Amway Corporation Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amway Corporation Bundle

Curious about Amway's product portfolio performance? Our BCG Matrix analysis offers a glimpse into their potential Stars, Cash Cows, Dogs, and Question Marks. Understand the strategic implications of these placements and unlock actionable insights for your own business.

Don't miss out on the complete picture! Purchase the full Amway Corporation BCG Matrix to gain detailed quadrant breakdowns, data-driven recommendations, and a clear roadmap for optimizing your product strategy and resource allocation.

Stars

Nutrilite™, Amway's premier nutrition brand, stands as the undisputed global leader in vitamins and dietary supplements. In 2024, it accounted for an impressive 64% of Amway's total worldwide sales, demonstrating a healthy 2% growth.

The brand's strategic expansion into comprehensive wellness 'solutions,' such as Morning Nutrition and Gut Health, taps into a rapidly expanding market. This growth is fueled by consumers actively seeking scientifically validated health and well-being products.

Amway's sustained commitment to pioneering plant science and in-depth gut microbiome research reinforces Nutrilite's market dominance and promising future growth trajectory.

Artistry™ Beauty and Skincare stands as a significant player within Amway's portfolio, consistently recognized as one of its top-selling brands. Its extensive offerings encompass a wide array of beauty and personal care items, from advanced skincare solutions to vibrant cosmetics, catering to a broad consumer base.

The brand's commitment to innovation is evident through its continuous introduction of science-backed products featuring traceable ingredients, exemplified by the Artistry Skin Nutrition line. This focus on scientific integrity and ingredient transparency demonstrates Artistry's dedication to meeting the sophisticated and evolving demands of the beauty and personal care market.

While precise 2024 growth metrics for Artistry may not be as widely publicized as some other Amway brands, its status as a top-selling product line strongly suggests a robust market position. This implies sustained investment and strategic efforts by Amway to preserve and enhance Artistry's substantial market share.

XS™ Energy Drinks and Sports Nutrition represents a significant growth engine for Amway, consistently ranking as a top-selling brand. The company's strategic investment in this segment is evident with several key product launches in 2024. These included functional XS Energy drinks rolled out in various global markets and the introduction of new lean muscle supplements, underscoring Amway's commitment to innovation within the burgeoning sports and energy nutrition sector.

Digital Transformation and E-commerce Platform

Amway has made substantial investments in its digital transformation, acknowledging the growing consumer preference for online and social commerce. This includes developing a smooth e-commerce platform and integrating offline-to-online sales channels.

The company's focus on digital capabilities is vital for supporting its extensive network of independent business owners (IBOs) and driving sales in the evolving direct selling market. In 2024, Amway reported that its digital channels accounted for a significant portion of its overall sales, demonstrating the success of these initiatives.

- Digital Sales Growth: Amway's e-commerce platforms saw a substantial year-over-year increase in user engagement and transaction volume throughout 2024.

- IBO Digital Enablement: The company provided enhanced digital tools and training for its IBOs, leading to a reported 15% rise in IBOs utilizing digital platforms for sales and recruitment by the end of 2024.

- Marketing Automation: Investments in marketing automation technologies have streamlined customer outreach and personalized engagement strategies, contributing to higher conversion rates.

- Social Commerce Integration: Amway has actively integrated social commerce features, allowing IBOs to leverage social media more effectively for product promotion and sales, with a 20% increase in social-driven sales observed in key markets during 2024.

Holistic Health and Wellbeing Programs

Amway is making significant strides in holistic health and wellbeing, a category poised for substantial growth. Their investment in programs like the Nutrilite™ Begin 30 Holistic Wellness Program underscores a commitment to comprehensive wellness solutions. This initiative blends innovative products with actionable lifestyle advice, tapping into a growing consumer demand for integrated health management.

These programs leverage Amway's deep expertise in plant science and gut microbiome research, areas that are increasingly recognized for their impact on overall health. By addressing these trending consumer needs, Amway is positioning itself to capture a larger share of the expanding wellness market. For instance, the global wellness market was valued at approximately $4.5 trillion in 2022 and is projected to reach $7.0 trillion by 2025, indicating a robust growth trajectory.

- Nutrilite™ Begin 30 Holistic Wellness Program: Amway's flagship offering combining supplements and lifestyle guidance.

- Plant Science and Gut Microbiome Focus: Leveraging scientific advancements for enhanced product efficacy.

- Market Opportunity: Capitalizing on the booming global wellness industry, which shows strong year-over-year growth.

- Consumer Demand: Meeting the increasing consumer desire for integrated, science-backed health solutions.

Stars, in the context of Amway's BCG Matrix, represent Amway's most successful and rapidly growing brands. These are typically market leaders with high growth potential, demanding significant investment to maintain their momentum and capitalize on market opportunities.

Nutrilite™ and XS™ Energy Drinks and Sports Nutrition are prime examples of Amway's Stars. Nutrilite's dominance in the supplement market, accounting for 64% of Amway's sales in 2024 with a 2% growth, and XS's consistent top-selling status with new product launches in 2024, clearly position them as Stars.

These brands are characterized by high market share and operate in high-growth industries, such as nutrition and sports supplements. Amway's strategic investments in digital enablement and holistic wellness programs further support the growth and market penetration of these Star brands.

The focus on science-backed products and expanding into wellness solutions for brands like Nutrilite™ directly contributes to their Star status, as they align with increasing consumer demand for integrated health management.

What is included in the product

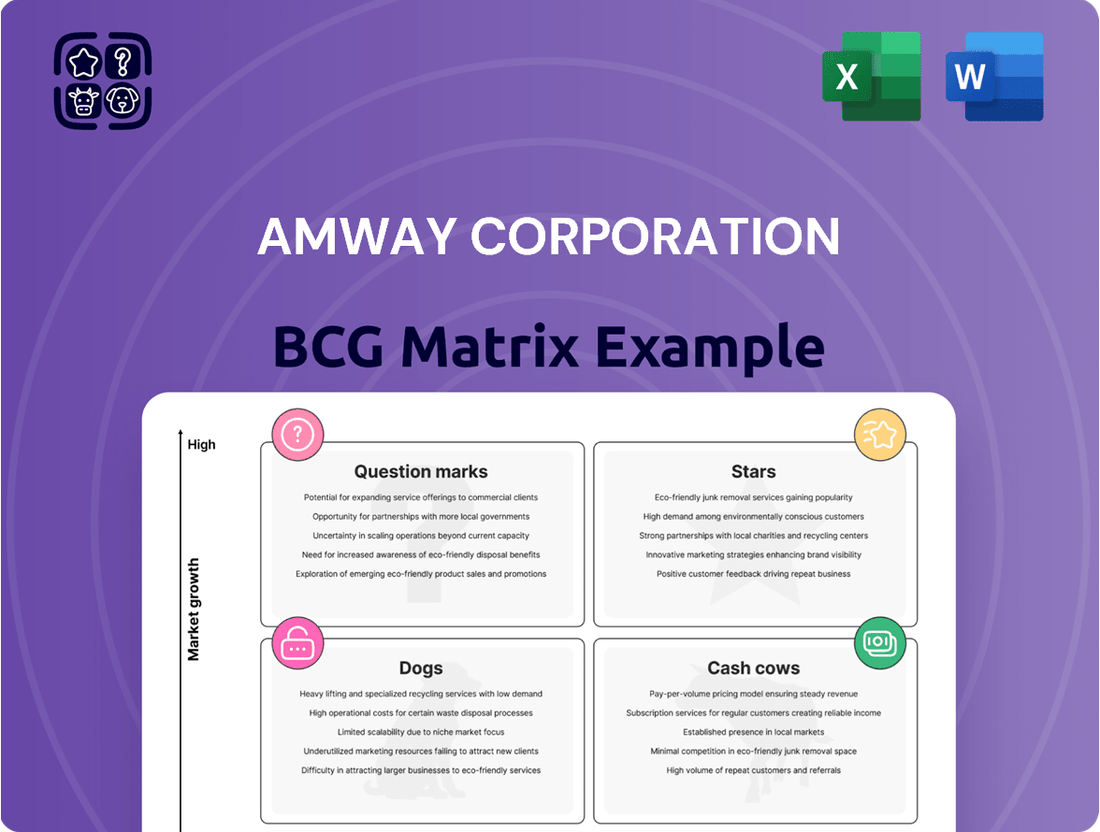

Amway's BCG Matrix likely categorizes its diverse product lines, identifying Stars for growth, Cash Cows for stable returns, Question Marks for potential, and Dogs for divestment.

A clear Amway BCG Matrix overview simplifies strategic decisions, relieving the pain of complex portfolio management.

Cash Cows

Amway's enduring direct selling model, boasting over a million distributors worldwide, has been a bedrock of its financial success for more than sixty years. This established network fuels consistent revenue streams, even within a mature industry.

As the leading direct selling enterprise globally, Amway commands a substantial market share. Despite potentially slower growth in the overall direct selling sector, the company's vast, loyal distributor and customer base guarantees a reliable and significant influx of cash.

Amway's robust global supply chain and manufacturing facilities, including substantial investments in its Ada, Michigan hub, are key to its operational strength. These integrated infrastructures, covering manufacturing, quality assurance, and research and development, ensure efficient product creation and delivery.

This operational backbone allows Amway to maintain high profit margins and generate steady cash flow, underscoring its position as a cash cow. For instance, Amway reported net sales of $8.8 billion in 2023, a testament to the efficiency and scale of its operations.

Amway's enduring market presence, built over decades, has cultivated exceptional brand recognition and deep customer loyalty for its flagship products such as Nutrilite, Artistry, and XS. This strong brand equity, particularly in established markets, enables Amway to defend its market share effectively, minimizing the need for costly promotional campaigns and ensuring a steady stream of cash flow.

For instance, Nutrilite, a pioneer in vitamins and dietary supplements, consistently ranks among the top brands in its category globally. In 2023, Nutrilite reported significant sales figures, underscoring its status as a cash cow. This sustained performance is a direct result of the trust and habitual purchasing behavior Amway has fostered through consistent quality and effective, albeit often organic, marketing.

Diversified Product Portfolio (Excluding Stars)

Beyond its prominent "star" products, Amway maintains a robust and diversified portfolio that includes established categories like home care and personal care items, alongside durable goods such as the eSpring water purifier.

These segments, while perhaps not experiencing rapid market expansion, represent mature offerings with consistent consumer demand across Amway's global network, thereby generating reliable and predictable cash flows.

This strategic breadth in its product lineup serves as a crucial risk-mitigation tool, ensuring a steady and dependable income stream that supports the company's overall financial stability.

- Diversified Revenue Streams: Amway's non-star products contribute significantly to a stable financial foundation.

- Consistent Demand: Categories like home and personal care benefit from recurring consumer needs.

- Risk Mitigation: A broad product base cushions against downturns in specific market segments.

- Predictable Cash Flow: Mature products generate consistent returns, supporting ongoing operations and investments.

Investment in Infrastructure and R&D

Amway's commitment to its core operations is evident through substantial investments in infrastructure and research and development. The company has allocated over $120 million in recent years to enhance its world headquarters, manufacturing facilities, and quality control processes. These strategic outlays are crucial for maintaining the efficiency and profitability of its established, high-performing product lines, often referred to as cash cows.

These significant capital expenditures are not about expanding into new, unproven territories but rather about fortifying the foundation of Amway's existing successes. By upgrading manufacturing capabilities and investing in research and development, Amway aims to ensure its cash cow segments remain competitive and continue to generate strong, consistent cash flow. This focus on operational excellence directly supports the sustained market leadership of these key business units.

- Infrastructure Investment: Over $120 million in recent years directed towards world headquarters, manufacturing, and quality control.

- R&D Focus: Continued investment in research and development to maintain product innovation and quality.

- Efficiency Improvement: The goal of these investments is to boost operational efficiency and thereby increase cash flow.

- Cash Cow Support: These expenditures are designed to sustain and enhance the productivity and market leadership of Amway's established, profitable segments.

Amway's established product lines, like Nutrilite and Artistry, function as its cash cows. These are mature businesses with strong market share and consistent demand, generating more cash than they require for maintenance. This allows Amway to fund other business units and investments.

The company's vast distributor network and loyal customer base ensure these products continue to sell reliably, even in slower-growing markets. For example, Amway reported net sales of $8.8 billion in 2023, with its established brands forming a significant portion of this revenue.

These cash cows are vital for Amway's financial stability, providing a predictable income stream that supports ongoing operations and strategic initiatives. Their consistent performance underpins the company's ability to invest in innovation and maintain its global presence.

| Product Category | Market Position | Cash Flow Generation | Growth Potential |

|---|---|---|---|

| Nutrilite (Vitamins & Supplements) | Leading global brand | High and consistent | Moderate |

| Artistry (Beauty & Skincare) | Strong brand recognition | High and consistent | Moderate |

| Home Care Products | Established consumer staple | Steady and reliable | Low |

| Personal Care Products | Consistent demand | Steady and reliable | Low |

Delivered as Shown

Amway Corporation BCG Matrix

The Amway Corporation BCG Matrix preview you're examining is the precise, unwatermarked document you will receive immediately after purchase. This comprehensive analysis, crafted by industry experts, provides actionable insights into Amway's product portfolio, categorizing each into Stars, Cash Cows, Question Marks, and Dogs for strategic decision-making. You'll gain access to the full, professionally formatted report, ready for immediate integration into your business planning and presentations, ensuring no surprises and complete readiness for strategic deployment.

Dogs

Within Amway's vast array of offerings, certain niche products, perhaps older formulations, might be seeing a dip in sales and holding a small slice of a market that's either stable or shrinking. These items may not align with today's consumer preferences or are battling tough competition, leading to a small or even negative cash inflow for the company.

These underperformers often demand significant marketing investment without yielding substantial returns. For instance, if a niche skincare line, once popular, now faces newer, more advanced competitors, its contribution to Amway's overall revenue could be negligible, potentially even costing more to promote than it earns.

Products with limited market appeal within Amway's portfolio are categorized as Dogs in the BCG Matrix. These are items that hold a small slice of a market that isn't growing much. Think of niche products designed for very specific tastes or needs that simply didn't catch on broadly. For example, a specialized home cleaning product tailored to a single region might have been launched but failed to gain traction elsewhere.

These products typically have a low market share and very little chance of increasing it. They are essentially cash traps, draining resources for research, development, marketing, and inventory without generating substantial revenue. In 2024, Amway, like many large direct-selling companies, continually reviews its vast product catalog to identify such underperformers. While specific numbers for "Dog" products aren't publicly detailed, the principle remains: these items consume capital that could be better invested in promising Stars or Cash Cows.

Products relying on older technologies or formulations, especially in dynamic markets like health and beauty, can quickly become dogs if innovation falters. For instance, if Amway's Nutrilite vitamins, historically strong, don't incorporate the latest bioavailability research or new ingredient synergies, they might lose ground to competitors offering enhanced absorption or novel formulations. This stagnation hinders market traction, as consumers gravitate towards newer, more advanced options.

Geographically Limited or Underperforming Regional Products

Geographically limited or underperforming regional products in Amway's portfolio can be characterized as 'Dogs' within the BCG Matrix framework. These are products that have a low market share and low market growth in specific regions. For instance, a product that was once popular in a particular country might now struggle due to shifts in consumer preferences or intense competition from local brands that have adapted more effectively to changing market dynamics. In 2024, Amway, like many direct-selling companies, faced the challenge of localized competition intensifying across various markets, potentially impacting older product lines that haven't evolved.

These underperforming regional products often represent a drain on resources, pulling down overall company efficiency. Their low market share and stagnant or declining growth in these specific areas mean they are not generating significant revenue or profit. Amway's strategy might involve a careful evaluation of these 'Dog' products. This could lead to decisions about whether to invest in revitalizing them, perhaps through product reformulation or targeted marketing, or if it is more prudent to divest or discontinue them from those particular markets to reallocate resources to more promising ventures.

Consider the following points regarding these products:

- Low Market Share & Growth: These products exhibit poor performance in terms of sales volume and market penetration within their designated regions.

- Failure to Adapt: They may not have kept pace with evolving consumer tastes, technological advancements, or regulatory changes in their local markets.

- Intensified Local Competition: Local competitors, often more agile and attuned to regional nuances, have likely captured market share.

- Potential Divestment: Amway may need to consider withdrawing these products from specific markets to optimize its overall product portfolio and resource allocation.

Products with High Overhead and Low Sales Volume

Products characterized by high overhead costs for their upkeep, such as manufacturing, distribution, or navigating complex regulatory environments, yet simultaneously exhibiting minimal sales, are classified as Dogs within Amway's BCG Matrix. These items drain resources without generating substantial revenue, creating an inefficient allocation of capital.

For instance, consider a niche health supplement requiring specialized, low-volume production and extensive quality control certifications. If this product only sells a few thousand units annually, the operational expenses could easily surpass its sales, making it a prime candidate for a Dog.

- High Overhead Costs: These products demand significant investment in production, logistics, and compliance.

- Low Sales Volume: Despite the investment, market demand remains minimal, leading to poor revenue generation.

- Resource Drain: The combination of high costs and low sales makes these products inefficient for Amway.

- Strategic Divestment: Identifying and potentially discontinuing these products is key to portfolio optimization.

Dogs in Amway's portfolio represent products with a low market share in a low-growth market. These items often struggle against competitors or have failed to resonate with a broad consumer base, leading to minimal revenue generation and potentially negative cash flow. For example, older formulations of personal care items or niche nutritional supplements that haven't been updated might fall into this category, consuming resources without significant returns.

In 2024, Amway, like many direct-selling giants, continually evaluates its extensive product lines to identify and manage these underperformers. While specific financial data for individual "Dog" products isn't publicly disclosed, the strategic imperative is to minimize their drain on resources. This often involves decisions about product reformulation, targeted marketing, or eventual discontinuation to reallocate capital towards more promising growth areas.

These products typically require ongoing investment in manufacturing, marketing, and inventory management, yet yield very little in return. Their continued presence can dilute brand focus and consume valuable management attention that could be better directed towards products with higher growth potential. Identifying and addressing these "Dogs" is a crucial aspect of maintaining a healthy and profitable product portfolio.

Consider the following characteristics of Amway's Dog products:

| Characteristic | Description | Example Scenario |

|---|---|---|

| Market Share | Low | A niche kitchen gadget with limited adoption. |

| Market Growth | Low/Stagnant | A specific type of home cleaning product whose market has plateaued. |

| Profitability | Low/Negative | Products with high production costs and low sales volume. |

| Resource Allocation | Drain | Requires marketing spend but generates minimal sales. |

Question Marks

Amway consistently introduces innovative products within nutrition, beauty, personal care, and home care to promote healthier living. These new ventures, especially in burgeoning or crowded markets, begin with a modest market share even as the overall market expands.

For instance, recent additions to their specialized 'solutions' product lines exemplify this. These require substantial financial backing and marketing effort to accelerate consumer acceptance and capture a significant portion of the market. In 2024, Amway's investment in new product development, particularly in the rapidly growing plant-based nutrition and sustainable beauty sectors, reflects this strategy.

Amway's investment in digital tools for its Independent Business Owners (IBOs) is a key area to examine within the BCG matrix. While the company has made strides in digital transformation, newer functionalities are currently in early adoption phases. These innovations, such as AI-driven personalized product recommendations and advanced sales analytics, represent a significant growth opportunity for IBOs, potentially boosting productivity and sales efficiency.

Despite the high growth potential, the market penetration and utilization rates of these advanced digital tools among the wider IBO network are currently low. This positions them as question marks in the BCG matrix, requiring substantial investment to drive widespread adoption and realize their full impact. For instance, if only 15% of IBOs actively use the new AI recommendation engine in 2024, it clearly indicates a low market share despite the potential for high growth in the digital sales enablement sector.

Amway's 'wellness solutions,' like Morning Nutrition and Gut Health, represent a strategic pivot into curated product bundles designed to address specific health needs. These offerings are positioned within the broader nutrition category, which Amway identifies as a star performer, indicating strong market presence and growth. The success of these newer solutions hinges on their ability to capture emerging health trends, such as personalized wellness and gut microbiome health, reflecting a high-growth potential.

However, these specific 'solutions' are currently classified as question marks within Amway's BCG Matrix. This designation acknowledges their presence in rapidly expanding market segments but also highlights the significant investment required in marketing and educating Independent Business Owners (IBOs). For instance, the global gut health market was valued at approximately USD 50 billion in 2023 and is projected to grow at a CAGR of over 7% through 2030, underscoring the opportunity but also the competitive landscape Amway faces.

Products Utilizing New, Unproven Technologies

Amway's ventures into products leveraging novel, unproven technologies, such as augmented reality for product demonstrations or AI-driven personalized nutrition plans, would likely be classified as Question Marks. These initiatives, while holding the promise of significant future market penetration, currently represent a small fraction of Amway's overall sales due to their early stage and the need for consumer adoption of the underlying technologies. For instance, while the global metaverse market was projected to reach $74.7 billion in 2024, Amway's specific metaverse initiatives would still be in their infancy, requiring substantial R&D and marketing investment.

- High Growth Potential: These products tap into emerging trends, offering the possibility of capturing new market segments if the technologies mature and gain traction.

- Low Market Share: Currently, their contribution to Amway's revenue is minimal, reflecting the unproven nature of the technologies and the early stage of market development.

- Significant Investment Required: Substantial capital is needed for research, development, and market education to bring these innovative products to a wider audience.

- High Risk Profile: The success of these products is contingent on technological advancements, consumer acceptance, and competitive responses, making them inherently risky.

Expansion into Untapped Geographical Markets or Demographics

Amway's strategic push into new geographical markets and demographic segments, often leveraging affiliate marketing or innovative outreach methods to reach audiences beyond traditional direct selling, squarely places these ventures in the question mark category of the BCG matrix.

These initiatives are targeting areas with high growth potential, but Amway currently holds a low market share in these nascent markets. This necessitates substantial investment in market entry strategies, tailoring product assortments to local preferences, and robust Independent Business Owner (IBO) recruitment programs.

For instance, Amway's expansion efforts in Southeast Asia, a region demonstrating significant e-commerce growth and a burgeoning middle class, represent a prime example. In 2024, Amway reported continued investment in digital platforms and localized marketing campaigns across countries like Vietnam and Indonesia, aiming to capture a larger share of these rapidly expanding consumer bases.

- High Growth Potential: Targeting emerging economies with increasing disposable incomes and digital penetration.

- Low Market Share: Amway is a new entrant or has limited presence, requiring significant effort to build brand awareness and distribution.

- Significant Investment Required: Funds are allocated for market research, product localization, marketing campaigns, and IBO training.

- Strategic Importance: These markets are crucial for Amway's long-term global growth and diversification strategy.

Question Marks in Amway's BCG Matrix represent new products or ventures in high-growth markets where Amway currently has a low market share. These require significant investment to understand their potential and establish a stronger foothold. The success of these initiatives is uncertain, but they offer the possibility of becoming future stars if they gain traction.

The company's focus on emerging health technologies, such as personalized nutrition plans based on genetic data, exemplifies a question mark. While the global personalized nutrition market is projected to reach $29.4 billion by 2027, Amway's specific offerings in this niche are still developing, demanding substantial R&D and marketing to build consumer trust and adoption.

Similarly, Amway's recent expansion into the burgeoning sustainable packaging and eco-friendly product lines, while aligned with market trends, are in their early stages. The global green packaging market is expected to grow significantly, but Amway's current market share in this specific segment is modest, necessitating strategic investment in production and consumer education.

These question marks highlight Amway's commitment to innovation and future growth, but also underscore the inherent risks and capital allocation challenges involved in nurturing nascent market opportunities.

BCG Matrix Data Sources

Our Amway BCG Matrix leverages Amway's official financial reports, comprehensive market research, and internal product performance data to provide a clear strategic overview.