Anglo American Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Anglo American Bundle

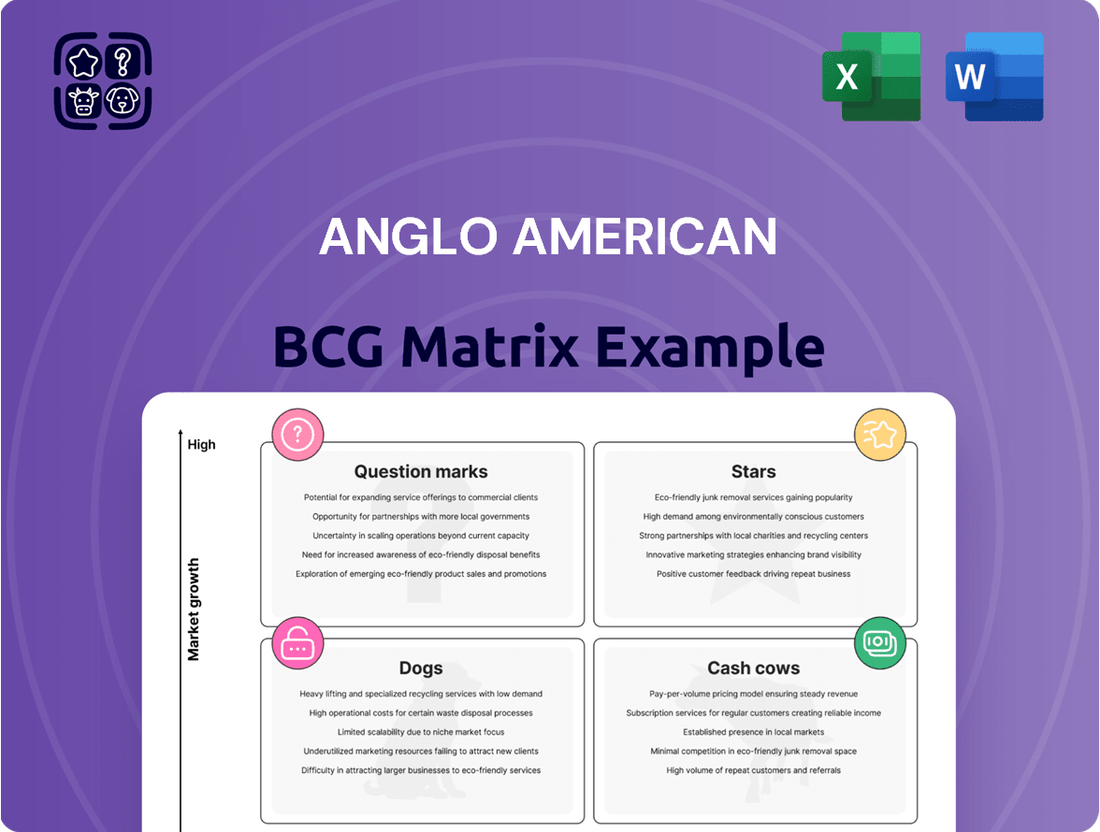

Unlock the strategic potential of the Anglo American BCG Matrix. This powerful tool categorizes their business units into Stars, Cash Cows, Dogs, and Question Marks, offering a clear snapshot of their market performance and growth prospects. Don't miss out on the critical insights that will shape your investment decisions.

Purchase the full Anglo American BCG Matrix report to gain a comprehensive understanding of each quadrant's implications. Discover actionable strategies for optimizing their product portfolio and maximizing profitability. This is your essential guide to navigating their competitive landscape.

Stars

Anglo American's copper portfolio, featuring Quellaveco, Los Bronces, and Collahuasi, represents a cornerstone of its growth strategy. Quellaveco, in particular, has demonstrated robust performance, contributing significantly to the company's output.

Los Bronces continues to be a strong performer, while Collahuasi is undergoing improvements to enhance its operational efficiency and output. These assets are strategically vital, aligning with the escalating global demand for copper, a critical component in the ongoing energy transition and electrification efforts.

In 2023, Anglo American's copper production reached 266,000 tonnes in the third quarter, with Quellaveco contributing 46,000 tonnes. The company anticipates its copper output to be between 250,000 and 275,000 tonnes for the full year 2023, underscoring the importance of these operations to its future financial health and market position.

Anglo American's premium iron ore segment, anchored by Minas-Rio and Kumba, remains a powerhouse, consistently generating robust financial results. In 2023, Kumba Iron Ore reported a revenue of $5.8 billion, showcasing the segment's significant contribution. These operations are strategically positioned to capitalize on the growing demand for high-quality iron ore, essential for steel decarbonization efforts.

The company's commitment to this sector is evident in recent developments. Minas-Rio's expansion projects are progressing, aiming to boost production capacity. Concurrently, Kumba has seen improvements in its rail logistics, enhancing efficiency and delivery capabilities, further solidifying its market position.

Anglo American is strategically reorienting its business towards 'future-enabling products.' This involves focusing on commodities crucial for decarbonization efforts in energy and transportation sectors, as well as those demanded by evolving consumer preferences.

This pivot is designed to enhance profitability by concentrating on high-margin commodities. For instance, in 2024, the company continued its investment in green hydrogen projects, recognizing the significant growth potential in this area.

Operational Excellence Initiatives

Anglo American is actively pursuing operational excellence through focused productivity enhancements and cost reduction programs. These initiatives are designed to streamline operations and improve efficiency across the board.

The company reported a significant reduction in unit costs for its key commodities. For instance, in the first half of 2024, their copper unit costs saw a notable decrease, contributing to improved profitability. This focus on efficiency is directly impacting their bottom line.

- Productivity Gains: Enhanced operational processes are yielding higher output per employee and per unit of input.

- Cost Reduction: Successful implementation of cost-saving measures, including supply chain optimization and energy efficiency, have lowered overall operating expenses.

- Financial Performance Boost: These efforts have directly translated into stronger financial results, particularly evident in the improved margins for copper and iron ore segments in early 2024.

- Unit Cost Improvement: Anglo American achieved a substantial year-on-year reduction in unit costs for key commodities like copper and iron ore during the first half of 2024, demonstrating the effectiveness of their programs.

Portfolio Simplification and Value Unlocking

Anglo American is actively simplifying its vast portfolio, a strategic move designed to sharpen its focus and unlock latent shareholder value. This process involves shedding non-core assets and potentially demerging certain businesses, aiming to create a more agile and transparent entity. For instance, the company announced in early 2024 its intention to exit its South African thermal coal operations, a significant step in this simplification journey.

The divestment strategy is anticipated to yield substantial financial benefits, improving the overall health and attractiveness of the company to investors. By concentrating on core mining operations with strong growth prospects, Anglo American expects to enhance its financial transparency and operational efficiency. This strategic realignment is crucial for navigating the evolving landscape of the mining industry and maximizing returns for its stakeholders.

- Portfolio Simplification: Anglo American is divesting non-core assets, such as its South African thermal coal business, to streamline operations.

- Value Unlocking: This strategic focus aims to enhance shareholder value through improved financial transparency and operational efficiency.

- Strategic Realignment: The company is concentrating on core mining assets with strong growth potential to navigate industry changes effectively.

- Financial Transparency: Simplification efforts are expected to lead to clearer financial reporting and a more understandable business structure.

Anglo American's copper and iron ore businesses are its primary Stars. Quellaveco and Los Bronces are key copper assets, with Quellaveco showing strong performance. Minas-Rio and Kumba Iron Ore represent the premium iron ore segment, both consistently delivering robust financial results and benefiting from expansion projects and logistics improvements.

| Asset | Commodity | Status | 2023 Production (Q3) | Strategic Importance |

| Quellaveco | Copper | Star | 46,000 tonnes | Key growth driver, high demand |

| Los Bronces | Copper | Star | N/A | Strong performer, vital for future |

| Minas-Rio | Iron Ore | Star | N/A | Premium segment, expansion underway |

| Kumba Iron Ore | Iron Ore | Star | N/A | Revenue of $5.8 billion (2023), logistics improvements |

What is included in the product

Provides a strategic overview of a company's product portfolio, categorizing them as Stars, Cash Cows, Question Marks, or Dogs.

Clear, actionable insights into portfolio balance, easing strategic decision-making.

Cash Cows

Anglo American showcased a robust operational performance in the first half of 2024, generating an underlying EBITDA of $5.0 billion. This strong cash generation, primarily from its copper and iron ore segments, underscores its position as a cash cow within the BCG matrix.

Despite a decrease in its overall product basket price, the company's financial resilience allowed for continued strategic investments and substantial dividend distributions to shareholders. This financial health is a testament to the consistent demand and profitability of its key commodities.

Anglo American's disciplined capital allocation strategy is a cornerstone of its financial health, evidenced by its commitment to a consistent dividend payout policy. This approach helps maintain a robust balance sheet, ensuring the company can invest in crucial areas like research and development and manage its corporate debt effectively.

In 2024, Anglo American continued to prioritize shareholder returns while strategically investing in its future. The company's financial reports for the period ending December 31, 2024, indicated a strong focus on operational efficiency and prudent cash management, allowing for continued investment in key growth projects and the servicing of existing debt obligations.

Anglo American's aggressive cost reduction programs are a key driver for its Cash Cow segment, aiming for substantial savings. The company is targeting a significant reduction in operating costs and capital expenditure through 2026, which directly bolsters profitability from its established, high-performing assets.

These efficiency gains translate into stronger profit margins and enhanced cash flow generation. For instance, Anglo American has previously highlighted its commitment to reducing its cost base, with specific programs designed to optimize operational efficiency and streamline supply chains, thereby maximizing returns from its mature mining operations.

High Margin Core Businesses

Anglo American's copper and premium iron ore segments are the company's cash cows, characterized by robust performance and impressive EBITDA margins. These operations are significant contributors to the company's financial strength, generating substantial cash flow.

The substantial cash generated from these high-margin core businesses provides Anglo American with the flexibility to reinvest in growth opportunities, pay down debt, or return capital to shareholders. For instance, in 2023, Anglo American's iron ore business reported an EBITDA margin of approximately 60%, while its copper operations achieved margins around 55%, underscoring their cash-generating power.

- High EBITDA Margins: Copper and premium iron ore segments consistently deliver strong profitability.

- Substantial Cash Generation: These businesses are key drivers of free cash flow for Anglo American.

- Strategic Reinvestment: Generated cash supports portfolio development and debt management.

- 2023 Performance: Iron ore EBITDA margins neared 60%, and copper margins were around 55%.

Mature Market Presence in Core Commodities

Anglo American's established presence in core commodities like copper and iron ore serves as a significant cash cow. These markets, fundamental to global industrial development, offer a stable foundation for consistent revenue generation even as the company pursues growth in other areas.

The sustained demand for these essential materials underpins their role as reliable cash generators. For instance, in 2023, Anglo American's iron ore segment, primarily from its Kumba operations, continued to be a strong performer, contributing significantly to the group's overall financial health. Similarly, copper, a key component in electrification and infrastructure, provides a steady income stream.

- Iron Ore Dominance: Kumba Iron Ore, a subsidiary, consistently delivers robust earnings, benefiting from high-quality ore reserves and efficient operations.

- Copper's Enduring Demand: The group's copper assets, particularly in South America, are well-positioned to capitalize on the increasing demand driven by the global energy transition.

- Commodity Price Resilience: While subject to market fluctuations, the long-term demand outlook for both iron ore and copper remains positive, ensuring a predictable cash flow.

Anglo American's copper and premium iron ore segments are its primary cash cows, consistently generating substantial profits and free cash flow. These operations benefit from high-quality assets and strong market positions, allowing for significant EBITDA margins. For example, in 2023, the iron ore segment achieved EBITDA margins of approximately 60%, while copper operations reported margins around 55%, demonstrating their robust profitability.

| Segment | 2023 EBITDA Margin | Key Contribution |

|---|---|---|

| Copper | ~55% | Strong demand from energy transition |

| Iron Ore | ~60% | High-quality reserves, efficient operations (e.g., Kumba) |

Preview = Final Product

Anglo American BCG Matrix

The Anglo American BCG Matrix preview you are examining is the identical, fully formatted document you will receive upon purchase, ensuring no surprises and immediate usability for your strategic planning needs.

This preview accurately represents the complete Anglo American BCG Matrix report you will download, containing all the detailed analysis and professional formatting ready for your business decision-making.

Rest assured, the Anglo American BCG Matrix you see here is the exact final version you will acquire, providing you with an immediately accessible and actionable tool for market analysis and portfolio management.

What you are currently viewing is the definitive Anglo American BCG Matrix document that will be delivered to you after your purchase, offering a comprehensive and professionally designed strategic resource.

Dogs

Anglo American's steelmaking coal business is being divested, a clear indicator of its classification as a 'Dog' within the BCG matrix. This strategic move signifies the company's intent to exit this segment, reflecting expectations of low future growth and a diminished market share within Anglo American's evolving portfolio.

In 2023, Anglo American's steelmaking coal segment reported EBITDA of $1.6 billion, a significant decrease from $5.8 billion in 2022, underscoring the challenging market conditions and the strategic rationale for divestment.

Anglo American is actively evaluating the future of its nickel operations, including the Barro Alto mine in Brazil. This strategic review is considering options such as care and maintenance or outright divestment, reflecting a potential shift in the company's portfolio.

The Barro Alto operation, given its current market position and growth outlook, aligns with the characteristics of a 'Dog' in the BCG matrix. This classification suggests that the business unit may have a low relative market share and operates in a low-growth industry segment, making it a candidate for divestment or restructuring to free up capital for more promising ventures.

Anglo American's strategic review, launched in 2023, scrutinizes all its assets, leaving no stone unturned. This rigorous assessment means any assets that have consistently underperformed or don't fit the company's forward-looking plans are candidates for divestment.

Historically underperforming assets, those failing to meet performance benchmarks or strategic alignment, are prime candidates for divestment. For instance, if an asset's return on capital employed (ROCE) has been consistently below the company's weighted average cost of capital (WACC), it signals a need for action. In 2023, Anglo American's focus on streamlining its portfolio means such assets are under intense scrutiny.

Reduced Production Guidance in Exiting Businesses

Anglo American's decision to reduce production guidance in certain segments, like steelmaking coal and nickel, clearly signals their classification as 'Dogs' within the BCG matrix. This strategic move reflects a deliberate effort to divest from underperforming or low-growth assets.

For instance, in 2023, Anglo American indicated a significant reduction in its steelmaking coal output, with a focus on optimizing operations for sale. Similarly, their nickel operations have faced challenges, leading to a reassessment of future production levels.

- Steelmaking Coal Production Decline: Anglo American has been scaling back its steelmaking coal output, a key indicator of its 'Dog' status in this segment.

- Nickel Operations Re-evaluation: The company is also adjusting its approach to nickel, signaling a potential reduction in future production guidance due to market conditions.

- Portfolio Streamlining: These production adjustments are part of a broader strategy to divest from businesses that are no longer considered core or high-potential.

- Focus on Core Assets: By reducing exposure to these 'Dog' segments, Anglo American aims to concentrate resources on its more promising 'Stars' and 'Cash Cows'.

Strategic Exit from Non-Core Assets

Anglo American's strategic exit from non-core assets aligns with its broader objective of portfolio simplification and a sharpened focus on high-margin commodities. This divestment approach confirms these businesses as question marks within its long-term strategic vision, indicating they do not fit the company's future growth trajectory.

The company has been actively shedding assets that do not contribute significantly to its core strengths or future profitability. For instance, in 2023, Anglo American completed the sale of its South African thermal coal operations, a move that generated substantial proceeds and allowed for a reallocation of capital towards more promising ventures.

- Portfolio Simplification: Exiting non-core assets streamlines operations and reduces complexity.

- Focus on High-Margin Commodities: Divestments allow for greater investment in profitable and growth-oriented sectors like copper and platinum group metals.

- Capital Reallocation: Proceeds from sales are strategically reinvested in core businesses or used to strengthen the balance sheet.

- Enhanced Shareholder Value: A more focused and efficient business structure aims to deliver improved returns for investors.

Anglo American's steelmaking coal and nickel businesses are prime examples of 'Dogs' within its BCG matrix. The company's strategic decisions to divest or significantly re-evaluate these segments, driven by declining performance and market challenges, underscore their classification.

The divestment of steelmaking coal and the ongoing review of nickel operations, including Barro Alto, highlight Anglo American's move away from low-growth, low-market-share assets. This aligns with the 'Dog' profile, where businesses are often candidates for divestment or restructuring to optimize the overall portfolio.

In 2023, Anglo American's steelmaking coal EBITDA fell to $1.6 billion from $5.8 billion in 2022, a stark indicator of the segment's struggles and the rationale behind its divestment strategy.

The company's 2023 strategic review scrutinized all assets, identifying underperforming units like steelmaking coal and nickel for potential divestment or significant operational changes.

| Business Segment | 2022 EBITDA (USD bn) | 2023 EBITDA (USD bn) | BCG Classification | Strategic Action |

|---|---|---|---|---|

| Steelmaking Coal | 5.8 | 1.6 | Dog | Divestment |

| Nickel | N/A (Data not directly comparable due to operational review) | N/A | Dog (Potential) | Strategic Review (Care & Maintenance or Divestment) |

Question Marks

De Beers, currently in the process of being separated from Anglo American, is navigating a difficult market. Diamond demand has weakened, and prices have seen a downturn, placing it in a 'Question Mark' position within the BCG matrix. This classification reflects the significant uncertainty surrounding its future as an independent company or under new ownership, requiring a strategic pivot to reignite growth.

The diamond industry faced a notable slowdown in 2023, with De Beers reporting a 10% decrease in rough diamond sales in the third quarter compared to the previous year, reaching $930 million. This downturn is attributed to factors like subdued consumer spending in key markets and an oversupply of polished diamonds. The company's ability to adapt to these shifting dynamics and secure its market position will be crucial for its future success.

Anglo American is preparing to demerge its Platinum Group Metals (PGMs) business, Anglo American Platinum, with the separation anticipated by mid-2025. This strategic move is intended to unlock value for shareholders, though the future growth prospects of the standalone PGM entity are currently uncertain, placing it firmly in the 'Question Mark' category of the BCG matrix.

Despite the planned demerger, the PGM market has experienced significant headwinds, characterized by weak cyclical demand and declining prices. For instance, platinum prices in 2024 have traded at levels significantly below their recent peaks, impacting profitability and investment sentiment within the sector.

The Woodsmith Project, Anglo American's significant venture into crop nutrients, currently sits as a Question Mark in the BCG matrix. Development has been deliberately paced to aid the company's balance sheet deleveraging efforts, with crucial technical studies still in progress.

Despite its immense, multi-generational resource scale, which preserves substantial long-term value, the project's immediate market penetration and revenue generation remain uncertain. This strategic pause, coupled with the inherent risks of bringing a new, large-scale resource to market, places it firmly in the Question Mark category, requiring careful management and future strategic decisions.

New Exploration or Greenfield Projects

New exploration or greenfield projects for Anglo American would fall into the question mark category of the BCG Matrix. These ventures represent significant investment opportunities with high potential but also considerable risk and uncertainty regarding future market share and profitability. For instance, developing a new mine from exploration to production can cost billions of dollars and take over a decade, with no guarantee of success.

While Anglo American has been actively divesting and restructuring, focusing on core assets, the company has also indicated a strategic interest in maintaining growth optionality. This suggests that while major, immediate greenfield announcements might be absent, the company is likely evaluating potential future projects. For example, in 2023, they were exploring opportunities in critical minerals, which often require greenfield development.

- High Capital Expenditure: Greenfield projects demand substantial upfront investment for exploration, development, and infrastructure.

- Uncertain Returns: The profitability of new ventures is uncertain until operations are established and markets are proven.

- Strategic Optionality: Anglo American is keeping options open for future growth, which could include new exploration.

- Focus on Core Assets: Current strategic priorities lean towards optimizing existing operations rather than immediate large-scale greenfield development.

Manganese Operations

Anglo American's manganese operations have experienced considerable volatility. For instance, production saw a significant dip due to cyclone damage in early 2024, but then rebounded strongly, with Q2 2025 production surging. This operational inconsistency, coupled with manganese's strategic importance in steelmaking and the growing battery sector, places it in a position that warrants close attention within the company's portfolio.

The fluctuating output and market dynamics suggest that manganese could be considered a 'Question Mark' in the BCG matrix. This classification implies that while the product has potential, its current market share and growth rate require careful evaluation and strategic investment to determine if it can become a 'Star' or if it needs to be divested.

- Production Fluctuations: Cyclone damage impacted output, followed by a notable surge in Q2 2025 production figures.

- Strategic Importance: Manganese is vital for steel production and has increasing relevance in the burgeoning battery market.

- Market Positioning: Volatile production and a potentially moderate market share position it as a 'Question Mark' requiring strategic oversight.

- Future Outlook: Investment decisions will determine if manganese operations can achieve a stronger market position or require a different strategic approach.

Question Marks represent business units with low market share in high-growth markets. Anglo American's De Beers, facing a downturn in diamond demand and prices, exemplifies this, requiring strategic adjustments to navigate market uncertainties. Similarly, the planned demerger of Anglo American Platinum places it in this category due to uncertain future growth prospects in a challenging PGM market.

The Woodsmith Project, despite its vast resource potential, remains a Question Mark due to its paced development and uncertain market penetration. New exploration ventures also fall into this category, demanding significant investment with uncertain returns. Anglo American's manganese operations, characterized by production volatility and strategic importance in evolving markets, also warrant careful consideration as a Question Mark.

| Business Unit | Market Growth | Market Share | BCG Classification | Rationale |

|---|---|---|---|---|

| De Beers | Moderate to High | Low to Moderate | Question Mark | Weakening diamond demand and prices, separation uncertainty. |

| Anglo American Platinum | Moderate to High | Low to Moderate | Question Mark | Uncertain future growth prospects post-demerger in a challenging PGM market. |

| Woodsmith Project | High | Low | Question Mark | Paced development, uncertain market penetration despite large resource scale. |

| New Exploration Ventures | High | Low | Question Mark | High investment, uncertain returns and future market share. |

| Manganese Operations | Moderate to High | Low to Moderate | Question Mark | Production volatility, strategic importance with evolving market dynamics. |

BCG Matrix Data Sources

Our Anglo American BCG Matrix is built on a foundation of robust data, integrating financial disclosures, market research, and industry reports to provide a comprehensive view of their business units.