Anora Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anora Bundle

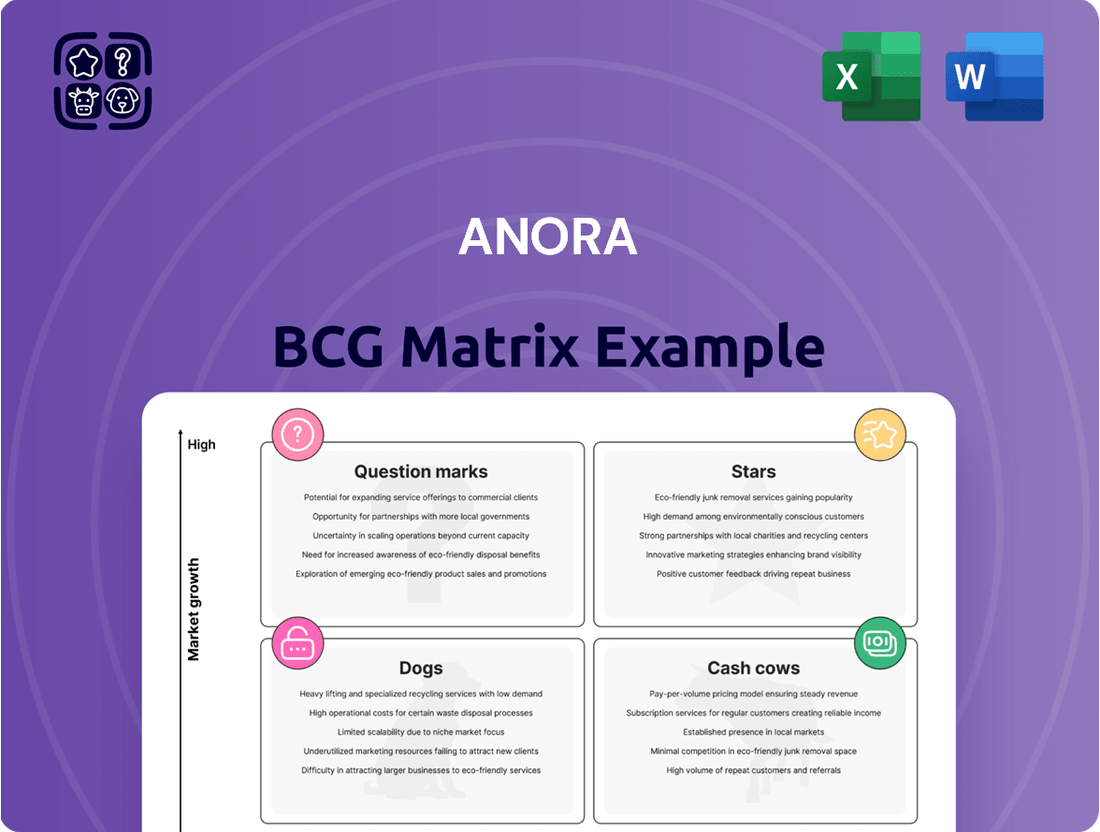

Uncover the strategic positioning of your products with the Anora BCG Matrix, a powerful tool for understanding market share and growth potential. This insightful overview highlights which products are poised for future success and which may require a strategic pivot.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Anora's leading Nordic wine brands are pivotal to its market dominance, particularly evident in their market share gains across Finland, Sweden, and Denmark. This performance indicates robust brand equity in a healthy market segment.

The company's strategic focus on driving category growth across various consumer occasions and distribution channels reinforces its ambition to be the premier wine and spirits provider in the Nordic region. This approach underpins the strength of its wine portfolio.

Koskenkorva Vodka, a leading Finnish spirit, is a significant performer within Anora's portfolio. Its net sales have demonstrated consistent year-over-year growth, now accounting for more than 17% of the company's total Spirits revenue. This robust market presence, coupled with substantial investments in achieving carbon neutrality for its distillery by 2026, firmly places Koskenkorva in the Star category of the BCG matrix.

Anora leads in Nordic sustainable packaging for wines and spirits, investing in climate-smart designs. They've launched wine bottles from 100% recycled PET (rPET) and are developing lighter glass bottles and Bag-in-Boxes with reduced carbon footprints.

These innovations cater to increasing consumer demand for eco-friendly products. For instance, their rPET bottles significantly cut emissions compared to traditional materials, positioning Anora to capture market share in the growing sustainable packaging segment.

Strategic Growth in International Markets

Anora's strategic vision includes aggressive international expansion, aiming to leverage its established sustainable brands beyond the Nordic region. This push signifies a commitment to capturing market share in emerging and high-potential global markets.

The company's current global reach is substantial, with exports to approximately 30 countries. This broad distribution network provides a solid foundation for accelerated growth initiatives in new territories.

Evidence of this momentum is clear in Anora's Q1 2025 performance, where international spirits markets demonstrated notable sales increases. This indicates a positive trend and validates the company's strategy for global market penetration.

- International Reach: Exports to nearly 30 global markets.

- Growth Driver: Focus on expanding market share with sustainable hero brands.

- Recent Performance: International spirits markets saw increased sales in Q1 2025.

Premium Wine Segment (Norway)

The premium wine segment in Norway represents a significant growth opportunity for Anora. This segment, accounting for 43% of all wine sales in Norway, is projected to expand further as consumer affluence increases and interest in higher-quality wines rises. Anora's established market leadership in this category provides a strong foundation for capturing this ongoing growth.

Anora's strategic focus on the premium wine segment is particularly relevant given the market dynamics. As of 2024, the Norwegian wine market continues its upward trajectory, with premium products driving a substantial portion of this expansion. Anora's deep understanding of consumer preferences and its robust portfolio within this segment are key competitive advantages.

- Market Share: Anora holds a leading position in the Norwegian wine market overall.

- Premium Segment Growth: The premium wine segment constitutes 43% of Norwegian wine sales and is expected to grow.

- Drivers: Growth is fueled by increasing consumer affluence and a heightened interest in premium wine products.

- Anora's Position: Anora's strong presence and leadership in the premium segment are well-positioned to capitalize on these trends.

Anora's Koskenkorva Vodka is a prime example of a Star in the BCG matrix, exhibiting strong market share in a high-growth category. Its consistent net sales growth, now representing over 17% of Anora's total Spirits revenue, underscores its position. The brand's commitment to carbon neutrality by 2026 further enhances its appeal in an increasingly sustainability-conscious market.

What is included in the product

Strategic guidance on investing, holding, or divesting business units based on market growth and share.

Anora's BCG Matrix provides a clear, visual overview, eliminating the pain of deciphering complex business unit performance.

Cash Cows

Anora commands a leading position in the Nordic wine market, especially in Finland, Norway, and Denmark, even within the grocery retail sector. This strong presence in a steady market environment ensures a reliable stream of income.

In 2024, Anora's wine segment continued to be a significant contributor, reflecting its established market share. For instance, the company reported robust sales in the Nordic wine category, underscoring its ability to generate consistent cash flow despite minor market fluctuations.

Anora's portfolio features established Nordic spirits like Linie aquavit and O.P. Anderson snaps, brands with deep roots and loyal followings across the region. These brands, while not leading growth charts, are crucial for their consistent revenue generation.

In 2023, Anora reported net sales of €679.8 million, with a significant portion likely contributed by these mature, cash-generating brands. Their stable demand and established distribution channels ensure predictable cash flow, supporting the company's overall financial health.

Anora's Industrial segment, encompassing distillation, bottling, logistics, and the creation of technical ethanol, potable ethanol, feed components, and barley starch, demonstrated a notable uplift in comparable EBITDA. This segment functions as a mature, dependable business, consistently producing robust cash flow via its vital services and products for both Anora's internal needs and external clientele.

Partner Brand Portfolio

Anora's partner brand portfolio, featuring established international wines and spirits, functions as a significant Cash Cow within its business strategy. Brands like Masi, Penfolds, Jack Daniels, and Jose Cuervo represent mature products with high market share in the Nordic region, generating consistent and substantial revenue.

These strong distribution agreements for well-known names ensure a predictable income stream, requiring minimal investment for continued growth. This stability is crucial for funding other areas of Anora's business, such as developing new products or expanding into emerging markets.

- Consistent Revenue: The established nature of brands like Jack Daniels and Jose Cuervo guarantees a steady cash inflow for Anora in the Nordics.

- High Market Share: Prominent wine brands such as Masi and Penfolds likely hold strong positions, contributing to reliable sales volumes.

- Low Investment Needs: As mature products, these partner brands typically require less capital for marketing and development compared to newer ventures.

- Profitability Driver: The predictable profitability of these brands allows Anora to allocate resources effectively across its broader portfolio.

Dividend Yield

Anora's dividend yield stands at an impressive 6.88%, a figure that notably surpasses its 5-year average. This robust dividend distribution is a strong indicator of the company's ability to generate substantial free cash flow. Such a payout often points to the existence of established business units, or cash cows, within Anora's portfolio that consistently produce surplus funds. These cash cows are crucial for supporting dividend payments and reinvesting in other areas of the business.

The substantial dividend yield suggests that Anora's operations are generating more cash than is needed for reinvestment, a hallmark of mature and profitable businesses. For instance, if Anora's 5-year average dividend yield was closer to 4%, the current 6.88% represents a significant increase, signaling enhanced cash generation capabilities. This financial strength allows the company to reward shareholders while still maintaining financial flexibility.

- Dividend Yield: 6.88% (as of latest available data).

- Comparison: Significantly higher than the 5-year average yield.

- Implication: Strong free cash flow generation from existing business segments.

- Strategic Significance: Funds shareholder distributions and potential future investments.

Cash Cows within Anora's portfolio represent established brands and business segments that generate consistent, reliable income with minimal need for further investment. These units are vital for Anora's financial stability, providing the necessary cash flow to support shareholder returns and fund growth initiatives in other areas of the business.

Anora's wine and spirits portfolio, particularly its partner brands like Jack Daniels and Jose Cuervo, exemplify these cash cows. These mature products benefit from high market share in the Nordic region, ensuring predictable sales volumes and substantial revenue generation.

The company's Industrial segment, focused on distillation and ethanol production, also functions as a dependable cash generator. This segment consistently produces robust cash flow through its essential services and products for both internal use and external clients.

Anora's strong dividend yield of 6.88% in 2024, exceeding its 5-year average, is a direct indicator of the substantial free cash flow generated by these mature business units.

| Segment/Brand Category | Market Position | Cash Flow Generation | Investment Need |

|---|---|---|---|

| Nordic Wines | Leading in Finland, Norway, Denmark | Reliable income stream | Low |

| Established Spirits (Linie, O.P. Anderson) | Deep roots, loyal following | Consistent revenue | Low |

| Partner Brands (Jack Daniels, Masi) | High market share in Nordics | Substantial, predictable revenue | Minimal |

| Industrial Segment | Dependable services and products | Robust cash flow | Low |

Delivered as Shown

Anora BCG Matrix

The Anora BCG Matrix preview you are currently viewing is the exact, final document you will receive upon purchase. This comprehensive report, designed for strategic clarity, contains no watermarks or demo content, ensuring you get a fully formatted and ready-to-use analysis for your business planning needs.

Dogs

Anora's overall net sales have seen a concerning downward trend. In the first quarter of 2025, net sales dipped by 3.8%, following a more significant decline of 4.7% for the entirety of 2024. This widespread decrease across all business segments points to a broader challenge in Anora's revenue generation capabilities.

The consistent falling sales suggest that Anora may be operating in markets with limited growth potential or that its products are losing ground to competitors. This situation places Anora's offerings squarely in the Dogs quadrant of the BCG Matrix, indicating a need for careful strategic consideration.

The Spirits segment in Nordic markets, excluding Sweden, experienced a notable net sales decrease of 4.5% in the first quarter of 2025. This downturn was observed across all these key regions, reflecting a challenging environment for Anora's spirits portfolio in these areas.

Overall for 2024, the spirits segment saw a 4.2% decline in net sales within these same markets. This consistent downward trend suggests many of Anora's spirits brands likely hold a low market share and are facing limited growth opportunities outside of Sweden, positioning them as potential 'Dogs' in the BCG matrix.

In Norway's spirits market, Cognac and brandy brands for Anora experienced a notable downturn in 2024. Net sales in this segment saw a decrease of 11.7%, largely due to a significant partner loss and reduced volumes for gin, indicating these specific products are likely positioned as Dogs within the Anora BCG Matrix.

Products Impacted by Monopoly Channel Challenges

Anora's spirits and wine portfolio faces significant headwinds in its monopoly channel, a critical distribution network in countries like Finland, Norway, and Sweden. This channel has seen 15 consecutive quarters of negative growth, a stark indicator of shifting consumer preferences or increased regulatory pressure impacting sales volumes.

Products deeply entrenched in these declining monopoly channels, without robust alternative distribution strategies, are categorized as potential 'Dogs' within the Anora BCG Matrix. This classification highlights their low growth prospects and the risk of diminishing market share.

For instance, specific Anora spirits brands that historically relied almost exclusively on these state-controlled outlets are now vulnerable. In 2024, Anora reported a notable decline in sales within these specific markets, directly attributable to the ongoing challenges in the monopoly channel. Without diversification, these products are likely to underperform.

- Monopoly Channel Decline: Anora has faced 15 consecutive quarters of negative growth in its core monopoly distribution channels.

- Geographic Impact: This decline is particularly pronounced in key markets such as Finland, Norway, and Sweden.

- Product Vulnerability: Spirits and wine products heavily dependent on these channels, without alternative distribution, are at high risk of becoming 'Dogs'.

- 2024 Performance: Anora's 2024 financial reports indicated a direct correlation between monopoly channel performance and overall spirits sales in these Nordic countries.

Underperforming New Product Launches (if any)

Anora's recent new product launches, while strategically important, have encountered challenges. Some of these new ventures are at risk of becoming Dogs within the BCG matrix if they don't quickly achieve significant market traction. This is particularly concerning given the substantial upfront investment required for new product development and market entry.

For instance, if a new product faces intense competition or operates in a market segment experiencing sluggish growth, its initial low market share could become entrenched. This scenario would necessitate a careful evaluation of continued resource allocation. In 2024, the average failure rate for new product launches across various industries hovered around 40%, highlighting the inherent risks Anora faces.

- Risk of Becoming a Dog: New launches failing to gain market adoption quickly risk becoming Dogs.

- High Initial Investment: Significant capital is tied up in these new ventures.

- Competitive/Slow Markets: These factors exacerbate the challenge of achieving market share.

- Monitoring Imperative: Close observation is crucial to identify and address underperformance early.

Products categorized as Dogs within Anora's portfolio exhibit low market share and operate in slow-growth or declining markets. This is evident in the consistent net sales decline across various segments, such as the 4.2% drop in spirits sales in Nordic markets (excluding Sweden) during 2024. Such underperforming products require careful strategic decisions regarding divestment or repositioning to avoid further resource drain.

The persistent negative growth in monopoly channels, which have seen 15 consecutive quarters of decline, directly impacts Anora's spirits and wine products heavily reliant on them. Without alternative distribution strategies, these offerings are prime candidates for the Dogs quadrant. For example, Cognac and brandy in Norway saw an 11.7% net sales decrease in 2024, largely due to external factors, further solidifying their 'Dog' status.

New product launches also face the risk of becoming Dogs if they fail to gain immediate market traction. Given the industry's average new product failure rate of around 40% in 2024, Anora must closely monitor these ventures. Products that don't quickly achieve significant market share in competitive or slow-growing segments are likely to become Dogs, necessitating a critical review of continued investment.

| Product Category | Market Trend | Anora's 2024 Performance (Example) | BCG Classification |

|---|---|---|---|

| Spirits (Nordic, ex-Sweden) | Declining | -4.2% Net Sales | Dog |

| Cognac & Brandy (Norway) | Declining | -11.7% Net Sales | Dog |

| Products in Monopoly Channels | Declining (15 consecutive quarters) | Significant sales impact | Potential Dog |

| New Product Launches | Varies (risk of low adoption) | High failure rate potential | Potential Dog |

Question Marks

Anora's introduction of new low-ABV wines into Finnish grocery stores aligns with a strategic move into a nascent market segment. This expansion leverages the 2018 regulatory shift permitting up to 8% ABV beverages in supermarkets, creating a fresh avenue for growth.

While this represents a promising opportunity, the current market share for these low-ABV wines remains modest. Consumer adoption and retailer engagement in cultivating this category are still in the early stages of development, indicating a Stars or Question Marks position within the BCG matrix.

Anora's expansion into Lithuania in Q2 2025 positions it as a new entrant in a potentially lucrative market. While the Lithuanian market offers growth opportunities, Anora's initial market share is expected to be negligible, necessitating substantial investment to build brand awareness and secure a competitive foothold.

In 2024, Anora strategically introduced a robust pipeline of new products within its spirits division. This included an impressive 14 distinct stock-keeping units (SKUs) of aquavit, alongside a seasonal winter apple variant of its popular Koskenkorva vodka. These launches are crucial for Anora to maintain its competitive edge and explore new consumer preferences in the dynamic spirits market.

While Koskenkorva typically demonstrates strong market performance, the newly launched aquavit and winter apple SKUs are currently classified as Stars in the Anora BCG Matrix. This classification reflects their nascent market penetration; their ultimate success and market share are still being established. Consequently, these products necessitate substantial marketing investment and promotional efforts to gain traction and thrive amidst intense competition.

Investments in Regenerative Farming

Anora's investment in regenerative farming aligns with a burgeoning consumer demand for sustainable products, positioning these initiatives within a high-growth market segment. While the current market share for regeneratively farmed products is likely modest, Anora's goal to reach 30% regeneratively cultivated barley in its grain spirit-based products by 2030 signifies a strategic move to capture this expanding niche. This requires substantial consumer engagement and education to drive adoption.

This strategic focus on regenerative agriculture can be viewed through the Anora BCG Matrix as a potential 'Question Mark' or 'Star' depending on market penetration and growth trajectory. The high-growth potential is evident, with the global market for sustainable agriculture projected to reach significant figures, with some estimates suggesting growth rates exceeding 10% annually in coming years. However, the current low market share and the need for consumer education indicate an early stage of development, requiring significant investment to cultivate market share.

- Market Potential: The global market for sustainable agriculture is experiencing robust growth, driven by increasing consumer awareness and demand for environmentally friendly products.

- Investment Requirement: Significant capital and effort are needed to scale regenerative farming practices and educate consumers about their benefits, impacting initial profitability.

- Brand Differentiation: Anora's commitment to regenerative farming offers a unique selling proposition, potentially capturing a premium market segment and enhancing brand loyalty.

- Future Growth: Achieving the 30% target by 2030 positions Anora as a leader in sustainable spirits, tapping into a long-term, high-growth consumer trend.

Digital Channel Development and Occasion-Led Innovations

Anora's strategic focus on developing robust digital channels and pioneering occasion-led innovations aims to deepen consumer connection and drive future growth. This approach targets burgeoning areas of consumer engagement and product development.

While these initiatives represent a high-potential growth vector, their current contribution to Anora's overall market share is likely modest. Significant investment and meticulous execution are therefore critical for these ventures to mature into substantial market drivers.

- Digital Channel Development: Anora is investing in creating seamless online purchasing experiences and personalized digital interactions to capture a larger share of the evolving consumer journey.

- Occasion-Led Innovations: The company is developing new product offerings and marketing campaigns tailored to specific consumer occasions, such as holidays or lifestyle events, to boost relevance and sales.

- Nascent Market Impact: Despite the strategic importance, these digital and occasion-led efforts are in their early stages, with their immediate impact on overall sales figures still developing.

- Investment and Execution: Success hinges on substantial financial commitment and effective implementation to transform these nascent initiatives into significant contributors to Anora's market position.

Question Marks in Anora's portfolio represent products or ventures with low current market share but operating in high-growth potential markets. These require significant investment to increase market penetration and establish a strong competitive position. Their future success is uncertain, making them a critical area for strategic decision-making.

Anora's expansion into new markets, such as Lithuania, and the development of nascent product categories like low-ABV wines, exemplify Question Marks. These initiatives are characterized by substantial investment needs and the requirement for consumer education and market development to achieve their growth potential.

The success of these Question Marks is vital for Anora's long-term growth strategy. By carefully managing and investing in these areas, Anora aims to transform them into future Stars or Cash Cows, thereby solidifying its market leadership.

In 2024, Anora's strategic focus on digital channels and occasion-led innovations also falls into the Question Mark category. While these areas show significant growth potential, their current market share is modest, demanding substantial investment and effective execution to realize their full impact.

| Product/Venture | Market Growth Potential | Current Market Share | Investment Need | Strategic Outlook |

|---|---|---|---|---|

| Low-ABV Wines (Finland) | High | Modest | High | Develop market, consumer education |

| Lithuanian Market Entry | High | Negligible | High | Brand building, market penetration |

| Regenerative Farming Initiatives | High | Low | High | Scale practices, consumer engagement |

| Digital Channels & Occasion Innovations | High | Modest | High | Deepen consumer connection, drive adoption |

BCG Matrix Data Sources

Our BCG Matrix leverages comprehensive market data, including sales figures, customer acquisition costs, and competitor analysis, to accurately position each product.