AMP SWOT Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMP Bundle

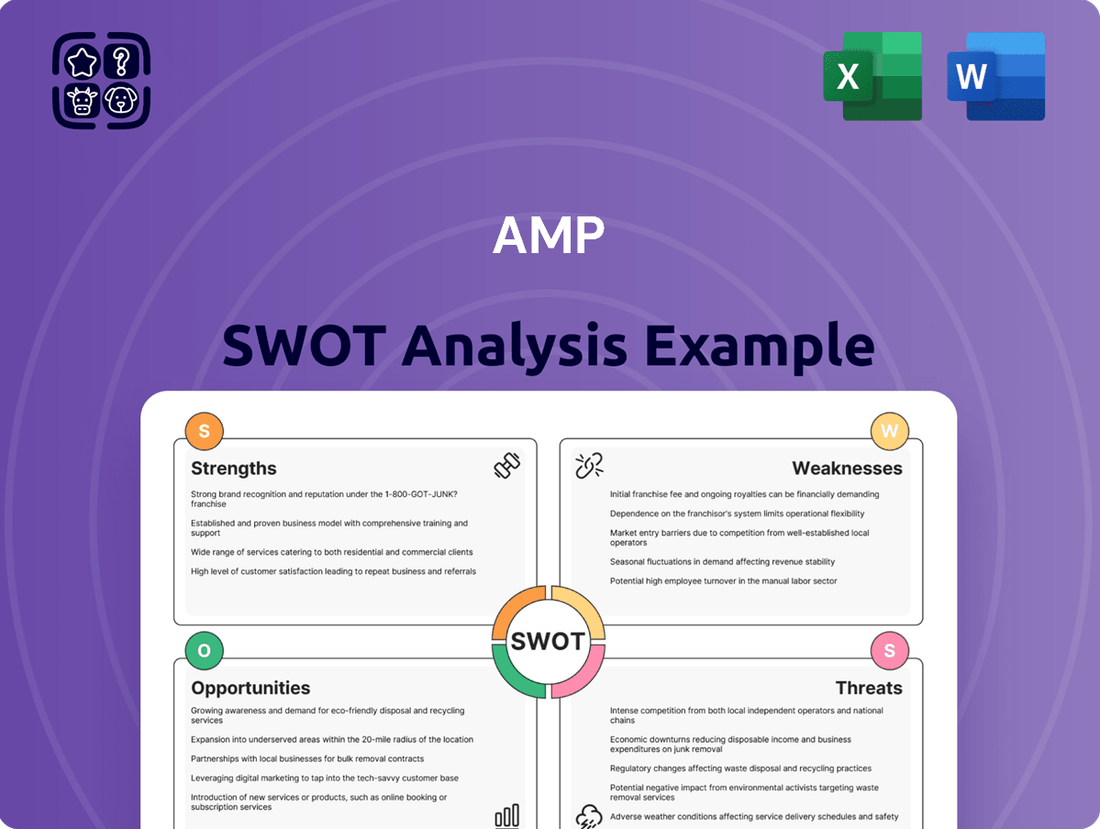

AMP's market position is shaped by its robust brand and expanding digital capabilities, but it also faces intense competition and evolving regulatory landscapes. Understanding these dynamics is crucial for anyone looking to invest or strategize within this sector.

Our comprehensive SWOT analysis dives deeper, revealing the intricate details of AMP's strengths, weaknesses, opportunities, and threats. This isn't just a summary; it's a strategic roadmap.

Want to truly grasp AMP's competitive edge and potential pitfalls? Purchase the full SWOT analysis to gain access to actionable insights, expert commentary, and a fully editable report designed for strategic planning.

Don't miss out on the complete picture. Unlock the detailed breakdowns and expert analysis that will empower your decision-making and provide a distinct advantage in this dynamic market.

Strengths

AMP's wealth management and superannuation operations are a notable strength, demonstrating robust performance. In fiscal year 2024, this division saw a significant improvement, not only stemming customer outflows but also boosting its underlying net profit after tax by an impressive 26.4%.

This segment is outperforming expectations, a key driver being strong investment returns. In 2024, AMP achieved top-quartile investment returns, directly contributing to improved cashflows and the overall positive trajectory of the business.

AMP's strategic pivot toward core businesses and growth is a significant strength, underscored by the sale of its Advice business in December 2024. This move allows AMP to concentrate on its ambition to be a leading retirement specialist and a prominent digital bank.

The company's strategy is firmly rooted in enhancing profitability and managing capital efficiently. This focus is crucial for sustainable growth and creating value for shareholders.

AMP is actively exploring new revenue streams, a key element of its forward-looking approach. This includes the planned launch of new digital offerings designed to capture emerging market opportunities.

By shedding non-core assets, AMP is better positioned to allocate resources to its strategic priorities. This sharpened focus is expected to drive operational improvements and strengthen its market position in the retirement and digital banking sectors.

AMP's commitment to digital transformation is a significant strength, evidenced by their ongoing investments in new capabilities. A key initiative is the launch of a new digital bank for small and personal banking, slated for February 2025, aiming to capture a wider customer base.

Furthermore, AMP is enhancing its digital advice offerings, a move expected to improve customer engagement and accessibility. The expansion of innovative retirement products on their North platform is also a critical component of this strategy. This platform has been successful in attracting new financial advisors, which in turn drives substantial inflows into their managed funds.

Improved Financial Performance and Capital Management

AMP has showcased a significant uplift in its financial performance and capital management strategies. In the fiscal year 2024, the company reported a notable 15.1% increase in underlying Net Profit After Tax (NPAT), reaching $236 million. This growth was bolstered by robust net cashflow generation across its wealth management operations, indicating operational efficiency and strong client engagement.

Further demonstrating its commitment to shareholder value, AMP successfully concluded a $1.1 billion capital return program to its shareholders, which commenced in August 2022. This initiative underscores the company's disciplined approach to capital allocation and its focus on delivering tangible returns.

- Substantial NPAT Growth: FY24 underlying NPAT increased by 15.1% to $236 million.

- Strong Cashflow: Wealth businesses experienced positive net cashflow momentum.

- Shareholder Capital Returns: Completed a $1.1 billion capital return program since August 2022.

Resilient Platforms Business

AMP's Platforms business demonstrates significant resilience, evidenced by an 18.9% surge in underlying Net Profit After Tax (NPAT) for FY24. This growth was fueled by favorable market conditions, robust net cash flow, and diligent cost management.

The North platform is a key driver of this strength, consistently securing new distribution agreements and attracting additional advisors. This expansion has propelled managed portfolios to an impressive $19.1 billion.

- Strong Profitability: Underlying NPAT up 18.9% in FY24.

- Growth Drivers: Benefited from positive market conditions and cost discipline.

- North Platform Expansion: Achieved $19.1 billion in managed portfolios.

- Advisor & Distribution Growth: Continues to attract new advisors and distribution agreements.

AMP's core wealth management and superannuation businesses are a significant strength, showing improved performance by stemming customer outflows and boosting underlying net profit after tax by 26.4% in FY24. Strong investment returns, achieving top-quartile performance in 2024, have further bolstered cashflows and the overall business trajectory.

The company's strategic focus on core businesses, including the sale of its Advice business in December 2024, positions it as a leading retirement specialist and digital bank. This sharpened focus, coupled with enhanced profitability and efficient capital management, supports sustainable growth and shareholder value.

| Metric | FY24 | FY23 |

| Underlying NPAT | $236 million | $205 million |

| Wealth Management NPAT Growth | 26.4% | N/A |

| Platforms NPAT Growth | 18.9% | N/A |

| Managed Portfolios (North) | $19.1 billion | N/A |

What is included in the product

Delivers a strategic overview of AMP’s internal and external business factors, outlining its strengths, weaknesses, opportunities, and threats.

Offers a clear, actionable framework to identify and address strategic weaknesses, alleviating the pain of uncertainty.

Weaknesses

AMP Bank experienced a significant dip in profitability, with its underlying Net Profit After Tax (NPAT) falling by 22.6% to $72 million in the fiscal year 2024. This decline is attributed to the bank's deliberate strategy of managing both its loan volumes and interest margins.

Furthermore, AMP Bank’s return on equity (ROE) stood at approximately 6% in the first half of 2024. This figure is notably lower than the bank's own cost of capital, signaling a persistent challenge in generating returns that adequately compensate for the risk involved, especially when contrasted with the performance of larger, established banks.

AMP's reputation has been significantly tarnished by past misconduct, notably exposed during the 2018 Hayne Royal Commission. This commission revealed widespread issues within the financial advice sector, including charging fees for no service, which directly impacted AMP's standing.

While AMP has implemented remediation programs and leadership changes since the commission, the lingering effects of this reputational damage continue to influence customer trust and brand perception. This historical context can make rebuilding confidence a slow and challenging process.

The legacy of past issues also means AMP remains under a microscope, potentially facing continued regulatory scrutiny. This scrutiny can translate into ongoing compliance costs and operational adjustments as the company works to demonstrate adherence to evolving standards and regain stakeholder confidence.

For instance, AMP reported significant remediation payments in its 2023 financial results, underscoring the ongoing financial impact of past conduct. While specific figures for 2024 are still emerging, the commitment to addressing these historical issues remains a key focus.

Even after AMP divested its advice business, there are still challenges in keeping its wealth Funds Under Management (FUM) in the medium term. This is a tricky part of the process, as moving things around can naturally lead to some losses.

The advisors and clients who were part of the AMP advice division, now operating as Akumin, might move their FUM elsewhere during this transition. This potential FUM attrition could definitely affect the performance of AMP's remaining wealth operations.

For instance, in the first half of 2024, AMP reported that its total FUM stood at $135.4 billion. While this reflects overall assets, a portion of this could be at risk due to the advice business separation.

Competitive Pressure in Financial Services

AMP operates within a fiercely competitive Australian financial services landscape. This includes formidable competition from major established banks and a growing number of agile fintech disruptors. This intense rivalry directly impacts AMP, particularly on its banking and wealth management platforms, leading to persistent pressure on profit margins.

The intense competition forces AMP to navigate significant margin pressures. In its banking and wealth platforms, this means fees are often constrained, requiring ongoing and substantial investment in product development and innovation. This continuous investment is crucial for AMP to maintain its market relevance and attract new customers in a crowded marketplace.

- Margin Compression: Increased competition can limit the fees AMP can charge, impacting profitability. For instance, the Australian banking sector saw net interest margins compress in recent years due to heightened competition.

- Innovation Imperative: To stay competitive, AMP must continually invest in new products and digital capabilities, which can be a significant cost. Fintechs, often unburdened by legacy systems, can innovate more rapidly.

- Customer Acquisition Costs: Attracting and retaining customers in a competitive market often requires higher marketing and acquisition spend.

Impact of Business Simplification on Statutory Profit

While AMP's underlying profit showed improvement, the company experienced a significant drop in its statutory net profit after tax (NPAT) for the fiscal year 2024. This figure fell to $150 million, a notable decrease from the $265 million reported in fiscal year 2023.

This reduction in statutory NPAT can be attributed to several factors related to business simplification and strategic divestments. Specifically, expenses incurred during the simplification process and a loss recognized from the sale of the Advice business played a crucial role in this decline.

The data highlights a key weakness: strategic restructuring, even when aimed at long-term health, can create short-term headwinds for reported profitability.

- Statutory NPAT Decline: FY24 statutory NPAT was $150 million, down from $265 million in FY23.

- Contributing Factors: Business simplification expenses and a loss on the Advice business sale impacted statutory profit.

- Strategic Impact: Restructuring efforts, while beneficial long-term, can negatively affect short-term reported earnings.

AMP's strategic restructuring, particularly the sale of its Advice business, has resulted in short-term financial headwinds. The company's statutory net profit after tax (NPAT) for fiscal year 2024 saw a significant drop to $150 million, down from $265 million in FY23. This decline is directly linked to expenses incurred during simplification and a loss recognized from the Advice business divestment, underscoring the immediate profitability impact of such strategic moves.

| Weakness | Description | Financial Impact (FY24 unless noted) |

| Statutory NPAT Decline | Significant drop in reported profit due to restructuring and divestments. | $150 million (FY24) vs $265 million (FY23) |

| Reputational Damage | Lingering effects from past misconduct, impacting customer trust. | Ongoing remediation costs and slower FUM growth potential. |

| Margin Compression | Intense competition in Australian financial services constrains fees. | Pressure on profitability across banking and wealth platforms. |

| FUM Attrition Risk | Potential loss of Funds Under Management from divested advice business. | $135.4 billion total FUM (H1 2024) with a portion at risk. |

Preview the Actual Deliverable

AMP SWOT Analysis

The preview you see is the actual SWOT analysis document you’ll receive upon purchase—no surprises, just professional quality. This gives you a clear understanding of the insights and structure you can expect. You’re viewing a live preview of the actual SWOT analysis file; the complete version becomes available after checkout. This ensures transparency and confidence in your decision to buy. It's the same comprehensive report that will be yours to use immediately.

Opportunities

Australia's demographic shift, with an aging population, creates a substantial market for retirement solutions. This, coupled with a superannuation and investment market valued at approximately $4.1 trillion as of late 2024, offers AMP a prime opportunity to solidify its position as a leading retirement specialist.

AMP is actively capitalizing on this by driving innovation in retirement planning. The company is developing advanced modelling tools and personalized investment strategies designed to meet the evolving needs of pre-retirees and retirees.

AMP is strategically positioned to grow by expanding its digital banking and advice services. The planned launch of a new digital bank in early 2025 specifically targets small businesses and personal banking clients, aiming to attract new customers and diversify AMP's funding sources. This move is crucial for staying competitive in a rapidly evolving financial landscape.

Moreover, AMP's investment in digital advice capabilities for its superannuation members presents a significant opportunity. This approach allows for more efficient and scalable client service, potentially reaching a broader audience with personalized financial guidance. By embracing digital channels, AMP can enhance customer engagement and deliver value more effectively.

AMP is actively integrating Artificial Intelligence (AI) to boost efficiency across its operations and elevate customer interactions. Their dedicated AI Centre of Excellence is a key driver in this strategy, focusing on enhancing business unit productivity.

Continued investments in digital and data capabilities are crucial for AMP. These investments are designed to streamline operations, leading to cost reductions and a better service experience for customers across all its platforms and banking divisions.

For instance, by 2024, many financial services firms, including those in AMP's sector, are seeing significant gains. Early adopters of AI in customer service have reported up to a 30% reduction in average handling times for inquiries, a tangible benefit AMP aims to replicate.

Furthermore, enhanced data analytics, powered by AI, can unlock new insights into customer behavior, enabling more personalized product offerings and proactive service, thereby improving customer retention and driving revenue growth.

Strategic Partnerships and Industry Consolidation

AMP's proactive engagement in strategic alliances, exemplified by its partnership in the Australian advice sector creating Akumin, highlights a key opportunity. This move positions AMP to capitalize on industry consolidation, potentially strengthening its market presence. Further collaborations or mergers could unlock significant growth avenues and operational efficiencies.

The company's willingness to form strategic partnerships, as seen with the advice business consolidation that established Akumin as Australia's largest provider, is a significant opportunity. This approach allows AMP to leverage external expertise and scale, thereby enhancing its competitive standing. Exploring further industry consolidation or strategic alliances could unlock new revenue streams and cost synergies.

- Strategic Partnerships: AMP's successful collaboration in the advice business, forming the largest Australian provider Akumin, demonstrates capability in strategic alliances.

- Industry Consolidation: Further participation in industry consolidation offers a path to enhance AMP's market share and operational scale.

- Growth Avenues: New partnerships and consolidation efforts can unlock diversified growth opportunities and revenue streams for AMP.

- Market Position: Strategic collaborations can significantly bolster AMP's competitive position within the financial services landscape.

Focus on ESG and Sustainable Investing

AMP can leverage the growing demand for Environmental, Social, and Governance (ESG) investing. By expanding its range of sustainable investment products and clearly communicating its own ESG performance, AMP can attract a significant segment of the market. This focus can also bolster its brand reputation, appealing to a broader client base seeking ethical investment choices.

The ESG market is experiencing substantial growth. For instance, sustainable funds globally saw net inflows of $142.2 billion in the first quarter of 2024, indicating strong investor interest. AMP has an opportunity to capture a share of this expanding market by offering innovative ESG solutions.

- Expand sustainable investment options: Offer a wider array of ESG-focused managed funds and superannuation options.

- Enhance ESG reporting: Transparently showcase AMP's corporate ESG initiatives and investment portfolio's ESG impact.

- Attract ethically-minded clients: Target investors who prioritize sustainability in their financial decisions, a demographic showing consistent growth.

AMP's focus on retirement solutions aligns with Australia's aging population and a $4.1 trillion superannuation market as of late 2024. The company is innovating with advanced modelling and personalized strategies to meet these evolving needs.

Expanding digital banking and advice services, including a planned digital bank in early 2025, aims to attract new customers and diversify funding. Digital advice for superannuation members offers scalable, personalized financial guidance.

AMP's integration of AI, driven by its AI Centre of Excellence, aims to boost efficiency and customer interactions, with early AI adopters in customer service reporting up to 30% reductions in handling times by 2024.

Strategic alliances, like the formation of Akumin in the advice sector, position AMP to benefit from industry consolidation, enhancing its market presence and potentially unlocking new growth avenues and efficiencies.

The growing demand for ESG investing presents an opportunity, with global sustainable funds attracting $142.2 billion in net inflows in Q1 2024. AMP can capitalize by expanding sustainable product offerings and enhancing ESG reporting.

Threats

AMP faces significant headwinds from escalating regulatory scrutiny within Australia's financial services sector. Ongoing reviews into banking competition and potential shifts in superannuation policy create an evolving compliance landscape.

Meeting these evolving regulatory demands translates directly into higher compliance costs and increased operational complexity for AMP. Failure to adhere to new regulations could also expose the company to substantial penalties, impacting financial performance and reputation.

For instance, the Australian Securities and Investments Commission (ASIC) has been actively enforcing consumer protection measures, leading to significant remediation costs for financial institutions in recent years. While specific figures for AMP's compliance investment in 2024 or projections for 2025 are not yet public, the trend across the industry indicates a sustained increase in these expenses.

Economic slowdowns, like the anticipated moderation in global growth for 2024-2025, coupled with persistently high interest rates, pose a significant threat to AMP. These factors can directly depress asset values, impacting AMP's substantial asset under management (AUM), which stood at AUD 205 billion as of December 31, 2023.

Investment market volatility, a recurring theme in recent years with significant swings in equity and fixed income markets, can erode investment returns and shake client confidence. For AMP, this translates into potential for reduced net inflows and increased outflows, as seen in periods of market uncertainty, directly affecting fee-based revenue streams.

Rising interest rates, while potentially boosting net interest margins for some financial institutions, can also increase borrowing costs for AMP and its clients, potentially dampening investment appetite and impacting the value of fixed-income heavy portfolios. This environment requires careful management of investment strategies to mitigate downside risk and maintain client trust.

As a financial services giant, AMP's extensive reliance on digital platforms makes it a prime target for cybersecurity threats. A successful data breach or even a significant system outage could have devastating consequences.

Such incidents can erode customer confidence, leading to customer attrition and loss of market share. The financial fallout from a breach can be immense, encompassing direct costs of remediation, potential compensation to affected parties, and significant operational disruptions.

Moreover, regulatory bodies worldwide are imposing stricter penalties for data protection failures. For instance, the Australian Prudential Regulation Authority (APRA) has been increasing its focus on cyber resilience for financial institutions. AMP could face substantial fines, as seen in other sectors, potentially running into millions of dollars, further compounding the financial impact.

Beyond financial and regulatory penalties, the reputational damage from a cybersecurity incident can be long-lasting. Rebuilding trust with customers and stakeholders after a breach is a challenging and costly endeavor, impacting brand perception and future business opportunities.

Disruption from Fintech Companies

Fintech startups are increasingly challenging established players like AMP by offering specialized digital financial services. These agile companies often leverage advanced technology to provide more efficient and cost-effective solutions, particularly in areas like digital banking and wealth management advice. For instance, the global fintech market was valued at approximately USD 2.5 trillion in 2023 and is projected to grow significantly, indicating a strong competitive pressure.

These disruptors can rapidly adapt to changing customer preferences and regulatory landscapes, often outmaneuvering larger, more traditional institutions. Their focus on user experience and transparent fee structures can attract a younger, digitally-native customer base. By mid-2024, many neobanks and robo-advisors have secured substantial funding and user growth, demonstrating their impact.

- Agile Innovation: Fintechs can deploy new digital tools and platforms much faster than incumbent institutions.

- Cost Efficiency: Lower overheads allow fintechs to offer competitive pricing, impacting AMP's fee-based revenue.

- Enhanced User Experience: Seamless digital interfaces and personalized services are key differentiators.

- Niche Market Focus: Specialized fintechs target specific customer segments with tailored offerings, like digital lending or international payments.

Talent Acquisition and Retention Challenges

AMP faces significant hurdles in securing and keeping skilled professionals. The financial advisory sector, along with technology and wealth management, is highly competitive, making it tough to attract top talent. For instance, in Australia, the average tenure for financial advisors can be relatively short, with many seeking opportunities offering better career progression or compensation packages. This intense competition directly impacts AMP's ability to build and maintain a robust workforce.

Losing experienced staff or struggling to bring in new expertise can significantly impede AMP's progress. This talent drain can slow down the execution of strategic growth plans, such as expanding digital offerings or entering new markets. Furthermore, operational efficiency can suffer when key roles are vacant or filled by less experienced individuals. In 2023, the Australian fintech sector alone saw significant investment, creating a strong pull for tech talent that AMP must contend with.

- Competitive Market: High demand for financial advisors, tech specialists, and wealth management experts creates a challenging recruitment environment.

- Talent Drain Impact: Losing key personnel can derail strategic growth and reduce operational effectiveness.

- Industry Trends: Significant investment in sectors like Australian fintech (e.g., over AUD 1.5 billion in 2023) intensifies the competition for technology talent.

- Retention Costs: High turnover necessitates ongoing recruitment and training expenses, impacting profitability.

AMP operates within an increasingly stringent regulatory environment in Australia, with ongoing reviews into banking competition and superannuation policy potentially impacting its operations. Meeting these evolving compliance demands adds to operational complexity and costs, with the Australian Securities and Investments Commission (ASIC) actively enforcing consumer protection measures.

Economic slowdowns and high interest rates present a significant threat to AMP's substantial asset under management, which was AUD 205 billion as of December 31, 2023. Market volatility can erode investment returns and client confidence, potentially leading to reduced net inflows and affecting fee-based revenue streams.

Cybersecurity threats pose a major risk to AMP's digital platforms, with the potential for devastating consequences from data breaches or system outages. Such incidents can erode customer confidence, leading to attrition and significant financial fallout, including remediation costs and potential penalties from bodies like the Australian Prudential Regulation Authority (APRA).

Agile fintech startups are increasingly challenging AMP by offering specialized digital financial services, leveraging advanced technology for efficient and cost-effective solutions. The global fintech market, valued at approximately USD 2.5 trillion in 2023, indicates strong competitive pressure from these disruptors who often excel in user experience and competitive pricing.

AMP faces challenges in attracting and retaining skilled professionals in the competitive financial advisory, technology, and wealth management sectors. High demand for talent, particularly in rapidly growing areas like Australian fintech, which saw over AUD 1.5 billion in investment in 2023, intensifies the competition and can impact strategic growth and operational effectiveness.

SWOT Analysis Data Sources

This analysis draws from robust data sources, including internal financial reports, comprehensive market research, and expert opinions from industry leaders to provide a well-rounded perspective.