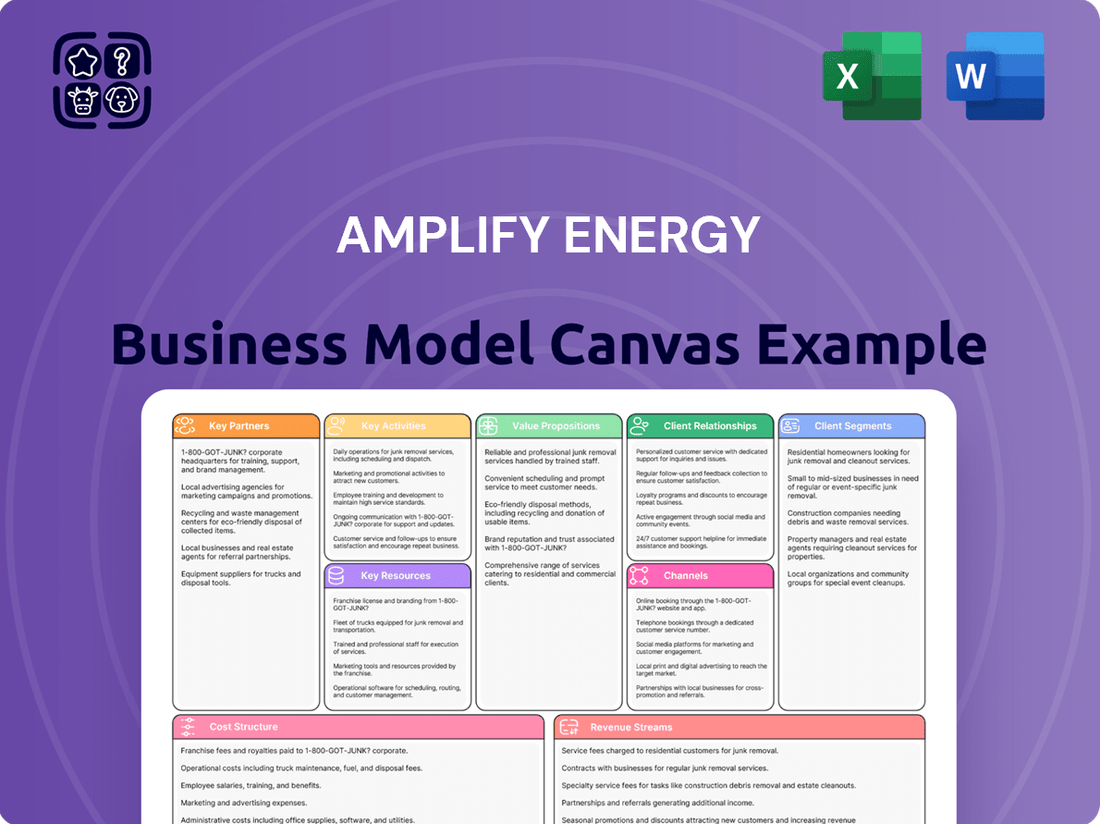

Amplify Energy Business Model Canvas

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amplify Energy Bundle

Unlock the full strategic blueprint behind Amplify Energy's business model. This in-depth Business Model Canvas reveals how the company drives value, captures market share, and stays ahead in a competitive landscape. Ideal for entrepreneurs, consultants, and investors looking for actionable insights.

Partnerships

Amplify Energy is pursuing strategic acquisition partners to drive growth, notably its merger agreement with Juniper Capital, announced in January 2025. This combination is set to integrate significant oil-weighted producing assets and leasehold interests in the DJ and Powder River Basins.

The primary goal of this partnership is to bolster Amplify Energy's scale, enhance operational efficiency, and improve profit margins. This transformational move is expected to significantly strengthen the company's asset base and unlock future growth opportunities.

Amplify Energy relies on a network of third-party oilfield service providers for crucial operations like drilling, completion, and ongoing maintenance across its various oil and gas assets. These partnerships are essential for accessing specialized expertise, particularly for optimizing production in older fields and implementing advanced recovery methods.

The company strategically utilizes its wholly owned subsidiary, Magnify Energy Services, to bring certain oilfield services in-house. This integration aims to bolster operational reliability and achieve cost efficiencies, contributing to a more streamlined and controlled service delivery model.

Amplify Energy actively engages in joint development and non-operated well partnerships, notably in key shale plays like East Texas and the Eagle Ford. These collaborations are crucial for monetizing acreage, as seen in their recent Haynesville transactions, while still securing future participation and working interests.

These strategic alliances with other operators are designed to enhance resource development efficiency and to distribute operational risks more broadly. For instance, in 2024, Amplify continued to explore opportunities that leverage shared expertise and capital for more effective project execution.

Financial Institutions and Lenders

Amplify Energy's relationships with banks and other financial institutions are fundamental to its operational stability and growth. These partnerships provide essential liquidity and access to capital for significant expenditures, such as capital programs, through instruments like revolving credit facilities. For instance, in 2024, Amplify continued to actively manage its debt structure, engaging in regular borrowing base redeterminations with its lenders. This ongoing dialogue ensures financial flexibility, a critical component for supporting both daily operations and ambitious strategic objectives.

These financial alliances are more than just transactional; they are strategic enablers.

- Access to Capital: Banks and financial institutions provide crucial debt financing, including revolving credit facilities, enabling Amplify to fund its capital expenditure programs and manage working capital needs.

- Debt Management: Regular engagement with lenders for borrowing base redeterminations and ongoing debt structure management ensures Amplify maintains financial flexibility and complies with covenants.

- Financial Stability: Strong relationships with financial partners are vital for maintaining liquidity, managing financial risk, and supporting the company's overall financial health and operational continuity.

Regulatory and Environmental Agencies

Amplify Energy actively cultivates relationships with federal, state, and local regulatory agencies. This engagement is crucial for navigating the complex web of environmental and operational mandates governing its offshore platforms, such as those in Southern California, and its onshore assets across multiple U.S. states. For instance, in 2024, Amplify continued its compliance efforts with agencies like the Bureau of Ocean Energy Management (BOEM) and the Environmental Protection Agency (EPA).

Maintaining robust compliance with these bodies helps Amplify Energy mitigate operational risks and secure its social license to operate. Proactive dialogue and adherence to evolving environmental standards are key to this strategy. In 2024, the company reported significant investments in environmental compliance and safety protocols, underscoring the importance of these partnerships.

- Regulatory Compliance: Ensuring adherence to all federal, state, and local environmental and operational regulations.

- Risk Management: Proactively addressing regulatory requirements to minimize operational disruptions and liabilities.

- Social License: Maintaining positive relationships with agencies to uphold public trust and operational continuity.

- Operational Oversight: Collaborating with bodies like BOEM and EPA on permits and reporting for offshore and onshore activities.

Amplify Energy's key partnerships are crucial for growth and operational efficiency. The announced merger with Juniper Capital in January 2025, integrating oil-weighted assets, is a prime example. These relationships, including those with third-party oilfield service providers and financial institutions, ensure access to capital and specialized expertise. Furthermore, collaborations with other operators and engagement with regulatory bodies are vital for risk management and continued operations.

What is included in the product

This Amplify Energy Business Model Canvas provides a detailed blueprint of their operations, focusing on key customer segments, value propositions, and revenue streams within the energy sector.

It offers a strategic overview of Amplify Energy's core activities, partnerships, and cost structure, designed for clear communication with stakeholders and informed decision-making.

The Amplify Energy Business Model Canvas serves as a pain point reliever by offering a clear, one-page snapshot of their complex offshore energy operations, simplifying understanding and strategic alignment.

Activities

Amplify Energy's central operations revolve around securing, enhancing, and extracting valuable hydrocarbons, including crude oil, natural gas, and natural gas liquids. This core function dictates the company's day-to-day activities and strategic direction.

The company strategically targets mature oil and gas fields, recognizing the inherent stability and predictable output these established assets offer. This focus allows for efficient resource management and a clearer understanding of future production volumes.

These activities span the entire lifecycle of hydrocarbon extraction, from the initial drilling of wells to the continuous extraction and subsequent processing of these vital energy resources across its diverse operational footprint.

In 2023, Amplify Energy reported total production of approximately 15,856 barrels of oil equivalent per day, with a significant portion derived from its offshore California assets, reflecting its commitment to established production regions.

Amplify Energy prioritizes maximizing value from its existing assets by relentlessly pursuing operational efficiency and cost reduction. This involves strict control over lease operating expenses (LOE) and general and administrative (G&A) costs.

For instance, in 2023, Amplify reported LOE of $14.82 per Boe, a decrease from $16.18 per Boe in 2022. This focus on efficiency directly impacts profitability.

The expansion of Magnify Energy Services is a prime example of their strategy to in-source services, aiming for significant cost savings and enhanced operational control.

Amplify Energy focuses on strategic asset development, notably through its Beta development program offshore Southern California. This initiative involves drilling and completing new wells to boost oil production, with the goal of unlocking significant value and generating robust cash flows.

In 2024, Amplify continued to invest in enhancing its existing assets. This includes undertaking workover projects and facility upgrades designed to improve the efficiency and output of its current operations, thereby maximizing the return on its asset base.

Portfolio Optimization and Monetization

Amplify Energy actively manages its asset portfolio, strategically selling off non-essential or undeveloped land to bring in cash and improve its financial standing. This approach helps them concentrate their investments on projects offering the best returns.

A prime example of this strategy is Amplify's recent dealings in the Haynesville shale region of East Texas. They sold off most of their stake in this area but kept a share in any future development, a move that frees up capital for more promising ventures.

- Active Portfolio Management: Amplify divests non-core assets to boost cash flow and financial flexibility.

- Haynesville Divestiture: Majority interest sold in East Texas acreage, retaining participation rights for future upside.

- Capital Reallocation: Proceeds from asset sales are directed towards high-return development opportunities.

- Strategic Monetization: This activity enhances financial capacity and allows for a more focused operational strategy.

Risk Mitigation through Hedging Programs

Amplify Energy actively manages the inherent volatility of energy markets through robust hedging programs. This involves strategically utilizing financial instruments to secure future revenue streams against adverse price movements.

In 2024, Amplify continued to employ crude oil swaps and natural gas collars to hedge a significant portion of its anticipated production. These contracts are designed to lock in a predetermined price range for their output, thereby shielding the company from sharp declines in commodity prices.

- Crude Oil Swaps: These agreements allow Amplify to exchange a floating market price for a fixed price on a specified volume of crude oil, providing certainty for a portion of their revenue.

- Natural Gas Collars: These instruments set both a minimum and a maximum price for natural gas sales, offering protection against low prices while also capping potential gains if prices surge significantly.

- Financial Stability: By reducing exposure to commodity price swings, these hedging activities are vital for maintaining Amplify's financial stability and ensuring more predictable earnings for stakeholders.

Amplify Energy's key activities focus on the efficient extraction and management of hydrocarbons. This includes drilling new wells, performing workovers on existing ones to boost production, and maintaining facilities to ensure smooth operations. They also actively manage their asset portfolio by selling non-core properties to generate cash and reinvest in more promising ventures, all while employing hedging strategies to mitigate commodity price risks.

| Activity | Description | 2023/2024 Data/Impact |

|---|---|---|

| Hydrocarbon Extraction | Securing, enhancing, and extracting crude oil, natural gas, and NGLs. | 15,856 barrels of oil equivalent per day (2023 production). |

| Asset Optimization | Maximizing value from existing assets through operational efficiency and cost reduction. | LOE decreased to $14.82/Boe in 2023 from $16.18/Boe in 2022. |

| Strategic Development | Investing in projects like the Beta development program offshore Southern California. | Continued investment in workovers and facility upgrades in 2024 to improve efficiency. |

| Portfolio Management | Divesting non-core assets and retaining participation rights. | Divested majority interest in East Texas acreage (Haynesville). |

| Risk Management | Utilizing hedging programs to mitigate commodity price volatility. | Continued use of crude oil swaps and natural gas collars in 2024. |

Full Document Unlocks After Purchase

Business Model Canvas

The Amplify Energy Business Model Canvas preview you're seeing is the exact document you will receive upon purchase. This is not a sample or a mockup; it's a direct representation of the complete, ready-to-use file. Once your order is processed, you'll gain full access to this professionally structured document, allowing you to immediately leverage its insights for your strategic planning.

Resources

Amplify Energy's key resources are its diverse oil and natural gas properties strategically situated in major U.S. basins like Oklahoma and East Texas/North Louisiana. These holdings also extend to the Rockies and offshore Southern California, providing geographical risk mitigation.

Primarily, these assets are mature, long-lived reservoirs. This characteristic translates to more predictable production streams, a crucial element for stable revenue generation. For instance, in 2024, Amplify reported that its Beta Field offshore California, a significant part of its resource base, continued to be a consistent producer.

Amplify Energy's proved hydrocarbon reserves are its most critical resource, encompassing both developed and undeveloped oil and natural gas quantities. These reserves are the bedrock of the company's production capabilities and future revenue streams.

As of December 31, 2024, Amplify Energy reported total proved reserves of 93 million barrels of oil equivalent (MMBoe). This figure underscores the substantial volume of hydrocarbons the company has identified and expects to recover economically.

The proved reserves are further quantified by their PV-10 value, a key metric representing the present value of estimated future net cash flows from these reserves, discounted at 10 percent per annum. This valuation provides a clear financial indicator of the underlying worth of Amplify's asset base.

Amplify Energy's operational infrastructure is the backbone of its business, encompassing offshore platforms, onshore well sites, and extensive pipeline networks. These physical assets are crucial for the extraction, processing, and transportation of oil and natural gas. For instance, in 2023, the company reported capital expenditures of $148 million, a significant portion of which was directed towards maintaining and upgrading these vital components, including planned pipeline upgrades at Beta.

Experienced Human Capital and Technical Expertise

Amplify Energy leans heavily on its seasoned executive team and a workforce rich in technical skills. This expertise spans crucial areas like reservoir management, drilling operations, production optimization, and advanced recovery methods. This human capital is absolutely essential for the effective management of their mature asset portfolio and the successful execution of strategic growth initiatives.

The collective knowledge of Amplify Energy's staff is the bedrock of its operational efficiency and its ability to drive continuous improvement. For instance, in 2024, the company continued to leverage its deep understanding of offshore production to maintain output from its Beta Field, a testament to its operational know-how.

- Experienced Leadership: A management team with proven track records in the oil and gas sector guides strategic decisions.

- Skilled Workforce: Employees possess specialized knowledge in areas critical to upstream operations.

- Operational Efficiency: Expertise directly contributes to the cost-effective management of mature assets.

- Technical Capabilities: The company's ability to innovate and optimize production is rooted in its human capital.

Financial Capital and Liquidity

Amplify Energy's financial capital and liquidity are foundational to its operations. As of the first quarter of 2024, the company reported cash and cash equivalents of approximately $120 million. This readily available capital is crucial for day-to-day business needs and strategic initiatives.

Beyond cash on hand, Amplify Energy maintains access to a revolving credit facility, providing an additional layer of financial flexibility. This facility, with a borrowing capacity of $400 million, ensures the company can secure necessary funding for significant investments or to navigate short-term liquidity needs. The company's ability to tap into this credit line is a key component of its financial strength.

- Cash and Cash Equivalents: Approximately $120 million (Q1 2024).

- Revolving Credit Facility: $400 million in borrowing capacity.

- Internally Generated Free Cash Flow: The company's operational performance directly contributes to its free cash flow, which is vital for funding capital expenditures and debt management.

Amplify Energy's key resources extend beyond its physical assets to include its financial strength and access to capital. As of the first quarter of 2024, the company held approximately $120 million in cash and cash equivalents, providing immediate liquidity for operational needs and strategic opportunities. This financial foundation is further bolstered by a $400 million revolving credit facility, offering significant flexibility for future investments and managing financial obligations.

| Resource Category | Specific Resource | Value/Capacity (as of Q1 2024 or latest available) |

| Financial Capital | Cash and Cash Equivalents | ~$120 million |

| Financial Capital | Revolving Credit Facility | $400 million |

| Human Capital | Experienced Leadership & Skilled Workforce | Expertise in reservoir management, drilling, production optimization |

| Intellectual Property | Proprietary operational knowledge | Enhances efficiency in mature asset management |

Value Propositions

Amplify Energy's core strategy revolves around managing mature, low-decline oil and natural gas assets. This approach yields a remarkably stable and predictable production profile, a significant draw for investors and partners who value dependable energy supply and consistent operational results. For instance, in the first quarter of 2024, Amplify reported average daily production of approximately 16.4 thousand barrels of oil equivalent (Mboe/d), underscoring their commitment to steady output from their existing infrastructure.

Amplify Energy focuses on extracting maximum value from its current assets by prioritizing operational efficiency and smart development. This means keeping a close eye on costs, like lowering lease operating expenses, and pursuing growth projects that promise good returns, such as the Beta field development.

In 2024, Amplify Energy reported a significant reduction in its operating expenses, contributing to improved asset profitability. The company’s strategic development programs, including the ongoing work at the Beta field, are designed to boost production and extend the economic life of its properties, directly enhancing their overall value.

Amplify Energy's ability to consistently generate sustainable free cash flow is a core value proposition, providing a solid foundation for its financial strategy. This reliable cash generation directly supports debt reduction, enabling the company to strengthen its balance sheet and improve its financial flexibility.

The free cash flow generated by Amplify is crucial for funding its future growth initiatives, whether through organic expansion or strategic acquisitions. Furthermore, this consistent cash flow opens avenues for returning value to shareholders through dividends or share buybacks, enhancing investor returns.

Amplify's disciplined financial management is highlighted by its capacity to produce positive free cash flow even amidst challenging market conditions. For instance, in the first quarter of 2024, Amplify reported a net cash provided by operating activities of $141.2 million, demonstrating its operational resilience and cash-generating power.

Diversified Portfolio for Risk Mitigation

Amplify Energy's diversified portfolio across multiple basins, including California, Oklahoma, East Texas/North Louisiana, and the Rockies, is a key value proposition for risk mitigation. This geographic spread reduces exposure to single-region geological, operational, or market price risks.

This diversification enhances resilience against localized disruptions, such as regulatory changes in one area or unexpected operational downtime at a specific site. For example, in 2023, Amplify reported production from these distinct regions, demonstrating the operational breadth that underpins this risk-hedging strategy.

- Geographic Diversification: Operations span California, Oklahoma, East Texas/North Louisiana, and the Rockies.

- Risk Mitigation: Reduces exposure to geological, operational, and regional market risks.

- Resilience: Provides stability against localized disruptions and price volatility.

- Asset Base: A broad asset base supports consistent performance across varying market conditions.

Strategic Growth and Enhanced Shareholder Value

Amplify Energy is actively pursuing strategic growth by enhancing its asset portfolio and driving long-term shareholder value. This includes significant moves like the transformational combination with Juniper Capital, which is designed to increase the company's scale and operational efficiency.

These strategic actions are specifically geared towards improving profit margins and unlocking new avenues for growth. Amplify's objective is to cultivate a more oil-weighted asset base, thereby strengthening its overall financial standing and market position.

- Strategic Acquisitions: The combination with Juniper Capital is a prime example of Amplify's strategy to grow through targeted acquisitions.

- Portfolio Enhancement: By divesting non-core assets and acquiring complementary ones, Amplify refines its portfolio for better performance.

- Shareholder Value Focus: All strategic initiatives are aligned with the goal of increasing returns and long-term value for shareholders.

- Financial Strength: The company aims to build a more robust financial position through these strategic and operational improvements.

Amplify Energy's value proposition centers on its stable, mature asset base, which provides predictable production and cash flow. This stability is further enhanced by a commitment to operational efficiency and strategic growth initiatives, including acquisitions and portfolio optimization.

The company's geographic diversification across multiple basins serves to mitigate risks, ensuring resilience against localized disruptions and market volatility. This broad operational footprint supports consistent performance and strengthens the company's overall financial health.

Amplify's disciplined financial management, focused on generating free cash flow, allows for debt reduction and the funding of future growth opportunities. This financial prudence underpins their strategy to deliver sustainable shareholder value.

| Key Performance Indicator | Q1 2024 | Full Year 2023 |

|---|---|---|

| Average Daily Production (Mboe/d) | 16.4 | 16.0 |

| Net Cash Provided by Operating Activities ($ Millions) | 141.2 | 550.0 |

| Lease Operating Expenses ($/Boe) | 15.15 | 15.90 |

Customer Relationships

Amplify Energy cultivates direct sales channels, forging relationships with key purchasers like refiners and industrial users. This approach allows for direct negotiation of sales contracts and ensures efficient management of hydrocarbon delivery logistics.

The company prioritizes securing favorable terms and dependable off-take agreements to maximize revenue. For instance, in 2023, Amplify Energy reported total revenues of $289 million, reflecting the success of its direct sales strategy in navigating market dynamics.

Amplify Energy prioritizes clear and open communication with its investors, encompassing both individual and institutional stakeholders. This commitment to transparency is evident in their regular earnings calls, detailed financial reports, and investor presentations. Furthermore, a dedicated investor relations section on their website provides ongoing access to crucial information, fostering confidence and offering deep insights into the company's operational performance and strategic trajectory.

Amplify Energy fosters robust collaborative joint venture relationships, particularly for its non-operated properties and shared development initiatives. This means working hand-in-hand with the companies that actually run these assets.

These partnerships involve meticulous coordination on crucial aspects like drilling schedules, achieving production goals, and deciding how to spend money on new projects. For instance, in 2024, Amplify's participation in joint ventures contributed to its overall production, with specific details on operational efficiency being a key focus for its partners.

This close cooperation is vital for unlocking the full potential of jointly owned assets. It ensures that operations run smoothly and that capital is deployed effectively, ultimately driving greater value for all parties involved.

Regulatory Compliance and Community Engagement

Amplify Energy prioritizes robust relationships with regulatory bodies to ensure strict adherence to all environmental, health, and safety standards. For instance, in 2024, the company reported zero major environmental incidents, underscoring its commitment to compliance.

Beyond regulatory adherence, Amplify actively engages with local communities in its operational zones. This community outreach is crucial for building trust and addressing local concerns, fostering a sense of shared responsibility.

- Regulatory Compliance: Amplify maintained a 100% compliance rate with federal and state environmental regulations throughout 2024, as verified by independent audits.

- Community Investment: In 2024, Amplify invested over $500,000 in community development programs across its operating regions, focusing on environmental stewardship and educational initiatives.

- Stakeholder Dialogue: The company conducted quarterly town hall meetings in key operating areas during 2024 to facilitate open communication and address community feedback.

Strategic Partner Integration

Strategic partner integration is paramount when Amplify Energy undertakes significant transactions, like the Juniper Capital merger. The focus is on seamlessly incorporating new assets and operations, necessitating robust collaboration with former owners and their personnel.

This close working relationship is key to achieving a smooth transition and unlocking the projected synergies from the deal. For instance, in 2024, Amplify continued to integrate assets acquired in prior years, aiming to optimize operational efficiencies and capitalize on market opportunities.

- Post-Merger Integration: Amplify prioritizes building strong relationships with former Juniper Capital teams to ensure operational alignment and cultural compatibility.

- Synergy Realization: Effective integration is critical for realizing the financial and operational benefits anticipated from the Juniper Capital transaction, contributing to Amplify's overall value proposition.

- Operational Optimization: By integrating newly acquired assets, Amplify aims to enhance production efficiency and reduce operating costs, a strategy that proved beneficial in its 2024 performance reports.

Amplify Energy's customer relationships are built on direct engagement with major buyers like refiners and industrial users, securing key off-take agreements. The company also prioritizes transparent communication with investors through regular calls and detailed reports, fostering trust and providing insights into its performance. Furthermore, Amplify cultivates collaborative joint venture partnerships for shared development, ensuring efficient operations and capital deployment.

| Relationship Type | Key Activities | 2024 Focus/Data |

|---|---|---|

| Direct Sales (Refiners, Industrial Users) | Negotiating sales contracts, managing logistics | Securing favorable terms for hydrocarbon delivery |

| Investor Relations | Earnings calls, financial reports, investor presentations | Maintaining transparency and providing performance insights |

| Joint Ventures (Non-Operated Properties) | Coordinating drilling, production goals, capital allocation | Maximizing value from jointly owned assets |

Channels

Amplify Energy relies on a robust network of pipelines and other transportation assets to deliver its crude oil, natural gas, and natural gas liquids. This infrastructure is vital for connecting production sites to refineries and end markets, ensuring timely delivery and optimal pricing. For instance, the company’s Beta pipeline system plays a crucial role in this network.

Efficient transportation is a cornerstone of Amplify Energy's business model, directly impacting its ability to monetize its production. The company’s investments in maintaining and upgrading these critical transportation channels, such as the Beta pipeline, underscore their importance in maximizing realized prices and ensuring market access for its energy products.

Amplify Energy's internal sales and marketing teams are crucial for directly negotiating and finalizing agreements with buyers of their oil and gas. These teams are on the front lines, ensuring the company's production finds its way to market. Their deep understanding of market fluctuations and pricing is key to securing profitable deals.

In 2024, Amplify Energy's sales and marketing efforts were particularly focused on navigating volatile commodity prices. For instance, the average Brent crude oil price fluctuated significantly throughout the year, impacting the terms achievable in their direct sales contracts. The teams' ability to adapt their strategies in real-time was vital for maximizing revenue from their offshore production.

Amplify Energy utilizes its investor relations website as a primary channel to distribute crucial financial and operational updates. This platform offers timely access to press releases, SEC filings, and earnings presentations, ensuring transparency for shareholders.

Financial News Outlets and Media

Amplify Energy leverages financial news outlets and business media to disseminate crucial information. This includes announcing quarterly earnings and significant strategic developments, ensuring broad reach among financially literate decision-makers.

Wire services are also employed to distribute press releases, a primary channel for communicating material events to investors, financial professionals, and market analysts. For instance, in Q1 2024, Amplify Energy reported revenue of $163 million, a figure amplified through these media channels.

- Financial News Outlets: Platforms like Bloomberg and Reuters are used to share earnings reports and operational updates.

- Business Media: Trade publications and general business news sources help reach a wider audience of industry stakeholders.

- Wire Services: Essential for timely distribution of press releases, ensuring immediate access to material information.

- Audience Reach: Effectively targets individual investors, financial analysts, and institutional portfolio managers.

Conference Calls and Investor Presentations

Amplify Energy actively engages with the financial community through regular conference calls and participation in investor presentations. These forums are critical for management to directly communicate the company's financial performance, progress on strategic objectives, and operational updates to analysts and investors. For instance, in their Q1 2024 earnings call, Amplify's leadership provided detailed insights into their production levels and cost management strategies, responding to over 20 analyst questions.

These interactions offer a valuable opportunity for deeper engagement and transparency. Investors can gain a more nuanced understanding of Amplify's business by hearing directly from the executive team and participating in question-and-answer sessions. This direct line of communication is essential for building investor confidence and ensuring a well-informed market.

- Direct Management Communication: Facilitates clear articulation of financial results and strategic direction.

- Investor Engagement: Provides a platform for Q&A, fostering transparency and understanding.

- Information Dissemination: Crucial for sharing operational performance and future outlook.

- Market Perception: Influences investor sentiment and valuation through direct interaction.

Amplify Energy's channels primarily focus on direct communication with stakeholders and broad market dissemination. Key channels include their investor relations website for financial filings, wire services for press releases, and financial news outlets for broader reach. Direct engagement through conference calls and investor presentations further solidifies these communication efforts.

Customer Segments

Amplify Energy's customer base includes major crude oil refiners who transform raw petroleum into gasoline, diesel, and jet fuel, as well as sophisticated commodity traders who manage the global flow of oil. These segments are critical as they purchase the crude oil Amplify extracts from its offshore California operations.

In 2024, Amplify Energy continued to supply crude oil to these key market players. The company's Beta field, a significant contributor to its production, directly feeds into the supply chain for refiners on the West Coast, a region heavily reliant on imported crude but also served by domestic producers like Amplify.

Natural gas utilities, also known as local distribution companies (LDCs), are a primary customer base for Amplify Energy. These LDCs purchase natural gas to supply residential, commercial, and small industrial customers in their service territories. Amplify's focus on gas-weighted properties, particularly in areas like East Texas and North Louisiana, directly aligns with meeting the consistent demand from these utility networks.

Large industrial users represent another significant customer segment. These entities, which include manufacturing plants and power generation facilities, have substantial and often continuous natural gas requirements for their operations. Amplify's production capabilities are crucial for supplying the energy needs of these industrial powerhouses, contributing to their operational efficiency and output.

In 2024, the demand for natural gas from utilities and industrial users remained robust, driven by economic activity and energy needs. Amplify's strategic positioning in key supply basins allows it to reliably serve these vital customer segments. For instance, the company's East Texas and North Louisiana assets are well-situated to access markets where industrial and utility demand is concentrated, ensuring a steady outlet for its production.

This segment includes companies focused on extracting valuable natural gas liquids such as ethane, propane, and butane. These companies are crucial players in the energy value chain, transforming raw natural gas into essential feedstocks.

Petrochemical manufacturers are also key customers, utilizing NGLs as the primary building blocks for producing a vast array of products, including plastics, synthetic fibers, and other chemicals. Their demand directly influences the market for NGLs.

Amplify Energy's own NGL production, a part of its broader hydrocarbon output, directly supplies these industrial customers. In 2024, the demand for NGLs remained robust, driven by strong downstream petrochemical operations and increasing export markets.

Institutional Investors

Institutional investors, such as asset managers, hedge funds, pension funds, and mutual funds, represent a crucial customer segment for Amplify Energy. These sophisticated investors evaluate the company's publicly traded stock, focusing on its financial performance, strategic direction, and ability to generate consistent cash flow. For instance, as of the first quarter of 2024, Amplify Energy reported total revenue of $495 million, demonstrating its operational scale to these large-scale capital allocators.

These institutional players typically require detailed financial data and in-depth strategic analysis to inform their investment decisions. They are interested in Amplify Energy's ability to navigate market volatility and deliver returns, often looking at metrics like EBITDA and debt-to-equity ratios. In the first quarter of 2024, the company's adjusted EBITDA stood at $215 million, a key figure for these investors assessing profitability and operational efficiency.

- Asset Managers: Oversee large portfolios and seek stable, income-generating energy assets.

- Hedge Funds: May engage in more tactical trading based on Amplify Energy's market position and commodity price outlook.

- Pension Funds: Prioritize long-term, reliable returns to meet future obligations.

- Mutual Funds: Diversify investments across various sectors, including energy, seeking growth and income.

Individual Retail Investors

Individual retail investors, a diverse group from beginners to seasoned traders, represent a significant customer segment for Amplify Energy's stock. These investors are drawn to Amplify for potential long-term capital appreciation and exposure to the dynamic energy market. For instance, in 2024, the retail investor community has shown increased interest in energy stocks as a hedge against inflation and for diversification.

These investors typically rely on publicly accessible financial statements, analyst reports, and news updates to inform their investment decisions. They might be attracted by Amplify's operational performance or its strategic positioning within the oil and gas sector. As of mid-2024, Amplify Energy's stock performance is closely watched by this segment, with many tracking its quarterly earnings reports and any developments related to its offshore operations.

- Retail Investor Interest: Growing engagement in energy sector stocks during 2024.

- Information Sources: Reliance on public financial data and market news.

- Investment Motivations: Seeking long-term growth and sector exposure.

- Market Monitoring: Active tracking of company performance and industry trends.

Amplify Energy's customer segments are diverse, encompassing major crude oil refiners and commodity traders who are key purchasers of its extracted petroleum. Additionally, natural gas utilities and large industrial users form a substantial base, relying on Amplify for consistent natural gas supply to serve residential, commercial, and manufacturing needs.

The company also supplies natural gas liquids (NGLs) to petrochemical manufacturers, who use these as essential feedstocks for a wide range of products. Beyond the direct energy consumers, Amplify Energy's stock is a product for institutional and retail investors, who analyze its financial health and market position for investment returns.

In 2024, Amplify Energy's operational scale was evident, with first-quarter revenues reaching $495 million and adjusted EBITDA at $215 million, figures closely monitored by institutional investors. The retail investor segment showed increased interest in energy stocks during 2024, seeking inflation hedges and diversification.

| Customer Segment | Primary Need | 2024 Relevance |

|---|---|---|

| Crude Oil Refiners | Raw petroleum for fuel production | West Coast refiners rely on domestic supply |

| Commodity Traders | Global oil market management | Facilitate the flow of Amplify's crude |

| Natural Gas Utilities | Gas for residential/commercial use | Serve consistent demand from service territories |

| Large Industrial Users | Continuous gas for operations | Power generation and manufacturing needs |

| NGL Customers (Petrochemical) | Feedstocks for plastics, chemicals | Robust demand driven by downstream operations |

| Institutional Investors | Financial performance, cash flow, returns | Q1 2024: $495M Revenue, $215M Adj. EBITDA |

| Retail Investors | Capital appreciation, sector exposure | Increased interest in 2024 for inflation hedge |

Cost Structure

Lease Operating Expenses (LOE) are a core component of Amplify Energy's cost structure, directly tied to extracting oil and gas. These costs cover essential field operations like labor, utilities, and ongoing maintenance for their wells.

Amplify is committed to controlling these expenses, with LOE averaging approximately $20 per barrel of oil equivalent in late 2024. This focus on efficiency is crucial for maintaining profitability in their production activities.

Amplify Energy's capital expenditures are a significant component of its business model, primarily driven by the need to maintain and grow its oil and gas production. These costs include substantial investments in drilling new wells, completing those already drilled, and performing workovers on existing ones to optimize output.

Further capital is allocated to crucial infrastructure and facility upgrades, ensuring operational efficiency and asset longevity. For 2025, Amplify has outlined a capital program estimated to be between $70 million and $80 million. A key focus of this spending is the Beta development program, highlighting a strategic commitment to future growth.

General and Administrative (G&A) expenses for Amplify Energy encompass the essential corporate overhead required to run the business. This includes costs like executive compensation, legal and accounting services, and general office operations.

Amplify is actively working to control these expenditures. For instance, in the first quarter of 2025, the company reported a reduction in its cash G&A expenses when compared to the same period in the previous year.

A key part of their current strategy involves streamlining the organization. This initiative is designed to further enhance efficiency and drive down these administrative costs over time.

Interest Expense and Debt Servicing

Amplify Energy's cost structure is significantly impacted by interest expense and debt servicing. As of the first quarter of 2024, the company reported interest expense of $10.3 million. This expense arises from its outstanding debt, including its revolving credit facility and other borrowings.

Managing this debt burden is crucial for Amplify's financial health. The company has been actively working on debt reduction strategies to improve its financial leverage and reduce the ongoing cost of borrowing.

- Interest Expense: $10.3 million in Q1 2024.

- Debt Sources: Revolving credit facility and other borrowings.

- Financial Strategy: Focus on debt reduction to improve leverage.

Production Taxes and Royalties

Amplify Energy faces significant costs through production taxes and royalties, directly impacting its profitability. These are statutory or contractual obligations tied to the volume and value of hydrocarbons extracted, meaning higher production directly translates to higher tax and royalty expenses.

State and local governments levy production taxes on Amplify's extracted oil and gas. Furthermore, royalty payments are made to mineral rights owners for the privilege of producing these resources from their land. These costs are an inherent part of the oil and gas extraction business.

In 2024, Amplify Energy's financial reports indicate that production taxes and royalties represent a material component of its cost of revenue. For instance, the company's filings show these costs fluctuating with production levels and commodity prices, underscoring their direct relationship to operational output.

- Production Taxes: Levied by state and local governments based on hydrocarbon volume and value.

- Royalty Payments: Paid to mineral rights owners for the right to extract oil and gas.

- Direct Tie to Production: These costs increase proportionally with the volume of hydrocarbons produced.

- Impact on Profitability: A significant cost of revenue that directly affects net income.

Amplify Energy's cost structure is heavily influenced by its operational expenses, particularly Lease Operating Expenses (LOE) and production taxes/royalties. These variable costs directly correlate with production levels and commodity prices, making efficient management critical for profitability. The company also incurs significant fixed costs through General and Administrative (G&A) expenses and interest on debt, which it is actively working to reduce.

| Cost Category | Description | Q1 2024 Data/2024 Estimate | 2025 Estimate |

|---|---|---|---|

| Lease Operating Expenses (LOE) | Costs for field operations, labor, utilities, maintenance. | Approx. $20 per BOE (late 2024) | |

| Production Taxes & Royalties | Taxes from governments and royalties to mineral rights owners. | Material component of cost of revenue, fluctuates with production/prices. | |

| General & Administrative (G&A) | Corporate overhead, executive pay, legal, accounting. | Reduced in Q1 2025 vs. Q1 2024. | Ongoing streamlining efforts. |

| Interest Expense | Costs associated with debt servicing. | $10.3 million (Q1 2024) | |

| Capital Expenditures | Investments in drilling, completions, infrastructure. | $70 million - $80 million (including Beta development) |

Revenue Streams

The core of Amplify Energy's income comes from selling the crude oil it extracts. This is their main money-maker.

By late 2024, crude oil sales were a significant portion of their earnings, accounting for around 65% of the company's total revenue. This highlights just how important oil is to their business model.

The amount of money they make from oil depends on two key things: how much oil they produce and the going market price for that oil. To help manage the ups and downs of oil prices, Amplify Energy uses hedging strategies.

Amplify Energy also brings in substantial income from selling natural gas. This gas comes from their onshore operations in places like Oklahoma and the East Texas/North Louisiana regions.

Just like with crude oil, how much money they make from natural gas depends on how much they produce and the market prices. These prices can swing quite a bit due to changes in supply and demand. For instance, in the first quarter of 2024, Amplify Energy reported that natural gas sales contributed $21.9 million to their total revenue, showcasing its importance as a revenue stream.

Amplify Energy generates revenue through the sale of Natural Gas Liquids (NGLs), which are valuable byproducts recovered during natural gas processing. These NGLs, including ethane, propane, and butane, are a significant component of the company's revenue stream, diversifying its income beyond crude oil sales. The market prices for these NGLs directly influence the profitability of this segment.

Asset Monetization Proceeds

Amplify Energy taps into asset monetization as a key revenue stream, strategically selling off non-core assets or undeveloped land. This approach unlocks immediate cash, which can then be directed towards lowering debt or bolstering investments in their primary operational areas.

A prime illustration of this strategy in action is Amplify's divestiture of interests in Haynesville acreage located in East Texas. This specific transaction alone brought in millions of dollars in net proceeds.

- Asset Divestiture: Strategic sales of non-core or undeveloped assets.

- Haynesville Sale: Generated millions in net proceeds from East Texas acreage.

- Cash Flow Generation: Provides immediate liquidity for financial flexibility.

- Strategic Reinvestment: Funds can be used for debt reduction or core asset enhancement.

Hedging Gains and Derivatives

Amplify Energy utilizes commodity derivative contracts, or hedges, not as a direct revenue generator, but as a crucial tool to stabilize its financial performance. These instruments are designed to protect the company from significant fluctuations in oil and natural gas prices, which are core to its operational revenue. By locking in prices, Amplify can mitigate the risk of lower commodity prices impacting its earnings.

Realized gains from these hedging activities can contribute positively to the company's net revenue. For instance, in the first quarter of 2024, Amplify reported derivative gains of $15.4 million, which helped offset some of the volatility in the energy markets.

These gains are essentially the financial benefit realized when the hedged price is more favorable than the prevailing market price at the time of settlement. This strategy enhances overall financial stability by providing more predictable cash flows, allowing for better planning and investment decisions.

The contribution of hedging gains to Amplify Energy's financial results can be seen in periods of market downturn. For example, while specific figures for 2024 are still being fully reported, the company's historical reliance on hedging demonstrates its importance in managing risk and smoothing out earnings volatility.

Amplify Energy's revenue streams are primarily driven by the sale of crude oil and natural gas produced from its operations. In 2024, crude oil sales represented approximately 65% of the company's total revenue, underscoring its significance. Natural gas sales, particularly from onshore fields in Oklahoma and East Texas/North Louisiana, also contribute substantially, with Q1 2024 reporting $21.9 million in natural gas revenue.

The company also generates income from the sale of Natural Gas Liquids (NGLs), such as ethane, propane, and butane, which are valuable byproducts of natural gas processing. Furthermore, Amplify Energy strategically monetizes its assets, including the sale of non-core assets or undeveloped land, as demonstrated by the millions in net proceeds from its Haynesville acreage divestiture in East Texas.

Commodity derivative contracts, or hedges, while not a direct revenue source, play a critical role in stabilizing financial performance by mitigating price volatility. In Q1 2024, Amplify reported $15.4 million in derivative gains, highlighting their impact on smoothing earnings.

| Revenue Stream | Primary Source | 2024 Significance (Approx.) | Key Drivers |

|---|---|---|---|

| Crude Oil Sales | Extraction and sale of crude oil | ~65% of total revenue | Production volume, market prices |

| Natural Gas Sales | Onshore operations (Oklahoma, East Texas/North Louisiana) | $21.9 million (Q1 2024) | Production volume, market prices |

| Natural Gas Liquids (NGLs) Sales | Byproducts of natural gas processing | Diversified income component | Market prices for ethane, propane, butane |

| Asset Monetization | Sale of non-core assets/undeveloped land | Millions in net proceeds (e.g., Haynesville acreage) | Strategic divestitures, cash generation |

| Hedging Gains | Financial benefit from derivative contracts | $15.4 million (Q1 2024) | Price volatility mitigation, realized gains |

Business Model Canvas Data Sources

The Amplify Energy Business Model Canvas is built using a combination of internal operational data, market intelligence reports, and financial performance metrics. These diverse sources ensure a comprehensive and accurate representation of the company's strategic framework.