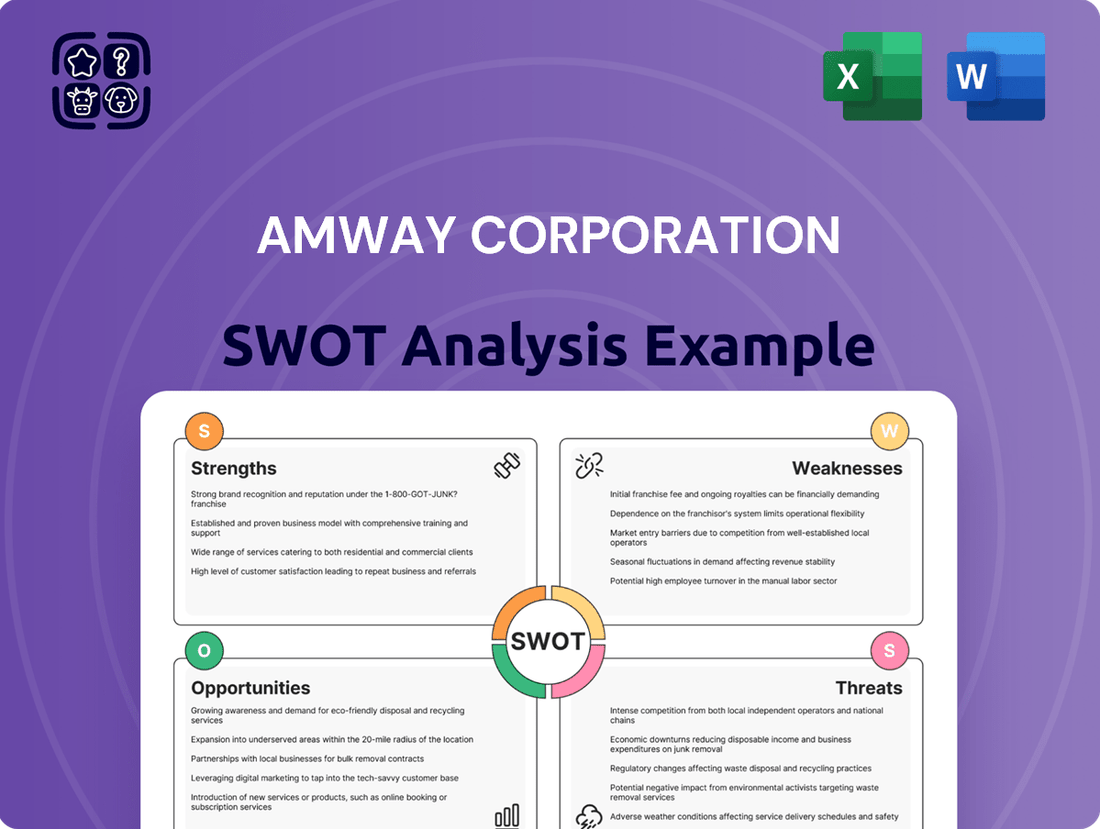

Amway Corporation SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amway Corporation Bundle

Amway's strengths lie in its vast global network and established brand recognition, but it faces challenges with its direct selling model and evolving market dynamics. Understanding these internal capabilities and external pressures is crucial for any stakeholder.

Want the full story behind Amway's strengths, risks, and growth drivers? Purchase the complete SWOT analysis to gain access to a professionally written, fully editable report designed to support planning, pitches, and research.

Strengths

Amway's global presence is a significant strength, with operations in over 100 countries and territories. This extensive international footprint diversifies its market base, mitigating risks associated with economic downturns in any single region. In 2023, Amway reported net sales of $8.4 billion, underscoring its substantial reach and market penetration.

The company's brand recognition is a cornerstone of its success, built over more than six decades. As the world's largest direct selling company, Amway has cultivated strong brand loyalty and trust among consumers and its independent business owners. This established reputation facilitates market entry and customer acquisition in new and existing markets.

Amway boasts a diverse and continuously evolving product portfolio, spanning health, beauty, personal care, and home care. This breadth includes over 115 items, featuring well-established flagship brands such as Nutrilite and Artistry, catering to a wide array of consumer needs.

The nutrition sector, spearheaded by the Nutrilite brand, demonstrated resilience with a 2% growth in 2024. This segment now accounts for a significant 64% of Amway's total global sales, underscoring the company's successful alignment with the increasing consumer demand for health and wellness products.

Amway's extensive Independent Business Owner (IBO) network is a significant strength, boasting over 1 million registered IBOs globally as of early 2024. This vast network, with over 250,000 IBOs in North America alone, forms the backbone of its direct selling model, providing a powerful and widespread distribution channel for its products.

Commitment to Innovation and R&D Investment

Amway is demonstrating a strong commitment to future growth through substantial investments in innovation and research and development. The company is undertaking significant renovations and expansions at its headquarters, focusing on enhancing its manufacturing, quality control, and R&D facilities. This strategic push aims to solidify its competitive edge in the evolving market landscape.

The company has earmarked substantial global investments, exceeding $300 million through 2024, specifically to fuel advancements in key areas. These investments are directed towards bolstering innovation, scientific research, digital technology adoption, and fostering entrepreneurship within the organization. This financial commitment underscores Amway's dedication to staying at the forefront of its industry.

- Significant R&D Investment: Amway is channeling over $300 million globally through 2024 into R&D, innovation, and digital technology.

- Facility Enhancements: Major renovations and expansions are underway at its headquarters to upgrade manufacturing, quality control, and research capabilities.

- Future-Oriented Strategy: These investments reflect a clear strategy to enhance scientific capabilities and foster entrepreneurship for long-term competitive advantage.

Established Legacy and Financial Stability

Amway's established legacy, dating back to its founding in 1959, provides a significant competitive advantage. This long history has allowed the company to cultivate deep market understanding and build a resilient business model capable of navigating diverse economic conditions.

Despite a reported 3% global sales decline to $7.4 billion in 2024, primarily attributed to currency fluctuations like the strong US dollar, Amway's financial stability remains a key strength. The company continues to invest strategically, demonstrating a commitment to future growth and market presence.

- Long-standing Market Presence: Founded in 1959, Amway benefits from decades of operational experience and brand recognition.

- Financial Resilience: While 2024 global sales were $7.4 billion, down 3%, the company's financial structure supports continued strategic investments.

- Brand Trust and Loyalty: The established legacy fosters consumer trust and a loyal distributor network, crucial for direct selling success.

Amway's extensive global reach, operating in over 100 countries, is a significant asset, diversifying its revenue streams and mitigating country-specific economic risks. The company's strong brand recognition, built over decades, fosters considerable consumer loyalty and trust, a critical factor in its direct selling model. Furthermore, Amway's diverse product portfolio, encompassing health, beauty, and home care, caters to a broad consumer base, with its Nutrilite brand alone showing 2% growth in 2024, highlighting its alignment with health and wellness trends.

| Strength | Description | Supporting Data |

|---|---|---|

| Global Presence | Operations in over 100 countries and territories. | Net sales of $8.4 billion in 2023. |

| Brand Recognition | Established over six decades, largest direct selling company. | Cultivated strong brand loyalty and trust. |

| Product Diversity | Health, beauty, personal care, home care. | Over 115 items, including flagship brands like Nutrilite and Artistry. |

| Nutrilite Performance | Key segment in health and wellness. | 2% growth in 2024, accounts for 64% of global sales. |

| IBO Network | Over 1 million registered IBOs globally (early 2024). | Over 250,000 IBOs in North America. |

What is included in the product

Delivers a strategic overview of Amway Corporation’s internal and external business factors, identifying its strong brand recognition and global reach alongside challenges like regulatory scrutiny and evolving sales models.

Uncovers critical market vulnerabilities and competitive advantages to inform Amway's strategic direction.

Identifies internal weaknesses and external opportunities, enabling Amway to proactively address challenges and capitalize on growth.

Weaknesses

Amway's multi-level marketing structure continues to be a significant weakness, often drawing scrutiny and public distrust due to its perceived similarities to pyramid schemes. This persistent negative perception can significantly hinder its ability to attract new distributors and customers, impacting overall sales growth and brand loyalty.

The ongoing debate surrounding the legitimacy of MLMs can create a challenging environment for Amway, potentially affecting its market penetration and the willingness of individuals to associate with the brand. For instance, a 2023 survey indicated that over 40% of consumers express skepticism towards MLM business models, a sentiment that directly impacts Amway's recruitment and sales efforts.

Amway's premium pricing strategy, while aiming for perceived quality, often places its products significantly higher than comparable items from competitors. For instance, while specific comparative pricing fluctuates, general market analysis in 2024 indicates that many direct-selling brands maintain more accessible price points, making Amway's offerings less attractive to a wider demographic seeking value.

This positioning inherently restricts Amway's addressable market, concentrating its appeal on consumers with higher disposable incomes. In a market increasingly sensitive to price, this can lead to a smaller customer base compared to companies that cater to a broader economic spectrum, potentially impacting overall sales volume and market share growth in 2024 and beyond.

Amway's business model hinges heavily on its network of independent distributors, meaning sales and expansion are directly tied to their individual efforts in recruitment and product sales. This creates a vulnerability; if distributor enthusiasm wanes or their sales productivity drops, Amway's overall growth can suffer significantly.

For instance, while Amway reported global net sales of $8.4 billion for 2023, a slight decrease from $8.1 billion in 2022, the performance of this vast distributor network is the primary driver behind these figures. A downturn in distributor engagement, perhaps due to economic pressures impacting their ability to invest time and resources, could lead to further sales volatility.

Limited Traditional Retail Availability

Amway's reliance on its direct selling model, primarily through independent distributors and online channels, significantly limits its presence in traditional retail environments. This absence from brick-and-mortar stores can hinder impulse buys and reduce visibility for consumers accustomed to browsing in physical locations. For instance, while Amway reported global sales of $8.1 billion in 2023, a substantial portion of this revenue is generated outside of conventional retail, indicating a strategic choice but also a potential barrier to wider consumer adoption.

The lack of widespread physical retail availability means Amway misses out on the broad market reach and spontaneous purchasing opportunities that conventional stores offer. This can be a disadvantage when competing with brands that have a strong presence on shelves in supermarkets, pharmacies, or department stores, where a larger segment of the population shops regularly. While Amway's online sales are robust, they don't fully replicate the convenience and discovery associated with in-person retail for many consumers.

This limitation in traditional retail channels can impact Amway's ability to attract new customers who may not be actively seeking out direct sellers or online platforms. The inconvenience of not finding products readily available in familiar retail settings might lead some potential buyers to opt for competitors with more accessible distribution networks.

Vulnerability to Regional Economic Slowdowns

Amway's extensive global reach, while a strength, also exposes it to significant regional economic vulnerabilities. Downturns and inflation in key markets can directly impact sales and profitability. For example, Amway India reported a net loss for the fiscal year 2024, underscoring the challenges faced in certain geographies.

Furthermore, Amway Malaysia experienced a notable sales decline during the same period. These instances highlight how localized economic headwinds can create substantial weaknesses for the corporation, even with its diverse international operations.

- Regional Economic Sensitivity: Amway's financial health is susceptible to localized economic slowdowns and inflationary pressures in its operating countries.

- Impact on Performance: Economic downturns in specific markets, such as the net loss reported by Amway India in FY2024, directly affect the company's overall financial performance.

- Sales Declines: Regional economic challenges can lead to reduced consumer spending, resulting in sales declines, as observed with Amway Malaysia's performance.

Amway's multi-level marketing model, while a core strategy, faces persistent public skepticism and regulatory scrutiny, often drawing comparisons to pyramid schemes. This negative perception can hinder distributor recruitment and customer acquisition, impacting growth. For instance, a 2023 survey indicated over 40% of consumers harbor skepticism towards MLMs, a sentiment that directly affects Amway's outreach efforts.

The company's premium pricing strategy, while aiming for quality, can make its products less accessible to a broader market compared to competitors with more competitive price points. This limits Amway's addressable market to consumers with higher disposable incomes, potentially capping overall sales volume and market share growth in 2024.

Amway's heavy reliance on its independent distributor network creates a significant vulnerability; if distributor engagement or sales productivity declines, the company's overall growth is directly impacted. For example, while Amway reported global net sales of $8.4 billion for 2023, this figure is entirely dependent on the performance of its vast distributor base, which can be affected by economic pressures.

The limited presence in traditional retail environments means Amway misses out on impulse purchases and the broad consumer reach that physical stores offer. While online sales are strong, they don't fully replicate the convenience and discovery associated with in-person retail for many shoppers, potentially hindering adoption by new customer segments.

Amway's global operations expose it to regional economic vulnerabilities; downturns and inflation in key markets can directly impact sales. For example, Amway India reported a net loss for fiscal year 2024, and Amway Malaysia saw a notable sales decline during the same period, illustrating how localized economic headwinds can create substantial weaknesses.

| Weakness Category | Description | Impact | Supporting Data Point (2023/2024) |

|---|---|---|---|

| MLM Perception | Public skepticism and regulatory scrutiny of multi-level marketing models. | Hinders distributor recruitment and customer acquisition. | 40% of consumers express skepticism towards MLMs (2023 survey). |

| Premium Pricing | Higher product prices compared to competitors. | Limits addressable market to higher-income consumers. | General market analysis in 2024 shows many direct-selling brands have more accessible price points. |

| Distributor Reliance | Dependence on independent distributors for sales and growth. | Sales volatility if distributor engagement or productivity drops. | Global net sales of $8.4 billion in 2023 driven by distributor network performance. |

| Limited Retail Presence | Absence from traditional brick-and-mortar retail environments. | Missed opportunities for impulse buys and broad consumer reach. | Global sales of $8.1 billion in 2023 generated outside conventional retail. |

| Regional Economic Sensitivity | Vulnerability to localized economic downturns and inflation. | Direct impact on sales and profitability in specific markets. | Amway India reported a net loss for FY2024; Amway Malaysia saw sales decline in the same period. |

Full Version Awaits

Amway Corporation SWOT Analysis

This preview reflects the real document you'll receive—professional, structured, and ready to use. You’re viewing a live preview of the actual SWOT analysis file for Amway Corporation. The complete version, detailing all strengths, weaknesses, opportunities, and threats, becomes available after checkout.

Opportunities

Emerging economies, especially in the Asia-Pacific region, Latin America, and Africa, offer substantial avenues for Amway's expansion. These markets are experiencing rising disposable incomes, creating a fertile ground for direct selling models. For instance, Amway China saw significant revenue growth in recent years, highlighting the potential in these dynamic regions.

Amway can capitalize on the accelerated digital transformation by investing more in its e-commerce platforms and digital marketing. This move is crucial for reaching younger, tech-savvy consumers who increasingly prefer online shopping. In 2024, global e-commerce sales are projected to reach over $6.3 trillion, highlighting the immense potential for Amway to expand its reach.

The widespread adoption of digital tools and social media for product promotion and recruitment presents a significant opportunity for market growth. Amway's independent business owners (IBOs) can leverage these platforms to connect with a broader audience, fostering community and driving sales. For instance, social commerce, which integrates shopping directly into social media feeds, is expected to grow substantially in the coming years.

Amway is well-positioned to leverage the growing consumer interest in health and wellness, particularly within its robust nutrition segment. The company can further capitalize on this trend by innovating with science-backed products that address emerging areas like gut health and holistic wellbeing, thereby attracting a wider audience seeking comprehensive wellness solutions.

Leveraging Advanced Technologies like AI and Metaverse

Amway can capitalize on the direct selling industry's growing AI integration for lead generation and sales optimization. For instance, AI-powered tools can analyze customer data to identify high-potential leads, personalize sales pitches, and automate routine customer service inquiries, thereby boosting distributor effectiveness.

The metaverse presents a novel opportunity for Amway to create engaging virtual experiences, such as product launches, training sessions, and social gatherings for its distributors and customers. This immersive approach can foster a stronger sense of community and provide unique interaction channels, potentially increasing engagement and sales.

By embracing these advanced technologies, Amway can enhance its operational efficiency and explore new, dynamic avenues for market penetration and customer relationship building.

- AI-driven lead scoring: Identifying and prioritizing the most promising customer prospects for distributors.

- Metaverse virtual events: Hosting immersive product showcases and distributor training sessions.

- Personalized customer engagement: Utilizing AI to tailor communication and offers to individual preferences.

Strategic Partnerships to Enhance Credibility and Reach

Amway can significantly boost its reputation and customer base by forming strategic partnerships. Collaborating with established local businesses, respected health experts, popular beauty salons, and influential social media personalities can lend substantial credibility to Amway's product lines. These alliances also serve as a powerful avenue to introduce Amway's offerings to entirely new demographics and reinforce consumer trust in the brand.

For instance, in 2024, influencer marketing continued to be a dominant force, with studies showing that 70% of consumers trust influencer recommendations over traditional advertising. By partnering with micro-influencers who have highly engaged niche audiences, Amway could tap into specific consumer groups with greater authenticity. Imagine a partnership with a well-regarded nutritionist to endorse Amway's health supplements or a collaboration with a popular beauty blogger to showcase their skincare range, reaching millions of potential new customers.

- Enhanced Product Endorsement: Collaborations with health experts and beauty professionals can validate product efficacy.

- Expanded Market Access: Partnerships with local businesses and influencers introduce Amway to new customer segments.

- Increased Brand Trust: Aligning with credible entities builds consumer confidence and brand loyalty.

- Digital Reach Amplification: Leveraging influencer platforms can significantly broaden Amway's online presence and engagement metrics.

Amway can leverage the growing global demand for health and wellness products, a sector projected to reach significant market value by 2025. Its established nutrition and beauty lines are well-positioned to capture this trend, with opportunities for product innovation in areas like personalized nutrition and sustainable beauty. For instance, the global wellness market was valued at over $4.5 trillion in 2022, with continued strong growth anticipated.

Expanding into emerging markets, particularly in Asia and Africa, presents a substantial growth opportunity for Amway. These regions often have a strong culture of direct selling and a growing middle class with increasing disposable income. Amway China, for example, has consistently been a major revenue driver, demonstrating the potential in these dynamic economies.

The company can further capitalize on the digital transformation by enhancing its e-commerce capabilities and digital marketing strategies. This includes leveraging social commerce and influencer marketing to reach younger demographics. Global e-commerce sales are expected to surpass $6.3 trillion in 2024, underscoring the importance of a robust online presence.

Strategic partnerships with local businesses, health experts, and social media influencers can significantly boost Amway's brand credibility and market reach. These collaborations can introduce Amway products to new audiences and reinforce trust. Influencer marketing, for example, saw 70% of consumers trusting influencer recommendations in 2024, making it a key channel for growth.

Threats

Amway faces increasing regulatory scrutiny, particularly concerning its multi-level marketing (MLM) model. Proposed Federal Trade Commission (FTC) rules for 2024-2025 aim to enhance income disclosures and prevent pyramid scheme-like operations, directly impacting how Amway must present its business opportunity. Failure to comply with these evolving regulations could lead to significant penalties and operational disruptions.

The legal landscape for MLMs is dynamic, and adverse legal judgments or new legislation could pose a substantial threat to Amway's established business practices. For instance, past lawsuits have scrutinized distributor compensation structures, and any future unfavorable rulings could necessitate costly adjustments to its operational framework and marketing strategies, potentially affecting its global market presence.

Amway navigates a fiercely competitive landscape, grappling with established direct-selling rivals such as Herbalife and Mary Kay. Beyond these, traditional fast-moving consumer goods (FMCG) companies and budget-friendly alternatives present significant challenges. For instance, the global direct selling market was valued at approximately $175 billion in 2023, a segment Amway operates within, highlighting the sheer volume of players vying for consumer attention and spend.

The market is characterized by numerous products with minimal switching costs, making it difficult for Amway to maintain customer loyalty and secure its market share. This ease of transition for consumers to alternative brands means Amway must constantly innovate and provide compelling value propositions to retain its customer base amidst this intense rivalry.

Consumers increasingly prioritize transparency, ethical sourcing, and sustainability, pushing companies like Amway to adapt. For instance, a 2024 survey indicated that over 60% of consumers consider a brand's environmental impact when making purchasing decisions. This trend necessitates Amway continually evolving its product lines and operational transparency to meet these shifting expectations.

Negative publicity, particularly concerning pyramid scheme accusations that have historically shadowed direct selling models, can significantly impact consumer and potential Independent Business Owner (IBO) acquisition. In 2024, social media sentiment analysis revealed that discussions around Amway's business model often included concerns about income disclosure and recruitment practices, highlighting the ongoing challenge of maintaining a positive public perception.

Economic Volatility and Inflationary Pressures Impacting Consumer Spending

Global economic instability, including factors like geopolitical tensions and supply chain disruptions, can significantly dampen consumer confidence. This uncertainty, combined with persistent inflationary pressures, directly erodes purchasing power, making consumers more cautious about discretionary spending, particularly on premium-priced goods.

The rising cost of living, driven by inflation, forces consumers to prioritize essential purchases over non-essential items. This shift in consumer behavior can lead them to seek out more budget-friendly alternatives to Amway's product portfolio, potentially impacting sales volume and market share.

- Inflationary Impact: In early 2024, global inflation rates, while showing some moderation from 2023 peaks, remained elevated in many key markets, impacting disposable income. For instance, the US CPI averaged around 3.1% in the first quarter of 2024, a notable increase from historical norms.

- Consumer Spending Trends: Reports from Q1 2024 indicated a slowdown in consumer spending growth in several developed economies, with a noticeable preference for value-oriented products and services. This trend directly challenges companies offering higher-priced, premium goods.

- Competitive Landscape: The economic climate intensifies competition from lower-cost brands and private-label products, forcing consumers to make difficult choices regarding their expenditures.

Challenges in IBO Recruitment and Retention due to Gig Economy Competition

The burgeoning gig economy, with platforms like Upwork and Fiverr, presents a significant challenge to Amway's Independent Business Owner (IBO) model. These platforms offer immediate income potential and flexible work arrangements, directly competing for individuals seeking supplemental earnings or entrepreneurial ventures. This shift makes it harder for Amway to attract and keep new IBOs who might find the established, often slower, growth path less appealing compared to the instant gratification offered by gig work.

Creator commerce, a rapidly expanding sector, further siphons off entrepreneurial talent. By 2024, the creator economy was projected to reach $250 billion globally, offering individuals direct monetization of their content and influence. This trend directly challenges the traditional MLM value proposition of building a business and earning through sales and recruitment, as creators can often achieve financial independence and flexibility more rapidly.

Amway's recruitment and retention efforts are consequently impacted as potential IBOs weigh the perceived benefits of the gig economy against the MLM structure. The allure of immediate project-based income and the direct control offered by gig platforms can overshadow the long-term potential of building an Amway business, leading to a more competitive landscape for acquiring and maintaining a dedicated sales force.

The competition for entrepreneurial talent is fierce. For instance, by early 2025, over 60 million Americans were estimated to be engaged in some form of gig work. This substantial pool of individuals actively seeking flexible income streams means Amway must continually adapt its recruitment strategies and highlight the unique long-term benefits of its business model to stand out.

Amway faces significant threats from evolving regulatory environments, particularly concerning its multi-level marketing (MLM) structure. Proposed FTC rules for 2024-2025 aim to increase income disclosure requirements and curb pyramid scheme-like operations, potentially forcing costly adjustments. Adverse legal judgments or new legislation could also necessitate fundamental changes to its compensation and marketing strategies, impacting its global operations.

The competitive landscape is intensifying, with both established direct-selling rivals and traditional FMCG companies vying for market share. In 2023, the global direct selling market was valued at approximately $175 billion, underscoring the high level of competition. Furthermore, a 2024 survey revealed that over 60% of consumers consider environmental impact in purchasing decisions, pressuring Amway to enhance its sustainability practices.

Economic instability and inflation pose a considerable threat, reducing consumer purchasing power and discretionary spending. In early 2024, US CPI averaged around 3.1%, impacting disposable incomes. This economic climate also fuels competition from lower-cost brands and private labels, forcing consumers to prioritize value. Consequently, Amway's premium-priced products may see reduced demand.

The rise of the gig economy and creator commerce presents a challenge to Amway's Independent Business Owner (IBO) model by offering more immediate income potential and flexibility. By early 2025, an estimated 60 million Americans were engaged in gig work, directly competing for entrepreneurial talent. The creator economy, projected to reach $250 billion globally by 2024, offers alternative avenues for income generation and entrepreneurship that may appeal more to potential IBOs.

SWOT Analysis Data Sources

This analysis is built upon a foundation of Amway's official financial statements, comprehensive market research reports, and insights from industry experts to provide a thorough and accurate SWOT assessment.