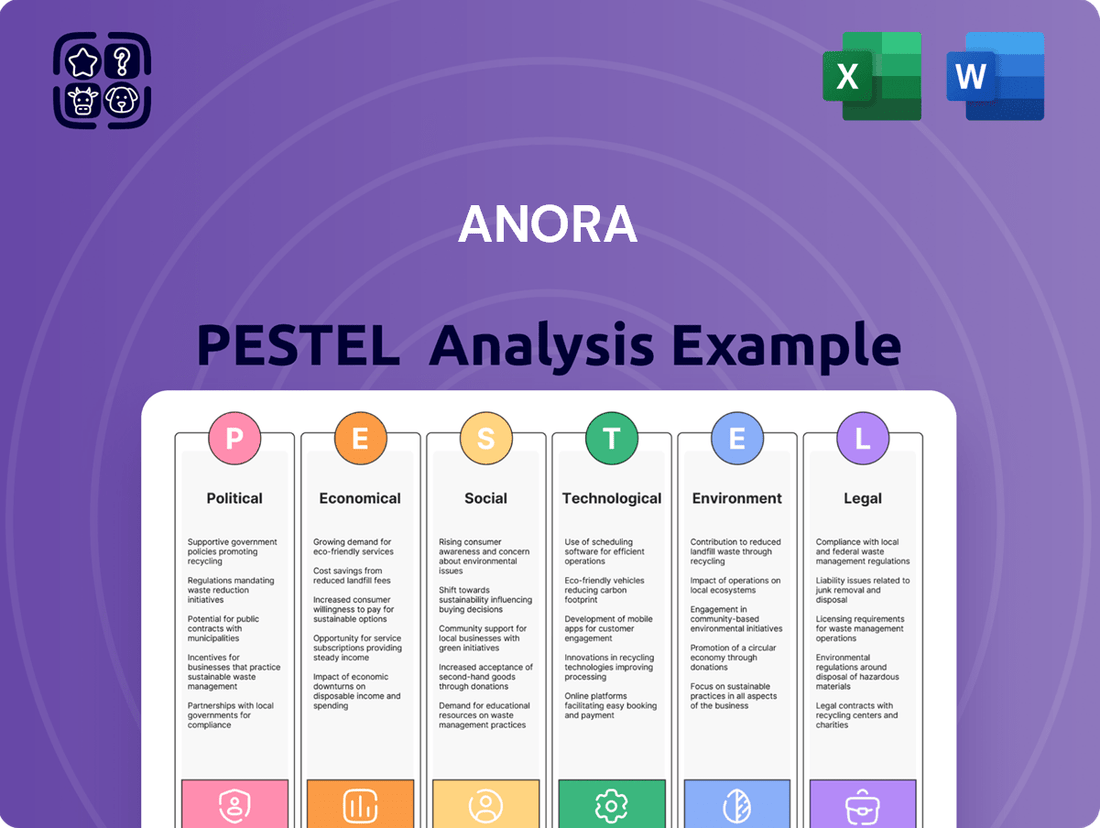

Anora PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anora Bundle

Unlock the critical external factors shaping Anora's trajectory with our comprehensive PESTLE analysis. Understand how political shifts, economic fluctuations, and technological advancements are impacting its market position. Equip yourself with actionable intelligence to navigate these forces and gain a competitive advantage. Download the full report now for an in-depth strategic overview.

Political factors

In Nordic countries, state-owned alcohol retail monopolies like Systembolaget in Sweden and Vinmonopolet in Norway are crucial for Anora, controlling a significant portion of its distribution and market access. These monopolies directly shape Anora's sales volumes and operational strategies.

Potential shifts in government policies, such as privatization debates or changes to purchasing mandates, represent a key political factor for Anora. For instance, discussions around liberalizing alcohol sales in Sweden could alter Anora's established distribution model.

Changes in alcohol taxation and excise duties significantly impact Anora's pricing and profitability across its key Nordic and Baltic markets. For instance, Finland, a major market for Anora, saw its excise duty on spirits increase by 10% in January 2024, a move aimed at curbing consumption and boosting state revenue. This necessitates Anora to carefully manage its pricing strategies to remain competitive while absorbing some of the increased tax burden, directly affecting consumer affordability and sales volumes.

Anora's reliance on international trade means that trade agreements and tariffs significantly influence its operational costs and market access. For instance, the United States-Mexico-Canada Agreement (USMCA), which replaced NAFTA, continues to shape trade dynamics for North American markets, potentially impacting Anora's sourcing of components or distribution of finished products. Changes in tariff rates, such as those seen in recent years affecting various goods, can directly increase the cost of imported materials or reduce the competitiveness of Anora's exports in global markets.

Regulatory Environment for Alcohol Marketing

Anora operates within a notably stringent regulatory framework for alcohol marketing across its Nordic and Baltic markets. This environment directly shapes how the company can communicate its brands to consumers. For instance, Finland's Alcohol Act, which has seen amendments in recent years, continues to impose limitations on where and how alcohol can be advertised, impacting Anora's promotional strategies.

Any future tightening of these regulations, such as further bans on digital advertising or stricter rules on product placement, would necessitate significant adaptation from Anora. The company would need to explore alternative, compliant marketing avenues to maintain brand visibility and engagement. For example, a potential shift towards experiential marketing or partnerships could become more critical if traditional advertising channels face additional restrictions.

Key aspects of the regulatory environment impacting Anora include:

- Advertising Restrictions: Strict limitations on advertising channels, including broadcast media and digital platforms, are common in Nordic countries.

- Content Regulations: Rules often govern the messaging and imagery used in alcohol advertising, prohibiting certain claims or depictions.

- Sales Channel Influence: Regulations tied to state-controlled retail monopolies, like Alko in Finland, also indirectly influence marketing opportunities.

- Public Health Focus: The overarching goal of public health and harm reduction underpins many of these marketing regulations.

Political Stability and Geopolitical Events

Political stability in Anora's key markets is paramount. For instance, the ongoing geopolitical tensions in Eastern Europe, which intensified in early 2022, continue to cast a shadow over global economic sentiment. This instability can directly affect consumer confidence, potentially leading to reduced discretionary spending on products Anora offers.

Broader geopolitical events, such as trade disputes or the emergence of new international alliances, can also significantly impact Anora's supply chain. For example, the heightened focus on supply chain resilience following the COVID-19 pandemic and subsequent disruptions in 2020-2021 has led many companies, including potentially Anora, to re-evaluate sourcing strategies. A major international conflict could further exacerbate these vulnerabilities, leading to increased operational costs or delays.

- Geopolitical Risk Index: Global geopolitical risk indicators, closely watched by businesses, showed a notable increase in 2023 compared to 2022, suggesting a more volatile operating environment.

- Trade Policy Shifts: Changes in trade agreements or the imposition of tariffs, such as those seen between major economic blocs in late 2023, could impact Anora's import/export costs and market access.

- Consumer Confidence Surveys: Recent surveys from late 2024 indicate a correlation between heightened global political uncertainty and a dip in consumer confidence in key Western markets, directly affecting demand for non-essential goods.

Government policies surrounding state-owned retail monopolies in Nordic countries significantly influence Anora's market access and sales volumes. For instance, discussions in Sweden regarding potential privatization of Systembolaget could alter Anora's distribution channels.

Taxation policies, particularly excise duties on spirits, directly impact Anora's profitability. Finland's 10% excise duty increase on spirits in January 2024 exemplifies how tax changes necessitate careful pricing strategies to maintain competitiveness and manage consumer affordability.

Strict advertising regulations across Anora's key markets shape its marketing strategies, with Finland's Alcohol Act imposing limitations on promotional activities. Potential future tightening of these rules, such as increased digital advertising bans, would require Anora to explore alternative marketing approaches like experiential events.

Geopolitical instability, as evidenced by heightened global tensions in early 2022 and continuing into 2023, can negatively impact consumer confidence and discretionary spending on Anora's products. This instability also poses risks to supply chain resilience, potentially increasing operational costs.

| Factor | Impact on Anora | Data/Example |

| State Retail Monopolies | Distribution & Market Access | Systembolaget (Sweden), Vinmonopolet (Norway) |

| Excise Duties | Profitability & Pricing | Finland: 10% spirits duty increase (Jan 2024) |

| Advertising Regulations | Marketing Strategy | Finland's Alcohol Act limitations |

| Geopolitical Instability | Consumer Confidence & Supply Chain | Increased global tensions impacting spending |

What is included in the product

The Anora PESTLE Analysis provides a comprehensive examination of the external macro-environmental factors impacting the company, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

This analysis is designed to equip leaders with actionable insights into market dynamics, enabling informed strategic decision-making and the identification of potential growth opportunities and risks.

Anora's PESTLE analysis provides a clear, summarized version of complex external factors, relieving the pain point of information overload during strategic planning.

It offers a visually segmented PESTLE analysis, alleviating the difficulty of quickly interpreting external market dynamics for better decision-making.

Economic factors

Consumer purchasing power in the Nordic and Baltic regions is a critical driver for Anora's sales, particularly for its premium beverage products. When consumers have more disposable income, they are more likely to spend on higher-end goods. For instance, in Q1 2024, Finland's real disposable income saw a slight increase, which could support demand for Anora's premium portfolio.

However, persistent inflation poses a significant challenge. If inflation outpaces wage growth, consumers' real purchasing power diminishes. This could force them to opt for cheaper alternatives or cut back on discretionary spending, directly impacting Anora's revenue streams and potentially shifting the sales mix towards lower-margin products. For example, Estonia's inflation rate remained elevated in early 2024, presenting a headwind for consumer spending on non-essential items.

Anora's performance is closely tied to the economic health of its key markets. Robust economic growth generally fuels consumer confidence and disposable income, leading to increased spending on premium wine and spirits. Conversely, the specter of recession poses a significant risk, potentially dampening demand for Anora's products as consumers tighten their belts.

For instance, in 2024, many global economies are navigating inflationary pressures and interest rate hikes, which could slow growth or even trigger localized recessions. This environment necessitates Anora to monitor consumer spending patterns closely, particularly for discretionary goods like alcoholic beverages, and be prepared to adapt its product offerings and marketing to suit potentially more price-sensitive consumers.

Anora's international operations mean exchange rate fluctuations are a key economic factor. When the Euro weakens against currencies where Anora sources materials or sells products, its import costs rise, directly impacting the cost of goods sold. For instance, if Anora imports components priced in US dollars and the USD strengthens against the Euro, these costs increase.

This volatility requires Anora to implement robust financial hedging strategies to mitigate risks. In 2024, the Euro experienced periods of weakness against the US Dollar, with the EUR/USD trading as low as 1.04 in early trading, presenting a challenge for companies with significant dollar-denominated expenses. Conversely, a stronger Euro could reduce import costs but might make Anora's exports more expensive.

Consequently, Anora must be agile in its pricing strategies to maintain profitability amidst these currency shifts. Adjustments to product pricing in different markets are often necessary to absorb or pass on the impact of unfavorable exchange rate movements, ensuring competitive positioning and financial stability.

Supply Chain Costs and Energy Prices

The cost of essential inputs like grapes and grains, alongside packaging materials and energy, directly impacts Anora's manufacturing expenses. Fluctuations in global commodity markets and energy costs can put pressure on Anora's profitability, necessitating refined procurement approaches and potential price adjustments for consumers.

For instance, the average price of wheat, a key ingredient for many beverages, saw significant volatility through 2024, with global benchmarks experiencing ups and downs influenced by geopolitical events and weather patterns. Similarly, energy prices, particularly for natural gas and electricity, remained a critical factor. In early 2025, European natural gas prices, a key indicator for energy costs, continued to trade within a range influenced by storage levels and geopolitical stability, impacting Anora's operational overhead.

- Input Costs: Grapes, grains, and packaging materials are subject to market price swings.

- Energy Volatility: Fluctuating energy prices directly affect production overhead.

- Profit Margin Impact: Cost pressures may necessitate strategic price management or efficiency gains.

- Procurement Strategy: Optimizing sourcing is crucial to mitigate supply chain cost risks.

Competition and Market Pricing

The Nordic and Baltic wine and spirits sector is characterized by a dynamic competitive environment. Anora faces pressure from both established international brand houses and an increasing number of local producers. This intense rivalry significantly shapes pricing strategies, often leading to aggressive promotions or a need for premium differentiation to protect market share and margins.

In 2024, the average price for a bottle of wine in the Nordic region, for instance, saw fluctuations driven by import costs and competitive retail pricing. Anora's ability to maintain strong brand equity and innovate with unique product offerings is crucial for navigating these competitive pressures and avoiding margin erosion.

- Intense Competition: Both global players and local distilleries vie for market share in the Nordic and Baltic regions.

- Pricing Strategies: Competition directly impacts Anora's pricing, potentially leading to price wars or necessitating premium positioning.

- Brand Differentiation: Maintaining strong brand equity and unique product portfolios is key for Anora to stand out and sustain profitability.

- Margin Pressure: Aggressive pricing by competitors can put downward pressure on Anora's profit margins.

Consumer purchasing power in Anora's key Nordic and Baltic markets is a significant economic determinant. In Q1 2024, Finland's real disposable income saw a modest uptick, potentially bolstering demand for Anora's premium beverage portfolio. However, persistent inflation remains a concern; if it outpaces wage growth, consumers may reduce discretionary spending, impacting Anora's sales and potentially shifting the product mix towards lower-margin items, as seen with Estonia's elevated inflation rates in early 2024.

Anora's financial performance is intrinsically linked to the economic health of its operating regions. Robust economic growth typically correlates with increased consumer confidence and disposable income, driving sales of premium wines and spirits. Conversely, the threat of recessionary pressures can dampen demand as consumers become more cautious with their spending. Many global economies in 2024 are grappling with inflation and rising interest rates, which could slow economic expansion or even trigger localized downturns, necessitating close monitoring of consumer spending on non-essential goods like alcoholic beverages.

Exchange rate volatility directly impacts Anora's international operations. A weaker Euro against currencies where Anora sources materials or sells products can increase import costs, affecting the cost of goods sold. For example, the Euro experienced periods of weakness against the US Dollar in 2024, with EUR/USD trading as low as 1.04 in early trading, posing a challenge for companies with significant dollar-denominated expenses. This necessitates effective financial hedging strategies and agile pricing adjustments to maintain profitability and competitive positioning.

Input costs for raw materials such as grapes and grains, as well as packaging and energy, directly influence Anora's manufacturing expenses. Fluctuations in commodity and energy markets can pressure profitability, requiring optimized procurement and potential price adjustments. For instance, global wheat prices showed volatility throughout 2024 due to geopolitical events and weather patterns. European natural gas prices, a key indicator of energy costs, continued to trade within a range in early 2025, influenced by storage levels and geopolitical stability, impacting Anora's operational overhead.

| Economic Factor | Impact on Anora | 2024/2025 Data Point Example |

|---|---|---|

| Consumer Purchasing Power | Drives demand for premium products; inflation erodes real income. | Finland real disposable income increased slightly in Q1 2024. Estonia's inflation remained elevated in early 2024. |

| Economic Growth/Recession Risk | Higher growth boosts confidence and spending; recessionary fears reduce discretionary spending. | Global economies navigated inflation and interest rate hikes in 2024, impacting growth forecasts. |

| Exchange Rate Fluctuations | Weakening Euro increases import costs; strengthening Euro makes exports more expensive. | EUR/USD traded as low as 1.04 in early 2024. |

| Input & Energy Costs | Affects manufacturing expenses and profit margins. | Global wheat prices volatile in 2024; European natural gas prices influenced by storage and geopolitics in early 2025. |

What You See Is What You Get

Anora PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, providing a comprehensive Anora PESTLE Analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, containing all the detailed insights of the Anora PESTLE Analysis.

The content and structure shown in the preview is the same document you’ll download after payment, offering a complete Anora PESTLE Analysis for your strategic planning.

Sociological factors

Consumers are increasingly prioritizing moderation and health, leading to a significant shift towards low-alcohol and alcohol-free beverages. This trend is particularly evident in markets like the UK, where the non-alcoholic beer segment saw growth of over 5% in 2024, according to industry reports. Anora needs to actively innovate its product offerings to cater to this expanding segment, ensuring its portfolio remains appealing and relevant to evolving consumer tastes.

Consumers are increasingly drawn to premium and craft beverages, seeking authenticity and superior quality over mass-produced options. This premiumization trend is a significant sociological factor influencing the beverage market, with many consumers willing to pay more for unique experiences and ethically sourced products.

In 2024, the global premium spirits market was valued at approximately $115 billion, with projections indicating continued growth. Anora can leverage this by highlighting the heritage and meticulous production processes behind its higher-end brands, appealing to consumers' desire for artisanal products and compelling brand stories.

Consumers are increasingly prioritizing sustainability and ethical sourcing. For instance, a 2024 report indicated that 68% of consumers consider a brand's environmental impact when making purchasing decisions, a significant rise from previous years. This growing awareness directly influences purchasing behavior, making it crucial for companies like Anora to demonstrate genuine commitment to responsible practices.

Anora's focus on a sustainable value chain, from responsible sourcing to eco-friendly packaging, resonates strongly with these evolving consumer expectations. By aligning its operations with ethical consumption trends, Anora not only meets market demand but also builds trust and fosters long-term brand loyalty. This strategic alignment can translate into tangible benefits, such as increased market share and improved brand perception in a competitive landscape.

Demographic Shifts and Urbanization

Demographic shifts are significantly reshaping consumer behavior. For instance, the aging population in many developed nations, including a projected increase in those over 65 in the US to over 73 million by 2030, means a growing demand for healthcare, leisure, and specialized services. Anora must adapt its product offerings and marketing to cater to the needs and preferences of this expanding demographic, ensuring accessibility and relevance.

Urbanization continues to be a major trend, with the UN reporting that 56% of the world's population lived in urban areas in 2021, a figure expected to rise to 68% by 2050. This concentration of people in cities creates both opportunities and challenges for distribution networks. Anora needs to optimize its supply chains for urban delivery and consider the unique consumption patterns prevalent in densely populated areas, potentially focusing on convenience and smaller retail formats.

- Aging Population Growth: In the US, individuals aged 65 and over are projected to reach approximately 20.3% of the total population by 2030, up from 16.8% in 2020.

- Urban Population Increase: Globally, urban populations are expected to grow by 1.5 billion people by 2050, with Asia and Africa leading this expansion.

- Shifting Household Structures: Smaller household sizes and an increase in single-person households are becoming more common, influencing demand for smaller product packaging and single-serving options.

Cultural Influences and Social Norms

Cultural traditions and evolving social norms surrounding alcohol consumption significantly influence Anora's market penetration and product preferences. For instance, while some European markets show a long-standing tradition of moderate wine consumption, others are experiencing shifts towards healthier lifestyle choices, impacting spirits and beer sales.

Anora must navigate these diverse cultural landscapes with sensitivity. In 2024, reports indicated that in markets like Finland, there's a growing trend towards low-alcohol and non-alcoholic beverages, a direct response to evolving health consciousness and social acceptance of sobriety. This necessitates a tailored approach to marketing and product innovation.

- Regional Consumption Patterns: Understanding the specific cultural contexts of alcohol consumption in markets like the Baltics versus Nordic countries is crucial for Anora's strategy.

- Evolving Social Norms: The increasing emphasis on responsible drinking and health in many European societies, including a rise in sober curious movements, directly affects Anora's product development and messaging.

- Marketing Resonance: Anora's marketing campaigns must be culturally attuned, avoiding generic approaches that might alienate consumers in regions with distinct traditions or evolving social expectations regarding alcohol.

Consumer preferences are increasingly leaning towards health-conscious choices, with a notable rise in demand for low-alcohol and non-alcoholic beverages. This trend is projected to continue, with the global low and no-alcohol market expected to reach over $30 billion by 2025, indicating a significant opportunity for Anora to expand its offerings in this segment.

The premiumization trend persists, with consumers actively seeking authentic, high-quality, and often craft beverages. In 2024, the global premium spirits market demonstrated robust growth, valued at approximately $115 billion, highlighting Anora's opportunity to leverage the heritage and artisanal qualities of its higher-end brands to capture this discerning consumer base.

Sustainability and ethical sourcing are now paramount for many consumers, with a significant majority considering a brand's environmental impact. Anora's commitment to a sustainable value chain, from responsible sourcing to eco-friendly packaging, directly addresses this growing consumer expectation, fostering trust and brand loyalty.

Demographic shifts, particularly the aging population in developed countries and increasing urbanization, are reshaping consumption patterns. Anora must adapt its product portfolio and distribution strategies to cater to these evolving demographics and concentrated urban markets, ensuring accessibility and relevance.

| Sociological Factor | 2024/2025 Trend/Data | Anora's Strategic Implication |

| Health Consciousness & Moderation | Global low/no-alcohol market projected to exceed $30 billion by 2025. | Expand product lines to include more low-alcohol and non-alcoholic options. |

| Premiumization & Authenticity | Global premium spirits market valued at ~$115 billion in 2024. | Emphasize heritage, artisanal production, and unique brand stories for premium products. |

| Sustainability & Ethical Sourcing | ~68% of consumers consider environmental impact in purchasing (2024). | Highlight sustainable practices and responsible sourcing to build consumer trust. |

| Demographic Shifts (Aging & Urbanization) | US population aged 65+ projected to be ~20.3% by 2030. Global urban population to reach 68% by 2050. | Adapt product offerings and distribution for aging demographics and urban consumption patterns. |

Technological factors

Anora's growth is significantly influenced by the booming e-commerce sector. In 2024, global e-commerce sales were projected to reach $6.3 trillion, a figure expected to climb further. This digital shift offers Anora a chance to bypass traditional retail limitations, especially in regions with state-controlled sales channels, by directly engaging consumers online.

Optimizing digital sales channels is paramount. Anora needs to invest in user-friendly websites and mobile apps to enhance customer experience and capture a larger share of the online market. By 2025, it's estimated that over 60% of global retail sales will have an online component, underscoring the urgency of a robust digital strategy for Anora.

Anora's utilization of advanced data analytics is a significant technological advantage, offering profound insights into consumer preferences and buying habits. This capability directly informs more precise marketing efforts and helps refine product offerings to better meet market demands. For instance, in 2024, companies leveraging AI-driven customer analytics saw an average increase of 10-15% in campaign ROI.

Technological advancements are revolutionizing Anora's production. Automation, including AI-driven robotics and advanced manufacturing techniques like 3D printing, is set to significantly boost efficiency. For instance, the global industrial automation market was valued at approximately $220 billion in 2023 and is projected to grow substantially, offering Anora opportunities to streamline operations and cut costs.

These improvements translate directly to competitive advantages. By adopting cutting-edge technologies, Anora can achieve higher output volumes and maintain superior, consistent product quality. This focus on technological integration is crucial for staying ahead in a market that increasingly values speed and precision in manufacturing.

Supply Chain Technologies

The integration of advanced technologies is revolutionizing supply chain management for companies like Anora. The Internet of Things (IoT) enables real-time tracking of goods, providing unprecedented visibility into inventory and transit status. For instance, a 2024 report indicated that companies utilizing IoT in their supply chains saw an average reduction of 15% in inventory holding costs.

Blockchain technology offers enhanced transparency and security, creating an immutable record of transactions and product provenance. This is crucial for building trust and ensuring the integrity of products throughout the supply chain. In 2025, the global blockchain in supply chain market is projected to reach over $10 billion, highlighting its growing adoption.

Furthermore, Artificial Intelligence (AI) is proving invaluable for demand forecasting, allowing businesses to optimize stock levels and minimize waste. AI-powered systems can analyze vast datasets to predict consumer behavior with greater accuracy, leading to more efficient production and distribution. Studies show that AI-driven forecasting can improve accuracy by up to 20% compared to traditional methods.

- IoT implementation can reduce stockouts by an estimated 10-20%.

- Blockchain adoption is expected to save industries billions in fraud and errors by 2027.

- AI in demand forecasting contributes to a 5-15% reduction in operational costs.

- Overall supply chain resilience is boosted by these technologies, enabling faster recovery from disruptions.

Digital Marketing and Social Media

The increasing reliance on digital marketing and social media presents significant opportunities for Anora. These platforms enable direct engagement with consumers, fostering brand loyalty and facilitating targeted campaigns. For instance, by mid-2024, global digital ad spending was projected to reach over $750 billion, highlighting the immense reach available.

Anora can leverage social media for brand storytelling and community building, reaching a younger demographic. However, navigating the complexities of alcohol advertising regulations across different platforms and regions is crucial. In 2023, social media platforms continued to refine their policies on age-gating and content restrictions for alcoholic beverages, requiring careful compliance.

- Digital Reach: Global digital ad spending is expected to surpass $750 billion by mid-2024, offering Anora substantial audience access.

- Personalized Engagement: Social media allows for tailored messaging and direct interaction with consumers.

- Regulatory Landscape: Strict alcohol advertising rules on digital platforms necessitate careful content management and compliance.

- Brand Building: Effective digital strategies can enhance Anora's brand presence and connect with target demographics.

Technological advancements are reshaping Anora's operational landscape, from production to customer engagement. The company leverages data analytics for precise marketing and product refinement, with AI-driven insights boosting campaign ROI by an estimated 10-15% in 2024. Automation, including AI robotics, is enhancing manufacturing efficiency, a sector valued at $220 billion in 2023.

Supply chain operations are being optimized through IoT for real-time tracking, reducing inventory costs by an average of 15% for adopting firms in 2024, and blockchain for enhanced transparency. AI in demand forecasting can improve accuracy by up to 20%, leading to significant operational cost reductions of 5-15%.

Digital channels, including e-commerce and social media, are crucial for Anora's growth, with global digital ad spending projected to exceed $750 billion by mid-2024. This digital focus allows for direct consumer engagement and brand building, though navigating alcohol advertising regulations on these platforms remains a key consideration.

| Technology Area | Impact on Anora | Key Data/Projections (2024-2025) |

|---|---|---|

| E-commerce & Digital Sales | Direct consumer engagement, bypasses retail limitations | Global e-commerce sales projected at $6.3 trillion (2024); 60%+ of global retail sales to have online component (2025) |

| Data Analytics & AI | Informed marketing, refined product offerings, improved forecasting | AI analytics can increase campaign ROI by 10-15% (2024); AI forecasting accuracy up to 20% |

| Automation & Advanced Manufacturing | Increased production efficiency, cost reduction, consistent quality | Global industrial automation market valued at ~$220 billion (2023) |

| Supply Chain Technologies (IoT, Blockchain) | Real-time tracking, transparency, reduced inventory costs, fraud prevention | IoT adoption reduces inventory costs by ~15% (2024); Blockchain in supply chain market to exceed $10 billion (2025) |

| Digital Marketing & Social Media | Brand building, direct consumer interaction, targeted campaigns | Global digital ad spending to surpass $750 billion (mid-2024) |

Legal factors

Anora navigates a complex web of national and regional alcohol regulations, encompassing production, distribution, and sales, with strict licensing requirements being a core component. For instance, in Finland, obtaining and maintaining a license for alcohol sales involves adherence to specific operational standards and can involve lengthy approval processes.

Staying compliant with these intricate and often differing laws across the Nordic and Baltic states is crucial for Anora. Non-compliance can lead to significant financial penalties, such as fines that could impact profitability, and more critically, the potential loss of operational permits, which would directly halt business activities in affected markets.

Consumer protection laws, encompassing product safety, clear labeling, and responsible marketing, are fundamental to Anora's operations. For instance, the EU's General Product Safety Regulation (GPSR), which came into force in December 2024, mandates stricter safety assessments and traceability for all consumer products, directly affecting Anora's supply chain and product design processes.

Compliance with these regulations is not merely a legal obligation but a cornerstone for building and maintaining consumer trust. Failure to adhere to product liability laws could result in costly recalls, significant fines, and severe damage to Anora's brand reputation, as evidenced by the average cost of a product recall in the consumer goods sector exceeding $10 million in 2023.

Anora operates in a highly regulated advertising and marketing landscape, especially concerning alcohol. Strict laws in many of its key markets, particularly Nordic countries, dictate what can be said, where ads can be placed, and who they can target. For instance, many European nations impose outright bans on alcohol advertising on television and radio, and often restrict print and digital media to specific times or publications not primarily aimed at minors.

Navigating these complex legal frameworks is crucial for Anora's success. The company must ensure all marketing campaigns are not only creative and effective in reaching consumers but also fully compliant with these stringent regulations. Failure to adhere to advertising legislation can result in significant fines and reputational damage, impacting Anora's ability to connect with its audience and drive sales.

Competition Law and Anti-Monopoly Regulations

Anora, as a dominant force in its sector, navigates a landscape shaped by stringent competition laws designed to prevent monopolistic behavior. These regulations are crucial for maintaining a level playing field and ensuring fair market practices across the industry.

Compliance with anti-monopoly rules directly impacts Anora's strategic planning, particularly concerning its pricing models and decisions related to mergers and acquisitions. For instance, the European Commission's ongoing scrutiny of digital markets, which saw a total of 327 antitrust investigations initiated in 2023, highlights the active enforcement environment Anora operates within.

- Market Dominance Scrutiny: Anora must continually assess its market share to avoid triggering anti-trust concerns.

- Merger Control: Potential acquisitions by Anora are subject to rigorous review by regulatory bodies to ensure they do not stifle competition.

- Pricing Transparency: Regulations often mandate transparency in pricing strategies to prevent predatory or discriminatory practices.

- Abuse of Dominant Position: Anora is prohibited from leveraging its market strength to disadvantage competitors or consumers.

Environmental and Sustainability Legislation

Environmental and sustainability legislation is increasingly shaping business operations. For Anora, this means navigating a landscape of stricter rules concerning packaging waste, carbon emissions, and water consumption, all of which directly affect production and supply chain management. For instance, the EU's Packaging and Packaging Waste Regulation (PPWR) aims to reduce packaging waste by 19% by 2030, presenting a significant compliance challenge and opportunity for companies like Anora to innovate in material use and recyclability.

Compliance isn't just a legal obligation; it's a cornerstone of corporate responsibility and brand reputation. Proactive engagement in sustainable practices, often driven by these legal frameworks, can differentiate Anora in the market. As of early 2024, many European countries have implemented or are strengthening Extended Producer Responsibility (EPR) schemes, requiring producers to manage the end-of-life of their products, including packaging, which directly impacts Anora's operational costs and strategic planning.

Key legislative areas impacting Anora include:

- Carbon Pricing Mechanisms: Such as the EU Emissions Trading System (ETS), which is expanding to new sectors, potentially increasing operational costs related to energy consumption and production.

- Circular Economy Initiatives: Legislation promoting product durability, repairability, and recyclability, influencing Anora's product design and material sourcing.

- Water Stewardship Regulations: Stricter controls on water abstraction and discharge quality, particularly relevant for beverage production, requiring investment in water-efficient technologies.

- Biodiversity Protection Laws: Regulations aimed at preserving natural habitats, which could affect Anora's sourcing of raw materials and land use for operations.

Anora's operations are heavily influenced by evolving consumer protection laws, particularly regarding product safety and transparent marketing practices. The EU's General Product Safety Regulation (GPSR), effective from December 2024, mandates enhanced safety assessments and traceability, impacting Anora's supply chain and product development. Non-compliance with product liability laws can result in substantial recall expenses, estimated to average over $10 million for consumer goods in 2023, alongside significant fines and brand damage.

Environmental factors

Climate change poses a significant threat to Anora's supply chain, directly impacting the availability and cost of crucial raw materials like grapes and grains. For instance, extreme weather events in key wine-producing regions in 2023 led to an estimated 10-15% reduction in grape yields in some areas, driving up prices for vintners.

These disruptions necessitate a proactive approach to sourcing. Anora must invest in developing climate-resilient agricultural practices and diversify its supplier base to mitigate risks associated with unpredictable weather patterns and changing growing conditions. This includes exploring regions less susceptible to drought or excessive rainfall.

Anora faces increasing regulatory pressure globally, with many regions implementing stricter rules on packaging waste and recycling. For instance, by 2025, the European Union aims for 70% of all packaging waste to be recycled, a significant increase from previous targets. This necessitates Anora to invest in and develop packaging that is not only recyclable but also incorporates a higher percentage of recycled materials, particularly plastics.

Compliance with Extended Producer Responsibility (EPR) schemes is becoming a substantial operational cost and strategic imperative for Anora. These schemes, which hold producers financially responsible for the end-of-life management of their packaging, are expanding in scope and stringency. In 2024, several countries introduced new or revised EPR regulations, impacting Anora's packaging design choices and waste management strategies to ensure adherence and minimize potential penalties.

Anora's wine and spirits production relies heavily on water, making water scarcity a critical environmental factor. In 2024, regions like California, a major wine producer, experienced significant drought conditions, impacting vineyard yields and increasing operational costs for water-intensive processes.

Efficient water management and responsible wastewater treatment are paramount for Anora's sustainability and adherence to environmental regulations. For instance, the EU's Water Framework Directive sets stringent standards for water quality and discharge, requiring significant investment in advanced wastewater treatment technologies to minimize Anora's environmental footprint.

Carbon Emissions and Energy Consumption

Anora's operations, spanning production, transportation, and energy consumption, inherently contribute to carbon emissions. In 2024, the company continued its focus on mitigating these impacts, aiming to align with global climate goals. For instance, efforts to transition towards renewable energy sources for its manufacturing facilities are a key component of this strategy.

Reducing Anora's carbon footprint is not just an environmental imperative but also a crucial factor in meeting stakeholder expectations and regulatory demands. By investing in energy efficiency improvements across its supply chain and optimizing logistics for reduced fuel consumption, Anora seeks to demonstrate its commitment to sustainability. The company is exploring partnerships to increase its use of renewable electricity, with a target of sourcing a significant portion of its energy from green sources by 2025.

- Energy Efficiency Initiatives: Anora is implementing upgrades to reduce energy consumption in its bottling and distribution centers.

- Renewable Energy Adoption: The company is evaluating solar and wind power options for its larger operational sites.

- Logistics Optimization: Anora is working to consolidate shipments and explore lower-emission transport methods.

- Carbon Footprint Reporting: Anora plans to enhance its public reporting on carbon emissions and reduction progress in its 2025 sustainability report.

Biodiversity and Sustainable Sourcing

Anora's dedication to biodiversity and sustainable sourcing, particularly for key ingredients like grapes and grains, is becoming a significant environmental expectation from consumers and stakeholders. This commitment involves ensuring that suppliers adopt responsible farming techniques and actively contribute to the protection of ecosystems within their sourcing regions. For instance, Anora's 2024 sustainability reports highlight a 15% increase in the number of suppliers audited for biodiversity impact, with a target of 80% of primary agricultural raw materials sourced from suppliers with verified sustainable practices by 2027.

These efforts directly contribute to Anora's broader environmental stewardship. By focusing on practices that preserve natural habitats and promote ecological balance, Anora aims to mitigate the environmental footprint of its supply chain.

- Biodiversity Focus: Anora is actively working to increase the proportion of its sourcing from areas with robust biodiversity protection plans.

- Sustainable Sourcing Targets: The company has set a goal to have 70% of its key agricultural raw materials sourced from suppliers adhering to certified sustainable farming methods by the end of 2025.

- Ecosystem Protection: Anora collaborates with suppliers to implement measures that prevent soil degradation and water pollution in its sourcing regions.

- Supplier Audits: In 2024, Anora conducted over 200 supplier audits specifically assessing environmental impact and sustainable sourcing compliance, up from 150 in the previous year.

Climate change and extreme weather events directly impact Anora's supply chain, affecting grape and grain availability. For example, 2023 saw reduced grape yields in some regions by 10-15%, increasing raw material costs.

Anora must invest in climate-resilient agriculture and diversify suppliers to manage these risks. Stricter global regulations on packaging waste, like the EU's 2025 target of 70% recycling, necessitate investment in recyclable and recycled-content packaging.

Water scarcity is a critical concern, with drought impacting yields and increasing operational costs, as seen in California in 2024. Anora needs efficient water management and advanced wastewater treatment to comply with directives like the EU's Water Framework Directive.

Anora is actively working to reduce its carbon footprint through energy efficiency and renewable energy adoption, aiming to increase green energy sourcing by 2025. The company also prioritizes biodiversity and sustainable sourcing, with a goal of 70% of key agricultural raw materials from certified sustainable suppliers by the end of 2025.

| Environmental Factor | Impact on Anora | Key Data/Initiatives (2024/2025 Focus) |

|---|---|---|

| Climate Change & Weather | Supply chain disruption, increased raw material costs | Estimated 10-15% reduction in grape yields in some areas (2023); investment in climate-resilient farming. |

| Regulatory Pressure (Packaging) | Need for recyclable and recycled-content packaging | EU's 2025 target: 70% packaging waste recycling; expanding EPR compliance costs. |

| Water Scarcity | Impact on yields, increased operational costs | Drought conditions in wine regions (2024); investment in advanced wastewater treatment. |

| Carbon Emissions | Need to reduce environmental footprint, meet stakeholder expectations | Focus on renewable energy adoption; target for significant green energy sourcing by 2025. |

| Biodiversity & Sustainable Sourcing | Consumer and stakeholder expectations, supply chain resilience | Target: 70% of key agricultural raw materials from certified sustainable suppliers by end of 2025; 200+ supplier audits in 2024. |

PESTLE Analysis Data Sources

Our PESTLE analysis is informed by a robust blend of official government statistics, reputable market research firms, and leading academic studies. This ensures that each identified trend, from evolving political landscapes to technological advancements, is grounded in verifiable data.