Amway Corporation PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amway Corporation Bundle

Navigate the complex external forces shaping Amway Corporation's future with our comprehensive PESTLE analysis. Understand how political shifts, economic volatility, and evolving social trends present both challenges and opportunities for this direct-selling giant. Gain a competitive edge by leveraging these critical insights.

Unlock actionable intelligence on Amway Corporation's operating environment. Our PESTLE analysis delves into technological advancements, environmental regulations, and legal frameworks impacting the company's strategic decisions. Download the full report to make informed business plans and investment choices.

Political factors

Amway, a global direct selling giant, navigates a complex web of government regulations concerning multi-level marketing (MLM) practices. These regulations, which vary significantly by country, directly influence Amway's operational strategies and its ability to expand into new markets. For instance, in 2024, several countries continued to review or update their MLM laws, with some imposing stricter requirements on recruitment practices and product claims, potentially impacting Amway's revenue streams and sales structures.

Compliance with over 100 different regulatory environments is a constant challenge for Amway. Failure to adhere to these diverse legal frameworks can lead to substantial fines, operational disruptions, and reputational damage. For example, in 2024, regulatory bodies in some Asian markets increased scrutiny on pyramid scheme allegations, prompting Amway to adapt its business models and distributor training programs to ensure alignment with local consumer protection laws.

The dynamic nature of these political factors means Amway must remain agile. Any shifts in government policy, such as increased oversight or outright bans on certain MLM structures, can have a profound impact on Amway's global business. The company's 2024 annual report highlighted ongoing efforts to lobby for clear and fair regulations, recognizing that regulatory uncertainty poses a significant risk to its long-term growth and profitability.

Consumer protection policies are paramount for Amway, particularly given its direct selling structure and product claims. The company actively manages these by offering robust consumer protection programs, like AMWAYPROMISE™, designed to foster trust and ensure compliance with global industry regulations. This proactive stance is crucial as Amway operates in diverse markets, each with its own consumer protection frameworks.

Amway's extensive global footprint, operating in over 100 countries, makes it highly sensitive to shifts in international trade relations and the imposition of tariffs. For instance, the ongoing trade tensions between major economies in 2024 could lead to increased import duties on raw materials or finished products, directly impacting Amway's cost of goods sold and profitability.

Changes in trade agreements, such as the potential renegotiation of existing pacts or the introduction of new ones, can significantly alter market access and operational costs for Amway. These fluctuations can disrupt its carefully managed, globally integrated end-to-end value supply chain, affecting everything from sourcing components to distributing finished goods to its independent distributors.

For example, in 2024, the World Trade Organization (WTO) reported that global trade growth was projected to be modest, highlighting the ongoing uncertainties in international commerce. Amway's ability to navigate these complexities by diversifying its sourcing and manufacturing locations, and by actively monitoring trade policy developments, is critical for maintaining its competitive edge and ensuring supply chain resilience.

Political Stability in Key Markets

Amway's global operations are intrinsically linked to the political stability of its key markets. For instance, in 2024, regions experiencing political unrest, such as certain parts of Eastern Europe and Africa, present significant operational risks, potentially impacting Amway's ability to reliably serve its distributors and customers. The company's reliance on direct selling models means that disruptions to local governance or social order can directly hinder sales activities and supply chain integrity.

Political shifts can also influence regulatory environments, affecting Amway's product approvals, marketing practices, and tax obligations. A 2024 report highlighted that changes in trade policies or import/export regulations in countries like China, a major market for Amway, can create immediate challenges. Amway's strategy of localized product development and distribution requires constant monitoring of these political dynamics to ensure compliance and market access.

- Geopolitical Risk Assessment: Amway continuously assesses geopolitical risks in over 100 countries, with particular attention to nations exhibiting fluctuating political stability in 2024.

- Regulatory Adaptation: The company actively adapts its business models to comply with evolving political and regulatory landscapes, a critical factor in markets like India where policy changes can be frequent.

- Supply Chain Resilience: Political instability in transit countries can disrupt Amway's global supply chain; for example, events in 2024 impacting shipping routes in the Red Sea have necessitated contingency planning.

- Market Access and Growth: Political stability is a prerequisite for sustained growth, with Amway's expansion plans in emerging markets in 2025 contingent on predictable governance and economic policies.

Government Health and Wellness Initiatives

Governments worldwide are placing a heightened emphasis on public health and wellness, a trend that directly impacts companies like Amway. This growing focus creates a fertile ground for Amway's core offerings in nutrition and wellbeing, potentially boosting demand for their products as consumers increasingly seek healthier options. For instance, in 2024, many national health ministries continued to roll out campaigns encouraging balanced diets and regular exercise, directly aligning with Amway's product portfolio.

However, this increased government scrutiny also brings potential challenges. Stricter regulations concerning health claims made about dietary supplements and nutritional products are becoming more common. In the 2024-2025 period, we saw regulatory bodies in several key markets, including the European Union and parts of Asia, review and tighten guidelines on what manufacturers can assert about their products' health benefits, requiring Amway to ensure meticulous compliance.

These governmental initiatives can be viewed through several lenses:

- Opportunity for Growth: Public health campaigns directly support the market for Amway's nutrition, weight management, and sports nutrition products.

- Regulatory Hurdles: Increased oversight on health claims necessitates robust scientific backing and careful marketing practices to avoid penalties.

- Consumer Education: Government-backed wellness programs can inadvertently educate consumers about the importance of supplements, potentially benefiting Amway.

- Market Access: Compliance with evolving health regulations is crucial for maintaining and expanding market access in various countries.

Amway's global operations are significantly shaped by government policies, particularly those concerning direct selling and consumer protection. In 2024, continued regulatory scrutiny in markets like China and India focused on distributor compensation structures and product claims, compelling Amway to adapt its compliance strategies to align with local laws and prevent potential market access issues.

What is included in the product

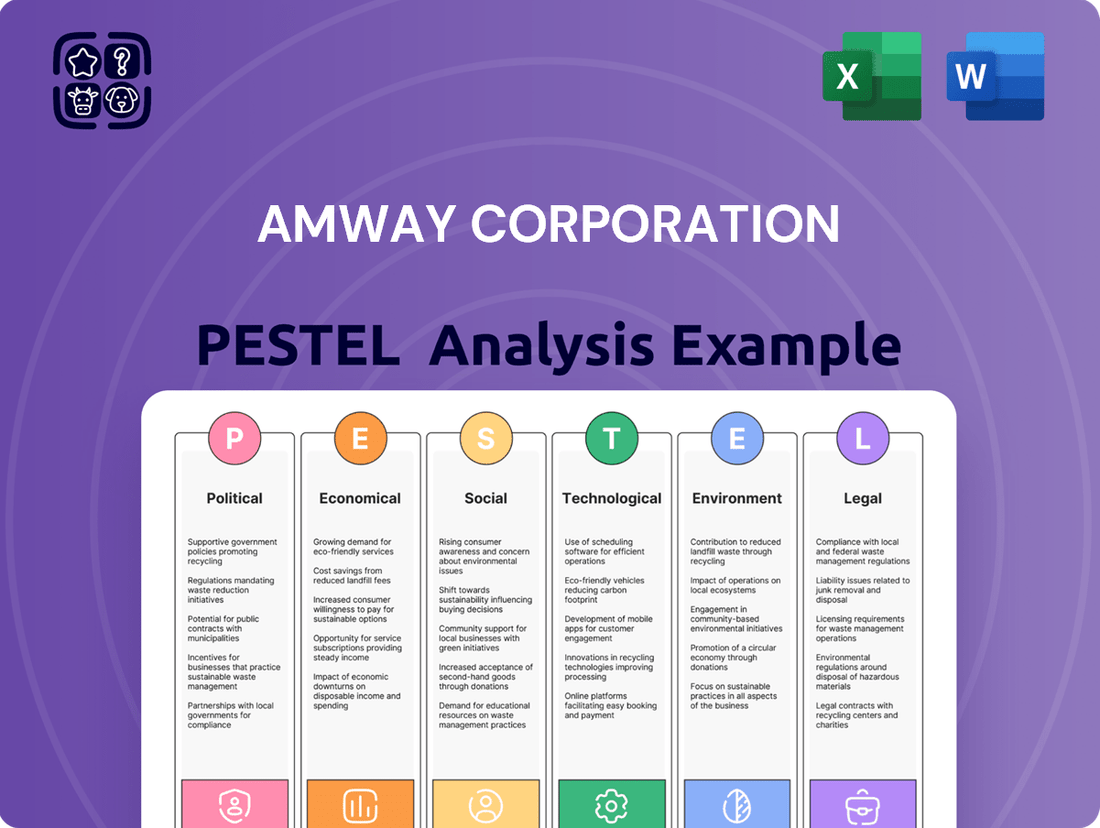

This PESTLE analysis delves into the external macro-environmental forces shaping Amway Corporation's operations, examining Political, Economic, Social, Technological, Environmental, and Legal factors.

It provides a strategic overview for identifying opportunities and navigating challenges within Amway's global marketplace.

A PESTLE analysis for Amway Corporation offers a pain point reliever by providing a clear, summarized version of external factors, simplifying complex market dynamics for easier strategic decision-making.

Economic factors

Amway's sales performance is directly tied to the health of the global economy. In 2024, the company reported sales of $7.4 billion, a 3% dip from the prior year. This decline was partly attributed to a strong US dollar, which impacts international earnings.

Economic slowdowns globally can significantly curb consumer spending, especially on discretionary items like Amway's premium product lines. This economic pressure requires Amway to continually innovate and strategically invest to secure its market standing.

Amway's global operations, spanning over 100 countries, expose its reported revenue to the volatility of currency fluctuations. For instance, the strength of the US dollar in 2024 directly impacted Amway's reported sales figures, highlighting how exchange rate movements can significantly influence financial results when international earnings are converted back to the home currency.

These currency shifts directly affect Amway's profitability on international sales. A stronger US dollar can diminish the value of revenue earned in weaker foreign currencies, thereby reducing the overall profitability when translated back into dollars. This presents a continuous challenge for the company in managing its foreign exchange exposure and maintaining consistent financial performance.

Amway's core strength lies in offering flexible income streams to its Independent Business Owners (IBOs), a model particularly attractive when traditional employment is uncertain. As of early 2024, with persistent inflation and varied global economic recovery, the allure of supplementary or primary income through direct selling and entrepreneurship remains high for many seeking financial independence.

The desire for entrepreneurial ventures, often fueled by economic shifts, directly impacts Amway's recruitment and sales potential. With unemployment rates fluctuating globally, individuals are increasingly exploring alternative income avenues, and Amway's platform provides a readily accessible entry point into building a personal business.

Inflation and Cost of Goods

Inflationary pressures directly impact Amway's operational costs, from sourcing raw materials for its health and beauty products to managing manufacturing and logistics. For instance, the U.S. Consumer Price Index (CPI) saw a notable increase, with annual inflation rates hovering around 3.4% in early 2024, a figure that can significantly elevate Amway's input expenses. This necessitates robust strategies to maintain profitability.

To counteract these rising costs, Amway's investment in its manufacturing and supply chain infrastructure becomes critical. By optimizing these areas, the company aims to mitigate the impact of inflation on its profit margins. This includes efforts to secure stable pricing for key ingredients and streamline distribution networks to reduce transportation expenses, ensuring product quality and availability for its global network of distributors.

The ability to implement effective pricing strategies is also paramount. While Amway aims to absorb some cost increases, passing on the full extent of inflation to consumers can affect sales volume. Balancing cost management with competitive pricing is a key challenge, particularly in markets with varying economic conditions and consumer spending power.

- Rising Input Costs: Inflation in 2024, with the U.S. CPI averaging 3.4%, increases expenses for raw materials, packaging, and energy.

- Supply Chain Resilience: Amway's investments in its global supply chain are designed to buffer against logistical cost volatility and ensure product continuity.

- Pricing Strategy: Balancing price adjustments to cover increased costs while remaining competitive is crucial for Amway's market position.

- Profit Margin Management: Effective cost control and strategic pricing are essential for Amway to maintain healthy profit margins amidst inflationary pressures.

Market Competition in Health, Beauty, and Home Care

Amway navigates a fiercely competitive landscape in health, beauty, and home care. This includes established brick-and-mortar retailers, rapidly growing e-commerce platforms, and a host of other direct selling organizations vying for consumer attention. Despite this intense rivalry, Amway maintained its position as the top direct selling company worldwide in 2024, underscoring its resilience and market penetration.

To stay ahead, Amway prioritizes ongoing product development and adapting to evolving consumer demands. A notable example is the increasing consumer interest in gut health, a trend Amway is actively addressing with new product lines. This strategic focus on innovation and alignment with current market needs is crucial for sustaining its competitive advantage.

- Global Reach: Amway's 2024 ranking as the number one direct selling company highlights its extensive global network and brand recognition.

- Evolving Consumer Needs: The company's investment in areas like gut health demonstrates a proactive approach to capitalizing on emerging consumer trends.

- Multi-Channel Competition: Amway competes not only with direct selling peers but also with traditional retail and burgeoning e-commerce giants.

Economic factors significantly shape Amway's performance, with global economic health directly influencing consumer spending on its product lines. In 2024, Amway reported sales of $7.4 billion, a 3% decrease from the previous year, partly due to a strong U.S. dollar impacting international earnings. This economic sensitivity necessitates continuous innovation and strategic investment to maintain market standing amidst potential slowdowns.

Inflationary pressures, exemplified by the U.S. CPI averaging 3.4% in early 2024, directly increase Amway's operational costs for raw materials, packaging, and energy. The company's investments in supply chain resilience and strategic pricing are crucial for buffering against these rising expenses and maintaining profit margins. Furthermore, the appeal of flexible income streams through Amway's direct selling model remains strong, particularly when traditional employment is uncertain, as individuals seek entrepreneurial opportunities.

Preview the Actual Deliverable

Amway Corporation PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, offering a comprehensive PESTLE analysis of the Amway Corporation. This detailed report covers Political, Economic, Social, Technological, Legal, and Environmental factors impacting Amway's operations and strategy. You'll gain valuable insights into the external forces shaping this global direct selling giant.

Sociological factors

Consumers are increasingly prioritizing health and wellbeing, a trend that directly benefits Amway, whose nutrition products accounted for a substantial 64% of its global sales in 2024. This growing demand fuels Amway's strategic focus and product innovation.

In response to this societal shift, Amway has introduced new offerings such as Morning Nutrition and Gut Health solutions, reflecting a comprehensive approach to wellness. This proactive product development is crucial for capturing market share in this expanding sector.

Public sentiment towards direct selling and multi-level marketing (MLM) models is a dynamic force, impacting Amway's ability to attract new Independent Business Owners (IBOs) and maintain consumer confidence. Surveys in 2024 indicate a growing awareness of both the opportunities and potential pitfalls associated with these business structures.

Amway actively works to cultivate a positive reputation by highlighting its dedication to transparency, robust consumer protection measures, and the promotion of ethical conduct among its IBOs. This commitment is crucial for fostering trust. For instance, Amway's 2024 annual report detailed significant investments in distributor education programs focused on compliance and consumer rights.

Amway's direct selling model is deeply rooted in community and social connection. The company actively cultivates a global network of Independent Business Owners (IBOs) and customers who often form strong bonds, sharing experiences and supporting each other's entrepreneurial journeys. This aligns with a fundamental human desire for belonging and shared purpose, which is a significant sociological trend.

In 2024, Amway reported that over 2 million IBOs across more than 100 countries and territories participate in its network, highlighting the vast scale of these social connections. The company's emphasis on mutual support and personal development within its community structure resonates with a growing societal appreciation for collaborative environments and the pursuit of a better quality of life.

Amway's commitment to corporate social responsibility, including significant volunteerism and charitable giving, further reinforces its community focus. For instance, in 2023, Amway employees and IBOs contributed thousands of volunteer hours to various causes worldwide, demonstrating a dedication to social well-being that complements its business operations and appeals to a society increasingly valuing ethical and community-minded corporations.

Demographic Shifts and Lifestyle Trends

Demographic shifts, such as an aging global population and evolving youth engagement, significantly impact Amway's product demand and its Independent Business Owner (IBO) recruitment strategies. By 2025, the proportion of individuals aged 65 and over is projected to reach approximately 1.1 billion globally, highlighting a substantial market for health and wellness products. This trend is reflected in Amway's portfolio, which increasingly features solutions catering to healthy aging and fitness, addressing the needs of a broad spectrum of age groups.

Amway is also adapting to contemporary lifestyle trends, including a heightened interest in digital interaction and the pursuit of flexible earning opportunities. In 2024, the gig economy continued to expand, with reports indicating that over 60 million Americans participated in some form of freelance or independent work, underscoring the appeal of Amway's direct selling model. The company's emphasis on digital platforms for training, sales, and community building aligns with these evolving consumer preferences.

- Aging Population Growth: Global population aged 65+ expected to exceed 1.1 billion by 2025, driving demand for health and wellness products.

- Digital Engagement: Increasing consumer reliance on digital channels for purchasing and information, necessitating robust online presence for Amway.

- Flexible Work Demand: Growing interest in flexible earning opportunities, a core tenet of Amway's direct selling business model, attracting new IBOs.

- Health and Wellbeing Focus: Continued consumer prioritization of health, fitness, and preventative care, aligning with Amway's product categories.

Ethical Consumerism and Social Responsibility

Consumers are increasingly scrutinizing brands for their ethical practices and commitment to social responsibility. This trend significantly influences purchasing behavior, pushing companies like Amway to demonstrate genuine engagement beyond profit motives.

Amway actively addresses these evolving consumer expectations through various sustainability initiatives, robust community support programs, and dedicated philanthropic efforts. These actions are designed to resonate with a growing segment of the market that values corporate citizenship.

In 2024 alone, Amway's commitment to social responsibility was evident through its significant contributions. The corporation donated over $14 million to various charitable causes, and its employees and Independent Business Owners (IBOs) dedicated substantial volunteer hours to support a wide array of global initiatives.

- Ethical Purchasing Drivers: Growing consumer demand for ethically sourced and produced goods.

- Amway's CSR Focus: Emphasis on sustainability, community engagement, and philanthropy.

- 2024 Corporate Giving: Over $14 million contributed to charitable causes.

- Volunteer Impact: Significant employee and IBO volunteer hours dedicated to global causes.

The increasing global emphasis on health and wellness directly benefits Amway, with nutrition products forming a significant portion of its sales. This trend is amplified by demographic shifts, such as an aging population, which drives demand for health-focused solutions.

Amway's direct selling model taps into the growing desire for flexible work arrangements and community connection. In 2024, over 60 million Americans participated in the gig economy, mirroring the appeal of Amway's Independent Business Owner (IBO) opportunities.

Societal views on direct selling and MLM models are evolving, prompting Amway to focus on transparency and ethical practices. The company's 2024 annual report highlighted investments in distributor education to ensure compliance and consumer protection.

Amway's corporate social responsibility initiatives, including substantial charitable giving and volunteerism, resonate with consumers who prioritize ethical business conduct. In 2024, Amway donated over $14 million to charitable causes, underscoring this commitment.

| Sociological Factor | Impact on Amway | Supporting Data (2024/2025 Projections) |

|---|---|---|

| Health & Wellness Focus | Increased demand for Amway's nutrition and personal care products. | 64% of Amway's global sales in 2024 were from nutrition products. |

| Aging Population | Growing market for anti-aging and health maintenance products. | Global population aged 65+ projected to exceed 1.1 billion by 2025. |

| Flexible Work Demand | Attracts new Independent Business Owners (IBOs) to the direct selling model. | Over 60 million Americans participated in the gig economy in 2024. |

| Ethical Consumerism | Requires Amway to demonstrate strong Corporate Social Responsibility (CSR). | Amway donated over $14 million to charitable causes in 2024. |

Technological factors

Amway is heavily investing in its digital transformation, with a reported significant increase in technology spending for 2024 and projected further growth in 2025 to bolster its e-commerce capabilities. This includes developing intuitive mobile applications and sophisticated online portals designed to equip its Independent Business Owners (IBOs) with robust digital tools.

These digital advancements empower IBOs to conduct their business operations seamlessly from anywhere, facilitating remote management and direct customer engagement through personalized digital storefronts. This strategic focus on technology aims to bridge the gap between traditional offline interactions and online sales channels, thereby elevating the overall customer journey.

Amway's dedication to innovation in product research and development is a significant technological factor. The company holds over 750 patents and pending patents, a testament to its ongoing investment in new ideas, particularly in areas like plant-based nutrition research.

Further bolstering this commitment, Amway has invested more than $120 million in expanding and upgrading its U.S. headquarters. This includes the establishment of a dedicated research center, specifically designed to enhance its capabilities in nutrition innovation, which directly fuels the creation of new and improved product offerings.

Amway is significantly investing in AI and data analytics to refine its operations. This includes offering personalized product recommendations to customers and optimizing marketing campaigns for better reach. By analyzing vast datasets, Amway aims to streamline its supply chain, ensuring products are available efficiently to its network of Independent Business Owners (IBOs).

The core objective behind this technological push is to empower IBOs. By providing them with data-driven insights and personalized tools, Amway seeks to simplify customer acquisition and foster stronger, long-term customer relationships. This focus on efficiency and personalized experiences is crucial for Amway's direct selling model.

Supply Chain Technology and Product Traceability

Amway leverages a sophisticated, globally integrated supply chain, employing technology to seamlessly manage inventory, production, and distribution. This technological backbone is crucial for maintaining operational efficiency and ensuring product availability across its vast network.

The company's commitment to transparency is exemplified by its Nutrilite and Glister brands, which pioneered end-to-end traceability in their manufacturing processes. This allows consumers to follow a product's journey, building trust and confidence.

Supporting this initiative, Amway has implemented new digital tools that offer business owners straightforward access to detailed product traceability information. This empowers distributors with knowledge, enhancing their ability to communicate product value to customers.

- Global Supply Chain Integration: Amway's modern, technology-driven supply chain coordinates global operations.

- Industry-First Traceability: Nutrilite and Glister brands offer end-to-end manufacturing process traceability.

- Enhanced Consumer Transparency: Traceability initiatives build consumer trust and provide product journey insights.

- Digital Tools for Distributors: New platforms grant easy access to product traceability data for business owners.

Social Media and Digital Marketing Tools for IBOs

Amway recognizes the significant influence of social media, integrating platforms like Instagram, Facebook, and TikTok to facilitate IBO engagement with both customers and potential entrepreneurs. This digital strategy allows for the dissemination of compelling content that showcases products and business opportunities.

New IBOs are provided with immediate access to a suite of digital marketing tools. These include personalized web pages and a library of pre-approved digital assets, streamlining their ability to market and sell effectively. This empowers them to cultivate their Amway businesses directly on social media platforms.

- Social Media Reach: Amway IBOs can leverage platforms with billions of active users, such as Facebook (2.9 billion monthly active users as of Q4 2023) and Instagram (over 2 billion monthly active users).

- Digital Asset Library: Amway's repository of approved digital content ensures brand consistency and compliance across all IBO marketing efforts.

- Customizable Web Pages: These tools allow IBOs to create unique online storefronts, enhancing their personal brand and customer interaction.

- IBO Digital Engagement: The focus on digital tools aims to equip IBOs with the necessary resources to build and expand their businesses efficiently in the current online landscape.

Amway's technological investments are central to its 2024-2025 strategy, focusing on digital transformation and AI. The company's increased spending aims to enhance e-commerce platforms and mobile applications, providing Independent Business Owners (IBOs) with advanced digital tools for remote business management and customer engagement.

Product innovation, backed by over 750 patents, is a key technological driver, particularly in plant-based nutrition research. Amway's $120 million investment in its U.S. headquarters includes a dedicated research center to further these advancements.

The company is integrating AI and data analytics for personalized recommendations and optimized marketing, alongside streamlining its global supply chain through technology for efficient inventory and distribution management.

Amway's commitment to transparency is evident in its brands' end-to-end traceability, supported by digital tools that grant IBOs easy access to product journey information, fostering consumer trust.

| Technology Focus | 2024/2025 Data/Projection | Impact |

| Digital Transformation Spending | Significant increase in 2024, projected further growth in 2025 | Enhanced e-commerce, mobile apps, and digital tools for IBOs |

| AI & Data Analytics Investment | Ongoing | Personalized recommendations, optimized marketing, supply chain efficiency |

| Patents & R&D Investment | Over 750 patents/pending patents; $120M+ in U.S. HQ expansion | Product innovation, especially in nutrition |

| Supply Chain Technology | Globally integrated systems | Efficient inventory, production, and distribution management |

Legal factors

Amway, operating in over 100 countries, navigates a complex web of direct selling regulations that dictate compensation structures, product claims, and distributor recruitment. Failure to adhere to these varied legal frameworks, which differ significantly by jurisdiction, can lead to substantial penalties and operational disruptions.

For instance, in 2023, several countries continued to scrutinize MLM practices, with some implementing stricter disclosure requirements for distributors and enhanced oversight of recruitment activities. Amway's global revenue in 2023 reached approximately $8.4 billion, underscoring the significant financial implications of maintaining compliance across its diverse markets.

Amway navigates a complex web of product safety and labeling laws globally, crucial for maintaining consumer trust and market access. These regulations dictate everything from ingredient disclosure and allergen warnings to specific manufacturing standards, ensuring products like their Nutrilite supplements and Artistry skincare meet rigorous safety benchmarks. For instance, in the European Union, the General Product Safety Regulation (2001/95/EC) and specific directives on cosmetics and food supplements impose strict requirements that Amway must meticulously follow across its operations.

Amway's reliance on intellectual property is substantial, underscored by its portfolio of over 750 patents and pending applications, particularly in nutrition and product development. These legal protections are vital for maintaining its competitive edge and recouping significant research and development expenditures.

Navigating the complexities of international patent laws is a critical legal factor for Amway, given its extensive global operations. Ensuring robust protection across diverse jurisdictions safeguards its innovations and market position worldwide.

Consumer Rights and Protection

Amway places a strong emphasis on consumer rights and protection, a critical element in its direct selling model. Initiatives like AMWAYPROMISE™ are designed to inform customers about their rights and provide clear channels for support and resolution, fostering a trustworthy environment. This commitment is essential for building and sustaining consumer confidence and long-term loyalty.

Adherence to robust consumer protection legislation is paramount for Amway's reputation and operational integrity. For instance, in 2024, regulatory bodies globally continued to scrutinize direct selling practices, reinforcing the need for transparency in product claims and compensation plans. Companies like Amway must ensure their practices align with these evolving legal landscapes to avoid penalties and maintain market access.

- Consumer Awareness Programs: Amway's AMWAYPROMISE™ ensures consumers understand their rights, including satisfaction guarantees and return policies, which are vital for trust in a direct sales environment.

- Regulatory Compliance: Staying abreast of and adhering to consumer protection laws in all operating markets, such as the Direct Selling Association (DSA) codes of ethics, is crucial for legal standing and brand reputation.

- Dispute Resolution: Providing accessible and fair mechanisms for resolving consumer complaints is a key legal and ethical obligation, reinforcing Amway's commitment to customer satisfaction and protection.

- Transparency in Business Practices: Clear disclosure of business opportunities, product pricing, and income potential, as mandated by various consumer protection statutes, builds credibility and prevents misleading representations.

Labor Laws and Independent Business Owners Classification

The classification of Amway's Independent Business Owners (IBOs) as independent contractors is a cornerstone of its legal framework, but it's also a frequent area of scrutiny under labor laws globally. Jurisdictions like the United States, with its evolving tests for contractor status, and European nations with stricter employee protections, present ongoing challenges. For instance, in 2023, several class-action lawsuits continued to challenge contractor classifications in the gig economy, a trend that directly impacts Amway's model.

Amway's compensation plans and operational guidelines must continuously adapt to ensure IBOs are demonstrably operating as independent entrepreneurs, not de facto employees. This involves careful structuring of incentives, training, and oversight to align with legal definitions, which can vary significantly. Failure to maintain this distinction can lead to significant penalties, including back wages, benefits, and taxes, as seen in past settlements involving similar direct selling models.

- Ongoing Legal Scrutiny: Labor laws in key markets are increasingly examining the true nature of contractor relationships, potentially impacting Amway's IBO classification.

- Jurisdictional Variations: Compliance requires navigating a complex web of differing national and regional labor regulations.

- Risk of Misclassification: Incorrectly classifying IBOs can result in substantial financial penalties and legal liabilities for Amway.

- Business Model Adaptation: Amway must ensure its operational structure and compensation models consistently support the independent contractor status of its IBOs.

Amway's business model, rooted in direct selling and independent distributors, faces constant legal scrutiny regarding its compensation structures and distributor classifications. Navigating varying international regulations on pyramid schemes and multi-level marketing (MLM) is paramount, with countries like the United States and those in the EU enforcing strict disclosure and recruitment rules. Failure to comply can result in significant fines, as seen in past settlements involving direct selling companies, impacting Amway's global revenue of approximately $8.4 billion in 2023.

Amway's commitment to consumer protection is legally mandated, requiring transparency in product claims and satisfaction guarantees. In 2024, regulatory bodies continued to emphasize clear communication regarding product efficacy and income potential for distributors. Amway's AMWAYPROMISE™ initiative addresses these concerns by outlining consumer rights and return policies, crucial for maintaining trust and avoiding legal challenges in its direct sales operations.

The classification of Amway's Independent Business Owners (IBOs) as independent contractors is a persistent legal challenge, with labor laws in various jurisdictions scrutinizing these relationships. Evolving tests for contractor status, particularly in the US and Europe, necessitate careful structuring of compensation and training to avoid misclassification liabilities. This is critical given the potential for significant financial penalties and back-wage claims, as demonstrated by class-action lawsuits impacting similar business models in 2023.

| Legal Factor | Description | 2023-2024 Impact/Consideration | Amway Revenue Context |

|---|---|---|---|

| Direct Selling Regulations | Laws governing compensation, product claims, and distributor recruitment in over 100 countries. | Increased scrutiny on MLM practices, stricter disclosure requirements, and oversight of recruitment activities. | $8.4 billion (2023) global revenue highlights significant compliance stakes. |

| Consumer Protection Laws | Mandates for transparency in product information, pricing, and satisfaction guarantees. | Continued emphasis by regulators on clear communication of product efficacy and distributor income potential. | Reinforces the need for initiatives like AMWAYPROMISE™ for trust and legal adherence. |

| Labor Laws & Contractor Classification | Regulations defining independent contractor vs. employee status, impacting IBO relationships. | Evolving tests for contractor status in key markets like the US and EU, leading to potential misclassification liabilities. | Necessitates careful structuring of IBO compensation and training to avoid penalties. |

| Intellectual Property Rights | Protection of patents, trademarks, and proprietary product formulations. | Amway holds over 750 patents and pending applications, crucial for competitive advantage and R&D recoupment. | Ensuring robust global IP protection is vital for market position. |

Environmental factors

Amway is deeply invested in sustainability, embedding eco-friendly manufacturing and operational practices throughout its business. The company is actively channeling resources into enhancing energy efficiency and curbing carbon emissions across its global headquarters and various offices. This dedication is further demonstrated through ongoing efforts to minimize waste generation.

Further solidifying its environmental commitment, Amway is implementing advanced techniques aimed at reducing both water consumption and overall energy usage. For instance, in 2023, Amway reported a 15% reduction in water usage at its Ada, Michigan manufacturing facility compared to 2020 benchmarks, and a 10% decrease in energy intensity across its global operations.

Amway's commitment to responsible sourcing is evident in its Nutrilite™ plant-based nutrition line. The company's global network of certified organic farms employs sustainable and regenerative agriculture practices. This approach not only guarantees the quality of its core ingredients but also underscores a dedication to environmental stewardship, a key consideration in today's market.

Amway is actively innovating in packaging to minimize environmental impact. A key initiative involves incorporating 30% recycled plastic into select skincare, personal care, and Nutrilite™ product packaging. This commitment led to a significant saving of over 230,000 pounds of virgin plastic in 2024, demonstrating a tangible reduction in waste.

The company's strategy extends to continuously exploring and adopting more sustainable packaging solutions. This includes a focus on utilizing readily recyclable materials and optimizing package size to further reduce resource consumption and waste generation.

Carbon Footprint Reduction and Renewable Energy

Amway is actively pursuing a reduction in its carbon footprint, with a stated goal to lower greenhouse gas emissions across its global operations. This commitment is underscored by an increasing reliance on renewable energy sources to power its facilities. These initiatives are central to Amway's evolving operational strategy, which prioritizes the reduction of emissions, water consumption, and overall energy usage to foster environmental preservation and minimize its ecological impact.

The company's focus on sustainability is reflected in its operational adjustments. Amway's endeavors are geared towards a more responsible approach to resource management, aiming to achieve tangible improvements in environmental performance. This strategic direction aligns with broader global trends and regulatory pressures encouraging businesses to adopt greener practices and invest in renewable energy solutions.

- Greenhouse Gas Emission Reduction: Amway has established targets to decrease its greenhouse gas emissions.

- Renewable Energy Adoption: The corporation is increasing its procurement and utilization of renewable energy sources for its operational needs.

- Operational Efficiency: Efforts are concentrated on reducing emissions, water usage, and energy consumption across all business functions.

- Environmental Footprint Minimization: These actions are designed to protect natural resources and lessen the company's overall environmental impact.

Regenerative Agriculture Practices

Amway is actively embracing regenerative agriculture, especially on its organic farms. This commitment is evident in its efforts to improve soil health, boost biodiversity, and conserve water resources.

A significant milestone was achieved in June 2024 when Amway's Brazil farm became the first acerola production farm globally to earn Regenerative Organic Certified® – Silver Level status. This certification underscores the company's dedication to sustainable farming methods that benefit both the environment and local communities.

- Soil Health: Regenerative practices focus on rebuilding soil organic matter and improving soil structure.

- Biodiversity: Efforts include increasing the variety of plant and animal life on farms.

- Water Conservation: Implementing techniques to use water more efficiently and protect water quality.

- Community Impact: Promoting healthier ecosystems and supporting sustainable livelihoods.

Amway's environmental strategy prioritizes reducing its ecological footprint through operational efficiencies and sustainable sourcing. The company is actively increasing its use of renewable energy, aiming to lower greenhouse gas emissions across its global operations. By 2024, Amway reported a 10% decrease in energy intensity across its global operations compared to 2020, with specific targets for further reductions.

| Initiative | 2023/2024 Data | Target/Goal |

|---|---|---|

| Water Usage Reduction (Ada, MI) | 15% reduction vs. 2020 | Continued reduction |

| Energy Intensity Reduction (Global) | 10% reduction vs. 2020 | Continued reduction |

| Recycled Plastic in Packaging | 30% in select products | Increase utilization |

| Virgin Plastic Saved (2024) | Over 230,000 pounds | Further reduction |

| Regenerative Organic Certified® Farms | 1 (Brazil - Acerola) | Expand certified farms |

PESTLE Analysis Data Sources

Our PESTLE analysis for Amway Corporation is built on a comprehensive review of official government publications, reputable market research firms, and global economic databases. This ensures that insights into political, economic, social, technological, legal, and environmental factors are grounded in current and verifiable data.