Anglo American Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anglo American Bundle

Curious about the engine driving Anglo American's global success? Our comprehensive Business Model Canvas breaks down their strategic genius, revealing how they create and deliver value. Dive into the details of their customer relationships, revenue streams, and cost structures.

Unlock the full strategic blueprint behind Anglo American's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Anglo American actively partners with technology firms and leading research institutions to pioneer and deploy cutting-edge mining solutions. These collaborations focus on advancements in automation, digitalization, and sophisticated data analytics, all designed to boost efficiency and safety while minimizing environmental footprints.

A prime example of this commitment is their ongoing trials with robotic exploration technologies, including the 'Spot' robot. This initiative is specifically geared towards enhancing underground mine inspections and enabling real-time operational monitoring, a critical step in modernizing mining practices.

Anglo American’s operations are heavily dependent on a broad spectrum of suppliers and contractors, providing essential equipment, specialized services, and vital operational support across its worldwide mining activities. These partnerships are fundamental to maintaining the seamless and effective execution of its extensive mining processes, from initial exploration phases through to the final stages of mineral processing.

The company procures a wide array of goods and services, encompassing everything from large-scale mining machinery and vehicles to sophisticated engineering expertise and maintenance solutions. For instance, in 2023, Anglo American continued its strategic sourcing efforts, with a significant portion of its capital expenditure dedicated to securing advanced mining technology and robust contractor services to optimize production and safety.

Anglo American frequently enters into joint ventures for significant mining endeavors, a strategy that allows for the sharing of substantial financial burdens, operational risks, and specialized knowledge. This collaborative approach is crucial for undertaking large-scale projects that might otherwise be too capital-intensive or complex for a single entity.

A prime illustration of this partnership model is Anglo American's involvement with Mitsubishi Corporation in the development of the Quellaveco copper mine. In this venture, Mitsubishi provided a significant 40% of the total project funding, underscoring the mutual benefit and shared commitment in such collaborations.

Local Communities and Governments

Anglo American prioritizes building robust relationships with local communities and governments across its operational areas. This commitment is fundamental to securing its social license to operate and fostering long-term sustainability. In 2024, the company continued its focus on community development programs, aiming to create shared value. For instance, initiatives in South Africa often target education and skills development, directly benefiting local populations.

Adherence to stringent regulatory frameworks is a cornerstone of Anglo American's engagement with governmental bodies. The company collaborates with a wide array of stakeholders, including business partners and community representatives, to ensure its operations contribute positively to the economic and social fabric of the countries it operates in. This collaborative approach is designed to unlock enduring value, reflecting a commitment to responsible resource development.

Key aspects of these partnerships include:

- Community Development Programs: Investing in local infrastructure, education, and healthcare to uplift communities.

- Local Employment and Procurement: Prioritizing hiring from local populations and sourcing goods and services from local businesses to stimulate economic growth.

- Regulatory Compliance and Engagement: Working closely with governments to meet and exceed environmental and social regulations, fostering transparent communication.

- Stakeholder Collaboration: Partnering with diverse groups to identify and address community needs and aspirations, ensuring mutual benefit.

Strategic Alliances for Portfolio Simplification

Anglo American actively cultivates strategic alliances to streamline its portfolio, focusing on core mining operations. These partnerships facilitate the divestment of non-core assets, thereby simplifying the business structure and enhancing operational focus. This approach allows for a more concentrated effort on high-value commodities.

A prime example is the Valterra Platinum demerger, successfully executed in May 2025, which effectively separated platinum assets. Furthermore, agreements are in place for the sale of its steelmaking coal and nickel businesses. These disposals involve key partners, notably Peabody Energy for steelmaking coal and MMG Singapore Resources Pte. Ltd. for nickel operations, underscoring the collaborative nature of these strategic realignments.

- Valterra Platinum Demerger: Completed in May 2025, this strategic move simplified Anglo American's platinum exposure.

- Steelmaking Coal Divestment: Agreement reached with Peabody Energy, signaling a shift away from this segment.

- Nickel Business Sale: MMG Singapore Resources Pte. Ltd. is the agreed partner for the nickel asset divestment.

Anglo American's key partnerships are vital for innovation, operational efficiency, and strategic portfolio management. Collaborations with technology providers and research institutions drive advancements in automation and digitalization, as seen with robotic exploration trials. Strategic alliances and joint ventures, like the one with Mitsubishi Corporation for the Quellaveco mine, share financial burdens and risks for large-scale projects.

The company also relies on a broad network of suppliers and contractors for essential equipment and services, with significant capital expenditure in 2023 directed towards advanced mining technology and contractor support. Furthermore, strong relationships with local communities and governments are crucial for social license and sustainability, with ongoing community development programs in 2024.

Strategic divestments, such as the Valterra Platinum demerger in May 2025 and agreements with Peabody Energy for steelmaking coal and MMG Singapore Resources for nickel, highlight partnerships in portfolio streamlining.

| Partnership Type | Key Partners | Purpose/Focus | Recent Activity/Example |

|---|---|---|---|

| Technology & Research | Various tech firms, research institutions | Automation, digitalization, data analytics, safety, environmental impact | Robotic exploration trials (e.g., 'Spot' robot) |

| Joint Ventures | Mitsubishi Corporation | Sharing financial burdens, operational risks for large projects | Quellaveco copper mine (Mitsubishi provided 40% funding) |

| Suppliers & Contractors | Broad spectrum of global suppliers | Essential equipment, specialized services, operational support | Significant 2023 capital expenditure on advanced technology and services |

| Community & Government | Local communities, governments | Social license, sustainability, economic development, regulatory compliance | 2024 community development programs (e.g., education in South Africa) |

| Portfolio Management | Peabody Energy, MMG Singapore Resources Pte. Ltd. | Divestment of non-core assets, portfolio simplification | Valterra Platinum demerger (May 2025), steelmaking coal and nickel asset sales |

What is included in the product

A detailed, pre-structured business model canvas specifically designed for Anglo American, offering a comprehensive overview of their operations and strategic direction.

This canvas breaks down Anglo American's approach into the 9 classic Business Model Canvas blocks, providing insights into their customer segments, value propositions, and operational strategies.

The Anglo American Business Model Canvas alleviates the pain of strategic uncertainty by providing a clear, visual framework that simplifies complex business operations.

It offers a structured approach to identify and address key business challenges, turning potential roadblocks into actionable insights.

Activities

Anglo American’s key activities heavily involve geological exploration to discover new mineral deposits and enhance its existing resource base. This proactive approach is crucial for long-term growth and sustainability.

The company undertakes extensive deep drilling programs, a vital step in confirming and refining mineralisation models. For instance, their work at Quellaveco, a significant copper project, exemplifies this commitment to understanding and quantifying resource potential.

Anglo American's core mining operations focus on extracting a diverse range of commodities, including copper, platinum group metals (PGMs), diamonds, iron ore, and metallurgical coal. These are sourced from extensive, long-term mining sites, utilizing both open-pit and underground techniques to maximize resource recovery.

The company actively optimizes its mine plans and manages complex logistics to ensure efficient and cost-effective extraction. In 2023, Anglo American reported a significant production volume for key commodities, with iron ore production reaching 197 million tonnes and PGM production at 4.0 million ounces, underscoring the scale of its operational activities.

Anglo American's key activities heavily involve the intricate processing and refining of extracted raw materials. This crucial stage transforms what comes out of the ground into valuable, marketable products that meet stringent industry standards. For instance, copper concentrate undergoes complex metallurgical processes to achieve the purity required for electrical applications.

These refining processes are sophisticated and varied, encompassing crushing, grinding, and flotation to separate valuable minerals from waste rock. Smelting and further refining then convert these concentrates into high-purity metals. In 2024, Anglo American continued to invest in advanced refining technologies to enhance efficiency and product quality across its diverse commodity portfolio.

Logistics and Supply Chain Management

Anglo American's logistics and supply chain management is a cornerstone of its operations, ensuring the efficient movement of resources and products across its global footprint. This encompasses the complex coordination of various transport modes, from rail networks to port facilities, which is particularly evident in their iron ore business where timely delivery is paramount. In 2024, the company continued to focus on optimizing these intricate networks to mitigate disruptions and control costs.

The company's commitment to supply chain excellence is demonstrated through its efforts to enhance rail and port performance. For instance, in their iron ore operations, reliable rail haulage and efficient port throughput are essential for meeting customer demand and maintaining competitive pricing. These logistical capabilities directly impact the cost of goods sold and overall profitability.

- Global Network Optimization: Managing the complex flow of raw materials and finished goods across continents, ensuring timely delivery and cost-effectiveness.

- Rail and Port Coordination: Critical for operations like iron ore, where efficient rail haulage and port handling are vital for market access and revenue generation.

- Supply Chain Resilience: Building robust systems to withstand potential disruptions, a key focus in the dynamic global commodity markets of 2024.

Sustainability and Innovation Initiatives

Anglo American actively embeds sustainability and innovation across its operations, a core element of its business model. This commitment translates into tangible efforts to shrink its environmental impact, elevate workplace safety, and pioneer more resource-efficient mining methods. For instance, the company is investing in advanced technologies to better manage waste materials, aiming to extract more value and reduce landfill. In 2023, Anglo American reported a 16% reduction in Scope 1 and 2 greenhouse gas emissions intensity compared to their 2020 baseline, demonstrating progress in their decarbonization journey.

The company's innovation pipeline is geared towards addressing key challenges in the mining sector. This includes developing new approaches to mineral processing and exploring the use of renewable energy sources to power its operations. Their focus on safety is underscored by the implementation of cutting-edge technologies, such as advanced automation and real-time monitoring systems, designed to prevent incidents and protect employees. By the end of 2024, Anglo American plans to have 100% of its managed operations covered by its proprietary safety management system.

Key Sustainability and Innovation Initiatives:

- Environmental Footprint Reduction: Initiatives focused on water stewardship, biodiversity protection, and emissions reduction. For example, in 2023, they achieved a 30% reduction in fresh water abstraction intensity across their operations compared to 2017.

- Enhanced Safety Protocols: Deployment of advanced technologies and behavioral safety programs to achieve zero harm. They reported a 15% reduction in their Total Recordable Injury Frequency Rate (TRIFR) in 2023.

- Efficient Mining Practices: Investment in R&D for more productive and less impactful extraction methods, including the development of autonomous haulage systems.

- Waste Material Management: Programs to reprocess tailings and find beneficial uses for waste rock, aiming to create circular economy opportunities.

Anglo American's key activities encompass the entire mining value chain, from initial exploration and resource discovery to the final delivery of refined commodities. This includes extensive geological surveying and deep drilling to identify and quantify mineral deposits, as seen in their work at major copper projects. The company then engages in large-scale extraction using both open-pit and underground methods across its diverse portfolio of metals and minerals.

Furthermore, Anglo American's operations involve sophisticated processing and refining techniques to transform raw ore into marketable products. This stage is critical for achieving the purity and specifications demanded by global markets. Efficient logistics and supply chain management are also central to their activities, ensuring the reliable movement of materials and finished goods worldwide. For instance, in 2023, iron ore production reached 197 million tonnes, highlighting the scale of their logistical operations.

Sustainability and innovation are embedded within their key activities. This involves reducing environmental impact through initiatives like water stewardship and emissions reduction, as evidenced by a 16% reduction in Scope 1 and 2 GHG emissions intensity by 2023 compared to 2020. They also focus on enhancing safety through advanced technologies and behavioral programs, aiming for zero harm, with a 15% reduction in TRIFR reported in 2023. Investment in efficient mining practices, including autonomous haulage systems, further defines their operational approach.

| Key Activity | Description | 2023/2024 Data/Focus |

|---|---|---|

| Exploration & Resource Discovery | Identifying and quantifying new mineral deposits. | Continued investment in geological surveying and deep drilling programs. |

| Mining Operations | Extraction of diverse commodities (copper, PGMs, diamonds, iron ore, coal). | Production of 197 million tonnes of iron ore in 2023. |

| Processing & Refining | Transforming raw materials into marketable products. | Investment in advanced refining technologies for enhanced efficiency and quality. |

| Logistics & Supply Chain | Efficient movement of materials globally. | Focus on optimizing rail and port performance for iron ore operations. |

| Sustainability & Innovation | Reducing environmental impact and improving safety. | 16% reduction in GHG emissions intensity (Scope 1 & 2) by 2023; 15% reduction in TRIFR in 2023. |

Preview Before You Purchase

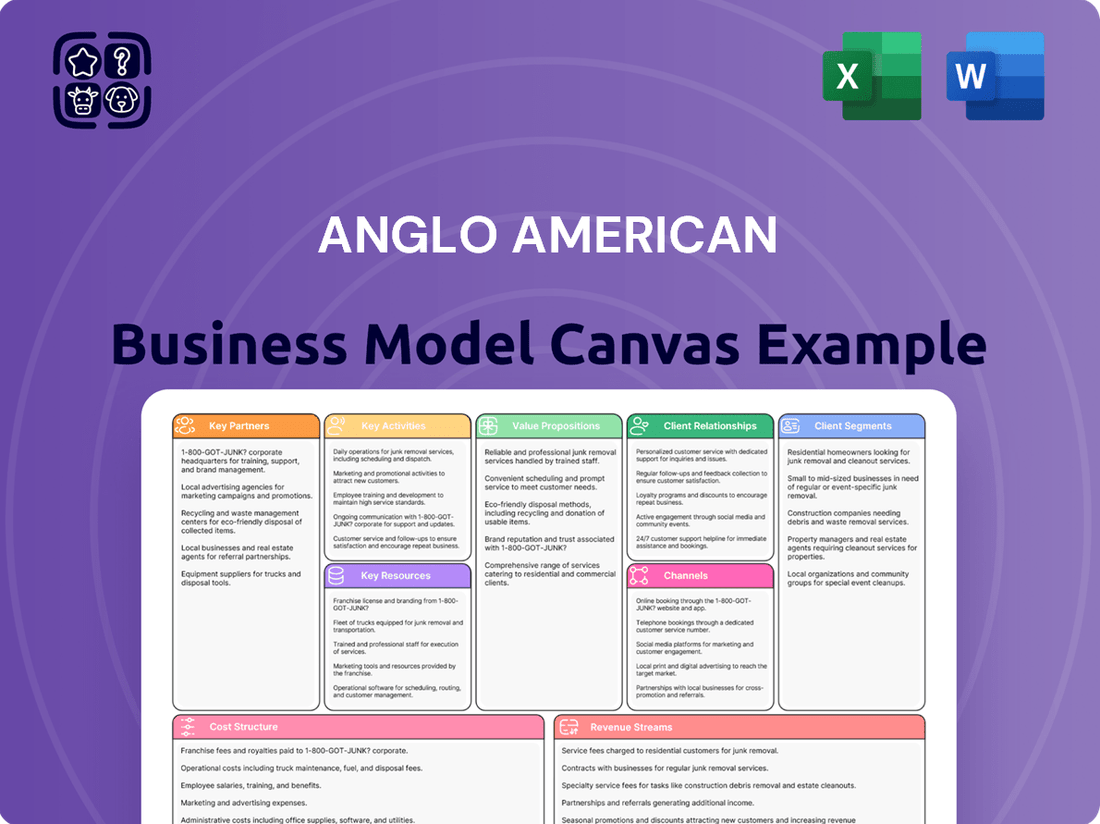

Business Model Canvas

The Anglo American Business Model Canvas preview you are viewing is the exact document you will receive upon purchase. This is not a sample or mockup, but a direct representation of the complete, ready-to-use file. Once your order is processed, you will gain full access to this professionally structured and formatted Business Model Canvas, enabling you to immediately begin refining your business strategy.

Resources

Anglo American's key resources are its extensive and varied holdings of high-quality mineral reserves. These include significant deposits of copper, platinum group metals, diamonds, iron ore, and metallurgical coal, which are crucial for its operations.

These long-life assets are the bedrock of the company's production capacity. For instance, as of the end of 2023, Anglo American reported attributable proven and probable reserves of approximately 36 million tonnes of copper and 173 million ounces of platinum group metals.

The company's strategic focus on these diverse, high-quality mineral reserves underpins its ability to generate consistent production and cash flow. This robust resource base is essential for sustaining its business model and delivering value to stakeholders.

Anglo American's mining infrastructure and equipment are its bedrock, encompassing vast mining sites, sophisticated processing plants, and extensive transportation networks like rail and ports. These physical assets are absolutely critical for their operational capacity, enabling the extraction and processing of minerals on a massive scale.

In 2024, the company continued to invest heavily in maintaining and upgrading this infrastructure. For instance, their operations rely on a significant fleet of heavy mining equipment, from massive haul trucks to advanced drilling machinery, all essential for efficient extraction.

The company's strategic focus includes optimizing these assets, such as the development of new rail lines and port facilities to ensure cost-effective and reliable movement of raw materials to global markets. This robust infrastructure underpins their ability to deliver on production targets.

Anglo American's operations rely heavily on a highly skilled workforce. This includes geologists for resource discovery, engineers for efficient extraction and processing, experienced operators for day-to-day mining activities, and astute management to guide strategy.

The collective expertise of these professionals is fundamental to Anglo American's success. Their deep understanding of exploration, mining techniques, mineral processing, and stringent safety protocols directly drives operational efficiency and fosters innovation within the company.

For instance, in 2023, Anglo American reported that its employees contributed to significant operational milestones, such as achieving 92% of its production targets for key commodities like copper and platinum group metals, a testament to their skilled execution.

Technology and Intellectual Property

Anglo American's technological prowess is anchored in its proprietary mining technologies, critical for efficient resource extraction and processing. These innovations are not just about digging deeper but doing so smarter and more sustainably. The company's investment in digital systems further enhances operational efficiency and data-driven decision-making across its global portfolio.

Intellectual property is a cornerstone, encompassing patents and trade secrets related to advanced geological survey methods and state-of-the-art extraction technologies. This intellectual capital directly supports their commitment to minimizing environmental impact. For instance, in 2023, Anglo American reported significant progress in its water stewardship initiatives, partly enabled by their proprietary water management technologies.

- Proprietary mining technologies for efficient extraction and processing.

- Digital systems enhancing operational efficiency and data analysis.

- Intellectual property covering advanced geological surveys and extraction methods.

- Environmental management IP focused on sustainable resource utilization.

Financial Capital

Anglo American requires substantial financial capital to fuel its extensive operations, which include significant capital expenditures for mine development and maintenance, ongoing exploration for new resource deposits, and strategic investments in new technologies and acquisitions. This financial backbone is crucial for maintaining its competitive edge in the global mining sector.

The company prioritizes a robust balance sheet and consistent cash generation. For instance, in 2023, Anglo American reported a strong financial performance, with underlying EBITDA reaching $10.1 billion, demonstrating its capacity to generate cash to reinvest in the business and reward shareholders.

- Capital Expenditures: In 2023, Anglo American's capital expenditure was $5.7 billion, reflecting investments in sustaining and developing its diverse portfolio of mines.

- Cash Generation: The company's focus on operational efficiency aims to bolster cash flow, which is vital for funding growth initiatives and dividend payments.

- Shareholder Returns: Anglo American aims to balance reinvestment with returning capital to shareholders, a strategy supported by its strong financial position.

Anglo American's key resources are its extensive and varied holdings of high-quality mineral reserves, including significant deposits of copper, platinum group metals, diamonds, iron ore, and metallurgical coal. These long-life assets, such as the approximately 36 million tonnes of copper and 173 million ounces of platinum group metals reserves reported at the end of 2023, form the bedrock of its production capacity and ability to generate consistent cash flow.

Value Propositions

Anglo American supplies critical metals and minerals like copper, platinum group metals (PGMs), diamonds, iron ore, and metallurgical coal. These are the foundational materials for everything from infrastructure development and advanced technologies to everyday consumer products.

In 2024, Anglo American's production of key commodities underscores its vital role. For instance, their copper output is essential for the global energy transition, powering electric vehicles and renewable energy infrastructure. PGMs are indispensable for catalytic converters, a cornerstone of emissions control in vehicles.

The company's iron ore and metallurgical coal are crucial for steel production, supporting global construction and manufacturing. Diamonds, while also a luxury good, are vital in industrial applications for cutting and polishing, contributing to various manufacturing processes.

These commodities are not just raw materials; they are enablers of progress. They are fundamental to decarbonization efforts, improving global living standards, and ensuring food security through agricultural machinery and fertilizer production.

Anglo American's commitment to responsible and sustainable sourcing underpins its business model, ensuring minerals are extracted with a strong focus on safety, environmental protection, and positive community impact. This dedication provides customers and investors with confidence in the ethical origins of their materials.

In 2024, Anglo American continued to invest in initiatives aimed at reducing its environmental footprint. For instance, their work on water stewardship saw them aim to reduce abstraction in water-scarce regions, a critical aspect of responsible resource management. This focus on sustainability is increasingly a key differentiator for stakeholders.

Anglo American is committed to providing high-quality mineral products, including premium iron ore, that consistently meet stringent industry standards and specific customer needs. This dedication to quality ensures that clients in sectors heavily reliant on raw materials receive dependable inputs for their operations.

In 2024, Anglo American's iron ore segment, particularly its Minas-Rio operations in Brazil, continued to be a cornerstone, producing high-grade iron ore fines. The reliability of this supply is crucial for steelmakers globally, where consistent quality directly impacts production efficiency and the final product's integrity.

Innovation in Mining

Anglo American's innovation in mining focuses on leveraging smart technology for improved operational outcomes. This translates to a more efficient, safer, and environmentally conscious approach to resource extraction.

The company's commitment to technological advancement means employing precise methods that reduce energy and water consumption. For instance, in 2024, Anglo American continued to invest in digital solutions across its operations, aiming for a significant reduction in its environmental footprint.

Key aspects of this innovation include:

- Precision Mining: Utilizing advanced sensors and data analytics for more targeted extraction, minimizing waste.

- Reduced Resource Intensity: Implementing technologies that significantly lower energy and water usage per tonne of material processed.

- Enhanced Safety Protocols: Deploying automation and remote monitoring to create safer working environments for employees.

- Digital Transformation: Integrating AI and machine learning to optimize mining processes, from exploration to processing.

Long-Term Value Creation for Stakeholders

Anglo American is dedicated to generating lasting value for all its stakeholders, including shareholders, employees, the communities where it operates, and its customers. This is achieved by modernizing its operations and concentrating on products that are essential for the future, such as those used in renewable energy and electric vehicles. This focus ensures that the company’s growth benefits everyone involved, not just financially.

The company's strategy emphasizes sustainable practices and responsible resource management, aiming to create a positive legacy. For instance, in 2023, Anglo American reported a strong commitment to environmental, social, and governance (ESG) principles, with significant investments in community development programs and a reduction in its carbon footprint. This approach underpins their long-term value creation model.

- Shareholder Returns: Anglo American aims to deliver robust financial returns through efficient operations and strategic growth, as demonstrated by its consistent dividend payouts and share price performance over the years.

- Employee Development: The company invests in its workforce through training and safety programs, fostering a skilled and engaged team essential for operational excellence.

- Community Impact: Anglo American prioritizes positive social impact through initiatives focused on education, health, and infrastructure development in its host communities, contributing to local prosperity.

- Customer Solutions: By supplying high-quality, responsibly sourced materials, Anglo American supports its customers in achieving their own sustainability and innovation goals, particularly in sectors like green technology.

Anglo American offers critical, high-quality metals and minerals essential for global development and the green transition. They provide foundational materials that enable infrastructure, advanced technologies, and consumer goods, with a strong emphasis on responsible sourcing and sustainability. Their commitment ensures customers and investors receive ethically produced materials, fostering trust and long-term partnerships.

Customer Relationships

Anglo American cultivates direct sales and key account management with its most significant industrial clients. These relationships are crucial for understanding and catering to the unique demands of sectors like steelmaking, automotive production, and high-end jewelry retail.

Dedicated sales teams and specialized key account managers are instrumental in nurturing these direct connections. This personalized approach ensures that Anglo American can effectively address the specific needs and evolving requirements of its major customers, fostering loyalty and long-term partnerships.

Anglo American frequently secures its future by entering into long-term supply agreements with major clients. This strategy offers both Anglo American and its customers a degree of certainty regarding volumes and pricing. For instance, in 2023, the company highlighted its ongoing efforts to strengthen these relationships, which are crucial for underpinning its significant capital investments in large, enduring mining operations.

Anglo American offers dedicated technical support to ensure customers effectively utilize their products. This includes expert guidance tailored to specific mineral applications and performance enhancement, aiming to maximize customer process efficiency.

Sustainability and ESG Engagement

Anglo American actively engages its customers on its Environmental, Social, and Governance (ESG) performance, recognizing its growing importance in purchasing decisions. This dialogue focuses on transparent reporting and collaborative discussions regarding responsible sourcing practices and the company's environmental footprint.

The company's commitment is demonstrated through detailed sustainability reports and direct customer interactions. For instance, in 2024, Anglo American continued to emphasize its progress in reducing greenhouse gas emissions, aiming for a 30% reduction by 2030 against a 2019 baseline.

- Responsible Sourcing: Customers are provided with information on the ethical and sustainable origins of Anglo American's products, ensuring supply chain integrity.

- Environmental Impact: Discussions highlight efforts to minimize water usage and biodiversity impact, with specific targets for 2025 and beyond.

- Social Contributions: Engagement includes sharing data on community investment and employee well-being initiatives, reinforcing the company's social license to operate.

Industry Associations and Forums

Anglo American actively participates in industry associations and forums to foster deeper connections with its diverse customer base, ranging from industrial manufacturers to automotive producers. These engagements are crucial for staying ahead of evolving market demands and collaboratively tackling shared industry challenges. For instance, in 2023, the company reported a significant increase in engagement at global mining and metals forums, directly translating into enhanced understanding of customer needs for critical minerals like copper and platinum group metals.

These platforms offer Anglo American invaluable opportunities to gather insights into emerging trends, such as the growing demand for materials essential for the green energy transition. By being present, the company can better align its product development and supply chain strategies with customer expectations. In 2024, Anglo American highlighted its participation in several key forums focused on sustainable mining practices, which directly informed its customer relationship strategies for high-purity iron ore customers.

- Customer Engagement: Direct interaction with a broad spectrum of customers, from industrial users to technology developers, at industry events.

- Market Intelligence: Gaining real-time understanding of market trends, customer preferences, and competitive landscapes.

- Industry Collaboration: Working with peers and stakeholders to address sector-wide issues like supply chain resilience and sustainability standards.

- Opportunity Identification: Uncovering new applications and market segments for its mineral products through dialogue and networking.

Anglo American's customer relationships are built on a foundation of direct engagement, long-term agreements, and robust technical support. The company prioritizes understanding the specific needs of key industrial clients, such as those in steelmaking and automotive production, through dedicated account management. This focus ensures tailored solutions and fosters enduring partnerships, underscored by a commitment to transparency in ESG performance and responsible sourcing, which is increasingly vital for customer purchasing decisions.

| Customer Relationship Aspect | Description | 2023/2024 Relevance |

|---|---|---|

| Direct Sales & Key Account Management | Personalized service for major industrial clients. | Crucial for understanding sector-specific demands in steel, auto, and jewelry. |

| Long-Term Supply Agreements | Securing future volumes and pricing certainty. | Underpins capital investment in enduring mining operations. |

| Technical Support | Expert guidance on product application and performance. | Maximizes customer process efficiency for mineral utilization. |

| ESG & Sustainability Dialogue | Transparent reporting on environmental and social impact. | Addresses growing importance in purchasing; 2024 focus on 30% GHG reduction by 2030. |

| Industry Forum Participation | Engagement to understand market trends and challenges. | Informed understanding of customer needs for critical minerals; 2023 saw increased forum engagement. |

Channels

Anglo American employs a direct sales force to engage with industrial clients worldwide, offering a personalized approach to selling its mineral products. This direct channel facilitates in-depth discussions, enabling the company to understand specific customer needs and provide customized solutions for commodities like iron ore and platinum group metals.

This direct sales strategy allows Anglo American to bypass intermediaries, fostering stronger relationships and ensuring better control over the sales process. In 2023, Anglo American's sales revenue reached approximately $28.2 billion, underscoring the significant volume and value handled through its dedicated sales teams.

Anglo American relies on a vast global network of shipping and logistics partners to move its diverse range of commodities, from iron ore and coal to platinum group metals and copper. This intricate web ensures products reach customers across continents efficiently. For instance, in 2023, the company's freight expenditures were a significant component of its operating costs, reflecting the scale of its global transportation needs.

The company's strategy emphasizes optimizing these networks to minimize transit times and costs, directly impacting its competitiveness. By securing favorable shipping rates and utilizing strategically located ports, Anglo American aims to provide reliable and timely delivery, a critical factor for its industrial and manufacturing clients.

Anglo American leverages trading desks and participation in global commodity markets to enhance flexibility in its sales channels for certain commodities. This strategic approach allows the company to manage price exposure effectively, ensuring more stable revenue streams even amidst market volatility. For instance, in 2024, the company's diversified commodity portfolio, including platinum group metals and iron ore, benefits from these market mechanisms to optimize sales and mitigate price risks.

De Beers Subsidiary (for Diamonds)

Anglo American leverages its De Beers subsidiary to manage a specialized distribution network for rough diamonds. This includes established, long-term sight holder agreements, which provide a consistent sales channel, and dynamic auction platforms for broader market engagement. These channels are crucial for realizing the value of their diamond assets.

De Beers' distribution strategy in 2024 continues to emphasize these distinct channels. The sight holder system, a cornerstone of their sales, ensures predictable demand and pricing for key clients. Auctions offer flexibility, allowing for the sale of various diamond qualities and quantities to a wider range of buyers.

- Sight Holder Agreements: These are long-term contracts with select diamond manufacturers and dealers, ensuring a steady flow of rough diamonds.

- Auctions: De Beers conducts regular auctions, providing a transparent and competitive marketplace for its rough diamond production.

- Market Reach: These channels collectively allow De Beers to reach a diverse global customer base, from large-scale manufacturers to smaller, specialized businesses.

Digital Platforms and Investor Relations

Anglo American leverages its corporate website as a primary digital hub, offering detailed information on its operations, sustainability efforts, and financial performance. This platform is crucial for engaging with a broad audience, from individual investors to institutional analysts, providing access to annual reports and investor presentations.

Investor relations are further supported through regular investor updates and webcasts, ensuring timely dissemination of crucial financial data and strategic outlooks. For instance, in their 2024 reports, Anglo American highlighted significant progress in their digital transformation initiatives, aiming to enhance transparency and accessibility for all stakeholders.

- Corporate Website: Serves as the central repository for all public company information, including financial statements and strategic updates.

- Investor Presentations: Provide in-depth analysis of performance and future outlook, often accompanied by live or recorded webcasts.

- Annual Reports: Comprehensive documents detailing financial results, operational achievements, and governance practices.

- Digital Communication Tools: Employed to reach a global audience of investors and financial professionals with key company news.

Anglo American utilizes a multi-faceted channel strategy, combining direct sales with sophisticated logistics and digital engagement. This approach ensures efficient delivery of its diverse commodity portfolio to a global industrial client base.

The company's direct sales force, handling commodities like iron ore and platinum group metals, fosters strong client relationships. In 2023, Anglo American's sales revenue was approximately $28.2 billion, reflecting the scale of these direct transactions.

A robust network of shipping and logistics partners is critical for global reach, with freight expenditures being a significant cost component in 2023. Trading desks and market participation offer flexibility and price risk management, particularly beneficial for commodities like platinum group metals in 2024.

The De Beers subsidiary employs specialized channels for diamonds, including sight holder agreements and auctions, ensuring diverse market access. The corporate website and investor relations activities provide transparency and accessibility for stakeholders, with digital transformation efforts highlighted in 2024 reports.

| Channel | Description | Key Commodities/Segments | 2023 Data Point | 2024 Outlook/Focus |

| Direct Sales Force | Personalized engagement with industrial clients | Iron Ore, Platinum Group Metals | ~$28.2B Sales Revenue | Strengthening client relationships |

| Global Logistics Network | Shipping and transportation of commodities | All commodities | Significant freight expenditures | Optimizing transit times and costs |

| Trading Desks/Markets | Flexible sales and price risk management | Platinum Group Metals, Iron Ore | N/A (Ongoing strategy) | Mitigating price risks |

| De Beers Distribution | Specialized channels for rough diamonds | Rough Diamonds | N/A (Ongoing strategy) | Sight holder agreements, auctions |

| Digital Hub (Website/IR) | Information dissemination and stakeholder engagement | All stakeholders | Digital transformation progress | Enhancing transparency and accessibility |

Customer Segments

Steel manufacturers represent a cornerstone customer segment for Anglo American, primarily relying on the company's iron ore and metallurgical coal. These are absolutely vital inputs for creating steel. In 2024, global steel production was projected to reach approximately 1.9 billion tonnes, underscoring the immense demand for these raw materials.

This segment encompasses a broad range of steelmakers, from large, integrated mills that handle the entire production process to electric arc furnace (EAF) operators who often recycle scrap steel. Anglo American's high-quality iron ore and coking coal are critical for the efficiency and quality of steel produced by both types of facilities.

The automotive industry represents a critical customer segment for Anglo American, primarily as a major consumer of platinum group metals (PGMs). These metals are essential for catalytic converters, which reduce harmful emissions from internal combustion engines. In 2024, the demand for PGMs in this sector remains significant, though it is evolving.

The accelerating global shift towards electric vehicles (EVs) is reshaping this relationship. While catalytic converter demand may see a long-term decline, the increasing production of EVs is driving a new demand for copper, which is vital for wiring, motors, and charging infrastructure. This transition underscores the industry's sensitivity to environmental regulations and technological advancements.

Anglo American's primary customer segment within the jewelry and luxury goods industry is the global diamond market, predominantly served through its significant stake in De Beers. This segment is highly sensitive to shifts in consumer sentiment and broader economic health, as discretionary spending on luxury items often fluctuates with economic cycles.

In 2024, the diamond industry experienced a notable rebound, with De Beers reporting a 7% increase in rough diamond sales by value in the first half of the year compared to the same period in 2023, reaching $2.6 billion. This indicates a positive trend driven by renewed consumer confidence and demand, particularly in key markets like the United States and China.

Electronics and Technology Manufacturers

Electronics and technology manufacturers are key customers for Anglo American, relying heavily on copper and other base metals. These materials are fundamental to a vast array of products, including the smartphones we use daily, the growing electric vehicle market, and the infrastructure supporting data centers and artificial intelligence. The demand from this segment is directly tied to the pace of technological innovation and the ongoing global push towards digitalization.

In 2024, the global semiconductor market, a core component of electronics manufacturing, was projected to reach approximately $600 billion, showcasing the immense scale of this customer base. Similarly, the electric vehicle market continued its rapid expansion, with global sales expected to surpass 15 million units in 2024, further underscoring the critical role of copper in this sector.

- Demand Drivers: Technological advancements, digitalization, and the proliferation of smart devices.

- Key Products: Smartphones, electric vehicles, data center components, AI hardware.

- Market Significance: A substantial and growing segment driven by innovation.

- Material Dependence: High reliance on copper and other base metals for manufacturing.

Agricultural Sector (for Crop Nutrients)

Anglo American is strategically targeting the agricultural sector with its polyhalite crop nutrient, a key input for enhancing food security and soil health. This represents a significant growth area for the company.

The demand for specialized fertilizers is on the rise globally, driven by the need for increased crop yields and sustainable farming practices. Anglo American's Woodsmith project is positioned to meet this demand.

- Growing Global Fertilizer Market: The global fertilizer market was valued at approximately $200 billion in 2023 and is projected to grow, with crop nutrients like polyhalite playing an increasingly important role.

- Food Security Imperative: With the global population expected to reach nearly 10 billion by 2050, efficient and sustainable agriculture is paramount, making crop nutrients a critical component.

- Polyhalite's Unique Benefits: Polyhalite offers a unique combination of essential nutrients (potassium, sulfur, magnesium, and calcium) in a single, low-chloride, slow-release form, which is highly beneficial for a wide range of crops.

The construction and infrastructure sector represents a significant customer base for Anglo American, particularly for its products like copper and iron ore. These materials are fundamental building blocks for everything from residential buildings to large-scale public works projects, driving demand through global development initiatives.

In 2024, global construction output was projected to see continued growth, with major infrastructure spending in regions like North America and Asia-Pacific. This trend directly translates into sustained demand for the raw materials Anglo American supplies, supporting the development of essential infrastructure worldwide.

| Customer Segment | Key Products Supplied | 2024 Market Context/Data |

|---|---|---|

| Steel Manufacturers | Iron Ore, Metallurgical Coal | Global steel production projected ~1.9 billion tonnes. |

| Automotive Industry | Platinum Group Metals (PGMs), Copper | Continued PGM demand for catalytic converters, growing copper demand for EVs. |

| Jewelry & Luxury Goods | Diamonds (via De Beers) | De Beers' H1 2024 rough diamond sales up 7% YoY to $2.6 billion. |

| Electronics & Technology | Copper, Other Base Metals | Semiconductor market projected ~$600 billion; EV sales >15 million units. |

| Agriculture | Polyhalite Crop Nutrient | Global fertilizer market ~$200 billion (2023), growing need for crop nutrients. |

| Construction & Infrastructure | Copper, Iron Ore | Projected growth in global construction output and infrastructure spending. |

Cost Structure

Operational costs, primarily mining and processing, represent Anglo American's most substantial expenditure. These costs cover the entire journey from extracting raw materials to refining them, including significant outlays for energy and water at their global operations.

In 2024, Anglo American has been actively pursuing cost reduction initiatives across its mining and processing activities. The company reported achieving substantial savings through these efforts, highlighting a strategic focus on efficiency improvements and optimized resource utilization to manage these significant operational expenses.

Anglo American's capital expenditure is substantial, covering both the upkeep of existing mines and the development of new ventures. In 2023, the company reported capital expenditure of $5.7 billion, a slight increase from $5.5 billion in 2022, reflecting ongoing investment in its portfolio.

The company has been actively pursuing disciplined capital allocation, aiming to optimize spending and achieve significant savings. For instance, Anglo American identified $1.8 billion in capital savings through 2026 as of its 2023 full-year results, demonstrating a strategic focus on efficiency in its growth and sustaining capital projects.

Labor costs are a significant component of Anglo American's expenses, encompassing wages, benefits, and various other employee-related outlays for its extensive global workforce. In 2023, the company reported employee-related expenses of $5.6 billion, reflecting the substantial investment in its people.

The company places a strong emphasis on maintaining a robust safety culture and ensuring the well-being of its employees. This commitment translates into ongoing investments in training, safety equipment, and health programs, which are integral to managing labor costs effectively and sustainably.

Logistics and Transportation Costs

Anglo American faces significant logistics and transportation costs, encompassing the movement of raw materials from its global mining operations to processing facilities and subsequently delivering finished products to customers. These expenses are heavily influenced by the availability and efficiency of critical infrastructure like rail networks, port facilities, and shipping routes.

In 2024, these costs remain a substantial component of Anglo American's operational expenditure. For instance, the company's reliance on rail to move bulk commodities from remote mine sites, such as its iron ore operations in South Africa, directly impacts its cost base. Similarly, port charges and international shipping rates, which can fluctuate based on global demand and fuel prices, add another layer of expense.

- Rail Costs: Expenses related to operating and maintaining rail lines, as well as freight charges for hauling ore and other materials.

- Port Charges: Fees associated with loading and unloading cargo at ports, including handling, storage, and terminal fees.

- Shipping Expenses: Costs incurred for chartering vessels and transporting goods across international waters, often a significant factor for a global miner.

- Infrastructure Performance: The reliability and capacity of transportation infrastructure directly affect transit times and overall logistics efficiency, impacting cost per tonne.

Environmental and Social Compliance Costs

Anglo American incurs significant expenditures to meet stringent environmental regulations and implement sustainability initiatives across its global operations. These costs are crucial for maintaining its social license to operate and ensuring responsible mining practices. For instance, in 2023, the company reported capital expenditure of $800 million related to environmental and social programs, a notable increase from previous years reflecting a heightened focus on climate change adaptation and biodiversity protection.

Community development programs are also a key component of Anglo American's cost structure, aimed at fostering positive relationships with the communities in which it operates. These investments often include infrastructure development, education, and healthcare initiatives. The company's commitment to these programs is underscored by its 2024 sustainability targets, which allocate over $250 million towards social impact projects over the next five years.

- Environmental Compliance: Costs associated with pollution control, waste management, water stewardship, and land rehabilitation.

- Sustainability Initiatives: Investments in renewable energy, carbon reduction technologies, and circular economy principles.

- Community Development: Expenditures on local employment, skills training, health services, education, and infrastructure improvements.

- Social License to Operate: Costs incurred to build and maintain trust and positive relationships with stakeholders, including local communities and governments.

Anglo American's cost structure is dominated by operational expenses, including mining, processing, and energy consumption, reflecting the capital-intensive nature of its business. The company actively pursues cost reduction, with significant capital expenditure allocated to both sustaining existing operations and developing new projects, aiming for efficiency gains. Labor costs, environmental compliance, and community development programs also represent substantial investments, crucial for maintaining its social license and operational sustainability.

| Cost Category | 2023 Data | 2024 Focus/Data |

|---|---|---|

| Operational Costs (Mining & Processing) | Substantial, driven by energy and water | Active cost reduction initiatives, focus on efficiency |

| Capital Expenditure | $5.7 billion (2023) | Disciplined allocation, $1.8 billion identified savings by 2026 |

| Labor Costs | $5.6 billion (2023) | Emphasis on safety, training, and health programs |

| Logistics & Transportation | Significant due to global operations | Impacted by rail, port, and shipping efficiency |

| Environmental & Social Programs | $800 million (2023 CapEx for Env/Social) | Over $250 million allocated for social impact projects (next 5 years from 2024) |

Revenue Streams

Anglo American generates significant revenue from selling copper, a crucial commodity for global electrification and infrastructure projects. The company's copper sales performance in 2024 was robust, reflecting sustained demand.

In the first half of 2024, Anglo American reported a substantial increase in copper production, reaching 367,000 tonnes, up 10% year-on-year. This higher output directly translated into stronger sales volumes for the period.

Anglo American generates substantial revenue from selling iron ore, especially high-grade products, to steelmakers worldwide. This segment is a cornerstone of their financial performance.

In 2023, Anglo American's iron ore segment, primarily from its operations in South Africa and Brazil, contributed significantly to its overall revenue, demonstrating its importance as a key revenue stream.

The demand for premium iron ore, which Anglo American is well-positioned to supply, directly impacts the pricing and volume of these sales, bolstering the company's top line.

Anglo American generates significant revenue from selling Platinum Group Metals (PGMs), including platinum, palladium, and rhodium. These precious metals are primarily supplied to the automotive sector for catalytic converters and to the jewelry industry. Despite facing market volatility, PGM sales remain a core revenue driver for the company.

Diamond Sales (via De Beers)

Anglo American's diamond sales, primarily through its De Beers subsidiary, represent a significant revenue stream. This segment is directly influenced by global demand for polished diamonds and the company's strategic management of its rough diamond inventory.

In 2024, De Beers reported strong sales, driven by robust consumer demand in key markets and effective inventory management. For instance, De Beers' rough diamond sales in the first cycle of 2024 reached $500 million, indicating a healthy market performance.

- De Beers' Rough Diamond Sales: Revenue generated from the sale of rough diamonds through its De Beers subsidiary.

- Market Demand Sensitivity: This revenue stream is heavily influenced by fluctuations in global consumer demand for polished diamonds.

- Inventory Adjustments: Anglo American, via De Beers, actively manages its rough diamond inventory to optimize sales and respond to market conditions.

- 2024 Performance Snapshot: De Beers reported $500 million in rough diamond sales during the first sales cycle of 2024, reflecting positive market engagement.

Metallurgical Coal Sales

Anglo American generates revenue from selling metallurgical coal, a key ingredient for steel production. This segment represents a significant, though shrinking, part of their business as the company actively simplifies its portfolio. In 2024, the company continued its divestment strategy, impacting the overall contribution from this revenue stream.

The company's strategy involves divesting certain assets to streamline operations and focus on core commodities. This means the revenue from metallurgical coal sales is expected to decline as these divestments progress.

- Revenue derived from the sale of metallurgical coal for steel manufacturing.

- This is a divesting business for Anglo American as part of its portfolio simplification efforts.

- The contribution of this revenue stream is decreasing due to ongoing divestments.

Anglo American's revenue streams are diverse, primarily driven by the sale of key commodities like copper, iron ore, and Platinum Group Metals (PGMs). Diamond sales through De Beers also contribute significantly, with strong performance noted in early 2024. The company is strategically divesting from metallurgical coal, which is impacting that revenue segment.

| Commodity | Key Application | 2024 Performance Indicator |

|---|---|---|

| Copper | Electrification, Infrastructure | 10% year-on-year production increase (H1 2024) |

| Iron Ore | Steel Production | Significant contribution in 2023, demand for premium grades |

| PGMs | Automotive (catalytic converters), Jewelry | Core revenue driver despite market volatility |

| Diamonds | Luxury Goods | $500 million in rough diamond sales (De Beers, Cycle 1 2024) |

| Metallurgical Coal | Steel Production | Decreasing contribution due to divestments |

Business Model Canvas Data Sources

The Anglo American Business Model Canvas is informed by comprehensive market analysis, internal operational data, and financial performance metrics. These sources provide a robust foundation for understanding the company's strategic positioning and future growth opportunities.