Andritz Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Andritz Bundle

Andritz operates within a dynamic industrial landscape, facing significant pressures from powerful buyers and intense rivalry among existing competitors. Understanding these forces is crucial for navigating its market effectively.

The complete report reveals the real forces shaping Andritz’s industry—from supplier influence to threat of new entrants. Gain actionable insights to drive smarter decision-making.

Suppliers Bargaining Power

Andritz, a major player in supplying complex plants and equipment, often depends on a select group of suppliers for highly specialized components and raw materials. This reliance creates a situation where these suppliers can wield considerable bargaining power, especially when Andritz requires unique or proprietary parts crucial for its operations.

This supplier leverage directly impacts Andritz by influencing the cost of essential inputs and dictating delivery schedules. For instance, if a critical component is only available from one or two specialized manufacturers, Andritz has limited options to negotiate price or expedite delivery, potentially leading to increased project costs and delays.

The heavy equipment and industrial plant sectors have grappled with significant supply chain disruptions. These include past shortages of critical components and ongoing challenges stemming from geopolitical instability and escalating raw material prices. For instance, the cost of key metals like steel and copper, essential for Andritz's machinery, saw substantial increases throughout 2023 and into early 2024, impacting overall production costs.

These persistent supply chain issues can bolster the bargaining power of suppliers. They may leverage these conditions to command higher prices for their goods or enforce less favorable contract terms on buyers like Andritz. This dynamic can directly affect Andritz's profitability and its ability to maintain competitive pricing for its products.

The integration of advanced technologies such as AI and automation is significantly transforming the supplier ecosystem. Suppliers who proactively adopt and leverage these innovations, offering enhanced efficiency or unique capabilities, are likely to see their influence grow. This technological edge can translate into increased bargaining power, as manufacturers like ANDRITZ may become more reliant on these specialized, tech-forward suppliers.

Limited Supplier Alternatives for Niche Markets

In niche segments within the pulp and paper or separation technology sectors, ANDRITZ might face a limited pool of suppliers capable of providing highly specialized equipment or services. This scarcity directly translates into enhanced bargaining power for these few suppliers.

For instance, if a particular type of advanced filtration system is only produced by a handful of global manufacturers, ANDRITZ's ability to negotiate favorable terms is diminished. This situation was evident in the demand for specialized components for advanced wastewater treatment plants, where lead times and pricing were significantly influenced by the limited number of certified producers.

- Limited Supplier Base: In highly specialized industrial equipment markets, the number of viable suppliers can be as low as two or three globally.

- Increased Supplier Leverage: When alternatives are scarce, suppliers can command higher prices and dictate terms more effectively.

- Impact on ANDRITZ: This can lead to higher input costs and potentially longer project timelines for ANDRITZ's complex engineering projects.

Impact of Supplier Consolidation

Consolidation within the industrial equipment supply chain significantly amplifies supplier bargaining power. As fewer, larger entities emerge, they gain a stronger collective voice to dictate pricing and terms. For a company like ANDRITZ, this means facing suppliers who can more effectively leverage their market position.

- Increased Pricing Leverage: Consolidated suppliers can command higher prices due to reduced competition, impacting ANDRITZ's cost of goods sold.

- Stricter Contract Terms: Larger suppliers may impose less favorable payment terms or delivery schedules, limiting flexibility.

- Reduced Supplier Options: Fewer suppliers mean less choice for ANDRITZ, potentially leading to dependence on specific, powerful entities.

- Impact on Innovation: Supplier consolidation can sometimes stifle innovation if dominant players are less incentivized to invest in new technologies for a smaller customer base.

The bargaining power of suppliers for Andritz is a significant factor, particularly in specialized segments of the pulp and paper and separation technology industries. When the supplier base is limited, often to just a few global manufacturers, these suppliers gain considerable leverage. This was highlighted in 2023 and early 2024 with rising costs for essential metals like steel and copper, directly impacting Andritz's input expenses.

Suppliers who adopt advanced technologies like AI and automation are also increasing their influence. For example, a supplier offering unique, technologically superior filtration systems can command higher prices and dictate terms due to Andritz's reliance on such specialized capabilities. This was observed with advanced wastewater treatment components, where limited certified producers led to extended lead times and increased costs.

Supplier consolidation further bolsters this power. As fewer, larger entities dominate the supply chain, they can more effectively dictate pricing and contract terms. This reduced competition means Andritz faces suppliers with greater pricing leverage and potentially stricter contractual obligations, impacting its cost of goods sold and operational flexibility.

| Factor | Description | Impact on Andritz | Data/Example (2023-2024) |

| Limited Supplier Base | Few global producers for specialized components | Reduced negotiation power, higher prices | E.g., specialized filtration systems |

| Raw Material Costs | Volatility in prices of key metals | Increased input costs, potential project delays | Steel and copper prices saw substantial increases |

| Technological Advancement | Suppliers adopting AI/automation | Increased reliance on tech-forward suppliers | Enhanced efficiency from specialized suppliers |

| Supplier Consolidation | Fewer, larger suppliers in the market | Greater pricing leverage, stricter terms | Reduced competition leading to higher costs |

What is included in the product

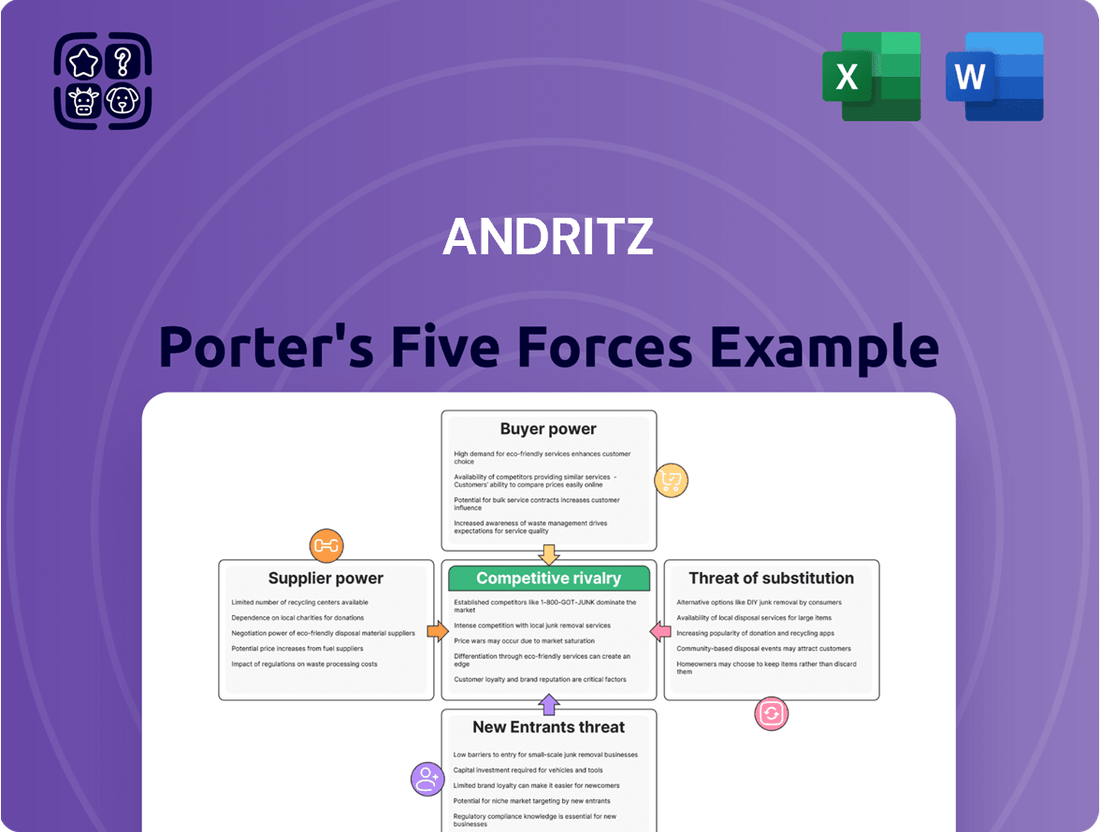

Analyzes the competitive intensity and profitability potential for Andritz by examining the power of buyers and suppliers, the threat of new entrants and substitutes, and the rivalry among existing competitors.

Effortlessly identify and mitigate competitive threats with a pre-built framework for analyzing industry power dynamics.

Customers Bargaining Power

ANDRITZ's customer base consists of major industrial players engaged in significant capital expenditures, often in the multi-million or even billion-euro range. These projects, spanning sectors like hydropower, pulp & paper, metals, and separation, represent substantial investments for the clients. This scale inherently grants customers significant bargaining power, enabling them to negotiate favorable terms, pricing, and detailed project specifications. For instance, a single large hydropower plant contract can represent a substantial portion of ANDRITZ's annual revenue, making customer satisfaction and competitive pricing paramount.

Customers in ANDRITZ's core sectors, like pulp and paper and hydropower, are increasingly demanding sustainable and digitized solutions. This focus on long-term efficiency and environmental responsibility gives them significant leverage. For instance, in 2024, the global market for sustainable pulp and paper technologies saw continued strong growth, driven by consumer and regulatory pressure, enabling customers to negotiate for greener and more advanced equipment.

ANDRITZ's strategic emphasis on its service division, which constituted 41% of its overall revenue in 2024 and climbed to an impressive 44% in the first half of 2025, highlights the development of robust, long-term engagements with its clientele.

These enduring service contracts, while fostering predictable revenue streams, inherently grant customers significant leverage due to their ongoing commitments and expectations for consistent, high-caliber support and performance.

Economic Uncertainties and Investment Delays

Global economic uncertainties, particularly evident in late 2024 and early 2025, are prompting customers to postpone significant capital expenditure projects. This widespread hesitancy directly translates into increased bargaining power for ANDRITZ’s customers. With reduced immediate demand for large-scale investments, customers are in a stronger position to negotiate more favorable pricing and contract terms.

This shift in market dynamics forces ANDRITZ to be more competitive in its bidding processes and to offer greater flexibility in payment schedules and project timelines. For instance, in sectors reliant on discretionary spending, a slowdown in consumer confidence or rising interest rates can amplify these customer-driven pressures.

- Delayed Investment Cycles: Global economic headwinds in 2024-2025 have led to a noticeable deferral of large capital projects by customers.

- Reduced Demand Impact: This postponement reduces immediate demand, giving customers leverage to negotiate better terms with suppliers like ANDRITZ.

- Competitive Pressure: ANDRITZ faces pressure to offer more attractive pricing and flexible contract conditions to secure business amidst customer caution.

- Sectoral Sensitivity: Industries sensitive to economic cycles, such as pulp and paper or hydropower, are particularly affected by these customer-driven negotiations.

Availability of Multiple Qualified Vendors

The availability of multiple qualified vendors significantly impacts the bargaining power of ANDRITZ's customers. Even though ANDRITZ is a major player, customers often find other global technology providers capable of supplying industrial plants and equipment. This competition means customers can shop around, compare pricing, and negotiate more effectively.

For instance, in the hydropower sector, ANDRITZ faces competition from established companies like Voith Group and GE Renewable Energy. This competitive landscape empowers customers to seek the best value, putting pressure on ANDRITZ to offer competitive terms and pricing to secure business. In 2023, the global hydropower market saw significant investment, with numerous projects requiring advanced technology, highlighting the importance of vendor choice for buyers.

- Competitive Landscape: ANDRITZ operates in markets with several other reputable global technology providers.

- Customer Negotiation Power: The presence of alternatives allows customers to compare offers and negotiate pricing and terms.

- Sector Examples: In hydropower, competitors like Voith Group and GE Renewable Energy provide customers with choices.

- Market Dynamics: In 2023, the global hydropower market's growth meant customers had more options to select from leading suppliers.

ANDRITZ's customers, particularly large industrial entities undertaking significant capital expenditures, wield considerable bargaining power. This strength is amplified by the availability of multiple global vendors capable of supplying similar industrial plants and equipment, as seen in the hydropower sector where competitors like Voith Group and GE Renewable Energy exist. The economic climate of late 2024 and early 2025, marked by global uncertainties, has further emboldened customers to postpone investments, leading them to negotiate more favorable pricing and flexible contract terms with suppliers like ANDRITZ.

| Customer Bargaining Power Factors | Impact on ANDRITZ | Supporting Data/Context |

| Customer Size and Project Scale | High leverage due to large contract values | Multi-million to billion-euro capital expenditures |

| Availability of Alternatives | Enables price comparison and negotiation | Competition in hydropower from Voith, GE Renewable Energy |

| Economic Uncertainty (2024-2025) | Increased customer caution and negotiation strength | Deferral of capital projects, reduced immediate demand |

| Demand for Sustainability/Digitalization | Customers negotiate for advanced, compliant solutions | Strong growth in sustainable pulp & paper tech in 2024 |

Same Document Delivered

Andritz Porter's Five Forces Analysis

This preview shows the exact document you'll receive immediately after purchase—a comprehensive Andritz Porter's Five Forces Analysis. You'll gain detailed insights into the bargaining power of suppliers and buyers, the threat of new entrants and substitute products, and the intensity of rivalry within the industry. This professionally formatted analysis is ready for your immediate use, providing a complete understanding of Andritz's competitive landscape.

Rivalry Among Competitors

ANDRITZ competes in mature sectors such as hydropower, pulp & paper, metals, and separation. These industries are dominated by a few large, established global companies. For instance, in the hydropower sector, companies like Voith Group and GE Renewable Energy are significant players, often vying for the same large-scale projects.

The pulp and paper industry also sees intense rivalry from giants like Valmet. This crowded competitive landscape means ANDRITZ faces considerable pressure to innovate and secure contracts, as market share is hard-won.

In 2023, the global pulp and paper market was valued at approximately $330 billion, highlighting the scale of the industries ANDRITZ operates within and the substantial market presence of its key rivals.

The pulp and paper industry, a core market for ANDRITZ, requires substantial upfront capital for machinery and plant construction, creating a significant barrier to entry. For instance, a new greenfield pulp mill can easily cost upwards of $1 billion, deterring smaller players and concentrating market share among established, well-capitalized firms. This high capital intensity inherently limits the number of competitors and intensifies rivalry among those who can afford to participate.

Maintaining technological leadership is paramount in this sector, necessitating continuous and significant investment in research and development. ANDRITZ's commitment to R&D, evident in its focus on innovative sustainable technologies like biomass energy solutions and advanced water treatment, is critical for staying ahead of rivals. Companies that fail to invest in cutting-edge solutions risk obsolescence, making technological prowess a key battleground for market dominance.

Competition is intense for both new plant projects and the crucial service sector, which is a significant and expanding revenue source for ANDRITZ across its various business segments. For instance, in 2024, the aftermarket services segment for industrial equipment, including those provided by companies like ANDRITZ, is projected to see continued growth, driven by the need to maintain and upgrade existing infrastructure.

The capacity to deliver complete service packages, from maintenance to upgrades, alongside highly efficient project execution, truly sets companies apart in this market. This focus on comprehensive support and reliable delivery is a primary differentiator, influencing customer loyalty and future business opportunities.

Market Fluctuations and Regional Dynamics

Competitive rivalry within the pulp and paper sector, for instance, saw a significant downturn, impacting ANDRITZ's order intake. Conversely, the Hydropower and Environment & Energy segments demonstrated robust growth, signaling a shift in market demand. This uneven development across business areas necessitates a tailored approach to competition, adapting strategies based on regional market strengths and weaknesses.

ANDRITZ's performance in 2024 highlights these regional dynamics. For example, while order intake in Pulp & Paper experienced a decline, the company's Hydropower division saw substantial increases, particularly in key European markets. This divergence demands a strategic recalibration, focusing resources and competitive efforts where growth opportunities are most pronounced.

- Regional Performance Variance: ANDRITZ's order intake in 2024 revealed a stark contrast between segments, with Hydropower and Environment & Energy showing strong growth, while Pulp & Paper faced declines.

- Strategic Adaptation: The company must adjust its competitive strategies to address these varying market conditions, prioritizing areas of high growth and mitigating challenges in weaker sectors.

- Market Responsiveness: ANDRITZ's ability to adapt its competitive approach based on specific regional and sector-based fluctuations is crucial for maintaining market share and profitability.

- 2024 Order Intake Data: Specific figures from 2024 indicated a significant positive trend in Hydropower orders, contrasting with a more subdued performance in other core segments.

Strategic Acquisitions and Capacity Adjustments

ANDRITZ's competitive rivalry is intensified by its strategic approach to acquisitions and capacity adjustments. For instance, the February 2025 acquisition of LDX Solutions significantly bolstered ANDRITZ's environmental technologies segment, demonstrating a proactive move to enhance its market position and offerings.

These strategic moves, coupled with ongoing capacity adjustments in response to evolving market dynamics, underscore a highly adaptive and aggressive competitive posture. Such actions directly influence the intensity of rivalry by reshaping market shares and technological capabilities within the industry.

- Strategic Acquisitions: ANDRITZ's acquisition of LDX Solutions in February 2025 for an undisclosed sum expanded its environmental technology portfolio, a key growth area.

- Capacity Adjustments: The company regularly reviews and adjusts its production capacities to align with demand fluctuations and optimize operational efficiency, impacting competitors' strategic planning.

- Market Responsiveness: These adaptive strategies allow ANDRITZ to quickly capitalize on emerging opportunities and mitigate risks, thereby increasing competitive pressure on rivals.

Competitive rivalry is a defining characteristic for ANDRITZ, operating in mature industries like pulp & paper and hydropower where established global players such as Voith Group and Valmet are significant competitors. This intense competition necessitates continuous innovation and efficient project execution to secure market share, especially as the aftermarket services sector grows. ANDRITZ's strategic acquisitions, like the February 2025 purchase of LDX Solutions, aim to bolster its position in key growth areas and adapt to market shifts, further intensifying the competitive landscape.

| Segment | 2024 Order Intake Trend | Key Competitors |

|---|---|---|

| Pulp & Paper | Decline | Valmet |

| Hydropower | Robust Growth | Voith Group, GE Renewable Energy |

| Environment & Energy | Strong Growth | Various specialized firms |

SSubstitutes Threaten

While hydropower has historically been a dominant renewable energy source, the increasing viability and decreasing costs of alternatives like solar and wind power present a significant substitution threat. For instance, global solar PV capacity is projected to reach over 3,000 GW by 2030, a substantial increase that directly competes for new energy generation investments.

Furthermore, advancements in battery storage technology are mitigating the intermittency issues of solar and wind, making them more attractive substitutes for baseload power previously dominated by hydropower. By 2024, the global energy storage market is expected to exceed $150 billion, indicating strong investor confidence in these competing technologies.

The threat of substitutes in the pulp and paper sector is significant, driven by digital transformation and innovative packaging solutions. For instance, the increasing adoption of e-readers and digital documents directly reduces the need for paper, impacting demand for pulp. Furthermore, the development of biodegradable and reusable packaging materials, like advanced bioplastics and molded fiber, poses a direct challenge to traditional paper-based packaging, a key market for pulp producers.

In the metals industry, advanced materials and novel manufacturing techniques are introducing potent substitutes. High-strength composites, for example, are increasingly used in automotive and aerospace applications, often replacing traditional steel and aluminum components. In 2024, the global advanced composites market was valued at approximately $100 billion, showcasing the growing penetration of these alternatives.

The threat of substitutes for ANDRITZ's separation and environmental solutions is significant, particularly as waste treatment and separation technologies continue to evolve. New chemical or biological processes could emerge as viable alternatives to traditional mechanical separation methods, potentially impacting ANDRITZ's market share.

The growing market for membrane separation technology, while a positive for ANDRITZ, also highlights the existence of alternative approaches. For instance, advancements in advanced oxidation processes or novel bioremediation techniques could offer competitive solutions in specific waste treatment applications, diverting demand from established mechanical systems.

Focus on Sustainable and Digital Solutions as Mitigation

ANDRITZ's commitment to sustainable and digital solutions directly counters the threat of substitutes. By offering advanced, eco-friendly technologies, the company makes it harder for less sustainable or outdated alternatives to gain traction. For instance, their focus on circular economy solutions in pulp and paper, like advanced recovery boilers and white liquor filtration, reduces reliance on virgin resources and energy-intensive processes, thus differentiating them from competitors offering less integrated or environmentally conscious options.

This strategic pivot is crucial in sectors where environmental regulations and operational efficiency are increasingly paramount. In 2023, the global market for industrial automation and digitalization, a key area for ANDRITZ, was estimated to be worth over $200 billion, with significant growth driven by sustainability initiatives. ANDRITZ's investments in R&D for these areas, which were substantial in their 2024 financial reporting, directly bolster their competitive position against simpler, less innovative substitute products.

The company's approach can be summarized as follows:

- Innovation in Sustainability: Developing and promoting technologies that reduce environmental impact and resource consumption, such as water treatment solutions and biomass energy systems.

- Digital Integration: Embedding smart technologies, IoT capabilities, and data analytics into their equipment and services to enhance performance, predictive maintenance, and operational efficiency.

- Lifecycle Value: Offering comprehensive solutions that consider the entire lifecycle of a product or process, thereby increasing customer loyalty and reducing the appeal of standalone or less integrated substitutes.

- Market Responsiveness: Actively adapting their product portfolio to meet the growing demand for green technologies and digital transformation across various industries they serve.

High Switching Costs for Integrated Plant Solutions

The threat of substitutes for Andritz's integrated plant solutions is significantly diminished by exceptionally high switching costs. For customers investing in large-scale industrial plants, such as those for pulp and paper or hydropower, the expense and complexity of replacing an entire operational system with a competitor's offering are prohibitive. This lock-in effect means that once a plant is installed and running, the immediate risk of customers switching to a substitute solution is very low, making ongoing service and upgrade contracts a more likely avenue for revenue.

These high switching costs are a direct result of the deep integration of Andritz's technologies within a customer's operational framework. Consider the pulp and paper industry: a mill might have millions invested in Andritz's digesters, recovery boilers, and chemical recovery systems, all working in concert. Replacing even one of these core components with a different manufacturer's equivalent would likely require significant modifications to the entire process, impacting efficiency and potentially requiring extensive retraining of staff. This integration creates a substantial barrier to entry for substitute technologies.

In 2024, the capital expenditure for a new pulp mill can easily exceed €1 billion, with integrated systems representing a substantial portion of that investment. For an existing mill, the cost of retooling to accommodate a substitute for a key Andritz system could easily run into tens or hundreds of millions of euros, not to mention the potential downtime and lost production. This economic reality strongly favors customers continuing with Andritz for maintenance, spare parts, and future upgrades, rather than seeking out entirely different substitute technologies.

- High Capital Investment: Customers invest heavily in integrated plant solutions, often in the hundreds of millions or even billions of euros.

- Process Integration: Andritz's systems are deeply embedded within a customer's operational workflow, making standalone component replacement difficult.

- Operational Disruption: Switching to a substitute technology would likely cause significant downtime and production losses, incurring substantial costs.

- Specialized Expertise: Operating and maintaining integrated plants requires specialized knowledge, which customers have already invested in for their current systems.

The threat of substitutes for Andritz's offerings is multifaceted, with technological advancements and evolving market demands creating new competitive landscapes. In the renewable energy sector, while hydropower remains a core area for Andritz, the rapid growth of solar and wind power, supported by improving battery storage, presents a significant substitution threat for new energy generation projects. For instance, global solar PV capacity is projected to exceed 3,000 GW by 2030, directly competing for investment. Similarly, the pulp and paper industry faces pressure from digitalization reducing paper demand and from innovative, sustainable packaging alternatives like bioplastics and molded fiber.

The metals industry sees advanced composites increasingly replacing traditional materials like steel and aluminum in sectors such as automotive and aerospace, with the global advanced composites market valued at around $100 billion in 2024. Even in separation and environmental solutions, emerging chemical or biological treatment processes, alongside advancements in membrane technology and bioremediation, offer potential substitutes for Andritz's mechanical separation methods.

Andritz actively mitigates these threats through a strategic focus on sustainability and digitalization. By developing advanced, eco-friendly technologies and integrating smart capabilities, the company aims to enhance operational efficiency and reduce environmental impact, thereby differentiating its offerings. For example, their circular economy solutions in pulp and paper reduce reliance on virgin resources. The industrial automation and digitalization market, a key focus for Andritz, was valued at over $200 billion in 2023, underscoring the demand for such integrated solutions.

The threat of substitutes for Andritz's integrated plant solutions is significantly reduced due to exceptionally high switching costs. These costs stem from the deep integration of Andritz's technologies within a customer's operational framework, often involving hundreds of millions or even billions of euros in capital investment. Replacing these complex, interconnected systems would necessitate substantial modifications, leading to operational disruption, downtime, and significant financial losses, making continued reliance on Andritz for upgrades and maintenance the more pragmatic choice.

Entrants Threaten

The threat of new entrants for Andritz is significantly mitigated by the extremely high capital investment required. Establishing R&D capabilities, state-of-the-art manufacturing facilities, and robust global distribution and service networks demands billions of dollars. For instance, building a new, competitive pulp and paper production line, a core area for Andritz, can easily cost upwards of $1 billion.

ANDRITZ's deep technological expertise and ongoing commitment to research and development present a significant hurdle for potential new entrants. Successfully entering markets like hydropower, pulp & paper, metals, and separation requires mastering highly specialized engineering skills and acquiring proprietary technologies, which can be prohibitively expensive and time-consuming.

ANDRITZ benefits immensely from its deeply entrenched customer relationships, often spanning decades with major industrial players. This loyalty, built on a global reputation for exceptional reliability and consistent quality, acts as a significant barrier. For instance, securing a contract with a major pulp and paper mill, a core market for ANDRITZ, involves rigorous vetting and a proven history of performance, which new entrants simply haven't accumulated.

Newcomers would struggle to replicate this trust and would face immense hurdles in even getting a foot in the door for large-scale projects. Competing against ANDRITZ’s established track record and the inherent risk aversion of large industrial clients means new entrants must offer a demonstrably superior value proposition or a significantly lower price point, both of which are difficult to achieve from the outset.

Regulatory Hurdles and Compliance Complexity

The industries ANDRITZ operates in, such as hydropower and pulp & paper, are heavily regulated. For instance, in 2024, the global pulp and paper market faced increasing scrutiny regarding sustainable forestry practices and emissions, with new entrants needing to comply with evolving environmental standards. This regulatory complexity acts as a significant barrier, requiring substantial investment in compliance and certification processes before a new player can even begin operations.

Navigating these intricate regulatory landscapes, which often include regional and international environmental protection laws, safety protocols, and operational permits, poses a substantial challenge. For example, obtaining the necessary approvals for a new hydropower project can take several years and involve extensive environmental impact assessments, a process that new entrants must meticulously manage. This adds considerable cost and time to market entry, deterring potential competitors.

- Stringent Environmental Regulations: Industries like pulp & paper and hydropower demand adherence to strict emissions and waste management standards, increasing operational costs for newcomers.

- Complex Safety Protocols: High-risk operations require new entrants to invest heavily in safety training, equipment, and compliance, often exceeding the capabilities of smaller firms.

- Certification Requirements: Obtaining industry-specific certifications, crucial for market access and credibility, involves lengthy and costly approval processes for new companies.

- Permitting Delays: Securing necessary operating permits for large-scale projects, particularly in infrastructure-heavy sectors, can extend market entry timelines significantly, adding to financial strain.

Global Presence and Service Network

ANDRITZ's formidable global presence, boasting over 280 locations worldwide as of early 2024, and its extensive service network present a substantial barrier to new entrants. Establishing a comparable infrastructure, capable of delivering responsive and localized support across diverse geographical markets, requires immense capital investment and time. This widespread operational footprint and established service capability significantly raise the cost and complexity for any potential competitor seeking to enter ANDRITZ's operating arenas.

The threat of new entrants is therefore mitigated by the sheer scale and established nature of ANDRITZ's global operations. Replicating a service network that spans continents, offering timely maintenance, spare parts, and technical expertise, is a daunting task for newcomers. This advantage is further underscored by ANDRITZ's commitment to customer proximity, a key factor in securing and retaining long-term service contracts, which are crucial for profitability in many of their industrial sectors.

The threat of new entrants for Andritz is low due to the massive capital requirements, deep technological expertise, and established customer relationships. Industries like pulp & paper and hydropower demand billions in investment and highly specialized skills, making market entry prohibitively expensive for newcomers. Furthermore, Andritz's global service network and decades-long client trust create significant barriers.

| Barrier Type | Description | Impact on New Entrants |

| Capital Requirements | Building world-class manufacturing and R&D facilities for sectors like pulp & paper can cost over $1 billion. | Extremely High |

| Technological Expertise | Mastering specialized engineering and proprietary technologies in hydropower and metals is complex and costly. | High |

| Customer Loyalty | Decades-long relationships built on reliability in core markets like pulp & paper are hard to replicate. | High |

| Regulatory Environment | Navigating stringent environmental and safety regulations, including lengthy permitting processes, deters new players. | High |

| Global Service Network | Establishing a comparable worldwide service and support infrastructure demands immense investment and time. | High |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis for Andritz leverages data from company annual reports, investor presentations, and industry-specific market research from firms like Mordor Intelligence and Fitch Ratings. We also incorporate insights from financial news outlets and competitor press releases to provide a comprehensive view of the competitive landscape.