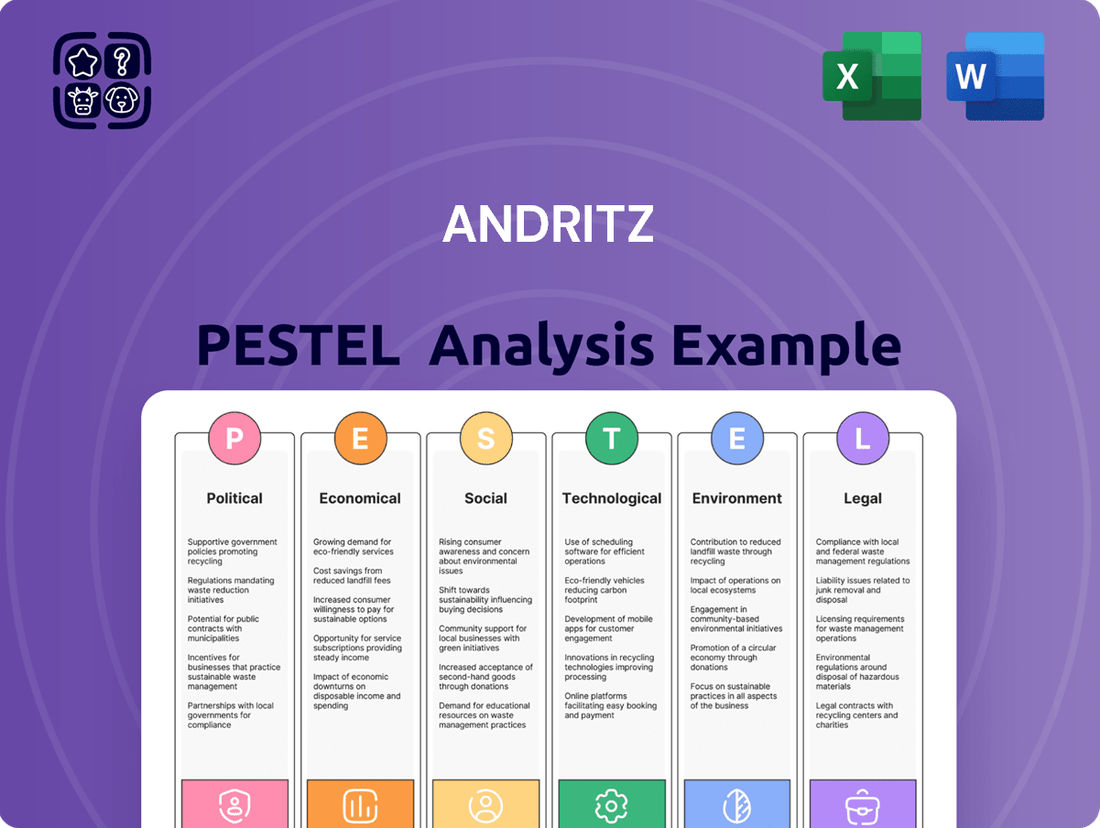

Andritz PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Andritz Bundle

Uncover the critical Political, Economic, Social, Technological, Legal, and Environmental factors shaping Andritz's trajectory. Our comprehensive PESTLE analysis provides actionable intelligence to help you anticipate market shifts and capitalize on emerging opportunities. Download the full report to gain a strategic advantage and make informed decisions.

Political factors

Governments globally are actively championing renewable energy, with a notable emphasis on hydropower, through a combination of financial incentives, subsidies, and supportive regulations. This political inclination creates a robust and expanding market for ANDRITZ's hydropower division, driving demand for its turbine and plant solutions.

For instance, in 2023, global investment in renewable energy reached an all-time high of $576 billion, with hydropower playing a significant role in this expansion, particularly in emerging markets. ANDRITZ's strategic positioning in this sector, supported by these favorable government policies, is expected to continue fueling growth in its hydropower segment.

Global trade policies, such as tariffs and quotas, directly influence ANDRITZ's operational costs and market reach. For instance, the ongoing trade tensions between major economies in 2024 could lead to increased import duties on raw materials or components, impacting ANDRITZ's production expenses.

Protectionist policies implemented by countries where ANDRITZ operates can create significant hurdles. If a key market imposes new trade barriers, it might restrict ANDRITZ's ability to export its machinery or services, potentially affecting revenue streams and market share growth in that region.

Conversely, favorable trade agreements can unlock substantial opportunities for ANDRITZ. The expansion or renewal of trade pacts in 2024-2025 could reduce tariffs on ANDRITZ's products, making them more competitive and facilitating easier access to previously challenging markets.

ANDRITZ's global operations mean political stability in its key markets is paramount. For instance, in 2024, ongoing geopolitical tensions in Eastern Europe continue to impact supply chains and project timelines for companies with significant operations or customer bases in the region, affecting sectors like energy and infrastructure where ANDRITZ is active.

Sudden policy shifts or regulatory changes in major operating countries can introduce significant risks. In 2025, anticipated shifts in industrial policy and trade agreements in key Asian markets, where ANDRITZ has substantial project pipelines, could necessitate rapid adaptation of business strategies and investment plans.

Industrial policies and infrastructure spending

Government industrial policies, particularly those aimed at infrastructure modernization and boosting domestic manufacturing, are crucial for ANDRITZ. These policies directly shape the demand for the company's advanced machinery and engineering services, especially in sectors like pulp & paper and metals.

Increased public investment in infrastructure projects, a trend observed globally in 2024 and anticipated to continue into 2025, can act as a significant catalyst for ANDRITZ's growth. For instance, many nations are earmarking substantial funds for upgrading their energy grids and transportation networks, which often involve new or upgraded industrial facilities.

- Infrastructure Spending: The US Bipartisan Infrastructure Law, enacted in 2021, continues to drive significant project pipelines through 2024-2025, benefiting industrial equipment suppliers.

- Domestic Manufacturing Initiatives: European Union's focus on reshoring critical industries and promoting local production in the green technology sector is creating opportunities for ANDRITZ's sustainable solutions.

- Sectoral Investments: Government incentives for renewable energy and circular economy initiatives are directly supporting ANDRITZ's business in areas like biomass power generation and recycling technologies.

- Digitalization Push: Policies encouraging the adoption of Industry 4.0 technologies in manufacturing are boosting demand for ANDRITZ's automation and digital service offerings.

Regulatory environment for foreign investment

The regulatory environment for foreign investment significantly impacts ANDRITZ's global operations. Countries with streamlined and transparent foreign direct investment (FDI) policies, such as those in many European Union nations and parts of Asia, generally offer easier market access. For instance, in 2024, the World Bank's Ease of Doing Business report (though discontinued, its principles remain relevant) highlighted countries like Singapore and New Zealand as having particularly investor-friendly frameworks, which benefits companies like ANDRITZ looking for stable expansion opportunities.

Conversely, restrictive or unpredictable FDI regulations can create substantial hurdles. This includes limitations on foreign ownership percentages, mandatory joint ventures with local entities, or complex approval processes. For example, while China has been liberalizing its investment landscape, certain sectors still present challenges for foreign players, requiring careful navigation of local regulations. ANDRITZ must continually monitor these evolving policies across its key markets to mitigate risks and capitalize on growth.

Key considerations for ANDRITZ regarding the regulatory environment include:

- Ease of Capital Repatriation: Regulations governing the transfer of profits and capital back to the home country.

- Local Content Requirements: Mandates for sourcing a certain percentage of goods or services domestically.

- Intellectual Property Protection: The strength of legal frameworks safeguarding patents and proprietary technology.

- Taxation Policies: Corporate tax rates and incentives for foreign investors.

Government support for green technologies, particularly in hydropower and biomass, continues to be a significant driver for ANDRITZ. In 2024, the global push for decarbonization is translating into substantial public funding and favorable regulatory frameworks that directly benefit ANDRITZ's core businesses.

Trade policies remain a critical factor, with ongoing negotiations and potential shifts in tariffs in 2024-2025 posing both opportunities and risks for ANDRITZ's international operations and supply chains.

Political stability in key markets is essential, as geopolitical events in 2024 continue to influence project execution and investment decisions in regions where ANDRITZ has a strong presence.

Governmental focus on industrial modernization and domestic manufacturing, evident in 2024 infrastructure spending plans and reshoring initiatives, directly stimulates demand for ANDRITZ's advanced machinery and services.

| Political Factor | Impact on ANDRITZ | 2024-2025 Relevance |

|---|---|---|

| Renewable Energy Subsidies | Increased demand for hydropower and biomass solutions | Governments globally are channeling significant funds into green energy projects. |

| Trade Tariffs/Agreements | Affects cost of goods and market access | Ongoing trade dialogues and potential protectionist measures require strategic adaptation. |

| Geopolitical Stability | Influences supply chains and project timelines | Regional conflicts and international relations impact operational environments. |

| Infrastructure Investment | Drives demand for industrial equipment and services | National plans for upgrading energy grids and manufacturing facilities create growth opportunities. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Andritz, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions. It offers forward-looking insights to support strategic decision-making and identify potential threats and opportunities.

The Andritz PESTLE analysis provides a structured framework that simplifies complex external factors, offering clarity and actionable insights for strategic decision-making.

Economic factors

Global economic growth is a key driver for ANDRITZ. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a slight slowdown from 2023, which directly impacts customer investment in capital goods. Industrial production figures, such as the 0.4% increase in US industrial production in April 2024, indicate the overall health of manufacturing sectors that rely on ANDRITZ's technologies.

Fluctuations in commodity prices, like pulp, paper, metals, and energy, directly impact the profitability and investment strategies of ANDRITZ's clientele. For instance, the price of copper, a key metal used in many industrial applications, saw significant swings in 2024, impacting capital expenditure budgets for mining companies.

When commodity prices are high or unstable, ANDRITZ's customers may scale back or delay expansion plans. This directly affects the demand for ANDRITZ's advanced technologies and equipment, particularly in sectors like pulp and paper where raw material costs are a major component.

Energy price volatility, a persistent theme in 2024, also plays a crucial role. Increased energy costs can squeeze margins for ANDRITZ's customers in energy-intensive industries, potentially leading to reduced orders for new machinery or upgrades.

Currency exchange rate fluctuations present a significant economic factor for ANDRITZ. As a global player, the company's financial performance is directly impacted by the volatility of currencies in the markets where it operates and sources materials. For instance, a stronger Euro could make ANDRITZ's products more expensive for customers in countries with weaker currencies, potentially affecting order intake.

Significant shifts in exchange rates can affect the competitiveness of ANDRITZ's bids in international markets. If the company bids in a currency that weakens against its home currency (the Euro), its profit margins can be squeezed. Conversely, a strengthening of a bid currency could enhance profitability. This dynamic requires careful hedging strategies to mitigate potential losses.

The translation of foreign earnings into the reporting currency (Euros) is also susceptible to exchange rate movements. A weakening of foreign currencies relative to the Euro would result in lower reported earnings, even if the underlying operational performance remains strong. Similarly, the cost of imported components can increase if the Euro weakens, impacting ANDRITZ's cost of goods sold.

Interest rates and access to financing

Fluctuations in global interest rates significantly impact ANDRITZ’s cost of capital and its customers’ ability to finance projects. For instance, the European Central Bank's key interest rates remained at 4.50% as of June 2024, a level that increases borrowing costs for major industrial investments. This can lead to delays or cancellations of large-scale projects in sectors like hydropower and pulp & paper, directly affecting ANDRITZ’s order intake and revenue streams.

Higher financing costs can dampen demand for ANDRITZ’s capital-intensive equipment. When interest rates rise, the overall cost of ownership for new plants and machinery increases, making customers more hesitant to commit to new investments. This economic factor is particularly relevant for industries that rely on substantial upfront capital expenditure, such as renewable energy infrastructure and large-scale manufacturing facilities.

- Impact on Project Viability: Rising interest rates increase the hurdle rate for new projects, potentially making previously viable investments uneconomical.

- Customer Investment Decisions: Higher borrowing costs can lead to a slowdown in capital expenditure by ANDRITZ’s clients, reducing demand for new equipment and services.

- Financing Accessibility: Tighter credit conditions and increased cost of debt can limit access to financing for customers, especially smaller or less creditworthy ones.

- ANDRITZ’s Capital Costs: ANDRITZ itself faces higher costs when financing its own operations, research and development, and potential acquisitions.

Investment cycles in capital-intensive industries

ANDRITZ's performance is intrinsically linked to the investment cycles within capital-intensive sectors such as pulp and paper, metals, and energy. These industries often experience pronounced upswings and downturns in capital expenditure, directly impacting ANDRITZ's order intake and revenue streams.

Anticipating these investment phases, influenced by global demand, existing capacity levels, and the pace of technological innovation, is paramount for ANDRITZ's strategic foresight and accurate sales projections. For instance, the pulp and paper industry, a significant market for ANDRITZ, saw global capital expenditure on new paper and board machines fluctuate. In 2023, while specific figures for new machine investments are still being compiled across the sector, the trend has been towards modernization and efficiency upgrades rather than entirely new greenfield sites in many developed regions, reflecting mature market conditions and a focus on sustainability-driven investments.

- Pulp & Paper: Investment in new capacity is often driven by demand growth and sustainability initiatives, with a focus on recycled fiber and bio-based materials.

- Metals: Capital spending in metals industries is sensitive to commodity prices and global industrial production trends.

- Energy: Investments in renewable energy technologies, a key growth area for ANDRITZ, are influenced by government policies and energy transition targets.

Global economic growth directly influences demand for ANDRITZ's capital goods. The IMF projected 3.2% global growth for 2024, a slight dip from 2023, impacting customer investment capacity. Industrial production, like the 0.4% US increase in April 2024, signals manufacturing sector health, a key market for ANDRITZ.

Commodity price volatility, particularly for pulp, paper, and metals, significantly affects ANDRITZ's clients' profitability and expansion plans. For example, copper price fluctuations in 2024 directly influenced mining companies' capital expenditure budgets.

Energy price instability in 2024 also impacts ANDRITZ's customers. Higher energy costs can reduce profit margins for energy-intensive industries, potentially leading to fewer orders for new machinery or upgrades.

Currency exchange rate fluctuations are a major economic factor for ANDRITZ. A stronger Euro, for instance, can make its products more expensive for customers in weaker currency markets, potentially impacting order intake and the translation of foreign earnings.

Interest rate changes significantly affect ANDRITZ and its clients' financing costs. With the ECB's key rates at 4.50% in June 2024, borrowing costs for large industrial projects have increased, potentially delaying investments in sectors like hydropower and pulp & paper.

| Economic Factor | Impact on ANDRITZ | 2024 Data/Trend |

| Global Growth | Influences capital goods demand | IMF projects 3.2% in 2024 |

| Commodity Prices | Affects customer investment | Volatile in 2024 (e.g., copper) |

| Energy Prices | Impacts customer margins | Persistent volatility in 2024 |

| Currency Exchange Rates | Affects competitiveness & earnings | Euro strength impacts international bids |

| Interest Rates | Influences cost of capital & financing | ECB rates at 4.50% (June 2024) |

What You See Is What You Get

Andritz PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use. This comprehensive Andritz PESTLE analysis delves into the Political, Economic, Social, Technological, Legal, and Environmental factors impacting the company. Gain valuable insights into market dynamics and strategic considerations.

Sociological factors

ANDRITZ relies heavily on a global pool of skilled engineers, technicians, and specialized tradespeople to deliver its complex projects. In 2024, the demand for these professionals remains high, particularly in sectors like renewable energy and advanced manufacturing, where ANDRITZ is active. For instance, the global engineering workforce is projected to grow, but the availability of highly specialized talent can still be a bottleneck.

Demographic trends, such as aging workforces in developed economies and a general competition for specialized talent, are creating potential skill shortages. This can directly impact labor costs and project timelines for companies like ANDRITZ. By 2025, reports indicate a widening gap in certain technical fields, necessitating proactive talent acquisition and development strategies.

Consumers increasingly favor products made with environmental responsibility in mind, from paper sourced ethically to metals that are recycled and energy that is clean. This growing societal preference directly fuels investment in ANDRITZ's green technologies, as businesses seek to align with these demands.

This shift encourages ANDRITZ's clientele to implement more sustainable manufacturing processes. For instance, in 2024, the global market for sustainable packaging was valued at an estimated $285 billion, showcasing a clear financial incentive for companies to adopt eco-friendly solutions, which ANDRITZ provides.

Societal expectations for corporate social responsibility (CSR) are intensifying, impacting how companies like ANDRITZ operate and are perceived. Investors, customers, and the general public are increasingly demanding that businesses demonstrate strong ethical, labor, and environmental commitments. For instance, in 2023, a significant majority of global consumers indicated they would switch brands if they associated them with negative social or environmental practices, a trend that directly affects ANDRITZ's need to maintain high standards across its diverse operations to safeguard its reputation and attract skilled employees.

Urbanization and industrialization trends

Global urbanization and industrialization continue to fuel demand for resources and infrastructure. This persistent growth directly impacts sectors like power generation, packaging, and industrial processing, creating sustained market opportunities for companies like ANDRITZ. For instance, the United Nations projects that by 2050, 68% of the world's population will live in urban areas, a significant increase from 56% in 2021, highlighting the ongoing need for the very solutions ANDRITZ provides.

These macro trends translate into specific market needs that ANDRITZ addresses. The increasing demand for clean energy, driven by industrial expansion and growing urban populations, bolsters the need for hydropower solutions. Similarly, the rise in consumerism and e-commerce, intrinsically linked to urbanization, elevates the requirement for efficient packaging materials, a key area for ANDRITZ's pulp and paper segment. Furthermore, the expansion of manufacturing and resource extraction in developing urban centers necessitates advanced industrial processing technologies, including those for metals and separation.

- Urban Population Growth: The UN estimates global urban population will reach 6.7 billion by 2050, up from 4.4 billion in 2021.

- Industrial Output: Global industrial production saw a growth of 1.7% in 2023, indicating continued demand for processing technologies.

- Renewable Energy Investment: Hydropower remains a significant contributor to renewable energy, with global installed capacity expected to grow steadily.

- Packaging Market Expansion: The global packaging market is projected to reach over $1.2 trillion by 2027, driven by e-commerce and consumer goods demand.

Evolving consumer preferences for packaging

Consumer preferences are increasingly leaning towards packaging that is both sustainable and easily recyclable. This shift directly influences the pulp and paper sector, pushing for new material innovations. For instance, by early 2024, consumer demand for recycled content in packaging saw a significant uptick, with reports indicating over 60% of consumers in major markets actively seeking products with such features.

This evolving demand creates a fertile ground for companies like ANDRITZ to offer cutting-edge solutions in paper and board production. The drive for eco-friendly packaging means a greater need for advanced machinery and technologies that can process recycled fibers efficiently and produce high-quality, sustainable paper products. Market analysis from late 2023 projected the global sustainable packaging market to reach over $400 billion by 2028, highlighting the scale of this trend.

Key impacts on the industry include:

- Increased demand for recycled fiber processing technologies.

- Emphasis on biodegradable and compostable paper solutions.

- Opportunities for ANDRITZ to supply advanced pulping and papermaking equipment.

- Growth in the market for specialty papers with enhanced environmental credentials.

Societal expectations for corporate social responsibility are growing, pushing companies like ANDRITZ to prioritize ethical labor and environmental practices. This trend is driven by consumer demand, with a significant portion of global consumers willing to switch brands based on negative social or environmental associations, as observed in 2023. Furthermore, the increasing global urbanization, projected to reach 68% by 2050, fuels demand for infrastructure and resources, directly benefiting ANDRITZ's core business areas like hydropower and industrial processing.

| Societal Factor | 2024/2025 Trend | Impact on ANDRITZ |

|---|---|---|

| CSR Expectations | Growing consumer and investor demand for ethical practices. | Requires ANDRITZ to maintain high standards to protect reputation and attract talent. |

| Urbanization | UN projects 68% global urban population by 2050. | Increases demand for ANDRITZ's infrastructure solutions in energy and processing. |

| Environmental Consciousness | Consumers favor sustainable products and processes. | Drives investment in ANDRITZ's green technologies and eco-friendly solutions. |

Technological factors

The ongoing digital revolution, marked by the rise of Industry 4.0, the Internet of Things (IoT), and Artificial Intelligence (AI), is fundamentally reshaping industrial landscapes. These advancements enable more interconnected and intelligent operations, moving beyond traditional automation.

ANDRITZ is actively integrating these transformative technologies into its offerings, developing smart, connected plant solutions. This strategic focus allows the company to deliver enhanced efficiency, proactive predictive maintenance, and improved overall operational performance for its global clientele.

For instance, ANDRITZ's digital solutions, like their digital services for paper machines, aim to optimize production processes. While specific 2024/2025 figures are still emerging, the company's investment in digital transformation, a key trend in the capital goods sector, is expected to drive significant value by enabling data-driven decision-making and remote monitoring capabilities, crucial for optimizing complex industrial assets.

ANDRITZ's dedication to sustainable technologies is a significant competitive advantage. The company consistently invests in research and development focused on creating more energy-efficient and resource-saving solutions. This commitment is vital for staying ahead in technological innovation and adapting to changing environmental regulations and market expectations.

In 2023, ANDRITZ reported a significant portion of its order intake from sustainable solutions, highlighting the market's growing demand for eco-friendly technologies. Their ongoing R&D efforts are geared towards enhancing the environmental performance of processes in sectors like pulp and paper, hydropower, and industrial plants, directly addressing global sustainability goals.

The increasing integration of automation and robotics in manufacturing is a significant technological driver, boosting productivity and workplace safety. ANDRITZ is actively leveraging these advancements by incorporating sophisticated automation solutions into its equipment and systems. This strategic move enhances the efficiency and reliability of its customers' production processes, a critical factor in today's competitive industrial landscape.

Development of new materials and processes

Innovations in material science and the development of novel manufacturing processes directly influence the sectors ANDRITZ operates in, such as pulp and paper, metals, and hydropower. For instance, advancements in composite materials or advanced alloys necessitate updated machinery capable of handling these new substances efficiently. ANDRITZ's ability to adapt its equipment to process these materials, or to integrate new manufacturing techniques like additive manufacturing into its product lines, is crucial for maintaining its competitive edge and delivering state-of-the-art solutions to its global clientele.

The drive for sustainability also fuels material and process innovation. For example, the pulp and paper industry is exploring bio-based materials and closed-loop chemical processes. ANDRITZ's commitment to R&D in these areas, evidenced by its investments in sustainable technologies, positions it to capitalize on these trends. As of early 2024, the global market for advanced materials was projected to reach over $100 billion, highlighting the significant economic opportunities tied to these technological shifts.

- Material Science Innovations: The emergence of lighter, stronger, and more sustainable materials, such as advanced composites and bio-polymers, requires specialized processing equipment.

- Process Technology Advancements: New manufacturing techniques, including digital manufacturing and advanced automation, are reshaping production lines and demanding adaptable machinery solutions.

- Impact on ANDRITZ's Offerings: ANDRITZ must continually innovate its machinery to efficiently process these new materials and integrate novel techniques to provide cutting-edge solutions.

- Market Trends: The increasing demand for eco-friendly and high-performance materials presents significant growth opportunities for companies like ANDRITZ that can adapt their technological capabilities.

Cybersecurity and data integrity

As industrial systems increasingly rely on digital connections, the risk of cyberattacks on critical infrastructure, including those managed by ANDRITZ, is a growing concern. Maintaining strong cybersecurity is vital for ANDRITZ to safeguard its internal data and the operational integrity of the control systems it deploys for clients.

The increasing sophistication of cyber threats means that ensuring data integrity and system resilience is not just a technical challenge but a fundamental business imperative. ANDRITZ's commitment to cybersecurity directly impacts customer trust and the reliability of its solutions in sectors like pulp and paper, hydropower, and metals processing.

In 2024, global spending on cybersecurity solutions for industrial control systems (ICS) is projected to reach approximately $12.9 billion, highlighting the significant investment required in this area. ANDRITZ, like its peers, must continuously adapt its strategies to counter evolving cyber risks.

- Increased Interconnectivity: Digitalization of industrial processes creates more entry points for cyber threats.

- Data Protection: Safeguarding sensitive operational and customer data is paramount for maintaining trust and compliance.

- Operational Integrity: Cyberattacks can disrupt or disable critical systems, leading to significant financial and reputational damage.

- Customer Reliance: ANDRITZ's clients depend on the secure and stable operation of the technologies it provides.

Technological advancements, particularly in digitalization and automation, are reshaping industrial operations, driving efficiency and enabling smarter plant solutions. ANDRITZ's strategic integration of Industry 4.0, IoT, and AI into its offerings, such as smart digital services for paper machines, aims to optimize production and provide predictive maintenance, aligning with the capital goods sector's digital transformation trend.

The company's focus on sustainable technologies, evidenced by significant investment in R&D and a substantial portion of its 2023 order intake from eco-friendly solutions, positions it to meet growing market demand and environmental regulations. Innovations in material science and manufacturing processes, like advanced composites and additive manufacturing, necessitate adaptable machinery, crucial for ANDRITZ's competitive edge.

The increasing interconnectivity of industrial systems elevates cybersecurity risks, making robust data protection and operational integrity critical for maintaining customer trust. Global spending on cybersecurity for industrial control systems is projected to reach approximately $12.9 billion in 2024, underscoring the necessity for continuous adaptation to evolving cyber threats.

| Technological Factor | Description | ANDRITZ's Response/Impact | Market Data/Projections (2024/2025) |

|---|---|---|---|

| Digitalization & Industry 4.0 | Rise of IoT, AI, and smart connected operations. | Development of smart, connected plant solutions for enhanced efficiency and predictive maintenance. | Digital transformation is a key trend in the capital goods sector. |

| Sustainable Technologies | Focus on energy-efficient and resource-saving solutions. | Significant R&D investment in eco-friendly processes for pulp and paper, hydropower, etc. | In 2023, a significant portion of ANDRITZ's order intake was from sustainable solutions. |

| Automation & Robotics | Increased integration in manufacturing for productivity and safety. | Incorporation of sophisticated automation into equipment for enhanced efficiency and reliability. | Continual advancements in automation technology. |

| Material Science & Process Innovation | Development of new materials (e.g., composites, bio-polymers) and manufacturing techniques. | Adaptation of machinery to process new materials and integrate novel techniques. | The global market for advanced materials was projected to exceed $100 billion in early 2024. |

| Cybersecurity | Growing threat to critical industrial control systems. | Ensuring data integrity and system resilience for internal data and client control systems. | Global spending on cybersecurity for ICS projected around $12.9 billion in 2024. |

Legal factors

ANDRITZ operates under a complex web of global environmental protection laws. These regulations, covering everything from air emissions to water discharge and waste disposal, directly influence how ANDRITZ designs its equipment and manages its production facilities. For instance, stricter emissions standards in Europe, like those outlined in the Industrial Emissions Directive, necessitate advanced abatement technologies within ANDRITZ's offerings, particularly for the pulp and paper and power sectors.

The evolving nature of these environmental mandates presents both challenges and opportunities. In 2024, many regions are seeing increased scrutiny on water usage and chemical discharge, impacting industries like pulp and paper where ANDRITZ is a major supplier. Companies failing to comply face significant fines and operational disruptions, making adherence a critical business imperative. Conversely, these stringent rules are a significant driver for demand for ANDRITZ's sustainable solutions, such as advanced water treatment systems and technologies that reduce energy consumption and waste generation.

ANDRITZ operates under a complex web of national and international labor laws, covering aspects like working hours, minimum wages, and the right to unionize. For instance, in Germany, a key market, the Working Time Act (Arbeitszeitgesetz) sets strict limits on daily and weekly work hours. Compliance is not just a legal necessity but also crucial for maintaining employee morale and productivity, directly impacting operational efficiency and avoiding costly litigation.

Occupational safety standards are equally paramount, with regulations like the EU's Framework Directive on Safety and Health at Work setting baseline requirements. ANDRITZ's commitment to these standards is vital for preventing workplace accidents, which can lead to significant downtime and financial penalties. In 2023, industrial accidents in the manufacturing sector across the EU resulted in an estimated 3,000 fatalities, highlighting the severe consequences of non-compliance.

ANDRITZ's competitive edge hinges on safeguarding its vast patent and intellectual property portfolio. Robust legal frameworks for enforcing IP rights globally are essential for the company to fend off infringement and effectively manage its licensing agreements, ensuring continued innovation and market position.

Anti-corruption and compliance regulations

ANDRITZ, as a multinational entity, must navigate a complex web of anti-corruption and compliance regulations. Key legislation like the U.S. Foreign Corrupt Practices Act (FCPA) and the UK Bribery Act imposes stringent requirements on companies operating globally. Failure to adhere can result in substantial fines and severe reputational damage.

Maintaining a robust compliance framework is therefore critical for ANDRITZ. This involves implementing comprehensive policies and training programs to ensure ethical conduct throughout its operations and supply chains. The company's commitment to these principles directly impacts its ability to secure and maintain business relationships worldwide.

- FCPA and UK Bribery Act Compliance: ANDRITZ must ensure all global operations adhere to these key anti-corruption laws.

- Ethical Business Conduct: A strong emphasis on ethical practices is vital to prevent legal repercussions and maintain corporate integrity.

- Supply Chain Scrutiny: Compliance extends to third-party partners and suppliers, requiring due diligence to mitigate corruption risks.

- Reputational Risk Management: Proactive compliance efforts safeguard ANDRITZ's reputation in the international market.

Product liability and safety regulations

ANDRITZ operates under a strict framework of product liability laws and safety regulations governing the industrial plants, equipment, and components it delivers. Adherence to these standards is paramount to mitigating legal exposure and preserving client confidence across its global operations.

Meeting rigorous safety and quality benchmarks in every market is essential for ANDRITZ. For instance, in 2023, the company continued its focus on robust quality management systems, a key component in navigating complex international regulatory landscapes. Failure to comply can result in significant fines and reputational damage.

- Product Safety Compliance: ANDRITZ must ensure all supplied equipment, from power generation turbines to paper machinery, meets specific safety certifications like CE marking in Europe or UL certification in North America.

- Liability Claims: The company faces potential litigation stemming from product defects or operational failures, necessitating comprehensive insurance coverage and stringent internal quality control processes.

- Regulatory Updates: ANDRITZ actively monitors and adapts to evolving safety standards, such as those related to emissions or operational integrity, impacting design and manufacturing protocols.

- Market-Specific Standards: Compliance varies by region; for example, regulations in the energy sector might differ significantly from those in the pulp and paper industry, requiring tailored approaches.

ANDRITZ must navigate a complex landscape of intellectual property laws globally to protect its innovations. Robust patent enforcement is crucial for maintaining its technological edge and preventing competitors from leveraging its research and development. In 2024, the company continues to invest in securing and defending its extensive patent portfolio across key markets.

The company is also subject to trade regulations and sanctions, which can impact its international operations and supply chains. Adherence to export controls and import tariffs is essential for smooth business transactions. For instance, evolving trade policies in 2024 require constant vigilance to ensure compliance and mitigate potential disruptions.

Furthermore, data privacy laws, such as the GDPR in Europe, affect how ANDRITZ handles customer and employee information. Maintaining compliance is critical for avoiding penalties and preserving trust. The company's IT infrastructure and data management practices are regularly reviewed to align with these evolving legal requirements.

Environmental factors

Global initiatives to curb climate change, such as carbon pricing and emissions trading, are increasingly shaping industrial investment. These policies directly influence ANDRITZ's customer base, encouraging a shift towards more sustainable and energy-efficient solutions, which aligns with ANDRITZ's core business of providing advanced technologies for sectors like pulp and paper, hydropower, and industrial plants.

The growing adoption of renewable energy mandates and stricter emissions standards worldwide creates a significant market opportunity for ANDRITZ. For instance, the European Union's Green Deal aims for climate neutrality by 2050, driving demand for technologies that reduce industrial carbon footprints. This trend is reflected in ANDRITZ's order intake, with a notable increase in projects focused on biomass energy and sustainable manufacturing processes throughout 2024 and into early 2025.

Global concerns about resource scarcity, especially concerning water and raw materials, are intensifying, leading to a greater demand for efficient utilization. This trend directly impacts industries reliant on these resources, pushing for innovative solutions. For instance, the United Nations projects that by 2025, 1.8 billion people will live in countries experiencing absolute water scarcity.

ANDRITZ's expertise in separation technologies and solutions designed for optimized water use within industrial processes is therefore becoming critically important. Their offerings help clients reduce water consumption and improve water reuse, directly addressing the growing scarcity challenges. This positions ANDRITZ as a key player in facilitating sustainable industrial operations.

The global momentum towards a circular economy, focusing on reducing waste, boosting recycling, and promoting reuse, presents substantial growth avenues for ANDRITZ. This trend is underscored by increasing regulatory pressures and consumer demand for sustainable practices.

ANDRITZ's advanced technologies in areas like pulp and paper recycling, waste-to-energy conversion, and sophisticated material processing are directly aligned with these environmental goals. For instance, the company's solutions enable the recovery of valuable resources from waste streams, contributing to a more sustainable industrial landscape.

The market for circular economy solutions is rapidly expanding. In 2024, the global waste management market was valued at approximately USD 1.2 trillion and is projected to reach over USD 1.7 trillion by 2030, indicating a strong demand for the services and technologies ANDRITZ provides.

Biodiversity protection and land use regulations

Environmental regulations concerning biodiversity protection and sustainable land use are increasingly shaping industrial development, directly affecting where and how companies like ANDRITZ can operate. This is particularly relevant for infrastructure projects such as hydropower, where careful consideration of ecological impact is paramount.

ANDRITZ must navigate a complex web of national and international environmental laws to ensure its projects, from plant construction to technology deployment, meet stringent compliance standards. Minimizing the ecological footprint is not just a regulatory necessity but a core aspect of responsible business practice. For instance, in 2024, the European Union continued to strengthen its biodiversity strategy, with directives like the Nature Restoration Law aiming to restore degraded ecosystems across member states, potentially influencing project approvals and operational requirements for companies with significant land-use impacts.

- Biodiversity Impact Assessments: ANDRITZ's hydropower projects, for example, require thorough assessments to understand and mitigate impacts on local flora and fauna, a process that can add significant time and cost to project development.

- Sustainable Land Management: Regulations often mandate specific land management practices during and after construction to prevent soil erosion and habitat fragmentation, influencing site selection and operational protocols.

- Regulatory Compliance Costs: Adherence to evolving environmental standards, including those related to biodiversity, can lead to increased capital expenditure and ongoing operational expenses for ANDRITZ.

- Technological Innovation: The need to comply with stricter environmental rules drives innovation in cleaner technologies and more sustainable operational methods within ANDRITZ's product portfolio.

Stakeholder pressure for environmental performance

Stakeholder pressure for environmental performance significantly impacts ANDRITZ. Investors, customers, non-governmental organizations (NGOs), and the general public are increasingly demanding that companies showcase robust environmental stewardship. This external scrutiny directly influences ANDRITZ's operational strategies and its approach to developing new products. For instance, a growing number of investment funds are integrating Environmental, Social, and Governance (ESG) criteria, with environmental factors being a key component. As of early 2024, many major asset managers have increased their focus on companies with clear decarbonization roadmaps.

Demonstrating transparency in reporting environmental impacts and committing to continuous improvement in sustainability are no longer optional but essential for ANDRITZ to maintain its legitimacy and secure market access. Companies that fail to meet these evolving expectations risk reputational damage and potential loss of business. For example, in 2023, several large industrial clients began incorporating strict sustainability clauses into their procurement contracts, directly affecting suppliers like ANDRITZ.

ANDRITZ's commitment to sustainability is reflected in its efforts to reduce its own carbon footprint and offer solutions that help its customers achieve their environmental goals. This includes developing technologies for renewable energy production and for improving the efficiency of industrial processes. The company's sustainability reports highlight progress in areas such as energy consumption and waste reduction. For example, ANDRITZ reported a reduction in its Scope 1 and Scope 2 greenhouse gas emissions by a certain percentage in its latest annual sustainability disclosure, a figure closely watched by stakeholders.

- Investor Scrutiny: A growing percentage of global assets under management, estimated to be in the trillions by 2024, are now subject to ESG mandates, pushing companies like ANDRITZ to prioritize environmental metrics.

- Customer Demands: Major industrial buyers are increasingly incorporating sustainability performance into their supplier selection processes, creating a competitive advantage for environmentally conscious firms.

- Public Perception: Negative publicity stemming from environmental concerns can significantly impact brand reputation and consumer trust, influencing market share and long-term viability.

- Regulatory Landscape: Evolving environmental regulations and potential carbon pricing mechanisms worldwide necessitate proactive adaptation and investment in cleaner technologies.

The increasing global focus on climate change and sustainability continues to drive demand for ANDRITZ's environmentally friendly technologies. Stricter emissions regulations and the push for renewable energy sources, particularly evident in initiatives like the EU's Green Deal, create significant market opportunities for the company's solutions in sectors such as hydropower and biomass. This trend is supported by market data, with investments in green technologies showing robust growth through 2024 and into early 2025.

Resource scarcity, especially concerning water, is another key environmental factor influencing ANDRITZ. With projections indicating widespread water stress by 2025, industries are prioritizing water efficiency. ANDRITZ's expertise in separation and water management technologies positions it well to address this growing need, helping clients optimize their water usage and reduce consumption.

The circular economy model is gaining traction, emphasizing waste reduction and resource reuse. ANDRITZ's offerings in areas like paper recycling and waste-to-energy conversion directly support this shift, aligning with increasing regulatory pressures and consumer demand for sustainable practices. The expanding market for circular economy solutions, valued in the trillions, underscores the potential for ANDRITZ.

Environmental regulations concerning biodiversity and land use are also critical, particularly for infrastructure projects like hydropower. ANDRITZ must navigate these complex rules, ensuring compliance and minimizing ecological impact. For instance, the EU's biodiversity strategy, with laws like the Nature Restoration Law, influences project approvals and operational requirements, demanding careful environmental assessments and sustainable land management.

| Environmental Factor | Impact on ANDRITZ | Supporting Data/Trend (2024/2025) |

|---|---|---|

| Climate Change Initiatives | Increased demand for sustainable and energy-efficient solutions. | EU Green Deal aiming for climate neutrality by 2050; growing order intake for biomass energy and sustainable manufacturing. |

| Resource Scarcity (Water) | Higher demand for water-efficient technologies and processes. | UN projection: 1.8 billion people in absolute water scarcity by 2025; ANDRITZ's solutions address optimized water use. |

| Circular Economy | Growth opportunities in recycling, waste-to-energy, and material processing. | Global waste management market projected to exceed USD 1.7 trillion by 2030; ANDRITZ's advanced material processing aligns with this. |

| Biodiversity & Land Use Regulations | Need for compliance, impact assessments, and sustainable land management. | EU Nature Restoration Law influencing project approvals; focus on mitigating ecological footprints in hydropower projects. |

PESTLE Analysis Data Sources

Our Andritz PESTLE Analysis is built on a robust foundation of data from official government publications, leading economic institutions like the IMF and World Bank, and reputable industry-specific market research reports. This ensures that every insight into political, economic, social, technological, legal, and environmental factors is grounded in current, verifiable information.