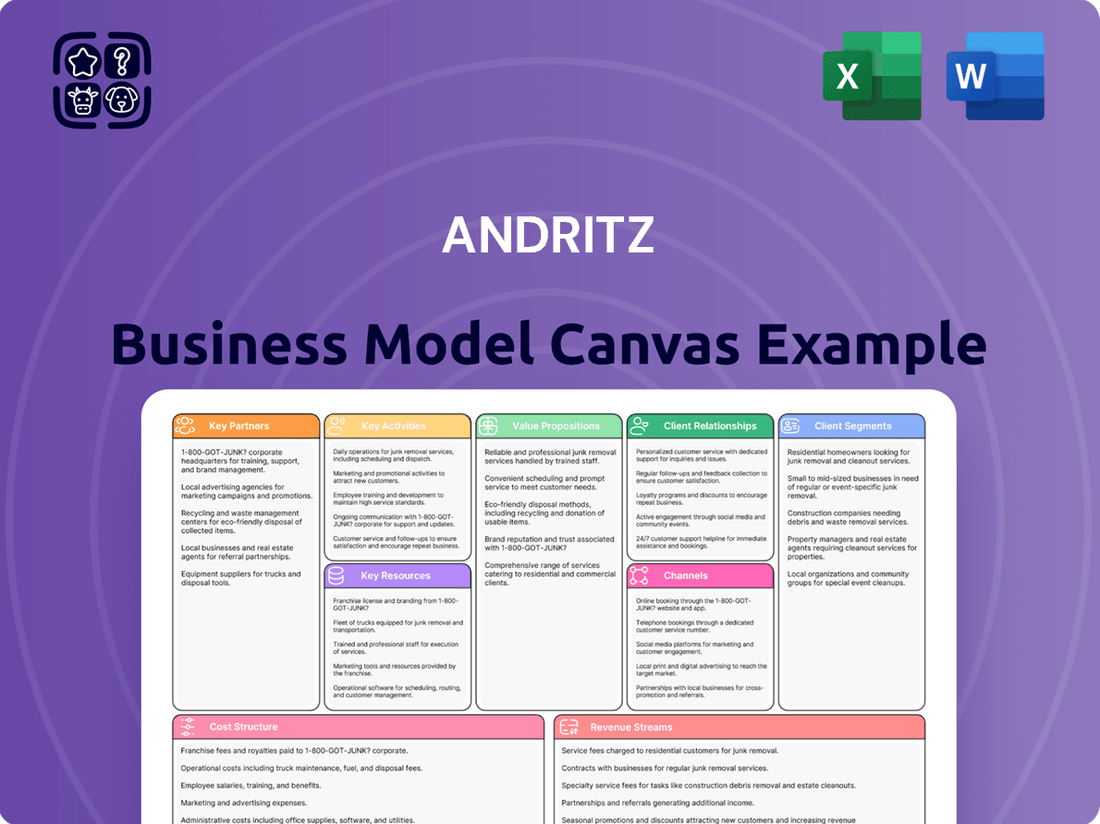

Andritz Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Andritz Bundle

Unlock the strategic blueprint behind Andritz's success with our comprehensive Business Model Canvas. This detailed analysis dissects their customer segments, value propositions, and revenue streams, offering a clear view of how they dominate the market. Download the full version to gain actionable insights for your own business strategy.

Partnerships

ANDRITZ's key partnerships are significantly bolstered by its strategic acquisition approach, enabling rapid market entry and technology integration. For instance, the February 2025 acquisition of LDX Solutions, a leader in emission reduction and environmental technologies, directly enhances ANDRITZ's portfolio in the crucial decarbonization sector. This move not only broadens their service offerings but also solidifies their footprint in North America, a key growth market.

Andritz actively cultivates an international network of research partners, frequently collaborating with universities on technology projects. This strategic approach ensures access to cutting-edge knowledge and a pipeline of highly qualified graduates, vital for driving innovation.

These collaborations are instrumental in developing advanced solutions for the green transition, a key focus for Andritz. For instance, in 2024, Andritz announced a significant partnership with the Graz University of Technology to advance research in sustainable biomass processing technologies.

ANDRITZ's supplier network is critical, providing essential components and raw materials for its sophisticated machinery and plant solutions. In 2024, the company continued to emphasize strategic partnerships to ensure a steady flow of high-quality inputs, vital for their diverse offerings in pulp and paper, hydropower, and industrial sectors.

Maintaining resilient supply chains is paramount for ANDRITZ's project delivery timelines and overall operational efficiency. The company's global supplier base, cultivated through strong, long-term relationships, underpins its ability to execute complex projects worldwide, contributing to its market leadership.

Industry Associations and Networks

ANDRITZ actively participates in sustainability networks, including the UN Global Compact, demonstrating a commitment to Environmental, Social, and Governance (ESG) principles. This engagement, as of early 2024, allows them to stay abreast of evolving best practices in sustainable operations and contribute to broader industry advancements.

Membership in industry-specific associations and networks is crucial for ANDRITZ. These affiliations enhance their knowledge base, particularly concerning technological innovations and market trends relevant to their core businesses like pulp and paper, hydropower, and metals. For instance, participation in groups focused on renewable energy technologies directly informs their strategy in the hydropower sector.

- Industry Associations: ANDRITZ is a member of numerous sector-specific organizations, fostering collaboration and knowledge sharing.

- Sustainability Networks: Active involvement in initiatives like the UN Global Compact underscores their dedication to responsible business conduct and ESG goals.

- Best Practice Adoption: These partnerships facilitate the adoption of leading industry standards and contribute to the development of new ones.

- Market Intelligence: Engagement with these networks provides valuable insights into emerging technologies and regulatory landscapes, crucial for strategic planning.

Customer Project Collaborations

ANDRITZ frequently partners with clients on significant projects, exemplified by its collaboration with Suzano on the world's largest pulp mill in Brazil. This deep integration ensures tailored solutions and successful project execution.

These collaborations foster strong, enduring customer relationships by involving clients directly in the development process. For instance, the Suzano project, a landmark in pulp production, highlights the success of such intensive, cooperative efforts.

- Customer Project Collaborations: ANDRITZ's deep engagement with clients on large-scale projects, like the Suzano pulp mill in Brazil, showcases a commitment to tailored solutions.

- Strategic Integration: This close coordination ensures the successful delivery of complex, customized equipment and systems, meeting specific client needs.

- Long-Term Loyalty: The collaborative approach builds significant customer loyalty, as seen in ongoing partnerships for major industrial developments.

ANDRITZ's key partnerships extend to its robust supplier network, crucial for sourcing components and raw materials. In 2024, the company focused on strengthening these relationships to ensure consistent quality and supply for its diverse machinery and plant solutions across sectors like pulp and paper and hydropower.

Furthermore, ANDRITZ actively engages with industry associations and sustainability networks, such as the UN Global Compact, to stay informed on technological advancements and best practices. This engagement, ongoing through 2024 and into early 2025, allows for knowledge sharing and the adoption of leading ESG principles.

The company also prioritizes research collaborations, including a 2024 partnership with Graz University of Technology to advance sustainable biomass processing. These academic ties provide access to cutting-edge research and talent, vital for ANDRITZ's innovation pipeline.

Strategic client collaborations are also paramount, with projects like the one with Suzano for the world's largest pulp mill in Brazil demonstrating deep integration and tailored solution delivery, fostering long-term loyalty.

What is included in the product

A detailed, pre-written business model canvas for Andritz, covering its core operations, customer relationships, and revenue streams within the pulp & paper, hydropower, and metals processing industries.

This model provides a strategic overview of Andritz's value proposition, key partners, and cost structure, designed for clear communication with stakeholders.

Provides a structured framework to pinpoint and address inefficiencies in Andritz's operations, acting as a pain point reliever by clarifying complex value chains.

Helps Andritz identify and resolve critical operational bottlenecks by offering a clear, visual representation of its entire business, thereby relieving pain points related to process optimization.

Activities

ANDRITZ invests heavily in research and development, allocating around 3% of its annual revenue to this critical area. This focus is primarily on enhancing environmental protection, improving energy and material efficiency, and extending the operational life of their machinery.

Their commitment to innovation is underscored by a robust portfolio of over 6,500 patent protections. These patents are a testament to their ongoing efforts to develop cutting-edge, sustainable technologies that maintain their competitive edge in the market.

ANDRITZ's core activities revolve around the intricate engineering and manufacturing of sophisticated plants, equipment, and systems tailored for industries like hydropower, pulp and paper, metals, and separation technologies. This encompasses the creation of specialized machinery, crucial for the operational success of these sectors.

With a robust global manufacturing network, ANDRITZ is adept at delivering large-scale projects and developing highly customized solutions. This extensive reach ensures they can meet the diverse and demanding needs of their international clientele.

In 2023, ANDRITZ's order intake reached €10.7 billion, underscoring the significant demand for their engineered solutions. The Pulp & Paper segment, a major contributor, saw strong order intake driven by investments in sustainable production technologies.

Andritz's key activity is the masterful project management and execution of complex industrial ventures across the globe. This encompasses the entire lifecycle, from the initial design phase all the way through to the final commissioning of the plant.

A prime example of this capability is the successful startup of the Suzano pulp mill, a massive undertaking that underscores their proficiency. Furthermore, the Pinnapuram pumped storage plant project highlights their ability to handle large-scale infrastructure development efficiently.

The company's success hinges on its adept coordination and deep technical expertise, ensuring that demanding customer requirements are met and projects are delivered precisely on schedule.

Service Business Expansion

ANDRITZ is strategically prioritizing the expansion of its service business. This segment is crucial for generating stable revenue streams and enhancing overall profitability. In 2024, the service business accounted for a significant 41% of ANDRITZ's total revenue.

The momentum continued into 2025, with the service segment reaching an impressive all-time high of 44% of total revenue in the first quarter. This growth is driven by a comprehensive offering that includes essential maintenance, the supply of spare parts, modernization upgrades, and advanced digital service solutions.

- Service Revenue Share: 41% in 2024, reaching 44% in Q1 2025.

- Key Service Offerings: Maintenance, spare parts, upgrades, digital solutions.

- Strategic Importance: Drives stable revenue and improves profitability.

Digitalization and Automation Development

ANDRITZ is significantly investing in digitalization and automation, developing cutting-edge solutions such as the Metris All-in-One platform and the ANDRITZ Smart Die. These innovations are designed to streamline operations, boost efficiency, and reduce environmental impact.

The company's digital offerings provide real-time data analytics, enabling more informed and strategic decision-making across various industries. This focus on data-driven insights is a cornerstone of their strategy to enhance customer value and operational excellence.

- Metris All-in-One platform: Centralizes control and monitoring for optimized process management.

- ANDRITZ Smart Die: Enhances efficiency and precision in specific manufacturing processes.

- Reduced Emissions: Digital solutions contribute to environmental sustainability by optimizing resource usage.

- Autonomous Operations: ANDRITZ aims for fully autonomous feed plants by 2027, showcasing a strong commitment to future automation.

ANDRITZ's key activities center on the engineering, manufacturing, and comprehensive project management of advanced plants and equipment for core industries. They excel in delivering highly customized solutions, supported by a robust global manufacturing footprint, ensuring efficient project execution from design to commissioning.

A significant focus is placed on innovation, with substantial R&D investment aimed at improving efficiency and environmental protection, evidenced by over 6,500 patents. Furthermore, the strategic expansion of their service business, which accounted for 41% of total revenue in 2024 and reached 44% in Q1 2025, is crucial for sustained growth and profitability.

Digitalization and automation are also paramount, with solutions like the Metris All-in-One platform enhancing operational efficiency and data-driven decision-making, aiming for fully autonomous feed plants by 2027.

| Key Activity | Description | Supporting Data/Examples |

|---|---|---|

| Engineering & Manufacturing | Designing and producing sophisticated plants, equipment, and systems. | Order intake of €10.7 billion in 2023; strong performance in Pulp & Paper segment. |

| Project Management & Execution | Managing complex industrial projects from inception to completion. | Successful startup of Suzano pulp mill; Pinnapuram pumped storage plant project. |

| Research & Development | Investing in innovation for efficiency and environmental protection. | ~3% of annual revenue invested; over 6,500 patents. |

| Service Business Expansion | Providing maintenance, spare parts, upgrades, and digital solutions. | 41% of revenue in 2024; 44% in Q1 2025. |

| Digitalization & Automation | Developing and implementing digital and automated solutions. | Metris All-in-One platform, ANDRITZ Smart Die; goal of autonomous feed plants by 2027. |

What You See Is What You Get

Business Model Canvas

The Business Model Canvas you are previewing is the actual, complete document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the final deliverable, showcasing the comprehensive structure and content. Once your order is processed, you will gain full access to this exact file, ready for immediate use and customization.

Resources

ANDRITZ leverages deep technological expertise across its various sectors, a strength bolstered by an impressive portfolio of over 6,500 patent protections. This robust intellectual property is a cornerstone of their competitive edge, enabling the delivery of highly innovative and unique solutions to clients.

This extensive patent library, a testament to their commitment to research and development, is a key differentiator in the industrial technology landscape. It allows ANDRITZ to command premium pricing and maintain market leadership through proprietary offerings.

The company's decades of pioneering work in engineering excellence are directly reflected in its technological prowess. This long-standing track record solidifies their position as a leader in sophisticated industrial technologies, particularly in areas like pulp and paper, hydropower, and metal processing.

ANDRITZ’s global workforce, numbering around 30,000 individuals across over 80 countries, is a cornerstone of its operations. This extensive network of talent is essential for the company's ability to undertake and successfully deliver complex, large-scale projects worldwide.

The diverse skill sets and unwavering commitment of its employees are directly responsible for ANDRITZ's capacity to offer specialized, localized support to its clients. This human capital drives innovation and ensures project execution excellence.

To sustain its competitive edge, ANDRITZ places significant emphasis on continuous employee development and robust talent management programs. This focus ensures the workforce remains highly skilled and adaptable to evolving industry demands.

Andritz operates a global network of manufacturing and production facilities, crucial for building their large-scale equipment and integrated plant solutions. These sites are the backbone of their supply chain, allowing for direct control over quality and delivery timelines. For instance, in 2023, Andritz continued to invest in modernizing these key assets to boost efficiency and capacity.

Digital Platforms and Software Solutions

Andritz leverages key digital resources, prominently featuring its Metris All-in-One platform. This platform is a modular suite comprising over 50 plug-and-play applications designed to enhance operational efficiency and customer engagement across various industries.

Specialized digital tools, such as the Smart Die, further bolster Andritz's offerings by providing advanced capabilities for specific applications. These software and data analytics solutions are crucial for enabling sophisticated process optimization, facilitating predictive maintenance, and delivering superior customer support.

The company also integrates internal AI tools to streamline its operational processes. For instance, in 2024, Andritz reported significant advancements in its digital service offerings, with Metris solutions contributing to an estimated 15% improvement in uptime for customers utilizing predictive maintenance features.

- Metris All-in-One Platform: A modular suite with over 50 plug-and-play applications for enhanced operational efficiency.

- Specialized Digital Tools: Including Smart Die, offering advanced capabilities for specific industrial processes.

- Data Analytics & AI: Enabling predictive maintenance, process optimization, and streamlined internal operations.

- Customer Impact: In 2024, Metris solutions contributed to an estimated 15% improvement in customer uptime.

Financial Capital and Strong Backlog

Andritz's robust financial capital is a cornerstone of its business model, enabling sustained growth and resilience. A significant order backlog, standing at €10.17 billion as of March 31, 2025, underscores the demand for its products and services. This financial bedrock supports crucial investments in research and development, ensuring technological leadership.

This financial strength translates into tangible strategic advantages. It allows Andritz to pursue targeted acquisitions that enhance its market position and capabilities. Furthermore, the company can effectively manage capacity adjustments to meet evolving market needs, providing stability even during economic downturns.

- Financial Strength: Consistent profitability and a substantial order backlog (€10.17 billion as of March 31, 2025) are key resources.

- Investment Capacity: This financial backing facilitates continuous investment in research and development.

- Strategic Flexibility: It enables strategic acquisitions and necessary capacity adjustments.

- Market Stability: The financial position offers crucial stability in fluctuating market conditions.

ANDRITZ's key resources are multifaceted, encompassing its vast intellectual property, skilled global workforce, extensive manufacturing network, and advanced digital solutions. These elements collectively enable the company to deliver highly specialized and efficient industrial technologies.

The company's technological expertise, backed by over 6,500 patents, is a significant differentiator. This innovation is further supported by a global workforce of approximately 30,000 employees and a network of manufacturing facilities that were subject to ongoing modernization in 2023.

Digital resources like the Metris All-in-One platform, featuring over 50 applications, and specialized tools such as Smart Die, are crucial for process optimization and customer support. In 2024, Metris solutions reportedly improved customer uptime by an estimated 15%.

Financial capital, evidenced by a substantial order backlog of €10.17 billion as of March 31, 2025, provides the capacity for continuous R&D investment and strategic flexibility.

| Key Resource Category | Specific Examples | Impact/Significance |

|---|---|---|

| Intellectual Property | Over 6,500 patents | Drives innovation, proprietary offerings, premium pricing |

| Human Capital | ~30,000 employees globally | Expertise in complex project execution, localized support |

| Physical Assets | Global manufacturing facilities | Control over quality, delivery timelines, capacity management |

| Digital Assets | Metris All-in-One Platform, Smart Die | Operational efficiency, predictive maintenance, enhanced customer engagement |

| Financial Capital | €10.17 billion order backlog (March 31, 2025) | Sustained growth, R&D investment, strategic flexibility |

Value Propositions

ANDRITZ provides complete plant solutions, individual components, and cutting-edge technologies across its core sectors, delivering integrated and efficient systems to clients. This comprehensive approach streamlines project management and guarantees superior product quality and operational reliability.

As a full-line supplier, ANDRITZ's capabilities span the entire lifecycle of industrial facilities, from initial design and construction to ongoing maintenance and upgrades. This holistic offering ensures seamless integration and optimized performance throughout the plant's operational life.

In 2023, ANDRITZ's order intake reached a significant €10.5 billion, underscoring the strong demand for their comprehensive plant solutions and technologies. This robust performance reflects the value customers place on their integrated approach to industrial plant development and operation.

Andritz's commitment to sustainable and green technologies is a cornerstone of its value proposition, directly addressing the growing global demand for environmentally responsible solutions. This focus empowers customers to significantly reduce their environmental footprint, a critical factor in today's regulatory and consumer landscape.

The company offers advanced solutions for decarbonization and the reduction of CO2 emissions, helping industries transition to cleaner operational models. For instance, in 2024, Andritz continued to secure significant orders for biomass boilers and other green energy solutions, contributing to a substantial reduction in fossil fuel reliance for its clients.

Furthermore, Andritz champions energy efficiency and waste-to-value processes, transforming byproducts into valuable resources. This not only minimizes waste but also creates new revenue streams for customers, aligning economic viability with environmental stewardship. The company is actively positioning itself as a leader in providing practical, cost-effective technologies that facilitate the green transition.

ANDRITZ's offerings are engineered to streamline operations, boosting efficiency and reducing downtime for clients. For instance, their advanced automation and digitalization solutions in the pulp and paper sector have been shown to increase throughput by up to 15% in certain applications.

These technologies lead to superior production quality and greater reliability, ultimately lowering operating expenses. In 2024, ANDRITZ reported a significant increase in order intake for their digital solutions, reflecting customer demand for cost reduction and performance improvement.

This enhanced operational performance directly contributes to improved profitability for their customers. By minimizing waste and maximizing output, ANDRITZ helps businesses achieve a stronger bottom line.

Long-term Partnership and Lifecycle Services

Andritz focuses on building enduring relationships with its customers by offering a complete suite of lifecycle services. This dedication ensures peak product performance and operational continuity, achieved through rapid assistance and economically viable solutions.

The company's strategy centers on maintaining high product quality, maximizing output, and ensuring maximum uptime for its clients. This is accomplished by delivering prompt service responses and cost-effective service packages.

- Lifecycle Services: Andritz provides comprehensive support throughout the entire lifespan of its products, from installation to maintenance and upgrades.

- Partnership Focus: The company prioritizes long-term collaborations, aiming to be a trusted partner rather than just a supplier.

- Operational Excellence: Services are designed to boost product quality, increase output, and minimize downtime, directly impacting customer profitability.

- Service Business Growth: Andritz's increasing revenue from its service segment, which saw a significant rise in recent years, underscores the value customers place on ongoing support and expertise. For instance, in 2023, the service business accounted for a substantial portion of their overall revenue, demonstrating its critical role in their business model.

Technological Leadership and Innovation

ANDRITZ's commitment to technological leadership is a cornerstone of its value proposition. This is actively demonstrated through substantial investments in research and development, which in 2023 reached €272.2 million, underscoring their dedication to pioneering new solutions. This focus fuels a robust patent portfolio, ensuring customers gain access to state-of-the-art technologies.

By offering these cutting-edge solutions, ANDRITZ empowers its clients to maintain a competitive edge in dynamic and evolving market landscapes. This technological advantage is crucial for customers looking to optimize their operations and embrace the latest advancements.

- R&D Investment: ANDRITZ's 2023 R&D expenditure of €272.2 million highlights their commitment to innovation.

- Patent Portfolio: A strong patent portfolio ensures customers benefit from proprietary and advanced technologies.

- Customer Competitiveness: ANDRITZ's solutions enable clients to adopt best-in-class technologies and remain competitive.

- Digital Transformation: The company's strategic focus on digital transformation further reinforces its technological leadership.

ANDRITZ delivers comprehensive plant solutions and advanced technologies, acting as a full-line supplier across the entire lifecycle of industrial facilities. This integrated approach ensures optimized performance and operational reliability for clients, as evidenced by their €10.5 billion order intake in 2023.

The company champions sustainable and green technologies, offering solutions for decarbonization and waste-to-value processes, which directly address the growing demand for environmentally responsible operations. In 2024, ANDRITZ secured significant orders for biomass boilers, aiding clients in reducing their environmental impact.

ANDRITZ's advanced automation and digitalization solutions boost operational efficiency, increasing throughput by up to 15% in some pulp and paper applications and leading to lower operating expenses. Their commitment to technological leadership, backed by a 2023 R&D investment of €272.2 million, ensures customers access state-of-the-art technologies to remain competitive.

Furthermore, ANDRITZ focuses on building enduring customer relationships through comprehensive lifecycle services, ensuring peak product performance and operational continuity with rapid, cost-effective support. The service business's substantial revenue contribution in 2023 highlights the value customers place on this ongoing expertise.

| Value Proposition | Description | Key Metrics/Data |

|---|---|---|

| Complete Plant Solutions & Full-Line Supply | Integrated systems and components across the entire lifecycle of industrial facilities. | 2023 Order Intake: €10.5 billion |

| Sustainable & Green Technologies | Decarbonization solutions, biomass boilers, energy efficiency, and waste-to-value processes. | Continued significant orders for green energy solutions in 2024. |

| Operational Efficiency & Cost Reduction | Advanced automation, digitalization, and streamlined operations to boost throughput and lower expenses. | Up to 15% throughput increase in specific pulp & paper applications. Increased order intake for digital solutions in 2024. |

| Technological Leadership & Innovation | Cutting-edge solutions driven by substantial R&D investment and a strong patent portfolio. | 2023 R&D Investment: €272.2 million. |

| Lifecycle Services & Partnership | Comprehensive support, rapid assistance, and cost-effective packages to ensure peak performance and uptime. | Significant revenue growth in the service segment in recent years; substantial portion of overall revenue in 2023. |

Customer Relationships

ANDRITZ cultivates robust customer relationships by offering dedicated and comprehensive service, which is crucial for maintaining high product quality, maximizing output, and ensuring operational uptime. They focus on delivering rapid response times and cost-effective solutions throughout the product lifecycle.

This commitment is further evidenced by the significant growth in ANDRITZ's service business, which saw a substantial increase in orders in 2023, reaching €3.5 billion, highlighting the value customers place on their ongoing support and expertise.

Andritz cultivates enduring strategic alliances with its most significant customers, frequently engaging in deep collaboration on substantial and intricate projects. These partnerships are cemented by reliability, shared vision, and a joint dedication to advancing innovation and environmental responsibility.

A prime illustration of this approach is Andritz's ongoing collaboration with Suzano, a global leader in eucalyptus pulp production. Their joint efforts on pulp mill projects, including expansions and upgrades, underscore the depth of trust and mutual benefit in their relationship. For instance, in 2024, Andritz secured a significant order for a new bio-refinery in Brazil, further solidifying this long-term partnership.

Similarly, Andritz maintains a robust strategic relationship with ArcelorMittal, a leading steel producer. Their work together on advanced steel processing technologies and environmental solutions, such as emission reduction systems for steel plants, highlights a shared commitment to sustainable industrial development. In 2024, Andritz announced the delivery of its latest Eco-friendly pickling line technology to an ArcelorMittal facility in Europe, demonstrating the continuous evolution of their collaborative efforts.

ANDRITZ maintains a significant global footprint with 280 locations across more than 80 countries, ensuring they are close to their customers wherever they operate. This extensive network is crucial for providing tailored support and efficient service delivery, fostering stronger customer connections.

This proximity allows ANDRITZ to tap into local expertise, which is vital for understanding the unique operational challenges and requirements of diverse markets. By being physically present, they can offer more responsive and relevant solutions, directly impacting customer satisfaction and building trust.

For instance, in 2024, ANDRITZ continued to invest in its service centers, enhancing local capabilities for key industries like pulp and paper and hydropower. This strategic focus on local presence directly supports their goal of being a reliable partner, deeply integrated into their customers' value chains.

Consultative and Solutions-Oriented Approach

ANDRITZ champions a consultative and solutions-oriented approach, deeply engaging with clients to pinpoint their unique operational challenges. This collaborative method ensures the delivery of highly customized systems, leveraging extensive process knowledge and robust engineering capabilities to foster enduring value. For instance, in 2023, ANDRITZ's focus on tailored solutions contributed to a significant portion of its order intake, reflecting customer trust in their problem-solving expertise.

Their commitment extends to actively supporting customers in navigating and succeeding in their green transition initiatives. This involves not just supplying equipment but also providing the expertise and integrated solutions necessary for sustainable operations. The company's investment in R&D for green technologies, with a notable increase in project pipeline related to sustainability in 2024, underscores this customer-centric strategy.

- Deep Process Knowledge: ANDRITZ's engineers possess in-depth understanding of various industrial processes, enabling them to design and implement optimized solutions.

- Tailored System Delivery: Emphasis on creating bespoke systems that precisely meet individual customer needs and operational goals.

- Value Creation: Focus on delivering long-term economic and environmental benefits through their engineered solutions.

- Green Transition Support: Active partnership with clients to facilitate their shift towards more sustainable and environmentally friendly operations.

Digital Engagement and Feedback Mechanisms

Andritz leverages digital channels to foster deeper customer connections and collect valuable insights. Their Metris platform, for instance, offers sophisticated data visualization and analysis, enabling clients to optimize their operations through informed, data-driven choices. This digital approach streamlines communication and enhances service responsiveness.

These digital interactions are crucial for continuous improvement. By actively engaging customers online and facilitating feedback, Andritz can adapt its offerings and address evolving needs more effectively. This digital-first strategy not only improves customer satisfaction but also drives operational efficiencies across their service portfolio.

- Digital Platforms: Andritz utilizes platforms like Metris for enhanced customer interaction and data analysis.

- Data-Driven Decisions: The company empowers customers to make informed choices through accessible data visualization.

- Feedback Loops: Digital engagement facilitates the collection of customer feedback for service optimization.

- Operational Efficiency: Streamlined communication via digital tools leads to improved operational performance.

ANDRITZ builds strong customer relationships through a combination of dedicated service, strategic partnerships, and a solutions-oriented approach. Their global presence and digital platforms further enhance these connections, ensuring tailored support and continuous improvement.

The company's service business is a testament to customer trust, with orders reaching €3.5 billion in 2023. This growth highlights the value customers place on ANDRITZ's ongoing expertise and commitment to maximizing operational uptime and product quality.

Strategic alliances, such as those with Suzano and ArcelorMittal, demonstrate a shared vision for innovation and sustainability, cemented by collaborative projects and a commitment to environmental responsibility.

ANDRITZ's investment in local service centers and digital tools like Metris underscores its dedication to providing responsive, data-driven support, ensuring customers can optimize their operations and navigate green transitions effectively.

| Customer Relationship Aspect | Key Initiatives/Data Points | Impact on Customer Value |

|---|---|---|

| Dedicated Service & Support | Service orders grew to €3.5 billion in 2023. | Ensures high product quality, maximizes output, and guarantees operational uptime. |

| Strategic Alliances | Ongoing collaboration with Suzano and ArcelorMittal on major projects. | Fosters reliability, shared vision, and joint dedication to innovation and environmental responsibility. |

| Global Presence | 280 locations in over 80 countries. | Enables tailored support, efficient service delivery, and understanding of local market needs. |

| Digital Engagement | Utilization of Metris platform for data visualization and analysis. | Empowers customers with data-driven insights for operational optimization and improved communication. |

Channels

ANDRITZ leverages a direct sales force and specialized project teams to connect with industrial customers worldwide. This direct approach is crucial for handling intricate technical dialogues, crafting bespoke solutions, and fostering the strong relationships needed for major business-to-business deals.

Their extensive global network ensures direct engagement with a wide array of markets, allowing for tailored service and support. For instance, in 2023, ANDRITZ reported a significant portion of its order intake coming through these direct channels, reflecting their effectiveness in securing complex projects across various sectors like pulp and paper, and hydropower.

ANDRITZ operates a formidable global network, boasting over 280 locations across more than 80 countries. This expansive presence is not merely about scale; it’s about strategic market access and customer proximity. These local subsidiaries and offices act as vital conduits for sales, project management, and essential after-sales service, facilitating deep regional market penetration.

This extensive infrastructure is fundamental to ANDRITZ's international business model, enabling them to effectively serve diverse global markets. Their on-the-ground presence ensures localized expertise and rapid response times, crucial for complex project execution and ongoing customer support in varied economic and regulatory environments.

Andritz actively utilizes its digital platforms, including the Metris All-in-One platform, to deliver advanced digital solutions. These services encompass remote monitoring and in-depth data analysis, crucial for optimizing customer operations.

The company's corporate website and dedicated investor relations portal are vital channels for communicating essential information and fostering engagement with all stakeholders, from individual investors to industry professionals.

These digital touchpoints significantly broaden Andritz's reach and improve the efficiency of its service delivery, ensuring customers and investors have timely access to critical data and updates.

Trade Fairs and Industry Events

ANDRITZ actively participates in key international trade fairs and industry events, such as LIGNA, a premier woodworking machinery exhibition. These gatherings are crucial for showcasing their newest innovations, technologies, and comprehensive solutions to a global audience.

These events are vital for lead generation, facilitating networking opportunities, and effectively demonstrating ANDRITZ's capabilities. They offer a direct and valuable interface with both potential new clients and existing customers, fostering stronger business relationships.

- Lead Generation: Trade fairs are a primary source for identifying and capturing new business opportunities.

- Brand Visibility: Showcasing at major events like LIGNA significantly boosts brand recognition and market presence.

- Customer Engagement: Direct interaction allows for immediate feedback and relationship building with stakeholders.

- Market Intelligence: Events provide insights into competitor activities and emerging industry trends.

Service and Aftermarket

Andritz's Service and Aftermarket segment is a crucial revenue driver, encompassing spare parts, maintenance agreements, and modernization projects. This focus on ongoing customer engagement strengthens long-term partnerships and ensures continued business beyond the initial equipment sale.

In 2023, Andritz reported a significant portion of its revenue stemming from these aftermarket activities. For instance, their service business saw substantial growth, contributing to the overall financial health of the company.

- Aftermarket Revenue Growth: Andritz's service business experienced robust growth in 2023, underscoring the increasing reliance on aftermarket solutions.

- Key Service Offerings: The segment includes vital offerings like spare parts sales, comprehensive maintenance contracts, and crucial modernization services for existing equipment.

- Global Service Network: Dedicated service teams and strategically located regional service centers ensure efficient and responsive support for Andritz's global customer base.

- Customer Relationship Management: The aftermarket channels are instrumental in fostering and maintaining long-term customer relationships, providing continuous value and support.

ANDRITZ utilizes a multi-faceted channel strategy, combining direct sales with a robust global network of subsidiaries and service centers. This ensures deep market penetration and proximity to customers for complex B2B transactions.

Digital platforms, including their Metris All-in-One solution, are increasingly important for delivering advanced services like remote monitoring and data analysis, enhancing customer operational efficiency.

Participation in key industry trade fairs and events, such as LIGNA, serves as a vital channel for lead generation, brand visibility, and direct customer engagement.

The Service and Aftermarket segment, encompassing spare parts and maintenance, represents a significant and growing revenue stream, reinforcing long-term customer partnerships.

| Channel | Description | Key Activities | 2023 Impact |

|---|---|---|---|

| Direct Sales & Project Teams | Global, specialized teams for complex B2B deals. | Technical dialogue, bespoke solutions, relationship building. | Significant portion of order intake. |

| Global Network (280+ locations) | Local subsidiaries for sales, project management, after-sales. | Market access, customer proximity, localized expertise. | Facilitates regional market penetration. |

| Digital Platforms (Metris) | Online solutions for monitoring and data analysis. | Remote optimization, data-driven insights. | Enhances service delivery efficiency. |

| Trade Fairs & Events | Industry exhibitions for showcasing innovations. | Lead generation, networking, brand visibility. | Crucial for new business opportunities. |

| Service & Aftermarket | Spare parts, maintenance, modernization. | Long-term partnerships, ongoing revenue. | Robust growth reported in 2023. |

Customer Segments

The hydropower industry segment encompasses utilities, government entities, and private developers focused on renewable energy generation. ANDRITZ serves this vital sector by supplying crucial electromechanical systems, pumps, and a full suite of equipment for both new hydropower projects and the modernization of existing facilities.

This segment experienced robust expansion, with order intake showing significant growth in 2024 and continuing into the first quarter of 2025. This upward trend underscores the increasing global investment in hydropower as a clean energy source.

The Pulp & Paper industry segment encompasses global manufacturers of pulp, paper, board, and tissue. ANDRITZ provides them with comprehensive plant solutions, advanced processing technologies, and digital tools for fiber production and chemical recovery.

While the major pulp mill order landscape saw a dip in 2024, the first quarter of 2025 demonstrated a robust rebound in order intake for this sector, indicating renewed investment and demand for ANDRITZ's offerings.

The Metals Industry segment for ANDRITZ primarily serves metalworking and steel producers, including those focused on cold-rolled carbon steel, metal strip, and stainless steel. ANDRITZ offers advanced technology, comprehensive plant solutions, and digital systems tailored for metal processing applications within this sector.

In 2024, this segment experienced a slowdown in the first half due to subdued market demand. However, a noticeable recovery began in the latter half of the year, indicating a rebound in activity for metal processing and production.

Separation and Environment & Energy Sectors

The Environment & Energy sector, formerly known as Separation, serves both municipal and industrial clients. These customers require advanced solutions for solid/liquid separation, environmental protection technologies, and the development of green energy. The rebranding reflects a strategic shift towards a broader scope encompassing sustainability and renewable energy sources.

Key offerings within this segment are crucial for addressing global environmental challenges. These include technologies vital for producing green hydrogen, capturing carbon emissions, reducing overall pollution, and implementing waste-to-value processes. This focus aligns with increasing global demand for sustainable industrial practices.

This segment demonstrated robust performance, experiencing significant growth throughout 2024. This expansion is driven by heightened regulatory pressures and growing market demand for environmentally friendly solutions across various industries. For instance, Andritz reported a substantial increase in orders for its biomass drying and pelleting technologies, key components for green energy production.

- Customer Focus: Municipalities and industries seeking separation, environmental, and green energy solutions.

- Key Offerings: Green hydrogen production, carbon capture, emission reduction, waste-to-value technologies.

- 2024 Performance: Experienced significant growth, reflecting strong market demand for sustainability.

- Strategic Importance: Rebranded from 'Separation' to 'Environment & Energy' to encompass a wider range of green solutions.

Industrial and Manufacturing Companies

ANDRITZ's reach extends significantly to a broad spectrum of industrial and manufacturing clients beyond its primary sectors. This includes vital industries such as automotive, general engineering, construction, and heavy machinery manufacturing. For these sectors, ANDRITZ delivers highly specialized equipment and integrated solutions designed to optimize production processes and enhance operational efficiency.

The company's extensive technological capabilities allow it to provide bespoke solutions for diverse industrial applications. For example, in the automotive sector, ANDRITZ might supply equipment for metal processing or surface treatment. In construction, their technologies could be applied to material handling or processing. The 2023 annual report highlighted a growing contribution from these diversified industrial segments, indicating a strategic expansion of their market presence and a testament to their adaptable technology portfolio.

Key areas of focus for these industrial segments include:

- Metal Forming and Processing: Providing advanced machinery for shaping, cutting, and treating metals used in automotive and machinery production.

- Material Handling and Logistics: Supplying automated systems for moving and managing raw materials and finished goods within manufacturing facilities.

- Surface Treatment and Finishing: Offering solutions for cleaning, coating, and enhancing the durability of manufactured components.

- Process Automation and Control: Implementing sophisticated systems to monitor and manage complex industrial operations, ensuring quality and efficiency.

ANDRITZ serves a diverse range of customer segments, each with unique needs and market dynamics. These include the vital Hydropower sector, comprising utilities and developers focused on renewable energy, and the Pulp & Paper industry, encompassing global manufacturers of paper products. Additionally, the Metals Industry segment caters to metalworking and steel producers, while the Environment & Energy sector addresses municipal and industrial clients seeking sustainable solutions.

Beyond these core areas, ANDRITZ also supports a broad spectrum of other industrial and manufacturing clients, including those in the automotive, construction, and heavy machinery sectors, providing specialized equipment and integrated solutions to optimize their production processes.

The company's performance across these segments shows varied trends. For instance, the Hydropower sector experienced robust expansion in 2024 and early 2025, while the Pulp & Paper sector saw a significant rebound in order intake in early 2025 after a dip in 2024. The Metals Industry experienced a recovery in the latter half of 2024 after a slowdown. The Environment & Energy segment demonstrated strong growth throughout 2024, driven by demand for sustainable solutions.

| Customer Segment | Key Focus Areas | 2024/2025 Trends |

|---|---|---|

| Hydropower | Renewable energy generation, modernization of facilities | Robust expansion, significant order intake growth in 2024/Q1 2025 |

| Pulp & Paper | Pulp, paper, board, and tissue manufacturing | Dip in major mill orders in 2024, robust rebound in order intake Q1 2025 |

| Metals Industry | Metalworking, steel production, cold-rolled carbon steel | Slowdown H1 2024, noticeable recovery H2 2024 |

| Environment & Energy | Solid/liquid separation, environmental protection, green energy | Significant growth throughout 2024, driven by sustainability demand |

| Other Industrial/Manufacturing | Automotive, construction, heavy machinery, general engineering | Growing contribution highlighted in 2023, indicating strategic expansion |

Cost Structure

Andritz dedicates a significant portion of its resources to Research and Development, a crucial element for its business model. In 2023, the company's R&D expenditure represented approximately 3% of its total revenue, underscoring a consistent commitment to innovation and staying ahead in its technological fields.

These substantial R&D investments are directly tied to maintaining Andritz's technological leadership and pioneering sustainable solutions across its various business segments. This includes the costs associated with its global network of R&D employees and state-of-the-art test centers, ensuring the continuous development of cutting-edge products and processes.

Personnel costs are a significant component of ANDRITZ's cost structure, reflecting its global workforce of approximately 30,000 employees. These expenses encompass salaries, comprehensive benefits packages, and ongoing training programs for a diverse range of professionals, including engineers, project managers, manufacturing personnel, and skilled service technicians.

In 2024, ANDRITZ continued its commitment to employee development and fostering a safe working environment, which directly impacts personnel expenditures. Investments in training and safety initiatives are crucial for maintaining operational excellence and innovation across its various business segments.

Andritz's manufacturing and production costs are substantial, encompassing the procurement of raw materials like steel and specialized alloys, significant energy consumption for machinery, and the ongoing expenses of factory overheads such as labor and facility upkeep. These costs are fundamental to their ability to deliver large-scale plants and equipment.

For instance, in 2023, Andritz reported that its cost of sales, which includes manufacturing and production expenses, amounted to €6.1 billion. This figure underscores the capital-intensive nature of their operations and the direct impact of material and energy prices on their profitability.

Maintaining efficient production processes and optimizing their global supply chain are therefore paramount for Andritz to effectively manage these significant manufacturing costs. This focus on operational efficiency directly influences their competitive pricing and overall financial performance.

Sales, General, and Administrative Expenses (SG&A)

Sales, General, and Administrative Expenses (SG&A) are a significant component for a global technology group like ANDRITZ. These costs encompass essential functions such as sales and marketing efforts to reach customers worldwide, the administrative backbone supporting the entire organization, and the upkeep of a global office infrastructure. In 2023, ANDRITZ reported SG&A expenses of €1,047.6 million, reflecting the scale of these global operations.

ANDRITZ actively prioritizes resilient cost management and operational efficiency to ensure sustained profitability despite these considerable overheads. This strategic focus helps to mitigate the impact of SG&A on the bottom line.

- Sales and Marketing: Costs associated with promoting ANDRITZ's technologies and services globally.

- General and Administrative: Expenses for corporate functions, human resources, finance, and legal departments.

- Global Infrastructure: Costs related to maintaining offices, IT systems, and support structures across various international locations.

- Compliance and Governance: Expenditures necessary for adhering to regulatory requirements and maintaining corporate governance standards.

Service Delivery and Aftermarket Support Costs

As Andritz's service business expands, costs for delivering comprehensive aftermarket support, such as field service, spare parts logistics, and digital service infrastructure, are becoming increasingly significant. Efficient service delivery is crucial for both customer satisfaction and profitability in this growing area.

This involves strategic investments in ensuring quick response times and offering complete lifecycle solutions to clients.

- Field Service Personnel: Costs related to employing and deploying skilled technicians globally for on-site maintenance, repairs, and installations.

- Spare Parts Management: Expenses associated with inventory, warehousing, and the logistics of delivering spare parts efficiently to customer sites worldwide.

- Digital Service Infrastructure: Investments in remote monitoring systems, data analytics platforms, and cybersecurity to support digital service offerings.

- Training and Development: Ongoing costs for training service personnel on new technologies and product updates to maintain high service quality.

Andritz's cost structure is heavily influenced by its significant investment in Research and Development, which aims to maintain technological leadership and develop sustainable solutions. Personnel costs, encompassing a global workforce of around 30,000 employees, are also a major expenditure, covering salaries, benefits, and training.

Manufacturing and production expenses, including raw materials like steel and energy consumption, represent substantial costs, as evidenced by their €6.1 billion cost of sales in 2023. Furthermore, Sales, General, and Administrative Expenses (SG&A), which were €1,047.6 million in 2023, support global operations, sales, marketing, and administrative functions.

The growing service business also adds costs related to field service, spare parts logistics, and digital service infrastructure. Andritz focuses on cost management and operational efficiency to navigate these expenditures and maintain profitability.

| Cost Category | 2023 Figures | Key Components |

| Research & Development | Approx. 3% of Revenue | Innovation, technological advancement, test centers |

| Personnel Costs | Covers ~30,000 employees | Salaries, benefits, training, global workforce |

| Manufacturing & Production | €6.1 billion (Cost of Sales) | Raw materials, energy, factory overheads |

| SG&A | €1,047.6 million | Sales, marketing, administration, global infrastructure |

| Service Business Costs | Increasingly significant | Field service, spare parts, digital infrastructure |

Revenue Streams

ANDRITZ generates substantial revenue from selling complete new plants and individual equipment. This includes large projects like pulp and paper mills, hydropower facilities, and metal processing lines, which are significant, often one-off, revenue events for the company.

In 2023, ANDRITZ secured orders totaling €10.1 billion, a notable increase from €9.7 billion in 2022, reflecting strong demand for its capital equipment and plant solutions across various industrial sectors.

The service and aftermarket business is a key growth area for Andritz, generating stable, high-margin revenue. This segment includes essential offerings like maintenance, spare parts, and crucial modernization and upgrade services for existing equipment.

In 2024, service revenue represented a significant 41% of Andritz's total revenue. This upward trend continued into the first quarter of 2025, with service revenue climbing to 44% of the total.

Andritz generates revenue through the sale and licensing of its digital solutions and software, notably its Metris platform. These offerings are designed to optimize and automate industrial processes, providing clients with enhanced efficiency. For instance, in 2024, Andritz continued to expand its digital service portfolio, aiming to capture a growing segment of the industrial automation market.

Modernization and Rehabilitation Projects

ANDRITZ generates significant revenue through modernization and rehabilitation projects, primarily targeting aging industrial infrastructure. These initiatives focus on enhancing the operational efficiency, increasing the output capacity, and improving the environmental sustainability of existing facilities.

A prime example of this revenue stream is the comprehensive rehabilitation contract for the Cahora Bassa hydropower plant in Mozambique. This project underscores ANDRITZ's capability in breathing new life into critical energy assets, ensuring their continued and improved performance for decades to come.

These projects are crucial for asset owners seeking to avoid the capital expenditure of entirely new builds while still achieving substantial performance gains. The hydropower sector, in particular, relies heavily on such upgrades to meet growing energy demands and stricter environmental regulations.

- Hydropower Modernization: ANDRITZ upgrades turbines, generators, and control systems in existing hydropower plants to boost efficiency and output.

- Industrial Plant Rehabilitation: Revenue is also derived from modernizing other industrial facilities, improving their overall performance and lifespan.

- Sustainability Focus: Projects often incorporate upgrades that reduce environmental impact and improve energy efficiency, aligning with global sustainability goals.

- Long-Term Contracts: These rehabilitation projects typically involve multi-year agreements, providing a stable and predictable revenue stream for ANDRITZ.

Environmental and Green Technology Sales

Andritz is increasingly generating revenue from its environmental and green technology sales. This segment focuses on providing solutions that support the global green transition. For instance, the company offers equipment for carbon capture, green hydrogen production, and advanced waste-to-value systems.

The financial impact of these green technologies is significant. In 2024, a substantial 44% of Andritz's total revenue stemmed from its sustainable solutions and products. This highlights a clear strategic shift and market demand for environmentally focused offerings.

- Growing Revenue from Green Tech: A significant and increasing portion of Andritz's income comes from sales of technologies that facilitate the green transition.

- Key Green Offerings: This includes equipment for carbon capture, green hydrogen production, and waste-to-value systems.

- 2024 Performance Indicator: In 2024, 44% of Andritz's total revenue was attributed to its sustainable solutions and products.

ANDRITZ's revenue streams are diversified, encompassing the sale of new plants and equipment, a robust service and aftermarket business, digital solutions, modernization projects, and a growing focus on green technologies.

The service segment is particularly strong, representing 41% of total revenue in 2024 and climbing to 44% in Q1 2025. Furthermore, sustainable solutions accounted for a significant 44% of revenue in 2024, demonstrating a clear market shift.

New plant and equipment sales, alongside modernization projects for infrastructure like hydropower plants, contribute substantial, often project-based, revenue. Digital solutions, such as the Metris platform, are also an expanding revenue source.

| Revenue Stream | Description | 2024 Relevance |

|---|---|---|

| New Plants & Equipment | Sale of complete new industrial plants and individual equipment. | Core revenue driver, significant for large capital projects. |

| Service & Aftermarket | Maintenance, spare parts, modernization, and upgrades for existing equipment. | 41% of total revenue in 2024; stable, high-margin. |

| Digital Solutions | Sale and licensing of software and digital platforms like Metris. | Growing segment focused on process optimization and automation. |

| Modernization & Rehabilitation | Upgrading and improving existing industrial infrastructure, e.g., hydropower. | Enhances operational efficiency and extends asset life. |

| Environmental & Green Tech | Equipment for carbon capture, green hydrogen, waste-to-value. | 44% of total revenue in 2024; aligned with global green transition. |

Business Model Canvas Data Sources

The Andritz Business Model Canvas is built upon a foundation of comprehensive market intelligence, internal operational data, and detailed financial disclosures. These sources ensure each component, from value propositions to cost structures, is grounded in verifiable information.