Amplify Energy Boston Consulting Group Matrix

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amplify Energy Bundle

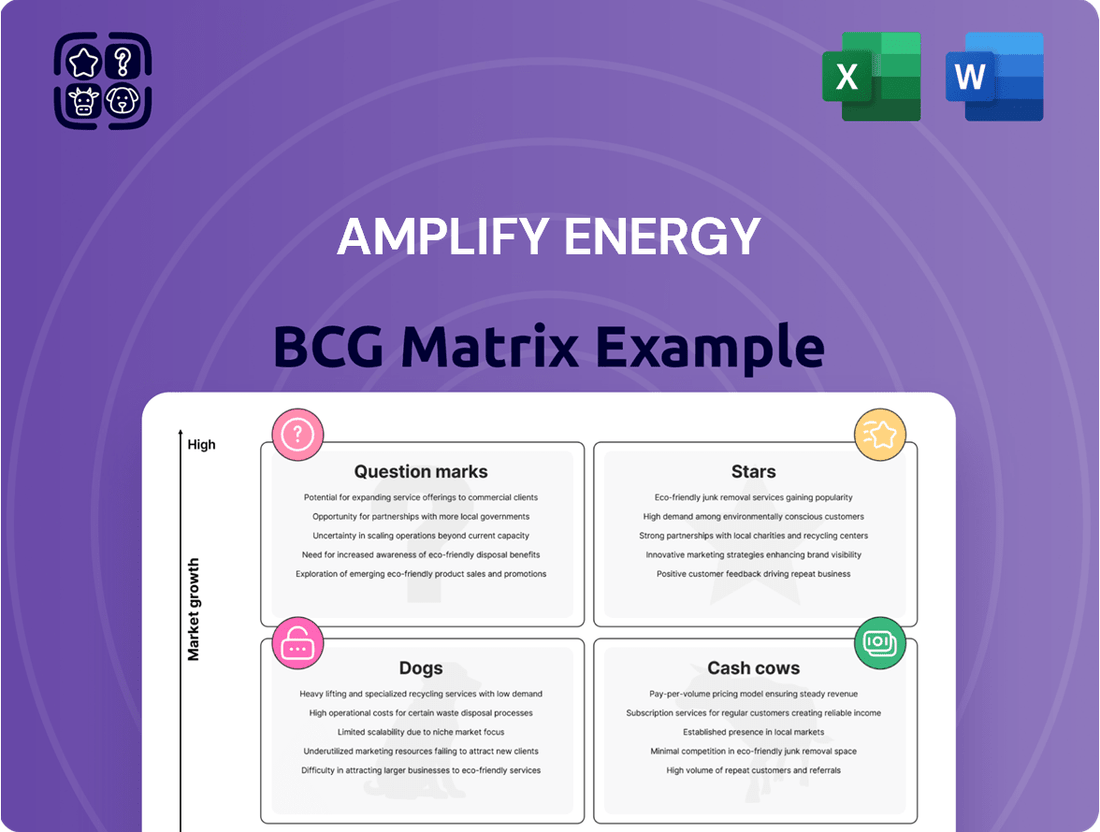

Amplify Energy's position within the BCG Matrix reveals a fascinating strategic landscape. Understanding whether their assets are Stars, Cash Cows, Dogs, or Question Marks is crucial for informed decision-making. This preview offers a glimpse into their market performance and potential.

To truly unlock the strategic advantages and pinpoint where Amplify Energy should focus its capital and innovation efforts, dive into the full BCG Matrix report. Gain a comprehensive understanding of their portfolio's strengths and weaknesses, and equip yourself with actionable insights for future growth.

Stars

Amplify Energy's Beta Field Development Program is a star performer within its portfolio, showcasing exceptional growth. The program's success is underscored by plans for six new well completions in 2025, building on the momentum from recent wells that have surpassed production expectations. This strategic development has already driven a substantial increase in Beta's output, which has climbed by roughly 35% since the beginning of 2024, highlighting its strong market potential and rapid expansion.

The acquisition of Juniper Capital's producing assets, slated for completion in Q2 2025, is a significant development for Amplify Energy. This deal brings a substantial portfolio of oil-weighted assets, primarily located in the DJ and Powder River Basins. These additions are expected to boost Amplify's overall scale and operational efficiency.

Amplify Energy's strategic pivot towards an increased oil-weighting, notably through its Juniper acquisition, signals a calculated move to benefit from anticipated oil price appreciation and bolster its revenue streams. This strategic alignment with oil-centric assets is designed to foster accelerated growth within a market environment that increasingly favors oil production.

Growth in Proved Undeveloped Reserves at Beta

Amplify Energy's Beta field is showing strong promise, particularly with its proved undeveloped reserves. The company's 2024 development activities have significantly boosted these reserves, signaling a robust future for the field.

This increase in proved undeveloped reserves is a key indicator of Beta's potential. These reserves are essentially a future production stream that can be developed over time, adding considerable value.

- Proved Undeveloped Reserves Growth: The 2024 development program at the Beta field led to a material increase in proved undeveloped reserves, highlighting its substantial future production capacity.

- Future Production Pipeline: These reserves represent a significant pipeline of oil and gas that can be converted into proved developed reserves, directly contributing to Amplify Energy's long-term growth strategy.

- Strategic Importance: The successful development of these reserves is critical for sustaining and growing Amplify Energy's production profile in the coming years.

Positive Analyst Outlook and Price Targets

Amplify Energy is currently enjoying a strong endorsement from financial analysts, with a consensus 'Strong Buy' rating reflecting significant market optimism. This positive sentiment is underpinned by an average analyst price target that suggests substantial room for growth, indicating confidence in the company's trajectory.

This robust outlook stems from Amplify Energy's strategic positioning and ongoing development initiatives, which analysts believe will drive future performance. The market's confidence is a key indicator of potential upside, making it an important consideration for investors.

- Strong Buy Consensus: Analysts have collectively issued a 'Strong Buy' recommendation for Amplify Energy.

- Significant Upside Potential: The average price target set by analysts implies considerable growth prospects for the company's stock.

- Driver of Confidence: This positive market view is directly linked to Amplify Energy's strategic plans and active development programs.

Amplify Energy's Beta Field Development Program is a clear star in its portfolio, demonstrating exceptional growth. The program's success is highlighted by plans for six new well completions in 2025, building on the strong performance of recent wells that have exceeded production expectations. This strategic development has already boosted Beta's output by approximately 35% since the start of 2024, underscoring its significant market potential and rapid expansion.

The acquisition of Juniper Capital's producing assets, expected to close in Q2 2025, is a major move for Amplify Energy. This deal will add a substantial collection of oil-weighted assets, mainly in the DJ and Powder River Basins, which are anticipated to increase Amplify's overall size and operational efficiency.

Amplify Energy's strategic shift towards a more oil-heavy portfolio, particularly with the Juniper acquisition, is a calculated effort to capitalize on expected oil price increases and strengthen its revenue. This focus on oil-centric assets is designed to drive faster growth in a market that increasingly favors oil production.

The Beta field is showing great promise for Amplify Energy, especially concerning its proved undeveloped reserves. The company's 2024 development activities have significantly increased these reserves, pointing to a strong future for the field.

This growth in proved undeveloped reserves is a key indicator of Beta's future value. These reserves represent a future production stream that can be developed over time, adding considerable value to Amplify Energy.

| Metric | Value (as of early 2025) | Significance |

|---|---|---|

| Beta Field Production Growth (YTD 2024) | ~35% increase | Demonstrates strong operational performance and market demand. |

| Planned Well Completions (2025) | 6 new wells | Indicates continued investment and expansion of production capacity. |

| Analyst Consensus | Strong Buy | Reflects high market confidence and expected future performance. |

| Average Analyst Price Target | Implies significant upside potential | Suggests substantial room for stock appreciation based on current valuations. |

What is included in the product

Amplify Energy's BCG Matrix highlights which business units to invest in, hold, or divest based on market share and growth.

The Amplify Energy BCG Matrix offers a clear, one-page overview, instantly clarifying each business unit's strategic position to alleviate confusion.

Cash Cows

Amplify Energy's mature conventional asset base in Oklahoma, Texas, and Louisiana represents a classic Cash Cow. These fields, with their stable production and existing infrastructure, generate consistent cash flow with relatively low reinvestment needs. For instance, in 2023, Amplify's conventional assets contributed significantly to its overall production, demonstrating their reliability as a foundational income stream.

Existing Beta Field production is a significant cash cow for Amplify Energy. This mature offshore asset in Southern California consistently delivers robust cash flow, a testament to its operational efficiency and established infrastructure.

The reliability of income from Beta Field is bolstered by relatively low ongoing promotional and placement investments. This mature production base allows Amplify Energy to allocate capital effectively to other growth areas.

Amplify Energy's Bairoil operations in the Rockies are a prime example of a cash cow within their portfolio. The company is actively working to boost efficiency here, focusing on improving their water-alternating-gas injection performance. This strategic move is designed to squeeze every bit of value from a mature asset.

These optimization efforts are directly aimed at maximizing cash flow. By implementing cost-saving projects and enhancing operational performance, Amplify ensures that Bairoil continues to be a stable financial contributor. For instance, in the first quarter of 2024, Amplify reported that their Rockies segment, which includes Bairoil, generated $15.1 million in adjusted EBITDA, highlighting the segment's robust cash-generating capabilities.

Magnify Energy Services Contribution

Magnify Energy Services, a wholly-owned subsidiary, is a key component in Amplify Energy's strategy, acting as a Cash Cow within the BCG Matrix framework. Its primary function is to bolster Amplify's competitive edge by driving down operational expenses across the company's established asset portfolio.

By focusing on operational enhancements, Magnify directly translates into improved profit margins and a stronger cash flow generation from Amplify's existing business operations. This efficiency boost is critical for funding growth initiatives in other areas of the company.

- Operational Efficiency Gains: Magnify's focus on reducing operating costs directly enhances profitability.

- Cash Flow Generation: Improved efficiency leads to higher cash flow from mature assets.

- Competitive Advantage: Lower costs bolster Amplify's position in the market.

- Subsidiary Contribution: Magnify's role is vital for overall financial health.

Consistent Free Cash Flow Generation

Amplify Energy's consistent free cash flow generation is a hallmark of its Cash Cow status within the BCG Matrix. The company has a remarkable history, having achieved positive free cash flow in 18 out of the last 19 fiscal quarters. This sustained performance underscores the profitability and stability of its current operations.

This reliable cash generation is crucial. It provides Amplify Energy with the necessary capital to manage its debt obligations and fund future strategic initiatives without needing to seek external financing. The strength of its existing asset base is clearly reflected in this consistent financial output.

- Consistent Free Cash Flow: Amplify Energy has generated positive free cash flow in 18 of the past 19 fiscal quarters.

- Robust Profitability: This demonstrates the strong profitability of its existing asset base.

- Capital for Growth: The generated cash supports debt reduction and strategic investments.

- Reduced External Reliance: Amplify Energy can fund its operations and growth without relying on external capital markets.

Amplify Energy's mature conventional assets, such as those in Oklahoma, Texas, and Louisiana, function as significant cash cows. These fields provide stable production and require minimal reinvestment, ensuring consistent cash flow. The Beta Field, a mature offshore asset, is another key cash cow, consistently generating robust cash flow due to its operational efficiency and established infrastructure.

The Bairoil operations in the Rockies also exemplify a cash cow. Amplify is focused on enhancing efficiency, particularly through improved water-alternating-gas injection, to maximize value from this mature asset. This strategic focus aims to boost cash flow by implementing cost-saving measures and optimizing performance. For example, Amplify's Rockies segment, including Bairoil, reported $15.1 million in adjusted EBITDA in Q1 2024, underscoring its strong cash-generating capability.

| Asset/Operation | BCG Category | Key Characteristics | 2024 Data Highlight |

| Conventional Assets (OK, TX, LA) | Cash Cow | Stable production, low reinvestment needs | Significant contributor to 2023 production |

| Beta Field | Cash Cow | Mature offshore asset, operational efficiency | Consistent robust cash flow |

| Bairoil (Rockies) | Cash Cow | Focus on efficiency improvements (e.g., WAG injection) | Rockies segment EBITDA: $15.1 million (Q1 2024) |

Delivered as Shown

Amplify Energy BCG Matrix

The Amplify Energy BCG Matrix you're previewing is the identical, fully formatted document you'll receive immediately after purchase. This means no watermarks, no altered content, and no surprises—just a professionally designed, analysis-ready report that’s yours to utilize for strategic decision-making.

Dogs

Amplify Energy is strategically evaluating the complete divestiture of its East Texas and Oklahoma assets, signaling these regions are not central to its growth strategy. This move suggests a focus on optimizing its portfolio by shedding less productive or high-cost operations. For instance, in 2024, Amplify completed the sale of certain Haynesville acreage in East Texas, a clear indication of its commitment to exiting these specific positions and reallocating capital to more promising ventures.

Amplify Energy's recent divestiture of its non-operated Eagle Ford assets in July 2025 marks a strategic move to concentrate on its core operational strengths. This decision reflects a clear understanding of the company's portfolio, shedding assets that may not offer the same growth potential or strategic alignment as its primary ventures. For instance, in the first quarter of 2024, Amplify reported total production of approximately 19,300 barrels of oil equivalent per day, with a significant portion stemming from its operated assets, highlighting the focus shift.

Amplify Energy divested specific portions of its undeveloped Haynesville acreage in East Texas during late 2024 and early 2025. This strategic move generated proceeds for the company while retaining a minority interest in these areas.

This monetization indicates that these particular undeveloped Haynesville assets were not considered a top priority for Amplify's internal development plans. The decision suggests they were viewed as less strategic for the company's long-term growth trajectory, allowing capital to be redeployed elsewhere.

Assets with Higher General and Administrative Expenses

Amplify Energy's divestiture strategy for its East Texas and Oklahoma assets is a clear move to reduce its general and administrative (G&A) expenses. This suggests these particular assets were weighing down the company's overhead more than they were contributing to overall profitability.

By shedding these assets, Amplify Energy is streamlining its operations. This focus on efficiency is crucial for improving the company's financial health.

- Divestiture Goal: To significantly decrease G&A expenses.

- Asset Performance: East Texas and Oklahoma assets likely had a high G&A burden relative to their operational contribution.

- Strategic Rationale: Improving overall operational efficiency and financial performance.

Production Roll-off from Less Productive Fields

Amplify Energy's mature fields, experiencing natural production declines, represent segments that align with the 'dog' category in a BCG Matrix analysis. These areas are characterized by low growth and, in some cases, diminishing returns, particularly when factoring in the impact of lower SEC pricing on proved developed reserves.

This situation highlights a strategic challenge where resources are not being effectively reinvested to revitalize these less productive assets. The company's focus remains on maximizing overall value, but the inherent characteristics of these declining fields necessitate careful management to avoid disproportionate resource allocation.

- Declining Production: Mature fields naturally see a decrease in output over time without significant new investment or enhanced recovery techniques.

- Lower SEC Pricing Impact: Reduced oil and gas prices, as reflected in SEC filings, can make these fields less economically viable, further solidifying their 'dog' status.

- Limited Revitalization Efforts: The lack of active revitalization suggests these fields are not seen as growth opportunities, fitting the 'dog' profile where cash flow may be minimal or negative.

- Strategic Consideration: Amplify must balance the cost of maintaining these declining assets against their contribution to overall production and cash flow.

Amplify Energy's mature fields, characterized by natural production declines, fit the 'dog' quadrant of the BCG Matrix. These assets exhibit low growth and potentially diminishing returns, especially when considering the impact of fluctuating commodity prices on their economic viability.

The company's strategic decision to divest certain East Texas and Oklahoma assets, as observed in 2024 and early 2025 divestitures, further underscores the classification of some portfolio segments as 'dogs'. These moves suggest a focus on shedding underperforming or non-core assets to improve overall portfolio efficiency and financial health.

For example, Amplify's reported production figures and asset sales indicate a deliberate shift away from areas with lower growth prospects or higher operational burdens, aligning with the typical characteristics of 'dog' assets that require careful management or divestment.

These mature fields, while potentially still generating some cash flow, are unlikely to be significant growth drivers for Amplify Energy in the near to medium term, necessitating a strategic approach to capital allocation and portfolio management.

| BCG Category | Amplify Energy Asset Example | Characteristics | Strategic Implication |

|---|---|---|---|

| Dog | Mature fields with declining production (e.g., certain East Texas/Oklahoma assets) | Low market growth, low relative market share, low profitability, high cost of maintenance | Divestiture, minimal investment, or cash harvesting |

Question Marks

Amplify Energy's acquisition of roughly 287,000 net acres in the DJ and Powder River Basins, through the Juniper Capital deal, positions these undeveloped areas as potential stars in its BCG Matrix. These vast leasehold interests hold considerable growth prospects for Amplify, signaling future upside.

However, these undeveloped acreage positions currently represent a low market share for Amplify. Significant future capital investment will be necessary to unlock their full potential and move them towards higher market share.

Amplify Energy's Beta development, currently a Star, has potential for further acceleration. This future growth is contingent on a significant uptick in commodity prices and improved capital availability. For instance, if crude oil prices were to consistently trade above $80 per barrel, it could unlock substantial investment for expanding Beta's reach.

This represents a high-growth opportunity, but it demands substantial, currently uncommitted capital to achieve its full potential. Without favorable market conditions and access to funding, the accelerated development might not materialize, leaving Beta at its current strong, but not exponentially growing, trajectory.

The successful integration of Juniper's assets is paramount for Amplify Energy to unlock the anticipated financial and diversification gains from the acquisition. This process, crucial for realizing the full value of the deal, presents a significant operational challenge.

While Juniper's assets offer high growth potential, their integration into Amplify's existing infrastructure is a complex undertaking. This complexity introduces execution risks that could impact the speed and effectiveness of realizing these growth prospects.

The ultimate impact of this integration on Amplify Energy's BCG Matrix positioning remains a question mark due to these inherent execution risks and the significant resources required. For instance, as of Q1 2024, Amplify reported a net loss of $26 million, highlighting the financial pressures that can affect integration efforts.

Leveraging Technology for Efficiency in New Areas

Amplify Energy's exploration into leveraging technology, such as real-time data analytics through a partnership with a tech firm, presents a question mark, particularly for its new or underperforming assets. The success of these technological integrations hinges on their ability to demonstrably improve operational efficiency and, consequently, boost market share for these specific business units.

The critical factor is whether these technological investments can translate into tangible performance improvements. For instance, if Amplify can use these analytics to reduce downtime on a new offshore platform, that would directly support its market share growth potential. Without clear evidence of such turnarounds or maximization, the technology's impact remains speculative.

- Investment Justification: The initial capital outlay for new technology needs to be offset by projected efficiency gains and revenue increases to justify its inclusion in the BCG matrix, especially for question mark assets.

- Performance Metrics: Establishing clear, measurable key performance indicators (KPIs) to track the impact of technology on operational efficiency and profitability is crucial for assessing market share growth potential.

- Implementation Risk: The successful deployment and integration of new technologies can be challenging, posing a risk to the projected benefits and overall market position of the affected assets.

- Data-Driven Decisions: Real-time data analytics can provide insights to optimize production, reduce costs, and identify new opportunities, thereby supporting a move from question mark to star in the BCG matrix if executed effectively.

Potential for New Strategic Partnerships or Joint Ventures

Amplify Energy actively seeks strategic partnerships by monetizing certain assets while maintaining working interests. This approach, particularly evident in areas like East Texas, highlights their openness to joint ventures. These collaborations are positioned as high-growth potential avenues, though their ultimate success hinges on effective teamwork and market acceptance.

For instance, in 2024, Amplify continued to explore opportunities that leverage shared infrastructure and operational efficiencies, a common driver for such partnerships. The company's strategy often involves identifying specific geographic regions or asset types where a joint venture can unlock greater value than either party could achieve alone. This could involve sharing exploration costs, development risks, or market access.

- Monetization Strategy: Amplify's practice of selling partial stakes in assets while keeping a working interest allows them to generate capital for reinvestment and de-risk operations, making them an attractive partner.

- Area of Mutual Interest: Focus areas like East Texas are prime candidates for joint ventures due to established infrastructure and potential for synergistic operations.

- High-Growth, Uncertain Outcomes: These partnerships are typically geared towards projects with significant upside potential but also inherent risks, requiring careful due diligence and alignment of objectives.

- Collaboration Dependency: The success of these ventures is intrinsically linked to the ability of partners to effectively collaborate, share resources, and adapt to market dynamics.

Amplify Energy's undeveloped acreage, acquired in the DJ and Powder River Basins, represents a significant question mark. While these areas hold substantial future growth prospects, their current market share is low, requiring considerable future capital investment to realize their potential.

The success of new technology integration, like real-time data analytics, for underperforming assets also remains a question mark. The ability of these investments to demonstrably improve operational efficiency and boost market share is critical, with Q1 2024 results showing a net loss of $26 million, underscoring the need for tangible performance improvements.

Strategic partnerships, while offering high-growth potential, introduce collaboration dependencies and uncertain outcomes. The effective integration of Juniper's assets, a complex undertaking with execution risks, further contributes to the question mark status of these growth initiatives.

| BCG Category | Amplify Energy Asset Example | Market Growth | Relative Market Share | Key Question Mark Factors |

|---|---|---|---|---|

| Question Marks | Undeveloped DJ & Powder River Basin Acreage | High (potential) | Low | Capital investment needs, realization of growth prospects |

| Question Marks | Technology Integration (new/underperforming assets) | Uncertain (depends on tech success) | Low to Medium | Demonstrable efficiency gains, market share impact |

| Question Marks | Strategic Partnerships (e.g., East Texas) | High (potential) | Varies (depends on partner) | Collaboration effectiveness, market acceptance, shared risk |

| Question Marks | Juniper Capital Asset Integration | High (potential) | Low (initially) | Operational complexity, execution risk, capital requirements |

BCG Matrix Data Sources

Our Amplify Energy BCG Matrix is built on a foundation of robust data, integrating publicly available financial statements, industry-specific market research, and official regulatory filings to ensure accurate strategic assessments.