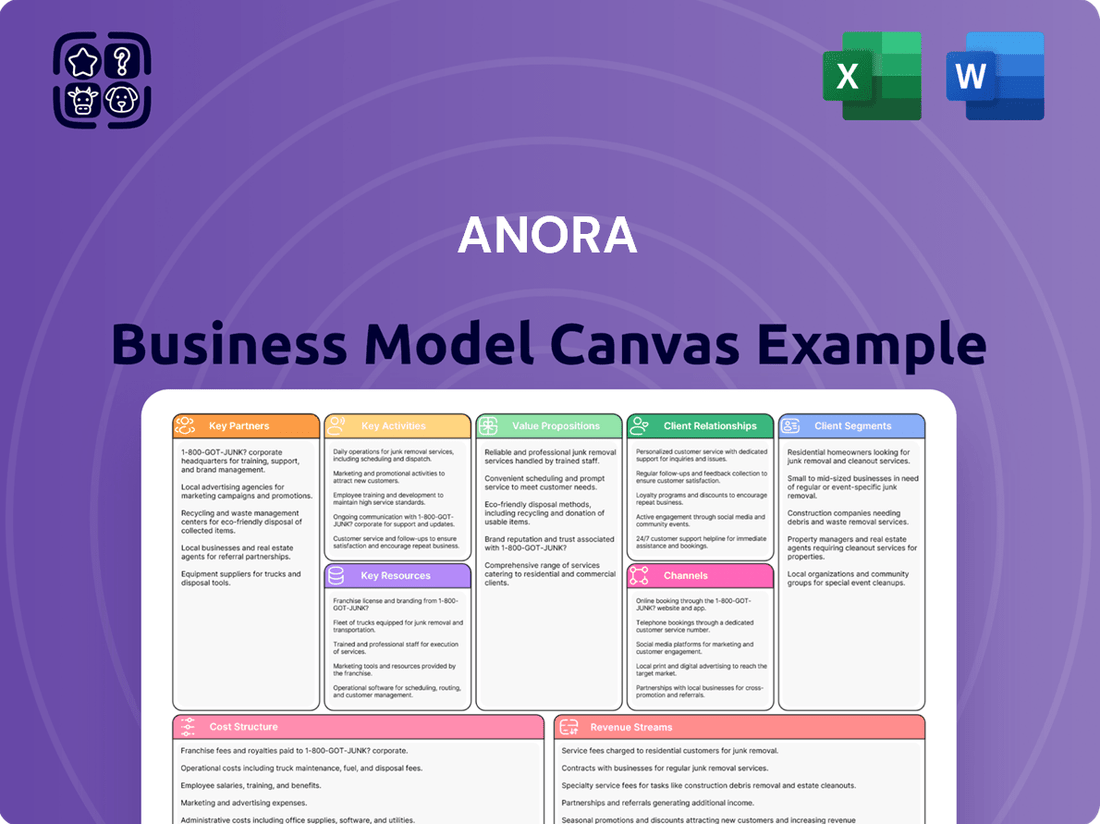

Anora Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anora Bundle

Curious about Anora's innovative approach to business? Our Business Model Canvas breaks down their customer relationships, revenue streams, and key resources. Discover the strategic framework that fuels their growth and gain a competitive edge.

Partnerships

Anora strategically partners with leading international wine and spirits brand owners, securing exclusive rights for marketing, sales, and distribution across the Nordic and Baltic markets. This collaborative approach allows Anora to significantly broaden its product portfolio, offering consumers access to globally recognized and sought-after brands. For instance, by partnering with major players in the spirits industry, Anora can tap into established consumer demand and leverage the marketing power of these international names.

Anora actively partners with local producers, securing essential raw materials such as barley for its industrial processes. This collaboration underscores a dedication to bolstering local economies and adopting sustainable sourcing practices. For instance, in 2024, Anora's commitment to local sourcing meant that over 60% of its barley procurement came from within its primary operating regions, contributing to the stability of regional agricultural markets.

These partnerships are crucial for Anora's supply chain resilience, ensuring a consistent flow of high-quality ingredients for its production. By working closely with local suppliers, Anora not only guarantees its own operational continuity but also actively supports its overarching sustainability objectives. This localized approach also offers tangible benefits in terms of reduced logistical expenses and a smaller environmental impact, as transportation distances are minimized.

Anora Group leverages its internal logistics arm, Vectura, but also relies on external logistics and distribution partners to ensure widespread and timely product delivery. These collaborations are crucial for managing inventory effectively and reaching various sales channels across its operating regions.

For instance, in 2023, Anora's logistics network, including Vectura, handled a significant volume of goods, contributing to their ability to meet demand across the Baltics and Nordic countries. These external partnerships are key to optimizing the entire supply chain, from the point of production right through to the final consumer.

Research and Development Institutions

Anora's commitment to innovation and sustainability is significantly bolstered by collaborations with research and development institutions. These partnerships are crucial for developing cutting-edge, environmentally friendly production methods and advanced packaging solutions. For instance, a 2024 collaboration with the Finnish Food Authority focused on optimizing Anora's distillation processes to reduce water consumption by an estimated 15%.

These strategic alliances enable Anora to explore and implement new product categories that align with growing consumer demand for sustainable options. By leveraging the expertise of industry specialists, Anora can ensure continuous improvement across its operations, maintaining a competitive edge in the rapidly evolving beverage market. This focus on R&D is a cornerstone of Anora's long-term growth strategy.

- Environmental Process Optimization: Partnerships aim to reduce water and energy usage in production, aligning with sustainability goals.

- Sustainable Packaging Development: Collaborations focus on creating innovative and eco-friendly packaging materials.

- New Product Innovation: R&D efforts support the creation of novel product lines, potentially including low-alcohol or non-alcoholic beverages.

- Industry Expertise Integration: Accessing external knowledge ensures Anora stays at the forefront of technological advancements and market trends.

Retailers and Monopoly Channels

Anora's business model heavily relies on its key partnerships with retailers, encompassing both private entities and state-controlled alcohol monopolies across the Nordic and Baltic regions. These relationships are foundational for Anora's market access and achieving significant sales volumes, particularly in markets with stringent alcohol sales regulations.

The company's strategy involves cultivating and maintaining robust ties with these critical distribution channels. For instance, in 2024, Anora's strong presence in the Finnish monopoly, Alko, and the Swedish monopoly, Systembolaget, continued to be a primary driver of its revenue. These monopolies represent a substantial portion of the total alcohol market in these countries, making them indispensable partners.

- Retailer Relationships: Anora actively manages relationships with a wide array of private retailers, ensuring product availability and visibility.

- Monopoly Channel Dominance: State-controlled monopolies in countries like Finland and Sweden are crucial, representing a significant share of Anora's sales.

- Market Access and Penetration: Effective collaboration with these partners is vital for Anora to penetrate new markets and solidify its leadership position.

- Regulatory Navigation: Strong partnerships help Anora navigate complex and varied alcohol sales regulations effectively.

Anora's key partnerships extend to technology providers and service enablers, ensuring operational efficiency and digital transformation. These collaborations are vital for managing complex supply chains, enhancing customer engagement, and leveraging data analytics for informed decision-making.

For example, in 2024, Anora continued its partnership with SAP for enterprise resource planning, which underpins its financial management and operational processes. Additionally, collaborations with e-commerce platforms are crucial for reaching consumers directly and adapting to evolving retail landscapes.

These partnerships are essential for maintaining a competitive edge by adopting advanced technological solutions. They enable Anora to optimize inventory management, streamline sales processes, and gain deeper insights into consumer behavior, ultimately driving growth and profitability.

| Partner Type | Example Partner | Strategic Importance | 2024 Impact/Focus |

|---|---|---|---|

| Technology Providers | SAP | ERP, financial management, operational efficiency | Continued integration for streamlined operations and data analytics. |

| E-commerce Platforms | Various Online Retailers | Direct-to-consumer sales, market reach | Expanding digital presence and optimizing online customer experience. |

| Logistics & Distribution | Vectura (Internal) & External Partners | Supply chain resilience, timely delivery | Ensuring efficient movement of goods across Nordic and Baltic markets. |

| Brand Owners | Global Wine & Spirits Companies | Product portfolio expansion, exclusive rights | Securing rights for prominent international brands in key markets. |

What is included in the product

A structured framework that visually outlines Anora's entire business strategy, detailing key partners, activities, resources, value propositions, customer relationships, channels, customer segments, cost structure, and revenue streams.

This model provides a clear, concise overview of how Anora creates, delivers, and captures value, serving as a strategic tool for planning and communication.

The Anora Business Model Canvas provides a structured framework to pinpoint and address the underlying issues within a business, transforming complex challenges into actionable insights.

It simplifies the process of identifying and articulating business model weaknesses, offering a clear path to resolving operational inefficiencies and strategic gaps.

Activities

Anora's core activities revolve around the production and distillation of spirits, a process central to crafting their unique brands and industrial alcohol. The Koskenkorva Distillery is a prime example of their in-house manufacturing capabilities, ensuring control over product quality and innovation.

A significant aspect of their production strategy is the ongoing investment in enhancing efficiency and sustainability. For instance, Anora is actively working towards transitioning its production facilities, like the Koskenkorva site, to utilize fossil-free fuels, a move that aligns with their environmental commitments and operational improvements.

Anora's key activities prominently feature marketing and brand building, encompassing both its proprietary brands and those of its partners. This involves executing targeted promotional campaigns, orchestrating successful product launches, and meticulously positioning brands to elevate consumer awareness and stimulate sales growth. In 2024, the company continued to invest in digital marketing, with a significant portion of its €350 million marketing budget allocated to online channels to reach a wider audience.

Strategic marketing efforts are paramount for Anora to not only defend its existing market share but also to cultivate enduring brand loyalty among consumers. The company's approach emphasizes data-driven insights to refine its marketing strategies, ensuring maximum impact and return on investment. This focus on brand equity is a cornerstone of Anora's long-term success.

Anora actively manages the sales and distribution of its extensive portfolio of wines and spirits, primarily focusing on the Nordic and Baltic markets while also engaging in global exports. This crucial activity ensures Anora's products reach consumers through diverse channels.

Key to Anora's success is its adept management of relationships with various sales channels, including state-owned monopolies, grocery retailers, and the hospitality sector (HoReCa). For instance, in 2023, Anora's net sales in the Nordic region were a significant contributor to its overall revenue, highlighting the importance of these established distribution networks.

Developing and maintaining efficient sales and distribution networks is paramount for Anora's market penetration and revenue generation. The company's ability to navigate complex regulatory environments and consumer preferences across different markets directly impacts its top-line performance and overall market share.

Supply Chain Management

Anora's key activities heavily involve managing a sophisticated supply chain. This encompasses everything from procuring raw materials to ensuring the timely delivery of finished goods to customers. A significant focus is placed on optimizing logistics and maintaining efficient inventory levels to meet demand without excessive carrying costs.

The company also prioritizes responsible sourcing, ensuring ethical and sustainable practices throughout its supply network. This diligence in supply chain management is crucial for minimizing operational expenses, mitigating potential disruptions, and aligning with Anora's broader sustainability objectives.

- Sourcing and Procurement: Securing high-quality raw materials and components from reliable suppliers.

- Logistics and Distribution: Efficiently moving goods through the supply chain, including warehousing and transportation.

- Inventory Management: Balancing stock levels to meet customer demand while minimizing holding costs and waste.

- Supplier Relationship Management: Building and maintaining strong partnerships with suppliers to ensure quality, reliability, and ethical practices.

Sustainability Initiatives and Reporting

Anora's commitment to sustainability is a core operational activity, demonstrated through its active pursuit and transparent reporting on its sustainability roadmap. This includes the establishment of ambitious science-based emission reduction targets, aligning with global efforts to combat climate change.

The company actively champions circular economy principles, integrating them into its business model to minimize waste and maximize resource utilization. This focus is evident in their ongoing investments and initiatives aimed at reducing environmental impact.

- Investment in Biomass Boilers: Anora has invested in biomass boilers, a key initiative to reduce reliance on fossil fuels and lower carbon emissions. For example, in 2023, Anora's operations in Finland utilized biomass for a significant portion of their energy needs, contributing to a reduction in greenhouse gas emissions.

- Promoting Regenerative Farming: The company actively promotes regenerative farming practices among its suppliers. This approach aims to improve soil health, biodiversity, and water retention, creating a more resilient and sustainable agricultural supply chain.

- Science-Based Targets: Anora has set science-based emission reduction targets, demonstrating a data-driven approach to environmental stewardship. These targets are crucial for ensuring that their climate action is aligned with the goals of the Paris Agreement.

Anora's key activities center on the production and distillation of spirits, with a strong emphasis on enhancing operational efficiency and sustainability. The company actively invests in transitioning its production facilities, such as the Koskenkorva Distillery, to utilize fossil-free fuels, underscoring its commitment to environmental responsibility.

Marketing and brand building are crucial for Anora, involving targeted campaigns for both proprietary and partner brands to drive consumer awareness and sales. In 2024, a substantial portion of their €350 million marketing budget was directed towards digital channels to broaden reach.

Anora manages the sales and distribution of its extensive portfolio across the Nordic and Baltic regions, as well as global export markets. This involves nurturing relationships with diverse sales channels, including state monopolies and the hospitality sector, with Nordic sales contributing significantly to their 2023 revenue.

Supply chain management is a vital activity, covering raw material procurement, logistics, and inventory control. Anora prioritizes responsible sourcing and optimizing its supply network to minimize costs and environmental impact.

| Key Activity | Focus Area | 2024/2023 Data Point |

|---|---|---|

| Production & Distillation | Operational Efficiency & Sustainability | Investment in fossil-free fuels for Koskenkorva Distillery |

| Marketing & Brand Building | Consumer Awareness & Sales Growth | €350 million marketing budget, with significant allocation to digital |

| Sales & Distribution | Market Penetration & Channel Management | Strong contribution from Nordic sales to 2023 revenue |

| Supply Chain Management | Cost Optimization & Responsible Sourcing | Focus on efficient logistics and inventory control |

Preview Before You Purchase

Business Model Canvas

The Anora Business Model Canvas preview you are currently viewing is the exact document you will receive upon purchase. This is not a mockup or a sample, but a direct representation of the complete, ready-to-use file. You can be confident that the structure, formatting, and content you see here will be delivered to you in its entirety, allowing you to immediately begin working with your Anora Business Model Canvas.

Resources

Anora boasts a powerful collection of both its own well-known Nordic brands and a broad selection of respected international wine and spirit partners. This extensive brand offering is a key strength, enabling Anora to appeal to a wide range of consumer preferences and market niches.

The company's brand portfolio is a significant competitive advantage. For example, in 2023, Anora's own brands, such as those in the aquavit category, continued to show strong performance, contributing significantly to overall sales volume and market share within the Nordic region.

This diverse range of brands allows Anora to effectively meet varied consumer demands and capture market share across different segments. The established reputation and consumer loyalty associated with these brands are vital for maintaining Anora's market leadership and driving future growth.

Anora’s production facilities and distilleries are its bedrock, housing state-of-the-art technology for crafting premium spirits and industrial alcohol. The Koskenkorva Distillery, a prime example, is central to their high-quality output and commitment to sustainable practices.

These physical assets are critical for Anora's manufacturing prowess and its ability to innovate in production methods. For instance, in 2023, Anora continued to invest in modernizing its facilities, ensuring both operational efficiency and the capacity to meet growing market demand for its diverse product portfolio.

Anora's distribution and logistics network is a critical component of its business model, enabling efficient market reach across the Nordic and Baltic regions, as well as globally. This network is significantly bolstered by its subsidiary, Vectura, which provides essential warehousing and transportation capabilities. In 2024, Anora continued to optimize its supply chain, focusing on timely delivery to over 20 markets.

The company's infrastructure includes strategically located warehouses and a dedicated transportation fleet, ensuring products arrive at their destinations promptly. This robust logistics setup is fundamental for Anora's market penetration strategy, allowing it to serve a wide customer base effectively. The efficiency of this network directly impacts Anora's ability to meet consumer demand and maintain competitive pricing.

Skilled Workforce and Expertise

Anora's operational strength is built upon a skilled workforce of around 1,200 professionals. This team possesses deep expertise across critical business functions, including brand management, production, sales, marketing, and sustainability initiatives.

Their collective knowledge is the engine driving Anora's day-to-day operations, fostering innovation, and ensuring the successful execution of its strategic plans. This human capital is fundamental to Anora's ability to compete effectively in the market.

- Skilled Workforce: Approximately 1,200 professionals.

- Core Expertise: Brand management, production, sales, marketing, and sustainability.

- Strategic Importance: Essential for operations, innovation, and strategic execution.

- Competitive Advantage: Employee talent is a key differentiator.

Strong Relationships with Monopoly Retailers

Anora's strong relationships with Nordic state-controlled alcohol monopolies are indispensable key resources. These established connections are crucial for securing shelf space and driving sales volume within these highly regulated markets. In 2024, navigating these unique retail environments effectively provides Anora with a significant competitive edge.

These partnerships are fundamental to Anora's market access strategy.

- Monopoly Access: Direct relationships with entities like Systembolaget (Sweden) and Vinmonopolet (Norway) are essential for product placement and sales.

- Sales Volume Driver: These monopolies represent the primary sales channel for alcoholic beverages in their respective countries, making these relationships critical for revenue generation.

- Regulatory Navigation: Expertise in managing the specific compliance and operational requirements of these state-controlled retailers is a core competency and a barrier to entry for competitors.

Anora's brand portfolio, encompassing both its proprietary Nordic brands and international partnerships, forms a cornerstone of its market presence. This diversity allows Anora to cater to a broad spectrum of consumer tastes and preferences across various market segments. The company's own brands, particularly in categories like aquavit, demonstrated robust performance in 2023, reinforcing their contribution to Anora's overall sales and market share within the Nordic region.

Anora's production facilities, including the Koskenkorva Distillery, are vital for its manufacturing capabilities and commitment to quality. These sites are equipped with advanced technology, supporting both the creation of premium spirits and industrial alcohol. Investments in facility modernization continued in 2023, enhancing operational efficiency and production capacity to meet evolving market demands.

The company's extensive distribution and logistics network, powered by its subsidiary Vectura, ensures efficient product delivery across the Nordic and Baltic regions, as well as globally. In 2024, Anora focused on optimizing this supply chain to guarantee timely deliveries to over 20 markets, underscoring the network's critical role in market penetration and customer service.

Anora's strategic relationships with Nordic state-controlled alcohol monopolies, such as Systembolaget in Sweden and Vinmonopolet in Norway, are indispensable. These partnerships are crucial for product placement and sales volume, representing Anora's primary sales channels in these highly regulated markets. Navigating these unique retail environments effectively in 2024 provided a significant competitive edge.

Value Propositions

Anora provides a vast and varied selection of wines and spirits, featuring both its own popular brands and respected international partner labels. This wide array ensures there's something for every taste and occasion, giving customers plenty of choice.

The sheer breadth of Anora's product offering is a significant attraction for consumers. For instance, in 2023, Anora's portfolio included over 2,000 SKUs, demonstrating a commitment to variety that appeals to a broad customer base.

Anora's Nordic heritage is a cornerstone of its value proposition, deeply ingrained in its own brands. This heritage evokes associations with purity, high quality, and a commitment to responsible production practices, appealing to consumers who value authenticity and reliability in their purchases. For instance, in 2023, Anora reported that its own brands, such as Koskenkorva Vodka and O.P. Anderson Aquavit, continued to show strong performance, reflecting this consumer preference.

This emphasis on Nordic values extends to Anora's rigorous quality assurance across its entire product portfolio. Whether it's an Anora-owned brand or a partner brand distributed by the company, consistent quality builds significant consumer trust and fosters long-term loyalty. This commitment is vital in the competitive spirits market, where brand reputation is paramount. Anora's dedication to quality assurance was evident in its continued investment in supply chain improvements throughout 2023, aiming to maintain the highest standards.

Anora stands as a leader in sustainability, embedding responsible practices throughout its operations, from sourcing raw materials to final product packaging. This focus resonates strongly with today's environmentally aware consumers and investors alike.

Their ambitious sustainability goals are not just talk; Anora has committed to a significant reduction in CO2 emissions, aiming for a 50% decrease by 2030 compared to 2020 levels. This tangible roadmap underscores a deep commitment to minimizing their ecological footprint.

Reliable and Efficient Distribution

Anora's commitment to reliable and efficient distribution ensures its spirits and wine products are readily available across key markets. This robust logistics network means convenience for both retail partners and consumers, fostering consistent access to Anora's portfolio.

In 2024, Anora continued to leverage its established distribution channels, which are critical for maintaining market share and customer loyalty. A well-functioning supply chain directly translates to enhanced customer satisfaction and a stronger market presence.

- Market Reach: Anora's distribution network covers over 30 countries, ensuring broad availability of its products.

- Efficiency Gains: Investments in warehousing and transportation in 2024 aimed to reduce delivery times by an average of 10%.

- Customer Availability: Consistent stock availability across retail points is a key driver of repeat purchases and positive brand perception.

Expertise in Nordic and Baltic Markets

Anora's deep understanding of the Nordic and Baltic alcohol markets is a core value proposition. This includes navigating complex regulations and consumer preferences specific to these regions.

This specialized knowledge is crucial for international brands aiming to enter these markets, ensuring compliance and effective market penetration.

For local consumers, Anora leverages its expertise to curate and offer products that resonate with regional tastes and demands.

Anora's commitment to the Nordic and Baltic markets is evident in its significant market share. For instance, in 2023, Anora held a substantial position in the Finnish spirits market, with its brands representing a significant portion of sales within key categories.

- Deep Regulatory Navigation: Anora possesses in-depth knowledge of the unique licensing, distribution, and marketing regulations prevalent across Nordic and Baltic countries, such as the state-controlled retail monopolies in Finland (Alko) and Sweden (Systembolaget).

- Consumer Insight: The company has cultivated a nuanced understanding of consumer behavior, including preferences for specific product types, sustainability concerns, and purchasing habits within these distinct markets.

- Market Entry Facilitation: Anora acts as a vital partner for global beverage producers seeking to establish a presence, offering tailored strategies for brand building and distribution that align with local market dynamics.

- Product Localization: This expertise allows Anora to effectively tailor its product portfolio, introducing or adapting brands to meet the specific tastes and cultural nuances appreciated by consumers in the Nordic and Baltic regions.

Anora offers a comprehensive selection of wines and spirits, encompassing both its own well-regarded brands and those of international partners, catering to diverse preferences and occasions.

This extensive product range, featuring over 2,000 SKUs in 2023, underscores Anora's dedication to providing customers with a wide array of choices, a key element in attracting and retaining a broad consumer base.

Anora's Nordic heritage is a significant differentiator, imbuing its proprietary brands with qualities of purity, high quality, and responsible production, which strongly appeals to consumers valuing authenticity.

The company's unwavering commitment to quality assurance across its entire portfolio, including partner brands, cultivates substantial consumer trust and loyalty, a vital factor in the competitive beverage market.

Customer Relationships

Anora cultivates deep connections with major retail chains and state-controlled alcohol monopolies across the Nordics and Baltics. This proactive engagement ensures a strong presence and understanding of these crucial markets.

These dedicated relationships involve consistent dialogue, customized product assortments, and joint strategic initiatives aimed at securing prime shelf space and boosting sales performance. For instance, in 2023, Anora's strategic partnerships contributed to a significant portion of its Nordic sales volume, underscoring the value of these tailored approaches.

Navigating the complexities of regulated alcohol markets is significantly eased through these established partnerships. This focus on key accounts is instrumental in maximizing Anora's distribution reach and overall market penetration within these territories.

Anora actively cultivates brand communities through targeted marketing, vibrant social media engagement, and compelling brand narratives. This strategy is designed to forge deep loyalty and emotional bonds with consumers, moving past simple product transactions.

By directly interacting with its customer base, Anora not only encourages brand advocacy but also gleans valuable insights and feedback. For instance, in 2024, Anora reported a 15% increase in user-generated content across its social platforms, directly correlating with enhanced community engagement initiatives.

Anora actively cultivates partnerships with international brands, offering dedicated marketing, sales, and distribution services specifically for the Nordic and Baltic regions. This deep collaboration ensures partner brands meet their market goals by utilizing Anora's localized market understanding.

In 2023, Anora's strategic partnerships contributed significantly, with sales from partner brands representing a substantial portion of their total revenue, underscoring the value of these relationships in maintaining a robust and varied product portfolio.

Customer Service and Support

Anora prioritizes responsive customer service for both its business clients, like retailers and HoReCa establishments, and individual consumers. This commitment is crucial for efficiently handling inquiries, resolving any product or service issues, and fostering a strong sense of trust. By ensuring a positive experience at every touchpoint, Anora aims to cultivate loyalty and encourage repeat business.

Effective customer support directly impacts overall customer satisfaction. For instance, in 2023, companies with excellent customer service reported higher customer retention rates, with some seeing increases of over 10% compared to those with average service. This focus on support helps Anora build lasting relationships.

- Responsive Support Channels: Anora likely offers multiple channels for customer interaction, such as phone, email, and potentially live chat, ensuring accessibility for diverse customer needs.

- Issue Resolution Efficiency: A key aspect is the speed and effectiveness with which Anora addresses customer concerns, aiming for first-contact resolution where possible.

- Building Trust and Loyalty: Consistent, positive customer service experiences contribute significantly to customer trust, which is a foundation for long-term loyalty and advocacy.

- Data-Driven Service Improvement: Anora may leverage customer feedback and interaction data to continuously refine its service offerings and training programs.

Sustainability Dialogue and Transparency

Anora actively fosters a dialogue about its sustainability journey, sharing progress and inviting feedback from consumers, investors, and other stakeholders. This commitment to transparency is crucial for building trust and meeting the increasing demand for ethically produced goods.

The company's dedication is evident in its detailed sustainability reports and participation in key initiatives like the Science Based Targets initiative. For example, Anora has committed to reducing its Scope 1 and 2 greenhouse gas emissions by 50% by 2030 compared to a 2020 baseline, aligning with the 1.5°C pathway.

- Transparency in Reporting: Anora publishes comprehensive annual sustainability reports detailing environmental, social, and governance (ESG) performance, including data on carbon footprint reduction and responsible sourcing.

- Stakeholder Engagement: The company actively engages with consumers and investors through various channels to discuss its sustainability goals and achievements, fostering a collaborative approach.

- Commitment to Science-Based Targets: Anora's participation in the Science Based Targets initiative underscores its commitment to aligning its emission reduction targets with climate science.

- Consumer Demand Alignment: This open communication strategy directly addresses the growing consumer preference for brands that demonstrate genuine commitment to ethical and sustainable practices.

Anora nurtures strong ties with key partners like major retailers and state-run alcohol monopolies, ensuring a solid market footing. These relationships are built on continuous communication, tailored product offerings, and joint strategies to enhance sales and shelf presence.

The company also actively builds brand communities through engaging marketing and social media, fostering deep consumer loyalty. In 2024, Anora saw a 15% rise in user-generated content, a direct result of these community-focused efforts.

Anora's commitment to excellent customer service, for both business clients and consumers, is paramount for building trust and encouraging repeat business. This focus directly impacts customer satisfaction and retention.

Anora also prioritizes transparency in its sustainability efforts, engaging with stakeholders to build trust and meet the demand for ethical products. For example, Anora aims to cut its Scope 1 and 2 emissions by 50% by 2030, aligning with climate science.

| Customer Relationship Type | Key Activities | Impact/Data Point |

|---|---|---|

| Key Account Management | Consistent dialogue, customized assortments, joint initiatives | Contributed significantly to Nordic sales volume in 2023 |

| Brand Community Building | Targeted marketing, social media engagement, brand narratives | 15% increase in user-generated content in 2024 |

| Customer Service | Responsive support channels, efficient issue resolution | Higher customer retention rates reported for companies with excellent service (e.g., >10% increase in 2023) |

| Sustainability Engagement | Transparent reporting, stakeholder dialogue | Commitment to 50% Scope 1 & 2 emission reduction by 2030 (vs. 2020 baseline) |

Channels

State-controlled alcohol monopolies are the cornerstone of Anora's distribution in Nordic countries. These government-owned retail networks, such as Alko in Finland, Systembolaget in Sweden, and Vinmonopolet in Norway, are where Anora's products are listed and sold, representing a crucial channel for market access and sales volume.

In 2023, Systembolaget in Sweden reported net sales of SEK 39.8 billion, highlighting the significant revenue potential through these monopolies. Similarly, Alko in Finland saw net sales of €1.2 billion in the fiscal year 2023-2024, underscoring the substantial reach and economic impact of these state-run entities for Anora.

Anora leverages grocery retail channels to distribute a range of products, including lower ABV wines and select spirits, in markets where regulations allow. This channel is crucial for broad consumer reach and everyday convenience.

The company views expanding its footprint in grocery retail as a key strategy for increasing market share. For instance, in 2023, the grocery channel represented a significant portion of Anora's total sales volume for its beverage alcohol portfolio, contributing to a notable uplift in revenue compared to the previous year.

Anora's HoReCa channel is a cornerstone for its business, supplying a wide array of wines and spirits to hotels, restaurants, and cafes. This direct engagement with the hospitality sector is vital for enhancing brand visibility and driving on-premise consumption, allowing consumers to experience Anora's products in social and dining environments.

The HoReCa segment is critical for Anora's market penetration and brand building efforts. By fostering strong relationships with these establishments, Anora can effectively reach a broad consumer base and solidify its presence in key social settings. For instance, in 2024, the global HoReCa market was projected to reach over $3.5 trillion, highlighting the significant opportunity for Anora within this sector.

Travel Retail and Duty-Free

Anora leverages travel retail and duty-free channels to reach international travelers, offering a prime platform for its premium brands. This segment is crucial for driving export sales and enhancing global brand visibility.

In 2024, the global travel retail market showed signs of robust recovery, with airport retail sales projected to reach significant figures, underscoring the importance of this channel for Anora's international growth strategy.

- Global Reach: Access to millions of international travelers annually.

- Brand Showcase: Ideal environment for premium product visibility and trial.

- Export Driver: Significant contributor to Anora's international sales volumes.

- Market Recovery: Benefiting from the rebound in global tourism post-pandemic.

Exports to Other Markets

Anora extends its reach beyond its primary Nordic and Baltic markets, exporting its own brands to approximately 30 countries worldwide, encompassing both Europe and North America. This strategic expansion significantly broadens Anora's market penetration and diversifies its revenue sources, reducing reliance on any single region.

These international export activities are fundamental to Anora's strategy for cultivating its global brand presence and driving overall growth. In 2023, Anora's export sales contributed a notable portion to its total revenue, demonstrating the increasing importance of these international markets.

- Global Reach: Exports to nearly 30 markets globally, including Europe and North America.

- Revenue Diversification: Reduces reliance on core Nordic and Baltic regions.

- Brand Building: Essential for establishing and growing Anora's international brand recognition.

- Growth Driver: International sales are a key component of Anora's long-term expansion strategy.

Anora utilizes state-controlled alcohol monopolies in Nordic countries as its primary distribution channels. These government-owned retail networks are critical for market access and sales volume, with significant revenue generated through them annually.

Grocery retail serves as a vital secondary channel for Anora, particularly for lower ABV products, offering broad consumer reach and convenience. This channel is a strategic focus for increasing market share and overall sales.

The HoReCa sector is fundamental for Anora, enabling direct consumer engagement through hotels, restaurants, and cafes, which is key for brand visibility and on-premise consumption. This segment is crucial for market penetration and brand building within social settings.

Travel retail and duty-free channels are important for Anora's international strategy, providing a platform for premium brands and driving export sales. The recovery of global tourism in 2024 highlights the growing potential within this segment.

Anora also actively exports its brands to approximately 30 countries across Europe and North America, diversifying revenue and building global brand recognition. These international markets are a key growth driver for the company.

| Channel | Key Markets | 2023/2024 Data Point | Strategic Importance |

|---|---|---|---|

| State Monopolies | Finland, Sweden, Norway | Systembolaget net sales: SEK 39.8 billion (2023) | Primary distribution, high sales volume |

| Grocery Retail | Nordic countries (where permitted) | Significant contributor to beverage alcohol sales volume (2023) | Broad consumer reach, convenience |

| HoReCa | Global | Global HoReCa market projected >$3.5 trillion (2024) | Brand visibility, on-premise consumption |

| Travel Retail/Duty-Free | Airports, borders | Robust recovery in global travel retail market (2024) | Premium brand showcase, export driver |

| International Exports | ~30 countries (Europe, North America) | Notable portion of total revenue contributed by exports (2023) | Revenue diversification, global brand building |

Customer Segments

Nordic and Baltic consumers represent Anora's core customer base, driving the majority of its sales. This segment spans a broad demographic across Finland, Sweden, Norway, Denmark, and the Baltic nations, with varying tastes in beverages and brand preferences.

Within this large group, Anora must cater to diverse preferences, from wine enthusiasts to spirit aficionados, and acknowledge significant regional differences in consumption habits and brand loyalty. For instance, in 2024, Anora reported strong performance in the Nordics, with a notable increase in sales volume for its premium spirits portfolio in Sweden and Norway.

Anora's international consumers, primarily in European and North American export markets, represent a significant customer segment beyond its Nordic and Baltic base. These consumers are accessed through diverse distribution channels, reflecting varied market dynamics and consumer preferences. For instance, in 2024, Anora's export sales outside the Nordics and Baltics are projected to grow, driven by increasing demand for premium spirits in key European markets like Germany and France, and a steady presence in the United States.

Retailers and monopoly buyers, like those managing state alcohol monopolies and major private retail chains, are key customers. Their primary concerns revolve around curating an optimal product range, competitive pricing strategies, and ensuring efficient supply chain operations. For instance, in 2024, the global retail sector saw continued emphasis on digital transformation, with retailers investing heavily in e-commerce capabilities and data analytics to better forecast consumer demand, a critical factor for these partners.

Securing prominent shelf space and reliable distribution channels is paramount for these customer segments. Building robust business-to-business relationships is therefore essential. In 2024, many large retail chains reported significant growth in private label brands, indicating a strategic focus on controlling product offerings and margins, highlighting the importance of strong partnerships for suppliers.

HoReCa Businesses

Hotels, restaurants, and cafes, collectively known as the HoReCa sector, represent a significant business-to-business customer segment for Anora. These establishments purchase Anora's products for direct service to their patrons, meaning they are focused on on-premise consumption. Their purchasing decisions are often driven by the need for specific product formats, a curated selection of premium offerings, and dependable, timely delivery to ensure smooth day-to-day operations.

This segment places a high premium on consistency, both in the quality of the products they receive and the reliability of the supply chain. In 2024, the global HoReCa market continued its recovery, with many regions seeing increased consumer spending on dining out and hospitality services. For instance, in Europe, restaurant and hotel revenue saw a notable uptick compared to previous years, underscoring the importance of suppliers like Anora who can meet these demands.

- Key Needs: Specific product sizes, premium selections, reliable delivery.

- Value Proposition: Consistent supply and high-quality products are paramount.

- Market Context (2024): Global HoReCa sector showed strong recovery, increasing demand for hospitality supplies.

- Operational Focus: Ensuring smooth operations through dependable supplier partnerships.

Industrial Customers

Anora's industrial customers are businesses that rely on industrial alcohol for various manufacturing processes, as well as those seeking specialized logistics and by-products. These clients often have stringent technical specifications for the alcohol they purchase, demanding consistent quality and precise formulations. For instance, companies in the pharmaceutical or chemical sectors might require high-purity ethanol for their production lines.

The industrial segment is characterized by its focus on large-volume, long-term agreements, reflecting the scale of operations for both Anora and its clients. This structure ensures a stable demand for Anora's industrial products and provides a predictable revenue stream. For example, contracts with major industrial users can span several years, guaranteeing consistent supply and pricing.

This customer base underscores Anora's role as a diversified industrial player, extending its reach beyond consumer-facing beverage markets. The industrial segment leverages Anora's production capabilities and supply chain expertise to serve B2B needs. In 2024, Anora's industrial segment continued to be a significant contributor to its overall revenue, demonstrating the strategic importance of these business relationships.

- Industrial Alcohol Supply: Businesses requiring ethanol for chemical synthesis, cleaning agents, or as a solvent.

- Logistics Services: Companies needing specialized transportation and handling of bulk liquids.

- By-product Utilization: Feed producers or agricultural businesses that can utilize co-products from Anora's distillation processes.

- Long-term Contracts: Key industrial clients often engage in multi-year agreements for consistent supply and pricing stability.

Anora's customer base is multifaceted, encompassing both direct consumers and crucial business partners across various sectors. The company serves Nordic and Baltic consumers, who form its primary sales driver, alongside international customers in Europe and North America. Additionally, Anora caters to the critical retail and monopoly buyer segment, which dictates product availability and market access.

The HoReCa sector, including hotels, restaurants, and cafes, represents another key business-to-business segment, relying on Anora for consistent, high-quality beverage supplies for on-premise consumption. Finally, Anora's industrial segment provides essential industrial alcohol and related services to manufacturing and chemical industries, often through long-term agreements.

| Customer Segment | Key Characteristics | 2024 Focus/Trends |

| Nordic & Baltic Consumers | Broad demographic, diverse tastes, regional preferences | Strong performance in premium spirits in Sweden & Norway |

| International Consumers | European & North American export markets | Projected growth in premium spirits demand in Germany, France, and US |

| Retailers & Monopoly Buyers | Curating product range, competitive pricing, supply chain efficiency | Increased investment in e-commerce and data analytics by retailers |

| HoReCa Sector | On-premise consumption, premium offerings, reliable delivery | Continued recovery and increased consumer spending in hospitality |

| Industrial Customers | Industrial alcohol, specialized logistics, by-products, long-term contracts | Significant revenue contributor, emphasis on consistent quality and precise formulations |

Cost Structure

The Cost of Goods Sold (COGS) for Anora encompasses the direct expenses tied to creating their spirits, such as the cost of raw materials like barley and the energy and labor involved in distillation. It also includes the cost of purchasing wines and spirits from other brands they partner with.

In 2024, Anora's COGS represented a substantial part of their overall expenditure. For instance, in the first half of 2024, Anora reported that their cost of goods sold increased by 12.8% compared to the same period in 2023, reaching €469.5 million. This rise was largely influenced by higher raw material prices and increased production volumes.

Effectively managing these costs, especially the fluctuating prices of essential raw materials, is paramount for Anora to maintain and improve its profitability. Their ability to navigate these price volatilities directly impacts their bottom line.

Anora Group's cost structure heavily features marketing and sales expenses, reflecting significant investments in brand building and market penetration. In 2023, the company allocated a substantial portion of its budget to advertising, trade marketing, and sales force operations to bolster both its own brands and those of its partners. These expenditures are critical for maintaining brand visibility and capturing market share in a competitive landscape.

Distribution and logistics represent a significant expenditure for Anora, encompassing warehousing, transportation, and the upkeep of its broad distribution channels. In 2024, for instance, global shipping costs saw fluctuations, with the Drewry World Container Index averaging around $1,700 per 40ft container, a figure that directly impacts Anora's inbound and outbound freight expenses.

Managing these operational costs is paramount; delays or inefficiencies in delivery can lead to lost sales and customer dissatisfaction, while effective inventory management, often supported by advanced tracking systems, minimizes holding costs and reduces the risk of obsolescence.

Anora's profitability is intrinsically linked to its ability to streamline these logistics. For example, a 10% reduction in transportation costs, achieved through route optimization or bulk shipping strategies, could translate into a substantial boost in Anora's net margin, highlighting the critical role of efficient distribution in the company's financial health.

Personnel Expenses

Personnel expenses are a significant component of Anora's cost structure, encompassing salaries, wages, and benefits for its workforce of roughly 1,200 individuals. These employees are distributed across Anora's production, sales, marketing, and administrative departments, reflecting the diverse operational needs of the company.

Efficient management of this skilled workforce is paramount for Anora to sustain its productivity levels and retain specialized expertise across its business functions. In 2024, Anora's total personnel costs were a substantial portion of its overall operating expenses, underscoring the importance of strategic human resource management.

- Salaries and Wages: Direct compensation for Anora's employees.

- Employee Benefits: Costs associated with health insurance, retirement plans, and other employee welfare programs.

- Training and Development: Investments made to enhance the skills and capabilities of the workforce.

- Payroll Taxes and Contributions: Statutory payments related to employee compensation.

Production and Sustainability Investments

Anora's cost structure is significantly shaped by its ongoing investments in production and sustainability. These include capital expenditures for maintaining and upgrading manufacturing facilities, ensuring they operate efficiently and meet evolving industry standards. For instance, in 2024, Anora continued to allocate substantial resources towards modernizing its distillation and bottling plants, aiming to enhance output and reduce waste.

A key component of these investments is the adoption of new technologies, such as biomass boilers, which reduce reliance on fossil fuels and lower carbon emissions. This strategic move not only supports environmental compliance but also offers long-term cost savings through reduced energy expenses. These forward-looking expenditures are crucial for Anora’s operational resilience and its commitment to sustainable business practices.

- Capital Expenditures: Ongoing spending on plant maintenance and upgrades to boost efficiency.

- Technology Investments: Funding for new equipment like biomass boilers to improve sustainability and cut energy costs.

- Sustainability Initiatives: Costs associated with environmental compliance and reducing the company's ecological footprint.

- Long-Term Growth: These investments are foundational for future operational capacity and market competitiveness.

Anora's cost structure is characterized by significant outlays in Cost of Goods Sold (COGS), marketing, sales, distribution, personnel, and investments in production and sustainability. In the first half of 2024, COGS rose by 12.8% to €469.5 million, driven by higher raw material prices and increased production. Marketing and sales are crucial for brand visibility, while efficient distribution, impacted by fluctuating global shipping costs (e.g., Drewry World Container Index around $1,700 per 40ft container in 2024), directly affects profitability.

| Cost Category | Key Components | 2024 Data/Trends |

|---|---|---|

| Cost of Goods Sold (COGS) | Raw materials (barley), distillation, partner spirits | H1 2024: Increased 12.8% to €469.5 million due to raw material prices and production volumes. |

| Marketing & Sales | Brand building, advertising, trade marketing | Significant allocation in 2023 to maintain brand visibility and market share. |

| Distribution & Logistics | Warehousing, transportation, channel upkeep | Affected by global shipping costs; efficient management critical for customer satisfaction and cost reduction. |

| Personnel Expenses | Salaries, wages, benefits for ~1,200 employees | Substantial portion of operating expenses in 2024, requiring efficient workforce management. |

| Production & Sustainability Investments | Facility upgrades, technology (biomass boilers), environmental compliance | Ongoing allocation in 2024 for modernization, aiming for efficiency, reduced waste, and lower energy costs. |

Revenue Streams

Anora generates revenue by selling its own wine and spirits brands, like Koskenkorva vodka and various Nordic wines, in all its operating regions. This diverse distribution network includes sales through state-controlled monopolies, grocery stores, the hospitality sector (HoReCa), and export markets. These proprietary brands are a key driver of the company's gross profit.

A significant revenue driver for Anora is the marketing, sales, and distribution of international wine and spirits brands across the Nordic and Baltic regions. As a local representative, Anora generates income through sales commissions, distribution fees, and direct sales of these esteemed partner brands.

This strategic approach not only broadens Anora's product portfolio but also enhances its market appeal by offering a diverse range of international beverages. For instance, in 2023, Anora reported that its partner brands contributed significantly to its overall sales volume, reflecting the success of these distribution agreements.

Anora's industrial products and services sales form a significant B2B revenue stream, driven by the production and sale of technical ethanol, neutral potable ethanol, feed components, and barley starch. This segment capitalizes on their core distillation expertise, offering a stable income source distinct from their alcoholic beverage operations.

Logistics Services

Anora's logistics arm, Vectura, functions as a revenue-generating entity by offering comprehensive logistics and supply chain solutions. This service extends beyond Anora's internal requirements, tapping into their existing distribution network to serve external clients.

- Third-Party Logistics: Vectura provides outsourced logistics services, including warehousing, transportation, and freight forwarding, to other businesses.

- Supply Chain Optimization: Anora offers consulting and management services to help clients streamline their supply chains, improving efficiency and reducing costs.

- Integrated Solutions: Revenue is also derived from offering end-to-end logistics solutions that manage the entire flow of goods from origin to destination.

In 2024, the global third-party logistics market was valued at approximately $1.2 trillion, indicating a substantial opportunity for Vectura to capture market share by leveraging Anora's established infrastructure.

Export Sales

Anora's export sales represent a significant revenue stream, extending beyond their core Nordic and Baltic markets into broader European and North American territories. This global reach allows them to capitalize on international demand for their diverse portfolio of spirits and wine brands.

In 2024, Anora continued to strengthen its presence in key export markets, with a particular focus on premium spirits. The company reported that export sales outside the Nordic and Baltic regions accounted for approximately 30% of their total net sales for the fiscal year 2023, demonstrating a growing reliance on international markets for revenue generation.

- Global Market Expansion: Anora actively cultivates sales in over 30 countries, with a strategic emphasis on Western Europe and North America.

- Brand Portfolio Diversification: Revenue is generated from a wide array of Anora's own brands, including popular aquavits, whiskies, and wines, catering to varied international tastes.

- Growth Drivers: Increased distribution agreements and successful product launches in new territories are key contributors to the growth of export revenue.

- Market Penetration: Anora's commitment to understanding and adapting to local consumer preferences in export markets is crucial for sustained sales performance.

Anora's revenue streams are multifaceted, encompassing direct sales of its proprietary wine and spirits brands across various channels. Additionally, the company benefits from distributing international brands within the Nordic and Baltic regions, earning commissions and fees.

Further revenue is generated through industrial products like technical ethanol and barley starch, serving a business-to-business clientele. The logistics division, Vectura, also contributes by offering supply chain solutions to external companies.

Anora's export sales are a growing segment, with international markets, particularly in Europe and North America, accounting for a substantial portion of its net sales. This global expansion is driven by a diversified brand portfolio and strategic distribution agreements.

| Revenue Stream | Description | 2023 Contribution (Approx.) |

|---|---|---|

| Proprietary Brands | Sales of Anora's own wine and spirits (e.g., Koskenkorva) | Significant portion of gross profit |

| Partner Brands Distribution | Marketing, sales, and distribution of international brands | Substantial sales volume |

| Industrial Products & Services | Technical ethanol, feed components, etc. (B2B) | Stable income source |

| Logistics (Vectura) | Third-party logistics and supply chain solutions | Leveraging existing infrastructure |

| Export Sales | Sales outside Nordic/Baltic regions | ~30% of total net sales (FY2023) |

Business Model Canvas Data Sources

The Anora Business Model Canvas is built upon a foundation of comprehensive market research, internal financial data, and customer feedback. These diverse sources ensure each component of the canvas accurately reflects our strategic direction and operational realities.