Amplify Energy PESTLE Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amplify Energy Bundle

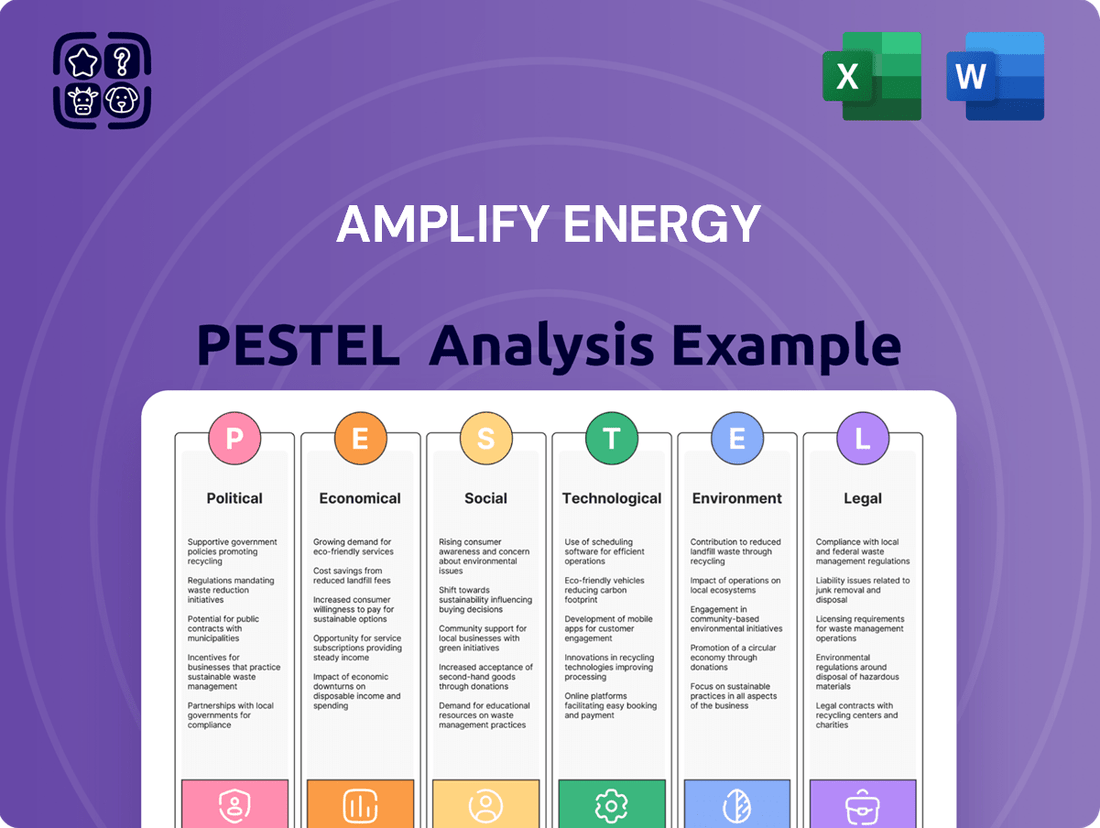

Amplify Energy operates within a dynamic external environment, shaped by evolving political landscapes, fluctuating economic conditions, and significant technological advancements. Understanding these forces is crucial for strategic planning and risk mitigation. Our comprehensive PESTLE analysis delves deep into these factors, providing actionable intelligence tailored for Amplify Energy.

Gain a critical edge by exploring the political, economic, social, technological, legal, and environmental factors impacting Amplify Energy. This expertly crafted PESTLE analysis offers the insights you need to anticipate market shifts and capitalize on opportunities. Download the full version now to unlock a clearer strategic vision.

Political factors

Government energy policies, especially those from federal and state authorities in Oklahoma, Texas, Louisiana, and California, are a major factor for Amplify Energy. These regulations, covering areas like drilling permits, leasing rules, and royalty payments, directly shape how Amplify can explore and produce oil and gas.

For instance, the Biden administration's focus on climate goals and energy transition may lead to stricter environmental regulations or changes in offshore leasing programs, impacting Amplify's Gulf of Mexico operations. In 2023, the U.S. saw continued debate around oil and gas leasing, with potential implications for future exploration rights.

While Amplify Energy's core business is in the United States, global geopolitical stability significantly influences its financial performance. For instance, the ongoing conflict in Eastern Europe and tensions in the Middle East have historically led to oil price volatility. In 2024, Brent crude prices have fluctuated, averaging around $83 per barrel as of mid-year, demonstrating how international events directly impact the revenue streams for companies like Amplify.

Disruptions in major oil-producing areas, such as OPEC+ production decisions or unexpected supply chain issues, can cause sharp price swings. This volatility makes it challenging for Amplify Energy to forecast revenue and plan capital expenditures effectively. For example, a sudden decrease in global demand due to geopolitical instability could depress oil prices, directly affecting Amplify's profitability in its offshore California operations.

Furthermore, domestic political stability within the states where Amplify operates, particularly California, is paramount. California's regulatory environment for offshore oil and gas, as seen with past pipeline safety concerns, can be subject to change. Consistent and predictable state-level policies are vital for Amplify to maintain operational continuity and make long-term investment decisions.

Taxation policies, such as corporate income taxes and potential severance taxes on oil and gas production, directly impact Amplify Energy's profitability. For instance, in 2024, the U.S. federal corporate tax rate stands at 21%, a key figure for Amplify's financial planning.

Government incentives, like tax credits for certain types of energy production, or conversely, policies aimed at discouraging fossil fuel extraction, significantly influence the economic feasibility of Amplify's operations. Changes in these incentives, such as the extension or modification of tax credits for marginal wells, can alter project economics.

Regulatory Environment on Emissions

The regulatory landscape for emissions is a significant political factor for Amplify Energy. Evolving federal and state regulations concerning greenhouse gas emissions, methane leakage, and air quality standards present ongoing compliance challenges and potential costs. For instance, the US Environmental Protection Agency (EPA) continues to refine its approach to methane emissions from the oil and gas sector, with proposed rules in 2024 and 2025 expected to increase monitoring and control requirements.

Stricter environmental regulations may require Amplify Energy to invest in new equipment or implement operational changes to reduce emissions. These adaptations can impact operational efficiency and necessitate substantial capital expenditures. For example, upgrades to capture fugitive methane emissions, a key focus of current regulatory efforts, could represent a notable upfront investment for the company.

To maintain its license to operate and avoid potential penalties, Amplify Energy must proactively adapt to these changing environmental requirements. This includes staying abreast of proposed legislation and implementing best practices for emissions management. The company's ability to navigate this complex regulatory environment will be crucial for its long-term sustainability and financial performance.

- Federal and State Emissions Standards: Amplify Energy faces a complex web of regulations, including those from the EPA and individual state environmental agencies, impacting operations.

- Methane Leakage Regulations: Increased scrutiny on methane emissions, a potent greenhouse gas, is driving new requirements for leak detection and repair (LDAR) programs across the industry.

- Air Quality Standards: Compliance with national ambient air quality standards (NAAQS) affects operational permits and can necessitate emission control technologies.

- Potential for Increased Compliance Costs: Investments in advanced emissions monitoring and control technologies, as well as potential fines for non-compliance, represent significant financial considerations.

Energy Security Initiatives

Government initiatives aimed at bolstering national energy security directly influence Amplify Energy. For instance, the US Department of Energy's efforts to increase domestic oil and gas production, as seen in strategic petroleum reserve releases and lease sales in 2024, can provide tailwinds for companies like Amplify. However, the increasing emphasis on renewable energy sources, with significant federal investment in solar and wind power, presents a long-term challenge by potentially reducing demand for fossil fuels. This dual impact necessitates careful strategic navigation for Amplify Energy.

Key government actions impacting energy security and Amplify Energy include:

- Support for Domestic Production: Policies encouraging domestic oil and gas extraction, potentially through tax incentives or streamlined permitting processes, directly benefit Amplify Energy's operational capacity and profitability. For example, the Inflation Reduction Act of 2022 includes provisions that could indirectly support fossil fuel infrastructure as part of a broader energy transition.

- Infrastructure Development: Government funding and regulatory approvals for pipelines and storage facilities are crucial for Amplify Energy to transport and store its products, impacting market access and operational efficiency.

- Energy Diversification Mandates: Government targets for renewable energy adoption and mandates for electric vehicle adoption can create long-term market uncertainties for fossil fuel producers by signaling a shift away from traditional energy sources.

- International Energy Relations: Geopolitical events and international agreements affecting global energy supply chains, such as those influencing OPEC+ decisions in 2024, can indirectly impact domestic production levels and pricing, creating both opportunities and risks for Amplify Energy.

Government policies on offshore leasing and environmental protection significantly shape Amplify Energy's operational landscape. For instance, the Bureau of Ocean Energy Management (BOEM) oversees federal offshore leasing, and its decisions in 2024 and beyond directly influence Amplify's access to exploration areas in the Gulf of Mexico.

The political climate regarding climate change and energy transition continues to impact regulatory frameworks. Stricter emissions standards, like those proposed by the EPA for methane in 2024, necessitate compliance investments, potentially increasing operational costs for Amplify.

Domestic political stability and state-level regulations, particularly in California, are crucial. California's stringent environmental rules and historical scrutiny of offshore operations, as seen with past pipeline incidents, create an unpredictable operating environment that requires constant adaptation.

Taxation policies, including corporate income taxes and potential severance taxes, directly affect Amplify's profitability. The U.S. federal corporate tax rate of 21% remains a key factor in financial planning, while state-specific tax regimes add another layer of complexity.

| Political Factor | Impact on Amplify Energy | 2024/2025 Relevance |

|---|---|---|

| Offshore Leasing Policies | Access to exploration and production areas. | BOEM lease sale schedules and decisions. |

| Environmental Regulations | Compliance costs, operational modifications. | EPA methane rules, state air quality standards. |

| Taxation Policies | Profitability, investment decisions. | U.S. federal corporate tax rate (21%), state severance taxes. |

| Energy Security Initiatives | Support for domestic production vs. renewable push. | Government investment in renewables vs. oil/gas infrastructure. |

What is included in the product

This PESTLE analysis provides a comprehensive examination of the external macro-environmental factors influencing Amplify Energy, covering Political, Economic, Social, Technological, Environmental, and Legal dimensions.

Amplify Energy's PESTLE analysis provides a clear, summarized version of external factors, alleviating the pain of sifting through complex data for quick strategic alignment.

Economic factors

Global oil and natural gas prices are the primary economic drivers for Amplify Energy. When crude oil prices are high, like the average Brent crude price of around $82 per barrel in early 2024, it directly boosts Amplify's revenue and profitability. Conversely, periods of low prices, such as the volatility seen in late 2023, can significantly strain the company's cash flow and limit its ability to invest in its operations.

Amplify Energy's reliance on mature fields makes it particularly vulnerable to price swings. The stability of commodity prices is therefore crucial for the company's financial health and operational planning. For instance, if oil prices were to consistently fall below a certain threshold, it could make production from these older, less efficient fields uneconomical.

Global demand for hydrocarbons remains a critical driver for Amplify Energy. In 2024, projections indicate continued, albeit moderate, growth in oil and gas consumption, largely fueled by developing economies and ongoing industrial activity. For instance, the International Energy Agency (IEA) forecasts a 1.1 million barrel per day increase in global oil demand for 2024, reaching 102.7 million barrels per day, demonstrating the persistent need for these energy sources.

Economic slowdowns, however, pose a significant risk. A contraction in global GDP, as seen in some periods of 2023, directly correlates with reduced industrial output and transportation needs, thereby dampening hydrocarbon demand and potentially impacting Amplify Energy's revenue streams. Conversely, a strong economic rebound in 2025 could significantly bolster demand, leading to higher commodity prices and encouraging greater investment in exploration and production activities for companies like Amplify Energy.

Rising inflation is a significant concern for Amplify Energy. For instance, in early 2024, inflation rates remained elevated, impacting the cost of essential inputs like materials and services. This can directly squeeze Amplify's profit margins as their operational expenses climb, making it harder to maintain profitability without passing costs onto consumers, which can be challenging in a competitive energy market.

Furthermore, the response to inflation, typically in the form of higher interest rates, presents another challenge. Central banks, including the Federal Reserve, continued to signal a hawkish stance through 2024, leading to increased borrowing costs. For Amplify Energy, this means that any new projects requiring significant capital investment or existing debt that needs refinancing will become more expensive. This directly affects their financial leverage and can deter future growth initiatives.

Capital Market Conditions

Capital market conditions are a major force for Amplify Energy. The availability of capital and how investors feel about fossil fuels directly impacts Amplify's ability to fund its operations, buy new assets, and grow. For instance, in early 2024, many energy companies faced higher borrowing costs as interest rates remained elevated, potentially increasing Amplify's cost of capital for new projects or refinancing existing debt. Investor sentiment, particularly towards oil and gas, can fluctuate significantly, affecting the valuation of companies like Amplify and their access to equity financing.

Access to both debt and equity markets, along with the associated costs, are vital for Amplify Energy. The company aims to get the most value from its current assets while also pursuing strategic development opportunities. A difficult investment climate, characterized by investor caution or a strong push towards renewables, could make it harder for Amplify to secure the necessary funding for these initiatives. For example, if major institutional investors continue to divest from fossil fuels, Amplify might find it more challenging to attract new equity capital, potentially impacting its growth plans.

Several factors shape these capital market conditions for Amplify Energy:

- Investor Sentiment: Growing ESG (Environmental, Social, and Governance) pressures continue to influence investment decisions, potentially leading to reduced capital allocation for fossil fuel companies.

- Interest Rates: Higher interest rates, as seen through mid-2024, increase the cost of debt financing, impacting Amplify's ability to fund acquisitions or development projects.

- Commodity Prices: While not directly capital markets, volatile oil and gas prices (e.g., Brent crude hovering around $80-$90 per barrel in early 2024) influence investor confidence and the perceived risk/reward of investing in the sector, thereby affecting capital availability.

- Regulatory Environment: Evolving regulations related to climate change and fossil fuel production can create uncertainty, which capital markets often penalize through higher risk premiums.

Technological Cost-Effectiveness

The economic viability of new drilling and production technologies is a critical factor for Amplify Energy, particularly in its mature field operations. Innovations that enhance oil recovery or optimize existing infrastructure can directly translate to improved profitability. For instance, advancements in digital oilfield technologies, which leverage data analytics for real-time monitoring and predictive maintenance, are becoming increasingly cost-effective. These technologies can reduce downtime and improve the efficiency of extraction processes.

Amplify Energy's ability to adopt and implement these cost-saving technologies efficiently will be a key differentiator. The company's focus on operational efficiency means that investing in technologies that lower the per-barrel lifting cost is paramount. This strategic adoption directly impacts the company's bottom line and its competitiveness in the energy market.

- Cost Reduction: Implementing advanced technologies can lower operational expenses by an estimated 10-15% in mature fields through improved efficiency and reduced waste.

- Enhanced Recovery: New extraction methods, such as improved oil recovery (IOR) techniques, can boost production from existing wells by up to 5-10%, directly increasing revenue.

- Investment in Digitalization: Companies are increasingly investing in digital solutions, with the global digital oilfield market projected to reach over $40 billion by 2025, indicating a strong trend toward technological cost-effectiveness.

- Profitability Impact: A 1% improvement in operational efficiency can translate to a significant boost in net profit margins for oil and gas companies, underscoring the importance of technological adoption.

Global economic growth directly influences Amplify Energy's demand for oil and gas. For instance, the International Monetary Fund (IMF) projected global growth to be 3.2% in 2024, a figure that underpins continued energy consumption. However, economic slowdowns can reduce industrial activity and transportation needs, impacting Amplify's revenue.

Inflationary pressures and subsequent interest rate hikes, as observed through mid-2024, increase Amplify Energy's operational costs and borrowing expenses. For example, elevated inflation in early 2024 meant higher costs for materials and services. This directly affects the company's profitability and the financial feasibility of new projects.

Capital market conditions, influenced by investor sentiment and commodity prices, are crucial for Amplify Energy's financing. High interest rates in 2024 made debt more expensive, potentially hindering investment in exploration and production. Additionally, investor focus on ESG factors can impact the availability of equity capital for fossil fuel companies.

Technological advancements in the energy sector offer opportunities for cost reduction and enhanced recovery for Amplify Energy. The digital oilfield market, projected to exceed $40 billion by 2025, highlights the trend towards efficiency. Implementing these technologies can improve operational performance and profitability in mature fields.

Full Version Awaits

Amplify Energy PESTLE Analysis

The preview shown here is the exact document you’ll receive after purchase—fully formatted and ready to use, detailing Amplify Energy's PESTLE analysis.

This is a real screenshot of the product you’re buying—delivered exactly as shown, no surprises, providing a comprehensive look at the Political, Economic, Social, Technological, Legal, and Environmental factors affecting Amplify Energy.

The content and structure shown in the preview is the same document you’ll download after payment, offering an in-depth understanding of the external forces shaping Amplify Energy's operations and strategy.

Sociological factors

Public sentiment towards fossil fuels is undergoing a significant shift, with growing environmental awareness directly influencing the social license for companies like Amplify Energy. Surveys in 2024 and early 2025 indicate a rising concern over climate change, with a majority of respondents in developed nations expressing a desire for faster transitions to renewable energy sources, potentially impacting long-term demand for hydrocarbons.

This evolving public perception, amplified by environmental advocacy groups, translates into increased pressure for more stringent regulations on fossil fuel operations. For instance, the International Energy Agency's 2024 reports highlighted a growing trend of divestment from fossil fuel assets by institutional investors, reflecting this societal unease and impacting capital availability for companies in the sector.

Amplify Energy must actively engage with these changing societal attitudes, demonstrating a commitment to environmental stewardship and potentially exploring diversification strategies. The company's ability to adapt to public demands for cleaner energy solutions will be crucial for maintaining its operational viability and reputation in the coming years.

Amplify Energy's operations across Oklahoma, Texas, Louisiana, and California necessitate strong community ties. In 2024, for instance, maintaining positive local relations is paramount to avoid disruptions. Negative sentiment from residents about environmental effects or operational impacts could translate into significant project delays or costly legal battles, impacting Amplify's ability to operate smoothly.

The availability of a skilled workforce in the oil and gas sector, especially in Amplify Energy's operational areas, is a significant sociological consideration. The industry faces challenges with an aging workforce, with the average age of oil and gas workers in the US hovering around 45-50 years, impacting knowledge transfer and recruitment.

Competition for talent remains fierce, not only within the energy sector but also from other industries seeking specialized engineering and technical skills. This dynamic, coupled with evolving educational pathways that may not always align with industry needs, directly affects Amplify Energy's ability to recruit and retain qualified professionals.

Maintaining a consistent supply of competent individuals is crucial for operational efficiency and future expansion. For instance, the Bureau of Labor Statistics projected a 5% growth in oil and gas extraction jobs between 2022 and 2032, indicating ongoing demand that Amplify Energy must meet.

Health and Safety Expectations

Societal expectations for health and safety in the oil and gas industry are increasingly stringent, demanding robust operational standards. Amplify Energy, like its peers, faces constant pressure to ensure the well-being of its workforce and the surrounding communities. Failure to meet these evolving expectations can result in significant reputational damage and costly legal consequences.

Proactive safety measures are not just a regulatory requirement but a critical component of corporate responsibility. For instance, the U.S. Bureau of Safety and Environmental Enforcement (BSEE) reported 131 incidents in 2023 on offshore platforms, highlighting the ongoing need for vigilance. Amplify Energy's commitment to safety directly impacts its social license to operate and investor confidence.

- Evolving Standards: Public scrutiny of industrial safety practices, especially after incidents like the 2021 pipeline rupture linked to Amplify Energy, drives higher expectations.

- Reputational Risk: Safety lapses can lead to severe brand damage, impacting customer loyalty and attracting regulatory attention.

- Legal and Financial Repercussions: Non-compliance with safety regulations can result in substantial fines and litigation costs, as seen in settlements following major industrial accidents.

- Employee and Public Well-being: Ensuring the safety of all stakeholders is a fundamental societal demand placed upon companies in high-risk sectors.

Corporate Social Responsibility (CSR)

Societal expectations for corporate social responsibility are growing, with stakeholders increasingly scrutinizing ethical business conduct. Amplify Energy's proactive engagement in environmental protection and community support directly impacts its brand image and ability to attract capital. For instance, in 2024, companies with robust ESG (Environmental, Social, and Governance) profiles saw an average 13% higher valuation compared to those with weaker profiles, according to a study by S&P Global.

Amplify Energy's commitment to transparent governance and community welfare can foster stronger relationships with local populations and regulators, thereby reducing operational risks. A 2025 report by the Edelman Trust Barometer indicated that 60% of consumers are more likely to buy from brands they trust to do the right thing. This trust is built on demonstrable CSR initiatives.

The company's investment in sustainable practices and community development is not just about reputation management; it's a strategic imperative. By aligning its operations with societal values, Amplify Energy can enhance its social license to operate and gain a competitive edge. For example, companies that actively report on their social impact, like Amplify Energy aims to do, often experience lower costs of capital, with some estimates suggesting a reduction of up to 2% in borrowing costs.

Key CSR considerations for Amplify Energy include:

- Environmental Stewardship: Investing in cleaner technologies and reducing emissions to meet evolving environmental standards and public expectations.

- Community Engagement: Supporting local economies and social programs in areas where it operates to build goodwill and a strong social license.

- Ethical Governance: Maintaining high standards of transparency, accountability, and ethical decision-making across all levels of the organization.

- Stakeholder Dialogue: Actively engaging with investors, employees, customers, and communities to understand and address their concerns regarding social and environmental impact.

Public sentiment is increasingly focused on environmental impact and corporate responsibility, influencing Amplify Energy's social license. Growing awareness of climate change, as reflected in 2024 surveys showing a majority favoring faster renewable energy transitions, puts pressure on fossil fuel companies.

This societal shift translates into demand for stricter regulations and impacts investment decisions; for example, the International Energy Agency noted significant divestment from fossil fuels by institutional investors in 2024, affecting capital access.

Amplify Energy must prioritize community relations to avoid operational disruptions, as negative local sentiment can lead to project delays and legal issues, underscoring the importance of proactive engagement in its operating regions.

The company faces a competitive landscape for skilled labor, with an aging workforce in the oil and gas sector and competition from other industries. This challenge impacts recruitment and knowledge transfer, despite projected job growth in extraction.

| Sociological Factor | Description | 2024/2025 Relevance |

|---|---|---|

| Public Opinion on Energy | Growing environmental consciousness and demand for renewables. | Influences social license and long-term demand for hydrocarbons. |

| Workforce Availability & Skills | Aging workforce, competition for talent, and evolving educational needs. | Impacts recruitment, retention, and operational efficiency. |

| Community Relations | Importance of local goodwill to prevent operational disruptions. | Negative sentiment can lead to delays and legal challenges. |

| Safety Expectations | Increasingly stringent societal demands for worker and public well-being. | Critical for reputation, legal compliance, and investor confidence. |

Technological factors

Amplify Energy's strategy heavily relies on maximizing output from its mature fields, making Enhanced Oil Recovery (EOR) techniques a cornerstone of its operational success. For instance, in 2024, the global EOR market was valued at approximately $25 billion, with projections indicating continued growth driven by the need to tap into previously uneconomical reserves.

Advancements in EOR, such as sophisticated CO2 injection and chemical flooding, offer Amplify Energy the potential to significantly boost recovery factors from its existing wells. These technologies, which saw substantial R&D investment in 2024, are proving vital in extending the economic life of older oil fields, directly impacting production volumes and revenue generation.

Digitalization and automation are reshaping the energy sector, offering significant opportunities for companies like Amplify Energy to boost efficiency and cut costs. By integrating advanced data analytics, AI, and automated systems, Amplify can streamline operations from exploration to production.

For instance, remote monitoring technologies allow for real-time oversight of offshore platforms, reducing the need for personnel on-site and enhancing safety. Predictive maintenance, powered by AI, can anticipate equipment failures before they occur, minimizing costly downtime. In 2023, the global oil and gas industry saw increased investment in digital transformation initiatives, with companies reporting an average of 5-10% cost reductions in operational areas through automation.

Amplify Energy can leverage these advancements to optimize drilling programs, improve resource allocation, and make more informed decisions, ultimately maximizing the value derived from its existing asset base. The ongoing advancements in these technologies are expected to further drive down operational expenditures and improve overall performance in the coming years.

Amplify Energy, while primarily focused on conventional oil and gas assets, can still benefit from advancements in drilling and completion technologies. Innovations like enhanced directional drilling allow for more precise well placement, maximizing reservoir contact and increasing production efficiency. For instance, the average horizontal well length in the Permian Basin, a major unconventional play, has increased significantly, demonstrating the trend towards more complex well designs that could inform conventional operations.

Improvements in wellbore integrity solutions are crucial for safety and operational longevity, reducing the risk of leaks and costly interventions. Furthermore, more efficient fracturing techniques, even in conventional reservoirs where they might be applied selectively, can unlock previously uneconomical reserves. These technological upgrades contribute to both cost reductions and a minimized environmental footprint, making them vital for Amplify Energy to monitor and potentially adopt.

Carbon Capture, Utilization, and Storage (CCUS)

The advancement and economic feasibility of Carbon Capture, Utilization, and Storage (CCUS) technologies are poised to gain significance for Amplify Energy, particularly as environmental mandates intensify. While Amplify Energy isn't directly engaged in CCUS development, the wider embrace of these solutions could impact the sustained demand for and societal approval of fossil fuels, thereby shaping policy and market trends.

The strategic importance of monitoring CCUS progress lies in its potential to influence the competitive landscape and regulatory environment for traditional energy sources. For instance, the U.S. Department of Energy's Bipartisan Infrastructure Law allocated $12 billion for CCUS development and deployment in 2022, signaling a significant governmental push that could accelerate industry adoption.

- CCUS Investment Growth: Global investment in CCUS projects reached an estimated $20 billion in 2023, with projections indicating continued expansion.

- Policy Support: The Inflation Reduction Act of 2022 enhanced tax credits for CCUS, making projects more economically viable.

- Technological Maturation: Ongoing research is improving the efficiency and reducing the cost of capture technologies, with some aiming for capture costs below $50 per ton of CO2 by 2030.

Renewable Energy Technological Advancements

Technological progress in renewable energy, particularly solar, wind, and battery storage, is accelerating. These advancements present a significant long-term competitive challenge to the demand for fossil fuels. For instance, the global average cost of electricity from utility-scale solar PV fell by an estimated 89% between 2010 and 2022, according to the International Renewable Energy Agency (IRENA).

While Amplify Energy currently focuses on oil and gas, the rising efficiency and declining costs of renewables are likely to hasten the energy transition. This shift could directly impact Amplify Energy's future market share and the viability of new investments in traditional hydrocarbon projects. The International Energy Agency (IEA) reported in 2023 that renewable energy sources accounted for over 80% of new global power capacity additions.

This broader technological evolution necessitates careful strategic planning for companies like Amplify Energy. Consider these key impacts:

- Accelerated Demand Shift: Falling renewable costs make them increasingly competitive, potentially reducing long-term demand for oil and gas.

- Investment Landscape Changes: Investors are increasingly favoring green energy, potentially impacting capital availability for hydrocarbon projects.

- Operational Efficiency Pressures: The drive for efficiency in renewables may indirectly pressure oil and gas companies to optimize their own operations.

Amplify Energy can leverage advancements in digitalization and automation to enhance operational efficiency and reduce costs. Technologies like AI-powered predictive maintenance and remote monitoring systems are crucial for minimizing downtime and improving safety, as evidenced by the oil and gas industry's increasing investment in digital transformation, which yielded average operational cost reductions of 5-10% in 2023.

Continued innovation in Enhanced Oil Recovery (EOR) techniques, such as CO2 injection and chemical flooding, is vital for maximizing output from Amplify Energy's mature fields. The global EOR market, valued at approximately $25 billion in 2024, demonstrates the industry's reliance on these technologies to unlock previously uneconomical reserves and extend asset life.

The increasing efficiency and declining costs of renewable energy technologies, such as solar and wind, present a long-term competitive challenge. For instance, the global average cost of utility-scale solar PV electricity dropped by about 89% between 2010 and 2022, signaling a significant shift that could impact future demand for fossil fuels.

Carbon Capture, Utilization, and Storage (CCUS) technologies are gaining traction, with global investment reaching an estimated $20 billion in 2023. While not directly involved, Amplify Energy must monitor CCUS progress as policy support, like enhanced tax credits from the Inflation Reduction Act of 2022, could influence the regulatory and market landscape for traditional energy sources.

Legal factors

Amplify Energy navigates a dense regulatory landscape, facing stringent federal, state, and local environmental laws. These cover critical areas like air emissions, water quality, waste disposal, and spill prevention, demanding constant vigilance and adherence. For instance, the EPA's Clean Air Act and Clean Water Act impose strict operational standards.

Compliance with bodies such as the Environmental Protection Agency (EPA) and various state environmental agencies is non-negotiable for Amplify Energy. Failure to meet these standards can lead to severe financial penalties; in 2023, the energy sector faced billions in environmental fines across the U.S. for various violations.

The consequences of non-compliance extend beyond financial penalties, potentially including costly operational shutdowns and significant damage to Amplify Energy's reputation. A notable example is the 2021 pipeline spill incident, which resulted in extensive environmental cleanup costs and legal liabilities, underscoring the critical importance of robust environmental management systems.

Amplify Energy's operations are heavily influenced by land use and permitting laws, which dictate where and how it can drill and produce oil and gas. These regulations cover property rights, zoning, and the entire permitting process. For instance, in California, where Amplify has significant offshore operations, the California Coastal Commission plays a crucial role in permitting, often imposing stringent environmental conditions. Failure to secure or maintain these permits, or changes in local opposition, can lead to significant project delays or outright cancellations, directly impacting production and revenue.

Amplify Energy must rigorously follow occupational health and safety rules, especially those from OSHA, to keep its employees safe. These rules span from ensuring safety at well sites to maintaining equipment and having plans for emergencies.

In 2023, OSHA reported over 2.8 million workplace injuries and illnesses across various industries, highlighting the critical need for robust safety protocols. For Amplify Energy, this means strict adherence to standards for handling hazardous materials, operating heavy machinery, and implementing comprehensive training programs.

Failure to comply can lead to significant fines; for instance, willful violations can incur penalties up to $15,625 per violation in 2024. Beyond financial penalties, ensuring worker well-being is paramount to prevent accidents, protect the company's reputation, and avoid costly liability claims, which could significantly impact Amplify Energy's financial performance.

Contractual Obligations and Disputes

Amplify Energy navigates a complex web of contractual obligations, including leases for offshore platforms, joint operating agreements with partners, and supply and transportation contracts crucial for its operations. These agreements are foundational to its business, but also present potential legal challenges.

Disputes stemming from these contracts can lead to substantial financial penalties and operational disruptions. For instance, a disagreement over production sharing in a joint operating agreement could halt output or incur significant legal fees. In 2023, Amplify Energy reported general and administrative expenses that included legal costs, reflecting the ongoing need for legal support in managing these relationships.

Therefore, robust contract management processes and access to experienced legal counsel are paramount for Amplify Energy. This proactive approach helps mitigate risks associated with breaches, interpretation issues, or non-performance by counterparties, ensuring the company's operational continuity and financial stability.

- Lease Agreements: Essential for securing offshore production sites, with terms dictating royalty payments and operational responsibilities.

- Joint Operating Agreements (JOAs): Govern shared ownership and operational control of assets with other energy companies, requiring meticulous adherence to agreed-upon procedures.

- Supply and Transportation Contracts: Secure vital resources and movement of produced hydrocarbons, with clauses covering pricing, delivery, and quality standards.

- Dispute Resolution Mechanisms: Often embedded within contracts, including arbitration or mediation, to address disagreements efficiently and minimize litigation.

Litigation Risks and Liability

Amplify Energy, like all companies in the oil and gas sector, navigates significant litigation risks. These can range from environmental lawsuits stemming from operational incidents to personal injury claims and shareholder disputes. The company must actively manage potential liabilities, particularly those associated with spills or accidents, and be prepared to mount robust legal defenses against any challenges that arise.

The aftermath of the 2021 pipeline spill off the coast of California serves as a stark reminder of these risks. Amplify Energy faced substantial legal actions and regulatory scrutiny. While the company reached settlements, including a $7.1 million settlement with local governments in 2024 to resolve claims related to the spill's impact, the experience underscores the financial and operational consequences of such events.

- Environmental Lawsuits: Amplify Energy must contend with potential legal challenges related to pollution and environmental damage, as seen in the 2021 pipeline spill litigation.

- Personal Injury Claims: The company faces liability for any accidents that result in injury to employees or third parties.

- Shareholder Disputes: Litigation can also arise from shareholders if they believe the company's management has not acted in their best interests, particularly concerning safety and environmental compliance.

- Regulatory Fines and Penalties: Beyond direct litigation, regulatory bodies can impose significant fines for non-compliance, adding to the overall legal cost burden.

To mitigate these exposures, Amplify Energy relies on comprehensive insurance coverage and sophisticated legal defense strategies. These measures are critical for protecting the company's assets and reputation in an industry inherently prone to legal entanglements.

Amplify Energy operates under a strict legal framework governing environmental protection, worker safety, and contractual agreements. Adherence to regulations from bodies like the EPA and OSHA is paramount to avoid substantial fines and operational disruptions. The company's 2023 general and administrative expenses included legal costs, reflecting the ongoing need for legal counsel in managing complex contracts and potential disputes.

The 2021 pipeline spill incident highlights significant litigation risks, with Amplify Energy facing substantial legal actions and reaching a $7.1 million settlement with local governments in 2024. This underscores the financial and reputational consequences of environmental non-compliance and operational incidents.

| Legal Factor | Impact on Amplify Energy | Relevant Data/Examples |

| Environmental Regulations | Compliance with EPA and state laws is critical; non-compliance leads to fines and operational shutdowns. | Billions in environmental fines levied across the energy sector in 2023. |

| Occupational Safety | Adherence to OSHA standards is vital for worker well-being and avoiding penalties. | Willful OSHA violations can incur penalties up to $15,625 per violation in 2024. |

| Contractual Obligations | Lease, JOAs, and supply contracts are foundational but can lead to disputes and financial penalties if breached. | Amplify Energy's 2023 G&A expenses included legal costs for contract management. |

| Litigation Risks | Environmental lawsuits, personal injury claims, and shareholder disputes pose significant liabilities. | $7.1 million settlement with local governments in 2024 related to the 2021 pipeline spill. |

Environmental factors

The intensifying global commitment to combating climate change, with a strong emphasis on reducing carbon emissions, presents a significant long-term challenge for fossil fuel producers like Amplify Energy. This trend is driving governments worldwide to implement more stringent environmental regulations and carbon pricing policies.

For instance, the European Union's Carbon Border Adjustment Mechanism (CBAM), fully implemented in 2026, will impose a price on carbon emissions for imported goods, potentially impacting the competitiveness of energy products. This regulatory environment, coupled with growing investor preference for sustainable assets, could lead to decreased demand for oil and gas, directly influencing Amplify Energy's strategic planning and investment horizons.

Amplify Energy's operations, especially in older oil fields, consume substantial amounts of water for processes like drilling and hydraulic fracturing. This reliance on water makes the company vulnerable to regional water scarcity, which can trigger more stringent regulations on water use and disposal. For instance, in California, where Amplify has significant operations, drought conditions have historically led to increased scrutiny of water consumption by industrial sectors.

The potential for stricter regulations on water usage and wastewater disposal directly impacts Amplify Energy's operational costs. Compliance with these evolving environmental standards, particularly concerning the treatment and discharge of produced water, can necessitate significant capital investment in advanced water management technologies. Furthermore, community concerns over water contamination can fuel opposition to new projects or expansions, adding another layer of operational risk.

Embracing sustainable water management is becoming a critical factor for long-term operational viability and social license to operate. By implementing efficient water recycling and reuse programs, Amplify Energy can mitigate the risks associated with water scarcity and regulatory changes. For example, the company's efforts to optimize water usage in its California operations reflect a growing industry trend towards more responsible resource management, aiming to reduce both environmental impact and operational expenditures.

Amplify Energy's operations in Oklahoma, Texas, Louisiana, and California necessitate careful management of their environmental footprint, particularly concerning biodiversity and habitat protection. The company's activities, which include oil and gas production and transportation, can affect sensitive ecosystems and the species within them. For instance, coastal areas in California and Louisiana are critical habitats for numerous marine and avian species, and any operational disruption could have significant consequences.

Regulatory frameworks are a key consideration, with laws like the Endangered Species Act and various state-level wetland protection statutes directly impacting Amplify Energy's operational flexibility. Failure to comply with these regulations, which could involve restrictions on drilling in or near protected habitats, can lead to substantial fines and project delays. In 2023, the U.S. Fish and Wildlife Service continued to list and protect numerous species across Amplify's operational regions, underscoring the ongoing need for vigilance.

Environmental impact assessments and robust mitigation strategies are therefore indispensable for Amplify Energy. These processes help identify potential risks to biodiversity and outline measures to minimize harm, such as spill prevention protocols and habitat restoration efforts. Demonstrating a commitment to these practices is vital not only for regulatory compliance but also for maintaining social license to operate and public trust, especially in environmentally sensitive areas.

Waste Management and Pollution Prevention

Amplify Energy faces significant challenges in managing waste generated from its offshore operations, including drilling fluids, produced water, and hazardous materials. These byproducts require stringent disposal and treatment protocols to prevent soil and water contamination, a critical aspect of environmental stewardship and regulatory compliance.

The company must adhere to strict regulations governing waste handling, treatment, and disposal, which are designed to safeguard ecosystems. Failure to comply can lead to substantial environmental liabilities and operational disruptions. In 2023, the U.S. Environmental Protection Agency (EPA) continued to enforce regulations like the Clean Water Act, impacting offshore discharge permits.

Effective waste management is not merely a compliance issue but a core component of operational integrity for Amplify Energy. Proactive strategies in pollution prevention and waste minimization are essential to mitigate risks and maintain a positive environmental record, thereby safeguarding the company's long-term viability.

- Waste Streams: Drilling fluids, produced water, and hazardous materials are key waste outputs.

- Regulatory Oversight: Strict adherence to EPA and other environmental agency regulations is mandatory.

- Environmental Impact: Proper waste management prevents soil and water contamination.

- Operational Risk: Ineffective waste handling can lead to significant environmental liabilities and operational shutdowns.

Energy Transition and Renewable Integration

The global push towards decarbonization, exemplified by the International Energy Agency's (IEA) projection that renewable energy sources will account for over 90% of global electricity capacity expansion in 2024, poses a significant environmental challenge for Amplify Energy. This transition impacts hydrocarbon demand and investor preferences, pushing companies like Amplify to consider long-term strategies for adaptation and potential diversification into cleaner energy sectors.

As of early 2024, the renewable energy sector continues its robust growth trajectory. For Amplify Energy, this means navigating a landscape where regulatory pressures and public opinion increasingly favor lower-carbon alternatives. The company's reliance on conventional assets necessitates a keen awareness of how evolving environmental standards and the accelerating energy transition could shape future market dynamics and capital allocation.

- Global Renewable Capacity Growth: The IEA reported that renewable energy additions in 2023 reached nearly 510 gigawatts (GW), a 50% increase from 2022, with solar PV dominating this expansion.

- Investor Sentiment Shift: A growing number of institutional investors are incorporating Environmental, Social, and Governance (ESG) criteria into their decision-making, potentially impacting Amplify Energy's access to capital if its portfolio isn't aligned with sustainability goals.

- Hydrocarbon Demand Outlook: While demand for oil and gas remains substantial in the near to medium term, long-term forecasts suggest a gradual decline as electrification and alternative fuels gain traction, requiring strategic foresight from Amplify Energy.

The global shift towards decarbonization presents a significant environmental challenge for Amplify Energy, with renewable energy capacity expanding rapidly. This trend influences hydrocarbon demand and investor preferences, pushing companies like Amplify to adapt and potentially diversify into cleaner energy sectors.

As of early 2024, the renewable energy sector continues its robust growth. For Amplify Energy, this means navigating a landscape where regulatory pressures and public opinion increasingly favor lower-carbon alternatives, impacting future market dynamics and capital allocation.

Amplify Energy's operations require careful management of water resources, particularly in regions like California which have experienced drought. Stricter regulations on water usage and wastewater disposal can increase operational costs and necessitate investment in advanced water management technologies.

Biodiversity and habitat protection are also critical environmental considerations for Amplify Energy, especially in its coastal operations. Compliance with regulations such as the Endangered Species Act is essential to avoid fines and project delays, underscoring the need for robust environmental impact assessments and mitigation strategies.

| Factor | Description | Impact on Amplify Energy | 2024/2025 Data/Trend |

| Climate Change & Decarbonization | Global efforts to reduce carbon emissions and transition to renewable energy sources. | Potential decrease in demand for oil and gas; increased regulatory scrutiny and investor pressure for ESG compliance. | IEA projects renewables to account for over 90% of global electricity capacity expansion in 2024. Institutional investors increasingly favor ESG criteria. |

| Water Scarcity & Regulations | Reliance on water for operations, vulnerable to regional scarcity and stricter usage/disposal regulations. | Increased operational costs; need for investment in water management technologies; potential project delays due to community concerns. | Drought conditions in California historically led to increased scrutiny of industrial water consumption. |

| Biodiversity & Habitat Protection | Impact of operations on ecosystems and species, necessitating compliance with environmental laws. | Risk of fines, project delays, and operational restrictions if regulations like the Endangered Species Act are not met. | U.S. Fish and Wildlife Service continued to list and protect numerous species across Amplify's operational regions in 2023. |

| Waste Management | Handling and disposal of drilling fluids, produced water, and hazardous materials from operations. | Requires adherence to strict EPA regulations to prevent soil and water contamination; non-compliance leads to environmental liabilities. | EPA continued to enforce regulations like the Clean Water Act in 2023, impacting offshore discharge permits. |

PESTLE Analysis Data Sources

Our Amplify Energy PESTLE Analysis is built on a robust foundation of data, drawing from official government energy policies, international economic reports from organizations like the IEA and OPEC, and reputable industry publications. This ensures a comprehensive understanding of the political, economic, and technological landscape impacting the energy sector.