Andritz Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Andritz Bundle

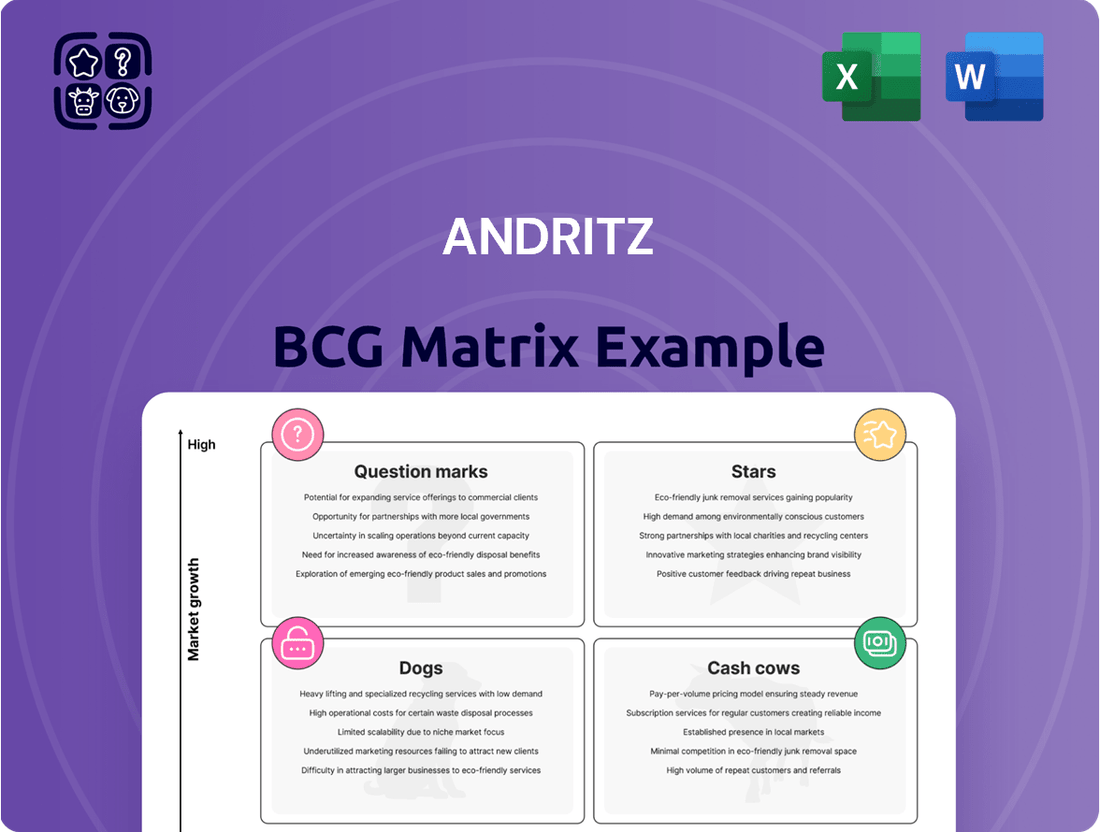

Uncover the strategic positioning of Andritz's product portfolio with our comprehensive BCG Matrix analysis. Understand which of their offerings are driving growth and which require careful consideration. This preview offers a glimpse into the core of their market strategy.

Dive deeper into this company’s BCG Matrix and gain a clear view of where its products stand—Stars, Cash Cows, Dogs, or Question Marks. Purchase the full version for a complete breakdown and strategic insights you can act on.

Stars

Andritz's hydropower segment is experiencing robust expansion, with order intake jumping by over 72% in the first half of 2025. This surge is largely fueled by significant investments in plant modernizations and new pumped storage facilities across Asia. Two substantial projects in India are particularly noteworthy, underscoring the growing global need for renewable energy and enhanced grid reliability.

Andritz is a major player in the rapidly growing green hydrogen market, offering comprehensive Power-to-X (P2X) solutions. This positions them well within the expanding energy transition landscape.

The company's commitment is evident through securing significant projects, like the 100 MW green hydrogen plant's authority engineering in Rostock, Germany. This project is a crucial component of Europe's Hydrogen Backbone initiative.

By focusing on green hydrogen, Andritz is strategically placed in a high-growth sector, signaling strong potential for future development and market penetration.

As the global push for decarbonization intensifies, Andritz's carbon capture technologies are positioning themselves as a star performer within its portfolio. The company is actively engaged in crucial front-end engineering design (FEED) studies for substantial carbon capture installations. This includes work on waste-to-energy facilities in Finland and a significant pre-engineering order for a carbon capture plant in Aarhus, Denmark, directly addressing the escalating demand for industrial emission reduction solutions.

Metals Processing for Electrification

Andritz's Metals Processing segment is a key driver of growth, especially with substantial order intake from China and the USA. This surge is directly linked to the global push for electrification.

The demand for specialized materials like high-end silicon steel, crucial for electric vehicles and power grids, is skyrocketing. This positions Metals Processing as a high-potential area within Andritz's portfolio.

- Metals Processing Order Intake: Andritz reported a significant increase in orders for its Metals Processing division in 2024, largely from major projects in China and the United States.

- Electrification Demand: The growth is directly attributable to the escalating need for advanced materials, such as high-grade silicon steel, essential for the manufacturing of electric vehicles and renewable energy infrastructure.

- Market Position: This segment represents a strong growth niche, capitalizing on the transformative shift towards electric mobility and sustainable power solutions.

Sustainable Nonwoven Applications

Andritz Nonwoven & Textile is strategically positioning itself in the sustainable nonwoven market, emphasizing advanced solutions for bio-wipes, flushable wipes, and Dry Molded Fiber technology. This focus aligns with a significant global trend towards eco-friendly products. For instance, the global nonwovens market was valued at approximately USD 130 billion in 2023 and is projected to grow substantially, with sustainability being a key driver.

The company's recent acquisition of Dan-Web further strengthens its capabilities in this expanding sector, particularly in offering environmentally conscious hygiene and packaging alternatives. This move allows Andritz to tap into the increasing consumer and regulatory pressure for greener materials. The market for sustainable hygiene products alone is experiencing robust growth, with many regions seeing double-digit percentage increases in demand for biodegradable and compostable options.

Andritz is well-equipped to capitalize on the rising demand for sustainable hygiene and packaging solutions. Their investment in technologies like Dry Molded Fiber, which reduces water usage and offers a biodegradable alternative to traditional plastics in packaging, directly addresses these market needs. The global market for molded fiber packaging is expected to reach over USD 40 billion by 2028, underscoring the significant opportunity.

Key areas of focus for Andritz in sustainable nonwovens include:

- Development of bio-based and biodegradable materials for wipes and hygiene products.

- Advancement of flushable nonwoven technologies to reduce environmental impact from wastewater systems.

- Expansion of Dry Molded Fiber (DMF) solutions for sustainable packaging applications.

- Leveraging acquisitions to broaden their portfolio and market reach in eco-friendly nonwoven segments.

Andritz's advancements in carbon capture technologies position this segment as a star performer. The company is actively involved in front-end engineering design studies for significant carbon capture installations, including waste-to-energy facilities in Finland and a pre-engineering order for a plant in Denmark. This focus directly addresses the growing global imperative to reduce industrial emissions.

The Metals Processing segment is also a strong contender, driven by increased order intake from China and the USA. This growth is directly linked to the global electrification trend and the rising demand for specialized materials like silicon steel for electric vehicles and power grids. This segment is a high-potential area, capitalizing on the shift towards electric mobility and sustainable energy solutions.

The company's strategic focus on sustainable nonwovens, including bio-wipes and Dry Molded Fiber technology, places it in a high-growth market. The global nonwovens market was valued at approximately USD 130 billion in 2023, with sustainability being a key growth driver. Andritz's acquisition of Dan-Web further strengthens its position in this environmentally conscious sector.

Andritz's hydropower segment is also a star, with order intake surging by over 72% in the first half of 2025, largely due to modernization projects and new pumped storage facilities, particularly in Asia. This reflects the increasing global demand for renewable energy and improved grid stability.

What is included in the product

Strategic guidance for optimizing a company's product portfolio based on market growth and share.

Identifies Stars, Cash Cows, Question Marks, and Dogs to inform investment and divestment decisions.

The Andritz BCG Matrix offers a clear, visual representation of business unit performance, alleviating the pain of strategic uncertainty.

Cash Cows

Andritz's global service business is a prime example of a cash cow, consistently contributing a significant portion of the company's revenue. In the second quarter of 2025, this segment reached an impressive all-time high, accounting for 44% of total revenue.

This robust performance is driven by the stable and recurring nature of service income, which spans across all of Andritz's diverse business areas. This predictability is crucial for maintaining healthy profit margins and provides a vital buffer against the inherent volatility often seen in capital equipment sales.

The strong and dependable earnings from the service division are instrumental in underpinning Andritz's overall financial stability. It effectively smooths out the cyclical ups and downs of project-based capital sales, thereby bolstering the company's long-term profitability and resilience in the market.

Andritz's established hydropower plant maintenance and rehabilitation services are a prime example of a Cash Cow. This segment benefits from a mature market and a substantial installed base of equipment globally, ensuring consistent demand for upgrades and servicing.

These long-term service agreements and modernization projects are characterized by high margins and predictable, recurring revenue streams, contributing significantly to Andritz's stable cash flow. In 2023, Andritz reported a strong order intake in its Hydro division, reflecting the ongoing need for maintaining and enhancing existing hydropower assets.

Andritz's traditional pulp & paper equipment, while facing some order volatility, represents a stable cash cow. The company's leadership in plant solutions for pulp, paper, board, and tissue production ensures consistent demand, especially for modernization and efficiency upgrades in existing mills.

This segment benefits from the ongoing need for operational improvements in established paper facilities, generating a reliable cash flow for Andritz. For instance, in 2023, Andritz reported a significant order intake in its Pulp & Paper segment, underscoring the continued relevance of its core offerings.

Mature Metals Industry Equipment

Andritz is a major player in the metals industry, supplying essential equipment for steel and metal processing. This sector, while not experiencing rapid growth, represents a stable market for the company.

The mature metals industry equipment segment functions as a Cash Cow for Andritz. Its established technologies and consistent demand from customers for maintenance and upgrades ensure steady revenue streams.

- Established Market Position: Andritz holds a significant market share in supplying equipment for traditional metals processing, leveraging its long-standing reputation and customer relationships.

- Consistent Cash Generation: The mature nature of the industry means customers have ongoing needs for spare parts, maintenance, and upgrades to existing machinery, providing a reliable source of income.

- Limited Investment Needs: While innovation occurs, the core technologies are well-understood, requiring less aggressive R&D investment compared to high-growth sectors, thus maximizing cash flow.

- 2024 Outlook: The global steel production is projected to remain relatively stable in 2024, with demand driven by infrastructure and construction, supporting Andritz's cash cow position in this segment.

Standard Separation Technologies

Andritz's Standard Separation Technologies, a cornerstone of their offerings, represent mature yet vital solutions within the BCG matrix. With over 150 years of expertise, Andritz provides a broad array of mechanical and thermal separation equipment, including screening, dewatering, and filtration systems. These technologies are fundamental across numerous industrial sectors, ensuring consistent demand and stable revenue streams.

The extensive market penetration and long-standing reliability of these standard separation solutions position them as reliable cash cows for Andritz. Their widespread adoption in industries such as pulp and paper, mining, and municipal wastewater treatment highlights their indispensable nature. For instance, in 2023, the pulp and paper sector, a major user of dewatering technologies, saw global production reach approximately 420 million metric tons, underscoring the continued need for efficient separation processes.

- Market Dominance: Andritz's long history and comprehensive portfolio in screening, dewatering, and filtration solidify their leading position in these foundational separation technologies.

- Stable Revenue: The essential nature of these solutions across diverse industries like pulp and paper, mining, and wastewater treatment guarantees a consistent and predictable cash flow.

- Industry Reliance: With over 150 years of experience, Andritz's separation technologies are trusted staples in industrial processes, ensuring ongoing demand and profitability.

- Global Impact: The widespread application of these technologies in managing resources and waste globally contributes to their status as a reliable cash-generating business segment.

Andritz's global service business, particularly in hydropower maintenance and modernization, acts as a robust cash cow. This segment, which represented 44% of total revenue in Q2 2025, benefits from a mature market and a substantial installed base, ensuring consistent demand for upgrades and servicing.

The metals industry equipment segment also functions as a cash cow for Andritz. With stable demand for maintenance and upgrades in the mature metals processing sector, this area provides steady revenue streams. Global steel production is projected to remain stable in 2024, supporting this segment's consistent cash generation.

Similarly, Andritz's standard separation technologies, like screening and dewatering, are well-established cash cows. Their essential nature across industries such as pulp and paper and mining guarantees predictable cash flow, with the pulp and paper sector alone producing around 420 million metric tons in 2023.

| Segment | BCG Classification | Key Characteristics | 2024/2025 Data Point |

| Global Service Business (Hydropower) | Cash Cow | Mature market, recurring revenue, high margins | 44% of total revenue (Q2 2025) |

| Metals Industry Equipment | Cash Cow | Stable demand, established technologies, ongoing maintenance needs | Projected stable global steel production in 2024 |

| Standard Separation Technologies | Cash Cow | Essential across industries, consistent demand, long-standing reliability | Pulp & Paper production ~420 million metric tons (2023) |

Full Transparency, Always

Andritz BCG Matrix

The preview you are seeing is the identical Andritz BCG Matrix document you will receive immediately after your purchase. This means you're getting the complete, unwatermarked, and fully formatted report, ready for immediate strategic application without any hidden surprises or demo content.

Dogs

Andritz's strategic direction prioritizes sustainable and efficient technologies. Consequently, older, less energy-efficient, or environmentally impactful solutions that haven't been modernized or retired are likely experiencing reduced market interest. These legacy products typically occupy a small portion of a contracting market, positioning them for potential divestment or substantial strategic reassessment.

Outdated spare parts and components for discontinued Andritz lines fall into the Dogs category of the BCG Matrix. As newer technologies emerge and older machinery is phased out, the market demand for these specific parts shrinks considerably. This creates a situation where maintaining inventory and providing support for these declining product lines becomes a significant cost with minimal revenue generation, signaling a low-growth, low-profitability segment.

Within Andritz's portfolio, certain segments within Pulp & Paper and Metals capital sales have been particularly susceptible to the economic headwinds of 2024. These areas experienced revenue declines due to weaker market demand. For instance, if specific product lines or geographical markets within Pulp & Paper continue to show persistently low order intake and revenue, even with broader market stabilization, they would fit this category.

Similarly, in the Metals sector, if certain niche capital equipment sales or specific regions continue to underperform without a clear path to recovery or new strategic drivers, these would represent segments heavily impacted. For example, a decline in orders for specialized rolling mills in a region facing prolonged industrial slowdown would exemplify such a situation, indicating a lack of immediate rebound potential.

Non-Strategic, Niche Product Lines with Limited Scalability

Andritz's strategic focus on decarbonization, digitalization, and service expansion means that highly specialized, small-scale product lines with limited scalability may not align with these core growth drivers. Such offerings, if they exist and do not contribute significantly to these pillars, could be categorized as Dogs in the BCG Matrix. Continued investment in these areas might offer minimal strategic or financial returns compared to more promising ventures.

For instance, if Andritz had a niche product line for a rapidly declining traditional industry, it might be considered a Dog. In 2024, Andritz reported a significant increase in its order intake, reaching €11.2 billion, indicating strong performance in its core strategic areas. This highlights the importance of aligning product portfolios with overarching growth strategies.

- Limited Alignment with Growth Pillars: Product lines that do not directly support decarbonization, digitalization, or service expansion initiatives.

- Low Scalability Potential: Offerings with inherent limitations in market reach or production volume growth.

- Minimal Strategic Contribution: Products that do not enhance Andritz's competitive positioning or future market opportunities.

- Suboptimal Resource Allocation: Continued investment in such products may divert resources from more strategically vital and profitable areas.

Underperforming Regional Operations or Joint Ventures

Underperforming regional operations or joint ventures within a global entity like Andritz, while not always publicly detailed, can represent a significant challenge. These units, especially if situated in markets experiencing low growth and lacking a distinct competitive edge, may drain valuable resources without yielding proportionate returns. For instance, if a specific regional division saw its revenue growth stagnate at 2% in 2024, significantly below the company's overall growth target of 5%, it would highlight such an issue.

Such underperforming segments would typically fall into the 'Dog' category of the BCG Matrix. This classification signifies low market share in a low-growth industry. The strategic implication is a need for careful assessment.

- Low Market Share: These operations often possess a minimal share of their respective regional markets.

- Low Market Growth: They are typically found in industries or geographical areas that are not expanding rapidly.

- Resource Drain: They can consume capital and management attention without generating substantial profits or growth.

- Re-evaluation or Divestment: The recommended strategy is often to either revitalize these operations or consider exiting them to reallocate resources more effectively.

Dogs within Andritz's portfolio are product lines or business units that have low market share in low-growth markets. These segments often require significant resources but yield minimal returns, making them candidates for divestment or careful restructuring. For example, a niche product serving a declining industrial sector would fit this description.

In 2024, while Andritz saw robust overall order intake of €11.2 billion, certain legacy product lines or underperforming regional operations might still exhibit characteristics of Dogs. These could include older technologies with diminishing demand or specific geographical segments facing prolonged economic stagnation.

The strategic implication for these Dog segments is to either revitalize them by aligning them with new growth drivers like decarbonization or digitalization, or to divest them to reallocate capital and management focus to more promising areas.

Consider a hypothetical scenario where a specific type of older machinery for a traditional manufacturing process, experiencing a 3% annual market decline, is still part of Andritz's offerings. If this product line holds only a 2% market share, it would clearly fall into the Dog category, representing a drain on resources with limited future potential.

Question Marks

Andritz is expanding its Power-to-X portfolio beyond green hydrogen to include e-methanol and e-ammonia production solutions. These sectors represent significant growth opportunities as industries seek sustainable alternatives to traditional fuels, with the global e-methanol market projected to reach billions by the late 2020s. Andritz’s early-stage involvement means its current market share is minimal, necessitating considerable investment to establish a strong foothold.

Andritz's Metris platform represents a significant play in the AI-driven autonomous plant systems sector, aligning with their strategy to boost operational efficiency and achieve autonomous pulp mills. This positions Metris as a potential star in the BCG matrix, given the high-growth, albeit nascent, market for such advanced industrial automation.

While Andritz is an innovator, the early stage of the autonomous plant market means substantial R&D investment and market penetration efforts are crucial for solidifying market share. The global industrial automation market is projected to reach over $300 billion by 2027, with AI-driven solutions representing a rapidly expanding segment.

Andritz is actively developing advanced industrial waste recycling technologies, exemplified by their investment in a pilot line for diaper waste recycling and broader waste-to-value solutions. This strategic focus taps into a rapidly expanding market fueled by the global push for circular economy principles and the escalating need for effective waste management.

These innovative recycling solutions are positioned to capitalize on a high-growth sector. For instance, the global waste management market was valued at approximately $1.6 trillion in 2023 and is projected to reach over $2.1 trillion by 2030, indicating substantial opportunity. Andritz's commitment to these areas aligns with this trend, addressing increasing waste challenges with sophisticated technological approaches.

While the potential is significant, Andritz's market share in these specialized and emerging recycling niches is likely still developing. This necessitates considerable market development efforts to establish a strong foothold and drive adoption of these advanced technologies.

Novel Bio-based Material Production Technologies

Andritz is pioneering novel bio-based material production technologies by repurposing horticultural substrates into sustainable wood fiber products. This strategic move leverages their established wood processing expertise for a burgeoning market focused on environmental responsibility and renewable materials.

This innovation positions Andritz in a niche but expanding sector, fueled by increasingly stringent environmental regulations and a rising consumer and industrial demand for eco-friendly alternatives. The company is actively building its footprint in this developing market.

- Market Entry: Andritz's venture into bio-based materials from horticultural substrates marks a new application for their core wood processing technologies.

- Sustainability Focus: The initiative aligns with global trends prioritizing renewable resources and circular economy principles, a key driver for market growth.

- Growth Potential: While currently a developing market, the demand for sustainable alternatives suggests significant future expansion opportunities for these bio-based materials.

- Technological Adaptation: Andritz's success hinges on its ability to adapt and optimize its existing wood processing machinery for these novel feedstocks.

New Applications in Alternative Protein Production

Andritz Separation has strategically partnered to offer advanced technologies for the burgeoning alternative protein market. This sector is experiencing significant growth, fueled by increasing global food security needs and a strong push for sustainability. For instance, the global plant-based meat market alone was valued at approximately USD 7.5 billion in 2023 and is projected to reach over USD 30 billion by 2030, demonstrating the immense potential.

As a relatively new entrant, Andritz's market share in this dynamic field is likely nascent. This presents a classic scenario for a question mark in a BCG matrix, indicating a need for substantial investment to capture a meaningful position in this high-growth, but currently low-share, segment.

- Market Entry: Andritz's recent strategic partnerships signal a focused effort to penetrate the alternative protein sector.

- Growth Potential: The alternative protein industry is a high-growth area, with projections indicating continued rapid expansion driven by consumer demand and environmental concerns.

- Investment Requirement: Significant capital investment will be crucial for Andritz to establish a strong market presence and compete effectively in this emerging market.

- Strategic Focus: This venture represents a strategic move to diversify and capitalize on future food production trends.

The alternative protein market represents a significant growth opportunity for Andritz, driven by global food security and sustainability trends. The plant-based meat market alone is expected to surge from approximately USD 7.5 billion in 2023 to over USD 30 billion by 2030.

Andritz's involvement in this sector, through strategic partnerships, positions them as a new entrant with a nascent market share. This characteristic places their alternative protein ventures firmly in the question mark category of the BCG matrix.

Significant investment is required to build market presence and compete effectively in this rapidly expanding, yet currently low-share, segment. This strategic focus aims to diversify Andritz's portfolio and capitalize on future food production trends.

| Business Unit | Product/Service | Market Growth | Market Share | BCG Category |

| Separation Technology | Alternative Protein Solutions | High | Low | Question Mark |

| Industrial Automation | Metris Platform (AI-driven autonomous systems) | High | Low | Question Mark |

| Power-to-X | e-Methanol & e-Ammonia Production | High | Low | Question Mark |

| Waste Management | Industrial Waste Recycling Technologies | High | Low | Question Mark |

| Bio-based Materials | Horticultural Substrate Repurposing | Medium-High | Low | Question Mark |

BCG Matrix Data Sources

Our Andritz BCG Matrix leverages comprehensive market data, including financial performance, industry growth rates, and competitor analysis, to accurately position business units.