Anglo American PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anglo American Bundle

Unlock critical insights into the forces shaping Anglo American's future with our comprehensive PESTLE analysis. Understand the political, economic, social, technological, legal, and environmental factors that present both opportunities and challenges for this global mining giant. Equip yourself with the knowledge to anticipate market shifts and make informed strategic decisions. Download the full analysis now and gain a decisive competitive advantage.

Political factors

Geopolitical volatility significantly influences Anglo American's operations, particularly with numerous elections scheduled globally in 2024. These political shifts can lead to resource nationalism, where governments prioritize domestic control over mineral resources. For instance, South Africa, a key operational area for Anglo American, saw the ANC secure 40% of the vote in the 2024 general election, signaling potential policy shifts that could impact mining regulations and investment frameworks.

Such policy changes, including new mining codes or increased taxation, can disrupt supply chains and deter foreign investment in the sector. Companies like Anglo American must actively monitor these evolving political landscapes and implement robust risk management strategies to navigate potential trade disputes and regulatory uncertainties, safeguarding their long-term strategic interests.

Governments are increasingly scrutinizing mining transactions, especially those involving critical minerals, creating potential regulatory hurdles that might favor smaller, less risky deals over large-scale mergers. This trend was evident in 2024 as several nations introduced stricter approval processes for foreign investment in strategic resource sectors.

Shifting green policies or new mining regulations enacted after elections could disrupt markets and deter investment. For instance, the European Union's revised Critical Raw Materials Act, with updated targets for domestic extraction and processing, could influence project development timelines and investment strategies for companies like Anglo American throughout 2025.

Anglo American actively engages with governments and multilateral institutions to stay abreast of policy evolution, regulatory changes, and permitting processes. This proactive approach is vital for securing and maintaining its license to operate, particularly as environmental, social, and governance (ESG) compliance becomes a more significant factor in project approvals.

Escalating trade wars and geopolitical friction are fragmenting mineral supply chains. Nations are prioritizing resource security, leading to a complex web of bilateral agreements, export curbs, and import duties. This dynamic introduces significant market volatility.

Anglo American faces the challenge of navigating these fragmented supply chains. For instance, the ongoing trade tensions between the US and China, two major consumers of metals, directly impact demand and pricing for commodities Anglo American produces, such as copper and platinum group metals. The company must adapt its logistics and sourcing strategies to mitigate potential disruptions in product availability and maintain market access.

Government Engagement and Policy Advocacy

Anglo American actively engages with governments globally, participating in dialogues focused on critical minerals access and the dynamic landscape of mining policy and regulation. This engagement is crucial for navigating the complexities of operating in various jurisdictions and ensuring alignment with national priorities.

The company's advocacy, often channeled through industry associations, aims to promote safer, cleaner, and more sustainable mining practices on an international scale. For instance, in 2024, Anglo American continued its participation in initiatives like the International Council on Mining and Metals (ICMM), which sets environmental and social performance standards for its members.

- Government Dialogue: Anglo American prioritizes understanding and influencing policy related to critical minerals, essential for the energy transition.

- International Advocacy: The company works through industry groups to shape global standards for mining safety and sustainability.

- Social License: Direct engagement with governments is key to maintaining the company's social license to operate and fostering positive stakeholder relations.

Political Stability in Operating Regions

Anglo American's operations are significantly shaped by the political stability of the countries where it has a presence. For instance, in 2024, the company continued to navigate the complex political landscape in South Africa, a major hub for its platinum and diamond operations, where policy shifts and social stability remain key considerations. Uncertainty surrounding upcoming elections or potential changes in government can introduce risks related to mining laws, taxation, and environmental regulations, directly impacting operational costs and investment decisions.

The company's exposure to diverse political environments means it must constantly monitor and adapt to evolving governance structures and policy frameworks. For example, in 2024, Anglo American continued its engagement with governments across its key operating regions, including South America and Australia, to ensure alignment with local regulatory requirements and to mitigate potential disruptions arising from political transitions. These ongoing assessments are crucial for maintaining operational continuity and a favorable investment climate.

Electoral cycles and the resulting policy shifts pose a continuous challenge. Changes in government can lead to alterations in mining concessions, royalty rates, or environmental standards, potentially affecting Anglo American's profitability and long-term strategic planning. The company's ability to foster strong relationships with host governments and to proactively address emerging political trends is vital for managing these risks and ensuring sustainable operations.

Key political factors influencing Anglo American's operations in 2024-2025 include:

- Regulatory Stability: Consistent and predictable mining and environmental regulations across operating regions are crucial for long-term investment.

- Government Relations: Maintaining positive and collaborative relationships with national and local governments is essential for smooth operations and license renewals.

- Socio-Political Stability: Addressing social unrest or community grievances that can arise from political instability can impact operational continuity and reputation.

- Policy Predictability: Anticipating and adapting to potential changes in fiscal policies, resource nationalism, and local content requirements remains a critical strategic imperative.

Political factors significantly shape Anglo American's global operations, with elections in key regions like South Africa in 2024 highlighting potential policy shifts impacting mining. Resource nationalism and evolving regulations, such as the EU's Critical Raw Materials Act, create both challenges and opportunities for domestic extraction and processing, influencing investment strategies through 2025.

The company actively engages with governments worldwide to navigate regulatory landscapes, maintain its social license to operate, and advocate for sustainable mining practices, as seen in its continued participation in industry initiatives like the ICMM. This proactive approach is vital for mitigating risks associated with trade wars, geopolitical friction, and the fragmentation of mineral supply chains, ensuring market access and operational continuity.

Political stability and predictable policy frameworks are paramount for Anglo American's long-term investment decisions and operational continuity. Navigating diverse governance structures and fostering strong government relations are essential for managing risks related to mining laws, taxation, and environmental standards across its South American, Australian, and South African operations.

What is included in the product

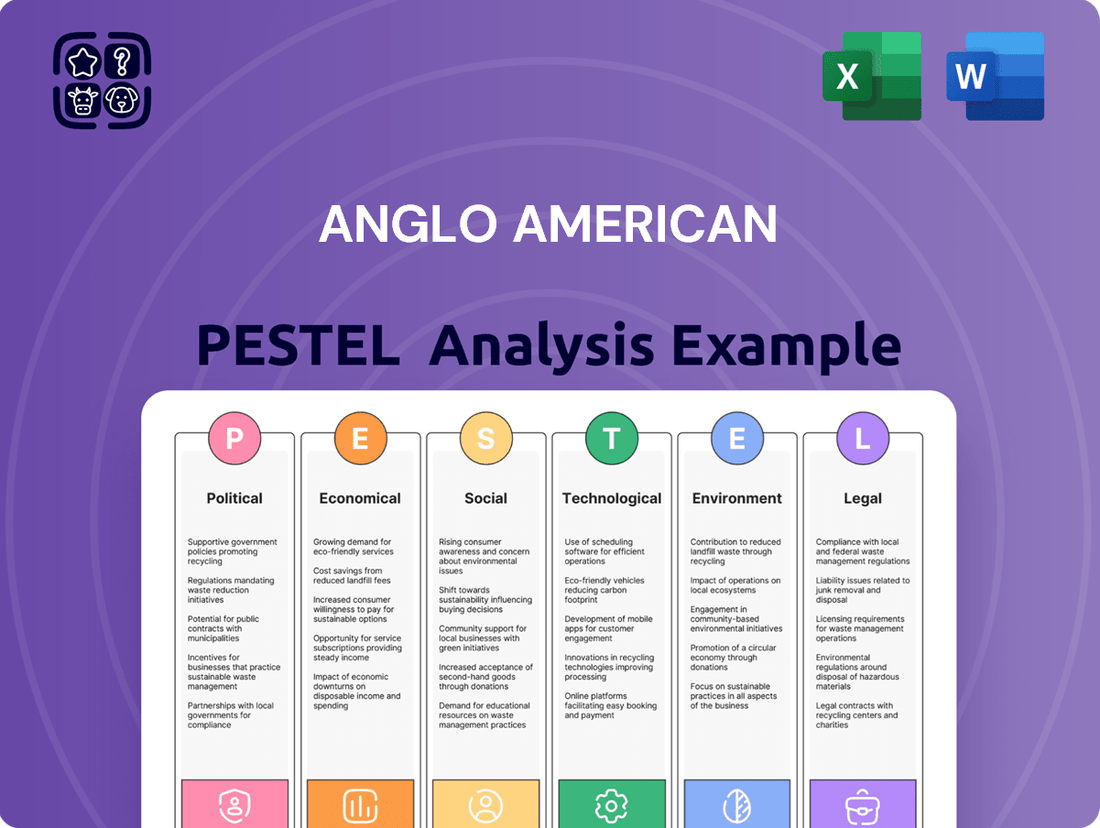

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors impacting Anglo American, covering Political, Economic, Social, Technological, Environmental, and Legal influences.

It offers actionable insights into how these forces shape the company's strategic landscape, identifying potential opportunities and threats for informed decision-making.

Provides a concise version that can be dropped into PowerPoints or used in group planning sessions, simplifying complex external factors for immediate strategic application.

Economic factors

Global commodity prices, especially for industrial metals, are projected to dip in 2025, a consequence of slowing economic expansion and plentiful supply. Conversely, gold prices are anticipated to reach unprecedented highs. This volatility directly influences Anglo American's financial performance, particularly concerning its core commodities such as copper, platinum group metals, diamonds, and iron ore.

Anglo American's financial results for 2024 clearly demonstrated this impact, showing a reduction in underlying EBITDA. This decline was primarily attributed to the downward pressure from lower commodity prices and a difficult market for rough diamond trading during the period.

A synchronized slowdown in major economies like China, the US, and Europe, alongside weakening demand, presents challenges for metals prices and Anglo American's asset valuations. For instance, global GDP growth forecasts for 2025 hover around 2.7% according to the IMF, a noticeable dip from previous years, directly impacting industrial demand.

While broader commodity prices are anticipated to soften in 2025, the accelerating energy transition is a significant tailwind for key metals such as copper and nickel. These are central to Anglo American's future strategy, with demand for copper, crucial for EVs and renewable energy infrastructure, expected to rise substantially over the next decade.

Anglo American's strategic pivot towards products vital for decarbonization and enhancing living standards positions it to capitalize on these evolving global trends. The company's focus on high-quality, low-carbon assets in copper and nickel, for example, aligns with projected demand growth driven by the green economy.

Inflationary pressures, while showing a slight moderation in 2024 from 2023 peaks, continue to be a significant factor affecting Anglo American's operational expenditures. For instance, the global inflation rate, though easing, remained elevated in many key markets throughout 2024, directly impacting the cost of raw materials, energy, and labor.

Supply chain disruptions and ongoing geopolitical tensions in 2024 exacerbated these cost challenges for Anglo American and the broader mining sector. These factors contributed to increased logistics expenses and volatility in the availability and pricing of essential inputs, creating operational hurdles.

In response, Anglo American has actively pursued and implemented substantial cost-saving initiatives. These measures are designed to directly mitigate the impact of rising inflation and supply chain issues, aiming to bolster the company's financial performance and resilience in a challenging economic environment.

Capital Allocation and Investment Strategies

Anglo American is actively reshaping its capital allocation, prioritizing investments in core, high-margin commodities like copper and premium iron ore, while divesting from less profitable or volatile assets. This strategic shift aims to bolster financial resilience and unlock greater shareholder value. For instance, the company announced in early 2024 its intention to sell its South African thermal coal assets, a move expected to generate significant proceeds and reduce carbon intensity.

The company's investment strategy for 2024 and 2025 is heavily influenced by the need to fund these portfolio adjustments and invest in growth areas, particularly in copper, which is seen as a key enabler of the global energy transition. Anglo American's 2023 capital expenditure was around $3.1 billion, with a focus on sustaining operations and advancing key projects, and future allocations will reflect this new strategic direction.

- Portfolio Optimization: Anglo American is shedding non-core assets, including its South African thermal coal operations, to sharpen its focus on copper, iron ore, and nutrients.

- Investment Focus: Capital will be directed towards high-margin copper projects and premium iron ore assets, aligning with global demand trends for electrification and infrastructure development.

- Financial Strategy: The company is exploring innovative financing and diversified funding sources to support its strategic transformation and ensure sustainable growth amidst evolving market conditions.

- Cost Management: Ongoing efforts to reduce operating costs are integral to the financial transformation, aiming to improve profitability and cash flow generation across the restructured business.

Currency Fluctuations and Exchange Rates

Currency fluctuations present a dynamic economic challenge for Anglo American. For instance, in early 2024, a weaker Chilean peso positively impacted results, but this benefit was counteracted by a stronger South African rand, highlighting the complex interplay of currency movements across its global operations. This constant recalibration is crucial for managing international financial performance.

The company's exposure to various foreign exchange markets means that shifts in exchange rates directly influence its reported revenues and costs. A stronger rand, for example, can make South African-sourced costs appear higher when translated into US dollars, affecting overall profitability. Conversely, a weaker rand can boost the rand-denominated value of dollar-priced sales.

- Impact on Revenue: Fluctuations can alter the dollar value of sales made in local currencies.

- Cost Management: Exchange rate changes affect the cost of imported materials and repatriated profits.

- Profitability: Net income can be significantly influenced by the combined effect of currency gains and losses.

- 2024 Observation: A weaker Chilean peso was offset by a stronger South African rand, demonstrating mixed currency impacts.

Global economic growth forecasts for 2025 suggest a slowdown, with the IMF predicting around 2.7% GDP growth. This moderation, coupled with easing inflation from 2023 peaks, impacts commodity demand and Anglo American's operational costs. For instance, while inflation is moderating, it remained elevated in key markets throughout 2024, increasing expenses for raw materials and labor.

The energy transition, however, presents a significant opportunity, driving demand for copper and nickel, which are central to Anglo American's strategy. Copper demand is expected to rise substantially, driven by electric vehicles and renewable energy infrastructure, a key focus for the company's future investments and portfolio adjustments.

Currency fluctuations continue to pose a challenge, with mixed impacts observed in early 2024; a weaker Chilean peso was offset by a stronger South African rand. This highlights the need for careful management of international financial performance across Anglo American's diverse global operations.

| Factor | 2024 Observation/Projection | Impact on Anglo American |

|---|---|---|

| Global GDP Growth | Forecasted around 2.7% for 2025 (IMF) | Potential slowdown in industrial demand for metals. |

| Inflation | Moderating from 2023 peaks, but remained elevated in key markets in 2024. | Increased operational expenditures (raw materials, labor, energy). |

| Energy Transition | Accelerating demand for copper and nickel. | Tailwind for key commodities, aligning with Anglo American's strategic focus. |

| Currency Exchange Rates | Mixed impacts in early 2024 (e.g., weaker Chilean peso vs. stronger South African rand). | Affects reported revenues, costs, and overall profitability. |

Same Document Delivered

Anglo American PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Anglo American PESTLE analysis provides actionable insights into the political, economic, social, technological, legal, and environmental factors impacting the market.

Sociological factors

Anglo American places significant emphasis on its Social License to Operate (SLO), viewing it as crucial for sustained success. This involves ongoing dialogue and trust-building with local communities and various stakeholders. For instance, in 2023, the company reported investing $109 million in community development programs globally, aiming to foster positive relationships and shared value.

The company actively seeks partnerships with governments, businesses, civil society organizations, and indigenous peoples to create mutual economic benefits. Understanding community sentiment is a key component, with Anglo American utilizing tools like mobile surveys and direct engagement to gauge perceptions, address grievances, and identify areas for collaboration. This proactive approach helps in navigating the complex social landscape inherent in mining operations.

Anglo American prioritizes strong community relations, aiming to foster development through its Sustainable Mining Plan and Collaborative Regional Development (CRD) program. These initiatives focus on enhancing health, education, and economic opportunities in areas surrounding its operations, with clear targets set for 2025 and 2030.

The company is dedicated to creating lasting shared value, ensuring benefits extend well beyond the operational lifespan of its mines. For example, in 2023, Anglo American invested $105 million in social value initiatives globally, directly supporting community development projects.

The mining sector, including Anglo American, grapples with significant labor shortages, particularly for skilled positions, which can impede crucial organizational transformations. In 2024, the World Economic Forum highlighted a growing skills gap in essential industries, a trend directly impacting mining's ability to adopt new technologies and operational efficiencies.

Anglo American places paramount importance on workforce safety and health, with a stated goal of achieving zero harm. This commitment is reinforced through visible felt leadership and rigorous contractor performance management, aiming to cultivate a secure working environment.

The company actively monitors and promotes diversity, tracking metrics for women in management and across the broader workforce. As of their latest reporting, Anglo American continues to emphasize initiatives for inclusion and professional development to build a more representative and capable team.

Human Rights and Ethical Sourcing

Societal expectations are placing increased pressure on companies like Anglo American to demonstrate strong performance in human rights and ethical sourcing. This heightened scrutiny is often driven by consumer awareness and advocacy groups, leading to a greater demand for transparency regarding a company's supply chain and operational impacts. The surge in Environmental, Social, and Governance (ESG)-related lawsuits underscores the financial and reputational risks associated with inadequate due diligence and disclosure in these areas.

Anglo American itself has encountered criticism concerning human rights and environmental issues at certain operational sites. This highlights the absolute necessity for the company to embed ethical sourcing and responsible practices throughout its entire value chain. To address these concerns, Anglo American has set a target for all its operations to complete third-party audits against responsible mine certification systems by 2025, aiming to validate their commitment to ethical standards.

The company's commitment to responsible mining is further evidenced by its participation in various initiatives and its stated goals. For instance, Anglo American's Sustainable Mining Plan includes specific targets related to community engagement and human rights. By 2024, the company aims to improve the quality of life for employees and host communities, with progress measured against a range of social performance indicators.

The financial implications of failing to meet these evolving societal standards can be significant. Investors increasingly integrate ESG factors into their decision-making, potentially impacting access to capital and company valuations. For example, a 2024 report by Morningstar indicated that ESG funds attracted substantial net inflows, suggesting a growing investor preference for companies with strong ethical credentials.

Stakeholder Expectations and Transparency

Stakeholder expectations are significantly shaping Anglo American's operational and reporting strategies. There's a growing demand from governments, investors, and the public for mining firms to not only focus on profits but also to actively manage their environmental and social impacts, requiring more openness about where materials come from and how they are handled. This push for accountability is a key driver in the industry.

Anglo American is actively addressing these demands by publishing detailed annual and sustainability reports. These reports offer a look into their day-to-day operations and their progress on sustainability goals, directly responding to the need for greater transparency and accountability from all stakeholders.

This dedication to being open is crucial for building and maintaining trust with both investors and consumers. For instance, in their 2023 Sustainability Report, Anglo American highlighted a 21% reduction in Scope 1 and 2 GHG emissions intensity compared to their 2018 baseline, demonstrating tangible progress in their environmental commitments.

- Increased Scrutiny: Growing pressure from governments, investors, and society for mining companies to balance profitability with environmental and social responsibility.

- Demand for Transparency: Stakeholders are demanding greater transparency in sourcing, operations, and reporting of sustainability efforts.

- Anglo American's Response: Publication of comprehensive annual and sustainability reports to provide insights and demonstrate accountability.

- Building Trust: Commitment to transparency is vital for fostering investor confidence and consumer trust in the company's practices.

Societal expectations are increasingly driving Anglo American's operational focus, demanding a balance between profitability and robust environmental and social stewardship. This heightened scrutiny, fueled by consumer awareness and advocacy groups, necessitates greater transparency regarding supply chains and operational impacts. The growing trend of ESG-related litigation underscores the financial and reputational risks associated with inadequate due diligence and disclosure.

Anglo American is actively responding to these evolving societal standards by publishing detailed annual and sustainability reports. These reports provide insights into daily operations and progress on sustainability goals, directly addressing the demand for accountability. For example, in their 2023 Sustainability Report, the company highlighted a 21% reduction in Scope 1 and 2 GHG emissions intensity compared to their 2018 baseline.

The company's commitment to responsible mining is further evidenced by its participation in various initiatives and its stated goals, such as improving the quality of life for employees and host communities by 2024. This dedication to transparency is crucial for building and maintaining trust with both investors and consumers, especially as investors increasingly integrate ESG factors into their decision-making, impacting capital access and company valuations.

The mining sector, including Anglo American, faces significant labor shortages for skilled positions, potentially hindering crucial organizational transformations. In 2024, the World Economic Forum noted a growing skills gap in essential industries, directly impacting mining's ability to adopt new technologies.

| Societal Factor | Anglo American's Response/Data | Year |

| Community Investment | $109 million in community development programs | 2023 |

| Social Value Initiatives | $105 million invested globally | 2023 |

| GHG Emissions Intensity Reduction | 21% reduction (Scope 1 & 2 vs. 2018) | 2023 |

| Skilled Labor Shortage Impact | Hindered transformation, noted by WEF | 2024 |

| Responsible Mine Audits | Target for all operations to complete by | 2025 |

Technological factors

Anglo American's FutureSmart Mining™ initiative is a technological roadmap focused on enhancing safety, efficiency, and environmental stewardship. This program leverages advanced technologies and data analytics across the entire mining lifecycle, from exploration to final product. For instance, in 2023, Anglo American reported a 15% reduction in energy intensity at its Quellaveco mine, partly attributed to FutureSmart Mining™ technologies.

Anglo American is heavily investing in automation and digitalization, recognizing their transformative potential. Advancements in electric and autonomous mining equipment are becoming commonplace, leading to a significant reduction in emissions and a notable boost in operational efficiency. For example, in 2024, the company continued to expand its fleet of autonomous haul trucks, which have demonstrated up to a 20% increase in productivity compared to conventional equipment.

Digital innovations, including the adoption of generative AI, are reshaping the mining landscape. These technologies are crucial for enhancing efficiency, cutting operational costs through sophisticated real-time data analysis, and enabling advanced predictive maintenance strategies and more accurate resource modeling. Anglo American's commitment to digital transformation is evident in its ongoing integration of these advanced solutions across its global mining operations, aiming for smarter, more sustainable extraction.

Anglo American is actively integrating cutting-edge processing technologies like bulk ore sorting (BOS) and coarse particle recovery (CPR). These innovations are designed to drastically cut down on energy and water usage within their mineral processing operations.

This strategic adoption of new tech is vital for achieving their ambitious 2030 Sustainable Mining Plan goals, specifically targeting enhanced energy efficiency and reduced fresh water abstraction. For instance, by 2023, they aimed to reduce water intensity by 20% compared to a 2015 baseline.

The company's commitment to innovation extends to continuously refining its processing methods. This ensures alignment with evolving sustainability objectives and regulatory demands, driving operational improvements and environmental stewardship.

Renewable Energy Integration

Anglo American is actively pursuing renewable energy integration to power its energy-intensive mining operations, aiming to significantly cut its carbon emissions. This strategic shift is driven by both environmental responsibility and the pursuit of long-term operational cost savings.

The company's Regional Renewable Energy Ecosystem initiative is a prime example of this commitment, focusing on incorporating solar, wind, and hydroelectric power. By 2024, Anglo American aims to source 50% of its electricity from renewable sources across its operations. This transition is crucial for achieving its broader decarbonization targets, with a goal to be carbon neutral by 2040.

- Renewable Energy Ecosystem: Anglo American is developing a comprehensive system to integrate renewable energy sources.

- Decarbonization Goals: The company targets carbon neutrality by 2040, with renewable energy being a key enabler.

- Cost Reduction: Transitioning to renewables is expected to lower operational expenses in the long run.

- 2024 Target: Aims to source 50% of electricity from renewables by 2024.

Data Analytics and AI for Operational Excellence

Anglo American is increasingly integrating data analytics and artificial intelligence (AI) to refine its mining operations. This technological shift is key to boosting efficiency, improving environmental, social, and governance (ESG) checks, and enhancing data management. For instance, AI can predict equipment failures, assess water-related risks, and track environmental impacts as they happen. In 2023, Anglo American reported a 15% reduction in unplanned downtime across key sites through predictive maintenance initiatives, a direct result of advanced data analytics.

The company uses these advanced tools to gain deeper operational insights, which helps in preventing accidents and maximizing the value derived from its mineral assets. By analyzing vast datasets, Anglo American can identify potential hazards before they occur and optimize extraction processes. Their commitment to data-driven decision-making is evident in their investments, with AI and analytics forming a core part of their digital transformation strategy, aiming for a safer and more productive mining future.

Key applications of data analytics and AI at Anglo American include:

- Predictive Maintenance: AI algorithms analyze sensor data from machinery to forecast potential breakdowns, allowing for proactive repairs and minimizing costly downtime.

- ESG Data Management: AI streamlines the collection and analysis of environmental and social data, supporting accurate ESG reporting and compliance.

- Operational Efficiency: Data analytics identify bottlenecks and inefficiencies in the mining process, leading to optimized resource allocation and improved output.

- Safety Enhancements: Real-time data monitoring and AI-powered risk assessment contribute to a safer working environment by flagging hazardous conditions.

Anglo American's technological advancements are central to its operational strategy, with a significant focus on automation and digitalization. The company is expanding its fleet of autonomous haul trucks, which in 2024 demonstrated up to a 20% productivity increase over conventional equipment. Furthermore, their FutureSmart Mining™ initiative, which leverages advanced data analytics, contributed to a 15% reduction in energy intensity at the Quellaveco mine in 2023.

The integration of generative AI is also a key technological driver, enhancing efficiency and reducing costs through real-time data analysis and predictive maintenance. These digital innovations are crucial for optimizing resource modeling and improving overall mining processes. Anglo American is committed to embedding these advanced solutions across its global operations to foster smarter and more sustainable extraction practices.

Anglo American is actively implementing cutting-edge processing technologies like bulk ore sorting and coarse particle recovery to significantly reduce energy and water consumption. These innovations are vital for achieving their 2030 Sustainable Mining Plan targets, which include substantial improvements in energy efficiency and water abstraction reduction. By 2023, the company was working towards a 20% reduction in water intensity compared to a 2015 baseline.

The company is also making strides in renewable energy integration, aiming to power its energy-intensive operations with cleaner sources to reduce carbon emissions and achieve long-term cost savings. Anglo American's Regional Renewable Energy Ecosystem initiative is a testament to this, with a target to source 50% of its electricity from renewables by 2024, supporting its goal of carbon neutrality by 2040.

| Technological Factor | Key Initiative/Technology | Impact/Benefit | Year/Target |

| Automation & Digitalization | Autonomous Haul Trucks | Up to 20% productivity increase | 2024 |

| Data Analytics & AI | FutureSmart Mining™ | 15% reduction in energy intensity | 2023 |

| Processing Technologies | Bulk Ore Sorting (BOS), Coarse Particle Recovery (CPR) | Reduced energy and water usage | Ongoing |

| Renewable Energy | Regional Renewable Energy Ecosystem | 50% electricity from renewables | 2024 Target |

Legal factors

Regulators globally are intensifying Environmental, Social, and Governance (ESG) standards, with a particular emphasis on carbon emission reductions, safeguarding biodiversity, and ensuring ethical supply chains, making robust compliance a critical factor for maintaining market competitiveness. For instance, the European Union's Corporate Sustainability Reporting Directive (CSRD), fully applicable from 2024, mandates extensive ESG disclosures for a broader range of companies.

Enhanced transparency and strict adherence to evolving international regulations, including new mandatory reporting frameworks, will be crucial for Anglo American to retain and attract investor confidence. This is particularly relevant as investors increasingly scrutinize companies' ESG performance to align with their own sustainability goals.

Anglo American's proactive approach, demonstrated by its commitment to publishing comprehensive annual and sustainability reports, highlights its dedication to meeting these escalating regulatory demands and showcasing its ongoing efforts in ESG compliance.

Securing environmental permits and social license is a major hurdle for mining projects, often proving more complex than the actual construction phase. Anglo American's Quellaveco expansion, for instance, necessitates meticulous adherence to environmental regulations and extensive community engagement to gain necessary approvals. Companies that proactively build strong community ties and robust environmental management plans tend to experience smoother and quicker permitting timelines.

The mining sector is experiencing a significant uptick in Environmental, Social, and Governance (ESG) related litigation. This includes facing new legal arguments and greater accountability for corporate leaders. For instance, in 2024, the number of ESG-focused lawsuits filed globally continued its upward trend, with a notable increase in cases targeting supply chain impacts.

Anglo American has encountered legal battles concerning human rights and environmental issues. These challenges underscore the critical importance of thorough due diligence and proactive community engagement to manage and reduce legal exposure. Past legal cases involving mining companies often cite historical operational impacts and unresolved community complaints as primary drivers.

Resource Ownership and Land Rights

Conflicts over land and resource ownership rights pose substantial legal hurdles for mining firms worldwide. These disagreements can cause significant operational interruptions, directly impacting production schedules and revenue streams. For instance, in 2023, Anglo American faced ongoing legal challenges related to land use and community rights in South Africa, which contributed to delays in certain project expansions.

Navigating diverse and often intricate land tenure systems is critical for companies like Anglo American. These systems vary greatly by jurisdiction, requiring meticulous legal due diligence and a deep understanding of local property laws. Failure to properly secure land rights can result in protracted legal battles and substantial financial penalties.

Engaging proactively and ethically with local communities and indigenous peoples is paramount to securing a social license to operate and ensuring legal access to resources. Anglo American's commitment to community engagement, as highlighted in their 2024 sustainability reports, aims to mitigate these risks by fostering trust and shared value. This includes respecting traditional land rights and incorporating community benefit agreements into project planning.

- Legal Risks: Disputes over land and resource ownership can lead to operational stoppages, impacting Anglo American's production targets and financial performance.

- Land Tenure Complexity: Navigating varied global land ownership laws requires robust legal frameworks and expert local knowledge to ensure compliance.

- Community Engagement: Proactive and ethical engagement with local and indigenous communities is vital for maintaining a social license to operate and avoiding legal challenges, as evidenced by Anglo American's ongoing efforts in regions like South America.

Anti-ESG Countercurrent and Legal Scrutiny

A growing political backlash against Environmental, Social, and Governance (ESG) investing is creating significant headwinds for sustainability initiatives. This countercurrent can translate into legal challenges for companies actively promoting ESG. For instance, in the US, several states have enacted laws restricting state pension funds from considering ESG factors, citing fiduciary duty concerns. This shift means companies must be prepared for complex litigation from various stakeholders, both supporting and opposing ESG integration.

Navigating this evolving legal terrain requires strong legal counsel. Companies are increasingly facing scrutiny over their ESG claims and disclosures. A 2024 report by Bloomberg Law indicated a rise in ESG-related litigation, with a particular focus on greenwashing allegations. Anglo American, like other global corporations, must ensure its sustainability reporting is legally sound and defensible against potential challenges, which could impact its operations and investor relations.

- Increased Litigation Risk: Companies promoting ESG may face lawsuits from anti-ESG groups alleging breaches of fiduciary duty or misleading statements.

- State-Level Restrictions: In the US, at least 18 states have passed laws or issued executive orders limiting the consideration of ESG factors in state investments as of early 2024.

- Focus on Disclosure Accuracy: Legal challenges are likely to center on the veracity and completeness of ESG data and reporting, requiring meticulous record-keeping.

- Need for Robust Legal Defense: Companies require sophisticated legal teams to proactively manage risks and respond to emerging legal challenges in the ESG space.

Legal frameworks governing mining operations are constantly evolving, with increased scrutiny on environmental impact and community relations. Anglo American faces challenges in securing permits, as seen with its Quellaveco expansion, which requires strict adherence to environmental regulations and community engagement. The company's proactive reporting on ESG compliance, including its 2024 sustainability reports, aims to build investor confidence amidst these complex legal landscapes.

Environmental factors

Anglo American is actively pursuing decarbonization, aiming for a 30% absolute reduction in Scope 1 and 2 greenhouse gas emissions by 2030, using 2016 as a baseline. This commitment involves significant investment in renewable energy sources and the development of new technologies to lower its environmental impact.

The company's strategy includes enhancing climate resilience to safeguard operations against increasingly frequent extreme weather events. For instance, in 2023, Anglo American reported a 13% reduction in Scope 1 and 2 GHG emissions compared to its 2016 baseline, demonstrating progress toward its 2030 goal.

Water scarcity presents a significant environmental challenge for mining companies like Anglo American. To address this, the company has set an ambitious target to cut its absolute fresh water withdrawal by 50% in water-stressed regions by 2030, compared to its 2015 levels. This commitment reflects a growing awareness of the environmental impact of water-intensive operations.

Anglo American is actively deploying advanced water management techniques to achieve these goals. For instance, at its Los Bronces operations, innovative systems are in place to drastically lower freshwater usage. The adoption of more precise technologies throughout its mining processes also plays a crucial role in minimizing water consumption.

Sustainable waste management is a critical environmental factor for mining operations. Anglo American is actively pursuing innovations to reduce waste and enhance recycling. For example, their work on Hydraulic Dewatered Stacking (HDS) aims to significantly alter how tailings are managed, potentially turning a waste product into a valuable resource for land rehabilitation.

The mining industry is increasingly focused on extracting critical minerals from electronic waste, a growing source of secondary materials. Furthermore, tailings, the residual material left after mineral processing, are being explored for repurposing into construction materials, demonstrating a shift towards a circular economy model. Anglo American's HDS technology is a key part of this strategy, potentially reducing the environmental footprint of tailings disposal.

Biodiversity and Land Rehabilitation

Protecting biodiversity and rehabilitating land impacted by mining are becoming critical for environmental responsibility. Regulators are enhancing ESG standards, with a significant emphasis on safeguarding biodiversity, and the economic value of 'natural capital' is increasingly acknowledged.

Anglo American is actively involved in reintroducing native plant species in areas surrounding its mining operations as part of its commitment to environmental restoration. For instance, their operations in South Africa have seen efforts to restore degraded land, with specific targets for vegetation cover and species diversity.

- Biodiversity Focus: Anglo American's rehabilitation programs aim to restore ecosystems and support local wildlife.

- Natural Capital Valuation: The company is exploring how to quantify and manage the economic value of natural resources impacted by its activities.

- Rehabilitation Efforts: In 2023, Anglo American reported progress on its rehabilitation projects, including the establishment of new habitats at several sites.

Environmental Impact of Operations

The physical footprint of mining, encompassing land use and pollution, is a critical environmental factor for Anglo American. The company is actively working to shrink this footprint per tonne of product by adopting more precise technologies, reducing energy consumption, and conserving water. For instance, in 2023, Anglo American reported a 10% reduction in water intensity across its operations compared to 2022, a testament to their efficiency drive.

Anglo American faces continuous scrutiny and legal challenges stemming from the environmental impacts of its operations. These concerns often revolve around issues like air pollution and the management of historical contamination sites. The company has committed significant resources to remediation efforts, with over $200 million allocated in 2024 for environmental rehabilitation projects across its global sites.

- Land Use: Anglo American's operations require substantial land, with rehabilitation efforts focused on restoring biodiversity and land functionality post-mining.

- Pollution Control: Investments in advanced dust suppression and water treatment technologies are key to mitigating air and water pollution.

- Resource Efficiency: The drive to use less energy and water per tonne of output directly addresses environmental sustainability and operational cost reduction.

- Legal & Regulatory Compliance: Adherence to stringent environmental regulations and proactive engagement on legacy environmental issues are paramount.

Anglo American is making strides in reducing its environmental impact, particularly concerning greenhouse gas emissions. The company aims for a 30% absolute reduction in Scope 1 and 2 emissions by 2030, using 2016 as a baseline. By 2023, they had already achieved a 13% reduction, showcasing tangible progress.

Water management is another critical area, with a target to cut fresh water withdrawal by 50% in water-stressed regions by 2030, compared to 2015 levels. This is supported by advanced techniques like Hydraulic Dewatered Stacking (HDS) for tailings management, which also aids in land rehabilitation.

The company is also committed to biodiversity and land rehabilitation, actively reintroducing native species and restoring degraded land. In 2023, progress was reported on these rehabilitation projects, including the establishment of new habitats at several sites, reflecting a growing acknowledgment of natural capital's economic value.

Anglo American is actively working to reduce its physical footprint through more precise technologies and resource efficiency. In 2023, water intensity saw a 10% reduction compared to the previous year, demonstrating a commitment to operational sustainability and cost reduction while also addressing pollution control and regulatory compliance.

| Environmental Factor | 2023 Progress/Data | Target/Commitment |

|---|---|---|

| Scope 1 & 2 GHG Emissions Reduction | 13% reduction vs 2016 baseline | 30% absolute reduction by 2030 (vs 2016) |

| Fresh Water Withdrawal Reduction | Not specified for 2023, but ongoing initiatives | 50% reduction in water-stressed regions by 2030 (vs 2015) |

| Water Intensity | 10% reduction vs 2022 | Continuous improvement |

| Land Rehabilitation | Progress reported on habitat establishment | Ongoing restoration of degraded land |

PESTLE Analysis Data Sources

Our PESTLE analysis for Anglo American draws from a robust blend of official company reports, financial market data, and industry-specific research. We incorporate insights from regulatory bodies, economic forecasts, and technological advancements to provide a comprehensive view.