Amplify Energy Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

Amplify Energy Bundle

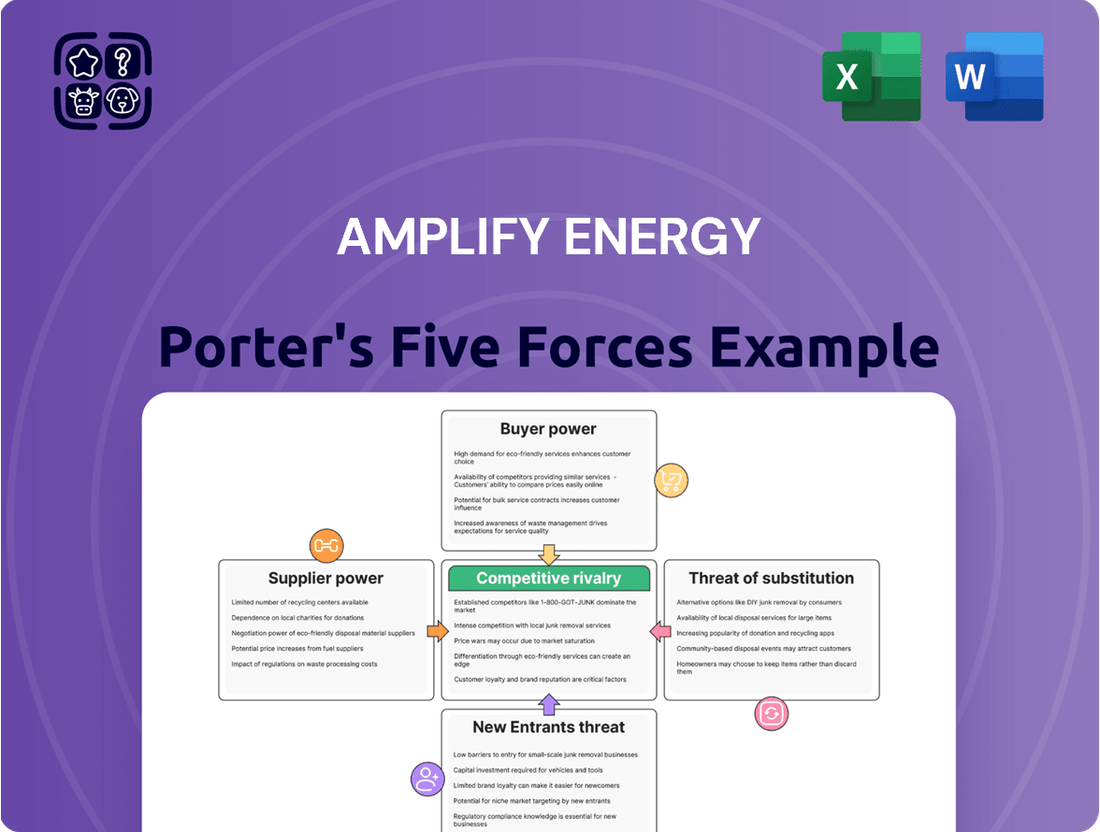

Amplify Energy faces moderate bargaining power from its buyers, as well as a notable threat from substitute energy sources. The intensity of rivalry within the oil and gas sector also presents significant challenges.

This brief snapshot only scratches the surface. Unlock the full Porter's Five Forces Analysis to explore Amplify Energy’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

The oil and gas sector, including companies like Amplify Energy, depends heavily on specialized equipment, advanced technology, and essential services. When a limited number of suppliers control these critical components, such as deepwater drilling rigs or sophisticated seismic survey technology, their ability to dictate terms and prices becomes substantial.

For Amplify Energy, which operates in established fields, existing supplier relationships are important. However, the introduction of new technologies or a consolidation among key service providers could alter the supplier landscape, potentially increasing their bargaining power. For instance, a shortage of specialized offshore vessels, a common issue in the industry, can significantly inflate costs for operators.

Switching suppliers in the oil and gas sector, particularly for specialized services like offshore pipeline maintenance or offshore platform operations, typically involves substantial financial and operational burdens. These can include the costs associated with retooling or replacing specialized equipment, retraining personnel on new systems and safety protocols, and undergoing lengthy re-certification processes to meet regulatory and industry standards.

For Amplify Energy, these high switching costs translate directly into increased bargaining power for its current suppliers. If a supplier provides critical components or services that are deeply integrated into Amplify's operations, the effort and expense required to transition to a new provider can be prohibitive, allowing the existing supplier to potentially command higher prices or less favorable terms.

Suppliers providing highly specialized or proprietary technologies, like advanced directional drilling equipment or unique geological analysis software, wield significant bargaining power. Amplify Energy's dependence on such distinctive solutions to boost output from its aging oil fields would naturally increase the leverage these suppliers hold.

Threat of Forward Integration by Suppliers

The threat of forward integration by suppliers poses a significant factor in Amplify Energy's operational landscape. If a supplier, particularly one with substantial capital and industry knowledge, were to acquire or develop its own oil and gas properties, it could directly enter into competition with Amplify. This would dramatically increase the supplier's bargaining power, as they would control both the supply of their specialized services or equipment and the end product.

While specialized service providers might find this path challenging due to the capital-intensive nature of exploration and production, large equipment manufacturers with significant financial resources could theoretically consider such a strategic move. The barriers to entry in the upstream oil and gas sector are substantial, requiring extensive expertise, regulatory navigation, and significant investment, which currently limits the prevalence of this threat.

For instance, in 2024, the average cost to drill and complete an offshore well can range from tens of millions to hundreds of millions of dollars, a considerable hurdle for most service companies. Companies like Schlumberger or Halliburton, while primarily service providers, possess the financial muscle to potentially explore such vertical integration, though their core business models remain focused on service provision.

- Supplier Forward Integration Risk: Suppliers acquiring or developing oil and gas properties to compete directly with Amplify Energy.

- Capital Intensive Barrier: Significant financial and operational hurdles for suppliers to enter upstream oil and gas operations.

- Industry Examples: Major oilfield service companies like Schlumberger or Halliburton possess the capital, though their focus is typically on services.

- 2024 Offshore Drilling Costs: Indicative costs of $10 million to over $100 million per well highlight the substantial barrier to entry for potential supplier integration.

Importance of Amplify Energy to Suppliers

For large, diversified oilfield service companies, Amplify Energy, as a smaller independent producer, might represent a smaller portion of their overall revenue. This reduces Amplify's influence over the supplier, as the supplier is less dependent on Amplify's business. For instance, in 2024, major oilfield service providers like Schlumberger or Halliburton reported revenues in the tens of billions, making Amplify's contribution relatively minor.

Conversely, for smaller, niche suppliers, Amplify might be a more significant customer, increasing Amplify's relative power. These specialized suppliers might rely more heavily on Amplify's contracts for their own operational stability. This dynamic means Amplify's bargaining power can vary significantly depending on the specific supplier and their market position.

- Supplier Dependence: Amplify's bargaining power is inversely related to a supplier's dependence on Amplify's business.

- Market Size of Suppliers: Larger, more diversified suppliers generally have less incentive to offer favorable terms to smaller clients like Amplify.

- Niche Supplier Relationships: Amplify may wield more influence with specialized suppliers who cater to a smaller customer base.

- Contractual Terms: The specific terms negotiated in contracts with suppliers are crucial in defining the balance of power.

Suppliers to Amplify Energy possess considerable bargaining power due to the specialized nature of oilfield services and equipment. A limited number of providers for critical components like advanced drilling technology or specialized offshore vessels can dictate terms. For example, in 2024, the substantial costs associated with offshore drilling, potentially exceeding $100 million per well, underscore the capital-intensive barriers that limit new entrants and bolster the power of existing specialized suppliers.

| Factor | Impact on Amplify Energy | Supplier Bargaining Power |

|---|---|---|

| Specialized Equipment & Technology Dependence | High reliance on unique drilling, seismic, or platform technologies | Strong |

| High Switching Costs | Significant financial and operational hurdles to change providers | Strong |

| Supplier Forward Integration Threat | Potential for large service firms to enter E&P | Moderate (limited by high entry barriers) |

| Supplier Dependence on Amplify | Inverse relationship: less dependence = more power for supplier | Varies (High for large service firms, lower for niche providers) |

What is included in the product

Amplify Energy's Porter's Five Forces analysis reveals the intense competitive pressures within the oil and gas industry, focusing on the bargaining power of buyers and suppliers, the threat of new entrants, and the impact of substitutes.

Instantly visualize the competitive landscape and identify key threats with a dynamic, interactive Porter's Five Forces model for Amplify Energy.

Customers Bargaining Power

Amplify Energy's customer base is largely concentrated among refiners and midstream companies, such as natural gas pipelines. This concentration means that if a few major buyers control a significant portion of the crude oil or natural gas market in Amplify's key operating areas like Oklahoma, Texas, and Louisiana, they can exert considerable influence. For instance, in 2024, the refining sector's demand for crude oil remains a critical factor, and large refiners can leverage their purchasing power to negotiate lower prices from producers like Amplify.

Customers who buy large quantities of oil and natural gas from Amplify Energy can indeed influence pricing. For instance, if a major industrial client or a large utility company represents a significant portion of Amplify's sales, they could negotiate for lower prices due to their substantial order volume.

However, the influence of even large individual buyers is often tempered by the broader global commodity market. In 2024, oil and gas prices are subject to a multitude of factors, including geopolitical events, supply and demand dynamics across continents, and the actions of major oil-producing nations. Therefore, unless a single customer accounts for an exceptionally large percentage of Amplify Energy's total production, their individual bargaining power might be limited compared to the overarching market forces.

For refiners and pipeline operators, switching suppliers for crude oil or natural gas generally presents low switching costs, particularly when dealing with standardized commodities. This accessibility to alternatives directly bolsters customer bargaining power, allowing them to easily explore other sources if Amplify Energy's pricing isn't competitive.

Availability of Substitute Products for Customers

Customers generally face limited direct substitutes for crude oil and natural gas in their core applications like transportation fuels and heating. This situation currently grants Amplify Energy and its peers considerable leverage.

However, the growing global emphasis on renewable energy sources presents a more indirect, long-term challenge. As alternative energy options become more viable and widespread, customer power could gradually increase.

For instance, in 2024, the International Energy Agency reported that renewable energy sources accounted for approximately 30% of global electricity generation, a figure expected to rise. This shift, while not an immediate substitute for oil and gas in all sectors, signals a future where customers have more choices, potentially dampening the bargaining power of traditional energy providers.

- Limited Direct Substitutes: Crude oil and natural gas remain essential for many industries with few immediate alternatives.

- Indirect Threat from Renewables: The long-term growth of renewable energy offers potential substitutes, gradually shifting power to customers.

- 2024 Data Point: Renewables comprised about 30% of global electricity generation in 2024, indicating a growing alternative landscape.

Customer's Price Sensitivity

Customers in the oil and gas sector, where Amplify Energy operates, exhibit significant price sensitivity. This is largely due to the commodity nature of oil and gas, meaning products are largely undifferentiated and interchangeable. Therefore, buyers will readily switch suppliers based on even minor price variations.

For instance, in 2024, crude oil prices experienced considerable volatility, impacting the cost structure for many of Amplify Energy's customers. This environment exacerbates their focus on securing the lowest possible prices for essential energy supplies.

- High Price Sensitivity: Buyers in the oil and gas market are inherently sensitive to price due to the standardized product.

- Impact of Price Fluctuations: Global oil and gas price swings directly affect customer profitability, making them wary of price hikes.

- Switching Behavior: Customers are likely to switch to competitors offering lower prices, increasing competitive pressure on Amplify Energy.

- 2024 Market Context: Volatile energy prices throughout 2024 intensified customer focus on cost management and price competitiveness.

Amplify Energy's customers, primarily refiners and midstream companies, possess considerable bargaining power due to the commodity nature of oil and gas, leading to high price sensitivity. In 2024, this was evident as fluctuations in crude oil prices directly impacted customer profitability, driving a strong focus on securing the lowest possible prices.

While direct substitutes for oil and gas remain limited, the growing global adoption of renewable energy sources presents an indirect, long-term threat. By 2024, renewables accounted for approximately 30% of global electricity generation, indicating a gradual shift towards alternative energy that could eventually diminish the bargaining power of traditional energy providers like Amplify.

| Factor | Impact on Amplify Energy | 2024 Relevance |

| Customer Concentration | High for major buyers | Large refiners can leverage purchasing power. |

| Switching Costs | Low for standardized commodities | Customers can easily switch suppliers for better pricing. |

| Price Sensitivity | Very High | Customers are highly responsive to price changes. |

| Availability of Substitutes | Limited Direct, Growing Indirect (Renewables) | Renewables at ~30% of global electricity generation in 2024 show increasing alternatives. |

Preview Before You Purchase

Amplify Energy Porter's Five Forces Analysis

This preview shows the exact Amplify Energy Porter's Five Forces Analysis you'll receive immediately after purchase, detailing the competitive landscape for the company. You'll gain a comprehensive understanding of the bargaining power of suppliers and buyers, the threat of new entrants and substitutes, and the intensity of rivalry within the energy sector. This professionally formatted document is ready for your immediate use.

Rivalry Among Competitors

The independent oil and natural gas sector, where Amplify Energy operates, is quite crowded. You have a mix of players, from the really big, integrated oil companies to many smaller, independent producers, especially in established areas like the ones Amplify focuses on. This means there's a lot of competition, and it can get pretty fierce on pricing, particularly when oil and gas prices are down. For instance, in 2024, the average number of active drilling rigs in the US fluctuated, but the presence of numerous smaller operators ensures a constant competitive pressure.

The oil and gas sector, particularly for mature assets like those Amplify Energy often focuses on, typically sees modest growth. This slower pace means companies are more inclined to fight harder for existing market share. For Amplify Energy, this translates to a competitive landscape where gaining ground often means acquiring other assets or getting the most out of what they already have, rather than riding a wave of new discoveries.

Crude oil and natural gas are fundamentally undifferentiated commodities, meaning customers perceive little difference between products from various suppliers. This lack of product differentiation forces companies within the energy sector, including Amplify Energy, to compete primarily on price, operational efficiency, and their underlying cost structures, intensifying competitive rivalry.

Amplify Energy's strategic focus on maximizing value from its existing assets through enhanced operational efficiency is a direct acknowledgment of this market reality. By optimizing production and minimizing costs, the company aims to gain a competitive edge in a market where product uniqueness is minimal.

Exit Barriers

Amplify Energy faces substantial exit barriers, particularly concerning its offshore California operations at Beta. Decommissioning costs for offshore platforms are notoriously high, often running into hundreds of millions of dollars, making it economically unfeasible to simply walk away from such assets. These costs are a significant factor that can trap companies in a market, even when conditions are unfavorable, as they must continue operations to offset these eventual liabilities.

The nature of offshore oil and gas infrastructure also contributes to these high exit barriers. Specialized equipment and the sheer scale of these facilities mean they have very limited alternative uses if a company decides to leave the sector. Amplify's commitment to long-term contractual obligations, if any, further solidifies their presence, preventing a swift or easy departure and ensuring continued competitive pressure within the market as firms strive to cover their fixed costs.

- Decommissioning Costs: Offshore platform removal can cost upwards of $100 million, a significant deterrent to exiting the market.

- Specialized Infrastructure: Amplify's Beta Field assets are highly specialized, with little to no resale or repurposing value, locking them into operations.

- Contractual Obligations: Long-term supply agreements or lease agreements can mandate continued production, even during periods of low oil prices.

- Fixed Cost Coverage: Companies may continue production at reduced margins to cover ongoing operational and fixed costs, thereby maintaining competitive intensity.

Diversity of Competitors

The energy sector is characterized by a wide array of competitors, each employing distinct strategies, pursuing varied objectives, and operating with different cost structures. This diversity inherently fuels intense rivalry, as some players might aggressively chase market share, while others prioritize maximizing profitability or focusing on long-term reserve growth. Amplify Energy's strategic emphasis on mature assets and operational efficiency sets it apart, yet it must navigate competition from entities with fundamentally different operational philosophies and market approaches.

For instance, in 2024, Amplify Energy's peers might include large integrated oil and gas companies with diversified portfolios, smaller independent producers focused on specific niche plays, and even private equity-backed firms with significant capital to deploy. These varied competitive landscapes mean that pricing pressures, technological adoption rates, and strategic maneuvering are constantly evolving. Amplify Energy's financial performance, such as its reported revenues and production volumes, is directly influenced by the competitive actions of these diverse market participants.

- Diverse Strategic Goals: Competitors may focus on market share, profitability, or reserve growth, creating varied competitive pressures.

- Cost Structure Differences: Companies with lower cost structures can exert significant pricing influence, impacting Amplify Energy.

- Amplify's Differentiation: Amplify Energy's focus on mature assets and operational efficiency is a key differentiator in a competitive field.

- Impact on Market Dynamics: The presence of diverse competitors shapes pricing, innovation, and overall market stability for Amplify Energy.

The competitive rivalry within Amplify Energy's operating environment is intense due to the commodity nature of oil and gas, leading to price-based competition. Many players, from majors to independents, vie for market share, especially in mature basins. Amplify's strategy of optimizing existing assets addresses this, as differentiation is minimal, forcing a focus on efficiency and cost management to stay competitive.

The market sees constant pressure from a wide range of competitors, each with different strategic aims and cost bases. For instance, in 2024, Amplify Energy navigates a landscape that includes large integrated companies with vast resources and smaller, agile independents. This diversity means pricing, technological adoption, and strategic moves by rivals directly impact Amplify's performance, making operational efficiency crucial for survival and growth.

| Competitive Factor | Description | Impact on Amplify Energy |

| Commodity Nature | Oil and gas are undifferentiated, leading to price-based competition. | Forces focus on cost efficiency and operational excellence. |

| Number of Competitors | Numerous players, from majors to independents, operate in the sector. | Intensifies rivalry for market share and resources. |

| Competitor Strategies | Varying goals (market share, profitability, growth) create diverse competitive pressures. | Requires strategic agility to counter different competitive approaches. |

| Cost Structures | Differences in cost bases allow some competitors to exert pricing influence. | Amplify must maintain a competitive cost structure to avoid margin erosion. |

SSubstitutes Threaten

The primary substitutes for Amplify Energy's oil and natural gas products are renewable energy sources like solar and wind, alongside nuclear power. While these alternatives present environmental advantages, their current price-performance trade-off for delivering consistent, large-scale energy, particularly for demanding sectors like transportation and heavy industry, can still make fossil fuels more appealing. For instance, in 2024, the levelized cost of electricity for solar PV continued its downward trend, with some utility-scale projects reporting costs below $30 per megawatt-hour, making them increasingly competitive with traditional energy sources.

Amplify Energy's customers, particularly those in the oil and gas sector, have a moderate propensity to switch to substitutes. This is influenced by evolving environmental regulations and a growing consumer preference for cleaner energy sources. For instance, the global push for decarbonization, evidenced by the International Energy Agency's (IEA) projection that renewable energy sources will account for over 90% of global electricity capacity expansion in the coming years, directly impacts demand for traditional fossil fuels.

The increasing cost-competitiveness of renewable energy sources directly impacts Amplify Energy. For instance, the levelized cost of electricity (LCOE) for utility-scale solar PV in the US averaged around $28 per megawatt-hour in 2023, a significant drop from previous years, making it a more viable substitute for traditional energy generation.

Improvements in energy storage technology further bolster the appeal of renewables. Battery storage costs have also seen substantial declines, reaching approximately $130 per kilowatt-hour for utility-scale systems in 2024, which helps mitigate the intermittency of solar and wind power, thereby strengthening their position as substitutes for fossil fuels.

This growing affordability and reliability of renewable alternatives exert downward pressure on the long-term pricing of oil and gas. As more consumers and industries shift towards cleaner energy, the demand for Amplify Energy's core products may diminish, impacting revenue and profitability.

Availability of Substitutes

The energy sector is witnessing a significant rise in substitutes for traditional oil and gas. The increasing deployment of renewable energy sources like solar and wind power, alongside the growing adoption of electric vehicles (EVs), directly challenges Amplify Energy's core business. For instance, by the end of 2023, global EV sales surpassed 13 million units, a substantial increase from previous years, indicating a tangible shift in energy consumption patterns.

Energy efficiency technologies also play a crucial role in reducing demand for fossil fuels. Innovations in building insulation, smart grid technologies, and more efficient industrial processes are collectively lowering the overall energy requirements, thereby diminishing the reliance on oil and gas products. This trend is projected to continue, with the International Energy Agency (IEA) forecasting significant energy savings from efficiency measures in the coming years.

While these substitutes may not yet fully replace all oil and gas applications, their expanding reach and technological advancements represent a clear and growing long-term threat. Amplify Energy must consider how this evolving landscape impacts its market share and future demand for its products and services.

Key substitute trends impacting Amplify Energy include:

- Renewable Energy Growth: Global renewable energy capacity additions reached record levels in 2023, with solar PV and wind power leading the expansion.

- Electric Vehicle Adoption: The global EV market share continued its upward trajectory in 2023, with projections indicating further acceleration in adoption rates.

- Energy Efficiency Gains: Policies and technological advancements are driving improved energy efficiency across residential, commercial, and industrial sectors.

Impact of Energy Transition and ESG Trends

The global shift towards cleaner energy sources and a growing emphasis on Environmental, Social, and Governance (ESG) principles significantly amplify the threat of substitutes for companies like Amplify Energy. Investors and governments are increasingly prioritizing renewable energy, which directly impacts demand for traditional fossil fuel products and services.

This trend is evident in the substantial investments flowing into renewable energy projects. For instance, global investment in energy transitions reached approximately $1.7 trillion in 2023, a record high according to the International Energy Agency (IEA). Such investments fuel innovation and cost reductions in alternatives like solar, wind, and battery storage, making them more competitive.

Policies designed to disincentivize fossil fuel consumption further bolster the threat of substitutes. Many nations are implementing carbon pricing mechanisms, stricter emissions standards, and mandates for renewable energy adoption. For example, the European Union's Fit for 55 package aims to cut greenhouse gas emissions by 55% by 2030, directly challenging the market for fossil fuels.

- Accelerated Investment in Renewables: Global energy transition investments hit a record $1.7 trillion in 2023, increasing the viability and attractiveness of substitute energy sources.

- Policy Disincentives for Fossil Fuels: Government regulations, such as carbon taxes and renewable energy mandates, make fossil fuel consumption less appealing and more costly.

- Technological Advancements in Alternatives: Continuous innovation in solar, wind, and energy storage technologies lowers costs and improves performance, making them stronger substitutes.

- Shifting Investor Preferences: A growing number of investors are divesting from fossil fuel assets and favoring companies with strong ESG performance, reducing capital availability for traditional energy firms.

The threat of substitutes for Amplify Energy's oil and gas products is significant and growing, driven by advancements in renewable energy and energy efficiency. The increasing cost-competitiveness of solar and wind power, coupled with improvements in battery storage, directly challenges fossil fuels. For instance, the levelized cost of electricity for utility-scale solar PV in the US averaged around $28 per megawatt-hour in 2023, making it a strong contender.

Global trends like the surge in electric vehicle adoption, with over 13 million units sold worldwide by the end of 2023, further reduce demand for gasoline and diesel. Energy efficiency measures also play a role, lowering overall energy consumption and, consequently, the need for Amplify Energy's products.

These substitutes are becoming more viable due to substantial investments in clean energy, with global energy transition investments reaching a record $1.7 trillion in 2023. Government policies, such as carbon pricing and renewable energy mandates, also disincentivize fossil fuel use, increasing the attractiveness and affordability of alternatives.

| Substitute Category | Key Drivers | Impact on Amplify Energy |

|---|---|---|

| Renewable Energy (Solar, Wind) | Decreasing LCOE, technological advancements | Reduced demand for fossil fuels in power generation |

| Electric Vehicles (EVs) | Falling battery costs, increasing model availability | Decreased demand for gasoline and diesel |

| Energy Efficiency | Policy incentives, technological innovation | Lower overall energy consumption, reduced fossil fuel reliance |

Entrants Threaten

The oil and natural gas exploration and production sector is inherently capital-intensive. Significant upfront investment is needed for acquiring leases, drilling wells, building essential infrastructure like pipelines, and adopting advanced technology. This substantial financial barrier effectively discourages many potential new players from entering the market.

For instance, in 2023, the average cost to drill an oil well in the United States could range from $2 million to $7.5 million, depending on the location and complexity. Amplify Energy, while focusing on mature fields, still faces considerable capital demands for ongoing development, maintenance, and operational efficiency, which acts as a deterrent to new entrants.

Established players in the oil and gas sector, like Amplify Energy, benefit significantly from economies of scale. This translates into lower per-unit production costs due to efficient operations and bulk purchasing power for equipment and services. For instance, in 2023, Amplify Energy reported total operating expenses of $391.1 million, a figure that new entrants would find challenging to match in terms of efficiency from the outset.

New companies entering the market would face substantial hurdles in achieving comparable cost efficiencies. Their smaller scale would likely result in higher purchasing costs and less optimized operational processes, making it difficult to compete on price with established firms. This cost disadvantage is a major deterrent for potential new entrants aiming to gain market share.

Amplify Energy's strategy to maximize value is intrinsically linked to leveraging its existing asset base for operational efficiency. This focus on optimizing current operations further solidifies its competitive advantage against smaller, less established entities. The company's ability to generate revenue of $557.5 million in 2023, while managing these operational costs, highlights its scale-driven efficiencies.

New companies entering the energy sector often struggle to gain access to critical distribution channels. For instance, securing space on existing pipeline networks or in refining facilities can be a significant hurdle, as these are often controlled by established players. This was evident in 2024, where capacity constraints in key midstream infrastructure limited options for emerging producers.

Government Policy and Regulation

Government policy and regulation significantly impact the threat of new entrants in the oil and gas sector, especially for offshore operations like Amplify Energy's Beta field. The industry faces rigorous environmental, safety, and operational mandates. For instance, in 2024, the U.S. Bureau of Ocean Energy Management (BOEM) continued to enforce strict leasing and permitting protocols for offshore activities, requiring extensive environmental impact assessments and adherence to safety standards.

New companies looking to enter this market must allocate substantial resources to navigate these complex regulatory landscapes. This includes obtaining numerous permits and ensuring compliance with evolving standards, which can add considerable time and cost to project development. These barriers effectively deter smaller or less capitalized new entrants, thereby moderating the overall threat.

Key regulatory considerations for new entrants include:

- Environmental Compliance: Meeting stringent emissions standards and waste disposal regulations.

- Safety Protocols: Adhering to offshore safety management systems and emergency response plans.

- Permitting and Licensing: Successfully navigating the lengthy and detailed approval processes for exploration and production.

Brand Loyalty and Switching Costs for Customers

While oil and natural gas are largely commodities, Amplify Energy benefits from established, long-term supply agreements with its customer base. These agreements, often coupled with a history of reliable service, foster a degree of customer loyalty. For instance, in 2024, Amplify Energy continued to serve major industrial clients who rely on consistent energy supply for their operations.

Disrupting these existing relationships would require new entrants to offer substantial price concessions or highly attractive contractual terms. The effort and potential risk associated with switching suppliers, particularly for large-scale industrial consumers, act as a barrier. This stickiness limits the immediate impact of new competitors on Amplify Energy's market share.

- Customer Loyalty: Long-term contracts and a track record of reliability build customer stickiness.

- Switching Costs: Industrial buyers face significant costs and operational challenges when changing energy suppliers.

- Price Sensitivity: New entrants must offer considerable price advantages to overcome established relationships.

- Market Inertia: Existing supply chains and operational integration make switching less appealing for many clients.

The threat of new entrants for Amplify Energy is generally considered low, primarily due to the immense capital requirements and established infrastructure in the oil and gas sector. For instance, the cost to drill offshore wells can run into tens of millions of dollars, a significant barrier for newcomers. Amplify Energy's operational scale, evidenced by its 2023 revenue of $557.5 million, allows for cost efficiencies that new, smaller entities struggle to replicate.

Furthermore, stringent government regulations, particularly for offshore operations, add layers of complexity and cost. Obtaining necessary permits and adhering to environmental and safety standards, as enforced by bodies like BOEM in 2024, demands substantial expertise and financial resources. These regulatory hurdles, combined with the difficulty in securing access to critical midstream infrastructure like pipelines, effectively limit the influx of new competitors.

| Factor | Impact on New Entrants | Amplify Energy's Position |

|---|---|---|

| Capital Intensity | Very High Barrier (e.g., $2M-$7.5M per onshore well in 2023) | Established capital access and economies of scale |

| Regulatory Environment | High Barrier (e.g., strict 2024 BOEM protocols) | Experienced in compliance and permitting |

| Infrastructure Access | Significant Challenge (e.g., 2024 pipeline capacity constraints) | Existing infrastructure and supply agreements |

| Economies of Scale | Disadvantage for new entrants (e.g., Amplify's $391.1M operating expenses in 2023) | Cost efficiencies and competitive pricing |

Porter's Five Forces Analysis Data Sources

Our Amplify Energy Porter's Five Forces analysis is built upon a foundation of robust data, including company financial statements, industry-specific market research reports, and regulatory filings. We also leverage insights from trade publications and economic indicators to provide a comprehensive view of the competitive landscape.