AMP Porter's Five Forces Analysis

Fully Editable

Tailor To Your Needs In Excel Or Sheets

Professional Design

Trusted, Industry-Standard Templates

Pre-Built

For Quick And Efficient Use

No Expertise Is Needed

Easy To Follow

AMP Bundle

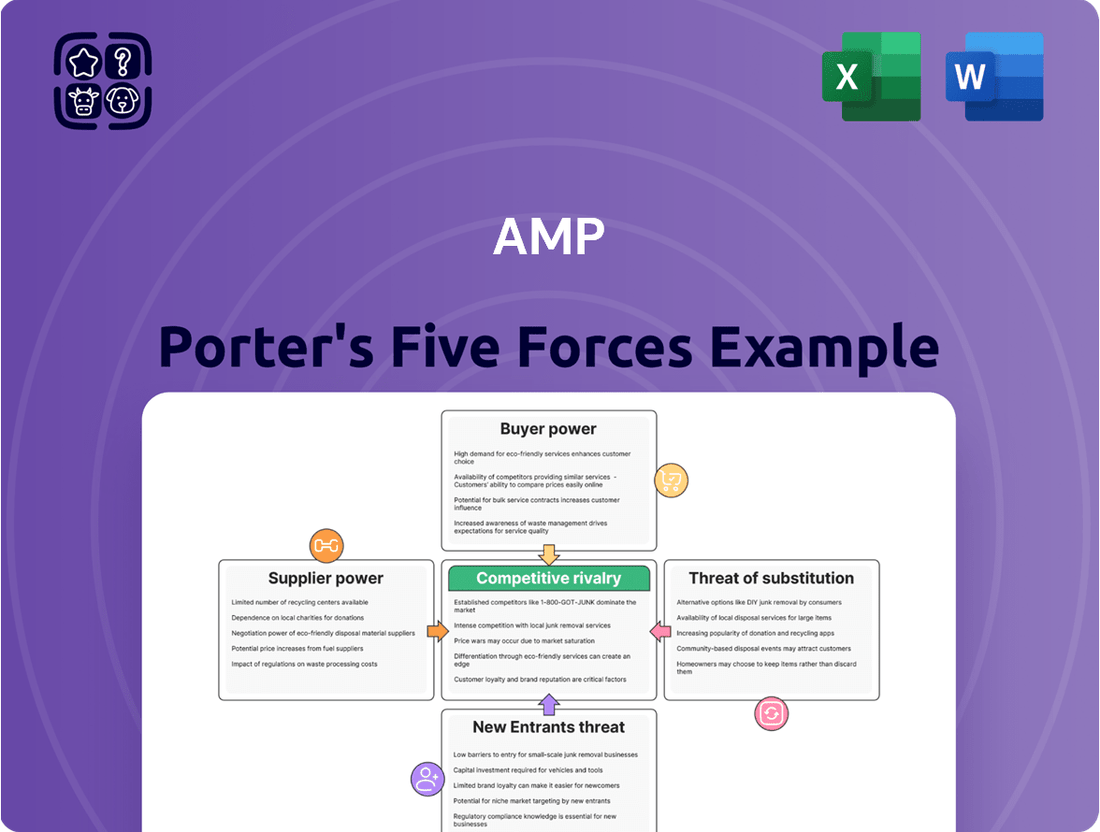

AMP's competitive landscape is shaped by five powerful forces, influencing profitability and strategic direction. Understanding the intensity of these forces—rivalry among existing competitors, the threat of new entrants, the bargaining power of buyers and suppliers, and the threat of substitute products—is crucial for any stakeholder. This brief snapshot only scratches the surface of AMP's market dynamics. Unlock the full Porter's Five Forces Analysis to explore AMP’s competitive dynamics, market pressures, and strategic advantages in detail.

Suppliers Bargaining Power

Supplier concentration significantly impacts AMP's bargaining power. The Australian financial services industry, including AMP, often depends on a limited number of specialized technology providers for essential systems like core banking, wealth management platforms, and data analytics. This limited choice for AMP means these suppliers, if they have few alternatives themselves, can exert considerable influence, potentially driving up costs or dictating less favorable terms.

Switching from one core technology or data provider to another for a large entity like AMP involves substantial financial and operational hurdles. Imagine the cost of integrating a new system, moving vast amounts of critical data, and then training hundreds, if not thousands, of employees on entirely new platforms. These are not minor expenses; they represent significant investments that can easily run into millions of dollars.

These high switching costs effectively lock AMP into existing supplier relationships, granting those suppliers considerable bargaining power. It’s not a simple matter of finding a cheaper or more advanced alternative when the cost and disruption of making that change are so immense. This leverage means suppliers can often dictate terms, potentially impacting AMP's profitability and operational flexibility.

For instance, a major financial services firm might face costs upwards of $10 million to $50 million or more to switch its core banking or trading platform, depending on its size and complexity. This substantial financial commitment makes renegotiating terms with existing providers a more attractive, albeit less ideal, option than a full-scale migration. In 2023, the average IT project cost overrun for large enterprises was reported to be around 20%, underscoring the inherent risks and expenses associated with such transitions.

Suppliers offering highly specialized financial data or unique software solutions, like those for superannuation administration, can wield significant bargaining power. When AMP relies on these distinct offerings, which aren't easily replicated by competitors, suppliers can often dictate higher prices or more favorable terms. For instance, if a particular data analytics firm provides AMP with insights that drive substantial customer acquisition, that firm's leverage increases considerably.

Threat of Forward Integration

While typically suppliers focus on their own operations, a significant threat arises if they consider forward integration into AMP's core business. For instance, a specialized financial data provider might develop its own wealth management platform, directly competing with AMP's offerings. This move would drastically shift the balance of power, giving that supplier immense leverage.

The barriers to entry for suppliers to successfully integrate forward are substantial, often requiring massive capital investment and regulatory compliance. However, for highly specialized technology or data firms, this might become a viable strategic option as the digital landscape evolves. AMP needs to proactively manage these relationships, ensuring its reliance on critical suppliers doesn't become a vulnerability.

Consider the fintech sector's growth; by mid-2024, fintech funding reached over $50 billion globally, indicating significant investment in innovation that could fuel forward integration strategies. AMP's strategic planning must account for these evolving competitive dynamics.

- Forward Integration Risk: Suppliers may develop direct competitive offerings.

- Increased Supplier Power: Successful integration significantly boosts supplier leverage.

- Barriers to Entry: High capital and regulatory hurdles exist for suppliers.

- Strategic Response: AMP must nurture strong relationships with key technology partners.

Availability of Substitutes for Suppliers

The availability of substitutes for a supplier's offerings significantly weakens their bargaining power. For instance, when AMP needs common services like cloud computing or general financial data, numerous vendors exist. This means AMP can easily switch providers or negotiate better terms, keeping procurement costs in check. In 2024, the competitive landscape for these services intensified, with many providers vying for market share, further diminishing any single supplier's leverage.

However, this dynamic shifts dramatically for highly specialized financial services technology. In such niche areas, the number of alternative suppliers is often limited. This scarcity grants those few specialized providers greater bargaining power, as AMP may have fewer options and face higher costs for critical, unique solutions. For example, acquiring advanced AI-driven trading algorithms or specialized regulatory compliance software might involve a very small pool of capable vendors, allowing them to command premium pricing.

- Limited Substitutes for Niche Tech: In 2024, the market for highly specialized financial technology saw fewer than five dominant players in several key areas, granting them substantial pricing power.

- Commodity Services Abound: For general IT infrastructure and data, over 50 major providers were actively competing in 2024, allowing for significant negotiation leverage for buyers like AMP.

- Impact on Procurement Costs: The difference in availability of substitutes directly impacts AMP's operational expenses, with niche technologies contributing to higher technology spend compared to widely available services.

The bargaining power of suppliers significantly influences AMP's operational costs and strategic flexibility. When suppliers are concentrated, offer unique or highly specialized products, or face low threats of forward integration, their ability to dictate terms increases. Conversely, the availability of substitutes and the presence of strong buyer power, like AMP's, can mitigate this influence.

| Factor | Impact on AMP's Supplier Bargaining Power | 2024 Data/Context |

|---|---|---|

| Supplier Concentration | High concentration grants suppliers greater power. | Limited specialized tech providers for core financial systems. |

| Switching Costs | High costs lock AMP into existing relationships, increasing supplier leverage. | Estimated $10M-$50M+ to switch core platforms; 20% IT project cost overruns common. |

| Product Differentiation | Unique or specialized offerings increase supplier power. | Niche fintech solutions, advanced AI algorithms command premium pricing. |

| Threat of Forward Integration | Potential for suppliers to enter AMP's business increases their leverage. | Fintech growth and investment ($50B+ global funding by mid-2024) fuels integration potential. |

| Availability of Substitutes | Abundance of substitutes weakens supplier power. | Many providers for commodity services (cloud, general data); few for specialized tech. |

What is included in the product

Analyzes the five competitive forces impacting AMP's profitability and strategic positioning within the financial services industry.

Quickly identify and mitigate competitive threats with a visual breakdown of all five forces, enabling proactive strategy adjustments.

Customers Bargaining Power

In Australia's financial services sector, particularly for everyday banking and straightforward investment products, customers are showing heightened price sensitivity. This trend is fueled by greater access to information and sophisticated comparison tools, allowing consumers to easily benchmark offerings. AMP faces limitations in charging premium fees for services like superannuation or banking if customers can readily find more cost-effective alternatives elsewhere.

The increasing cost of living further exacerbates this customer behavior. As household budgets tighten, consumers are becoming more deliberate and cost-conscious in their financial decisions. For instance, in the 2024 financial year, average household disposable income growth in Australia has been modest, making every dollar count and driving a stronger focus on value for money in financial products.

Customers now have unprecedented access to information about financial products, their performance, and associated fees, largely thanks to the proliferation of comparison websites and digital platforms. This surge in readily available data empowers consumers to make more educated choices, diminishing their dependence on any single financial institution like AMP. For instance, in 2024, a significant portion of consumers actively used online tools to compare financial services, indicating a clear shift towards informed decision-making.

The digital transformation sweeping across the financial services sector has been a primary driver of this enhanced customer information availability. This increased transparency fundamentally shifts the power dynamic, giving customers greater leverage in negotiations and product selection. As more individuals utilize these digital resources, their ability to scrutinize offerings and demand better value from providers like AMP continues to grow, directly impacting the bargaining power of customers.

For many standard financial products, customers face minimal switching costs, especially with streamlined digital onboarding. This ease of transition, exemplified by the ability to move superannuation funds or banking accounts, significantly enhances customer bargaining power.

While some financial advice relationships might involve higher switching hurdles, the overall trend leans towards lower barriers. This shift compels companies like AMP to prioritize customer retention and deliver superior value propositions to maintain their market position.

In 2024, the digital transformation in financial services has further amplified this trend. For instance, research indicates that over 60% of consumers are comfortable switching financial providers for better rates or services, directly impacting competitive pressures.

Customer Concentration (Institutional vs. Retail)

AMP's customer base spans both retail investors and large institutional clients, each wielding different levels of bargaining power. Individual retail clients, while numerous, typically have minimal individual influence. Their collective power is dispersed, making it difficult to negotiate terms.

However, institutional investors, such as corporate superannuation funds, represent significant volumes of assets under management. This concentration of capital grants them substantial bargaining power. For instance, a large super fund moving its assets can represent a material impact on AMP's revenue and profitability, allowing them to negotiate more favorable fees or service levels.

The trend towards consolidation in the Australian superannuation landscape further amplifies this institutional power. As mega funds emerge, the ability for a few large entities to dictate terms increases.

- Institutional clients, due to asset volume, hold significant bargaining power against AMP.

- Retail clients possess limited individual bargaining power.

- The growth of mega super funds in Australia consolidates customer power, impacting AMP.

Threat of Backward Integration by Customers

Customers, especially those with substantial assets like high-net-worth individuals or self-managed superannuation funds (SMSFs), possess significant bargaining power. This is amplified by their ability to bypass traditional financial intermediaries. For instance, the growth in SMSFs in Australia, which reached an estimated $846 billion in assets under management as of June 2023, highlights a trend of individuals taking direct control of their investments.

The threat of backward integration, where customers choose to manage their finances directly rather than through advisors or fund managers, directly challenges established businesses. This capability effectively increases the customer's leverage. Direct investment platforms and the proliferation of robo-advisors have made it easier and more cost-effective for individuals to manage their portfolios, further empowering them.

Consider the impact on traditional financial advisory firms. As more clients opt for direct investing, these firms face pressure to demonstrate added value beyond basic portfolio management. The ease of access to market data and trading tools means customers can increasingly perform tasks previously exclusive to professionals.

This shift is not just theoretical; data from 2024 indicates a continued increase in self-directed investing. For example, online brokerage accounts have seen substantial growth, with many platforms reporting record numbers of new accounts opened by retail investors seeking greater control and potentially lower fees. This trend directly translates to increased customer bargaining power.

- Direct Investment Growth: The value of assets managed by SMSFs in Australia grew by 6.5% in the year to June 2023, reaching $846 billion, indicating a strong trend towards self-management.

- Robo-advisor Adoption: Global assets under management for robo-advisors were projected to exceed $3.4 trillion by 2026, showcasing the increasing acceptance and adoption of automated investment solutions.

- Online Brokerage Activity: In 2023, major online brokerages reported a significant uptick in trading volumes and new account openings, demonstrating a sustained interest in direct market participation.

- Customer Empowerment: The availability of sophisticated financial tools and platforms at lower costs empowers customers to negotiate better terms or seek alternative service providers.

Customers, particularly those managing significant wealth, wield substantial bargaining power. This is amplified by their increasing ability to bypass traditional financial institutions and manage investments directly. The rise of self-managed superannuation funds (SMSFs) in Australia, with assets reaching an estimated $846 billion by June 2023, exemplifies this trend towards direct control and greater leverage.

The accessibility of sophisticated investment platforms and robo-advisors, projected to manage over $3.4 trillion globally by 2026, further empowers individuals. This allows them to negotiate more favorable terms or seek alternative providers, putting pressure on established firms like AMP to offer competitive pricing and superior value.

| Metric | Value | Source/Period |

|---|---|---|

| SMSF Assets Under Management | $846 billion | June 2023 |

| Projected Robo-advisor AUM | >$3.4 trillion | 2026 |

| Customer Switching Comfort | >60% | 2024 (estimated) |

Preview the Actual Deliverable

AMP Porter's Five Forces Analysis

This preview showcases the complete AMP Porter's Five Forces Analysis, detailing the bargaining power of buyers, the threat of new entrants, the threat of substitute products or services, the intensity of rivalry among existing competitors, and the bargaining power of suppliers. The document you see here is the exact, professionally formatted analysis you'll receive immediately after purchase. There are no placeholders or sample sections; what you are previewing is precisely the final deliverable, ready for your strategic planning needs.

Rivalry Among Competitors

The Australian financial services sector is a battleground, with AMP facing a multitude of competitors. Major domestic banks like Commonwealth Bank and Westpac, alongside industry super funds such as AustralianSuper and Hostplus, vie for market share. Global players like BlackRock and Vanguard also exert significant influence, particularly in asset management. This crowded field means AMP must constantly innovate and offer competitive pricing to retain its customers.

The Australian financial services sector is experiencing robust growth, with projections indicating continued expansion. Notably, wealth management and superannuation segments are significant contributors to this overall upward trend.

While a growing market can sometimes temper competitive intensity as firms chase new opportunities, the Australian superannuation landscape is mature and undergoing consolidation. This dynamic means rivalry remains intense, particularly for the substantial existing member assets, rather than solely focusing on new acquisitions.

Product and service differentiation is a key battleground for AMP in a highly competitive financial services landscape. Companies vie for customer loyalty by offering superior digital platforms, tailored financial advice, and strong investment returns. AMP's strategic push into digital advice and its competitive superannuation products are designed to carve out a distinct market position.

In 2024, the Australian superannuation market, where AMP operates, saw continued innovation in digital customer engagement. For instance, many competitor super funds reported significant growth in app usage, with over 60% of members actively using digital tools for account management and investment choices. This underscores the importance of AMP's investment in its digital offerings to remain competitive.

Beyond digital, differentiation also hinges on the quality and accessibility of financial advice. Many Australians, particularly those approaching retirement, seek personalized guidance. AMP's ability to deliver this, whether through human advisors or sophisticated robo-advice platforms, will be critical in setting it apart from rivals who may focus more narrowly on investment products alone.

Fee structures and the performance of investment options remain fundamental differentiators. Customers are increasingly discerning about the value they receive for their money. AMP's performance in delivering competitive net returns after fees, compared to industry benchmarks and peers, directly impacts its ability to attract and retain assets under management, especially in its core superannuation and wealth management segments.

High Exit Barriers

The financial services sector, including companies like AMP, faces substantial exit barriers. These are driven by significant investments in fixed assets, such as IT infrastructure and office spaces, coupled with stringent regulatory requirements that make winding down operations a complex and costly process. For instance, in 2023, AMP continued its strategic simplification by divesting its remaining stake in AMP Capital’s infrastructure debt platform, aiming to reduce complexity, but its core insurance and wealth management businesses inherently possess high exit barriers.

These elevated exit barriers compel companies to remain active players even when market conditions are unfavorable, leading to intensified competition. Existing firms are less likely to exit, meaning new entrants face a crowded field where incumbents are reluctant to cede market share. This sticky competitive environment means companies must continually innovate and manage costs effectively to survive and thrive.

AMP's strategic moves, such as the sale of its Australian and New Zealand wealth management businesses, demonstrate a recognition of these dynamics. By streamlining its structure, AMP seeks to focus on its more profitable core areas, though the inherent nature of financial services means high exit barriers will persist for its remaining operations.

The persistence of high exit barriers in financial services means that competitive rivalry is often characterized by a battle for market share rather than a quick exit by struggling players. This can lead to prolonged periods of intense competition, impacting profitability for all involved. For example, the Australian wealth management sector has seen significant consolidation driven by regulatory changes and fee pressure, further highlighting the difficultly of exiting the market gracefully.

- High Fixed Asset Investment: Financial institutions typically require substantial investments in technology, real estate, and compliance systems, making divestment or closure expensive.

- Regulatory Hurdles: Strict regulations governing financial services mean that exiting the market involves complex approvals and often requires maintaining certain capital levels or customer protections during the wind-down process.

- Operational Complexity: Unwinding operations, transferring client accounts, and managing legacy liabilities in financial services are intricate tasks that incur significant costs and time.

- Reputational Risk: A poorly managed exit can damage a company's reputation and affect its ability to operate in other markets or its parent company's standing.

Strategic Stakes and Aggressiveness of Competitors

Competitive rivalry within the Australian financial services sector is fierce, with key players aggressively vying for market share and technological advancement. Major banks, for instance, are channeling substantial capital into digital transformation initiatives to enhance customer experience and operational efficiency. This strategic push is critical as industry super funds continue their rapid ascent, steadily capturing a larger portion of the market. For AMP, this heightened competitive intensity, fueled by ambitious strategic goals and the allure of substantial financial returns, necessitates a constant focus on innovation and agile adaptation to remain competitive.

The aggressive pursuit of market share is evident in the ongoing digital investment by major Australian banks. For example, Commonwealth Bank of Australia (CBA) reported a 9% increase in its digital customer base in the first half of 2024, reaching over 7.5 million active digital customers. Similarly, Westpac has committed A$1.5 billion over three years to enhance its digital capabilities. This investment underscores the strategic importance of digital channels in attracting and retaining customers in a market where superannuation funds are also gaining significant traction, with the Australian superannuation industry managing over A$3.5 trillion in assets as of late 2023, a considerable portion of which has shifted from traditional retail providers to industry funds.

- Digital Transformation Investment: Major Australian banks are heavily investing in digital platforms, with figures showing significant growth in digital customer bases.

- Super Fund Growth: Industry super funds continue to increase their market share, managing trillions in assets and presenting a strong competitive challenge.

- Strategic Imperative: The aggressive competitive landscape forces incumbent players like AMP to continually innovate and adapt their strategies to maintain relevance and market position.

- Innovation Pressure: The drive for innovation is a direct response to the strategic stakes involved, where capturing market share translates to significant long-term financial returns.

Competitive rivalry in Australia's financial sector is intense, driven by significant digital investment from major banks and the growing market share of superannuation funds. AMP must continuously innovate and adapt its offerings to compete effectively against these formidable players.

The pressure to differentiate is high, with companies focusing on superior digital platforms, personalized advice, and strong investment returns. AMP's strategic focus on digital advice and competitive superannuation products aims to carve out a distinct market position amidst this challenging environment.

High exit barriers, including substantial fixed asset investments and stringent regulatory requirements, mean that companies are compelled to remain active, intensifying competition. This environment necessitates constant innovation and cost management for survival and growth.

| Competitor Type | Key Players | 2024 Focus Areas | Competitive Actions |

|---|---|---|---|

| Major Banks | CBA, Westpac | Digital Transformation, Customer Experience | Investing billions in digital capabilities, growing digital customer bases |

| Superannuation Funds | AustralianSuper, Hostplus | Market Share Growth, Member Engagement | Rapidly increasing assets under management, enhancing digital tools |

| Global Asset Managers | BlackRock, Vanguard | Investment Performance, Fee Competitiveness | Offering competitive investment products and low fees |

SSubstitutes Threaten

The rise of direct investment platforms and robo-advisors presents a significant threat of substitution for AMP's traditional financial advice and managed investment services. These digital alternatives, like Wealthsimple or Vanguard Personal Advisor Services, offer increasingly sophisticated, low-cost investment management, attracting a growing segment of investors who are comfortable with digital interactions and seek streamlined, fee-efficient solutions. For instance, by 2024, the global robo-advisory market was projected to exceed $2.5 trillion in assets under management, a clear indicator of their growing appeal and competitive pressure on incumbents.

Self-Managed Superannuation Funds (SMSFs) present a considerable threat of substitution for AMP's traditional superannuation offerings. Individuals with substantial assets and a desire for direct control over their investments can opt for SMSFs, bypassing retail and industry funds. This trend is fueled by a growing segment of financially savvy Australians looking to manage their retirement savings more actively.

The appeal of SMSFs lies in their flexibility and potential for tailored investment strategies. As of June 30, 2023, there were over 590,000 SMSFs in Australia, managing over AUD 877 billion in assets, according to the Australian Taxation Office (ATO). This demonstrates a significant and growing market share that could otherwise be captured by AMP.

Customers increasingly have access to direct banking services, such as online-only banks and digital payment platforms, which often present lower fees and a more seamless user experience than traditional offerings like AMP Bank. For instance, neobanks have seen significant growth, with some reporting millions of customers in just a few years, highlighting a strong preference for digital-first financial solutions.

The rapid expansion of digital wallets and contactless payment technologies further solidifies this trend, actively reshaping consumer habits and expectations around how they manage their money. This shift means that the convenience and efficiency offered by these alternatives can directly compete with the established services of incumbent banks.

Alternative Asset Classes and Investment Vehicles

Investors have a growing array of investment choices beyond traditional managed funds and superannuation, directly impacting AMP's market position. Alternative asset classes like direct property, private equity (for eligible investors), and even cryptocurrencies offer distinct risk-return profiles that can be seen as substitutes. For instance, the global real estate market saw significant investment flows, with residential property investment continuing to be a popular alternative for many seeking tangible assets.

The burgeoning interest in Environmental, Social, and Governance (ESG) investing further diversifies investor options. Many are now directing capital towards specialized ESG-focused funds and alternative investment vehicles that align with their values, potentially diverting funds that might otherwise have been allocated to AMP's conventional offerings. By mid-2024, sustainable investing assets under management globally continued to climb, reflecting this trend.

- Direct Property: Real estate offers tangible asset ownership, often perceived as a hedge against inflation, providing an alternative to managed property funds.

- Cryptocurrencies: Digital assets present a high-volatility, high-potential-return alternative, attracting a segment of investors seeking uncorrelated growth.

- Private Equity: While often less accessible, private equity investments offer exposure to non-publicly traded companies, a distinct alternative to listed equities within managed funds.

- ESG-Focused Alternatives: Specialized funds and direct investments in sustainable businesses cater to the growing demand for ethical and environmentally conscious portfolios.

Do-It-Yourself (DIY) Financial Management

The rise of Do-It-Yourself (DIY) financial management presents a significant threat of substitutes for traditional advice and wealth management services. As financial literacy grows, fueled by accessible online platforms and educational content, a segment of individuals, particularly those with less complex financial situations, are opting to manage their own investments, retirement planning, and budgeting. This trend directly impacts the demand for services that were once the exclusive domain of financial professionals.

For instance, in 2024, a substantial portion of the population is actively engaging with personal finance apps and online investment platforms. Studies from late 2023 and early 2024 indicate that over 70% of millennials and Gen Z are comfortable using digital tools for managing their money. This DIY inclination means fewer individuals may seek out or rely on comprehensive wealth management offerings for basic financial needs, thereby reducing the client base for established firms.

- Increased Accessibility: Online resources and user-friendly financial apps make it easier than ever for individuals to access information and tools for self-management.

- Cost Savings: DIY approaches often bypass advisory fees, making them a more budget-friendly option for individuals.

- Growing Financial Literacy: A greater emphasis on financial education in recent years empowers individuals to take control of their financial futures.

- Targeted Solutions: For straightforward financial goals, DIY solutions can be highly effective and tailored to specific needs, reducing the perceived value of broader wealth management packages.

The threat of substitutes for AMP's services is multifaceted, stemming from digital alternatives, self-directed investment options, and evolving consumer preferences. Robo-advisors and direct investment platforms offer lower-cost, streamlined investment management, appealing to a digitally savvy demographic. For example, the global robo-advisory market was projected to exceed $2.5 trillion in assets under management by 2024, indicating significant competitive pressure.

Entrants Threaten

The Australian financial services sector presents a formidable challenge to new entrants due to extensive regulatory barriers. Companies seeking to operate in this space must navigate complex licensing procedures and meet rigorous capital adequacy requirements, often mandated by bodies like the Australian Securities and Investments Commission (ASIC) and the Australian Prudential Regulation Authority (APRA).

These compliance obligations are not only intricate but also incur substantial costs, effectively acting as a significant deterrent. For instance, obtaining and maintaining necessary licenses in Australia can involve extensive legal and administrative expenses, making it difficult for smaller or less-resourced entities to enter the market.

Launching a full-service financial operation, akin to AMP's integrated model spanning wealth management, banking, and investments, requires immense upfront capital. This includes significant outlays for sophisticated technology platforms, robust physical and digital infrastructure, and extensive marketing campaigns to build brand recognition.

New entrants face a formidable challenge in achieving the scale necessary to vie with established giants like AMP. For instance, the Australian wealth management sector alone saw total assets under management reach approximately AUD 3.1 trillion in 2024, indicating the sheer volume required to gain market traction and operational efficiencies.

Brand recognition and trust are critical barriers for new entrants in the financial services sector, particularly for products demanding long-term commitment like superannuation and retirement planning. Established players, such as AMP, have cultivated strong brand reputations over many years, fostering deep customer loyalty and confidence. This accumulated trust is a significant hurdle for newcomers seeking to establish themselves in a market where financial security and reliability are paramount.

Access to Distribution Channels and Customer Base

New entrants into the financial services sector, particularly those looking to compete with established players like AMP, face considerable hurdles in accessing crucial distribution channels and building a loyal customer base. AMP, for instance, leverages its decades-old relationships with financial advisers, a robust online client portal, and a substantial legacy customer base, all of which provide a significant head start and competitive moat. This established infrastructure makes it difficult for newcomers to gain traction quickly.

The sheer scale of AMP’s existing adviser network is a formidable barrier. As of late 2024, AMP Australia’s financial advice network continued to be a cornerstone of its distribution strategy, serving hundreds of thousands of clients. For a new entrant, replicating this reach requires substantial investment in recruitment, training, and incentives, a process that can take years and significant capital. Furthermore, acquiring new customers in a market where trust and existing relationships are paramount is a slow and costly endeavor.

- Established Adviser Networks: AMP's extensive and long-standing relationships with financial advisers provide preferential access to client bases, a difficult advantage for new entrants to replicate.

- Customer Acquisition Costs: The cost to acquire a new customer in the financial services industry remains high, particularly for firms lacking brand recognition and established trust.

- Digital Channel Opportunities: While traditional channels present barriers, the growth of digital platforms and fintech solutions in 2024 offers some avenues to lower entry costs for distribution, though market penetration remains challenging.

- Legacy Customer Base: AMP's large existing customer pool offers significant cross-selling and up-selling opportunities, a valuable asset that new entrants must painstakingly build from scratch.

Emergence of Fintech and Niche Players

While the established financial services industry, including AMP, traditionally benefits from high barriers to entry like regulatory hurdles and capital requirements, the landscape is shifting. The emergence of fintech and niche players presents a significant threat. These agile companies can bypass some of the complexities faced by incumbents by focusing on specific market segments.

Fintech disruptors, for instance, are leveraging innovative technology and often operate with leaner cost structures. This allows them to offer competitive pricing or superior digital experiences in areas like digital wealth management, payments, or specialized lending. For example, challenger banks in Australia have seen substantial customer growth, with some reporting hundreds of thousands of active users within a few years of launch. This indicates a direct challenge to traditional banking and wealth management models.

- Fintech Investment Surge: Global fintech investment reached over $100 billion in 2023, indicating significant capital flowing into new entrants.

- Niche Market Dominance: Companies like Square (now Block) initially focused on payment processing for small businesses, demonstrating how a niche can be a powerful entry point.

- Digital-First Advantage: Many new entrants offer fully digital platforms, appealing to younger demographics and those seeking seamless online experiences, a segment AMP also serves.

- Lower Overhead: Without the legacy systems and extensive physical branch networks of traditional institutions, fintechs often have a structural cost advantage.

These specialized players don't need to replicate AMP's entire business model to be disruptive. By excelling in a particular area, such as providing faster loan approvals or offering more personalized investment advice through AI, they can chip away at AMP's market share in those specific segments. This forces incumbents like AMP to continuously innovate and adapt to remain competitive in an increasingly dynamic market.

The threat of new entrants in the Australian financial services sector is tempered by significant capital requirements and the need for extensive regulatory compliance, creating high barriers. However, the rise of fintech companies and specialized financial technology providers is introducing new competitive dynamics. These entities can leverage digital platforms and innovative business models to target specific market niches, potentially eroding market share from established players like AMP by offering tailored services or more competitive pricing.

The substantial assets under management in Australia, exceeding AUD 3.1 trillion in wealth management as of 2024, highlight the scale required to compete effectively. While regulatory hurdles and the need for substantial upfront capital remain significant deterrents for traditional new entrants, the agility and lower overhead of digital-first fintechs offer a more accessible entry point into specific segments of the market.

| Barrier Type | Impact on New Entrants | Example for AMP/Australia |

|---|---|---|

| Regulatory Compliance | High; complex licensing, capital adequacy | ASIC/APRA requirements for financial services |

| Capital Requirements | High; technology, infrastructure, marketing | Launching a full-service wealth management operation |

| Brand Recognition & Trust | High; long-standing customer loyalty | AMP's established reputation in superannuation |

| Distribution Channels | High; adviser networks, legacy customer base | AMP's extensive financial adviser network |

| Fintech Disruption | Moderate to High; niche focus, digital advantage | Challenger banks gaining hundreds of thousands of users |

Porter's Five Forces Analysis Data Sources

Our Porter's Five Forces analysis is built on a robust foundation of data, including proprietary market research, public company filings, and expert interviews. This multi-faceted approach ensures a comprehensive understanding of industry structure and competitive dynamics.